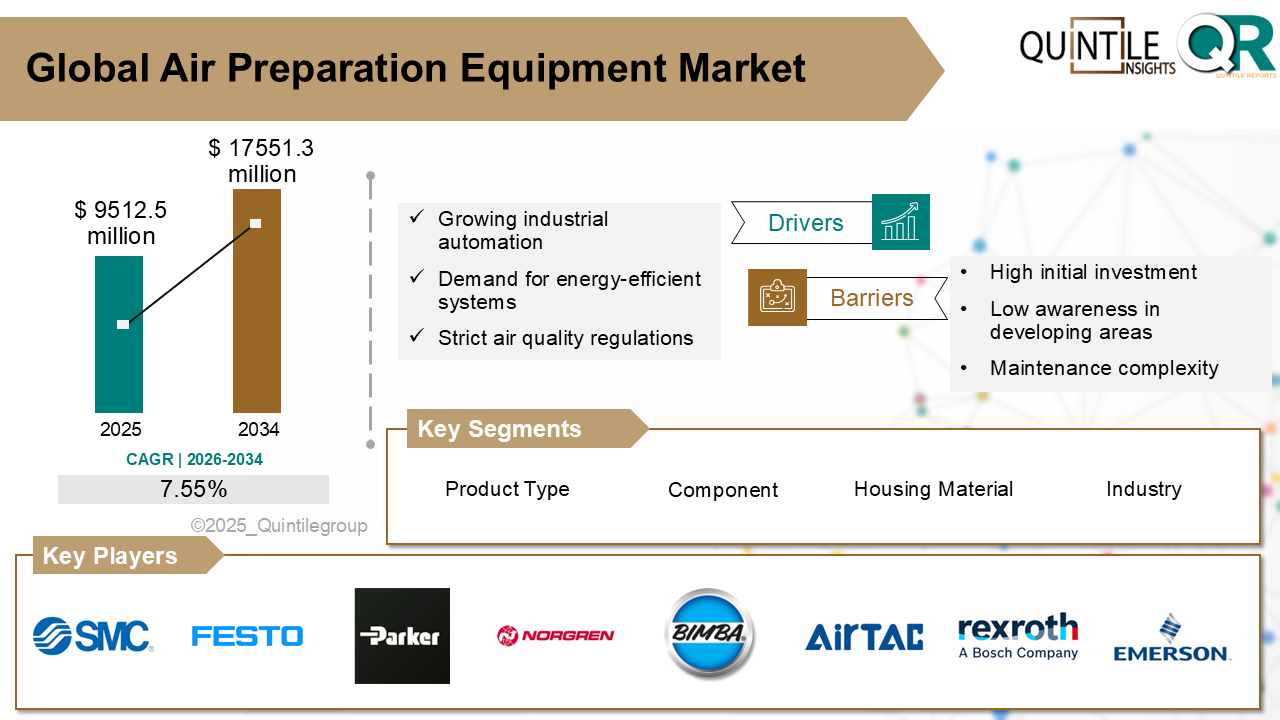

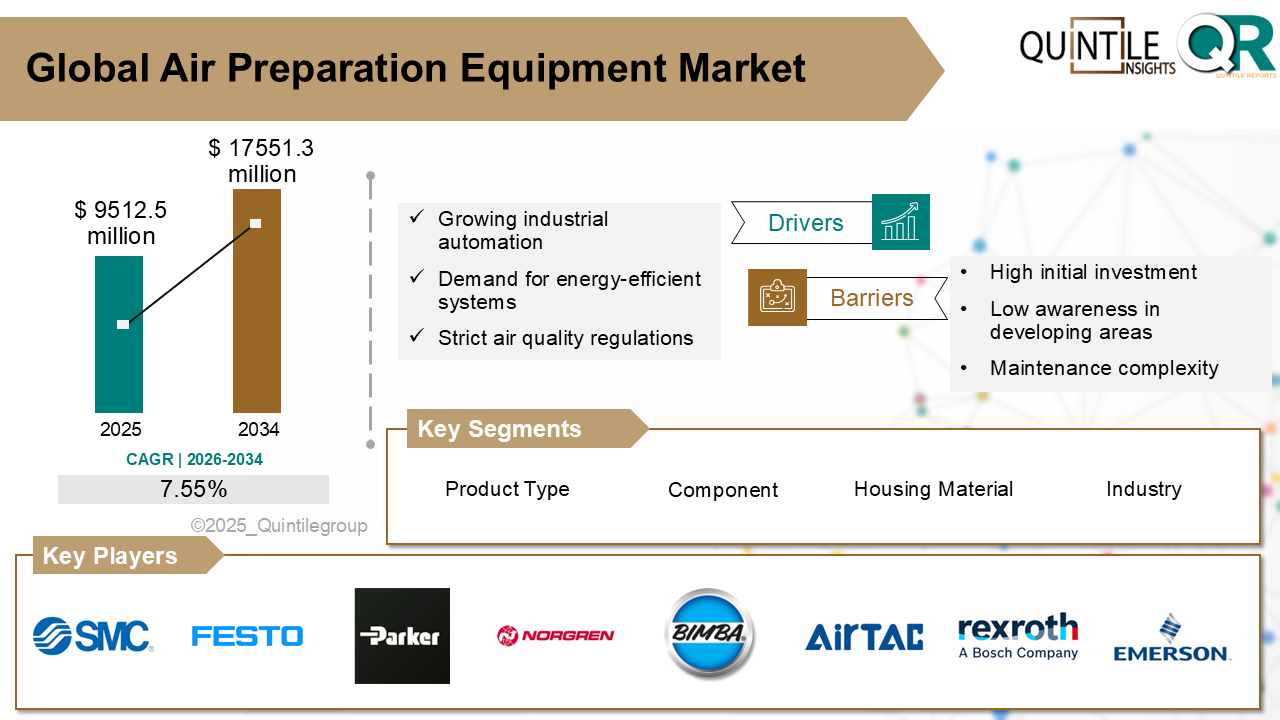

The Global Air Preparation Equipment Market was valued at USD 9512.5 Million in 2025 and is projected to reach USD 17551.3 Million by 2035, expanding at a robust CAGR of 7.29% during the forecast period from 2026 to 2035. The Air Preparation Equipment market report delivers a comprehensive industry assessment by analyzing macroeconomic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to provide a clear outlook on future growth potential.

With 2025 as the base year, the Air Preparation Equipment market is experiencing steady expansion driven by continuous innovation, rising demand across end-use industries, and rapid technological progress. Market participants are increasingly optimizing their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to shifting competitive dynamics.

Looking ahead to 2035, the market is expected to maintain strong growth momentum, supported by sustained investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that focus on innovation, agile GTM execution, and alignment with evolving customer needs are well positioned to achieve long-term success. The report provides in-depth insights into key market drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by robust qualitative and quantitative analysis spanning 2017 to 2035.

The air preparation equipment market refers to the global and regional market for devices and systems used to treat and condition compressed air before it is delivered to pneumatic equipment and tools. This equipment ensures that air is clean, dry, and at the appropriate pressure, thereby preventing damage, wear, or inefficiency in downstream components. Key products in this market include air filters, regulators, lubricators, dryers, and condensate management systems, often integrated into FRL (Filter-Regulator-Lubricator) units for compact and efficient air treatment solutions.

These systems are vital in various industries such as manufacturing, automotive, food and beverage, pharmaceuticals, packaging, and electronics, where the quality of compressed air directly affects production quality and equipment longevity. Air preparation equipment is typically mounted at the point of use or within centralized compressed air systems, and is available in multiple configurations to suit different flow rates, pressure levels, and contamination control requirements. Products often conform to global standards such as ISO 8573 to ensure consistent air quality and performance.

Rapid adoption of industrial automation and Industry 4.0 practices across manufacturing sectors. As factories embrace automation and smart production methods, the demand for clean, dry, and regulated compressed air increases. Air preparation equipment like filters, regulators, and lubricators (FRLs) are essential to maintain compressed-air quality and ensure optimal performance of pneumatic systems. This trend is especially strong in electronics, automotive, food & beverage, and pharmaceutical production lines.

Increasing focus on energy efficiency and sustainability. Rising energy costs and environmental targets are driving demand for systems that minimize pressure loss and reduce power consumption. Manufacturers are being incentivized to adopt energy efficient dryers, filters, and variable-speed solutions that align with sustainability goals while lowering operational expenses.

Stringent regulatory standards for air quality and emissions globally. Governments and agencies across regions including North America, Europe, and Asia-Pacific are tightening norms related to workplace air quality, compressed-air purity, and industrial emissions. These regulations compel companies to upgrade to high-performance air preparation equipment that guarantees compliance and protects product integrity.

Growing demand for contaminant- and moisture-free air in critical industries. Sectors such as pharmaceuticals, food & beverage, semiconductor manufacturing, and healthcare require ultra-clean air to ensure product safety and process efficiency. This increases reliance on advanced filtration, drying, and separation technologies designed for high-purity applications.

Rising adoption of IoT-enabled air preparation systems with predictive capabilities. Smart FRL units equipped with sensors, connectivity, and AI-powered analytics support real-time monitoring and predictive maintenance. This integration enhances reliability, reduces downtime, and strengthens supply chain resilience amid tariffs and lead time pressures.

High installation and maintenance costs of air preparation systems act as a significant deterrent for small and medium-sized enterprises. Air preparation units comprising filters, regulators, lubricators, and dryers are crucial for efficient pneumatic operations. However, the upfront investment, combined with recurring costs for part replacements and preventive maintenance, can be prohibitive for SMEs, especially in cost-sensitive sectors like textiles, packaging, or small-scale manufacturing.

Complex system integration and compatibility issues with existing pneumatic infrastructure limit market adoption. Older manufacturing setups may not be designed to accommodate modern modular air preparation units or smart monitoring sensors. This makes integration costly and technically challenging. Incompatibility between equipment from different manufacturers can also result in inefficiencies or system failures, discouraging upgrades in aging plants.

Lack of awareness regarding the long-term benefits of clean, regulated compressed air affects demand in emerging economies. In many developing regions, industrial players focus more on upfront cost savings than on the preventive value of air preparation. As a result, they may bypass or underutilize such equipment, leading to increased wear and tear on downstream pneumatic tools and systems. This short-term cost focus restrains the widespread adoption of air preparation solutions.

Fluctuating demand from key end-use industries due to economic uncertainty can reduce equipment procurement and investment. Industries such as automotive, manufacturing, and construction are cyclical and sensitive to macroeconomic shifts. During downturns or disruptions (e.g., supply chain shortages or rising inflation), capital expenditure on support systems like air preparation equipment is often delayed or canceled. This makes the market vulnerable to industrial volatility.

North America dominates the air preparation equipment market due to its advanced manufacturing base, stringent air quality regulations, and high adoption of pneumatic systems. The United States sees strong demand across industries such as automotive, food & beverage, and pharmaceuticals, where clean, dry, and regulated compressed air is critical. Canada also shows steady growth, particularly in process industries and in facilities adopting energy-efficient pneumatic solutions.

Europe holds a significant share, driven by automation in industries and strict health and safety standards related to air quality and equipment performance. Countries like Germany, the UK, and Italy are investing in clean and sustainable manufacturing, which includes the use of efficient air preparation units such as filters, dryers, and regulators. The region’s strong presence in automotive and packaging sectors further fuels the demand for reliable pneumatic air treatment systems.

Asia-Pacific, especially China, India, Japan, and South Korea, is the fastest-growing region due to rapid industrial expansion, rising labor costs leading to automation, and the growing adoption of pneumatic tools. China leads in both manufacturing and usage of air preparation components, driven by the electronics, automotive, and textile industries. India is increasing its investments in industrial automation and infrastructure, creating a steady rise in demand for air treatment systems.

Latin America is experiencing gradual growth, led by countries like Brazil and Mexico where industrialization and the adoption of compressed air systems are increasing. Demand is particularly strong in food processing, automotive components, and light manufacturing. However, economic fluctuations and limited technical awareness can hamper full-scale adoption of high-end air preparation solutions.

The Middle East & Africa region shows growing interest in air preparation equipment, especially in the oil & gas, construction, and manufacturing sectors. Countries like the UAE and Saudi Arabia are investing in smart factories and industrial zones, which rely on efficient pneumatic systems for safe operations. In Africa, South Africa leads in terms of industrial usage, though limited infrastructure and inconsistent access to advanced equipment restrain broader market growth.

The United States is driving demand through industrial automation and need for compressed air system efficiency:

The U.S. air preparation equipment market is growing steadily due to the widespread adoption of pneumatic systems in automated manufacturing and the increasing focus on optimizing compressed air usage. Industries such as automotive, food & beverage, packaging, and electronics rely heavily on clean, dry, and regulated air to operate pneumatic tools, actuators, and machinery with precision and consistency driving demand for filters, regulators, lubricators (FRLs), and dryers.

With rising energy costs and sustainability goals, U.S. manufacturers are prioritizing air system efficiency and reliability, making air preparation units essential for preventing moisture, contaminants, and pressure fluctuations. Additionally, OSHA and ISO standards for workplace safety and compressed air quality further encourage the use of advanced air treatment solutions. The growth of smart factories and predictive maintenance practices is also boosting interest in digitally monitored, energy-efficient air prep systems across U.S. industrial facilities.

Germany is accelerating demand through precision engineering and emphasis on energy-efficient pneumatics:

Germany’s air preparation equipment market is driven by the country’s advanced manufacturing sector, where high-precision pneumatic systems are essential in industries like automotive, machinery, food processing, and electronics. To maintain optimal performance and reduce wear in complex automated systems, manufacturers increasingly rely on high-quality air preparation units including filters, regulators, dryers, and lubricators to deliver clean, dry, and pressure-stable air.

In addition, Germany’s strong commitment to energy efficiency and sustainability reinforced by both EU regulations and national initiatives has encouraged the adoption of smart air management solutions that reduce leakage, improve system control, and lower overall energy consumption. With Industry 4.0 integration advancing rapidly, the demand for intelligent, sensor-equipped air prep systems that enable predictive maintenance and enhanced productivity is growing across German production facilities.

Japan is fueling demand through miniaturized automation and strict quality control in manufacturing:

Japan’s air preparation equipment market is largely driven by the country’s focus on compact, high-precision automation in industries such as electronics, automotive components, and medical devices. These sectors rely heavily on consistent and contaminant-free pneumatic systems to maintain product quality, reduce equipment wear, and support cleanroom-level operations making air preparation units like filters, regulators, and dryers essential.

Additionally, Japan’s manufacturing philosophy emphasizes efficiency, minimal waste, and preventative maintenance, which aligns with the use of advanced air treatment systems that support long-term operational reliability. The integration of smart sensors and compact air preparation modules into automated lines also supports Japan’s ongoing transition to smart factories. With tight tolerances, aging infrastructure, and high standards for quality and cleanliness, demand for precise and space-efficient air prep solutions continues to grow in Japan.

The air preparation equipment market is highly competitive, spurred by a strong wave of innovation in smart, modular, and energy-efficient systems. Manufacturers are increasingly integrating IoT-enabled sensors, Industry 4.0 features, predictive maintenance, and digital twins with FRL (filter-regulator-lubricator) units, optimizing air supply quality and system uptime. This emphasis on real-time monitoring and automated optimization helps firms stand out through R&D and technological integration.

Environmental concerns and regulatory compliance are major competitive drivers. Energy-efficient designs that reduce leakage, pressure drops, and emissions like variable speed drives and eco-friendly materials are becoming standard. The move toward cleaner air specifically through high-performance filters adhering to ISO 8573 standards supports sustainability claims, particularly for industries like food, pharma, and electronics, which demand sterile, contaminant-free air.

Price competitiveness remains pivotal, especially in industries deploying large-scale compressed air systems. Despite high upfront costs for advanced FRL systems, providers who balance initial investment with energy savings and lifecycle benefits (TCO) maintain an edge. SMEs in developing regions may hesitate, but tailored solutions—such as compact, modular units—help broaden market penetration.

Scalability and global footprint are other critical differentiators. The Asia-Pacific region, notably China and India, is witnessing rapid adoption driven by industrial automation policies and smart factory initiatives. North America and Europe continue to demand high-quality, regulatory-compliant systems, fueling steady growth and enabling international players to leverage regional manufacturing for responsiveness.

Customization and value-added services are becoming key differentiators. Providers are rolling out pre-assembled, hygienic FRLs tuned for specific sectors like food & beverage, as demonstrated by recent product launches from leading players. IoT-enabled equipment featuring real-time diagnostics, smart controls, and remote maintenance is gaining steam. These tailored, user-centric solutions especially smart modular units are delivering better performance, reliability, and brand visibility, giving suppliers a strategic edge in competitive tenders.

Key players in the market are SMC Corporation, Festo AG & Co. KG, Parker Hannifin Corporation, Norgren Inc. (IMI Precision Engineering), Bimba Manufacturing Company, Airtac International Group, Bosch Rexroth AG, Emerson Electric Co., Camozzi Automation SpA, ASCO Valve Inc., AVENTICS GmbH, Janatics India Pvt. Ltd., Omega Air.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Air Preparation Equipment market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Air Preparation Equipment market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Air Preparation Equipment market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Air Preparation Equipment market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Air Preparation Equipment market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 7.29 from 2026 to 2035 |

| Base Year | 2025 |

| Actual Estimates / Historical Data | 2017 - 2024 |

| Forecast Period | 2026 - 2035 |

| Quantitative Units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country Scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment Covered by Product Type & Configuration |

|

| The Segment Covered by Port Size & Relieving Type |

|

| Companies Covered |

|

| Report Coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free Customization Scope (Equivalent to 5 Analyst Working Days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Air Preparation Equipment market share, size, and revenue growth rate were created by Quintile Report™. Air Preparation Equipment analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Air Preparation Equipment Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Air Preparation Equipment Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Air Preparation Equipment Market, by Region, (USD Million) 2017-2035

Table 21 China Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Air Preparation Equipment Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Air Preparation Equipment Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Air Preparation Equipment Market: market scenario

Fig.4 Global Air Preparation Equipment Market competitive outlook

Fig.5 Global Air Preparation Equipment Market driver analysis

Fig.6 Global Air Preparation Equipment Market restraint analysis

Fig.7 Global Air Preparation Equipment Market opportunity analysis

Fig.8 Global Air Preparation Equipment Market trends analysis

Fig.9 Global Air Preparation Equipment Market: Segment Analysis (Based on the scope)

Fig.10 Global Air Preparation Equipment Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Air Preparation Equipment Market was valued at USD 9512.5 Million in 2025 and is projected to reach USD 17551.3 Million by 2035, expanding at a robust CAGR of 7.29% during the forecast period from 2026 to 2035. The Air Preparation Equipment market report delivers a comprehensive industry assessment by analyzing macroeconomic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to provide a clear outlook on future growth potential.

With 2025 as the base year, the Air Preparation Equipment market is experiencing steady expansion driven by continuous innovation, rising demand across end-use industries, and rapid technological progress. Market participants are increasingly optimizing their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to shifting competitive dynamics.

Looking ahead to 2035, the market is expected to maintain strong growth momentum, supported by sustained investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that focus on innovation, agile GTM execution, and alignment with evolving customer needs are well positioned to achieve long-term success. The report provides in-depth insights into key market drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by robust qualitative and quantitative analysis spanning 2017 to 2035.

The air preparation equipment market refers to the global and regional market for devices and systems used to treat and condition compressed air before it is delivered to pneumatic equipment and tools. This equipment ensures that air is clean, dry, and at the appropriate pressure, thereby preventing damage, wear, or inefficiency in downstream components. Key products in this market include air filters, regulators, lubricators, dryers, and condensate management systems, often integrated into FRL (Filter-Regulator-Lubricator) units for compact and efficient air treatment solutions.

These systems are vital in various industries such as manufacturing, automotive, food and beverage, pharmaceuticals, packaging, and electronics, where the quality of compressed air directly affects production quality and equipment longevity. Air preparation equipment is typically mounted at the point of use or within centralized compressed air systems, and is available in multiple configurations to suit different flow rates, pressure levels, and contamination control requirements. Products often conform to global standards such as ISO 8573 to ensure consistent air quality and performance.

Rapid adoption of industrial automation and Industry 4.0 practices across manufacturing sectors. As factories embrace automation and smart production methods, the demand for clean, dry, and regulated compressed air increases. Air preparation equipment like filters, regulators, and lubricators (FRLs) are essential to maintain compressed-air quality and ensure optimal performance of pneumatic systems. This trend is especially strong in electronics, automotive, food & beverage, and pharmaceutical production lines.

Increasing focus on energy efficiency and sustainability. Rising energy costs and environmental targets are driving demand for systems that minimize pressure loss and reduce power consumption. Manufacturers are being incentivized to adopt energy efficient dryers, filters, and variable-speed solutions that align with sustainability goals while lowering operational expenses.

Stringent regulatory standards for air quality and emissions globally. Governments and agencies across regions including North America, Europe, and Asia-Pacific are tightening norms related to workplace air quality, compressed-air purity, and industrial emissions. These regulations compel companies to upgrade to high-performance air preparation equipment that guarantees compliance and protects product integrity.

Growing demand for contaminant- and moisture-free air in critical industries. Sectors such as pharmaceuticals, food & beverage, semiconductor manufacturing, and healthcare require ultra-clean air to ensure product safety and process efficiency. This increases reliance on advanced filtration, drying, and separation technologies designed for high-purity applications.

Rising adoption of IoT-enabled air preparation systems with predictive capabilities. Smart FRL units equipped with sensors, connectivity, and AI-powered analytics support real-time monitoring and predictive maintenance. This integration enhances reliability, reduces downtime, and strengthens supply chain resilience amid tariffs and lead time pressures.

High installation and maintenance costs of air preparation systems act as a significant deterrent for small and medium-sized enterprises. Air preparation units comprising filters, regulators, lubricators, and dryers are crucial for efficient pneumatic operations. However, the upfront investment, combined with recurring costs for part replacements and preventive maintenance, can be prohibitive for SMEs, especially in cost-sensitive sectors like textiles, packaging, or small-scale manufacturing.

Complex system integration and compatibility issues with existing pneumatic infrastructure limit market adoption. Older manufacturing setups may not be designed to accommodate modern modular air preparation units or smart monitoring sensors. This makes integration costly and technically challenging. Incompatibility between equipment from different manufacturers can also result in inefficiencies or system failures, discouraging upgrades in aging plants.

Lack of awareness regarding the long-term benefits of clean, regulated compressed air affects demand in emerging economies. In many developing regions, industrial players focus more on upfront cost savings than on the preventive value of air preparation. As a result, they may bypass or underutilize such equipment, leading to increased wear and tear on downstream pneumatic tools and systems. This short-term cost focus restrains the widespread adoption of air preparation solutions.

Fluctuating demand from key end-use industries due to economic uncertainty can reduce equipment procurement and investment. Industries such as automotive, manufacturing, and construction are cyclical and sensitive to macroeconomic shifts. During downturns or disruptions (e.g., supply chain shortages or rising inflation), capital expenditure on support systems like air preparation equipment is often delayed or canceled. This makes the market vulnerable to industrial volatility.

North America dominates the air preparation equipment market due to its advanced manufacturing base, stringent air quality regulations, and high adoption of pneumatic systems. The United States sees strong demand across industries such as automotive, food & beverage, and pharmaceuticals, where clean, dry, and regulated compressed air is critical. Canada also shows steady growth, particularly in process industries and in facilities adopting energy-efficient pneumatic solutions.

Europe holds a significant share, driven by automation in industries and strict health and safety standards related to air quality and equipment performance. Countries like Germany, the UK, and Italy are investing in clean and sustainable manufacturing, which includes the use of efficient air preparation units such as filters, dryers, and regulators. The region’s strong presence in automotive and packaging sectors further fuels the demand for reliable pneumatic air treatment systems.

Asia-Pacific, especially China, India, Japan, and South Korea, is the fastest-growing region due to rapid industrial expansion, rising labor costs leading to automation, and the growing adoption of pneumatic tools. China leads in both manufacturing and usage of air preparation components, driven by the electronics, automotive, and textile industries. India is increasing its investments in industrial automation and infrastructure, creating a steady rise in demand for air treatment systems.

Latin America is experiencing gradual growth, led by countries like Brazil and Mexico where industrialization and the adoption of compressed air systems are increasing. Demand is particularly strong in food processing, automotive components, and light manufacturing. However, economic fluctuations and limited technical awareness can hamper full-scale adoption of high-end air preparation solutions.

The Middle East & Africa region shows growing interest in air preparation equipment, especially in the oil & gas, construction, and manufacturing sectors. Countries like the UAE and Saudi Arabia are investing in smart factories and industrial zones, which rely on efficient pneumatic systems for safe operations. In Africa, South Africa leads in terms of industrial usage, though limited infrastructure and inconsistent access to advanced equipment restrain broader market growth.

The United States is driving demand through industrial automation and need for compressed air system efficiency:

The U.S. air preparation equipment market is growing steadily due to the widespread adoption of pneumatic systems in automated manufacturing and the increasing focus on optimizing compressed air usage. Industries such as automotive, food & beverage, packaging, and electronics rely heavily on clean, dry, and regulated air to operate pneumatic tools, actuators, and machinery with precision and consistency driving demand for filters, regulators, lubricators (FRLs), and dryers.

With rising energy costs and sustainability goals, U.S. manufacturers are prioritizing air system efficiency and reliability, making air preparation units essential for preventing moisture, contaminants, and pressure fluctuations. Additionally, OSHA and ISO standards for workplace safety and compressed air quality further encourage the use of advanced air treatment solutions. The growth of smart factories and predictive maintenance practices is also boosting interest in digitally monitored, energy-efficient air prep systems across U.S. industrial facilities.

Germany is accelerating demand through precision engineering and emphasis on energy-efficient pneumatics:

Germany’s air preparation equipment market is driven by the country’s advanced manufacturing sector, where high-precision pneumatic systems are essential in industries like automotive, machinery, food processing, and electronics. To maintain optimal performance and reduce wear in complex automated systems, manufacturers increasingly rely on high-quality air preparation units including filters, regulators, dryers, and lubricators to deliver clean, dry, and pressure-stable air.

In addition, Germany’s strong commitment to energy efficiency and sustainability reinforced by both EU regulations and national initiatives has encouraged the adoption of smart air management solutions that reduce leakage, improve system control, and lower overall energy consumption. With Industry 4.0 integration advancing rapidly, the demand for intelligent, sensor-equipped air prep systems that enable predictive maintenance and enhanced productivity is growing across German production facilities.

Japan is fueling demand through miniaturized automation and strict quality control in manufacturing:

Japan’s air preparation equipment market is largely driven by the country’s focus on compact, high-precision automation in industries such as electronics, automotive components, and medical devices. These sectors rely heavily on consistent and contaminant-free pneumatic systems to maintain product quality, reduce equipment wear, and support cleanroom-level operations making air preparation units like filters, regulators, and dryers essential.

Additionally, Japan’s manufacturing philosophy emphasizes efficiency, minimal waste, and preventative maintenance, which aligns with the use of advanced air treatment systems that support long-term operational reliability. The integration of smart sensors and compact air preparation modules into automated lines also supports Japan’s ongoing transition to smart factories. With tight tolerances, aging infrastructure, and high standards for quality and cleanliness, demand for precise and space-efficient air prep solutions continues to grow in Japan.

The air preparation equipment market is highly competitive, spurred by a strong wave of innovation in smart, modular, and energy-efficient systems. Manufacturers are increasingly integrating IoT-enabled sensors, Industry 4.0 features, predictive maintenance, and digital twins with FRL (filter-regulator-lubricator) units, optimizing air supply quality and system uptime. This emphasis on real-time monitoring and automated optimization helps firms stand out through R&D and technological integration.

Environmental concerns and regulatory compliance are major competitive drivers. Energy-efficient designs that reduce leakage, pressure drops, and emissions like variable speed drives and eco-friendly materials are becoming standard. The move toward cleaner air specifically through high-performance filters adhering to ISO 8573 standards supports sustainability claims, particularly for industries like food, pharma, and electronics, which demand sterile, contaminant-free air.

Price competitiveness remains pivotal, especially in industries deploying large-scale compressed air systems. Despite high upfront costs for advanced FRL systems, providers who balance initial investment with energy savings and lifecycle benefits (TCO) maintain an edge. SMEs in developing regions may hesitate, but tailored solutions—such as compact, modular units—help broaden market penetration.

Scalability and global footprint are other critical differentiators. The Asia-Pacific region, notably China and India, is witnessing rapid adoption driven by industrial automation policies and smart factory initiatives. North America and Europe continue to demand high-quality, regulatory-compliant systems, fueling steady growth and enabling international players to leverage regional manufacturing for responsiveness.

Customization and value-added services are becoming key differentiators. Providers are rolling out pre-assembled, hygienic FRLs tuned for specific sectors like food & beverage, as demonstrated by recent product launches from leading players. IoT-enabled equipment featuring real-time diagnostics, smart controls, and remote maintenance is gaining steam. These tailored, user-centric solutions especially smart modular units are delivering better performance, reliability, and brand visibility, giving suppliers a strategic edge in competitive tenders.

Key players in the market are SMC Corporation, Festo AG & Co. KG, Parker Hannifin Corporation, Norgren Inc. (IMI Precision Engineering), Bimba Manufacturing Company, Airtac International Group, Bosch Rexroth AG, Emerson Electric Co., Camozzi Automation SpA, ASCO Valve Inc., AVENTICS GmbH, Janatics India Pvt. Ltd., Omega Air.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Air Preparation Equipment market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Air Preparation Equipment market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Air Preparation Equipment market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Air Preparation Equipment market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Air Preparation Equipment market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 7.29 from 2026 to 2035 |

| Base Year | 2025 |

| Actual Estimates / Historical Data | 2017 - 2024 |

| Forecast Period | 2026 - 2035 |

| Quantitative Units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country Scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment Covered by Product Type & Configuration |

|

| The Segment Covered by Port Size & Relieving Type |

|

| Companies Covered |

|

| Report Coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free Customization Scope (Equivalent to 5 Analyst Working Days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Air Preparation Equipment market share, size, and revenue growth rate were created by Quintile Report™. Air Preparation Equipment analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Air Preparation Equipment Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Air Preparation Equipment Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Air Preparation Equipment Market, by Region, (USD Million) 2017-2035

Table 21 China Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Air Preparation Equipment Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Air Preparation Equipment Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Air Preparation Equipment Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Air Preparation Equipment Market: market scenario

Fig.4 Global Air Preparation Equipment Market competitive outlook

Fig.5 Global Air Preparation Equipment Market driver analysis

Fig.6 Global Air Preparation Equipment Market restraint analysis

Fig.7 Global Air Preparation Equipment Market opportunity analysis

Fig.8 Global Air Preparation Equipment Market trends analysis

Fig.9 Global Air Preparation Equipment Market: Segment Analysis (Based on the scope)

Fig.10 Global Air Preparation Equipment Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report OverviewThe Global Gas Cylinder Market was valued at USD 12.36 million in 2025 and is project

Read MoreReport OverviewThe Global Drone Mapping Market was valued at USD 2.62 billion in 2025 and is project

Read MoreReport OverviewThe Global CBD Extraction Equipment Market was valued at USD 67.62 million in 2025 an

Read More