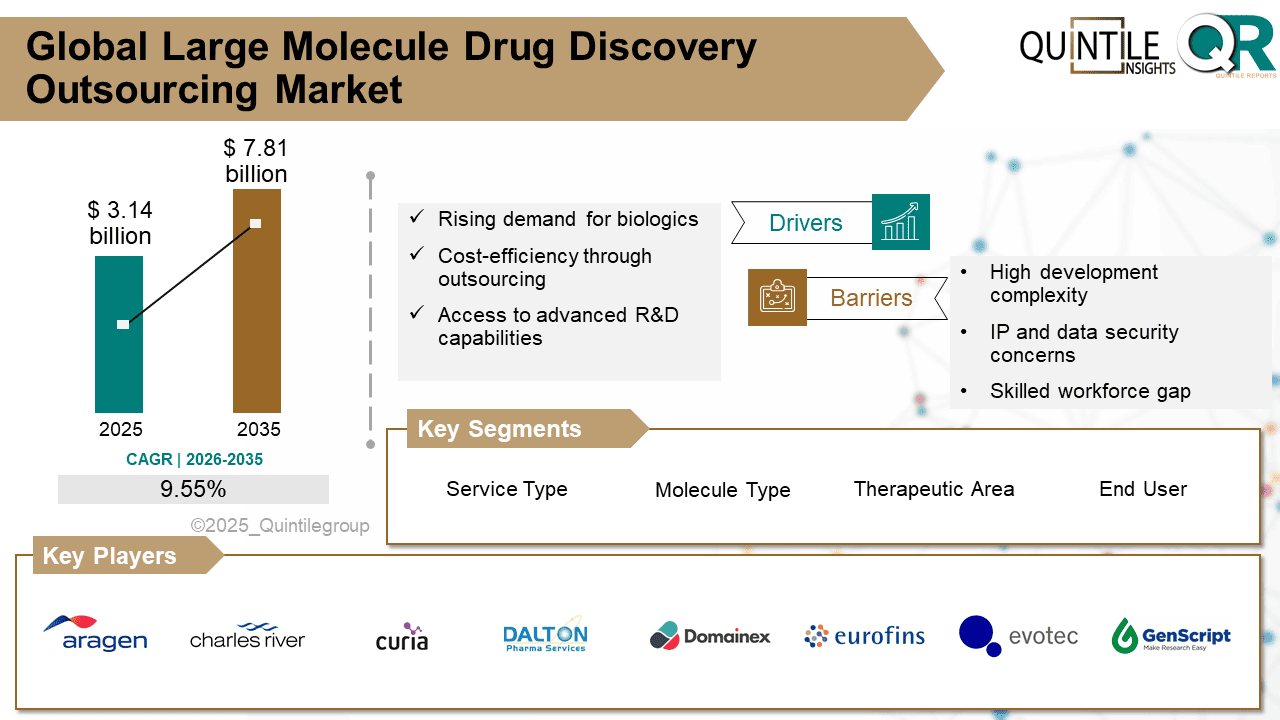

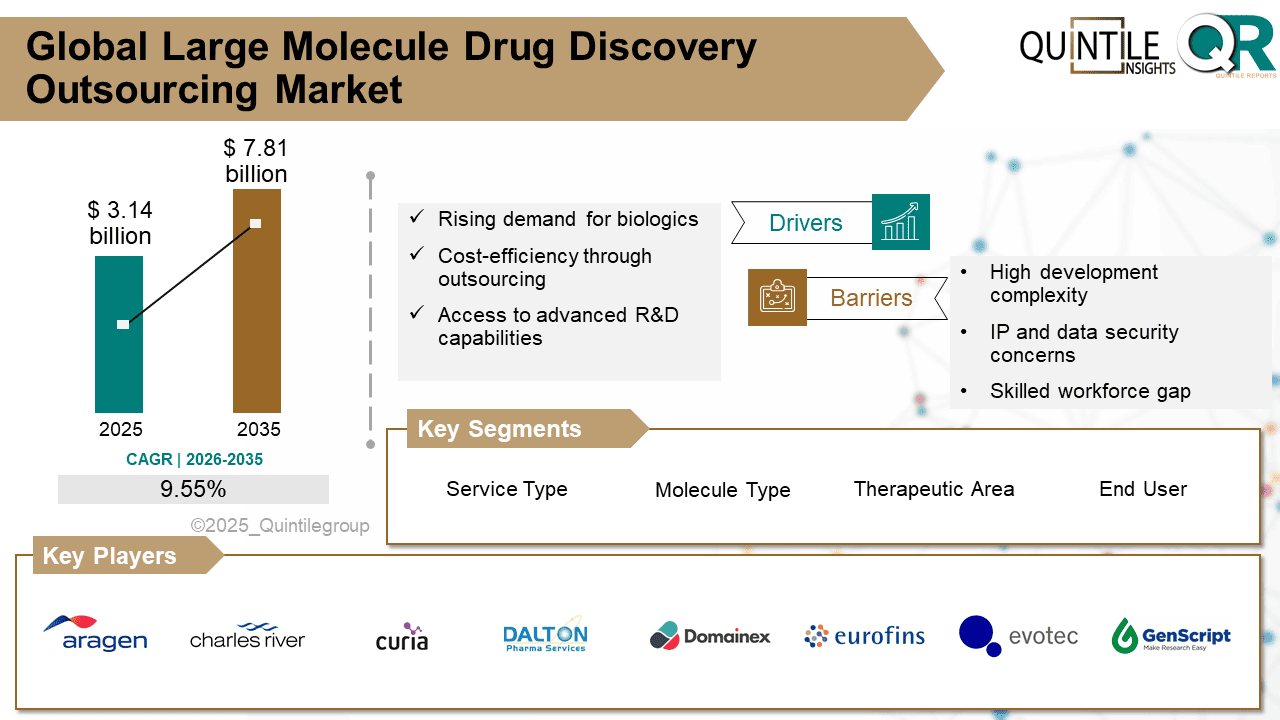

The Global Large Molecule Drug Discovery Outsourcing Market was estimated at USD 3.14 billion in 2026 and is projected to reach USD 7.81 billion by 2035, reflecting a robust CAGR of 9.55% over the forecast period from 2026 to 2035. The Large Molecule Drug Discovery Outsourcing market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Large Molecule Drug Discovery Outsourcing market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Large Molecule Drug Discovery Outsourcing market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Key trends influencing the Large Molecule Drug Discovery Outsourcing market include the rapid adoption of digital technologies, the integration of sustainable practices, and the increasing importance of customer experience. These trends are not only driving growth but also creating new challenges for industry participants, who must adapt their GTM strategies to navigate regulatory changes, supply chain disruptions, and fluctuating economic conditions. Despite these challenges, the Large Molecule Drug Discovery Outsourcing market is poised for sustained growth, with emerging markets playing a critical role in the expansion of the industry.

Looking ahead, the Large Molecule Drug Discovery Outsourcing market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Large Molecule Drug Discovery Outsourcing market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

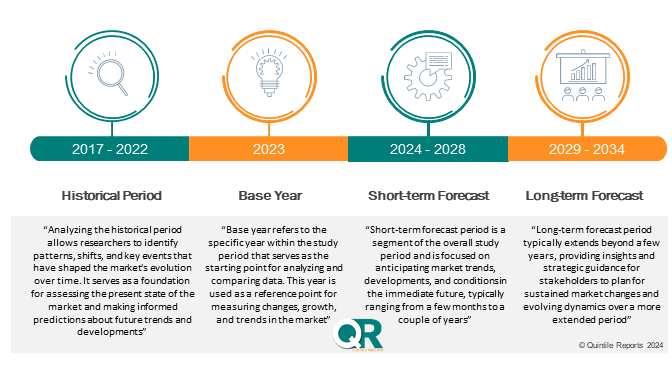

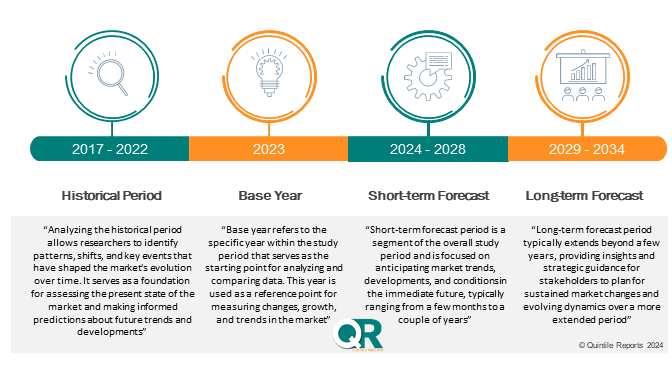

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period.

Large Molecule Drug Discovery Outsourcing Market

The large molecule drug discovery outsourcing market involves pharmaceutical and biotechnology firms partnering with specialized external organizations, such as Contract Research Organizations (CROs), to handle different phases of biologics drug discovery. This includes outsourcing activities like target identification, lead optimization, preclinical development, and certain components of clinical trials.

The advantages of collaborating with a Contract Research Organization (CRO) vary based on the specific requirements of each clinical trial; however, several clear benefits consistently emerge from these partnerships. Engaging a well-established, globally active CRO can significantly enhance the effectiveness of a project by providing access to extensive expertise, infrastructure, and resources. Such organizations bring valuable insights into diverse regulatory frameworks and geographic markets, enabling smoother trial execution and improved compliance. Ultimately, the success of the collaboration often depends on aligning the CROs capabilities with the strategic objectives of the sponsor company.

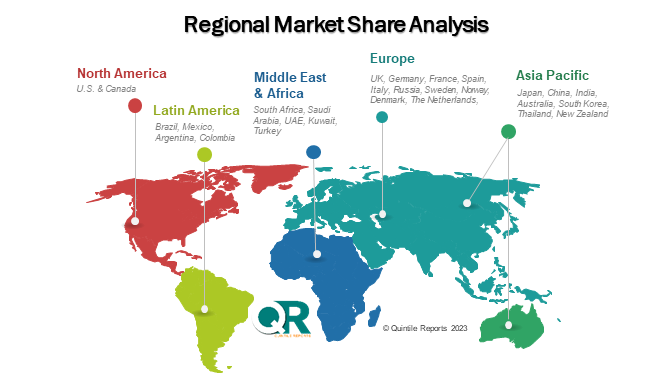

What are the drivers of the large molecule drug discovery outsourcing marketThe dynamics of the North American clinical CRO market are shaped by various forces including technological advancements, regulatory pressures, and evolving healthcare needs. Pharmaceutical companies are increasingly outsourcing clinical trials to CROs to reduce costs and expedite research and development processes.

The European Unions strong regulatory framework and advanced healthcare systems make it a key hub for clinical research, with around 2,800 trials authorized annually across multiple Member States. European CROs support pharmaceutical and biotech companies by offering end-to-end services such as regulatory compliance, data management, and medical writing, ensuring efficient and compliant trial execution across the region.

Asia Pacific is a growing hub for clinical trials, supported by regulatory encouragement for Multi-Regional Clinical Trials, a large and diverse patient population, and lower competition for recruitment. The region offers cost advantages, high disease prevalence, strong academic infrastructure, and improving quality standards aligned with ICH-GCP. Enhanced IP protection further strengthens its position as a preferred destination for clinical research.

In Latin America, Contract Research Organizations play a key role in supporting pharmaceutical, biotechnology, and medical device companies by offering essential external study services. In 2023, CROs accounted for a significant 88.24% revenue share in the medical segment, reflecting their importance in managing the complexities of clinical research and ensuring trial success across the region.

The Middle East and Africa (MEA) region is gradually emerging as a potential destination for clinical trials, driven by growing healthcare infrastructure, increasing disease burden, and government initiatives to boost clinical research. Key factors such as a diverse patient population, lower operational costs, and improving regulatory frameworks are attracting pharmaceutical and biotechnology companies to outsource clinical trials to CROs in this region.

Country-Wise Outlook:U.S. Market Dominance Fueled by Innovation and Regulatory Leadership: The U.S. remains the largest contributor to the North American CRO market, driven by the high volume of clinical trials, a favorable regulatory environment, and a thriving pharmaceutical industry. The U.S. leads the global clinical CRO market due to strong R&D investment, a large pharmaceutical base, and advanced healthcare infrastructure. CROs play a key role in reducing costs and accelerating development for sponsors, supported by regulatory guidance from the FDA.

Emerging trends such as decentralized clinical trials, AI-driven recruitment, real-world evidence, and block chain adoption are transforming clinical research in the U.S. These innovations enhance efficiency, data accuracy, and patient access, reinforcing the country's position as a global hub for outsourced clinical trials.

Germanys Diversified CRO Sector Strengthens Europes Drug Development Pipeline: Germany, the leading pharmaceutical market in Europe and the fourth largest globally, plays a key role in contract research and development. Faced with patent expirations, biosimilar competition, and pricing pressures, pharmaceutical and biotech firms are increasingly outsourcing to accelerate drug development and boost efficiency.

The countrys CRO landscape is highly diversified, with many SMEs offering end-to-end services from target validation and lead optimization to ADMET studies and clinical trial management. Supported by strong biomedical infrastructure and advanced technologies, Germany's CROs cover all stages of drug development, including preclinical studies and Phase IIII trials. This broad service spectrum highlights the sectors versatility and depth.

Japans Regulatory Expertise and Localized Partnerships Drive Trial Success: Japan, the third-largest pharmaceutical market globally, remains a key region for biopharmaceutical innovation and clinical development. Partnering with experienced Japanese CROs enables pharmaceutical and biotech companies to navigate local regulatory complexities, optimize trial timelines and costs, and ensure high-quality outcomes.

Local CROs offer deep knowledge of PMDA requirements, strong relationships with medical institutions, and culturally attuned project management. Full-service CROs in Japan provide end-to-end support across all phases of development, including study design, regulatory affairs, patient recruitment, and clinical operations, making them essential partners for successful trial execution in the Japanese market.

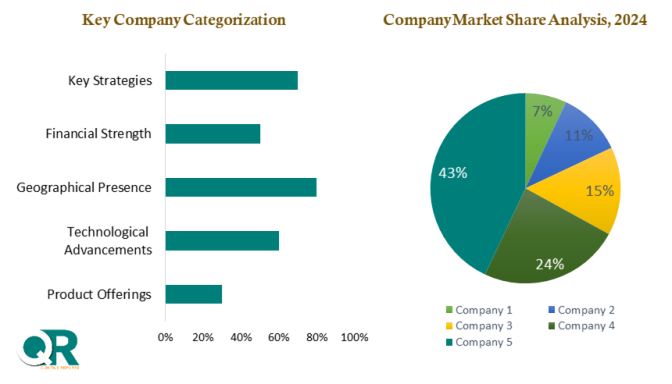

Competitive Analysis:Leading CROs leverage digital platforms to conduct decentralized clinical trials (DCTs). The Association of Clinical Research Organizations (ACRO) offers a detailed Quality-by-Design Manual, risk assessment tools, and DCT data flow maps, aiding CROs in implementing compliant and patient-centric remote research.

Artificial intelligence and real-world data are transforming trial design, patient recruitment, and decision-making. According to CTTI, AI-driven platforms significantly accelerate insights, and CROs like IQVIA are leveraging these tools for greater efficiency and personalized approaches.

Regulatory expertise remains critical. ACROs risk-based monitoring and FDA-aligned quality frameworks highlight the importance of compliance leadership. CROs well-versed in regulatory landscapes can minimize delays and ensure trial integrity.

The combination of digital innovation, AI, and regulatory alignment sets top CROs apart. Those who apply validated technologies while maintaining global compliance standards are best positioned to lead in an increasingly complex and competitive clinical trial environment.

Key players in the market Aragen Life Sciences (GVK Biosciences), Charles River Laboratories, Curia (Albany Molecular Research Inc.), Dalton Pharma Services, Domainex, Eurofins, Evotec SE, GenScript, Jubilant Biosys, Laboratory Corporation of America Holdings, Pharmaron, QIAGEN, Syngene International, Thermo Fisher Scientific, WuXi AppTec.

Recent Development:

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Large Molecule Drug Discovery Outsourcing market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Large Molecule Drug Discovery Outsourcing market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

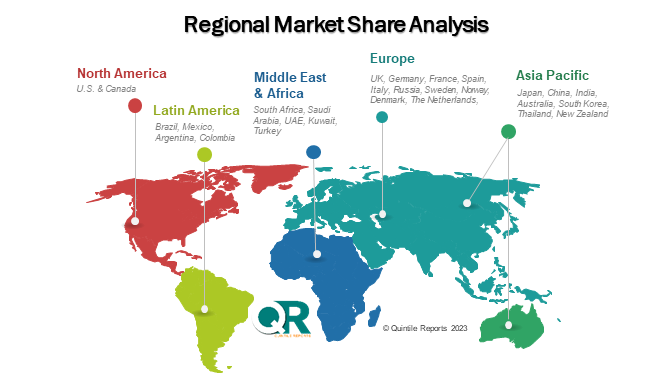

The chapter in Large Molecule Drug Discovery Outsourcing market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Large Molecule Drug Discovery Outsourcing market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

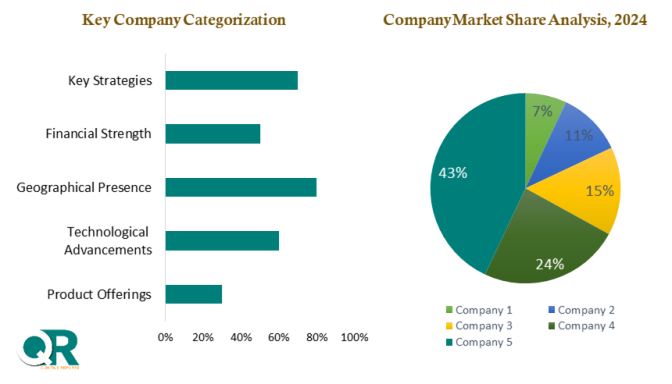

This section of a Large Molecule Drug Discovery Outsourcing market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2025 |

| Growth Rate | CAGR of 9.55 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Technology |

|

| The Segment covered by Type |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Large Molecule Drug Discovery Outsourcing market share, size, and revenue growth rate were created by Quintile Report™. Large Molecule Drug Discovery Outsourcing analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Large Molecule Drug Discovery Outsourcing Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Large Molecule Drug Discovery Outsourcing Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Large Molecule Drug Discovery Outsourcing Market, by Region, (USD Million) 2017-2035

Table 21 China Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Large Molecule Drug Discovery Outsourcing Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Large Molecule Drug Discovery Outsourcing Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Large Molecule Drug Discovery Outsourcing Market: market scenario

Fig.4 Global Large Molecule Drug Discovery Outsourcing Market competitive outlook

Fig.5 Global Large Molecule Drug Discovery Outsourcing Market driver analysis

Fig.6 Global Large Molecule Drug Discovery Outsourcing Market restraint analysis

Fig.7 Global Large Molecule Drug Discovery Outsourcing Market opportunity analysis

Fig.8 Global Large Molecule Drug Discovery Outsourcing Market trends analysis

Fig.9 Global Large Molecule Drug Discovery Outsourcing Market: Segment Analysis (Based on the scope)

Fig.10 Global Large Molecule Drug Discovery Outsourcing Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Large Molecule Drug Discovery Outsourcing Market was estimated at USD 3.14 billion in 2026 and is projected to reach USD 7.81 billion by 2035, reflecting a robust CAGR of 9.55% over the forecast period from 2026 to 2035. The Large Molecule Drug Discovery Outsourcing market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Large Molecule Drug Discovery Outsourcing market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Large Molecule Drug Discovery Outsourcing market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Key trends influencing the Large Molecule Drug Discovery Outsourcing market include the rapid adoption of digital technologies, the integration of sustainable practices, and the increasing importance of customer experience. These trends are not only driving growth but also creating new challenges for industry participants, who must adapt their GTM strategies to navigate regulatory changes, supply chain disruptions, and fluctuating economic conditions. Despite these challenges, the Large Molecule Drug Discovery Outsourcing market is poised for sustained growth, with emerging markets playing a critical role in the expansion of the industry.

Looking ahead, the Large Molecule Drug Discovery Outsourcing market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Large Molecule Drug Discovery Outsourcing market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period.

Large Molecule Drug Discovery Outsourcing Market

The large molecule drug discovery outsourcing market involves pharmaceutical and biotechnology firms partnering with specialized external organizations, such as Contract Research Organizations (CROs), to handle different phases of biologics drug discovery. This includes outsourcing activities like target identification, lead optimization, preclinical development, and certain components of clinical trials.

The advantages of collaborating with a Contract Research Organization (CRO) vary based on the specific requirements of each clinical trial; however, several clear benefits consistently emerge from these partnerships. Engaging a well-established, globally active CRO can significantly enhance the effectiveness of a project by providing access to extensive expertise, infrastructure, and resources. Such organizations bring valuable insights into diverse regulatory frameworks and geographic markets, enabling smoother trial execution and improved compliance. Ultimately, the success of the collaboration often depends on aligning the CROs capabilities with the strategic objectives of the sponsor company.

What are the drivers of the large molecule drug discovery outsourcing marketThe dynamics of the North American clinical CRO market are shaped by various forces including technological advancements, regulatory pressures, and evolving healthcare needs. Pharmaceutical companies are increasingly outsourcing clinical trials to CROs to reduce costs and expedite research and development processes.

The European Unions strong regulatory framework and advanced healthcare systems make it a key hub for clinical research, with around 2,800 trials authorized annually across multiple Member States. European CROs support pharmaceutical and biotech companies by offering end-to-end services such as regulatory compliance, data management, and medical writing, ensuring efficient and compliant trial execution across the region.

Asia Pacific is a growing hub for clinical trials, supported by regulatory encouragement for Multi-Regional Clinical Trials, a large and diverse patient population, and lower competition for recruitment. The region offers cost advantages, high disease prevalence, strong academic infrastructure, and improving quality standards aligned with ICH-GCP. Enhanced IP protection further strengthens its position as a preferred destination for clinical research.

In Latin America, Contract Research Organizations play a key role in supporting pharmaceutical, biotechnology, and medical device companies by offering essential external study services. In 2023, CROs accounted for a significant 88.24% revenue share in the medical segment, reflecting their importance in managing the complexities of clinical research and ensuring trial success across the region.

The Middle East and Africa (MEA) region is gradually emerging as a potential destination for clinical trials, driven by growing healthcare infrastructure, increasing disease burden, and government initiatives to boost clinical research. Key factors such as a diverse patient population, lower operational costs, and improving regulatory frameworks are attracting pharmaceutical and biotechnology companies to outsource clinical trials to CROs in this region.

Country-Wise Outlook:U.S. Market Dominance Fueled by Innovation and Regulatory Leadership: The U.S. remains the largest contributor to the North American CRO market, driven by the high volume of clinical trials, a favorable regulatory environment, and a thriving pharmaceutical industry. The U.S. leads the global clinical CRO market due to strong R&D investment, a large pharmaceutical base, and advanced healthcare infrastructure. CROs play a key role in reducing costs and accelerating development for sponsors, supported by regulatory guidance from the FDA.

Emerging trends such as decentralized clinical trials, AI-driven recruitment, real-world evidence, and block chain adoption are transforming clinical research in the U.S. These innovations enhance efficiency, data accuracy, and patient access, reinforcing the country's position as a global hub for outsourced clinical trials.

Germanys Diversified CRO Sector Strengthens Europes Drug Development Pipeline: Germany, the leading pharmaceutical market in Europe and the fourth largest globally, plays a key role in contract research and development. Faced with patent expirations, biosimilar competition, and pricing pressures, pharmaceutical and biotech firms are increasingly outsourcing to accelerate drug development and boost efficiency.

The countrys CRO landscape is highly diversified, with many SMEs offering end-to-end services from target validation and lead optimization to ADMET studies and clinical trial management. Supported by strong biomedical infrastructure and advanced technologies, Germany's CROs cover all stages of drug development, including preclinical studies and Phase IIII trials. This broad service spectrum highlights the sectors versatility and depth.

Japans Regulatory Expertise and Localized Partnerships Drive Trial Success: Japan, the third-largest pharmaceutical market globally, remains a key region for biopharmaceutical innovation and clinical development. Partnering with experienced Japanese CROs enables pharmaceutical and biotech companies to navigate local regulatory complexities, optimize trial timelines and costs, and ensure high-quality outcomes.

Local CROs offer deep knowledge of PMDA requirements, strong relationships with medical institutions, and culturally attuned project management. Full-service CROs in Japan provide end-to-end support across all phases of development, including study design, regulatory affairs, patient recruitment, and clinical operations, making them essential partners for successful trial execution in the Japanese market.

Competitive Analysis:Leading CROs leverage digital platforms to conduct decentralized clinical trials (DCTs). The Association of Clinical Research Organizations (ACRO) offers a detailed Quality-by-Design Manual, risk assessment tools, and DCT data flow maps, aiding CROs in implementing compliant and patient-centric remote research.

Artificial intelligence and real-world data are transforming trial design, patient recruitment, and decision-making. According to CTTI, AI-driven platforms significantly accelerate insights, and CROs like IQVIA are leveraging these tools for greater efficiency and personalized approaches.

Regulatory expertise remains critical. ACROs risk-based monitoring and FDA-aligned quality frameworks highlight the importance of compliance leadership. CROs well-versed in regulatory landscapes can minimize delays and ensure trial integrity.

The combination of digital innovation, AI, and regulatory alignment sets top CROs apart. Those who apply validated technologies while maintaining global compliance standards are best positioned to lead in an increasingly complex and competitive clinical trial environment.

Key players in the market Aragen Life Sciences (GVK Biosciences), Charles River Laboratories, Curia (Albany Molecular Research Inc.), Dalton Pharma Services, Domainex, Eurofins, Evotec SE, GenScript, Jubilant Biosys, Laboratory Corporation of America Holdings, Pharmaron, QIAGEN, Syngene International, Thermo Fisher Scientific, WuXi AppTec.

Recent Development:

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Large Molecule Drug Discovery Outsourcing market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Large Molecule Drug Discovery Outsourcing market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Large Molecule Drug Discovery Outsourcing market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Large Molecule Drug Discovery Outsourcing market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Large Molecule Drug Discovery Outsourcing market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2025 |

| Growth Rate | CAGR of 9.55 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Technology |

|

| The Segment covered by Type |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Large Molecule Drug Discovery Outsourcing market share, size, and revenue growth rate were created by Quintile Report™. Large Molecule Drug Discovery Outsourcing analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Large Molecule Drug Discovery Outsourcing Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Large Molecule Drug Discovery Outsourcing Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Large Molecule Drug Discovery Outsourcing Market, by Region, (USD Million) 2017-2035

Table 21 China Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Large Molecule Drug Discovery Outsourcing Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Large Molecule Drug Discovery Outsourcing Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Large Molecule Drug Discovery Outsourcing Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Large Molecule Drug Discovery Outsourcing Market: market scenario

Fig.4 Global Large Molecule Drug Discovery Outsourcing Market competitive outlook

Fig.5 Global Large Molecule Drug Discovery Outsourcing Market driver analysis

Fig.6 Global Large Molecule Drug Discovery Outsourcing Market restraint analysis

Fig.7 Global Large Molecule Drug Discovery Outsourcing Market opportunity analysis

Fig.8 Global Large Molecule Drug Discovery Outsourcing Market trends analysis

Fig.9 Global Large Molecule Drug Discovery Outsourcing Market: Segment Analysis (Based on the scope)

Fig.10 Global Large Molecule Drug Discovery Outsourcing Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Minimal Residual Disease Testing Market Report SummaryThe Global Minimal Residual Disease Testing Ma

Read MoreReport Descriptions: The Global Companion Animal Diagnostics Market was estimated at USD 6.95 billio

Read MoreReport Descriptions: The Global Cryoablation Probe Market was estimated at USD 216.09 million in 202

Read More