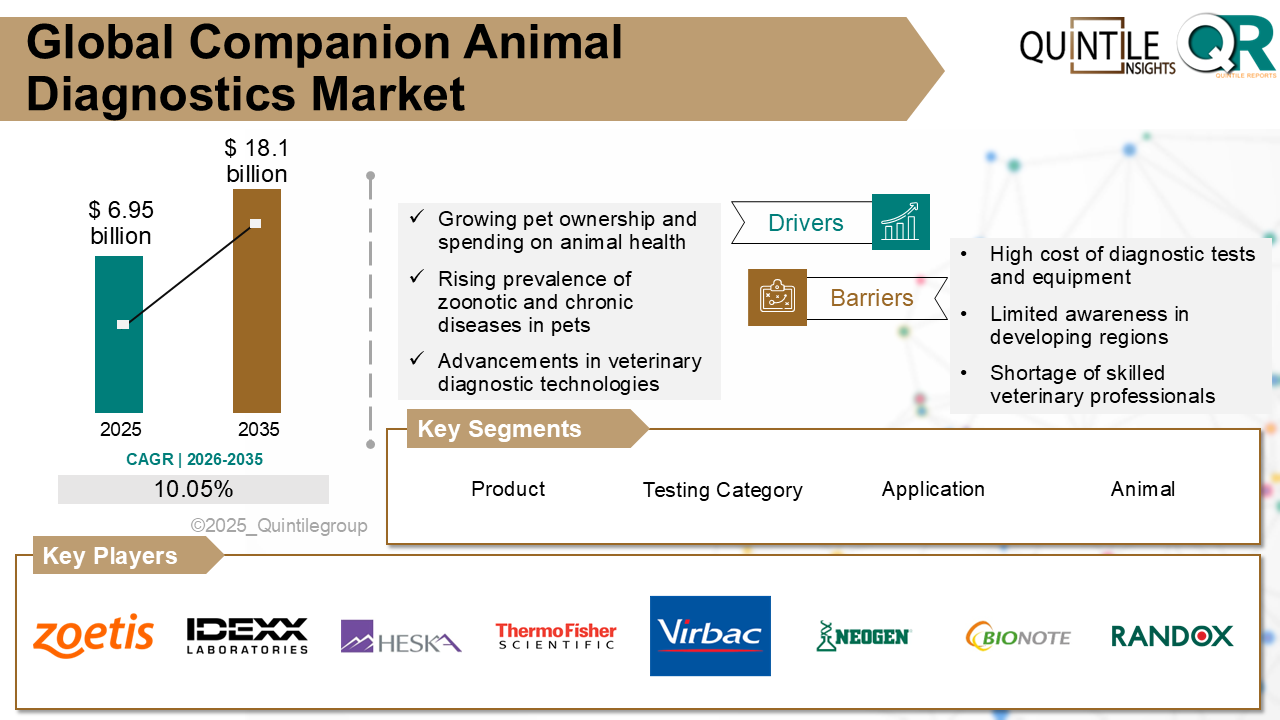

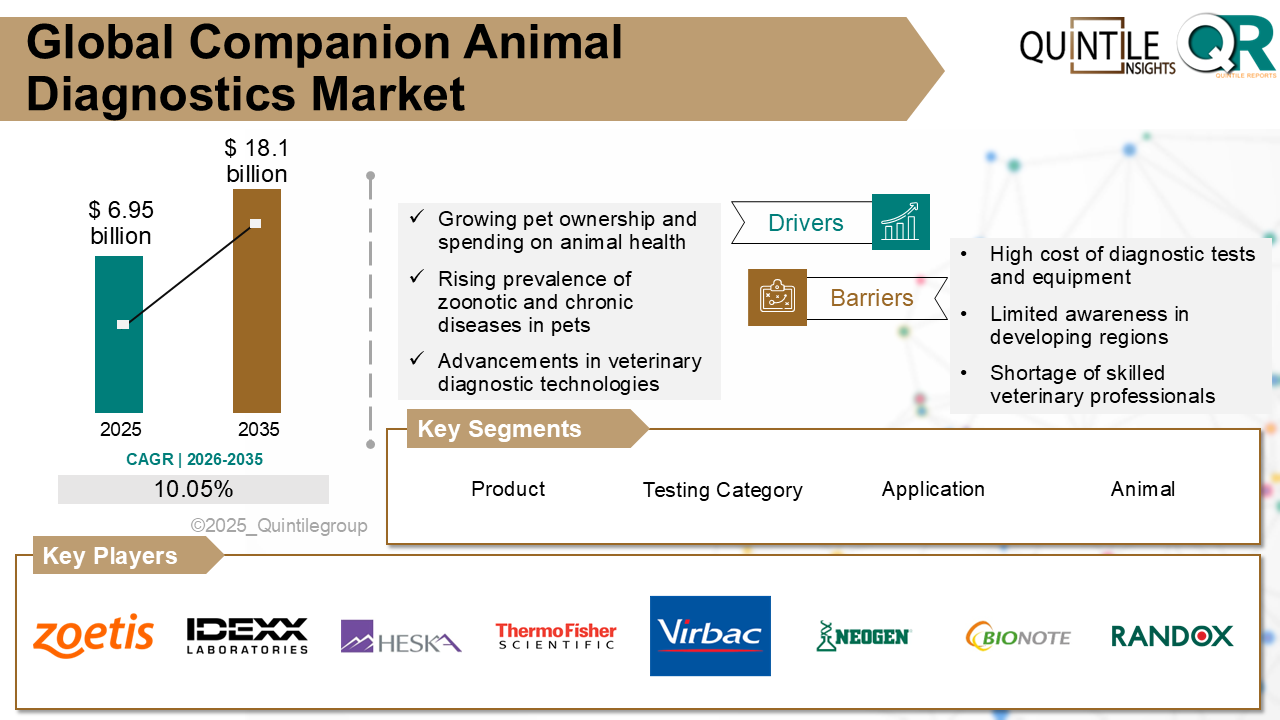

The Global Companion Animal Diagnostics Market was estimated at USD 6.95 billion in 2025 and is projected to reach USD 18.1 billion by 2035, growing at a robust CAGR of 10.05% during the forecast period from 2026 to 2035. The Companion Animal Diagnostics market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Companion Animal Diagnostics market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017 - 2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026 - 2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026 - 2035, enabling stakeholders to evaluate market growth potential over the forecast period.

The companion animal diagnostics market comprises diagnostic instruments, consumables, reagents, software, and services used to detect, monitor, and manage diseases in companion animals such as dogs, cats, horses, and exotic pets. Diagnostic modalities span clinical chemistry, hematology, immunodiagnostics, molecular diagnostics (PCR, NGS), urinalysis, imaging (X-ray, ultrasound, CT, MRI), and point-of-care (POC) testing.

This market is emphasized on the total revenue generated by manufacturers and diagnostic service providers supplying veterinary clinics, animal hospitals, reference laboratories, and research institutions. As pets increasingly receive human-equivalent healthcare, diagnostics have become a core pillar of modern veterinary medicinesupporting early disease detection, chronic disease management, preventive screening, and personalized treatment pathways.

The market is driven by a powerful combination of demographic, technological, and economic shifts within global pet healthcare.

Despite strong growth fundamentals, structural and economic barriers persist.

North America: The largest and most advanced market, driven by high pet ownership, strong insurance coverage, and rapid adoption of AI-enabled and point-of-care diagnostics. IDEXX and Zoetis dominate with continuous innovation.

Europe: Growth is supported by preventive care awareness, robust animal welfare regulations, and expanding molecular and genetic testingespecially in Germany, the UK, and France.

Asia Pacific: The fastest-growing region, with pet ownership rising at double-digit rates in China and India. Increased investment in veterinary infrastructure and affordable diagnostics is expanding access.

Latin America: Steady growth led by Brazil and Mexico, where clinics are upgrading to biochemistry analyzers, imaging tools, and infectious disease screening platforms.

Middle East & Africa: An emerging market driven by premium veterinary services in GCC countries and growing demand for mobile, AI-enabled, and molecular diagnostics.

United States:

The U.S. accounts for the largest share of global companion animal diagnostics revenue. Approximately 70% of U.S. households (87 million homes) own at least one pet. Chronic disease incidence and preventive wellness programs are driving widespread adoption of point-of-care analyzers, PCR testing, and AI-driven imaging. Companies like IDEXX and Zoetis continue to expand in-clinic diagnostics, with cancer screening emerging as a high-growth segment.

Germany:

Germanys market is shaped by preventive healthcare culture and rising pet insurance coverage. Dog and cat ownership increased from 40% to 46% of households between 2017 and 2024, significantly boosting routine diagnostic demand. Clinics increasingly adopt molecular diagnostics, wellness panels, and digital health tools, reinforcing Germanys role as a leading EU diagnostics market.

Japan:

Japans diagnostics market is driven by aging pets and a deep emotional bond between owners and animals. With nearly 19 million dogs and cats, pets outnumber children under 15. High adoption of AI-enabled health monitoring apps and precision diagnostics supports early disease detection and longevity-focused care.

The companion animal diagnostics market is highly competitive, with differentiation driven by technology, speed, accuracy, and ecosystem integration. Market leaders invest heavily in molecular diagnostics, AI-assisted imaging, and cloud-based data platforms.

Point-of-care diagnostics are a major battleground, as clinics demand fast results, minimal sample volumes, and ease of use. Companies bundling analyzers with consumables, software, and decision-support tools gain long-term customer loyalty.

Price sensitivity remains important in emerging markets, favoring companies offering cost-effective multi-analyte panels and modular diagnostic systems. Regional players compete by tailoring solutions to local disease profiles and breed-specific needs.

Service-based differentiation is increasing. Leading firms now offer digital records, tele-diagnostics, AI interpretation, and remote monitoringtransforming diagnostics into a recurring, data-driven service model.

Key players include IDEXX Laboratories, Zoetis Inc., Heska Corporation, Thermo Fisher Scientific Inc., Virbac, Neogen Corporation, BioNote Inc., Randox Laboratories, Abaxis (Zoetis), Mars Petcare (Antech Diagnostics), bioMrieux SA, Scil Animal Care Company GmbH, Fujifilm Corporation, QIAGEN N.V., and other players.

July 2024: Mars acquired Cerba Healthcares stake in Cerba Vet and ANTAGENE, strengthening its companion animal diagnostics portfolio.

January 2024: Zoetis expanded its Vetscan Imagyst platform with AI-powered urine sediment analysis, enhancing in-clinic diagnostic precision.

May 2024: Zoetis launched the Vetscan OptiCell analyzer, an AI-driven cartridge-based hematology system for advanced in-clinic CBC testing.

February 2025: IDEXX shares rose ~10% following strong demand for companion animal testing products, including a late-stage canine lymphoma Cancer Dx screening test.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Companion Animal Diagnostics market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Companion Animal Diagnostics market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Companion Animal Diagnostics market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Companion Animal Diagnostics market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Companion Animal Diagnostics market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 10.05 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product Type |

|

| The Segment covered by Imaging & Modality |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Companion Animal Diagnostics market share, size, and revenue growth rate were created by Quintile Report™. Companion Animal Diagnostics analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Companion Animal Diagnostics Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Companion Animal Diagnostics Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Companion Animal Diagnostics Market, by Region, (USD Million) 2017-2035

Table 21 China Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Companion Animal Diagnostics Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Companion Animal Diagnostics Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Companion Animal Diagnostics Market: market scenario

Fig.4 Global Companion Animal Diagnostics Market competitive outlook

Fig.5 Global Companion Animal Diagnostics Market driver analysis

Fig.6 Global Companion Animal Diagnostics Market restraint analysis

Fig.7 Global Companion Animal Diagnostics Market opportunity analysis

Fig.8 Global Companion Animal Diagnostics Market trends analysis

Fig.9 Global Companion Animal Diagnostics Market: Segment Analysis (Based on the scope)

Fig.10 Global Companion Animal Diagnostics Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Companion Animal Diagnostics Market was estimated at USD 6.95 billion in 2025 and is projected to reach USD 18.1 billion by 2035, growing at a robust CAGR of 10.05% during the forecast period from 2026 to 2035. The Companion Animal Diagnostics market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Companion Animal Diagnostics market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017 - 2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026 - 2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026 - 2035, enabling stakeholders to evaluate market growth potential over the forecast period.

The companion animal diagnostics market comprises diagnostic instruments, consumables, reagents, software, and services used to detect, monitor, and manage diseases in companion animals such as dogs, cats, horses, and exotic pets. Diagnostic modalities span clinical chemistry, hematology, immunodiagnostics, molecular diagnostics (PCR, NGS), urinalysis, imaging (X-ray, ultrasound, CT, MRI), and point-of-care (POC) testing.

This market is emphasized on the total revenue generated by manufacturers and diagnostic service providers supplying veterinary clinics, animal hospitals, reference laboratories, and research institutions. As pets increasingly receive human-equivalent healthcare, diagnostics have become a core pillar of modern veterinary medicinesupporting early disease detection, chronic disease management, preventive screening, and personalized treatment pathways.

The market is driven by a powerful combination of demographic, technological, and economic shifts within global pet healthcare.

Despite strong growth fundamentals, structural and economic barriers persist.

North America: The largest and most advanced market, driven by high pet ownership, strong insurance coverage, and rapid adoption of AI-enabled and point-of-care diagnostics. IDEXX and Zoetis dominate with continuous innovation.

Europe: Growth is supported by preventive care awareness, robust animal welfare regulations, and expanding molecular and genetic testingespecially in Germany, the UK, and France.

Asia Pacific: The fastest-growing region, with pet ownership rising at double-digit rates in China and India. Increased investment in veterinary infrastructure and affordable diagnostics is expanding access.

Latin America: Steady growth led by Brazil and Mexico, where clinics are upgrading to biochemistry analyzers, imaging tools, and infectious disease screening platforms.

Middle East & Africa: An emerging market driven by premium veterinary services in GCC countries and growing demand for mobile, AI-enabled, and molecular diagnostics.

United States:

The U.S. accounts for the largest share of global companion animal diagnostics revenue. Approximately 70% of U.S. households (87 million homes) own at least one pet. Chronic disease incidence and preventive wellness programs are driving widespread adoption of point-of-care analyzers, PCR testing, and AI-driven imaging. Companies like IDEXX and Zoetis continue to expand in-clinic diagnostics, with cancer screening emerging as a high-growth segment.

Germany:

Germanys market is shaped by preventive healthcare culture and rising pet insurance coverage. Dog and cat ownership increased from 40% to 46% of households between 2017 and 2024, significantly boosting routine diagnostic demand. Clinics increasingly adopt molecular diagnostics, wellness panels, and digital health tools, reinforcing Germanys role as a leading EU diagnostics market.

Japan:

Japans diagnostics market is driven by aging pets and a deep emotional bond between owners and animals. With nearly 19 million dogs and cats, pets outnumber children under 15. High adoption of AI-enabled health monitoring apps and precision diagnostics supports early disease detection and longevity-focused care.

The companion animal diagnostics market is highly competitive, with differentiation driven by technology, speed, accuracy, and ecosystem integration. Market leaders invest heavily in molecular diagnostics, AI-assisted imaging, and cloud-based data platforms.

Point-of-care diagnostics are a major battleground, as clinics demand fast results, minimal sample volumes, and ease of use. Companies bundling analyzers with consumables, software, and decision-support tools gain long-term customer loyalty.

Price sensitivity remains important in emerging markets, favoring companies offering cost-effective multi-analyte panels and modular diagnostic systems. Regional players compete by tailoring solutions to local disease profiles and breed-specific needs.

Service-based differentiation is increasing. Leading firms now offer digital records, tele-diagnostics, AI interpretation, and remote monitoringtransforming diagnostics into a recurring, data-driven service model.

Key players include IDEXX Laboratories, Zoetis Inc., Heska Corporation, Thermo Fisher Scientific Inc., Virbac, Neogen Corporation, BioNote Inc., Randox Laboratories, Abaxis (Zoetis), Mars Petcare (Antech Diagnostics), bioMrieux SA, Scil Animal Care Company GmbH, Fujifilm Corporation, QIAGEN N.V., and other players.

July 2024: Mars acquired Cerba Healthcares stake in Cerba Vet and ANTAGENE, strengthening its companion animal diagnostics portfolio.

January 2024: Zoetis expanded its Vetscan Imagyst platform with AI-powered urine sediment analysis, enhancing in-clinic diagnostic precision.

May 2024: Zoetis launched the Vetscan OptiCell analyzer, an AI-driven cartridge-based hematology system for advanced in-clinic CBC testing.

February 2025: IDEXX shares rose ~10% following strong demand for companion animal testing products, including a late-stage canine lymphoma Cancer Dx screening test.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Companion Animal Diagnostics market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Companion Animal Diagnostics market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Companion Animal Diagnostics market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Companion Animal Diagnostics market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Companion Animal Diagnostics market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 10.05 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product Type |

|

| The Segment covered by Imaging & Modality |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Companion Animal Diagnostics market share, size, and revenue growth rate were created by Quintile Report™. Companion Animal Diagnostics analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Companion Animal Diagnostics Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Companion Animal Diagnostics Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Companion Animal Diagnostics Market, by Region, (USD Million) 2017-2035

Table 21 China Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Companion Animal Diagnostics Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Companion Animal Diagnostics Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Companion Animal Diagnostics Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Companion Animal Diagnostics Market: market scenario

Fig.4 Global Companion Animal Diagnostics Market competitive outlook

Fig.5 Global Companion Animal Diagnostics Market driver analysis

Fig.6 Global Companion Animal Diagnostics Market restraint analysis

Fig.7 Global Companion Animal Diagnostics Market opportunity analysis

Fig.8 Global Companion Animal Diagnostics Market trends analysis

Fig.9 Global Companion Animal Diagnostics Market: Segment Analysis (Based on the scope)

Fig.10 Global Companion Animal Diagnostics Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy