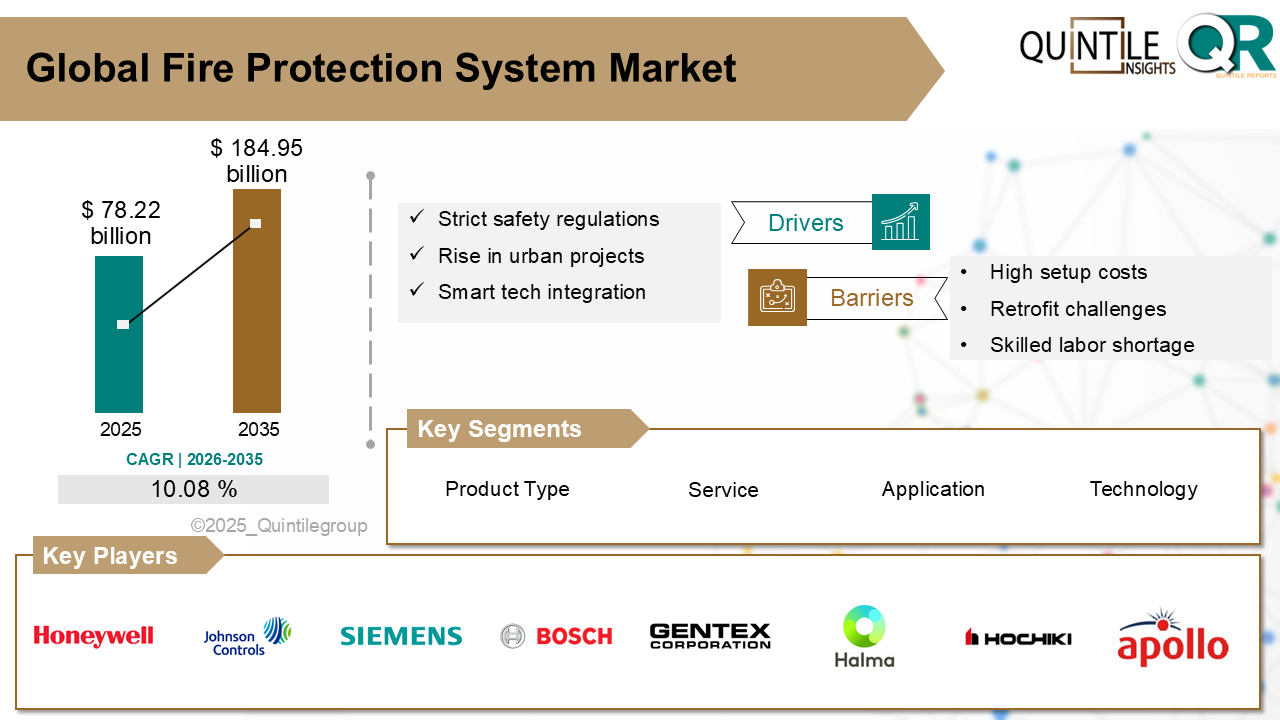

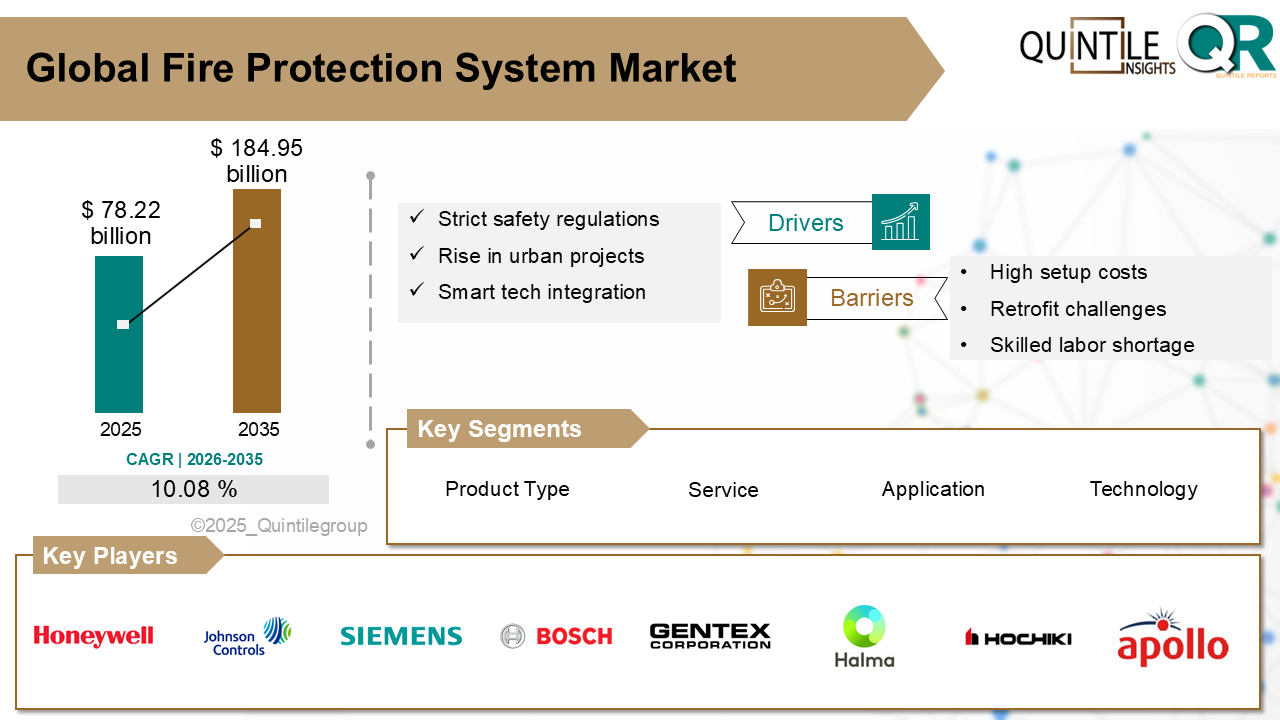

The Global Fire Protection System Market was valued at USD 78.22 billion in 2025 and is projected to reach USD 184.95 billion by 2035, expanding at a robust CAGR of 10.08% during the forecast period from 2026 to 2035. The Fire Protection System market report delivers a comprehensive industry assessment by analyzing macroeconomic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to provide a clear outlook on future growth potential.

With 2025 as the base year, the Fire Protection System market is experiencing steady expansion driven by continuous innovation, rising demand across end-use industries, and rapid technological progress. Market participants are increasingly optimizing their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to shifting competitive dynamics.

Looking ahead to 2035, the market is expected to maintain strong growth momentum, supported by sustained investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that focus on innovation, agile GTM execution, and alignment with evolving customer needs are well positioned to achieve long-term success. The report provides in-depth insights into key market drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by robust qualitative and quantitative analysis spanning 2017 to 2035.

The fire protection system market refers to the global and regional market for technologies and solutions designed to detect, control, suppress, and prevent fires across residential, commercial, industrial, and institutional settings. These systems encompass a broad range of products, including fire detection (smoke, heat, flame detectors), suppression systems (sprinklers, gas-based systems, foam), fire extinguishers, alarm and notification systems, and fire response control panels. They are integral to ensuring life safety, asset protection, and regulatory compliance in both new constructions and retrofit projects.

Traditionally driven by building safety codes and insurance requirements, the market is now shaped by smart integration trends, where fire protection systems are interconnected with building automation and IoT platforms for real-time monitoring and predictive maintenance. Growing urbanisation, increased infrastructure investment, and rising awareness of fire hazards in high-risk industries such as oil & gas, manufacturing, and data centres are key demand drivers. The fire protection system market serves building owners, facility managers, industrial operators, and public safety agencies, with both active and passive fire protection technologies contributing to market growth.

The major spurring force for the fire protection system market is the growing stringency of fire safety regulations in commercial, industrial, and residential applications. Global regulatory bodies and governments have introduced stringent building codes and security regulations to minimise the danger from fire hazards. Compliance with these standards has become obligatory for constructing buildings, and thus, fire detection, suppression, and alarm systems are being installed on a large scale.

The second major driver is increased urbanisation and increased growth in construction activities, especially in developing economies. Construction of high-rise buildings, intelligent cities, shopping malls, airports, and data centers enhances the demand for effective fire protection solutions to safeguard occupants and infrastructure. With increased asset value and population density in cities, demand for combined and automated fire systemsa measure of rapid response and less human interventionhas grown manyfold.

The market is also experiencing expansion due to growing awareness of safety and risk mitigation within industrial installations, particularly in industries such as oil & gas, manufacturing, and chemical processing. The facilities are prone to fire due to the usage of combustible materials and sophisticated equipment.

Technology innovation also takes the lead, with intelligent fire safety systems with IoT, AI, and cloud-based monitoring increasingly becoming popular. These systems introduce predictive maintenance, real-time notifications, remote monitoring, and advanced diagnostics, all of which enhance emergency preparedness.

Finally, increasing insurance compliance needs and business liability issues are encouraging companies to install and maintain certified fire protection systems. Insurers are providing increased coverage or lower premiums for structures with new, code-compliant fire protection and making it an economically viable option for companies and property owners.

Fire protection systemsespecially sophisticated ones such as sprinkler systems, gas suppression systems, and smart alarm systemsare very expensive to install. They need specialized design, infrastructure, and experienced professionals, which fall beyond the financial capabilities of small and medium businesses.

Installation of new fire protection systems within historic buildings is usually complicated by architectural limitations and legacy electrical or plumbing infrastructure. Incompatibility with older infrastructure of legacy infrastructure from newer fire safety technologies can lead to technical inefficiencies, compliance issues, or over-engineering.

A lack of standard global fire safety codes and differential regional laws makes operation challenging for manufacturers and contractors. While some countries have strict safety requirements, other countries have extremely lenient or poorly enforced laws, creating mixed demand in the market. The firms need to make products conform in different states, which is expensive and time-consuming and deters economies of scale.

Fire alarm systems, particularly heat and smoke detectors, are susceptible to false alarms caused by dust, humidity, or improper calibration. Repeated false alarms interfere with business, lead to occupant desensitisation, and undermine faith in system reliability. In addition, automation suppression system failure can cause damage to equipment or pose safety risks and thus add liability and maintenance inspection.

Throughout most of the developing nations, there is a low level of awareness concerning fire protection regulations and either no or insufficient building codes. This means there is little demand for commercial and residential market fire protection systems due to the sheer size of the hazard. Limited access to financing and the absence of insurance incentives also discourage the development of these markets, with most of the world's infrastructure remaining uncovered.

North America is the leader in the fire protection industry with its market dominance. It's driven by expansion across commercial and industrial usese.g., retail complexes, data centers, power facilitiesby smart-building takeup and regulatory pressures (e.g., NFPA codes). Industry leaders like Honeywell, Johnson Controls, and Gentex are the trend setters with IoT-capable detection devices, self-sustaining suppression, and performance tracking.

Europe is driven by stringent building safety codes and green building standards to adopt fire protection solutions. Germany, France, and the UK are retrofitting buildings with sprinklers, alarm systems, and suppression products. Interoperability with building management systems and conformity at the EU level are the focus in the region.

The Asia-Pacific market is the most rapidly growing fire protection market. Urbanisation in China, India, Japan, and Southeast Asia is creating demand. Huge infrastructure development, high-rise complexes, factories, combined with increased awareness of fire safety, are driving automated detection, suppression systems, and intelligent fire alarm installations.

Latin America is experiencing consistent development in fire protection due to rising urban infrastructure in Brazil, Mexico, and Argentina. Commercial and industrial markets are adopting comprehensive systemssprinklers, extinguishers, and detection modulesto address the growing building safety requirements and reduce risks in manufacturing and energy industries.

Middle East & Africa is witnessing growing investment in fire protection systems, largely in GCC countries, North Africa, and regions in sub-Saharan Africa. Advanced sprinklers, passive fire protection, and cleverly networked alarm systems are being fitted into complex city developments, oil and gas complexes, and high-end hospitality complexes. Regional players such as NAFFCO in the UAE are growing regional reach.

The United States dominates the world market for the fire protection system industry, supported by rising investments in wildlandurban interface (WUI) regions. Another overwhelming driving force is the dynamite expansion in wildlandurban interface (WUI) regions where expanding residential areas confront more flammable wildlands, feeling heightened wildfire threat and demand for state-of-the-art protection systems.

Integrated fire protection systems such as smart alarms, automated sprinkler systems, water-mist systems, and real-time aerial detection are being implemented in California in Colorado and Oregon to safeguard homes in WUI areas from deadly wildfires. The innovation is a wake-up reaction to catastrophic occurrences such as the January 2025 Southern California wildfires that engulfed more than 18,000 buildings and highlighted the need for fire-resistant defences.

In addition, insurance caps are pushing private deployment of fire suppression upgrades. As insurers jack up premiums or deny coverage where danger lurks, building owners are putting in personal hydrants, private pumps, and intelligent suppression systemsrationalised to get favourable insurance terms. Private investments of this kind are quick to go mainstream in prosperous and exposed neighbourhoods..

Germany is also the leader in the European market for fire protection systems due to an insistence on a strict regulation policy and an ingrained culture of industrial risk management and safety. The application of fire codes like DIN 4102 and VdS standards, and the European Construction Products Regulation (CPR), requires sophisticated fire detection, suppression, and evacuation technologies in all forms of buildingresidential, commercial, and industrial.

Germany's logistics and manufacturing industrial sectors, on a mass scalespecifically automotive, chemical, and electronicsconsider fire protection as a cornerstone of business resilience. It has resulted in increasing demand for intelligent fire alarm systems, smart fire detection systems, and integrated alarm networks for industrial use, mainly in states like North Rhine-Westphalia and Baden-Wrttemberg that house a high number of high-risk manufacturing units.

In parallel, new construction of energy-efficient buildings and retrofit initiatives under KfW development loans are propelling the adoption of sophisticated, code-enforced fire protection solutions in residential and public buildings. German technology giants Siemens, Bosch Building Technologies, and Minimax are at the forefront of the market with networked fire protection systems that include IoT connectivity, predictive maintenance, and system-wide compliance with changing digital building requirements.

Japan's fast-growing urbanisation, particularly in megacities such as Tokyo and Osaka, is the power behind its fire protection systems market. With sky-scraping skyscrapers, highly developed housing, and rising commercial complexes, there is a high risk of fire propagation. This population density elevates the demand for advanced systems, ranging from highly technical smoke and heat sensors to large sprinkler systems, to provide occupant safety in highly populated areas.

Strict government regulations and building codes also fuel the trend. Japan's Fire Service Act and Building Standards Act require extensive fire protection systems in new constructions and extensive renovations. The Japan Fire Equipment Inspection Institute and the Fire & Disaster Management Agency strictly apply these standards. As regulations changegreater use of smart detection and IoT-based suppressiondevelopers and facilities managers are forced to put in compliant, high-tech systems.

The fire protection industry is characterized by the capacity of vendors to integrate sophisticated safety solutions on integrated platforms. Companies are competing on the basis of synchronized systems that include detection, suppression, alarm, and building automation interfaces.

This integration provides every feature to work synergistically when there is an event, saving response time and eliminating manual monitoringa huge benefit to facility managers and building owners who operate in high-density or sensitive applications.

Operators are pushing integration with shared protocols, sensors enabled by the internet of things, and modular architecture that accommodates legacy suppression agents and newer green technologies. The leaders are companies that create systems that interact gorgeously with smart building controls, emergency notification systems, and facility management software.

These solutions provide real-time visibility, predictive maintenance notifications, and remote diagnosis all of which equate to enhanced safety assurance, less downtime, and lower lifecycle cost.

Last but not least, system integration is not an amenity it's the strategic value anchor of the fire protection industry. It has an influence on regulatory compliance, operational performance, and end-user confidence. Firms providing integrated platforms that are flexible yet robust will have market preference, create more profound customer relationships, and define the future of intelligent fire safety infrastructure.

Key players in the market are Honeywell International Inc., Johnson Controls International plc, Siemens AG, Robert Bosch GmbH, Gentex Corporation, Halma plc, Hochiki Corporation, United Technologies Corporation (Carrier), Minimax Viking GmbH, Securiton AG, Napco Security Technologies, Eaton Corporation plc, Apollo Fire Detectors Ltd., Tyco International, NAFFCO (National Fire Fighting Manufacturing FZCO), Fike Corporation.

In October 2024, Tyco, a subsidiary of Johnson Controls, launched its IntelliGuard Smart Fire Suppression System with predictive analytics, IoT-sensor-based connectivity, and cloud-based monitoring, targeting the protection of high-value assets. The system facilitates real-time alerting and proactive maintenance.

In April 2025, Honeywell closed the acquisition of Lifeline Fire & Safety, a premium fire detection and emergency evacuation products firm. The acquisition is to enhance Honeywell's product portfolio in smart alarm systems and increase its coverage of services in North America.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Fire Protection System market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Fire Protection System market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Fire Protection System market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Fire Protection System market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Fire Protection System market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 10.08 from 2026 to 2035 |

| Base Year | 2025 |

| Actual Estimates / Historical Data | 2017 - 2024 |

| Forecast Period | 2026 - 2035 |

| Quantitative Units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country Scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment Covered by Product Type |

|

| The Segment Covered by Service |

|

| Companies Covered |

|

| Report Coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free Customization Scope (Equivalent to 5 Analyst Working Days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Fire Protection System market share, size, and revenue growth rate were created by Quintile Report™. Fire Protection System analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Fire Protection System Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Fire Protection System Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Fire Protection System Market, by Region, (USD Million) 2017-2035

Table 21 China Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Fire Protection System Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Fire Protection System Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Fire Protection System Market: market scenario

Fig.4 Global Fire Protection System Market competitive outlook

Fig.5 Global Fire Protection System Market driver analysis

Fig.6 Global Fire Protection System Market restraint analysis

Fig.7 Global Fire Protection System Market opportunity analysis

Fig.8 Global Fire Protection System Market trends analysis

Fig.9 Global Fire Protection System Market: Segment Analysis (Based on the scope)

Fig.10 Global Fire Protection System Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Fire Protection System Market was valued at USD 78.22 billion in 2025 and is projected to reach USD 184.95 billion by 2035, expanding at a robust CAGR of 10.08% during the forecast period from 2026 to 2035. The Fire Protection System market report delivers a comprehensive industry assessment by analyzing macroeconomic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to provide a clear outlook on future growth potential.

With 2025 as the base year, the Fire Protection System market is experiencing steady expansion driven by continuous innovation, rising demand across end-use industries, and rapid technological progress. Market participants are increasingly optimizing their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to shifting competitive dynamics.

Looking ahead to 2035, the market is expected to maintain strong growth momentum, supported by sustained investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that focus on innovation, agile GTM execution, and alignment with evolving customer needs are well positioned to achieve long-term success. The report provides in-depth insights into key market drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by robust qualitative and quantitative analysis spanning 2017 to 2035.

The fire protection system market refers to the global and regional market for technologies and solutions designed to detect, control, suppress, and prevent fires across residential, commercial, industrial, and institutional settings. These systems encompass a broad range of products, including fire detection (smoke, heat, flame detectors), suppression systems (sprinklers, gas-based systems, foam), fire extinguishers, alarm and notification systems, and fire response control panels. They are integral to ensuring life safety, asset protection, and regulatory compliance in both new constructions and retrofit projects.

Traditionally driven by building safety codes and insurance requirements, the market is now shaped by smart integration trends, where fire protection systems are interconnected with building automation and IoT platforms for real-time monitoring and predictive maintenance. Growing urbanisation, increased infrastructure investment, and rising awareness of fire hazards in high-risk industries such as oil & gas, manufacturing, and data centres are key demand drivers. The fire protection system market serves building owners, facility managers, industrial operators, and public safety agencies, with both active and passive fire protection technologies contributing to market growth.

The major spurring force for the fire protection system market is the growing stringency of fire safety regulations in commercial, industrial, and residential applications. Global regulatory bodies and governments have introduced stringent building codes and security regulations to minimise the danger from fire hazards. Compliance with these standards has become obligatory for constructing buildings, and thus, fire detection, suppression, and alarm systems are being installed on a large scale.

The second major driver is increased urbanisation and increased growth in construction activities, especially in developing economies. Construction of high-rise buildings, intelligent cities, shopping malls, airports, and data centers enhances the demand for effective fire protection solutions to safeguard occupants and infrastructure. With increased asset value and population density in cities, demand for combined and automated fire systemsa measure of rapid response and less human interventionhas grown manyfold.

The market is also experiencing expansion due to growing awareness of safety and risk mitigation within industrial installations, particularly in industries such as oil & gas, manufacturing, and chemical processing. The facilities are prone to fire due to the usage of combustible materials and sophisticated equipment.

Technology innovation also takes the lead, with intelligent fire safety systems with IoT, AI, and cloud-based monitoring increasingly becoming popular. These systems introduce predictive maintenance, real-time notifications, remote monitoring, and advanced diagnostics, all of which enhance emergency preparedness.

Finally, increasing insurance compliance needs and business liability issues are encouraging companies to install and maintain certified fire protection systems. Insurers are providing increased coverage or lower premiums for structures with new, code-compliant fire protection and making it an economically viable option for companies and property owners.

Fire protection systemsespecially sophisticated ones such as sprinkler systems, gas suppression systems, and smart alarm systemsare very expensive to install. They need specialized design, infrastructure, and experienced professionals, which fall beyond the financial capabilities of small and medium businesses.

Installation of new fire protection systems within historic buildings is usually complicated by architectural limitations and legacy electrical or plumbing infrastructure. Incompatibility with older infrastructure of legacy infrastructure from newer fire safety technologies can lead to technical inefficiencies, compliance issues, or over-engineering.

A lack of standard global fire safety codes and differential regional laws makes operation challenging for manufacturers and contractors. While some countries have strict safety requirements, other countries have extremely lenient or poorly enforced laws, creating mixed demand in the market. The firms need to make products conform in different states, which is expensive and time-consuming and deters economies of scale.

Fire alarm systems, particularly heat and smoke detectors, are susceptible to false alarms caused by dust, humidity, or improper calibration. Repeated false alarms interfere with business, lead to occupant desensitisation, and undermine faith in system reliability. In addition, automation suppression system failure can cause damage to equipment or pose safety risks and thus add liability and maintenance inspection.

Throughout most of the developing nations, there is a low level of awareness concerning fire protection regulations and either no or insufficient building codes. This means there is little demand for commercial and residential market fire protection systems due to the sheer size of the hazard. Limited access to financing and the absence of insurance incentives also discourage the development of these markets, with most of the world's infrastructure remaining uncovered.

North America is the leader in the fire protection industry with its market dominance. It's driven by expansion across commercial and industrial usese.g., retail complexes, data centers, power facilitiesby smart-building takeup and regulatory pressures (e.g., NFPA codes). Industry leaders like Honeywell, Johnson Controls, and Gentex are the trend setters with IoT-capable detection devices, self-sustaining suppression, and performance tracking.

Europe is driven by stringent building safety codes and green building standards to adopt fire protection solutions. Germany, France, and the UK are retrofitting buildings with sprinklers, alarm systems, and suppression products. Interoperability with building management systems and conformity at the EU level are the focus in the region.

The Asia-Pacific market is the most rapidly growing fire protection market. Urbanisation in China, India, Japan, and Southeast Asia is creating demand. Huge infrastructure development, high-rise complexes, factories, combined with increased awareness of fire safety, are driving automated detection, suppression systems, and intelligent fire alarm installations.

Latin America is experiencing consistent development in fire protection due to rising urban infrastructure in Brazil, Mexico, and Argentina. Commercial and industrial markets are adopting comprehensive systemssprinklers, extinguishers, and detection modulesto address the growing building safety requirements and reduce risks in manufacturing and energy industries.

Middle East & Africa is witnessing growing investment in fire protection systems, largely in GCC countries, North Africa, and regions in sub-Saharan Africa. Advanced sprinklers, passive fire protection, and cleverly networked alarm systems are being fitted into complex city developments, oil and gas complexes, and high-end hospitality complexes. Regional players such as NAFFCO in the UAE are growing regional reach.

The United States dominates the world market for the fire protection system industry, supported by rising investments in wildlandurban interface (WUI) regions. Another overwhelming driving force is the dynamite expansion in wildlandurban interface (WUI) regions where expanding residential areas confront more flammable wildlands, feeling heightened wildfire threat and demand for state-of-the-art protection systems.

Integrated fire protection systems such as smart alarms, automated sprinkler systems, water-mist systems, and real-time aerial detection are being implemented in California in Colorado and Oregon to safeguard homes in WUI areas from deadly wildfires. The innovation is a wake-up reaction to catastrophic occurrences such as the January 2025 Southern California wildfires that engulfed more than 18,000 buildings and highlighted the need for fire-resistant defences.

In addition, insurance caps are pushing private deployment of fire suppression upgrades. As insurers jack up premiums or deny coverage where danger lurks, building owners are putting in personal hydrants, private pumps, and intelligent suppression systemsrationalised to get favourable insurance terms. Private investments of this kind are quick to go mainstream in prosperous and exposed neighbourhoods..

Germany is also the leader in the European market for fire protection systems due to an insistence on a strict regulation policy and an ingrained culture of industrial risk management and safety. The application of fire codes like DIN 4102 and VdS standards, and the European Construction Products Regulation (CPR), requires sophisticated fire detection, suppression, and evacuation technologies in all forms of buildingresidential, commercial, and industrial.

Germany's logistics and manufacturing industrial sectors, on a mass scalespecifically automotive, chemical, and electronicsconsider fire protection as a cornerstone of business resilience. It has resulted in increasing demand for intelligent fire alarm systems, smart fire detection systems, and integrated alarm networks for industrial use, mainly in states like North Rhine-Westphalia and Baden-Wrttemberg that house a high number of high-risk manufacturing units.

In parallel, new construction of energy-efficient buildings and retrofit initiatives under KfW development loans are propelling the adoption of sophisticated, code-enforced fire protection solutions in residential and public buildings. German technology giants Siemens, Bosch Building Technologies, and Minimax are at the forefront of the market with networked fire protection systems that include IoT connectivity, predictive maintenance, and system-wide compliance with changing digital building requirements.

Japan's fast-growing urbanisation, particularly in megacities such as Tokyo and Osaka, is the power behind its fire protection systems market. With sky-scraping skyscrapers, highly developed housing, and rising commercial complexes, there is a high risk of fire propagation. This population density elevates the demand for advanced systems, ranging from highly technical smoke and heat sensors to large sprinkler systems, to provide occupant safety in highly populated areas.

Strict government regulations and building codes also fuel the trend. Japan's Fire Service Act and Building Standards Act require extensive fire protection systems in new constructions and extensive renovations. The Japan Fire Equipment Inspection Institute and the Fire & Disaster Management Agency strictly apply these standards. As regulations changegreater use of smart detection and IoT-based suppressiondevelopers and facilities managers are forced to put in compliant, high-tech systems.

The fire protection industry is characterized by the capacity of vendors to integrate sophisticated safety solutions on integrated platforms. Companies are competing on the basis of synchronized systems that include detection, suppression, alarm, and building automation interfaces.

This integration provides every feature to work synergistically when there is an event, saving response time and eliminating manual monitoringa huge benefit to facility managers and building owners who operate in high-density or sensitive applications.

Operators are pushing integration with shared protocols, sensors enabled by the internet of things, and modular architecture that accommodates legacy suppression agents and newer green technologies. The leaders are companies that create systems that interact gorgeously with smart building controls, emergency notification systems, and facility management software.

These solutions provide real-time visibility, predictive maintenance notifications, and remote diagnosis all of which equate to enhanced safety assurance, less downtime, and lower lifecycle cost.

Last but not least, system integration is not an amenity it's the strategic value anchor of the fire protection industry. It has an influence on regulatory compliance, operational performance, and end-user confidence. Firms providing integrated platforms that are flexible yet robust will have market preference, create more profound customer relationships, and define the future of intelligent fire safety infrastructure.

Key players in the market are Honeywell International Inc., Johnson Controls International plc, Siemens AG, Robert Bosch GmbH, Gentex Corporation, Halma plc, Hochiki Corporation, United Technologies Corporation (Carrier), Minimax Viking GmbH, Securiton AG, Napco Security Technologies, Eaton Corporation plc, Apollo Fire Detectors Ltd., Tyco International, NAFFCO (National Fire Fighting Manufacturing FZCO), Fike Corporation.

In October 2024, Tyco, a subsidiary of Johnson Controls, launched its IntelliGuard Smart Fire Suppression System with predictive analytics, IoT-sensor-based connectivity, and cloud-based monitoring, targeting the protection of high-value assets. The system facilitates real-time alerting and proactive maintenance.

In April 2025, Honeywell closed the acquisition of Lifeline Fire & Safety, a premium fire detection and emergency evacuation products firm. The acquisition is to enhance Honeywell's product portfolio in smart alarm systems and increase its coverage of services in North America.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Fire Protection System market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Fire Protection System market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Fire Protection System market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Fire Protection System market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Fire Protection System market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 10.08 from 2026 to 2035 |

| Base Year | 2025 |

| Actual Estimates / Historical Data | 2017 - 2024 |

| Forecast Period | 2026 - 2035 |

| Quantitative Units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country Scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment Covered by Product Type |

|

| The Segment Covered by Service |

|

| Companies Covered |

|

| Report Coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free Customization Scope (Equivalent to 5 Analyst Working Days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Fire Protection System market share, size, and revenue growth rate were created by Quintile Report™. Fire Protection System analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Fire Protection System Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Fire Protection System Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Fire Protection System Market, by Region, (USD Million) 2017-2035

Table 21 China Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Fire Protection System Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Fire Protection System Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Fire Protection System Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Fire Protection System Market: market scenario

Fig.4 Global Fire Protection System Market competitive outlook

Fig.5 Global Fire Protection System Market driver analysis

Fig.6 Global Fire Protection System Market restraint analysis

Fig.7 Global Fire Protection System Market opportunity analysis

Fig.8 Global Fire Protection System Market trends analysis

Fig.9 Global Fire Protection System Market: Segment Analysis (Based on the scope)

Fig.10 Global Fire Protection System Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy