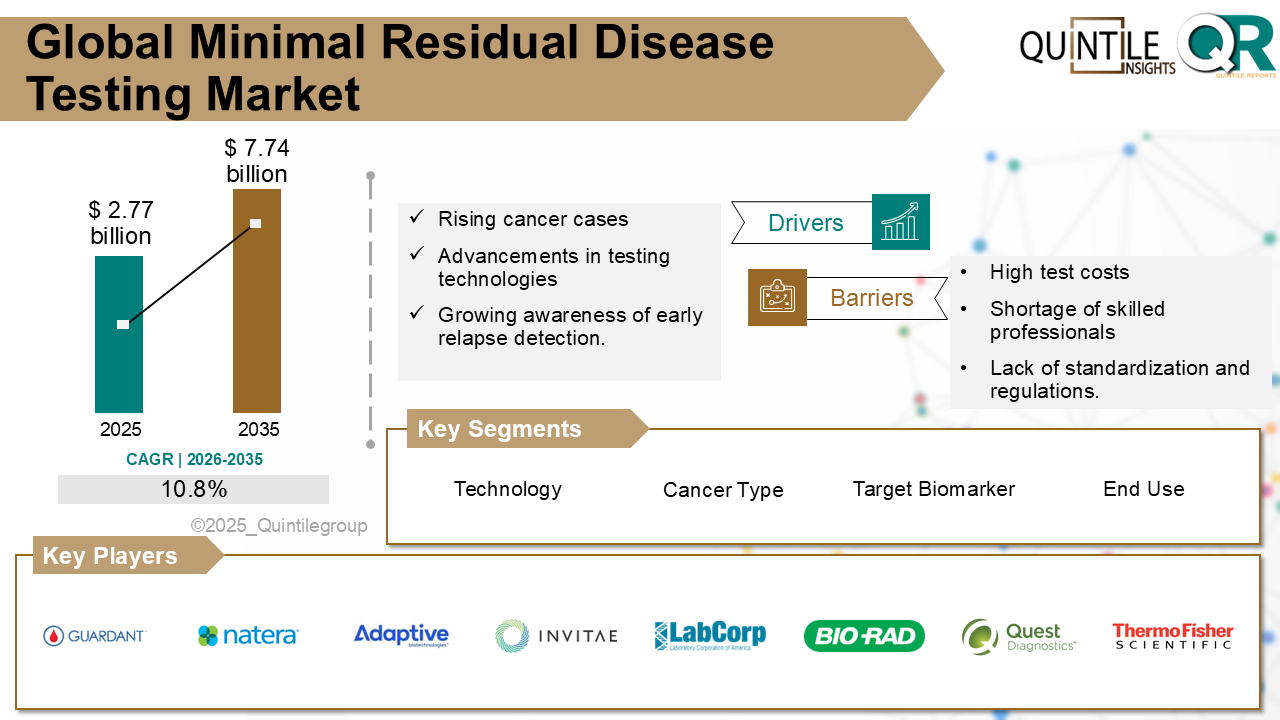

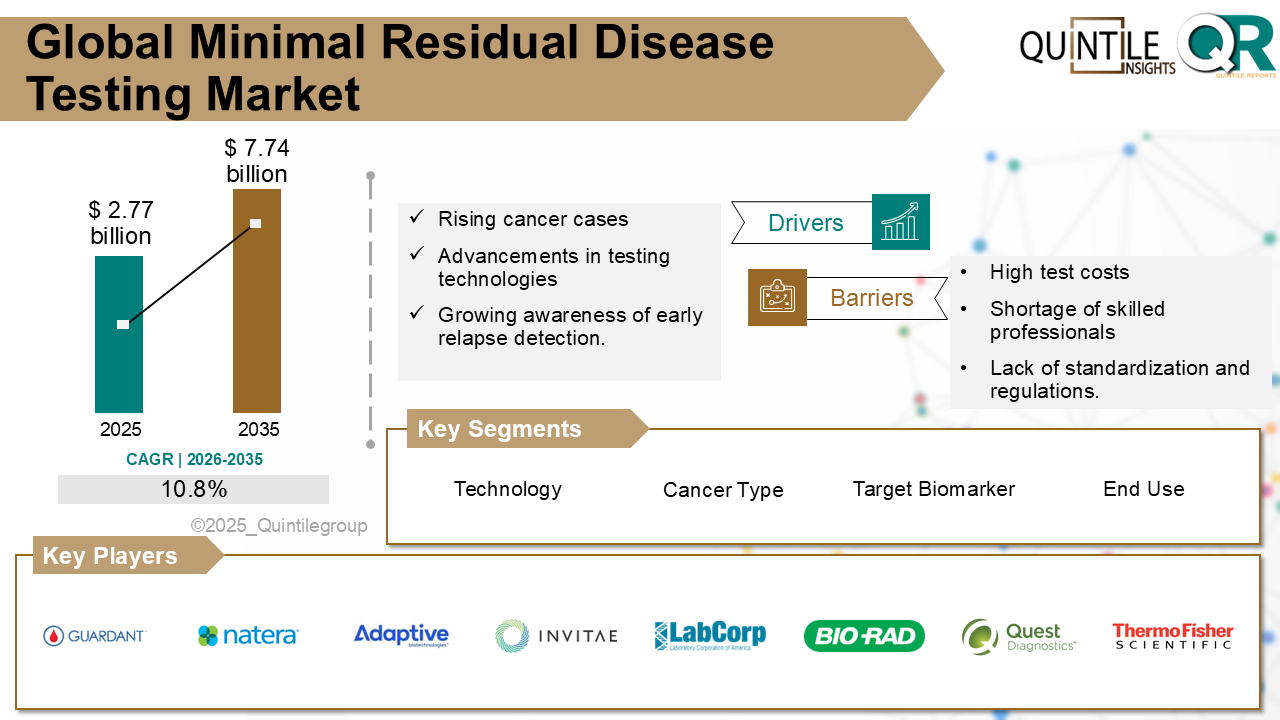

The Global Minimal Residual Disease Testing Market was valued at USD 2.77 billion in 2025 and is projected to reach USD 7.74 billion by 2035, expanding at a robust CAGR of 10.8% during the forecast period from 2026 to 2035. The Minimal Residual Disease Testing market report delivers a comprehensive industry assessment by analyzing macroeconomic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to provide a clear outlook on future growth potential.

With 2025 as the base year, the Minimal Residual Disease Testing market is experiencing steady expansion driven by continuous innovation, rising demand across end-use industries, and rapid technological progress. Market participants are increasingly optimizing their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to shifting competitive dynamics.

Looking ahead to 2035, the market is expected to maintain strong growth momentum, supported by sustained investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that focus on innovation, agile GTM execution, and alignment with evolving customer needs are well positioned to achieve long-term success. The report provides in-depth insights into key market drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by robust qualitative and quantitative analysis spanning 2017 to 2035.

Minimal residual disease (MRD) refers to the extremely small number of cancer cells that may remain in a patient's body even after they have undergone treatment and appear to be in remission through standard diagnostic methods. These residual cells are often undetectable using conventional imaging or laboratory techniques but can eventually lead to relapse if not identified and addressed. MRD testing is especially important in the management of blood cancers like leukemia, lymphoma, and multiple myeloma, and is increasingly being applied in certain solid tumors as well.

MRD testing uses highly sensitive and advanced techniques such as Next-Generation Sequencing (NGS), Flow Cytometry, and Polymerase Chain Reaction (PCR) to detect and quantify these minimal cancer cells. This testing plays a crucial role in evaluating treatment effectiveness, predicting the likelihood of relapse, and guiding further therapeutic decisions. Additionally, MRD serves as a significant endpoint in clinical trials, helping researchers assess the success of new treatment approaches.

Rising prevalence of cancer cases worldwide, particularly blood-related cancers like leukemia, lymphoma, and multiple myeloma, is a major driver in the Minimal Residual Disease (MRD) testing market. The high risk of relapse in these cancers after initial treatment fuels the demand for highly sensitive detection tools like MRD tests that can identify even the smallest number of remaining cancer cells.

The growing shift toward precision and personalized medicine is further accelerating the adoption of MRD testing. As oncologists aim to tailor therapies based on individual patient profiles, MRD testing serves as a critical decision-making tool to guide treatment intensity and duration based on the patient's molecular response to therapy.

Technological advancements in molecular diagnosticsparticularly in next-generation sequencing (NGS), flow cytometry, and digital PCRconstitute another fundamental driver of the market. These innovations have greatly enhanced the sensitivity, speed, and accuracy of MRD detection, making the technology more accessible and reliable in clinical settings.

Supportive regulatory frameworks and increasing reimbursement coverage by healthcare payers, including Medicare in the U.S., are encouraging wider adoption. As MRD testing receives recognition as a clinical and trial endpoint, stakeholders are investing more heavily in its development and integration into routine care.

The integration of MRD as a biomarker in clinical trials, combined with pharmaceutical companies growing interest in using MRD to assess early treatment efficacy, adds further momentum. In the end analysis, the convergence of high cancer recurrence, diagnostic innovation, personalized therapy, and regulatory support is poised to drive strong and steady growth in the MRD testing market.

High cost and uneven reimbursement coverage can be seen as one of the primary challenges in the Minimal Residual Disease (MRD) testing market. Advanced MRD assays that rely on ultra-deep next-generation sequencing (NGS) can cost well over US $1,500 per sample, making them financially inaccessible for many patients and healthcare systems. Additionally, many payers still classify these tests as investigational, meaning reimbursement is often denied. A Delphi panel of myeloma experts ranked access to testing and difficulties in reimbursement from payers among the top barriers to routine use. An Anti-Money Laundering review also emphasized that the lack of payer coverage keeps most NGS-based MRD tests confined to clinical trials and research labs.

Technical complexity and infrastructure requirements pose another substantial restraint on the market. Running an MRD assay requires highly sensitive and advanced platforms such as digital PCR, eight- to ten-colour flow cytometers, or high-depth NGS, along with validated bioinformatics pipelines and trained personnel capable of interpreting low-frequency variants. Reviews on lymphoma and mantle-cell MRD methods point out the high cost and specificity required to analyze the results, mandating technical expertise. Many diagnostic centres, particularly in low-resource settings, lack the capital equipment and skilled staff required to carry out such sophisticated testing in-house.

Lack of international standardization and harmonized reporting adds to the list of major challenges. Laboratories across the globe still rely on differing sample-processing protocols, antibody or sequencing panels, and even mathematical denominators when calculating MRD load. The lack of standardization limits cross-study comparison, weakens clinical decision-making, and has prompted efforts from organizations like the European Leukemia Network (ELN) to develop unified MRD testing workflows.

Biological and analytical hurdles in solid tumors also significantly restrain the expansion of MRD testing beyond hematologic malignancies. Solid tumors often release extremely small amounts of circulating-tumor DNA (ctDNA) into the bloodstream. Post-treatment ctDNA fragments may account for as little as 0.1% of the total cell-free DNA, increasing the risk of false-negative results. Additionally, mutations from clonal haematopoiesis or other non-cancerous cells can mimic tumor-derived DNA, contributing to false-positive outcomes. These biological complexities have delayed the validation of MRD assays in solid tumors and currently restrict their broader clinical and commercial application.

The MRD testing market in North America is driven by a combination of advanced healthcare infrastructure, high awareness among clinicians, and strong adoption of precision oncology practices. The presence of major diagnostic and biotechnology companies, such as Adaptive Biotechnologies, Guardant Health, and Thermo Fisher Scientific, contributes significantly to market growth. Regulatory support from agencies like the FDA, along with favourable reimbursement policies in the U.S. and Canada, further accelerates the use of MRD testing in clinical settings. There is high demand for MRD assays in hematologic malignancies, and increasing adoption in solid tumors is opening new opportunities for companies offering innovative NGS and digital PCR solutions. Collaborations between academic institutions and diagnostic developers also enhance research-based applications, particularly in clinical trials.

In Europe, the MRD testing market is influenced by strong public health systems, research funding, and widespread implementation of personalized medicine strategies. Countries like Germany, the United Kingdom, and France are leading in the adoption of molecular diagnostic tools, including MRD testing, due to their emphasis on evidence-based treatment pathways and value-based care. European Union initiatives aimed at enhancing cancer care and early detection create a favourable policy environment for MRD technologies. Demand is steadily rising as hospitals and cancer centers integrate MRD testing into post-treatment surveillance and relapse prediction protocols. Furthermore, opportunities are emerging through pan-European collaborations and cross-border clinical trials that promote standardization and scalability of MRD workflows.

Asia-Pacific represents the fastest-growing region in the MRD testing market, fuelled by increasing cancer incidence, rising healthcare expenditures, and government-led precision medicine initiatives. Countries like China, Japan, and India are witnessing rapid improvements in molecular diagnostic infrastructure. For example, Chinas Health China 2030 initiative and Japans strong innovation ecosystem are enabling broader MRD deployment. In India, affordability and awareness are improving through public-private partnerships and diagnostic outreach. There's significant demand for cost-effective and scalable MRD testing methods, particularly in urban centers, with rural expansion offering untapped opportunities. Additionally, rising clinical research activity and medical tourism are fostering growth and investments in oncology diagnostics across the region.

In Latin America, the MRD testing market is in its developing phase, but is gaining traction due to improving access to diagnostic services and growing awareness of personalized cancer treatment. Countries such as Brazil, Mexico, and Argentina are showing increasing demand for advanced diagnostic tests as part of national cancer care reforms and public-private healthcare initiatives. While challenges like limited infrastructure and reimbursement persist, international partnerships and technology transfer programs are creating new market entry points for global players. Opportunities exist in the expansion of NGS platforms and in integrating MRD into therapeutic decision-making for leukemia and lymphoma, especially in urban healthcare settings where medical resources are more concentrated.

The MRD testing market in the Middle East & Africa is growing gradually, driven by a rising cancer burden, improving diagnostic awareness, and expanding private-sector healthcare investments. Countries such as the UAE and Saudi Arabia are actively modernizing their healthcare systems and have shown interest in incorporating molecular diagnostics like MRD into oncology workflows. High-net-worth individuals in the Gulf Cooperation Council (GCC) region are increasingly seeking advanced cancer monitoring tools, creating demand for premium diagnostic services. Opportunities also lie in regional collaborations with European and U.S.-based biotech firms to build diagnostic infrastructure. In Africa, although growth is slower due to economic constraints and limited access, international health partnerships and non-profit cancer programs are beginning to create a pathway for MRD test adoption.

Adoption of advanced technologies like NGS, digital PCR, and flow cytometry accelerates MRD testing growth in the U.S.:

The MRD testing market in the United States is primarily driven by the rapid adoption of advanced molecular diagnostic technologies such as next-generation sequencing (NGS), digital PCR, and flow cytometry. These technologies have become integral to precision oncology, enabling highly sensitive detection of residual cancer cells, especially in haematological malignancies. Major healthcare providers and diagnostic labs across the U.S. have embraced these platforms, with digital PCR market size reaching USD 239.5 million in 2023. Additionally, flow cytometry accounts for over 41% of global MRD testing revenue, showcasing its dominant presence in U.S. laboratories.

The market also benefits from strong infrastructure and supportive reimbursement policies. Institutions like the FDA have granted approvals for MRD assays, and Medicare coverage has expanded for certain MRD tests, improving accessibility. Leading biotech firms such as Adaptive Biotechnologies and Guardant Health, in partnership with major academic centers, are propelling innovation and deployment. These collaborations support the growth of tumor-informed MRD assays and personalized monitoring programs. The combination of advanced technology, regulatory support, and clinical demand positions the U.S. as the leading force in the global MRD testing market.

Germany leads in MRD testing through rising adoption of genomic profiling and molecular diagnostics:

Germany leads the MRD testing market in Europe due to its strong emphasis on genomic profiling and molecular diagnostics within cancer care. The country has been at the forefront of adopting precision oncology approaches, integrating technologies like next-generation sequencing (NGS), flow cytometry, and digital PCR into routine clinical practice. These advanced tools enable highly sensitive detection of minimal residual disease, particularly in haematological cancers such as leukemia and lymphoma. As the demand for early relapse prediction and personalized treatment increases, German healthcare institutions are rapidly incorporating MRD testing into their oncology workflows.

Government initiatives and healthcare policies in Germany also support the widespread use of molecular diagnostics. The German Federal Ministry of Education and Research (BMBF) and major academic research networks have invested significantly in cancer genomics and clinical trials. Additionally, the country's robust reimbursement structure and partnerships between biotech companies and university hospitals have accelerated the validation and commercialization of MRD testing solutions. These factors collectively position Germany as a key driver of MRD innovation and implementation in the European region.

Japans Precision Medicine Agenda Accelerates MRD Adoption:

Japan has made major advancements in precision oncology through government-led initiatives. The Ministry of Health, Labour and Welfare (MHLW) launched a national cancer genomic medicine program in 2017, establishing 11 core hospitals and over 150 liaison centers. The creation of the C-CAT database supports nationwide genomic data sharing. Key NGS panels like FoundationOne CDx and Guardant360 have been approved and reimbursed under the national insurance system, creating a strong foundation for integrating MRD testing into clinical workflows.

Japan is also driving MRD research through large-scale ctDNA trials. The Japan Society of Clinical Oncology recently published a national framework for ctDNA-based MRD testing across tumor types. The SCRUM-MONSTAR-SCREEN-3 study, led by Myriad Genetics and the National Cancer Centre, is evaluating an ultra-sensitive whole-genome MRD assay in over 1,200 cancer patients. Interim 2025 data show 100% baseline ctDNA detection and the ability to identify tumor fractions as low as 0.0001%, demonstrating strong potential for widespread MRD adoption.

The MRD testing market is highly competitive, driven by rapid technological innovation in platforms such as next-generation sequencing (NGS), digital PCR, and flow cytometry. Companies are competing by improving assay sensitivity, turnaround times, and multi-cancer detection capabilities, especially in both hematologic and emerging solid tumor applications. Innovation is essential to stay ahead, and major players are differentiating their platforms to meet the rising demand for precision oncology tools.

This innovation race has led to increased collaboration among diagnostic companies, biotech firms, and healthcare networks. Strategic partnershipssuch as Adaptive Biotechnologies with Takeda, and Bio-Rad with Allegheny Health Networkhelp combine technical development with clinical deployment, offering a competitive edge through faster validation and broader clinical integration. Such alliances strengthen product pipelines while improving clinical utility and market access.

Competition in the ctDNA-based MRD segment is intensifying, particularly among Guardant Health, Natera, and Exact Sciences. These companies are focusing on early recurrence monitoring through personalized and tumor-informed liquid biopsy tests like Signatera, Reveal, and Oncodetect. Their ability to detect cancer earlier than imaging provides a unique selling point, pushing them to lead the blood-based MRD space.

Mergers and acquisitions have become a strategic tool for expansion and consolidation in the market. Key examples include Quest Diagnostics acquiring Haystack Oncology to gain MRD expertise, indicating that large diagnostics firms are acquiring smaller innovators to build out MRD capabilities quickly. These moves not only expand test portfolios but also enhance R&D capacity and global reach.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Minimal Residual Disease Testing market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Minimal Residual Disease Testing market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Minimal Residual Disease Testing market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Minimal Residual Disease Testing market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Minimal Residual Disease Testing market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

Key Players Operating in the Minimal Residual Disease Testing Market are as follows:

Quintile Reports has segmented the Minimal Residual Disease Testing market into the following segments:

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 10.8 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Minimal Residual Disease Testing market share, size, and revenue growth rate were created by Quintile Report. Minimal Residual Disease Testing analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst atsales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Minimal Residual Disease Testing Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Minimal Residual Disease Testing Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Minimal Residual Disease Testing Market, by Region, (USD Million) 2017-2035

Table 21 China Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Minimal Residual Disease Testing Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Minimal Residual Disease Testing Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Minimal Residual Disease Testing Market: market scenario

Fig.4 Global Minimal Residual Disease Testing Market competitive outlook

Fig.5 Global Minimal Residual Disease Testing Market driver analysis

Fig.6 Global Minimal Residual Disease Testing Market restraint analysis

Fig.7 Global Minimal Residual Disease Testing Market opportunity analysis

Fig.8 Global Minimal Residual Disease Testing Market trends analysis

Fig.9 Global Minimal Residual Disease Testing Market: Segment Analysis (Based on the scope)

Fig.10 Global Minimal Residual Disease Testing Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Minimal Residual Disease Testing Market was valued at USD 2.77 billion in 2025 and is projected to reach USD 7.74 billion by 2035, expanding at a robust CAGR of 10.8% during the forecast period from 2026 to 2035. The Minimal Residual Disease Testing market report delivers a comprehensive industry assessment by analyzing macroeconomic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to provide a clear outlook on future growth potential.

With 2025 as the base year, the Minimal Residual Disease Testing market is experiencing steady expansion driven by continuous innovation, rising demand across end-use industries, and rapid technological progress. Market participants are increasingly optimizing their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to shifting competitive dynamics.

Looking ahead to 2035, the market is expected to maintain strong growth momentum, supported by sustained investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that focus on innovation, agile GTM execution, and alignment with evolving customer needs are well positioned to achieve long-term success. The report provides in-depth insights into key market drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by robust qualitative and quantitative analysis spanning 2017 to 2035.

Minimal residual disease (MRD) refers to the extremely small number of cancer cells that may remain in a patient's body even after they have undergone treatment and appear to be in remission through standard diagnostic methods. These residual cells are often undetectable using conventional imaging or laboratory techniques but can eventually lead to relapse if not identified and addressed. MRD testing is especially important in the management of blood cancers like leukemia, lymphoma, and multiple myeloma, and is increasingly being applied in certain solid tumors as well.

MRD testing uses highly sensitive and advanced techniques such as Next-Generation Sequencing (NGS), Flow Cytometry, and Polymerase Chain Reaction (PCR) to detect and quantify these minimal cancer cells. This testing plays a crucial role in evaluating treatment effectiveness, predicting the likelihood of relapse, and guiding further therapeutic decisions. Additionally, MRD serves as a significant endpoint in clinical trials, helping researchers assess the success of new treatment approaches.

Rising prevalence of cancer cases worldwide, particularly blood-related cancers like leukemia, lymphoma, and multiple myeloma, is a major driver in the Minimal Residual Disease (MRD) testing market. The high risk of relapse in these cancers after initial treatment fuels the demand for highly sensitive detection tools like MRD tests that can identify even the smallest number of remaining cancer cells.

The growing shift toward precision and personalized medicine is further accelerating the adoption of MRD testing. As oncologists aim to tailor therapies based on individual patient profiles, MRD testing serves as a critical decision-making tool to guide treatment intensity and duration based on the patient's molecular response to therapy.

Technological advancements in molecular diagnosticsparticularly in next-generation sequencing (NGS), flow cytometry, and digital PCRconstitute another fundamental driver of the market. These innovations have greatly enhanced the sensitivity, speed, and accuracy of MRD detection, making the technology more accessible and reliable in clinical settings.

Supportive regulatory frameworks and increasing reimbursement coverage by healthcare payers, including Medicare in the U.S., are encouraging wider adoption. As MRD testing receives recognition as a clinical and trial endpoint, stakeholders are investing more heavily in its development and integration into routine care.

The integration of MRD as a biomarker in clinical trials, combined with pharmaceutical companies growing interest in using MRD to assess early treatment efficacy, adds further momentum. In the end analysis, the convergence of high cancer recurrence, diagnostic innovation, personalized therapy, and regulatory support is poised to drive strong and steady growth in the MRD testing market.

High cost and uneven reimbursement coverage can be seen as one of the primary challenges in the Minimal Residual Disease (MRD) testing market. Advanced MRD assays that rely on ultra-deep next-generation sequencing (NGS) can cost well over US $1,500 per sample, making them financially inaccessible for many patients and healthcare systems. Additionally, many payers still classify these tests as investigational, meaning reimbursement is often denied. A Delphi panel of myeloma experts ranked access to testing and difficulties in reimbursement from payers among the top barriers to routine use. An Anti-Money Laundering review also emphasized that the lack of payer coverage keeps most NGS-based MRD tests confined to clinical trials and research labs.

Technical complexity and infrastructure requirements pose another substantial restraint on the market. Running an MRD assay requires highly sensitive and advanced platforms such as digital PCR, eight- to ten-colour flow cytometers, or high-depth NGS, along with validated bioinformatics pipelines and trained personnel capable of interpreting low-frequency variants. Reviews on lymphoma and mantle-cell MRD methods point out the high cost and specificity required to analyze the results, mandating technical expertise. Many diagnostic centres, particularly in low-resource settings, lack the capital equipment and skilled staff required to carry out such sophisticated testing in-house.

Lack of international standardization and harmonized reporting adds to the list of major challenges. Laboratories across the globe still rely on differing sample-processing protocols, antibody or sequencing panels, and even mathematical denominators when calculating MRD load. The lack of standardization limits cross-study comparison, weakens clinical decision-making, and has prompted efforts from organizations like the European Leukemia Network (ELN) to develop unified MRD testing workflows.

Biological and analytical hurdles in solid tumors also significantly restrain the expansion of MRD testing beyond hematologic malignancies. Solid tumors often release extremely small amounts of circulating-tumor DNA (ctDNA) into the bloodstream. Post-treatment ctDNA fragments may account for as little as 0.1% of the total cell-free DNA, increasing the risk of false-negative results. Additionally, mutations from clonal haematopoiesis or other non-cancerous cells can mimic tumor-derived DNA, contributing to false-positive outcomes. These biological complexities have delayed the validation of MRD assays in solid tumors and currently restrict their broader clinical and commercial application.

The MRD testing market in North America is driven by a combination of advanced healthcare infrastructure, high awareness among clinicians, and strong adoption of precision oncology practices. The presence of major diagnostic and biotechnology companies, such as Adaptive Biotechnologies, Guardant Health, and Thermo Fisher Scientific, contributes significantly to market growth. Regulatory support from agencies like the FDA, along with favourable reimbursement policies in the U.S. and Canada, further accelerates the use of MRD testing in clinical settings. There is high demand for MRD assays in hematologic malignancies, and increasing adoption in solid tumors is opening new opportunities for companies offering innovative NGS and digital PCR solutions. Collaborations between academic institutions and diagnostic developers also enhance research-based applications, particularly in clinical trials.

In Europe, the MRD testing market is influenced by strong public health systems, research funding, and widespread implementation of personalized medicine strategies. Countries like Germany, the United Kingdom, and France are leading in the adoption of molecular diagnostic tools, including MRD testing, due to their emphasis on evidence-based treatment pathways and value-based care. European Union initiatives aimed at enhancing cancer care and early detection create a favourable policy environment for MRD technologies. Demand is steadily rising as hospitals and cancer centers integrate MRD testing into post-treatment surveillance and relapse prediction protocols. Furthermore, opportunities are emerging through pan-European collaborations and cross-border clinical trials that promote standardization and scalability of MRD workflows.

Asia-Pacific represents the fastest-growing region in the MRD testing market, fuelled by increasing cancer incidence, rising healthcare expenditures, and government-led precision medicine initiatives. Countries like China, Japan, and India are witnessing rapid improvements in molecular diagnostic infrastructure. For example, Chinas Health China 2030 initiative and Japans strong innovation ecosystem are enabling broader MRD deployment. In India, affordability and awareness are improving through public-private partnerships and diagnostic outreach. There's significant demand for cost-effective and scalable MRD testing methods, particularly in urban centers, with rural expansion offering untapped opportunities. Additionally, rising clinical research activity and medical tourism are fostering growth and investments in oncology diagnostics across the region.

In Latin America, the MRD testing market is in its developing phase, but is gaining traction due to improving access to diagnostic services and growing awareness of personalized cancer treatment. Countries such as Brazil, Mexico, and Argentina are showing increasing demand for advanced diagnostic tests as part of national cancer care reforms and public-private healthcare initiatives. While challenges like limited infrastructure and reimbursement persist, international partnerships and technology transfer programs are creating new market entry points for global players. Opportunities exist in the expansion of NGS platforms and in integrating MRD into therapeutic decision-making for leukemia and lymphoma, especially in urban healthcare settings where medical resources are more concentrated.

The MRD testing market in the Middle East & Africa is growing gradually, driven by a rising cancer burden, improving diagnostic awareness, and expanding private-sector healthcare investments. Countries such as the UAE and Saudi Arabia are actively modernizing their healthcare systems and have shown interest in incorporating molecular diagnostics like MRD into oncology workflows. High-net-worth individuals in the Gulf Cooperation Council (GCC) region are increasingly seeking advanced cancer monitoring tools, creating demand for premium diagnostic services. Opportunities also lie in regional collaborations with European and U.S.-based biotech firms to build diagnostic infrastructure. In Africa, although growth is slower due to economic constraints and limited access, international health partnerships and non-profit cancer programs are beginning to create a pathway for MRD test adoption.

Adoption of advanced technologies like NGS, digital PCR, and flow cytometry accelerates MRD testing growth in the U.S.:

The MRD testing market in the United States is primarily driven by the rapid adoption of advanced molecular diagnostic technologies such as next-generation sequencing (NGS), digital PCR, and flow cytometry. These technologies have become integral to precision oncology, enabling highly sensitive detection of residual cancer cells, especially in haematological malignancies. Major healthcare providers and diagnostic labs across the U.S. have embraced these platforms, with digital PCR market size reaching USD 239.5 million in 2023. Additionally, flow cytometry accounts for over 41% of global MRD testing revenue, showcasing its dominant presence in U.S. laboratories.

The market also benefits from strong infrastructure and supportive reimbursement policies. Institutions like the FDA have granted approvals for MRD assays, and Medicare coverage has expanded for certain MRD tests, improving accessibility. Leading biotech firms such as Adaptive Biotechnologies and Guardant Health, in partnership with major academic centers, are propelling innovation and deployment. These collaborations support the growth of tumor-informed MRD assays and personalized monitoring programs. The combination of advanced technology, regulatory support, and clinical demand positions the U.S. as the leading force in the global MRD testing market.

Germany leads in MRD testing through rising adoption of genomic profiling and molecular diagnostics:

Germany leads the MRD testing market in Europe due to its strong emphasis on genomic profiling and molecular diagnostics within cancer care. The country has been at the forefront of adopting precision oncology approaches, integrating technologies like next-generation sequencing (NGS), flow cytometry, and digital PCR into routine clinical practice. These advanced tools enable highly sensitive detection of minimal residual disease, particularly in haematological cancers such as leukemia and lymphoma. As the demand for early relapse prediction and personalized treatment increases, German healthcare institutions are rapidly incorporating MRD testing into their oncology workflows.

Government initiatives and healthcare policies in Germany also support the widespread use of molecular diagnostics. The German Federal Ministry of Education and Research (BMBF) and major academic research networks have invested significantly in cancer genomics and clinical trials. Additionally, the country's robust reimbursement structure and partnerships between biotech companies and university hospitals have accelerated the validation and commercialization of MRD testing solutions. These factors collectively position Germany as a key driver of MRD innovation and implementation in the European region.

Japans Precision Medicine Agenda Accelerates MRD Adoption:

Japan has made major advancements in precision oncology through government-led initiatives. The Ministry of Health, Labour and Welfare (MHLW) launched a national cancer genomic medicine program in 2017, establishing 11 core hospitals and over 150 liaison centers. The creation of the C-CAT database supports nationwide genomic data sharing. Key NGS panels like FoundationOne CDx and Guardant360 have been approved and reimbursed under the national insurance system, creating a strong foundation for integrating MRD testing into clinical workflows.

Japan is also driving MRD research through large-scale ctDNA trials. The Japan Society of Clinical Oncology recently published a national framework for ctDNA-based MRD testing across tumor types. The SCRUM-MONSTAR-SCREEN-3 study, led by Myriad Genetics and the National Cancer Centre, is evaluating an ultra-sensitive whole-genome MRD assay in over 1,200 cancer patients. Interim 2025 data show 100% baseline ctDNA detection and the ability to identify tumor fractions as low as 0.0001%, demonstrating strong potential for widespread MRD adoption.

The MRD testing market is highly competitive, driven by rapid technological innovation in platforms such as next-generation sequencing (NGS), digital PCR, and flow cytometry. Companies are competing by improving assay sensitivity, turnaround times, and multi-cancer detection capabilities, especially in both hematologic and emerging solid tumor applications. Innovation is essential to stay ahead, and major players are differentiating their platforms to meet the rising demand for precision oncology tools.

This innovation race has led to increased collaboration among diagnostic companies, biotech firms, and healthcare networks. Strategic partnershipssuch as Adaptive Biotechnologies with Takeda, and Bio-Rad with Allegheny Health Networkhelp combine technical development with clinical deployment, offering a competitive edge through faster validation and broader clinical integration. Such alliances strengthen product pipelines while improving clinical utility and market access.

Competition in the ctDNA-based MRD segment is intensifying, particularly among Guardant Health, Natera, and Exact Sciences. These companies are focusing on early recurrence monitoring through personalized and tumor-informed liquid biopsy tests like Signatera, Reveal, and Oncodetect. Their ability to detect cancer earlier than imaging provides a unique selling point, pushing them to lead the blood-based MRD space.

Mergers and acquisitions have become a strategic tool for expansion and consolidation in the market. Key examples include Quest Diagnostics acquiring Haystack Oncology to gain MRD expertise, indicating that large diagnostics firms are acquiring smaller innovators to build out MRD capabilities quickly. These moves not only expand test portfolios but also enhance R&D capacity and global reach.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Minimal Residual Disease Testing market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Minimal Residual Disease Testing market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Minimal Residual Disease Testing market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Minimal Residual Disease Testing market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Minimal Residual Disease Testing market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

Key Players Operating in the Minimal Residual Disease Testing Market are as follows:

Quintile Reports has segmented the Minimal Residual Disease Testing market into the following segments:

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 10.8 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Minimal Residual Disease Testing market share, size, and revenue growth rate were created by Quintile Report. Minimal Residual Disease Testing analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst atsales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Minimal Residual Disease Testing Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Minimal Residual Disease Testing Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Minimal Residual Disease Testing Market, by Region, (USD Million) 2017-2035

Table 21 China Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Minimal Residual Disease Testing Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Minimal Residual Disease Testing Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Minimal Residual Disease Testing Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Minimal Residual Disease Testing Market: market scenario

Fig.4 Global Minimal Residual Disease Testing Market competitive outlook

Fig.5 Global Minimal Residual Disease Testing Market driver analysis

Fig.6 Global Minimal Residual Disease Testing Market restraint analysis

Fig.7 Global Minimal Residual Disease Testing Market opportunity analysis

Fig.8 Global Minimal Residual Disease Testing Market trends analysis

Fig.9 Global Minimal Residual Disease Testing Market: Segment Analysis (Based on the scope)

Fig.10 Global Minimal Residual Disease Testing Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy