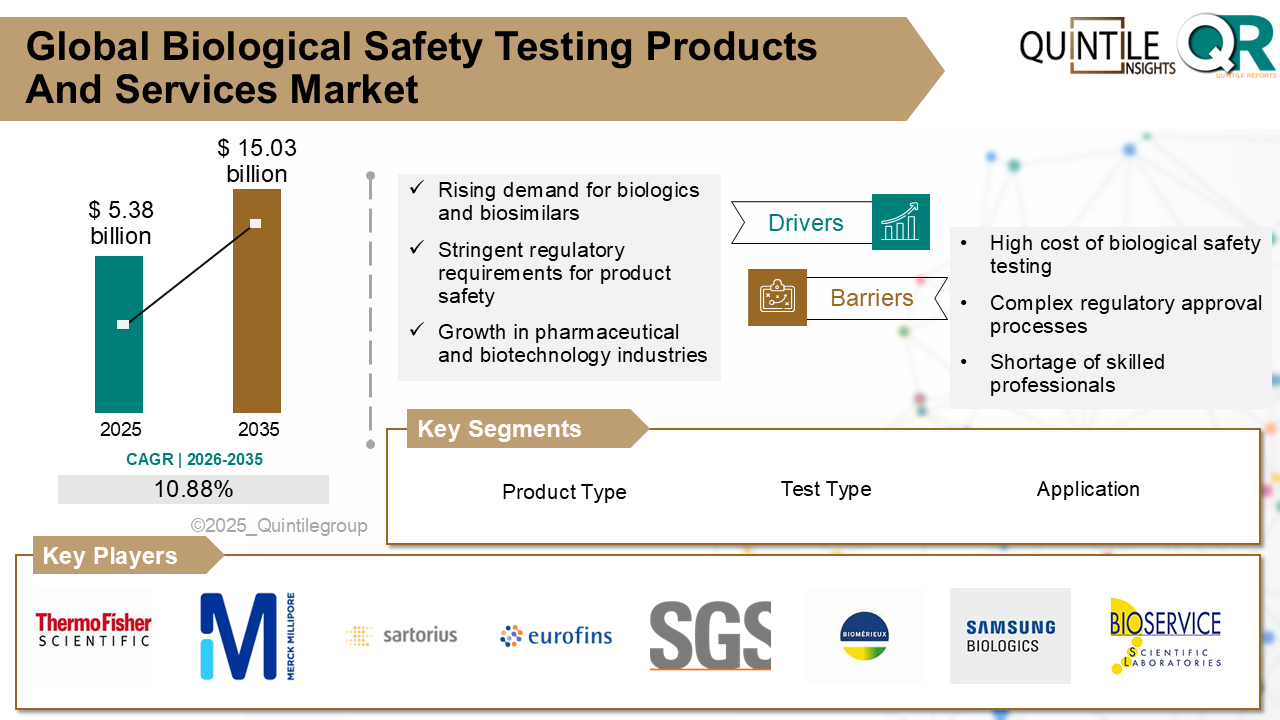

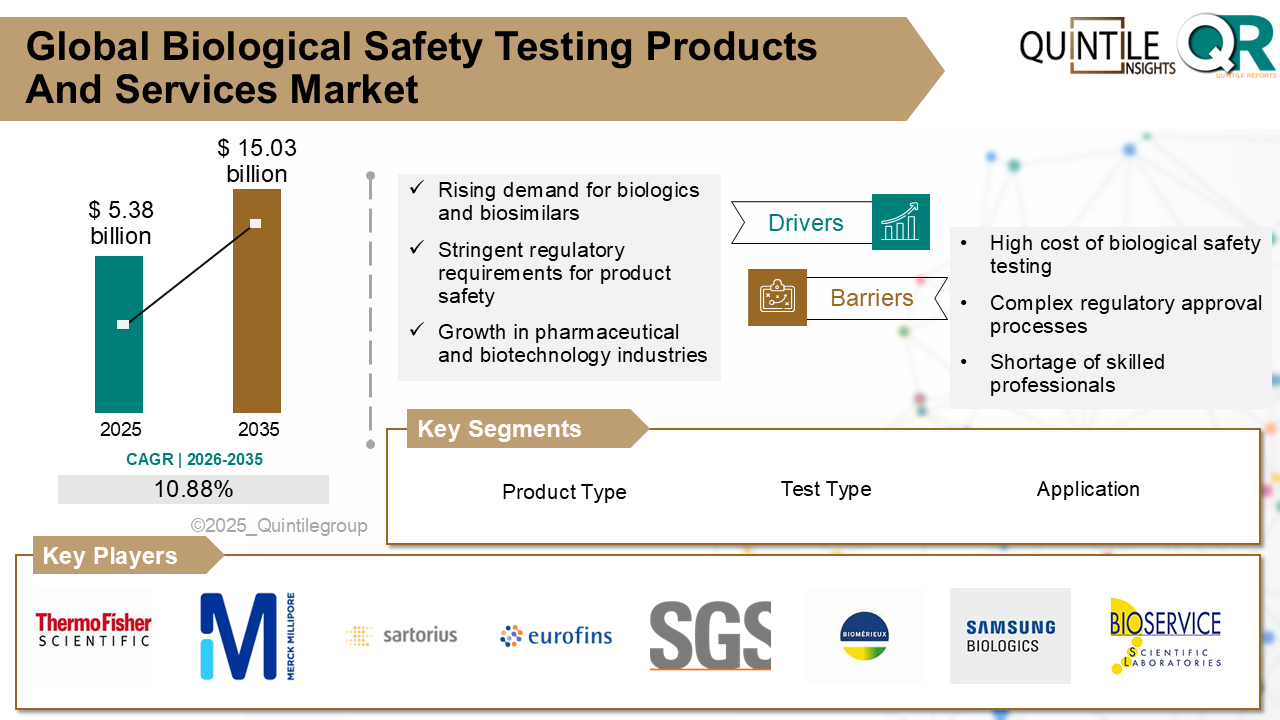

The Global Biological Safety Testing Products and Services Market was estimated at USD 5.38 billion in 2025 and is projected to reach USD 15.03 billion by 2035, growing at a robust CAGR of 10.88% during the forecast period from 2026 to 2035. The Biological Safety Testing Products and Services market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Biological Safety Testing Products and Services market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017 - 2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026 - 2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026 - 2035, enabling stakeholders to evaluate market growth potential over the forecast period.

The biological safety testing products and services market encompasses a comprehensive ecosystem of products, platforms, technologies, and outsourced services used to ensure the safety, purity, potency, and regulatory compliance of biologics, vaccines, cell & gene therapies, and advanced therapeutics.

The market includes critical testing areas such as sterility testing, endotoxin testing, viral clearance, adventitious agent detection, bioburden analysis, cell line authentication, and residual host cell contamination testing. These services are delivered through reagents and kits, analytical instruments, and contract testing services provided by specialized CROs and CDMOs. As biologics now represent over 35% of the global pharmaceutical pipeline, biological safety testing has become a non-negotiable pillar of modern drug development and manufacturing.

The market is expanding rapidly due to regulatory tightening, biologics innovation, and technological transformation.

Despite strong growth, structural and operational challenges persist.

North America: The largest and most advanced market, accounting for over 40% of global revenue. Growth is driven by strict FDA oversight, heavy biologics investment, and rapid adoption of automation and AI-enabled testing.

Europe: A highly regulated but innovation-focused market led by Germany and Switzerland. EMA-driven biosafety standards and strong biosimilar pipelines support sustained demand.

Asia Pacific: The fastest-growing region, expanding at 1012% CAGR. China and India are scaling biologics manufacturing and clinical trials, driving demand for local and outsourced safety testing.

Latin America: Moderate growth led by Brazil and Mexico, supported by improving healthcare infrastructure and export-oriented regulatory alignment.

Middle East & Africa: Early-stage but promising, driven by healthcare modernization, public-private partnerships, and growing awareness of biosafety compliance.

United States:

The U.S. dominates the global biological safety testing market, supported by the worlds largest biopharmaceutical industry and stringent FDA requirements. With 20,000+ active clinical trials and annual biotech R&D spending exceeding USD 100 billion, demand for sterility, viral safety, and genetic testing remains unparalleled. Major investmentssuch as Mercks USD 305 million integrated biosafety and cell banking facilityhighlight the shift toward in-house, high-speed testing models.

Germany:

Germany is Europes biosafety testing powerhouse, benefiting from a strong pharmaceutical base, EMA-aligned regulations, and deep academiaindustry collaboration. The country employs 130,000+ biotech professionals and invests billions annually in life science R&D, accelerating adoption of automated and AI-driven biosafety platforms.

Japan:

Japans biological safety testing market is driven by its aging population, advanced healthcare system, and strong biologics pipeline. With biotech R&D spending exceeding USD 15 billion annually, Japan emphasizes high-throughput, molecular, and precision testing under PMDA oversight, positioning it as a key Asia-Pacific hub.

The biological safety testing market is highly competitive and expertise-driven. Market leaders differentiate through regulatory credibility, testing breadth, turnaround time, and integration depth.

Companies offering end-to-end testing solutionsfrom raw material qualification to final product releasegain a strategic advantage by reducing complexity for biopharma clients. Advanced capabilities in viral clearance, NGS-based adventitious agent detection, and AI-assisted data interpretation are key competitive levers.

Strategic partnerships with CDMOs, expansion into emerging biologics hubs, and continuous investment in automation define leadership positioning. Regulatory expertise is equally critical, as compliance failures can disqualify vendors from high-value biologics programs.

Key players include Charles River Laboratories, Thermo Fisher Scientific Inc., Merck KGaA (MilliporeSigma), Sartorius AG, Eurofins Scientific, SGS SA, bioMrieux, Lonza Group, Samsung Biologics, WuXi AppTec, Promega Corporation, Cytovance Biologics, Toxikon Corporation, Avance Biosciences, BSL Bioservice, and other players.

April 2025: Eurofins expanded its U.S. biosafety footprint with a new ethylene oxide (EtO) sterilization solution, strengthening medical device and biologics safety services.

May 2025: Chengdu Origen Biotechnology and Vanotech advanced VAN-2401 into a multi-center Phase 1 clinical trial in the U.S., underscoring rising biosafety testing demand for next-generation gene therapies.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Biological Safety Testing Products and Services market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Biological Safety Testing Products and Services market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Biological Safety Testing Products and Services market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Biological Safety Testing Products and Services market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Biological Safety Testing Products and Services market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 10.88 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product |

|

| The Segment covered by Application |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Biological Safety Testing Products and Services market share, size, and revenue growth rate were created by Quintile Report™. Biological Safety Testing Products and Services analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Biological Safety Testing Products and Services Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Biological Safety Testing Products and Services Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Biological Safety Testing Products and Services Market, by Region, (USD Million) 2017-2035

Table 21 China Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Biological Safety Testing Products and Services Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Biological Safety Testing Products and Services Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Biological Safety Testing Products and Services Market: market scenario

Fig.4 Global Biological Safety Testing Products and Services Market competitive outlook

Fig.5 Global Biological Safety Testing Products and Services Market driver analysis

Fig.6 Global Biological Safety Testing Products and Services Market restraint analysis

Fig.7 Global Biological Safety Testing Products and Services Market opportunity analysis

Fig.8 Global Biological Safety Testing Products and Services Market trends analysis

Fig.9 Global Biological Safety Testing Products and Services Market: Segment Analysis (Based on the scope)

Fig.10 Global Biological Safety Testing Products and Services Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Biological Safety Testing Products and Services Market was estimated at USD 5.38 billion in 2025 and is projected to reach USD 15.03 billion by 2035, growing at a robust CAGR of 10.88% during the forecast period from 2026 to 2035. The Biological Safety Testing Products and Services market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Biological Safety Testing Products and Services market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017 - 2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026 - 2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026 - 2035, enabling stakeholders to evaluate market growth potential over the forecast period.

The biological safety testing products and services market encompasses a comprehensive ecosystem of products, platforms, technologies, and outsourced services used to ensure the safety, purity, potency, and regulatory compliance of biologics, vaccines, cell & gene therapies, and advanced therapeutics.

The market includes critical testing areas such as sterility testing, endotoxin testing, viral clearance, adventitious agent detection, bioburden analysis, cell line authentication, and residual host cell contamination testing. These services are delivered through reagents and kits, analytical instruments, and contract testing services provided by specialized CROs and CDMOs. As biologics now represent over 35% of the global pharmaceutical pipeline, biological safety testing has become a non-negotiable pillar of modern drug development and manufacturing.

The market is expanding rapidly due to regulatory tightening, biologics innovation, and technological transformation.

Despite strong growth, structural and operational challenges persist.

North America: The largest and most advanced market, accounting for over 40% of global revenue. Growth is driven by strict FDA oversight, heavy biologics investment, and rapid adoption of automation and AI-enabled testing.

Europe: A highly regulated but innovation-focused market led by Germany and Switzerland. EMA-driven biosafety standards and strong biosimilar pipelines support sustained demand.

Asia Pacific: The fastest-growing region, expanding at 1012% CAGR. China and India are scaling biologics manufacturing and clinical trials, driving demand for local and outsourced safety testing.

Latin America: Moderate growth led by Brazil and Mexico, supported by improving healthcare infrastructure and export-oriented regulatory alignment.

Middle East & Africa: Early-stage but promising, driven by healthcare modernization, public-private partnerships, and growing awareness of biosafety compliance.

United States:

The U.S. dominates the global biological safety testing market, supported by the worlds largest biopharmaceutical industry and stringent FDA requirements. With 20,000+ active clinical trials and annual biotech R&D spending exceeding USD 100 billion, demand for sterility, viral safety, and genetic testing remains unparalleled. Major investmentssuch as Mercks USD 305 million integrated biosafety and cell banking facilityhighlight the shift toward in-house, high-speed testing models.

Germany:

Germany is Europes biosafety testing powerhouse, benefiting from a strong pharmaceutical base, EMA-aligned regulations, and deep academiaindustry collaboration. The country employs 130,000+ biotech professionals and invests billions annually in life science R&D, accelerating adoption of automated and AI-driven biosafety platforms.

Japan:

Japans biological safety testing market is driven by its aging population, advanced healthcare system, and strong biologics pipeline. With biotech R&D spending exceeding USD 15 billion annually, Japan emphasizes high-throughput, molecular, and precision testing under PMDA oversight, positioning it as a key Asia-Pacific hub.

The biological safety testing market is highly competitive and expertise-driven. Market leaders differentiate through regulatory credibility, testing breadth, turnaround time, and integration depth.

Companies offering end-to-end testing solutionsfrom raw material qualification to final product releasegain a strategic advantage by reducing complexity for biopharma clients. Advanced capabilities in viral clearance, NGS-based adventitious agent detection, and AI-assisted data interpretation are key competitive levers.

Strategic partnerships with CDMOs, expansion into emerging biologics hubs, and continuous investment in automation define leadership positioning. Regulatory expertise is equally critical, as compliance failures can disqualify vendors from high-value biologics programs.

Key players include Charles River Laboratories, Thermo Fisher Scientific Inc., Merck KGaA (MilliporeSigma), Sartorius AG, Eurofins Scientific, SGS SA, bioMrieux, Lonza Group, Samsung Biologics, WuXi AppTec, Promega Corporation, Cytovance Biologics, Toxikon Corporation, Avance Biosciences, BSL Bioservice, and other players.

April 2025: Eurofins expanded its U.S. biosafety footprint with a new ethylene oxide (EtO) sterilization solution, strengthening medical device and biologics safety services.

May 2025: Chengdu Origen Biotechnology and Vanotech advanced VAN-2401 into a multi-center Phase 1 clinical trial in the U.S., underscoring rising biosafety testing demand for next-generation gene therapies.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Biological Safety Testing Products and Services market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Biological Safety Testing Products and Services market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Biological Safety Testing Products and Services market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Biological Safety Testing Products and Services market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Biological Safety Testing Products and Services market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 10.88 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product |

|

| The Segment covered by Application |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Biological Safety Testing Products and Services market share, size, and revenue growth rate were created by Quintile Report™. Biological Safety Testing Products and Services analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Biological Safety Testing Products and Services Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Biological Safety Testing Products and Services Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Biological Safety Testing Products and Services Market, by Region, (USD Million) 2017-2035

Table 21 China Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Biological Safety Testing Products and Services Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Biological Safety Testing Products and Services Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Biological Safety Testing Products and Services Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Biological Safety Testing Products and Services Market: market scenario

Fig.4 Global Biological Safety Testing Products and Services Market competitive outlook

Fig.5 Global Biological Safety Testing Products and Services Market driver analysis

Fig.6 Global Biological Safety Testing Products and Services Market restraint analysis

Fig.7 Global Biological Safety Testing Products and Services Market opportunity analysis

Fig.8 Global Biological Safety Testing Products and Services Market trends analysis

Fig.9 Global Biological Safety Testing Products and Services Market: Segment Analysis (Based on the scope)

Fig.10 Global Biological Safety Testing Products and Services Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Minimal Residual Disease Testing Market Report SummaryThe Global Minimal Residual Disease Testing Ma

Read MoreReport Descriptions: The Global Companion Animal Diagnostics Market was estimated at USD 6.95 billio

Read MoreReport Descriptions: The Global Cryoablation Probe Market was estimated at USD 216.09 million in 202

Read More