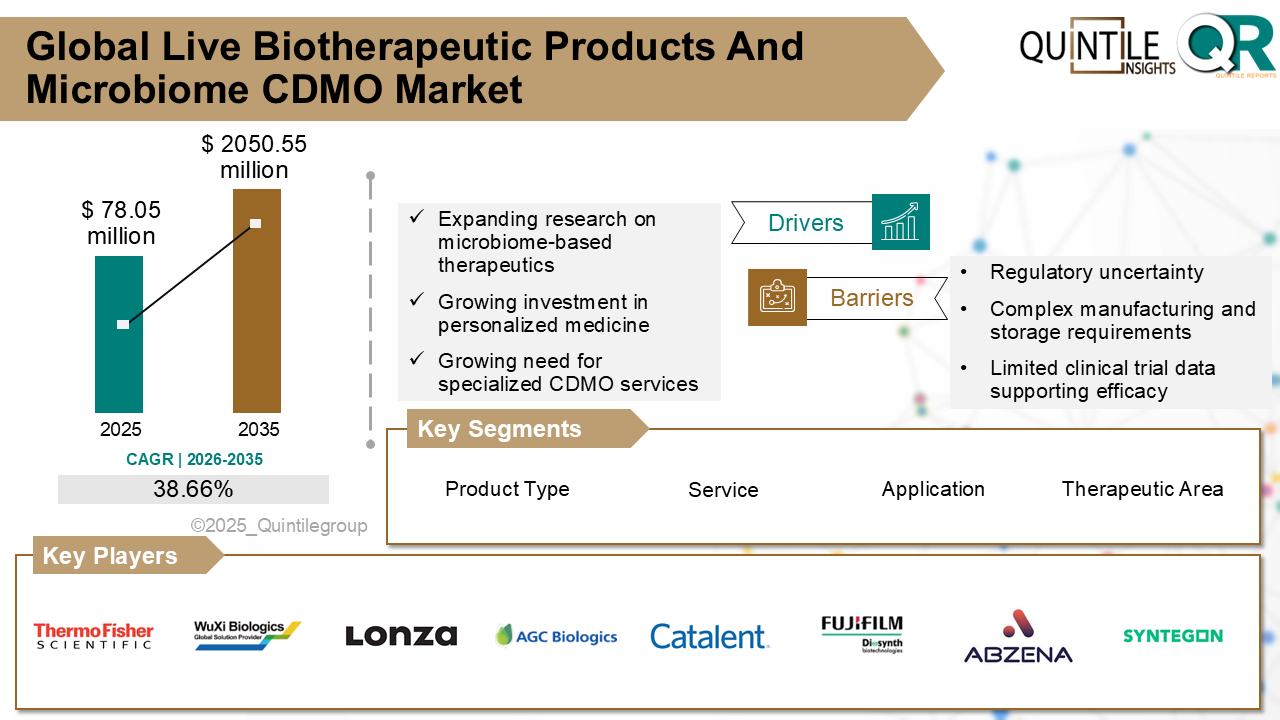

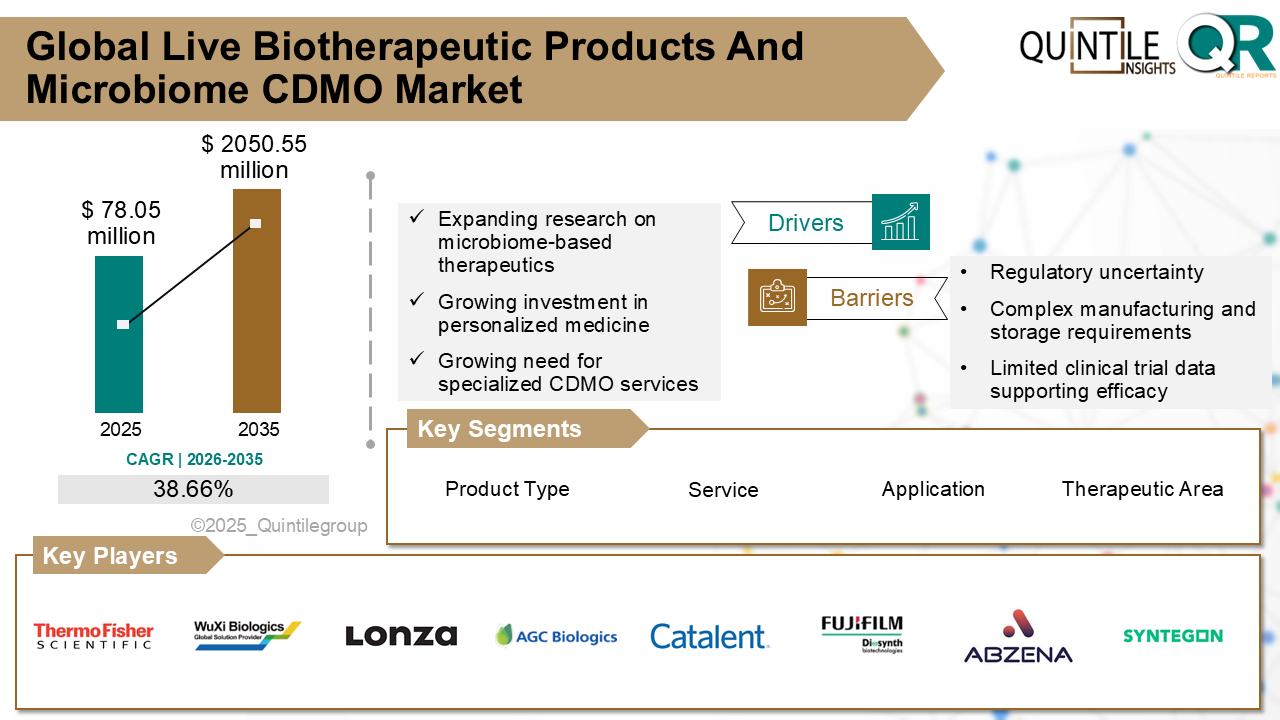

The Global Live Biotherapeutic Products And Microbiome CDMO Market was estimated at USD 78.05 million in 2026 and is projected to reach USD 2050.55 million by 2035, reflecting a robust CAGR of 38.66% over the forecast period from 2026 to 2035. The Live Biotherapeutic Products And Microbiome CDMO market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Live Biotherapeutic Products And Microbiome CDMO market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Live Biotherapeutic Products And Microbiome CDMO market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Key trends influencing the Live Biotherapeutic Products And Microbiome CDMO market include the rapid adoption of digital technologies, the integration of sustainable practices, and the increasing importance of customer experience. These trends are not only driving growth but also creating new challenges for industry participants, who must adapt their GTM strategies to navigate regulatory changes, supply chain disruptions, and fluctuating economic conditions. Despite these challenges, the Live Biotherapeutic Products And Microbiome CDMO market is poised for sustained growth, with emerging markets playing a critical role in the expansion of the industry.

Looking ahead, the Live Biotherapeutic Products And Microbiome CDMO market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Live Biotherapeutic Products And Microbiome CDMO market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period.

The live biotherapeutic products and microbiome CDMO market refers to the development, manufacturing, and outsourcing services for therapies that are based on live microorganisms. These products, known as Live Biotherapeutic Products (LBPs), are designed for disease treatment or prevention and are different from probiotics, as they are not categorized as food or supplements.

The market supports pharmaceutical and biotech companies through research, clinical trials, process development, and GMP manufacturing. Contract Development and Manufacturing Organizations (CDMOs) play a key role by offering expertise in handling live, anaerobic, and strictly regulated organisms. This market is growing as the role of the human microbiome becomes more central to the treatment of gastrointestinal, immune, neurological, and metabolic diseases.

What are the drivers of live biotherapeutic products and microbiome CDMO marketThe rising incidence of chronic diseases such as inflammatory bowel disease (IBD), diabetes, colorectal cancer, and obesity is progressing rapidly across the world. Approximately 2 million people worldwide are affected by colorectal cancer (CRC). As a result, this increases the demand for therapies targeting the gut microbiome, as chronically diseased patients are now understood to have microbial imbalance in the gut.

Pharma and biotech companies are increasing investments in microbiome-based drug development. Most of these firms rely on CDMOs for support in scaling live microbial production and ensuring safety, sterility, and consistency.

Easier regulatory pathways, including fast-track and orphan designations in the U.S. and EU, are speeding up clinical development. Regulatory agencies are releasing clearer guidance specific to live biotherapeutics.

Private funding and large pharma collaborations with microbiome startups are growing. This fuels the pipeline of live microbial candidates and increases the need for qualified manufacturing partners.

Demand is also rising for targeted, non-systemic therapies with fewer side effects. LBPs fit this demand by offering localized effects within the body using native or engineered bacteria.

What are the challenges and restraining factors of live biotherapeutic products and microbiome CDMO marketThe number of approved live biotherapeutic products is still very low. Most candidates remain in preclinical or early clinical stages, which limits commercial demand in the near term.

Manufacturing LBPs is complex. It requires keeping live bacteria viable while ensuring consistent quality. Anaerobic species add further difficulty, as they cannot be exposed to oxygen during processing.

GMP facilities for LBPs are scarce. Only a few CDMOs offer the cleanroom design, containment controls, and validation processes needed for these live organisms.

Regulatory standards for LBPs are still evolving. Different countries apply varying expectations, making global development and approval harder.

There is a shortage of experienced staff. Expertise in anaerobic fermentation, cell banking, and QC testing for live microbes is limited and in high demand.

What are the regional trends of live biotherapeutic products and microbiome CDMO marketNorth America holds the largest market share. The U.S. leads with advanced CDMO infrastructure, a large base of microbiome biotech startups, and FDA guidance specific to LBPs. Canada is also growing its presence in microbial manufacturing.

Europe is advancing with coordinated efforts to support microbiome drug development. The EU has issued early regulatory frameworks for LBPs. Countries like France, Belgium, and the U.K. are investing in microbiome clusters and clinical trial capacity.

Asia Pacific is expanding with government support for biotech R&D and domestic CDMO growth. Japan and South Korea are developing national microbiome research platforms, and CDMOs are upgrading for anaerobic and live microbial handling.

Latin America is at an early stage. Brazil and Argentina are expanding their biotech sectors, with growing interest in local production capabilities for next-generation therapies.

Middle East & Africa have limited market activity but growing scientific interest. Universities and health systems in the UAE and South Africa are conducting small-scale microbiome research.

Country-Wise Outlook:The U.S. is the largest market for live biotherapeutics and microbiome CDMO services. Over half of global microbiome startups are U.S.-based, supported by top academic institutions like Harvard, MIT, and Stanford. Research funded by the Human Microbiome Project and venture capital contributes significantly to the microbiome pipeline.

Several CDMOs operate GMP-compliant suites for live organisms, including anaerobic fermentation. The FDAs guidance on LBPs has improved regulatory clarity. Companies benefit from accelerated clinical trial programs and orphan drug designations. Demand for CDMOs is increasing, especially from early-stage firms needing help with process development, fill-finish, and scale-up.

Germany builds microbiome capacity through CDMO upgrades and public-private research hubs:Germany is one of Europes leading countries in microbiome drug development, supported by a well-developed pharmaceutical industry and public health research institutions. Major biotech clusters in Berlin, Munich, and Heidelberg are involved in gut microbiome research and clinical trials.

The German CDMO landscape is supported by strong government and EU funding initiatives, including the High-Tech Strategy 2025, which aims at sustainable development for society. Collaborations between CDMOs, university hospitals, and biotech firms are helping move live biotherapeutics from lab to clinic. Germanys regulatory framework and experience with biologics production make it a strong player in the EUs microbiome manufacturing landscape.

Japan strengthens biomanufacturing through local CDMO investments and microbiome research:Japan is expanding its role in the microbiome field through academic-industry partnerships and national health initiatives. The country focuses on aging-related diseases, brain-gut health, and metabolic disorders where LBPs show promise.

Local CDMOs are upgrading their facilities to meet LBP production standards. Japans Pharmaceuticals and Medical Devices Agency (PMDA) monitors clinical trial applications for live biotherapeutics, creating a pathway for local development and manufacturing. Research institutions are actively mapping regional microbiomes to inform product design.

Competitive Analysis:The microbiome CDMO segment is still young but growing fast. Only a few service providers offer full support for live biotherapeutics, including strain isolation, anaerobic fermentation, downstream purification, fill-finish, and stability testing.

Top CDMOs are adding capacity through modular GMP suites designed for live organism handling. Cleanroom design, segregated airflow, and oxygen-free environments are critical. CDMOs that can meet these standards while scaling quickly are gaining more contracts.

Smaller CDMOs are forming partnerships with early-stage microbiome companies, helping them navigate early testing, IND submission, and small-batch supply. Global CDMOs are expanding through acquisitions and joint ventures to offer microbiome services.

The key competitive edge is the ability to ensure viability and purity of the organisms through clinical and commercial production. CDMOs with strong quality systems, regulatory experience, and flexibility in working with novel strains are better positioned to serve this market.

Key players in the market include: Lonza, Catalent, WuXi Biologics, Samsung Biologics, Fujifilm Diosynth Biotechnologies, Thermo Fisher Scientific, Patheon, AMRI, Recipharm, BioVectra, Charles River Laboratories, AGC Biologics, Abzena, Syntegon, BioNTech Manufacturing GmbH, and others.

Recent Development:In October 2023, Gilead Sciences, Inc. and Assembly Biosciences, Inc. announced a 12-year collaboration to foster research and develop antiviral therapeutics with an initial focus on herpesviruses, hepatitis B virus (HBV), and hepatitis D virus (HDV).

In January 2025, AGC Biologics site in Milan will begin lentiviral vector commercial manufacturing for Adaptimmunes Lete-Cel product, a therapy advancing the field of solid tumor cancers with cell therapy.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Live Biotherapeutic Products And Microbiome CDMO market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Live Biotherapeutic Products And Microbiome CDMO market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Live Biotherapeutic Products And Microbiome CDMO market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Live Biotherapeutic Products And Microbiome CDMO market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Live Biotherapeutic Products And Microbiome CDMO market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 38.66 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product |

|

| The Segment covered by Service |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Live Biotherapeutic Products And Microbiome CDMO market share, size, and revenue growth rate were created by Quintile Report™. Live Biotherapeutic Products And Microbiome CDMO analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Live Biotherapeutic Products And Microbiome CDMO Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Live Biotherapeutic Products And Microbiome CDMO Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Live Biotherapeutic Products And Microbiome CDMO Market, by Region, (USD Million) 2017-2035

Table 21 China Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Live Biotherapeutic Products And Microbiome CDMO Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Live Biotherapeutic Products And Microbiome CDMO Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Live Biotherapeutic Products And Microbiome CDMO Market: market scenario

Fig.4 Global Live Biotherapeutic Products And Microbiome CDMO Market competitive outlook

Fig.5 Global Live Biotherapeutic Products And Microbiome CDMO Market driver analysis

Fig.6 Global Live Biotherapeutic Products And Microbiome CDMO Market restraint analysis

Fig.7 Global Live Biotherapeutic Products And Microbiome CDMO Market opportunity analysis

Fig.8 Global Live Biotherapeutic Products And Microbiome CDMO Market trends analysis

Fig.9 Global Live Biotherapeutic Products And Microbiome CDMO Market: Segment Analysis (Based on the scope)

Fig.10 Global Live Biotherapeutic Products And Microbiome CDMO Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Live Biotherapeutic Products And Microbiome CDMO Market was estimated at USD 78.05 million in 2026 and is projected to reach USD 2050.55 million by 2035, reflecting a robust CAGR of 38.66% over the forecast period from 2026 to 2035. The Live Biotherapeutic Products And Microbiome CDMO market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Live Biotherapeutic Products And Microbiome CDMO market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Live Biotherapeutic Products And Microbiome CDMO market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Key trends influencing the Live Biotherapeutic Products And Microbiome CDMO market include the rapid adoption of digital technologies, the integration of sustainable practices, and the increasing importance of customer experience. These trends are not only driving growth but also creating new challenges for industry participants, who must adapt their GTM strategies to navigate regulatory changes, supply chain disruptions, and fluctuating economic conditions. Despite these challenges, the Live Biotherapeutic Products And Microbiome CDMO market is poised for sustained growth, with emerging markets playing a critical role in the expansion of the industry.

Looking ahead, the Live Biotherapeutic Products And Microbiome CDMO market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Live Biotherapeutic Products And Microbiome CDMO market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period.

The live biotherapeutic products and microbiome CDMO market refers to the development, manufacturing, and outsourcing services for therapies that are based on live microorganisms. These products, known as Live Biotherapeutic Products (LBPs), are designed for disease treatment or prevention and are different from probiotics, as they are not categorized as food or supplements.

The market supports pharmaceutical and biotech companies through research, clinical trials, process development, and GMP manufacturing. Contract Development and Manufacturing Organizations (CDMOs) play a key role by offering expertise in handling live, anaerobic, and strictly regulated organisms. This market is growing as the role of the human microbiome becomes more central to the treatment of gastrointestinal, immune, neurological, and metabolic diseases.

What are the drivers of live biotherapeutic products and microbiome CDMO marketThe rising incidence of chronic diseases such as inflammatory bowel disease (IBD), diabetes, colorectal cancer, and obesity is progressing rapidly across the world. Approximately 2 million people worldwide are affected by colorectal cancer (CRC). As a result, this increases the demand for therapies targeting the gut microbiome, as chronically diseased patients are now understood to have microbial imbalance in the gut.

Pharma and biotech companies are increasing investments in microbiome-based drug development. Most of these firms rely on CDMOs for support in scaling live microbial production and ensuring safety, sterility, and consistency.

Easier regulatory pathways, including fast-track and orphan designations in the U.S. and EU, are speeding up clinical development. Regulatory agencies are releasing clearer guidance specific to live biotherapeutics.

Private funding and large pharma collaborations with microbiome startups are growing. This fuels the pipeline of live microbial candidates and increases the need for qualified manufacturing partners.

Demand is also rising for targeted, non-systemic therapies with fewer side effects. LBPs fit this demand by offering localized effects within the body using native or engineered bacteria.

What are the challenges and restraining factors of live biotherapeutic products and microbiome CDMO marketThe number of approved live biotherapeutic products is still very low. Most candidates remain in preclinical or early clinical stages, which limits commercial demand in the near term.

Manufacturing LBPs is complex. It requires keeping live bacteria viable while ensuring consistent quality. Anaerobic species add further difficulty, as they cannot be exposed to oxygen during processing.

GMP facilities for LBPs are scarce. Only a few CDMOs offer the cleanroom design, containment controls, and validation processes needed for these live organisms.

Regulatory standards for LBPs are still evolving. Different countries apply varying expectations, making global development and approval harder.

There is a shortage of experienced staff. Expertise in anaerobic fermentation, cell banking, and QC testing for live microbes is limited and in high demand.

What are the regional trends of live biotherapeutic products and microbiome CDMO marketNorth America holds the largest market share. The U.S. leads with advanced CDMO infrastructure, a large base of microbiome biotech startups, and FDA guidance specific to LBPs. Canada is also growing its presence in microbial manufacturing.

Europe is advancing with coordinated efforts to support microbiome drug development. The EU has issued early regulatory frameworks for LBPs. Countries like France, Belgium, and the U.K. are investing in microbiome clusters and clinical trial capacity.

Asia Pacific is expanding with government support for biotech R&D and domestic CDMO growth. Japan and South Korea are developing national microbiome research platforms, and CDMOs are upgrading for anaerobic and live microbial handling.

Latin America is at an early stage. Brazil and Argentina are expanding their biotech sectors, with growing interest in local production capabilities for next-generation therapies.

Middle East & Africa have limited market activity but growing scientific interest. Universities and health systems in the UAE and South Africa are conducting small-scale microbiome research.

Country-Wise Outlook:The U.S. is the largest market for live biotherapeutics and microbiome CDMO services. Over half of global microbiome startups are U.S.-based, supported by top academic institutions like Harvard, MIT, and Stanford. Research funded by the Human Microbiome Project and venture capital contributes significantly to the microbiome pipeline.

Several CDMOs operate GMP-compliant suites for live organisms, including anaerobic fermentation. The FDAs guidance on LBPs has improved regulatory clarity. Companies benefit from accelerated clinical trial programs and orphan drug designations. Demand for CDMOs is increasing, especially from early-stage firms needing help with process development, fill-finish, and scale-up.

Germany builds microbiome capacity through CDMO upgrades and public-private research hubs:Germany is one of Europes leading countries in microbiome drug development, supported by a well-developed pharmaceutical industry and public health research institutions. Major biotech clusters in Berlin, Munich, and Heidelberg are involved in gut microbiome research and clinical trials.

The German CDMO landscape is supported by strong government and EU funding initiatives, including the High-Tech Strategy 2025, which aims at sustainable development for society. Collaborations between CDMOs, university hospitals, and biotech firms are helping move live biotherapeutics from lab to clinic. Germanys regulatory framework and experience with biologics production make it a strong player in the EUs microbiome manufacturing landscape.

Japan strengthens biomanufacturing through local CDMO investments and microbiome research:Japan is expanding its role in the microbiome field through academic-industry partnerships and national health initiatives. The country focuses on aging-related diseases, brain-gut health, and metabolic disorders where LBPs show promise.

Local CDMOs are upgrading their facilities to meet LBP production standards. Japans Pharmaceuticals and Medical Devices Agency (PMDA) monitors clinical trial applications for live biotherapeutics, creating a pathway for local development and manufacturing. Research institutions are actively mapping regional microbiomes to inform product design.

Competitive Analysis:The microbiome CDMO segment is still young but growing fast. Only a few service providers offer full support for live biotherapeutics, including strain isolation, anaerobic fermentation, downstream purification, fill-finish, and stability testing.

Top CDMOs are adding capacity through modular GMP suites designed for live organism handling. Cleanroom design, segregated airflow, and oxygen-free environments are critical. CDMOs that can meet these standards while scaling quickly are gaining more contracts.

Smaller CDMOs are forming partnerships with early-stage microbiome companies, helping them navigate early testing, IND submission, and small-batch supply. Global CDMOs are expanding through acquisitions and joint ventures to offer microbiome services.

The key competitive edge is the ability to ensure viability and purity of the organisms through clinical and commercial production. CDMOs with strong quality systems, regulatory experience, and flexibility in working with novel strains are better positioned to serve this market.

Key players in the market include: Lonza, Catalent, WuXi Biologics, Samsung Biologics, Fujifilm Diosynth Biotechnologies, Thermo Fisher Scientific, Patheon, AMRI, Recipharm, BioVectra, Charles River Laboratories, AGC Biologics, Abzena, Syntegon, BioNTech Manufacturing GmbH, and others.

Recent Development:In October 2023, Gilead Sciences, Inc. and Assembly Biosciences, Inc. announced a 12-year collaboration to foster research and develop antiviral therapeutics with an initial focus on herpesviruses, hepatitis B virus (HBV), and hepatitis D virus (HDV).

In January 2025, AGC Biologics site in Milan will begin lentiviral vector commercial manufacturing for Adaptimmunes Lete-Cel product, a therapy advancing the field of solid tumor cancers with cell therapy.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Live Biotherapeutic Products And Microbiome CDMO market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Live Biotherapeutic Products And Microbiome CDMO market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Live Biotherapeutic Products And Microbiome CDMO market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Live Biotherapeutic Products And Microbiome CDMO market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Live Biotherapeutic Products And Microbiome CDMO market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 38.66 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product |

|

| The Segment covered by Service |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Live Biotherapeutic Products And Microbiome CDMO market share, size, and revenue growth rate were created by Quintile Report™. Live Biotherapeutic Products And Microbiome CDMO analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Live Biotherapeutic Products And Microbiome CDMO Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Live Biotherapeutic Products And Microbiome CDMO Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Live Biotherapeutic Products And Microbiome CDMO Market, by Region, (USD Million) 2017-2035

Table 21 China Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Live Biotherapeutic Products And Microbiome CDMO Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Live Biotherapeutic Products And Microbiome CDMO Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Live Biotherapeutic Products And Microbiome CDMO Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Live Biotherapeutic Products And Microbiome CDMO Market: market scenario

Fig.4 Global Live Biotherapeutic Products And Microbiome CDMO Market competitive outlook

Fig.5 Global Live Biotherapeutic Products And Microbiome CDMO Market driver analysis

Fig.6 Global Live Biotherapeutic Products And Microbiome CDMO Market restraint analysis

Fig.7 Global Live Biotherapeutic Products And Microbiome CDMO Market opportunity analysis

Fig.8 Global Live Biotherapeutic Products And Microbiome CDMO Market trends analysis

Fig.9 Global Live Biotherapeutic Products And Microbiome CDMO Market: Segment Analysis (Based on the scope)

Fig.10 Global Live Biotherapeutic Products And Microbiome CDMO Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Minimal Residual Disease Testing Market Report SummaryThe Global Minimal Residual Disease Testing Ma

Read MoreReport Descriptions: The Global Companion Animal Diagnostics Market was estimated at USD 6.95 billio

Read MoreReport Descriptions: The Global Cryoablation Probe Market was estimated at USD 216.09 million in 202

Read More