The Global Drone Surveying Market was valued at USD 3.29 billion in 2025 and is projected to reach USD 12.71 billion by 2035, expanding at a robust CAGR of 20.28% during the forecast period from 2026 to 2035. The Drone Surveying market report delivers a comprehensive industry assessment by analyzing macroeconomic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to provide a clear outlook on future growth potential.

With 2025 as the base year, the Drone Surveying market is experiencing steady expansion driven by continuous innovation, rising demand across end-use industries, and rapid technological progress. Market participants are increasingly optimizing their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to shifting competitive dynamics.

Looking ahead to 2035, the market is expected to maintain strong growth momentum, supported by sustained investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that focus on innovation, agile GTM execution, and alignment with evolving customer needs are well positioned to achieve long-term success. The report provides in-depth insights into key market drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by robust qualitative and quantitative analysis spanning 2017 to 2035.

The drone surveying market refers to the global and regional market for modern methods of collecting geospatial data using unmanned aerial vehicles (UAVs), commonly known as drones. It is an efficient and cost-effective alternative to traditional surveying methods. The process involves a drone equipped with cameras and sensors flying over an area of interest to capture high-resolution images and spatial data from multiple angles. These images are then processed using specialized software to create detailed maps, 3D models, and other geospatial products.

Key components of drone surveying include UAV platforms, high-resolution cameras (RGB and multispectral), GPS/GNSS/IMU systems for precise positioning, and sensors such as LiDAR. Applications in mining and construction include topographic mapping, volumetric calculations, site planning and monitoring, environmental impact assessments, safety inspections, and progress tracking. When combined with RTK/PPK workflows and GCPs/CPs, drone surveying can achieve centimetre-level accuracy and supports seamless integration with GIS, BIM, and AI/ML platforms.

The market is advancing rapidly due to innovations in drone hardware and sensors, including the integration of LiDAR, RTK/PPK systems, and high-resolution multispectral cameras. These technologies significantly enhance data quality, operational efficiency, and autonomous flight capability, enabling high-precision surveying outcomes.

Time and cost efficiency is another major driver. Compared with traditional ground-based surveys, drones can capture detailed geospatial data in a fraction of the time, reducing labor intensity, equipment costs, and project timelines while increasing update frequency.

The shortage of skilled surveying professionals, particularly in developed markets with aging workforces, is accelerating adoption. Drone surveying enables smaller teams to perform extensive and accurate surveys, helping organizations address labor gaps without sacrificing precision.

Rapid urban development and infrastructure expansion, especially in emerging economies, are increasing demand for fast, scalable, and high-resolution mapping tools. Drone surveying supports construction planning, land-use management, and environmental impact assessments across large-scale projects.

Growing compatibility of drone data with GIS, BIM, and AI platforms is improving data-driven decision-making across construction, agriculture, and mining. At the same time, governments worldwide are updating UAV regulations to support commercial drone operations, further encouraging adoption.

Regulatory complexity remains a major hurdle. Operators must obtain licenses, flight clearances, and comply with altitude and airspace restrictions, particularly near airports or sensitive zones. Managing approvals for Beyond Visual Line of Sight (BVLOS) operations is often time-consuming and restrictive.

Weather dependency significantly impacts survey operations. Strong winds, rain, fog, or extreme temperatures can destabilize drones, reduce sensor accuracy, and lead to mission delays or cancellations.

Limited battery life poses another challenge. Most commercial drones offer only 2040 minutes of flight time, requiring frequent battery swaps and complicating large-area survey logistics.

Drone surveys generate large volumes of data that require advanced processing software, high-performance computing, and skilled analysts. Errors in georeferencing caused by GPS interference or insufficient ground control points can compromise data quality, increasing time and costs.

Additionally, privacy, safety, and cybersecurity concerns persist, particularly in populated areas. Risks include mid-air collisions, signal interference, and unauthorized data access, necessitating strict adherence to safety protocols and airspace management systems.

North America is driving innovation in drone surveying, with developers receiving regulatory waivers for BVLOS operations to monitor power lines, solar farms, and infrastructure assets. These advances support safer, more frequent inspections and broader commercial adoption.

Europe benefits from increasing regulatory clarity. The UK has implemented new BVLOS rules for infrastructure inspection, enabling drone use in power line and wind turbine maintenance projects, improving efficiency and operational safety.

Asia-Pacific is witnessing rapid growth as governments promote drone adoption for infrastructure and agriculture. India uses drone fleets for government-backed missions, while Chinas commercial drone usage is expanding rapidly through state-supported infrastructure programs.

Latin America is adopting UAVs for infrastructure and environmental monitoring. In Brazil, drones support Amazon conservation by mapping tree species, aiding indigenous communities, and enabling real-time deforestation monitoring through collaborative programs.

The Middle East and Africa are using drones for smart-city development, oil & gas inspections, and environmental mapping. In the UAE and Saudi Arabia, projects such as NEOM rely heavily on drone surveys and digital twins for large-scale planning.

Drone surveying is widely adopted across U.S. industries including agriculture, construction, powerline inspection, and emergency response. Supportive FAA regulations, pilot certification programs, and BVLOS waivers have enabled routine commercial drone use. State agencies deploy drones for disaster assessment, transportation planning, and land management, improving response speed and accuracy.

Germany is a European leader in drone surveying, supported by strong government backing and a clear regulatory framework. The country is piloting U-Space zones to manage drone traffic safely in urban and industrial areas. Drones are widely used for infrastructure inspection, agriculture, and environmental monitoring.

Japan relies on drone technology to manage aging infrastructure and workforce shortages. UAVs are used to survey roads, tunnels, and bridges, and to assess disaster damage. In agriculture, drones support crop spraying, health monitoring, and soil analysis. Government subsidies, pilot programs, and public-private partnerships continue to accelerate adoption.

Competition centers on integrated sensor packages combining LiDAR, multispectral, thermal, and RGB cameras to deliver richer data. Companies leveraging AI-enabled autonomy gain advantages through real-time mapping, object detection, and anomaly identification.

Access to BVLOS permissions is increasingly critical, enabling providers to cover larger areas at lower costs. The shift toward Drone-as-a-Service (DaaS) models reduces upfront investment barriers, while real-time data fusion and edge-AI processing are redefining competitive differentiation.

Key players include DJI, Parrot SA, Trimble Inc., senseFly (AgEagle Aerial Systems), Delair, 3D Robotics, PrecisionHawk, AeroVironment Inc., Teledyne FLIR LLC, Microdrones, Kespry, Raptor Maps, DroneDeploy, Wingtra, Quantum Systems, Skydio, Autel Robotics, Yuneec International, Pix4D, Bentley Systems, and other players.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Drone Surveying market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Drone Surveying market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Drone Surveying market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Drone Surveying market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Drone Surveying market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 20.28 from 2026 to 2035 |

| Base Year | 2025 |

| Actual Estimates / Historical Data | 2017 - 2024 |

| Forecast Period | 2026 - 2035 |

| Quantitative Units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country Scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment Covered by Type |

|

| The Segment Covered by Component |

|

| Companies Covered |

|

| Report Coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free Customization Scope (Equivalent to 5 Analyst Working Days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Drone Surveying market share, size, and revenue growth rate were created by Quintile Report™. Drone Surveying analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Drone Surveying Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Drone Surveying Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Drone Surveying Market, by Region, (USD Million) 2017-2035

Table 21 China Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Drone Surveying Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Drone Surveying Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Drone Surveying Market: market scenario

Fig.4 Global Drone Surveying Market competitive outlook

Fig.5 Global Drone Surveying Market driver analysis

Fig.6 Global Drone Surveying Market restraint analysis

Fig.7 Global Drone Surveying Market opportunity analysis

Fig.8 Global Drone Surveying Market trends analysis

Fig.9 Global Drone Surveying Market: Segment Analysis (Based on the scope)

Fig.10 Global Drone Surveying Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Drone Surveying Market was valued at USD 3.29 billion in 2025 and is projected to reach USD 12.71 billion by 2035, expanding at a robust CAGR of 20.28% during the forecast period from 2026 to 2035. The Drone Surveying market report delivers a comprehensive industry assessment by analyzing macroeconomic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to provide a clear outlook on future growth potential.

With 2025 as the base year, the Drone Surveying market is experiencing steady expansion driven by continuous innovation, rising demand across end-use industries, and rapid technological progress. Market participants are increasingly optimizing their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to shifting competitive dynamics.

Looking ahead to 2035, the market is expected to maintain strong growth momentum, supported by sustained investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that focus on innovation, agile GTM execution, and alignment with evolving customer needs are well positioned to achieve long-term success. The report provides in-depth insights into key market drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by robust qualitative and quantitative analysis spanning 2017 to 2035.

The drone surveying market refers to the global and regional market for modern methods of collecting geospatial data using unmanned aerial vehicles (UAVs), commonly known as drones. It is an efficient and cost-effective alternative to traditional surveying methods. The process involves a drone equipped with cameras and sensors flying over an area of interest to capture high-resolution images and spatial data from multiple angles. These images are then processed using specialized software to create detailed maps, 3D models, and other geospatial products.

Key components of drone surveying include UAV platforms, high-resolution cameras (RGB and multispectral), GPS/GNSS/IMU systems for precise positioning, and sensors such as LiDAR. Applications in mining and construction include topographic mapping, volumetric calculations, site planning and monitoring, environmental impact assessments, safety inspections, and progress tracking. When combined with RTK/PPK workflows and GCPs/CPs, drone surveying can achieve centimetre-level accuracy and supports seamless integration with GIS, BIM, and AI/ML platforms.

The market is advancing rapidly due to innovations in drone hardware and sensors, including the integration of LiDAR, RTK/PPK systems, and high-resolution multispectral cameras. These technologies significantly enhance data quality, operational efficiency, and autonomous flight capability, enabling high-precision surveying outcomes.

Time and cost efficiency is another major driver. Compared with traditional ground-based surveys, drones can capture detailed geospatial data in a fraction of the time, reducing labor intensity, equipment costs, and project timelines while increasing update frequency.

The shortage of skilled surveying professionals, particularly in developed markets with aging workforces, is accelerating adoption. Drone surveying enables smaller teams to perform extensive and accurate surveys, helping organizations address labor gaps without sacrificing precision.

Rapid urban development and infrastructure expansion, especially in emerging economies, are increasing demand for fast, scalable, and high-resolution mapping tools. Drone surveying supports construction planning, land-use management, and environmental impact assessments across large-scale projects.

Growing compatibility of drone data with GIS, BIM, and AI platforms is improving data-driven decision-making across construction, agriculture, and mining. At the same time, governments worldwide are updating UAV regulations to support commercial drone operations, further encouraging adoption.

Regulatory complexity remains a major hurdle. Operators must obtain licenses, flight clearances, and comply with altitude and airspace restrictions, particularly near airports or sensitive zones. Managing approvals for Beyond Visual Line of Sight (BVLOS) operations is often time-consuming and restrictive.

Weather dependency significantly impacts survey operations. Strong winds, rain, fog, or extreme temperatures can destabilize drones, reduce sensor accuracy, and lead to mission delays or cancellations.

Limited battery life poses another challenge. Most commercial drones offer only 2040 minutes of flight time, requiring frequent battery swaps and complicating large-area survey logistics.

Drone surveys generate large volumes of data that require advanced processing software, high-performance computing, and skilled analysts. Errors in georeferencing caused by GPS interference or insufficient ground control points can compromise data quality, increasing time and costs.

Additionally, privacy, safety, and cybersecurity concerns persist, particularly in populated areas. Risks include mid-air collisions, signal interference, and unauthorized data access, necessitating strict adherence to safety protocols and airspace management systems.

North America is driving innovation in drone surveying, with developers receiving regulatory waivers for BVLOS operations to monitor power lines, solar farms, and infrastructure assets. These advances support safer, more frequent inspections and broader commercial adoption.

Europe benefits from increasing regulatory clarity. The UK has implemented new BVLOS rules for infrastructure inspection, enabling drone use in power line and wind turbine maintenance projects, improving efficiency and operational safety.

Asia-Pacific is witnessing rapid growth as governments promote drone adoption for infrastructure and agriculture. India uses drone fleets for government-backed missions, while Chinas commercial drone usage is expanding rapidly through state-supported infrastructure programs.

Latin America is adopting UAVs for infrastructure and environmental monitoring. In Brazil, drones support Amazon conservation by mapping tree species, aiding indigenous communities, and enabling real-time deforestation monitoring through collaborative programs.

The Middle East and Africa are using drones for smart-city development, oil & gas inspections, and environmental mapping. In the UAE and Saudi Arabia, projects such as NEOM rely heavily on drone surveys and digital twins for large-scale planning.

Drone surveying is widely adopted across U.S. industries including agriculture, construction, powerline inspection, and emergency response. Supportive FAA regulations, pilot certification programs, and BVLOS waivers have enabled routine commercial drone use. State agencies deploy drones for disaster assessment, transportation planning, and land management, improving response speed and accuracy.

Germany is a European leader in drone surveying, supported by strong government backing and a clear regulatory framework. The country is piloting U-Space zones to manage drone traffic safely in urban and industrial areas. Drones are widely used for infrastructure inspection, agriculture, and environmental monitoring.

Japan relies on drone technology to manage aging infrastructure and workforce shortages. UAVs are used to survey roads, tunnels, and bridges, and to assess disaster damage. In agriculture, drones support crop spraying, health monitoring, and soil analysis. Government subsidies, pilot programs, and public-private partnerships continue to accelerate adoption.

Competition centers on integrated sensor packages combining LiDAR, multispectral, thermal, and RGB cameras to deliver richer data. Companies leveraging AI-enabled autonomy gain advantages through real-time mapping, object detection, and anomaly identification.

Access to BVLOS permissions is increasingly critical, enabling providers to cover larger areas at lower costs. The shift toward Drone-as-a-Service (DaaS) models reduces upfront investment barriers, while real-time data fusion and edge-AI processing are redefining competitive differentiation.

Key players include DJI, Parrot SA, Trimble Inc., senseFly (AgEagle Aerial Systems), Delair, 3D Robotics, PrecisionHawk, AeroVironment Inc., Teledyne FLIR LLC, Microdrones, Kespry, Raptor Maps, DroneDeploy, Wingtra, Quantum Systems, Skydio, Autel Robotics, Yuneec International, Pix4D, Bentley Systems, and other players.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Drone Surveying market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Drone Surveying market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Drone Surveying market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Drone Surveying market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Drone Surveying market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 20.28 from 2026 to 2035 |

| Base Year | 2025 |

| Actual Estimates / Historical Data | 2017 - 2024 |

| Forecast Period | 2026 - 2035 |

| Quantitative Units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country Scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment Covered by Type |

|

| The Segment Covered by Component |

|

| Companies Covered |

|

| Report Coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free Customization Scope (Equivalent to 5 Analyst Working Days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Drone Surveying market share, size, and revenue growth rate were created by Quintile Report™. Drone Surveying analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Drone Surveying Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Drone Surveying Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Drone Surveying Market, by Region, (USD Million) 2017-2035

Table 21 China Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Drone Surveying Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Drone Surveying Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Drone Surveying Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Drone Surveying Market: market scenario

Fig.4 Global Drone Surveying Market competitive outlook

Fig.5 Global Drone Surveying Market driver analysis

Fig.6 Global Drone Surveying Market restraint analysis

Fig.7 Global Drone Surveying Market opportunity analysis

Fig.8 Global Drone Surveying Market trends analysis

Fig.9 Global Drone Surveying Market: Segment Analysis (Based on the scope)

Fig.10 Global Drone Surveying Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report OverviewThe Global Gas Cylinder Market was valued at USD 12.36 million in 2025 and is project

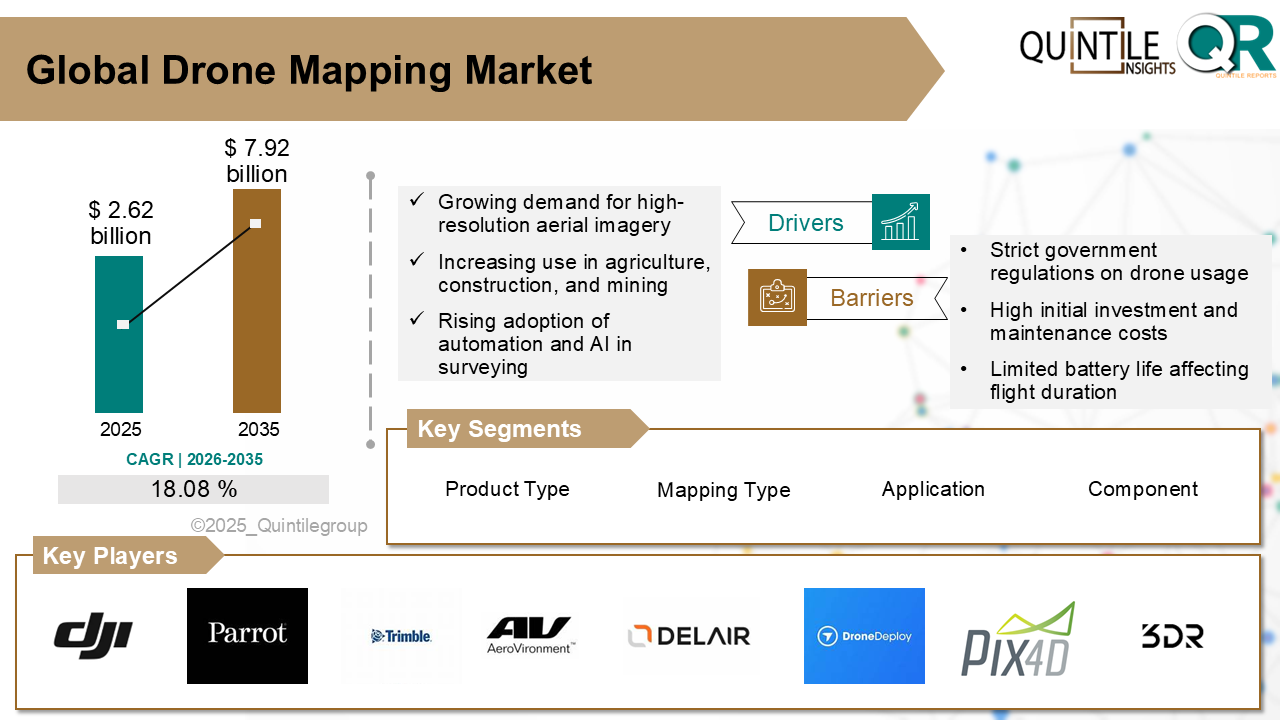

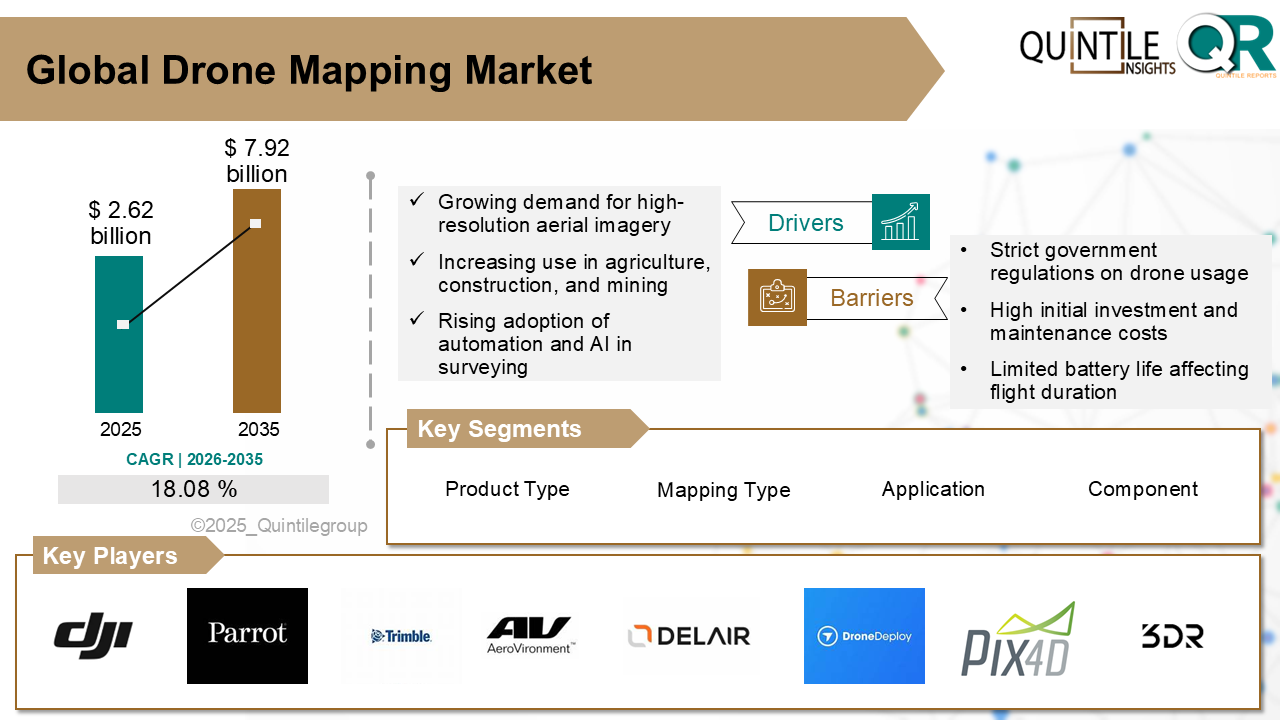

Read MoreReport OverviewThe Global Drone Mapping Market was valued at USD 2.62 billion in 2025 and is project

Read MoreReport OverviewThe Global CBD Extraction Equipment Market was valued at USD 67.62 million in 2025 an

Read More