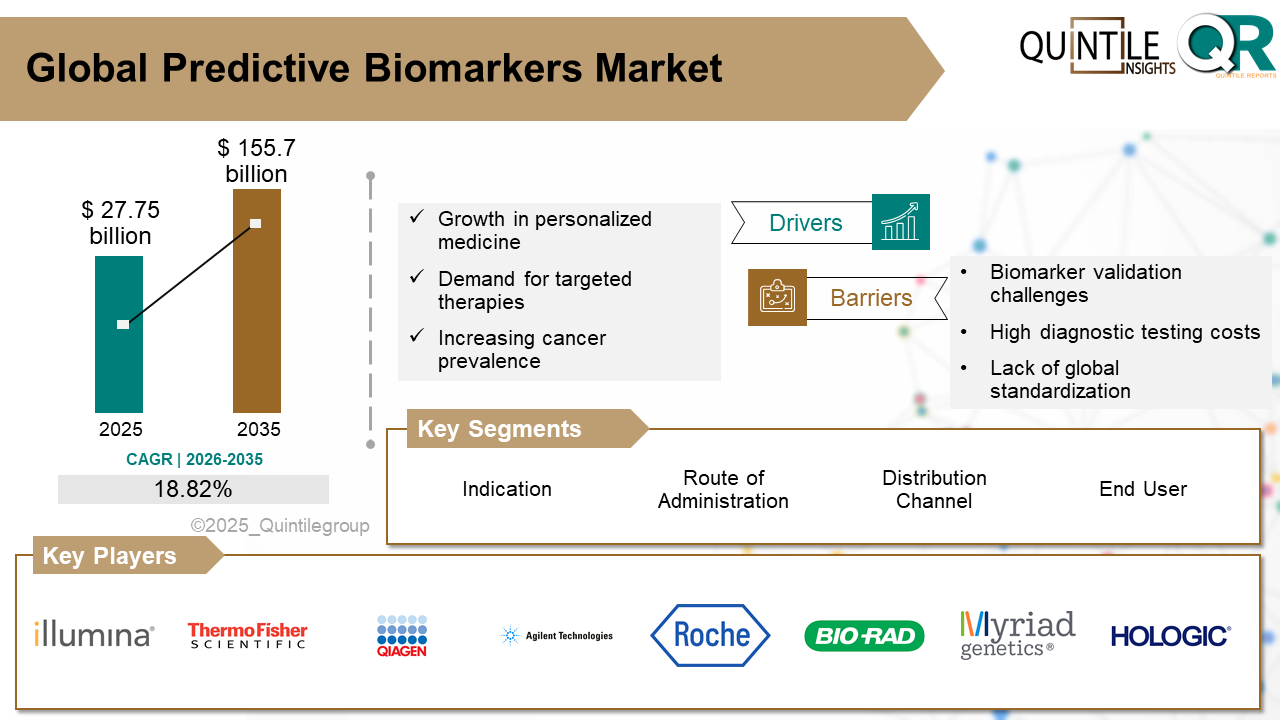

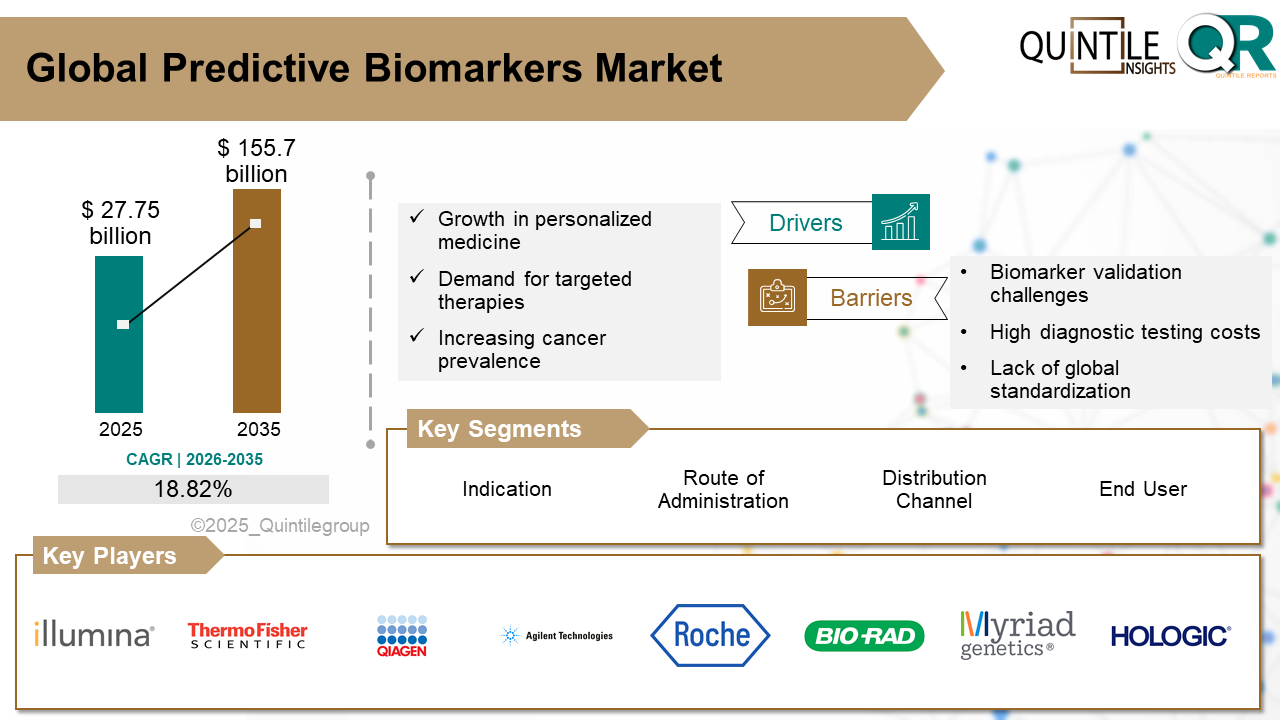

The Global Predictive Biomarkers Market was estimated at USD 27.75 billion in 2026 and is projected to reach USD 155.7 billion by 2035, reflecting a robust CAGR of 18.82% over the forecast period from 2026 to 2035. The Predictive Biomarkers market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Predictive Biomarkers market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Predictive Biomarkers market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Key trends influencing the Predictive Biomarkers market include the rapid adoption of digital technologies, the integration of sustainable practices, and the increasing importance of customer experience. These trends are not only driving growth but also creating new challenges for industry participants, who must adapt their GTM strategies to navigate regulatory changes, supply chain disruptions, and fluctuating economic conditions. Despite these challenges, the Predictive Biomarkers market is poised for sustained growth, with emerging markets playing a critical role in the expansion of the industry.

Looking ahead, the Predictive Biomarkers market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Predictive Biomarkers market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period.

The predictive biomarkers market refers to the global and regional market for is a biological indicator that helps identify individuals who are more likely than others without the biomarker to experience a favorable or unfavorable outcome from exposure to a medical product or environmental agent. These biomarkers can guide clinical decisions by signaling who may respond positively or negatively to a specific treatment or intervention, including drugs, medical devices, procedures, or lifestyle changes. In clinical trials, predictive biomarkers can support the design of enriched study populations to increase the likelihood of detecting treatment effects, particularly when only a subset of individuals is expected to benefit.

Predictive biomarkers are not limited to therapeutic interventions but also apply to exposures such as environmental toxins, tobacco smoke, alcohol, or radiation. In these contexts, predictive biomarkers identify individuals more or less likely to experience harmful or beneficial outcomes due to such exposures. They can reflect either innate host characteristics (like genetic markers or metabolic function) or features of the disease or condition itself. These biomarkers help assess susceptibility and act as effect modifiers, informing both risk assessment and targeted prevention strategies.

The growing emphasis on personalized treatment strategies is driving demand for predictive biomarkers that help tailor therapies to individual patient profiles.

Predictive biomarkers are increasingly used to improve clinical trial efficiency through patient stratification and enrichment, reducing time and cost in drug development.

Innovations in sequencing technologies and molecular diagnostics are enabling more accurate identification and validation of predictive biomarkers.

Regulatory agencies are encouraging the integration of predictive biomarkers with companion diagnostics, accelerating their adoption in clinical and commercial settings.

The predictive biomarkers market is driven by the growing demand for precision medicine, where treatments are tailored based on individual biological profiles. Predictive biomarkers enable better patient stratification and targeted therapies, improving treatment outcomes and reducing adverse effects. Their role in drug development is expanding, as they help identify responsive patient populations, streamline clinical trials, and reduce costs and timelines.

The market faces significant challenges, including the high cost and complexity of biomarker discovery, validation, and integration into clinical practice. There is a lack of standardization in testing protocols, which affects reproducibility and reliability across different settings. Additionally, navigating the regulatory landscape is difficult due to varying global guidelines and uncertainty around reimbursement policies for biomarker-based diagnostics.

Further constraints include ethical concerns and data privacy issues, especially related to genetic information used in biomarker studies. Ensuring patient confidentiality and meeting data protection requirements like HIPAA and GDPR are critical but challenging. These factors collectively slow down adoption and limit broader clinical use, especially in resource-constrained healthcare systems.

North America, led by the United States, holds the largest share of the global predictive biomarkers market. The region benefits from a well-developed healthcare infrastructure, a high volume of clinical trials, and strong investment in precision medicine. Adoption is particularly high in oncology and immunology, supported by the presence of major pharmaceutical and diagnostics companies. Regulatory support from agencies like the FDA also facilitates faster commercialization of biomarker-based diagnostics and companion diagnostics.

Europe is a mature market driven by strong academic research networks, government funding, and rising adoption of personalized treatment approaches. Countries like Germany, the UK, and France are leading in integrating biomarkers into healthcare systems. The EUs focus on reducing healthcare variability through precision medicine is accelerating biomarker use in oncology, rare diseases, and neurology. Collaborative efforts among pharma companies, CROs, and academic institutions are helping to expand the application of predictive biomarkers across various therapeutic areas.

Asia-Pacific is the fastest-growing region, fueled by increasing healthcare investments, a rising burden of chronic diseases, and rapid adoption of advanced diagnostics in countries like China, Japan, South Korea, and India. Government-supported genomics programs and growing local biotech ecosystems are accelerating biomarker research. The market is also seeing growth in non-invasive diagnostic solutions and AI-powered platforms, particularly in Japan and South Korea, while China is scaling up domestic biomarker capabilities for oncology and other diseases.

Latin America is an emerging market with growing interest in precision medicine, particularly in Brazil, Mexico, and Argentina. However, adoption remains limited due to infrastructure constraints and reimbursement challenges. Efforts to increase participation in international clinical trials and regional collaborations are supporting gradual growth. Public health systems are beginning to explore biomarker-driven approaches in oncology and infectious diseases, though progress varies significantly by country.

The Middle East and Africa region is in the early stages of predictive biomarker adoption. High disease burden and increasing awareness are creating opportunities, particularly in urban centers and private healthcare networks. Countries like the UAE, Saudi Arabia, and South Africa are making investments in medical research and personalized medicine, but challenges such as limited infrastructure, regulatory complexity, and cost barriers continue to slow broader market penetration. Regional collaborations and technology transfer are expected to support future growth.

United States Dominates Global Predictive Biomarkers Market Leadership:

The United States leads the global predictive biomarkers market, supported by its advanced healthcare infrastructure, strong regulatory frameworks, and widespread adoption of personalized medicine. The country hosts a large number of clinical trials, particularly in oncology, and is at the forefront of integrating biomarkers into routine clinical workflows.

Major pharmaceutical companies, top-tier research institutions, and government-backed programs such as the Precision Medicine Initiative play a pivotal role in advancing the field. The growing use of AI, machine learning, and genomic technologies is enabling faster biomarker discovery and improving predictive accuracy in areas like cancer, autoimmune disorders, and neurological diseases.

Germany Strengthens European Predictive Biomarkers Innovation Hub:

Germany is a prominent player in Europes predictive biomarkers market, driven by its strong biomedical research ecosystem, robust healthcare infrastructure, and proactive approach to precision diagnostics. The countrys biopharmaceutical and biotech industries are deeply involved in developing innovative biomarker-based solutions, often in collaboration with academic and clinical partners.

Awareness of personalized treatment strategies is steadily increasing among healthcare professionals and patients. Germany is also encouraging innovation through public-private partnerships, government-funded R&D programs, and favorable regulatory policies, helping expand the role of predictive biomarkers in both therapeutic development and patient care.

Japan Accelerates Precision Medicine through Predictive Biomarkers Adoption:

Japans predictive biomarkers market is growing at a rapid pace, driven by its aging population, rising disease burden, and strong commitment to precision medicine. The government actively promotes genomic screening and real-world data collection through national initiatives aimed at optimizing treatment outcomes and advancing biomarker-based therapies.

Academic institutions, hospitals, and pharmaceutical companies are closely collaborating to identify and validate predictive biomarkers for cancer, metabolic, and neurodegenerative diseases. Japan is also advancing in non-invasive diagnostic approaches and AI-powered platforms, helping clinicians make more accurate, individualized treatment decisions while contributing to global biomarker research efforts.

The predictive biomarkers market is highly competitive and innovation-driven, with companies striving to advance biomarker discovery, validation, and integration into clinical workflows. Players compete on the strength of their platforms, with a growing focus on multi-omics approaches, artificial intelligence, and machine learning for improved prediction accuracy. The ability to shorten development timelines and deliver clinically relevant markers is a key competitive edge.

Regulatory compliance and alignment with companion diagnostic requirements have become critical. Companies with proven track records of securing FDA or EMA approvals gain a significant advantage, especially when partnering with pharmaceutical firms for biomarker-linked drug development. Success in navigating evolving regulatory frameworks is increasingly seen as a marker of long-term competitiveness.

Data access and analytical capabilities are emerging as core differentiators. Organizations that can integrate real-world data, clinical outcomes, and genomics at scale are better positioned to deliver personalized, actionable insights. Competitive firms invest in platforms that unify fragmented datasets and enable more accurate patient stratification and treatment guidance.

Partnerships and collaborations play a central role in maintaining market presence. Firms that build strategic alliances with pharma companies, academic institutions, and healthcare providers can co-develop predictive tools and speed up commercialization. Such alliances also enable companies to expand geographically and diversify therapeutic applications beyond oncology.

Key players in the market are Roche Diagnostics, Thermo Fisher Scientific, Qiagen N.V., Illumina, Inc., Agilent Technologies, Bio-Rad Laboratories, Myriad Genetics, Hologic, Inc., Abbott Laboratories, Siemens Healthineers, GE Healthcare, PerkinElmer, Inc., Merck KGaA, Danaher Corporation, Sysmex Corporation.

In August 2024, FDA approves Illumina cancer biomarker test with two companion diagnostics to rapidly match patients to targeted therapies.

In March 2024, Volastra Therapeutics Announces New and Expanded Partnerships with AI and Precision-Medicine Leaders to Broaden Potential of KIF18A Inhibitors Across Cancer.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Predictive Biomarkers market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Predictive Biomarkers market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Predictive Biomarkers market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Predictive Biomarkers market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Predictive Biomarkers market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 18.82 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Indication |

|

| The Segment covered by Route of Administration |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Predictive Biomarkers market share, size, and revenue growth rate were created by Quintile Report™. Predictive Biomarkers analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Predictive Biomarkers Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Predictive Biomarkers Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Predictive Biomarkers Market, by Region, (USD Million) 2017-2035

Table 21 China Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Predictive Biomarkers Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Predictive Biomarkers Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Predictive Biomarkers Market: market scenario

Fig.4 Global Predictive Biomarkers Market competitive outlook

Fig.5 Global Predictive Biomarkers Market driver analysis

Fig.6 Global Predictive Biomarkers Market restraint analysis

Fig.7 Global Predictive Biomarkers Market opportunity analysis

Fig.8 Global Predictive Biomarkers Market trends analysis

Fig.9 Global Predictive Biomarkers Market: Segment Analysis (Based on the scope)

Fig.10 Global Predictive Biomarkers Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Predictive Biomarkers Market was estimated at USD 27.75 billion in 2026 and is projected to reach USD 155.7 billion by 2035, reflecting a robust CAGR of 18.82% over the forecast period from 2026 to 2035. The Predictive Biomarkers market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Predictive Biomarkers market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Predictive Biomarkers market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Key trends influencing the Predictive Biomarkers market include the rapid adoption of digital technologies, the integration of sustainable practices, and the increasing importance of customer experience. These trends are not only driving growth but also creating new challenges for industry participants, who must adapt their GTM strategies to navigate regulatory changes, supply chain disruptions, and fluctuating economic conditions. Despite these challenges, the Predictive Biomarkers market is poised for sustained growth, with emerging markets playing a critical role in the expansion of the industry.

Looking ahead, the Predictive Biomarkers market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Predictive Biomarkers market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period.

The predictive biomarkers market refers to the global and regional market for is a biological indicator that helps identify individuals who are more likely than others without the biomarker to experience a favorable or unfavorable outcome from exposure to a medical product or environmental agent. These biomarkers can guide clinical decisions by signaling who may respond positively or negatively to a specific treatment or intervention, including drugs, medical devices, procedures, or lifestyle changes. In clinical trials, predictive biomarkers can support the design of enriched study populations to increase the likelihood of detecting treatment effects, particularly when only a subset of individuals is expected to benefit.

Predictive biomarkers are not limited to therapeutic interventions but also apply to exposures such as environmental toxins, tobacco smoke, alcohol, or radiation. In these contexts, predictive biomarkers identify individuals more or less likely to experience harmful or beneficial outcomes due to such exposures. They can reflect either innate host characteristics (like genetic markers or metabolic function) or features of the disease or condition itself. These biomarkers help assess susceptibility and act as effect modifiers, informing both risk assessment and targeted prevention strategies.

The growing emphasis on personalized treatment strategies is driving demand for predictive biomarkers that help tailor therapies to individual patient profiles.

Predictive biomarkers are increasingly used to improve clinical trial efficiency through patient stratification and enrichment, reducing time and cost in drug development.

Innovations in sequencing technologies and molecular diagnostics are enabling more accurate identification and validation of predictive biomarkers.

Regulatory agencies are encouraging the integration of predictive biomarkers with companion diagnostics, accelerating their adoption in clinical and commercial settings.

The predictive biomarkers market is driven by the growing demand for precision medicine, where treatments are tailored based on individual biological profiles. Predictive biomarkers enable better patient stratification and targeted therapies, improving treatment outcomes and reducing adverse effects. Their role in drug development is expanding, as they help identify responsive patient populations, streamline clinical trials, and reduce costs and timelines.

The market faces significant challenges, including the high cost and complexity of biomarker discovery, validation, and integration into clinical practice. There is a lack of standardization in testing protocols, which affects reproducibility and reliability across different settings. Additionally, navigating the regulatory landscape is difficult due to varying global guidelines and uncertainty around reimbursement policies for biomarker-based diagnostics.

Further constraints include ethical concerns and data privacy issues, especially related to genetic information used in biomarker studies. Ensuring patient confidentiality and meeting data protection requirements like HIPAA and GDPR are critical but challenging. These factors collectively slow down adoption and limit broader clinical use, especially in resource-constrained healthcare systems.

North America, led by the United States, holds the largest share of the global predictive biomarkers market. The region benefits from a well-developed healthcare infrastructure, a high volume of clinical trials, and strong investment in precision medicine. Adoption is particularly high in oncology and immunology, supported by the presence of major pharmaceutical and diagnostics companies. Regulatory support from agencies like the FDA also facilitates faster commercialization of biomarker-based diagnostics and companion diagnostics.

Europe is a mature market driven by strong academic research networks, government funding, and rising adoption of personalized treatment approaches. Countries like Germany, the UK, and France are leading in integrating biomarkers into healthcare systems. The EUs focus on reducing healthcare variability through precision medicine is accelerating biomarker use in oncology, rare diseases, and neurology. Collaborative efforts among pharma companies, CROs, and academic institutions are helping to expand the application of predictive biomarkers across various therapeutic areas.

Asia-Pacific is the fastest-growing region, fueled by increasing healthcare investments, a rising burden of chronic diseases, and rapid adoption of advanced diagnostics in countries like China, Japan, South Korea, and India. Government-supported genomics programs and growing local biotech ecosystems are accelerating biomarker research. The market is also seeing growth in non-invasive diagnostic solutions and AI-powered platforms, particularly in Japan and South Korea, while China is scaling up domestic biomarker capabilities for oncology and other diseases.

Latin America is an emerging market with growing interest in precision medicine, particularly in Brazil, Mexico, and Argentina. However, adoption remains limited due to infrastructure constraints and reimbursement challenges. Efforts to increase participation in international clinical trials and regional collaborations are supporting gradual growth. Public health systems are beginning to explore biomarker-driven approaches in oncology and infectious diseases, though progress varies significantly by country.

The Middle East and Africa region is in the early stages of predictive biomarker adoption. High disease burden and increasing awareness are creating opportunities, particularly in urban centers and private healthcare networks. Countries like the UAE, Saudi Arabia, and South Africa are making investments in medical research and personalized medicine, but challenges such as limited infrastructure, regulatory complexity, and cost barriers continue to slow broader market penetration. Regional collaborations and technology transfer are expected to support future growth.

United States Dominates Global Predictive Biomarkers Market Leadership:

The United States leads the global predictive biomarkers market, supported by its advanced healthcare infrastructure, strong regulatory frameworks, and widespread adoption of personalized medicine. The country hosts a large number of clinical trials, particularly in oncology, and is at the forefront of integrating biomarkers into routine clinical workflows.

Major pharmaceutical companies, top-tier research institutions, and government-backed programs such as the Precision Medicine Initiative play a pivotal role in advancing the field. The growing use of AI, machine learning, and genomic technologies is enabling faster biomarker discovery and improving predictive accuracy in areas like cancer, autoimmune disorders, and neurological diseases.

Germany Strengthens European Predictive Biomarkers Innovation Hub:

Germany is a prominent player in Europes predictive biomarkers market, driven by its strong biomedical research ecosystem, robust healthcare infrastructure, and proactive approach to precision diagnostics. The countrys biopharmaceutical and biotech industries are deeply involved in developing innovative biomarker-based solutions, often in collaboration with academic and clinical partners.

Awareness of personalized treatment strategies is steadily increasing among healthcare professionals and patients. Germany is also encouraging innovation through public-private partnerships, government-funded R&D programs, and favorable regulatory policies, helping expand the role of predictive biomarkers in both therapeutic development and patient care.

Japan Accelerates Precision Medicine through Predictive Biomarkers Adoption:

Japans predictive biomarkers market is growing at a rapid pace, driven by its aging population, rising disease burden, and strong commitment to precision medicine. The government actively promotes genomic screening and real-world data collection through national initiatives aimed at optimizing treatment outcomes and advancing biomarker-based therapies.

Academic institutions, hospitals, and pharmaceutical companies are closely collaborating to identify and validate predictive biomarkers for cancer, metabolic, and neurodegenerative diseases. Japan is also advancing in non-invasive diagnostic approaches and AI-powered platforms, helping clinicians make more accurate, individualized treatment decisions while contributing to global biomarker research efforts.

The predictive biomarkers market is highly competitive and innovation-driven, with companies striving to advance biomarker discovery, validation, and integration into clinical workflows. Players compete on the strength of their platforms, with a growing focus on multi-omics approaches, artificial intelligence, and machine learning for improved prediction accuracy. The ability to shorten development timelines and deliver clinically relevant markers is a key competitive edge.

Regulatory compliance and alignment with companion diagnostic requirements have become critical. Companies with proven track records of securing FDA or EMA approvals gain a significant advantage, especially when partnering with pharmaceutical firms for biomarker-linked drug development. Success in navigating evolving regulatory frameworks is increasingly seen as a marker of long-term competitiveness.

Data access and analytical capabilities are emerging as core differentiators. Organizations that can integrate real-world data, clinical outcomes, and genomics at scale are better positioned to deliver personalized, actionable insights. Competitive firms invest in platforms that unify fragmented datasets and enable more accurate patient stratification and treatment guidance.

Partnerships and collaborations play a central role in maintaining market presence. Firms that build strategic alliances with pharma companies, academic institutions, and healthcare providers can co-develop predictive tools and speed up commercialization. Such alliances also enable companies to expand geographically and diversify therapeutic applications beyond oncology.

Key players in the market are Roche Diagnostics, Thermo Fisher Scientific, Qiagen N.V., Illumina, Inc., Agilent Technologies, Bio-Rad Laboratories, Myriad Genetics, Hologic, Inc., Abbott Laboratories, Siemens Healthineers, GE Healthcare, PerkinElmer, Inc., Merck KGaA, Danaher Corporation, Sysmex Corporation.

In August 2024, FDA approves Illumina cancer biomarker test with two companion diagnostics to rapidly match patients to targeted therapies.

In March 2024, Volastra Therapeutics Announces New and Expanded Partnerships with AI and Precision-Medicine Leaders to Broaden Potential of KIF18A Inhibitors Across Cancer.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Predictive Biomarkers market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Predictive Biomarkers market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Predictive Biomarkers market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Predictive Biomarkers market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Predictive Biomarkers market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 18.82 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Indication |

|

| The Segment covered by Route of Administration |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Predictive Biomarkers market share, size, and revenue growth rate were created by Quintile Report™. Predictive Biomarkers analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Predictive Biomarkers Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Predictive Biomarkers Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Predictive Biomarkers Market, by Region, (USD Million) 2017-2035

Table 21 China Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Predictive Biomarkers Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Predictive Biomarkers Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Predictive Biomarkers Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Predictive Biomarkers Market: market scenario

Fig.4 Global Predictive Biomarkers Market competitive outlook

Fig.5 Global Predictive Biomarkers Market driver analysis

Fig.6 Global Predictive Biomarkers Market restraint analysis

Fig.7 Global Predictive Biomarkers Market opportunity analysis

Fig.8 Global Predictive Biomarkers Market trends analysis

Fig.9 Global Predictive Biomarkers Market: Segment Analysis (Based on the scope)

Fig.10 Global Predictive Biomarkers Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Minimal Residual Disease Testing Market Report SummaryThe Global Minimal Residual Disease Testing Ma

Read MoreReport Descriptions: The Global Companion Animal Diagnostics Market was estimated at USD 6.95 billio

Read MoreReport Descriptions: The Global Cryoablation Probe Market was estimated at USD 216.09 million in 202

Read More