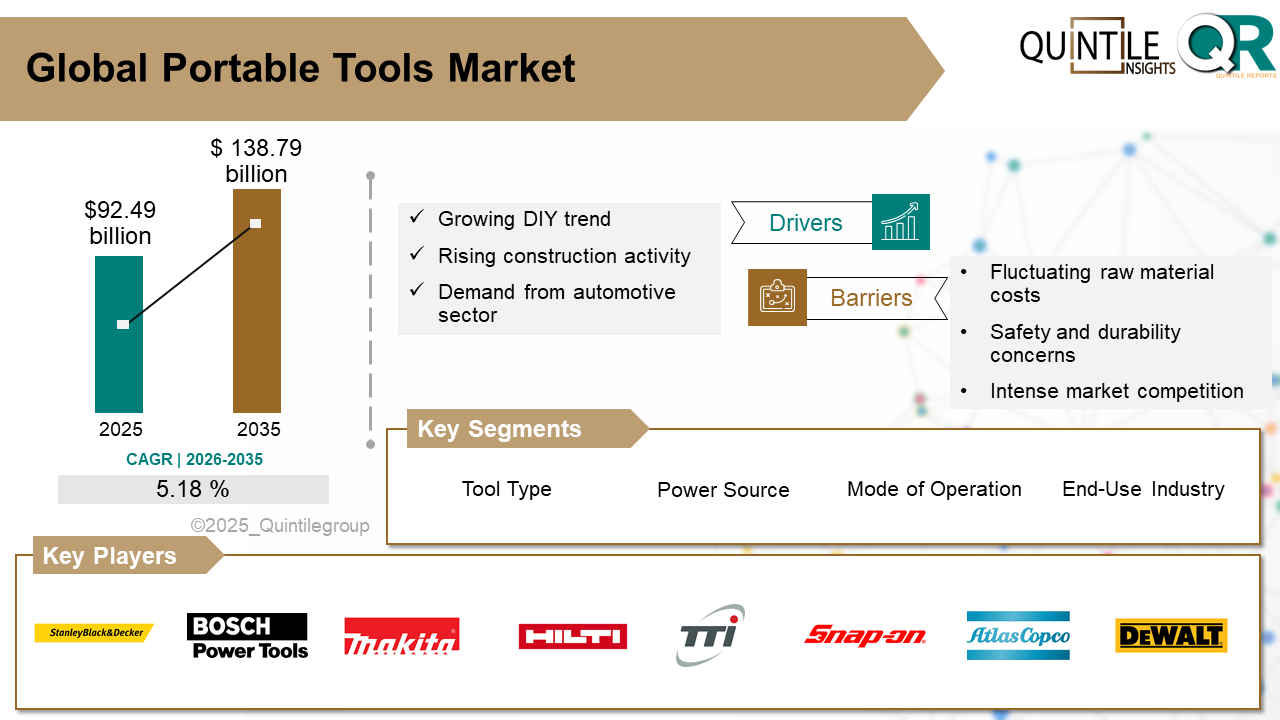

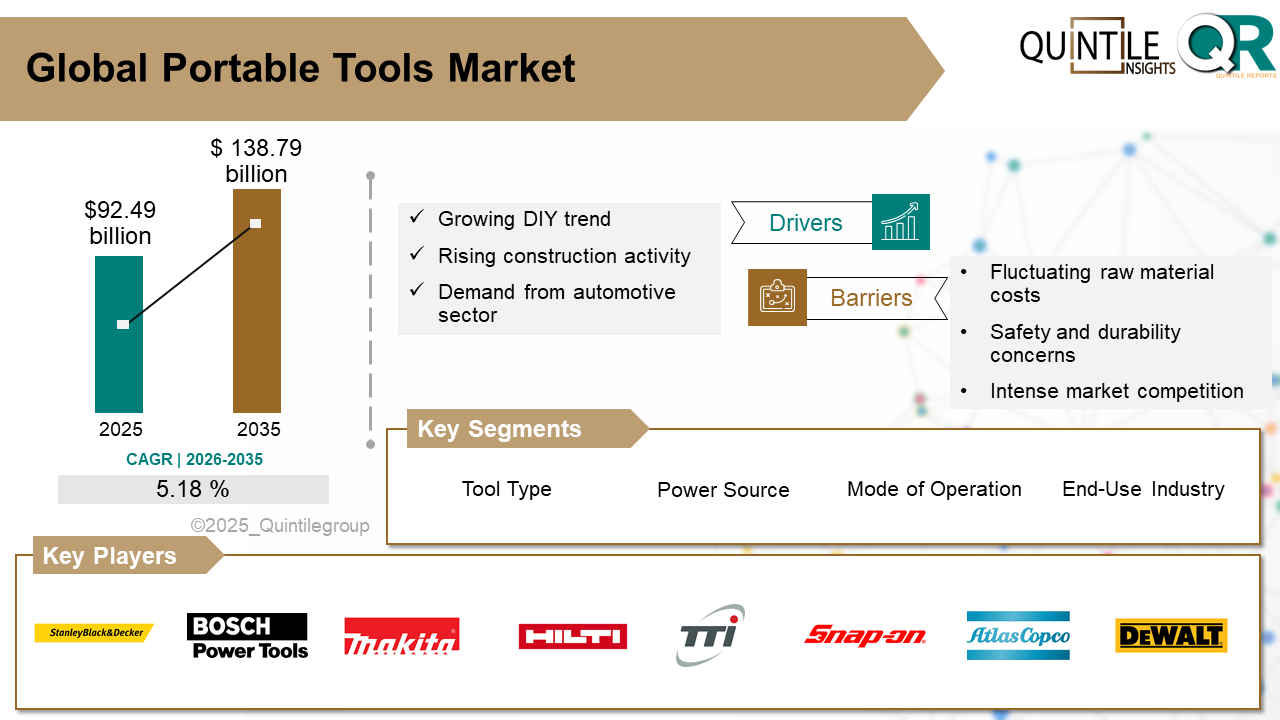

The Global Portable Tools Market was valued at USD 92.49 billion in 2025 and is projected to reach USD 138.79 billion by 2035, expanding at a robust CAGR of 5.18% during the forecast period from 2026 to 2035. The Portable Tools market report delivers a comprehensive industry assessment by analyzing macroeconomic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to provide a clear outlook on future growth potential.

With 2025 as the base year, the Portable Tools market is experiencing steady expansion driven by continuous innovation, rising demand across end-use industries, and rapid technological progress. Market participants are increasingly optimizing their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to shifting competitive dynamics.

Looking ahead to 2035, the market is expected to maintain strong growth momentum, supported by sustained investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that focus on innovation, agile GTM execution, and alignment with evolving customer needs are well positioned to achieve long-term success. The report provides in-depth insights into key market drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by robust qualitative and quantitative analysis spanning 2017 to 2035.

The portable tools market refers to the global and regional market for compact, handheld tools designed for easy transportation and versatile use across residential, commercial, and industrial applications. These tools are engineered to deliver mobility, flexibility, and efficiency for tasks such as construction, woodworking, metalworking, electrical work, and DIY home improvement.

The category includes both corded and battery-operated (cordless) tools such as drills, saws, grinders, sanders, impact drivers, and heat guns. Traditionally dominated by electrically powered tools, the market has increasingly embraced lithium-ion battery technologies that offer higher performance, longer runtimes, and cordless convenience.

Manufacturers are also integrating smart features, ergonomic designs, and brushless motors to enhance productivity, safety, and durability. The market serves professionals in construction and maintenance, industrial technicians, and DIY hobbyists, with demand shaped by infrastructure development, renovation activity, and the growth of do-it-yourself culture.

The rapid transition toward lithium-ion battery platforms and improvements in energy density have fueled the adoption of high-performance cordless tools. These advancements deliver longer runtime, faster charging, and improved mobility, significantly boosting on-site productivity.

Workplace safety regulations from bodies such as OSHA are driving demand for tools with protective features including insulation, blade guards, vibration reduction, and dust control systems to ensure safer operation.

Sustainability policies and environmental awareness are influencing tool design and adoption. Manufacturers are developing energy-efficient, low-noise, and low-emission tools that align with green building codes and sustainable construction practices.

Lenient emissions standards and global clean-energy initiatives are accelerating the shift toward battery-powered, low-emission portable tools, particularly in construction and industrial sectors seeking to reduce carbon footprints.

Modern portable tools increasingly embed IoT and smart connectivity features, enabling remote diagnostics, asset tracking, performance monitoring, and integration into smart workshop and Industry 4.0 environments.

Advanced portable toolsespecially cordless models with brushless motorsoften carry premium price tags. Although they offer long-term efficiency, the high upfront cost can deter small businesses and DIY users, particularly when battery replacement and servicing costs are considered.

Cordless tools rely heavily on lithium-ion batteries, which experience capacity fading of approximately 0.030.05% per cycle. Battery degradation in extreme temperatures and potential fire risks from thermal instability can limit adoption in demanding industrial environments.

Exposure to vibration from handheld tools can lead to serious health issues such as hand-arm vibration syndrome (HAVS), vibration white finger (VWF), and carpal tunnel syndrome. Addressing these risks requires vibration-dampening designs, PPE, training, and regulated usage timeadding cost and complexity.

Manufacturing tools from metals and plastics generates a substantial carbon footprint. Battery recycling remains costly and underdeveloped, with many lithium-ion batteries ending up in landfills. Stricter environmental regulations are forcing manufacturers to invest in greener materials and circular economy solutions.

In rural and developing regions, limited access to electricity, internet connectivity, spare parts, and after-sales service restricts the adoption and long-term usability of advanced portable tools.

North America leads with a mature professional and DIY market. High adoption of cordless, compact, and ergonomic tools is driven by safety regulations, smart tool integration, and certification standards such as UL and ANSI. Energy-efficient and low-noise designs are increasingly prioritized.

Europes market is shaped by automotive, aerospace, and construction demand. Buyers emphasize precision, ergonomics, vibration control, and recyclability. Compliance with CE/UKCA standards and green building regulations strongly influences purchasing decisions.

Asia-Pacific is the fastest-growing region, driven by rapid urbanization and manufacturing growth in China, India, Japan, and Southeast Asia. Battery-powered drills, saws, and compact machine tools dominate demand, supported by local manufacturing and advancements in lithium-ion technology.

Latin America shows steady growth fueled by infrastructure development in Brazil, Mexico, and Argentina. Demand centers on rugged, low-maintenance tools for small builders and homeowners, with rising e-commerce penetration improving product accessibility.

The region experiences moderate growth, supported by construction, oil & gas, and mining projects. Demand focuses on heavy-duty portable tools suitable for harsh site conditions, with expanding retail and online distribution channels.

The U.S. dominates the portable tools market due to a strong DIY culture, rising home renovation activity, and suburban remodeling trends. Online platforms such as YouTube and TikTok have fueled DIY engagement, increasing demand for user-friendly, ergonomic cordless tools.

Retailers like Home Depot, Lowes, and Amazon are expanding smart-enabled tool ecosystems with brushless motors, fast-charging batteries, and Bluetooth tracking, enhancing customer loyalty and market penetration.

Germanys strong mechanical engineering, automotive, and industrial base drives demand for high-performance portable tools. The shift toward Industry 4.0 has increased adoption of digitally connected tools for predictive maintenance and real-time diagnostics.

Japans aging workforce and labor shortages are driving demand for lightweight, ergonomic, and easy-to-use portable tools. Government subsidies and productivity programs support the adoption of smart, eco-friendly cordless tool platforms.

The portable tools market is highly competitive, driven by innovation in battery technology, brushless motors, ergonomics, and IoT connectivity. Market leaders compete on tool ecosystems that allow multiple tools to share a single battery platform.

R&D capabilities, supply chain resilience, and digital sales channels are critical differentiators. Manufacturers are also focusing on noise reduction, compact designs, and sustainable materials to capture premium and consumer-facing segments.

Key players include Stanley Black & Decker, Bosch Power Tools, Makita Corporation, Hilti Group, Techtronic Industries (TTI), Snap-on Incorporated, Atlas Copco, DEWALT, Milwaukee Tool, Festool, Husqvarna Group, RIDGID, Koki Holdings (HiKOKI), Einhell Germany AG, Chervon Holdings, Apex Tool Group, Positec Group, Panasonic Electric Works, Ryobi Tools, and WORX.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Portable Tools market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Portable Tools market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Portable Tools market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Portable Tools market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Portable Tools market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 5.18 from 2026 to 2035 |

| Base Year | 2025 |

| Actual Estimates / Historical Data | 2017 - 2024 |

| Forecast Period | 2026 - 2035 |

| Quantitative Units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country Scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment Covered by Tool Type |

|

| The Segment Covered by Power Source |

|

| Companies Covered |

|

| Report Coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free Customization Scope (Equivalent to 5 Analyst Working Days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Portable Tools market share, size, and revenue growth rate were created by Quintile Report™. Portable Tools analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Portable Tools Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Portable Tools Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Portable Tools Market, by Region, (USD Million) 2017-2035

Table 21 China Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Portable Tools Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Portable Tools Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Portable Tools Market: market scenario

Fig.4 Global Portable Tools Market competitive outlook

Fig.5 Global Portable Tools Market driver analysis

Fig.6 Global Portable Tools Market restraint analysis

Fig.7 Global Portable Tools Market opportunity analysis

Fig.8 Global Portable Tools Market trends analysis

Fig.9 Global Portable Tools Market: Segment Analysis (Based on the scope)

Fig.10 Global Portable Tools Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Portable Tools Market was valued at USD 92.49 billion in 2025 and is projected to reach USD 138.79 billion by 2035, expanding at a robust CAGR of 5.18% during the forecast period from 2026 to 2035. The Portable Tools market report delivers a comprehensive industry assessment by analyzing macroeconomic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to provide a clear outlook on future growth potential.

With 2025 as the base year, the Portable Tools market is experiencing steady expansion driven by continuous innovation, rising demand across end-use industries, and rapid technological progress. Market participants are increasingly optimizing their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to shifting competitive dynamics.

Looking ahead to 2035, the market is expected to maintain strong growth momentum, supported by sustained investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that focus on innovation, agile GTM execution, and alignment with evolving customer needs are well positioned to achieve long-term success. The report provides in-depth insights into key market drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by robust qualitative and quantitative analysis spanning 2017 to 2035.

The portable tools market refers to the global and regional market for compact, handheld tools designed for easy transportation and versatile use across residential, commercial, and industrial applications. These tools are engineered to deliver mobility, flexibility, and efficiency for tasks such as construction, woodworking, metalworking, electrical work, and DIY home improvement.

The category includes both corded and battery-operated (cordless) tools such as drills, saws, grinders, sanders, impact drivers, and heat guns. Traditionally dominated by electrically powered tools, the market has increasingly embraced lithium-ion battery technologies that offer higher performance, longer runtimes, and cordless convenience.

Manufacturers are also integrating smart features, ergonomic designs, and brushless motors to enhance productivity, safety, and durability. The market serves professionals in construction and maintenance, industrial technicians, and DIY hobbyists, with demand shaped by infrastructure development, renovation activity, and the growth of do-it-yourself culture.

The rapid transition toward lithium-ion battery platforms and improvements in energy density have fueled the adoption of high-performance cordless tools. These advancements deliver longer runtime, faster charging, and improved mobility, significantly boosting on-site productivity.

Workplace safety regulations from bodies such as OSHA are driving demand for tools with protective features including insulation, blade guards, vibration reduction, and dust control systems to ensure safer operation.

Sustainability policies and environmental awareness are influencing tool design and adoption. Manufacturers are developing energy-efficient, low-noise, and low-emission tools that align with green building codes and sustainable construction practices.

Lenient emissions standards and global clean-energy initiatives are accelerating the shift toward battery-powered, low-emission portable tools, particularly in construction and industrial sectors seeking to reduce carbon footprints.

Modern portable tools increasingly embed IoT and smart connectivity features, enabling remote diagnostics, asset tracking, performance monitoring, and integration into smart workshop and Industry 4.0 environments.

Advanced portable toolsespecially cordless models with brushless motorsoften carry premium price tags. Although they offer long-term efficiency, the high upfront cost can deter small businesses and DIY users, particularly when battery replacement and servicing costs are considered.

Cordless tools rely heavily on lithium-ion batteries, which experience capacity fading of approximately 0.030.05% per cycle. Battery degradation in extreme temperatures and potential fire risks from thermal instability can limit adoption in demanding industrial environments.

Exposure to vibration from handheld tools can lead to serious health issues such as hand-arm vibration syndrome (HAVS), vibration white finger (VWF), and carpal tunnel syndrome. Addressing these risks requires vibration-dampening designs, PPE, training, and regulated usage timeadding cost and complexity.

Manufacturing tools from metals and plastics generates a substantial carbon footprint. Battery recycling remains costly and underdeveloped, with many lithium-ion batteries ending up in landfills. Stricter environmental regulations are forcing manufacturers to invest in greener materials and circular economy solutions.

In rural and developing regions, limited access to electricity, internet connectivity, spare parts, and after-sales service restricts the adoption and long-term usability of advanced portable tools.

North America leads with a mature professional and DIY market. High adoption of cordless, compact, and ergonomic tools is driven by safety regulations, smart tool integration, and certification standards such as UL and ANSI. Energy-efficient and low-noise designs are increasingly prioritized.

Europes market is shaped by automotive, aerospace, and construction demand. Buyers emphasize precision, ergonomics, vibration control, and recyclability. Compliance with CE/UKCA standards and green building regulations strongly influences purchasing decisions.

Asia-Pacific is the fastest-growing region, driven by rapid urbanization and manufacturing growth in China, India, Japan, and Southeast Asia. Battery-powered drills, saws, and compact machine tools dominate demand, supported by local manufacturing and advancements in lithium-ion technology.

Latin America shows steady growth fueled by infrastructure development in Brazil, Mexico, and Argentina. Demand centers on rugged, low-maintenance tools for small builders and homeowners, with rising e-commerce penetration improving product accessibility.

The region experiences moderate growth, supported by construction, oil & gas, and mining projects. Demand focuses on heavy-duty portable tools suitable for harsh site conditions, with expanding retail and online distribution channels.

The U.S. dominates the portable tools market due to a strong DIY culture, rising home renovation activity, and suburban remodeling trends. Online platforms such as YouTube and TikTok have fueled DIY engagement, increasing demand for user-friendly, ergonomic cordless tools.

Retailers like Home Depot, Lowes, and Amazon are expanding smart-enabled tool ecosystems with brushless motors, fast-charging batteries, and Bluetooth tracking, enhancing customer loyalty and market penetration.

Germanys strong mechanical engineering, automotive, and industrial base drives demand for high-performance portable tools. The shift toward Industry 4.0 has increased adoption of digitally connected tools for predictive maintenance and real-time diagnostics.

Japans aging workforce and labor shortages are driving demand for lightweight, ergonomic, and easy-to-use portable tools. Government subsidies and productivity programs support the adoption of smart, eco-friendly cordless tool platforms.

The portable tools market is highly competitive, driven by innovation in battery technology, brushless motors, ergonomics, and IoT connectivity. Market leaders compete on tool ecosystems that allow multiple tools to share a single battery platform.

R&D capabilities, supply chain resilience, and digital sales channels are critical differentiators. Manufacturers are also focusing on noise reduction, compact designs, and sustainable materials to capture premium and consumer-facing segments.

Key players include Stanley Black & Decker, Bosch Power Tools, Makita Corporation, Hilti Group, Techtronic Industries (TTI), Snap-on Incorporated, Atlas Copco, DEWALT, Milwaukee Tool, Festool, Husqvarna Group, RIDGID, Koki Holdings (HiKOKI), Einhell Germany AG, Chervon Holdings, Apex Tool Group, Positec Group, Panasonic Electric Works, Ryobi Tools, and WORX.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Portable Tools market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Portable Tools market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Portable Tools market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Portable Tools market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Portable Tools market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 5.18 from 2026 to 2035 |

| Base Year | 2025 |

| Actual Estimates / Historical Data | 2017 - 2024 |

| Forecast Period | 2026 - 2035 |

| Quantitative Units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country Scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment Covered by Tool Type |

|

| The Segment Covered by Power Source |

|

| Companies Covered |

|

| Report Coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free Customization Scope (Equivalent to 5 Analyst Working Days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Portable Tools market share, size, and revenue growth rate were created by Quintile Report™. Portable Tools analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Portable Tools Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Portable Tools Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Portable Tools Market, by Region, (USD Million) 2017-2035

Table 21 China Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Portable Tools Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Portable Tools Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Portable Tools Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Portable Tools Market: market scenario

Fig.4 Global Portable Tools Market competitive outlook

Fig.5 Global Portable Tools Market driver analysis

Fig.6 Global Portable Tools Market restraint analysis

Fig.7 Global Portable Tools Market opportunity analysis

Fig.8 Global Portable Tools Market trends analysis

Fig.9 Global Portable Tools Market: Segment Analysis (Based on the scope)

Fig.10 Global Portable Tools Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report OverviewThe Global Gas Cylinder Market was valued at USD 12.36 million in 2025 and is project

Read MoreReport OverviewThe Global Drone Mapping Market was valued at USD 2.62 billion in 2025 and is project

Read MoreReport OverviewThe Global CBD Extraction Equipment Market was valued at USD 67.62 million in 2025 an

Read More