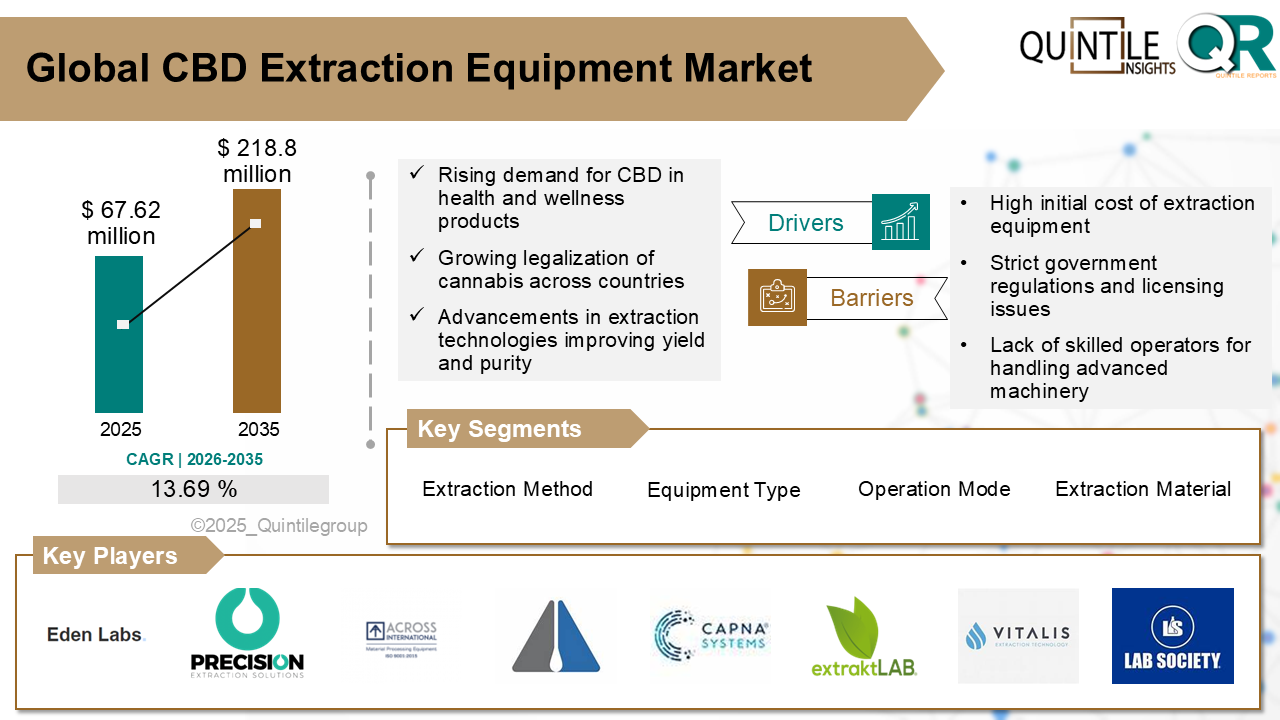

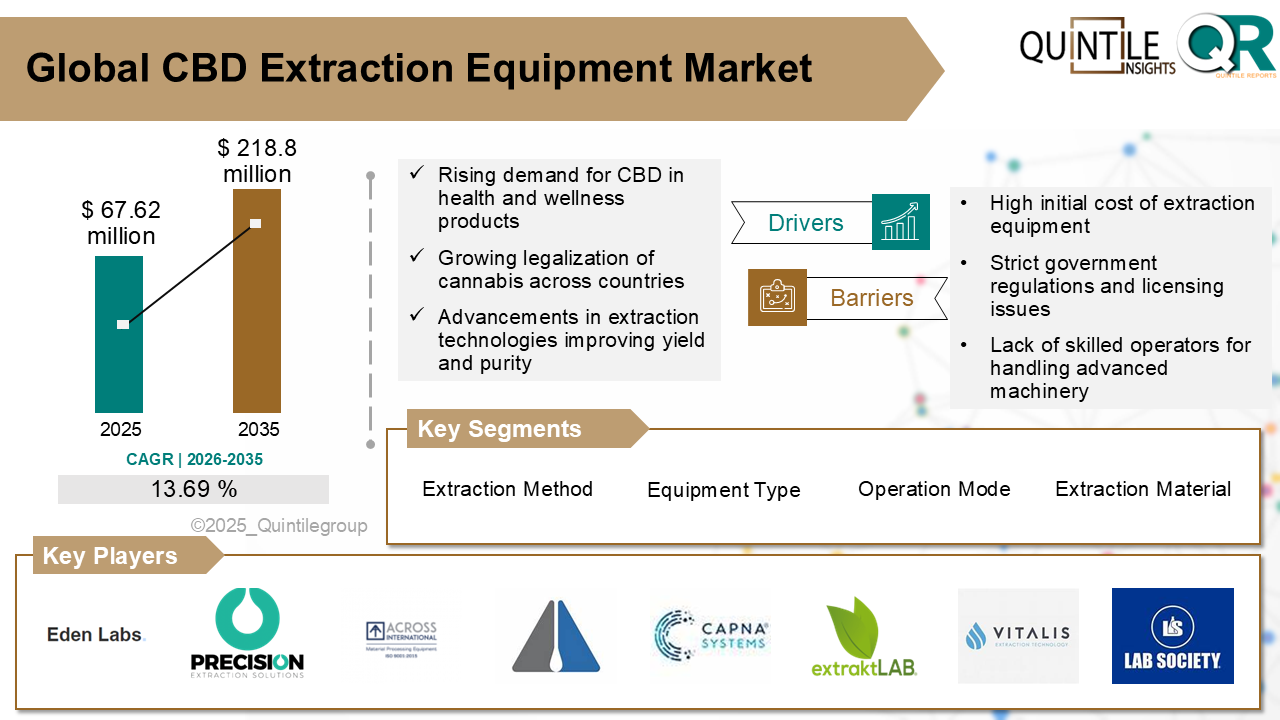

The Global CBD Extraction Equipment Market was valued at USD 67.62 million in 2025 and is projected to reach USD 218.8 million by 2035, expanding at a robust CAGR of 13.69% during the forecast period from 2026 to 2035. The CBD Extraction Equipment market report delivers a comprehensive industry assessment by analyzing macroeconomic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to provide a clear outlook on future growth potential.

With 2025 as the base year, the CBD Extraction Equipment market is experiencing steady expansion driven by continuous innovation, rising demand across end-use industries, and rapid technological progress. Market participants are increasingly optimizing their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to shifting competitive dynamics.

Looking ahead to 2035, the market is expected to maintain strong growth momentum, supported by sustained investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that focus on innovation, agile GTM execution, and alignment with evolving customer needs are well positioned to achieve long-term success. The report provides in-depth insights into key market drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by robust qualitative and quantitative analysis spanning 2017 to 2035.

The CBD extraction equipment market focuses on specialized machinery designed to extract cannabidiol (CBD) from hemp or cannabis plants, playing a critical role in determining the quality, purity, and consistency of CBD-based products. This market includes a broad range of equipment, from advanced extraction systemssuch as closed-loop CO, ethanol, and hydrocarbon extraction unitsto essential filtration and separation tools like vacuum pumps, Buchner funnels, and molecular sieves. Post-processing equipment is equally important, handling purification, solvent recovery, distillation, and packaging.

Among extraction methods, supercritical CO extraction is widely favored for producing high-purity extracts at industrial scale, while ethanol and hydrocarbon extraction offer speed and efficiency. Solventless mechanical methods, such as rosin presses, are also gaining popularity for their clean, chemical-free appeal. As demand rises for CBD oils, tinctures, edibles, capsules, and topicals, the scalability and performance of extraction equipment are becoming increasingly critical within the broader cannabis and wellness industries.

The CBD extraction equipment market is experiencing strong growth, driven by a combination of regulatory reforms, technological innovation, and rising consumer demand.

One of the most significant drivers is the global legalization of cannabis and hemp, particularly across North America, Europe, and parts of Asia. Countries such as Canada, Germany, and Thailand are modernizing regulatory frameworks, opening new markets for medical and wellness-focused CBD products.

Consumer demand for CBD-infused wellness, pharmaceutical, and nutraceutical products is expanding rapidly, supported by growing awareness of CBDs therapeutic potential. With a substantial global user base and rising healthcare needs, the requirement for high-quality, consistent CBD extracts continues to increase.

Technological advancements are another major growth catalyst. Innovations such as AI-integrated extraction systems, eco-friendly solvents, supercritical CO technology, and GMP-compliant automation are improving efficiency, yield, and regulatory compliance. Turnkey and end-to-end automated solutions are emerging as key differentiators.

Finally, strong venture capital investment and strategic partnershipsparticularly with pharmaceutical and nutraceutical companiesare helping manufacturers scale production, develop continuous extraction systems, and offset high initial capital requirements.

A major restraint is the high initial capital investment required to establish advanced extraction facilities, especially those using supercritical CO or cryogenic ethanol systems. These systems require sophisticated infrastructure, high-pressure safety mechanisms, and specialized expertise, limiting accessibility for startups and small operators.

The market also faces challenges from a fragmented and evolving regulatory landscape. Regulations vary widely across countries and even within regions, creating uncertainty and increasing compliance complexity.

Another significant challenge is the shortage of skilled operators and technical experts capable of running modern extraction systems. This talent gap is particularly evident in emerging markets, leading to operational inefficiencies and quality risks.

Even after installation, ongoing operational and maintenance costs remain high. Energy consumption, solvent procurement, routine system maintenance, and compliance testing continue to put pressure on profit margins.

North America leads the global CBD extraction equipment market, driven by early legalization and technological leadership in the United States and Canada. Supercritical CO extraction dominates due to its suitability for pharmaceutical-grade CBD. The 2018 U.S. Farm Bill enabled large-scale industrial operations, accelerating demand for automated, GMP-compliant systems. However, varying state-level regulations continue to raise compliance costs, pushing companies toward partnerships and venture-backed expansion.

Europes market is expanding rapidly, supported by legalization trends in Germany, Italy, and the UK and a strong focus on pharmaceutical-grade extraction. Advanced facilities using supercritical CO and cryo-ethanol technologies are becoming more common. While regulatory fragmentation across EU member states remains a challenge, rising e-commerce activity and investment in terpene-rich and full-spectrum extracts are driving innovation.

The Asia Pacific region is led by Australia and New Zealand, where growth is driven by pharmaceutical and food & beverage applications. Adoption of Industry 4.0 and AI-optimized extraction systems is increasing efficiency and output. Regulatory uncertainty persists in emerging markets such as Thailand, but rising investment in solventless and export-oriented extraction technologies is supporting long-term growth.

Latin America is leveraging its strong agricultural base and favorable climate for biomass cultivation. Countries such as Colombia and Uruguay are focusing on ethanol and hydrocarbon extraction methods due to cost efficiency. While infrastructure limitations and regulatory inconsistencies restrict large-scale scalability, partnerships with global technology providers are enabling gradual market development.

This region faces strict regulations and limited infrastructure, which constrain large-scale investments. However, medical cannabis legalization in countries such as Israel and South Africa has driven interest in small-scale CO extraction systems. The region remains highly dependent on imported equipment, but favorable cultivation conditions present long-term opportunities.

The U.S. CBD extraction equipment market benefits from the legalization of hemp-derived CBD and strong demand across pharmaceutical, wellness, and food sectors. Advanced supercritical CO and ethanol systems, combined with automation and AI integration, dominate the landscape. Despite regulatory complexity, the U.S. hosts hundreds of licensed extraction facilities and remains a global innovation hub.

Germany stands out as Europes most regulated and quality-focused CBD market. Supercritical CO extraction is widely used for pharmaceutical-grade production. Strong government research support, skilled labor, and partnerships with pharmaceutical firms continue to strengthen Germanys position as a leader in compliant, high-precision extraction.

Japans CBD extraction equipment market is still in early stages due to strict THC regulations. Ethanol extraction dominates, with limited adoption of CO systems. Most equipment is imported, and growth is expected to be gradual as regulations clarify and consumer interest in wellness-focused CBD products increases.

Competition in the CBD extraction equipment market is intensifying around technology sophistication, efficiency, compliance, customization, and scalability. Supercritical CO remains the preferred method for high-purity extraction, while automation and AI integration are improving yield and consistency. Manufacturers offering turnkey, scalable systems with integrated post-processing gain a competitive edge. Compliance with GMP and ISO standards, along with the ability to serve niche applications such as full-spectrum and isolate production, is becoming increasingly critical.

Key players include Eden Labs, Precision Extraction Solutions, Apeks Supercritical, Delta Separations, Capna Systems, extraktLAB, Root Sciences, Vitalis Extraction Technology, Lab Society, Luna Technologies, Across International, Pinnacle Stainless, and Pope Scientific, among others.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our CBD Extraction Equipment market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of CBD Extraction Equipment market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in CBD Extraction Equipment market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our CBD Extraction Equipment market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a CBD Extraction Equipment market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 13.69 from 2026 to 2035 |

| Base Year | 2025 |

| Actual Estimates / Historical Data | 2017 - 2024 |

| Forecast Period | 2026 - 2035 |

| Quantitative Units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country Scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment Covered by Extraction Method |

|

| The Segment Covered by Equipment Type |

|

| Companies Covered |

|

| Report Coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free Customization Scope (Equivalent to 5 Analyst Working Days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 CBD Extraction Equipment market share, size, and revenue growth rate were created by Quintile Report™. CBD Extraction Equipment analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global CBD Extraction Equipment Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global CBD Extraction Equipment Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global CBD Extraction Equipment Market, by Region, (USD Million) 2017-2035

Table 21 China Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global CBD Extraction Equipment Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global CBD Extraction Equipment Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global CBD Extraction Equipment Market: market scenario

Fig.4 Global CBD Extraction Equipment Market competitive outlook

Fig.5 Global CBD Extraction Equipment Market driver analysis

Fig.6 Global CBD Extraction Equipment Market restraint analysis

Fig.7 Global CBD Extraction Equipment Market opportunity analysis

Fig.8 Global CBD Extraction Equipment Market trends analysis

Fig.9 Global CBD Extraction Equipment Market: Segment Analysis (Based on the scope)

Fig.10 Global CBD Extraction Equipment Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global CBD Extraction Equipment Market was valued at USD 67.62 million in 2025 and is projected to reach USD 218.8 million by 2035, expanding at a robust CAGR of 13.69% during the forecast period from 2026 to 2035. The CBD Extraction Equipment market report delivers a comprehensive industry assessment by analyzing macroeconomic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to provide a clear outlook on future growth potential.

With 2025 as the base year, the CBD Extraction Equipment market is experiencing steady expansion driven by continuous innovation, rising demand across end-use industries, and rapid technological progress. Market participants are increasingly optimizing their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to shifting competitive dynamics.

Looking ahead to 2035, the market is expected to maintain strong growth momentum, supported by sustained investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that focus on innovation, agile GTM execution, and alignment with evolving customer needs are well positioned to achieve long-term success. The report provides in-depth insights into key market drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by robust qualitative and quantitative analysis spanning 2017 to 2035.

The CBD extraction equipment market focuses on specialized machinery designed to extract cannabidiol (CBD) from hemp or cannabis plants, playing a critical role in determining the quality, purity, and consistency of CBD-based products. This market includes a broad range of equipment, from advanced extraction systemssuch as closed-loop CO, ethanol, and hydrocarbon extraction unitsto essential filtration and separation tools like vacuum pumps, Buchner funnels, and molecular sieves. Post-processing equipment is equally important, handling purification, solvent recovery, distillation, and packaging.

Among extraction methods, supercritical CO extraction is widely favored for producing high-purity extracts at industrial scale, while ethanol and hydrocarbon extraction offer speed and efficiency. Solventless mechanical methods, such as rosin presses, are also gaining popularity for their clean, chemical-free appeal. As demand rises for CBD oils, tinctures, edibles, capsules, and topicals, the scalability and performance of extraction equipment are becoming increasingly critical within the broader cannabis and wellness industries.

The CBD extraction equipment market is experiencing strong growth, driven by a combination of regulatory reforms, technological innovation, and rising consumer demand.

One of the most significant drivers is the global legalization of cannabis and hemp, particularly across North America, Europe, and parts of Asia. Countries such as Canada, Germany, and Thailand are modernizing regulatory frameworks, opening new markets for medical and wellness-focused CBD products.

Consumer demand for CBD-infused wellness, pharmaceutical, and nutraceutical products is expanding rapidly, supported by growing awareness of CBDs therapeutic potential. With a substantial global user base and rising healthcare needs, the requirement for high-quality, consistent CBD extracts continues to increase.

Technological advancements are another major growth catalyst. Innovations such as AI-integrated extraction systems, eco-friendly solvents, supercritical CO technology, and GMP-compliant automation are improving efficiency, yield, and regulatory compliance. Turnkey and end-to-end automated solutions are emerging as key differentiators.

Finally, strong venture capital investment and strategic partnershipsparticularly with pharmaceutical and nutraceutical companiesare helping manufacturers scale production, develop continuous extraction systems, and offset high initial capital requirements.

A major restraint is the high initial capital investment required to establish advanced extraction facilities, especially those using supercritical CO or cryogenic ethanol systems. These systems require sophisticated infrastructure, high-pressure safety mechanisms, and specialized expertise, limiting accessibility for startups and small operators.

The market also faces challenges from a fragmented and evolving regulatory landscape. Regulations vary widely across countries and even within regions, creating uncertainty and increasing compliance complexity.

Another significant challenge is the shortage of skilled operators and technical experts capable of running modern extraction systems. This talent gap is particularly evident in emerging markets, leading to operational inefficiencies and quality risks.

Even after installation, ongoing operational and maintenance costs remain high. Energy consumption, solvent procurement, routine system maintenance, and compliance testing continue to put pressure on profit margins.

North America leads the global CBD extraction equipment market, driven by early legalization and technological leadership in the United States and Canada. Supercritical CO extraction dominates due to its suitability for pharmaceutical-grade CBD. The 2018 U.S. Farm Bill enabled large-scale industrial operations, accelerating demand for automated, GMP-compliant systems. However, varying state-level regulations continue to raise compliance costs, pushing companies toward partnerships and venture-backed expansion.

Europes market is expanding rapidly, supported by legalization trends in Germany, Italy, and the UK and a strong focus on pharmaceutical-grade extraction. Advanced facilities using supercritical CO and cryo-ethanol technologies are becoming more common. While regulatory fragmentation across EU member states remains a challenge, rising e-commerce activity and investment in terpene-rich and full-spectrum extracts are driving innovation.

The Asia Pacific region is led by Australia and New Zealand, where growth is driven by pharmaceutical and food & beverage applications. Adoption of Industry 4.0 and AI-optimized extraction systems is increasing efficiency and output. Regulatory uncertainty persists in emerging markets such as Thailand, but rising investment in solventless and export-oriented extraction technologies is supporting long-term growth.

Latin America is leveraging its strong agricultural base and favorable climate for biomass cultivation. Countries such as Colombia and Uruguay are focusing on ethanol and hydrocarbon extraction methods due to cost efficiency. While infrastructure limitations and regulatory inconsistencies restrict large-scale scalability, partnerships with global technology providers are enabling gradual market development.

This region faces strict regulations and limited infrastructure, which constrain large-scale investments. However, medical cannabis legalization in countries such as Israel and South Africa has driven interest in small-scale CO extraction systems. The region remains highly dependent on imported equipment, but favorable cultivation conditions present long-term opportunities.

The U.S. CBD extraction equipment market benefits from the legalization of hemp-derived CBD and strong demand across pharmaceutical, wellness, and food sectors. Advanced supercritical CO and ethanol systems, combined with automation and AI integration, dominate the landscape. Despite regulatory complexity, the U.S. hosts hundreds of licensed extraction facilities and remains a global innovation hub.

Germany stands out as Europes most regulated and quality-focused CBD market. Supercritical CO extraction is widely used for pharmaceutical-grade production. Strong government research support, skilled labor, and partnerships with pharmaceutical firms continue to strengthen Germanys position as a leader in compliant, high-precision extraction.

Japans CBD extraction equipment market is still in early stages due to strict THC regulations. Ethanol extraction dominates, with limited adoption of CO systems. Most equipment is imported, and growth is expected to be gradual as regulations clarify and consumer interest in wellness-focused CBD products increases.

Competition in the CBD extraction equipment market is intensifying around technology sophistication, efficiency, compliance, customization, and scalability. Supercritical CO remains the preferred method for high-purity extraction, while automation and AI integration are improving yield and consistency. Manufacturers offering turnkey, scalable systems with integrated post-processing gain a competitive edge. Compliance with GMP and ISO standards, along with the ability to serve niche applications such as full-spectrum and isolate production, is becoming increasingly critical.

Key players include Eden Labs, Precision Extraction Solutions, Apeks Supercritical, Delta Separations, Capna Systems, extraktLAB, Root Sciences, Vitalis Extraction Technology, Lab Society, Luna Technologies, Across International, Pinnacle Stainless, and Pope Scientific, among others.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our CBD Extraction Equipment market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of CBD Extraction Equipment market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in CBD Extraction Equipment market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our CBD Extraction Equipment market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a CBD Extraction Equipment market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 13.69 from 2026 to 2035 |

| Base Year | 2025 |

| Actual Estimates / Historical Data | 2017 - 2024 |

| Forecast Period | 2026 - 2035 |

| Quantitative Units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country Scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment Covered by Extraction Method |

|

| The Segment Covered by Equipment Type |

|

| Companies Covered |

|

| Report Coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free Customization Scope (Equivalent to 5 Analyst Working Days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 CBD Extraction Equipment market share, size, and revenue growth rate were created by Quintile Report™. CBD Extraction Equipment analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global CBD Extraction Equipment Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global CBD Extraction Equipment Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global CBD Extraction Equipment Market, by Region, (USD Million) 2017-2035

Table 21 China Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global CBD Extraction Equipment Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global CBD Extraction Equipment Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global CBD Extraction Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global CBD Extraction Equipment Market: market scenario

Fig.4 Global CBD Extraction Equipment Market competitive outlook

Fig.5 Global CBD Extraction Equipment Market driver analysis

Fig.6 Global CBD Extraction Equipment Market restraint analysis

Fig.7 Global CBD Extraction Equipment Market opportunity analysis

Fig.8 Global CBD Extraction Equipment Market trends analysis

Fig.9 Global CBD Extraction Equipment Market: Segment Analysis (Based on the scope)

Fig.10 Global CBD Extraction Equipment Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy