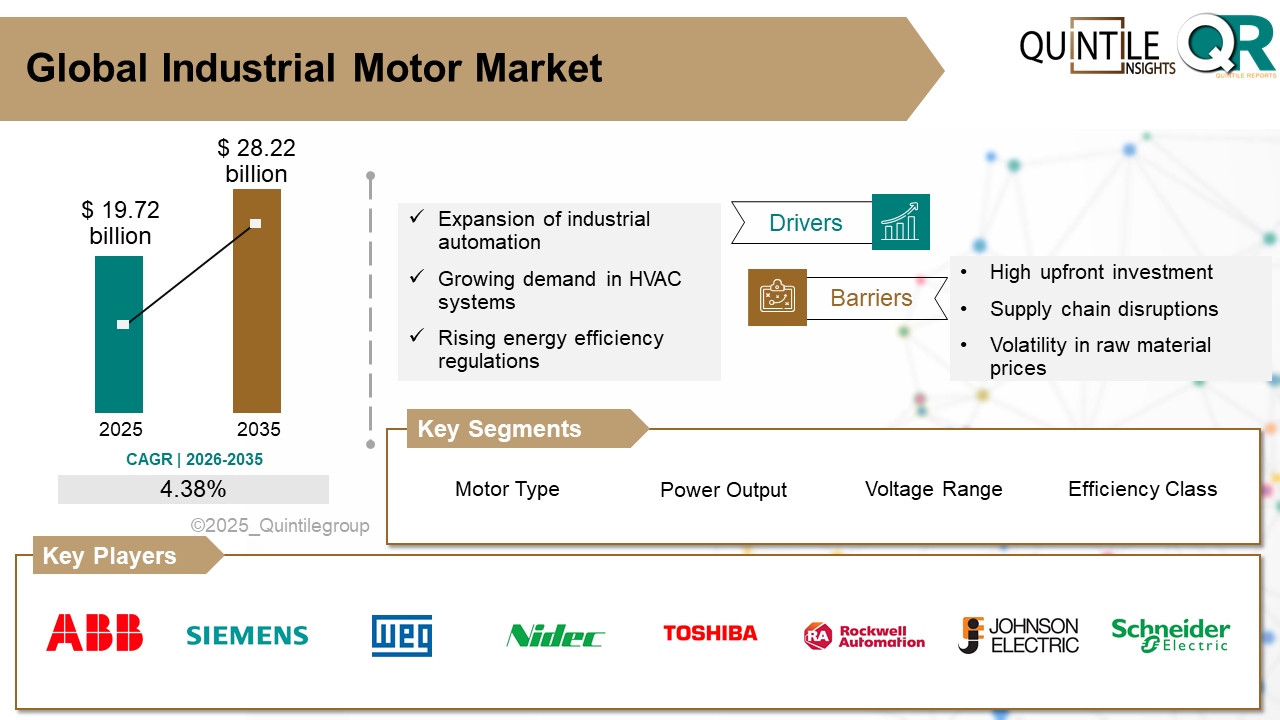

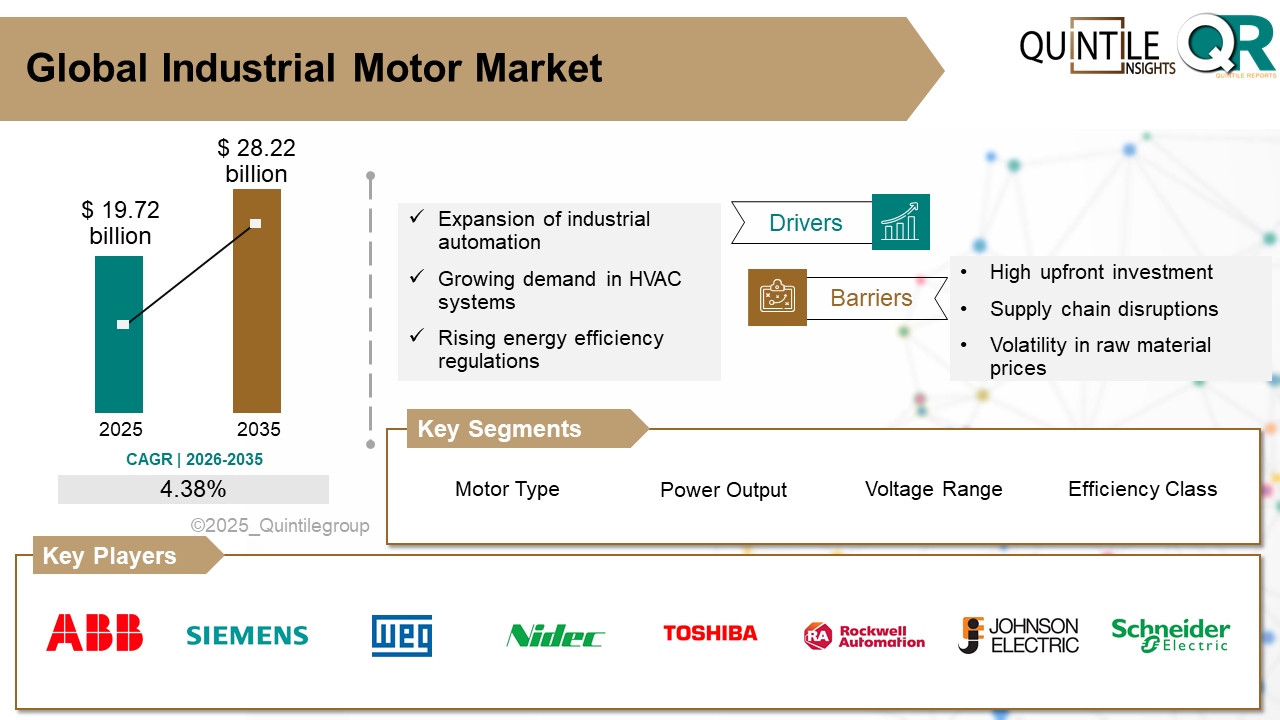

The Global Industrial Motor Market was valued at USD 19.72 billion in 2025 and is projected to reach USD 28.22 billion by 2035, expanding at a robust CAGR of 4.38% during the forecast period from 2026 to 2035. The Industrial Motor market report delivers a comprehensive industry assessment by analyzing macroeconomic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to provide a clear outlook on future growth potential.

With 2025 as the base year, the Industrial Motor market is experiencing steady expansion driven by continuous innovation, rising demand across end-use industries, and rapid technological progress. Market participants are increasingly optimizing their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to shifting competitive dynamics.

Looking ahead to 2035, the market is expected to maintain strong growth momentum, supported by sustained investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that focus on innovation, agile GTM execution, and alignment with evolving customer needs are well positioned to achieve long-term success. The report provides in-depth insights into key market drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by robust qualitative and quantitative analysis spanning 2017 to 2035.

The industrial motor brakes market refers to the global and regional market for braking systems specifically designed to control motion, enable safe stopping, and hold industrial electric motors across a wide range of machinery and automation applications. These brakes are critical components in equipment such as hoists, conveyors, elevators, packaging machines, robotics, and machine tools, where they ensure load retention, emergency shutdown, and precise motion control.

Traditionally dominated by spring-applied, electrically released fail-safe brakes, the market has evolved to include permanent-magnet, disc, drum, and linear braking systems. Advanced technologies such as dynamic braking, regenerative energy capture, low-inertia designs, and servo-compatible integrated brakes are increasingly being adopted. A key innovation trend is the rise of smart motor brakes embedded with diagnostic sensors that support predictive maintenance, real-time monitoring, and Industry 4.0 system integration.

The strongest driver of the industrial motor brakes market is the rapid expansion of industrial automation and robotics across manufacturing, logistics, and material handling sectors. Automated systems such as robotic arms, conveyors, and feeders require highly accurate, repeatable, and fail-safe braking to operate smoothly and safely. As factories modernize under Industry 4.0 initiatives, demand for advanced motor braking solutions continues to rise.

Another major driver is the growing emphasis on workplace safety and regulatory compliance. Organizations such as OSHA and ISO mandate fail-safe braking systems and emergency stop functionality to reduce machinery-related accidents. Compliance requirements are pushing industries to replace outdated mechanical brakes with certified, high-performance braking solutions.

The increasing deployment of heavy-duty equipment in sectors such as construction, mining, power generation, and wind energy is also boosting demand. Equipment like cranes, hoists, earthmovers, and wind turbines require high-torque, load-holding motor brakes capable of operating reliably under extreme conditions.

Sustainability and energy efficiency goals are shaping market trends as well. Manufacturers are developing regenerative and energy-efficient electromagnetic brakes that reduce power consumption and emissions, supporting green manufacturing initiatives.

Technological innovation is another powerful driver. The integration of IoT-enabled sensors, predictive maintenance analytics, and telematics allows real-time performance monitoring and remote diagnostics. These smart industrial motor brakes are increasingly embedded in digital maintenance ecosystems.

Finally, the growth of electric vehicle (EV) and renewable energy manufacturing is opening new application areas. EV production lines, battery plants, and renewable energy systems require precise and reliable braking for safety and motion control, further driving market adoption.

One of the primary restraints is the high cost of advanced motor braking systems, particularly DC, AC, torque, and IoT-enabled smart brakes. The upfront investment for procurement and integration, along with recurring costs for maintenance, inspection, and component replacement, creates a significant barrier for small and medium-sized enterprises (SMEs).

The market is also vulnerable to raw material price volatility and supply chain disruptions. Industrial motor brakes rely on steel, friction materials, sensors, and electronic components, all of which are subject to fluctuating prices that impact manufacturing costs, lead times, and profitability.

System integration complexity presents another challenge. Retrofitting brakes into existing machinery or automated drive systems requires precise engineering and calibration. Improper integration can result in downtime, production losses, and safety risks, particularly in continuous-process industries.

Additionally, skills shortages limit adoption of advanced braking technologies. Smart and electronically controlled motor brakes require specialized expertise for installation, configuration, and diagnosticsskills that are often scarce in emerging markets.

North America represents a mature and dominant market, supported by advanced manufacturing, aerospace, automotive, and renewable energy industries. Strong safety regulations and digitalization initiatives are driving adoption of electromagnetic and intelligent motor brakes integrated with automation and telematics platforms.

Europe is characterized by steady growth driven by energy efficiency and sustainability mandates. Industrial motor brakes are widely used in automotive, rail, and renewable energy applications, with rising demand for environment-friendly and digitally monitored braking systems that comply with EU standards.

Asia-Pacific is the fastest-growing region due to rapid industrialization in China, India, Japan, and South Korea. Expanding manufacturing, construction, mining, and renewable sectors are fueling demand for precision DC brakes, electromagnetic systems, and IoT-enabled variants. Local OEMs are investing in R&D to deliver cost-effective smart solutions.

Latin America is witnessing moderate growth driven by mining, construction, energy, and food & packaging industries. Adoption focuses on durable hydraulic and pneumatic brakes used in cranes, hoists, and industrial machinery, supported by infrastructure investments and OEM partnerships.

The Middle East & Africa region shows modest growth led by oil & gas, mining, and large-scale infrastructure projects. Demand is rising for robust, high-torque, and energy-efficient braking solutions, particularly for heavy equipment and wind energy installations.

The United States is the largest industrial motor brakes market, driven by modernization of aging manufacturing facilities. Industrial clusters in the Midwest are replacing conventional systems with high-performance, safety-compliant motor brakes that support automation, reduce downtime, and improve regulatory compliance.

Germanys market is driven by rapid adoption of automated material handling systems in logistics and manufacturing. Electrically released spring-applied and fail-safe brakes are widely deployed in conveyors, cranes, and packaging lines, supported by strong domestic manufacturers and Industry 4.0 initiatives.

Japans industrial motor brakes market benefits from extensive use of robotics and automation in automotive and electronics manufacturing. Integration of electromagnetic and servo-actuated smart brakes with IoT diagnostics is accelerating adoption, supported by major motor manufacturers and smart factory initiatives.

Competition in the industrial motor brakes market increasingly centers on IoT-enabled intelligence and predictive maintenance. Manufacturers are embedding sensors to monitor temperature, wear, and engagement state, transforming brakes into active system components. Suppliers offering retrofit-compatible smart solutions and seamless integration with SCADA and MES platforms gain a competitive edge. Predictive, data-driven braking systems are becoming central to uptime optimization, safety assurance, and operational efficiency.

Key players include ABB, Siemens, Altra Industrial Motion, Eaton, Warner Electric, Lenze, Hilliard Corp., Nexen Group, Ogura Industrial Corp., KEB Automation, Brook Crompton, WEG, Danaher Motion, Oriental Motor Co., and Regal Rexnord.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Industrial Motor market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Industrial Motor market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Industrial Motor market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Industrial Motor market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Industrial Motor market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 4.38 from 2026 to 2035 |

| Base Year | 2025 |

| Actual Estimates / Historical Data | 2017 - 2024 |

| Forecast Period | 2026 - 2035 |

| Quantitative Units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country Scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment Covered by Motor Type |

|

| The Segment Covered by Power Output & Voltage Range |

|

| Companies Covered |

|

| Report Coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free Customization Scope (Equivalent to 5 Analyst Working Days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Industrial Motor market share, size, and revenue growth rate were created by Quintile Report™. Industrial Motor analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Industrial Motor Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Industrial Motor Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Industrial Motor Market, by Region, (USD Million) 2017-2035

Table 21 China Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Industrial Motor Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Industrial Motor Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Industrial Motor Market: market scenario

Fig.4 Global Industrial Motor Market competitive outlook

Fig.5 Global Industrial Motor Market driver analysis

Fig.6 Global Industrial Motor Market restraint analysis

Fig.7 Global Industrial Motor Market opportunity analysis

Fig.8 Global Industrial Motor Market trends analysis

Fig.9 Global Industrial Motor Market: Segment Analysis (Based on the scope)

Fig.10 Global Industrial Motor Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Industrial Motor Market was valued at USD 19.72 billion in 2025 and is projected to reach USD 28.22 billion by 2035, expanding at a robust CAGR of 4.38% during the forecast period from 2026 to 2035. The Industrial Motor market report delivers a comprehensive industry assessment by analyzing macroeconomic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to provide a clear outlook on future growth potential.

With 2025 as the base year, the Industrial Motor market is experiencing steady expansion driven by continuous innovation, rising demand across end-use industries, and rapid technological progress. Market participants are increasingly optimizing their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to shifting competitive dynamics.

Looking ahead to 2035, the market is expected to maintain strong growth momentum, supported by sustained investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that focus on innovation, agile GTM execution, and alignment with evolving customer needs are well positioned to achieve long-term success. The report provides in-depth insights into key market drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by robust qualitative and quantitative analysis spanning 2017 to 2035.

The industrial motor brakes market refers to the global and regional market for braking systems specifically designed to control motion, enable safe stopping, and hold industrial electric motors across a wide range of machinery and automation applications. These brakes are critical components in equipment such as hoists, conveyors, elevators, packaging machines, robotics, and machine tools, where they ensure load retention, emergency shutdown, and precise motion control.

Traditionally dominated by spring-applied, electrically released fail-safe brakes, the market has evolved to include permanent-magnet, disc, drum, and linear braking systems. Advanced technologies such as dynamic braking, regenerative energy capture, low-inertia designs, and servo-compatible integrated brakes are increasingly being adopted. A key innovation trend is the rise of smart motor brakes embedded with diagnostic sensors that support predictive maintenance, real-time monitoring, and Industry 4.0 system integration.

The strongest driver of the industrial motor brakes market is the rapid expansion of industrial automation and robotics across manufacturing, logistics, and material handling sectors. Automated systems such as robotic arms, conveyors, and feeders require highly accurate, repeatable, and fail-safe braking to operate smoothly and safely. As factories modernize under Industry 4.0 initiatives, demand for advanced motor braking solutions continues to rise.

Another major driver is the growing emphasis on workplace safety and regulatory compliance. Organizations such as OSHA and ISO mandate fail-safe braking systems and emergency stop functionality to reduce machinery-related accidents. Compliance requirements are pushing industries to replace outdated mechanical brakes with certified, high-performance braking solutions.

The increasing deployment of heavy-duty equipment in sectors such as construction, mining, power generation, and wind energy is also boosting demand. Equipment like cranes, hoists, earthmovers, and wind turbines require high-torque, load-holding motor brakes capable of operating reliably under extreme conditions.

Sustainability and energy efficiency goals are shaping market trends as well. Manufacturers are developing regenerative and energy-efficient electromagnetic brakes that reduce power consumption and emissions, supporting green manufacturing initiatives.

Technological innovation is another powerful driver. The integration of IoT-enabled sensors, predictive maintenance analytics, and telematics allows real-time performance monitoring and remote diagnostics. These smart industrial motor brakes are increasingly embedded in digital maintenance ecosystems.

Finally, the growth of electric vehicle (EV) and renewable energy manufacturing is opening new application areas. EV production lines, battery plants, and renewable energy systems require precise and reliable braking for safety and motion control, further driving market adoption.

One of the primary restraints is the high cost of advanced motor braking systems, particularly DC, AC, torque, and IoT-enabled smart brakes. The upfront investment for procurement and integration, along with recurring costs for maintenance, inspection, and component replacement, creates a significant barrier for small and medium-sized enterprises (SMEs).

The market is also vulnerable to raw material price volatility and supply chain disruptions. Industrial motor brakes rely on steel, friction materials, sensors, and electronic components, all of which are subject to fluctuating prices that impact manufacturing costs, lead times, and profitability.

System integration complexity presents another challenge. Retrofitting brakes into existing machinery or automated drive systems requires precise engineering and calibration. Improper integration can result in downtime, production losses, and safety risks, particularly in continuous-process industries.

Additionally, skills shortages limit adoption of advanced braking technologies. Smart and electronically controlled motor brakes require specialized expertise for installation, configuration, and diagnosticsskills that are often scarce in emerging markets.

North America represents a mature and dominant market, supported by advanced manufacturing, aerospace, automotive, and renewable energy industries. Strong safety regulations and digitalization initiatives are driving adoption of electromagnetic and intelligent motor brakes integrated with automation and telematics platforms.

Europe is characterized by steady growth driven by energy efficiency and sustainability mandates. Industrial motor brakes are widely used in automotive, rail, and renewable energy applications, with rising demand for environment-friendly and digitally monitored braking systems that comply with EU standards.

Asia-Pacific is the fastest-growing region due to rapid industrialization in China, India, Japan, and South Korea. Expanding manufacturing, construction, mining, and renewable sectors are fueling demand for precision DC brakes, electromagnetic systems, and IoT-enabled variants. Local OEMs are investing in R&D to deliver cost-effective smart solutions.

Latin America is witnessing moderate growth driven by mining, construction, energy, and food & packaging industries. Adoption focuses on durable hydraulic and pneumatic brakes used in cranes, hoists, and industrial machinery, supported by infrastructure investments and OEM partnerships.

The Middle East & Africa region shows modest growth led by oil & gas, mining, and large-scale infrastructure projects. Demand is rising for robust, high-torque, and energy-efficient braking solutions, particularly for heavy equipment and wind energy installations.

The United States is the largest industrial motor brakes market, driven by modernization of aging manufacturing facilities. Industrial clusters in the Midwest are replacing conventional systems with high-performance, safety-compliant motor brakes that support automation, reduce downtime, and improve regulatory compliance.

Germanys market is driven by rapid adoption of automated material handling systems in logistics and manufacturing. Electrically released spring-applied and fail-safe brakes are widely deployed in conveyors, cranes, and packaging lines, supported by strong domestic manufacturers and Industry 4.0 initiatives.

Japans industrial motor brakes market benefits from extensive use of robotics and automation in automotive and electronics manufacturing. Integration of electromagnetic and servo-actuated smart brakes with IoT diagnostics is accelerating adoption, supported by major motor manufacturers and smart factory initiatives.

Competition in the industrial motor brakes market increasingly centers on IoT-enabled intelligence and predictive maintenance. Manufacturers are embedding sensors to monitor temperature, wear, and engagement state, transforming brakes into active system components. Suppliers offering retrofit-compatible smart solutions and seamless integration with SCADA and MES platforms gain a competitive edge. Predictive, data-driven braking systems are becoming central to uptime optimization, safety assurance, and operational efficiency.

Key players include ABB, Siemens, Altra Industrial Motion, Eaton, Warner Electric, Lenze, Hilliard Corp., Nexen Group, Ogura Industrial Corp., KEB Automation, Brook Crompton, WEG, Danaher Motion, Oriental Motor Co., and Regal Rexnord.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Industrial Motor market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Industrial Motor market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Industrial Motor market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Industrial Motor market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Industrial Motor market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 4.38 from 2026 to 2035 |

| Base Year | 2025 |

| Actual Estimates / Historical Data | 2017 - 2024 |

| Forecast Period | 2026 - 2035 |

| Quantitative Units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country Scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment Covered by Motor Type |

|

| The Segment Covered by Power Output & Voltage Range |

|

| Companies Covered |

|

| Report Coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free Customization Scope (Equivalent to 5 Analyst Working Days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Industrial Motor market share, size, and revenue growth rate were created by Quintile Report™. Industrial Motor analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Industrial Motor Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Industrial Motor Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Industrial Motor Market, by Region, (USD Million) 2017-2035

Table 21 China Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Industrial Motor Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Industrial Motor Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Industrial Motor Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Industrial Motor Market: market scenario

Fig.4 Global Industrial Motor Market competitive outlook

Fig.5 Global Industrial Motor Market driver analysis

Fig.6 Global Industrial Motor Market restraint analysis

Fig.7 Global Industrial Motor Market opportunity analysis

Fig.8 Global Industrial Motor Market trends analysis

Fig.9 Global Industrial Motor Market: Segment Analysis (Based on the scope)

Fig.10 Global Industrial Motor Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report OverviewThe Global Gas Cylinder Market was valued at USD 12.36 million in 2025 and is project

Read MoreReport OverviewThe Global Drone Mapping Market was valued at USD 2.62 billion in 2025 and is project

Read MoreReport OverviewThe Global CBD Extraction Equipment Market was valued at USD 67.62 million in 2025 an

Read More