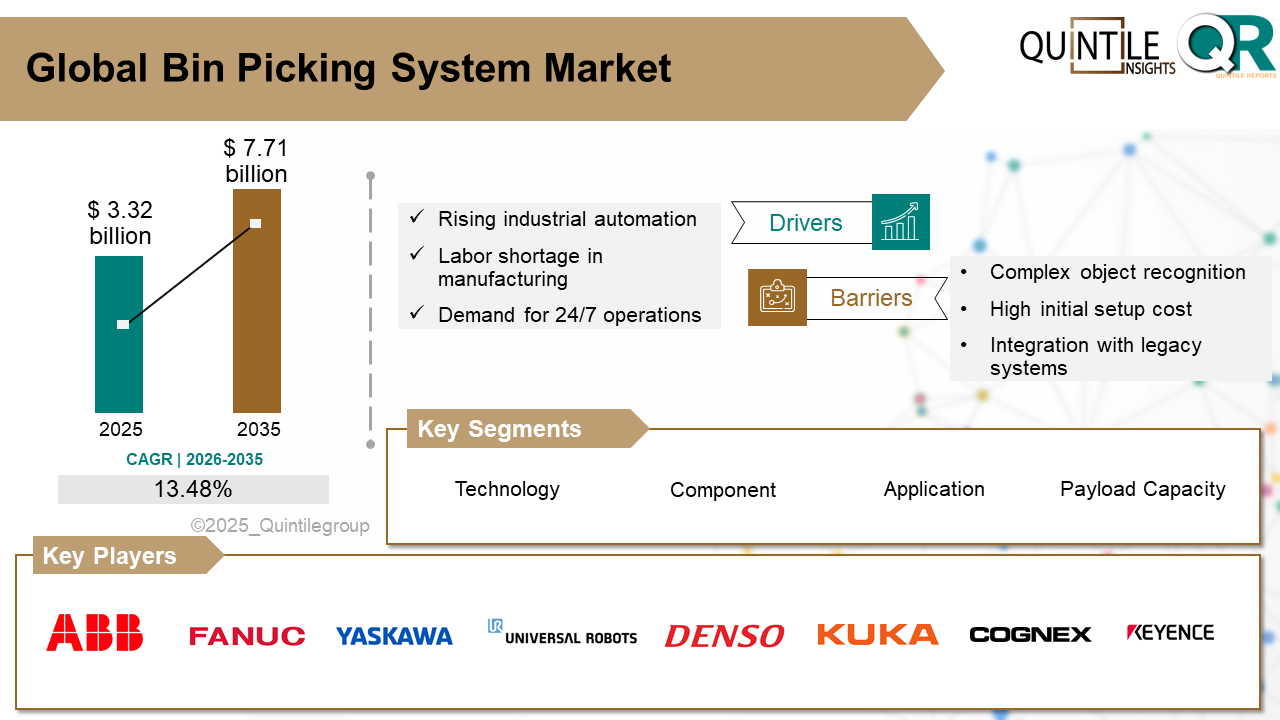

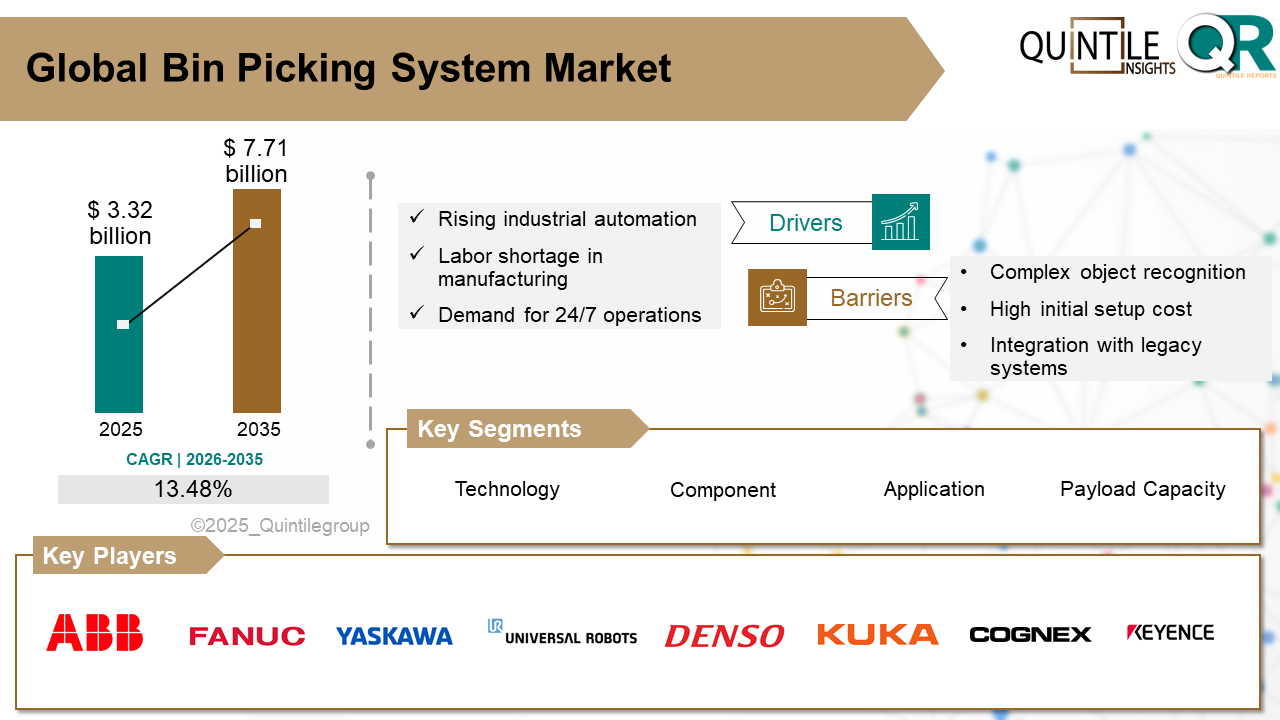

The Global Bin Picking System Market was valued at USD 3.32 billion in 2025 and is projected to reach USD 7.71 billion by 2035, expanding at a robust CAGR of 13.48% during the forecast period from 2026 to 2035. The Bin Picking System market report delivers a comprehensive industry assessment by analyzing macroeconomic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to provide a clear outlook on future growth potential.

With 2025 as the base year, the Bin Picking System market is experiencing steady expansion driven by continuous innovation, rising demand across end-use industries, and rapid technological progress. Market participants are increasingly optimizing their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to shifting competitive dynamics.

Looking ahead to 2035, the market is expected to maintain strong growth momentum, supported by sustained investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that focus on innovation, agile GTM execution, and alignment with evolving customer needs are well positioned to achieve long-term success. The report provides in-depth insights into key market drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by robust qualitative and quantitative analysis spanning 2017 to 2035.

The bin picking system market refers to the global and regional market for automated solutions in which a robot identifies, selects, and retrieves objects randomly placed in bins or containers. Earlier systems relied mainly on 2D vision, but modern bin picking has evolved significantly with the integration of 3D computer vision, artificial intelligence (AI), and advanced robotics. The process typically involves detecting the most accessible item, estimating its 3D position and orientation, planning a collision-free robotic path, and executing the pick.

Modern 3D bin picking systems use technologies such as stereo cameras, structured light, and laser triangulation to generate high-resolution depth maps. These enable robots to isolate individual parts even when they are stacked or tangled. Guided by end-of-arm tooling (EOAT) such as suction cups or multi-finger grippers, robotic arms execute precise picks based on object geometry and material. Increasing use of machine learning allows systems to continuously improve performance by learning from past successes and failures. Despite challenges like grasp errors and pose estimation failures, advances in sensor fusion, AI-enhanced vision, and EOAT customization are making bin picking a reliable and scalable automation solution.

Labor shortages across both developed and emerging economies are a major driver of bin picking adoption. Industries face rising wage pressure, demographic shifts, and reduced availability of workers for repetitive and physically demanding tasks. Bin-picking systems enable continuous, lights-out operations, improving productivity, consistency, ergonomics, and workplace safety while reducing reliance on manual labor.

The rapid expansion of e-commerce has sharply increased demand for high-speed order fulfillment and warehouse automation. Consumers expect faster deliveries, placing pressure on logistics operations. Bin-picking systems improve picking speed, accuracy, and scalability, helping fulfillment centers manage demand spikes and reduce lead times.

Advancements in AI-powered perception and high-resolution 3D vision have significantly improved object detection and grasp accuracy. Technologies such as real-time depth cameras and neural-network-based grasp planning now enable thousands of reliable picks per hour, even for complex materials like shiny metals or transparent plastics.

The rise of collaborative robots (cobots) has made bin picking more accessible. Cobots can be deployed with minimal safety infrastructure and programmed easily. When combined with plug-and-play 3D vision systems, they allow manufacturers of all sizes to implement flexible bin-picking solutions without major retooling.

Many manufacturers are moving toward fully automated lights-out factories. Bin-picking systems play a foundational role by autonomously feeding, sorting, and organizing parts, enabling round-the-clock production with minimal human intervention.

Bin-picking systems depend heavily on accurate 3D perception. Even minor distortions in point cloud data caused by lighting conditions, reflectivity, or sensor limitations can result in dropped items, misalignment, or collisions. Transparent, reflective, or black objects are especially difficult to detect reliably.

Occlusion and clutter present major challenges. Objects that are stacked, entangled, or partially hidden complicate segmentation and pose estimation. Addressing these issues often requires multi-angle scanning or active vision, increasing system complexity and processing time.

System integration complexity is another restraint. Bin-picking solutions must be seamlessly integrated with robots, vision systems, control software, conveyors, and sometimes warehouse management systems. Poor integration can lead to latency, calibration drift, and reduced uptime.

High initial investment in hardware, software licenses, and system integration limits adoption among small and mid-sized enterprises (SMEs). Frequent reconfiguration for varying part types and SKUs can further increase total cost of ownership and delay return on investment.

North America leads global bin-picking deployment, driven primarily by e-commerce logistics. Large-scale automation in fulfillment centers has significantly improved throughput and reduced labor strain. Strong R&D ecosystems and collaboration between industry and academia continue to accelerate innovation.

Europes market is shaped by Industry 4.0 initiatives, with strong adoption among SMEs, particularly in Germany. Modular, cobot-based bin-picking systems are favored for flexibility, safety, and small-batch production environments.

Asia Pacific is rapidly modernizing industrial workflows. Countries like Japan and China are deploying AI-driven 3D vision bin-picking systems across manufacturing and logistics. Local technology providers are expanding adoption through cost-competitive solutions.

In Latin America, bin-picking adoption remains in the pilot stage. Multinational integrators are introducing selective automation in automotive, food, and packaging industries, but high capital costs and limited integration expertise slow broader uptake.

The GCC region is piloting bin-picking systems in e-commerce and logistics hubs as part of smart warehouse initiatives. Adoption elsewhere in Africa remains limited but is supported by increasing infrastructure investments.

The U.S. dominates bin-picking innovation through large-scale deployment in e-commerce logistics. Advanced robotic systems now handle a majority of inventory items in fulfillment centers. Collaboration between robotics startups, research institutions, and large enterprises continues to push advancements in perception, grasp planning, and system reliability.

Germany leads Europe in flexible bin-picking adoption, particularly among SMEs. Modular cobot systems integrated with advanced 3D vision enable safe, adaptable automation for small-batch production. National and EU-level funding further supports AI-enhanced robotics innovation.

Japan excels in high-precision bin-picking solutions for automotive and electronics manufacturing. Advanced stereo vision and motion planning systems achieve very high pick success rates, addressing labor shortages and supporting long-term manufacturing sustainability.

Competition in the bin picking system market is driven by system accuracy, throughput, flexibility, and scalability. Large automation vendors provide fully integrated solutions for high-volume manufacturing, while cobot-based platforms expand known accessibility for SMEs. Advanced AI vision providers focus on handling complex materials and reducing cycle time. Academic spin-offs continue to influence the market with innovations in adaptive grasping and recovery algorithms.

Key players include ABB, FANUC Corporation, Yaskawa Electric Corporation, Universal Robots, DENSO Robotics, KUKA AG, Cognex Corporation, Keyence Corporation, Omron Corporation, Kawasaki Robotics, Schunk GmbH, Epson Robots, Nachi-Fujikoshi Corp., Pick-it 3D, Zivid, Photoneo, Soft Robotics, and others.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Bin Picking System market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Bin Picking System market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Bin Picking System market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Bin Picking System market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Bin Picking System market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 13.48 from 2026 to 2035 |

| Base Year | 2025 |

| Actual Estimates / Historical Data | 2017 - 2024 |

| Forecast Period | 2026 - 2035 |

| Quantitative Units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country Scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment Covered by Technology & Vision Type |

|

| The Segment Covered by Components & System Type |

|

| Companies Covered |

|

| Report Coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free Customization Scope (Equivalent to 5 Analyst Working Days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Bin Picking System market share, size, and revenue growth rate were created by Quintile Report™. Bin Picking System analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Bin Picking System Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Bin Picking System Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Bin Picking System Market, by Region, (USD Million) 2017-2035

Table 21 China Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Bin Picking System Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Bin Picking System Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Bin Picking System Market: market scenario

Fig.4 Global Bin Picking System Market competitive outlook

Fig.5 Global Bin Picking System Market driver analysis

Fig.6 Global Bin Picking System Market restraint analysis

Fig.7 Global Bin Picking System Market opportunity analysis

Fig.8 Global Bin Picking System Market trends analysis

Fig.9 Global Bin Picking System Market: Segment Analysis (Based on the scope)

Fig.10 Global Bin Picking System Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Bin Picking System Market was valued at USD 3.32 billion in 2025 and is projected to reach USD 7.71 billion by 2035, expanding at a robust CAGR of 13.48% during the forecast period from 2026 to 2035. The Bin Picking System market report delivers a comprehensive industry assessment by analyzing macroeconomic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to provide a clear outlook on future growth potential.

With 2025 as the base year, the Bin Picking System market is experiencing steady expansion driven by continuous innovation, rising demand across end-use industries, and rapid technological progress. Market participants are increasingly optimizing their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to shifting competitive dynamics.

Looking ahead to 2035, the market is expected to maintain strong growth momentum, supported by sustained investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that focus on innovation, agile GTM execution, and alignment with evolving customer needs are well positioned to achieve long-term success. The report provides in-depth insights into key market drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by robust qualitative and quantitative analysis spanning 2017 to 2035.

The bin picking system market refers to the global and regional market for automated solutions in which a robot identifies, selects, and retrieves objects randomly placed in bins or containers. Earlier systems relied mainly on 2D vision, but modern bin picking has evolved significantly with the integration of 3D computer vision, artificial intelligence (AI), and advanced robotics. The process typically involves detecting the most accessible item, estimating its 3D position and orientation, planning a collision-free robotic path, and executing the pick.

Modern 3D bin picking systems use technologies such as stereo cameras, structured light, and laser triangulation to generate high-resolution depth maps. These enable robots to isolate individual parts even when they are stacked or tangled. Guided by end-of-arm tooling (EOAT) such as suction cups or multi-finger grippers, robotic arms execute precise picks based on object geometry and material. Increasing use of machine learning allows systems to continuously improve performance by learning from past successes and failures. Despite challenges like grasp errors and pose estimation failures, advances in sensor fusion, AI-enhanced vision, and EOAT customization are making bin picking a reliable and scalable automation solution.

Labor shortages across both developed and emerging economies are a major driver of bin picking adoption. Industries face rising wage pressure, demographic shifts, and reduced availability of workers for repetitive and physically demanding tasks. Bin-picking systems enable continuous, lights-out operations, improving productivity, consistency, ergonomics, and workplace safety while reducing reliance on manual labor.

The rapid expansion of e-commerce has sharply increased demand for high-speed order fulfillment and warehouse automation. Consumers expect faster deliveries, placing pressure on logistics operations. Bin-picking systems improve picking speed, accuracy, and scalability, helping fulfillment centers manage demand spikes and reduce lead times.

Advancements in AI-powered perception and high-resolution 3D vision have significantly improved object detection and grasp accuracy. Technologies such as real-time depth cameras and neural-network-based grasp planning now enable thousands of reliable picks per hour, even for complex materials like shiny metals or transparent plastics.

The rise of collaborative robots (cobots) has made bin picking more accessible. Cobots can be deployed with minimal safety infrastructure and programmed easily. When combined with plug-and-play 3D vision systems, they allow manufacturers of all sizes to implement flexible bin-picking solutions without major retooling.

Many manufacturers are moving toward fully automated lights-out factories. Bin-picking systems play a foundational role by autonomously feeding, sorting, and organizing parts, enabling round-the-clock production with minimal human intervention.

Bin-picking systems depend heavily on accurate 3D perception. Even minor distortions in point cloud data caused by lighting conditions, reflectivity, or sensor limitations can result in dropped items, misalignment, or collisions. Transparent, reflective, or black objects are especially difficult to detect reliably.

Occlusion and clutter present major challenges. Objects that are stacked, entangled, or partially hidden complicate segmentation and pose estimation. Addressing these issues often requires multi-angle scanning or active vision, increasing system complexity and processing time.

System integration complexity is another restraint. Bin-picking solutions must be seamlessly integrated with robots, vision systems, control software, conveyors, and sometimes warehouse management systems. Poor integration can lead to latency, calibration drift, and reduced uptime.

High initial investment in hardware, software licenses, and system integration limits adoption among small and mid-sized enterprises (SMEs). Frequent reconfiguration for varying part types and SKUs can further increase total cost of ownership and delay return on investment.

North America leads global bin-picking deployment, driven primarily by e-commerce logistics. Large-scale automation in fulfillment centers has significantly improved throughput and reduced labor strain. Strong R&D ecosystems and collaboration between industry and academia continue to accelerate innovation.

Europes market is shaped by Industry 4.0 initiatives, with strong adoption among SMEs, particularly in Germany. Modular, cobot-based bin-picking systems are favored for flexibility, safety, and small-batch production environments.

Asia Pacific is rapidly modernizing industrial workflows. Countries like Japan and China are deploying AI-driven 3D vision bin-picking systems across manufacturing and logistics. Local technology providers are expanding adoption through cost-competitive solutions.

In Latin America, bin-picking adoption remains in the pilot stage. Multinational integrators are introducing selective automation in automotive, food, and packaging industries, but high capital costs and limited integration expertise slow broader uptake.

The GCC region is piloting bin-picking systems in e-commerce and logistics hubs as part of smart warehouse initiatives. Adoption elsewhere in Africa remains limited but is supported by increasing infrastructure investments.

The U.S. dominates bin-picking innovation through large-scale deployment in e-commerce logistics. Advanced robotic systems now handle a majority of inventory items in fulfillment centers. Collaboration between robotics startups, research institutions, and large enterprises continues to push advancements in perception, grasp planning, and system reliability.

Germany leads Europe in flexible bin-picking adoption, particularly among SMEs. Modular cobot systems integrated with advanced 3D vision enable safe, adaptable automation for small-batch production. National and EU-level funding further supports AI-enhanced robotics innovation.

Japan excels in high-precision bin-picking solutions for automotive and electronics manufacturing. Advanced stereo vision and motion planning systems achieve very high pick success rates, addressing labor shortages and supporting long-term manufacturing sustainability.

Competition in the bin picking system market is driven by system accuracy, throughput, flexibility, and scalability. Large automation vendors provide fully integrated solutions for high-volume manufacturing, while cobot-based platforms expand known accessibility for SMEs. Advanced AI vision providers focus on handling complex materials and reducing cycle time. Academic spin-offs continue to influence the market with innovations in adaptive grasping and recovery algorithms.

Key players include ABB, FANUC Corporation, Yaskawa Electric Corporation, Universal Robots, DENSO Robotics, KUKA AG, Cognex Corporation, Keyence Corporation, Omron Corporation, Kawasaki Robotics, Schunk GmbH, Epson Robots, Nachi-Fujikoshi Corp., Pick-it 3D, Zivid, Photoneo, Soft Robotics, and others.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Bin Picking System market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Bin Picking System market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Bin Picking System market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Bin Picking System market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Bin Picking System market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 13.48 from 2026 to 2035 |

| Base Year | 2025 |

| Actual Estimates / Historical Data | 2017 - 2024 |

| Forecast Period | 2026 - 2035 |

| Quantitative Units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country Scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment Covered by Technology & Vision Type |

|

| The Segment Covered by Components & System Type |

|

| Companies Covered |

|

| Report Coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free Customization Scope (Equivalent to 5 Analyst Working Days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Bin Picking System market share, size, and revenue growth rate were created by Quintile Report™. Bin Picking System analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Bin Picking System Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Bin Picking System Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Bin Picking System Market, by Region, (USD Million) 2017-2035

Table 21 China Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Bin Picking System Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Bin Picking System Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Bin Picking System Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Bin Picking System Market: market scenario

Fig.4 Global Bin Picking System Market competitive outlook

Fig.5 Global Bin Picking System Market driver analysis

Fig.6 Global Bin Picking System Market restraint analysis

Fig.7 Global Bin Picking System Market opportunity analysis

Fig.8 Global Bin Picking System Market trends analysis

Fig.9 Global Bin Picking System Market: Segment Analysis (Based on the scope)

Fig.10 Global Bin Picking System Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report OverviewThe Global Gas Cylinder Market was valued at USD 12.36 million in 2025 and is project

Read MoreReport OverviewThe Global Drone Mapping Market was valued at USD 2.62 billion in 2025 and is project

Read MoreReport OverviewThe Global CBD Extraction Equipment Market was valued at USD 67.62 million in 2025 an

Read More