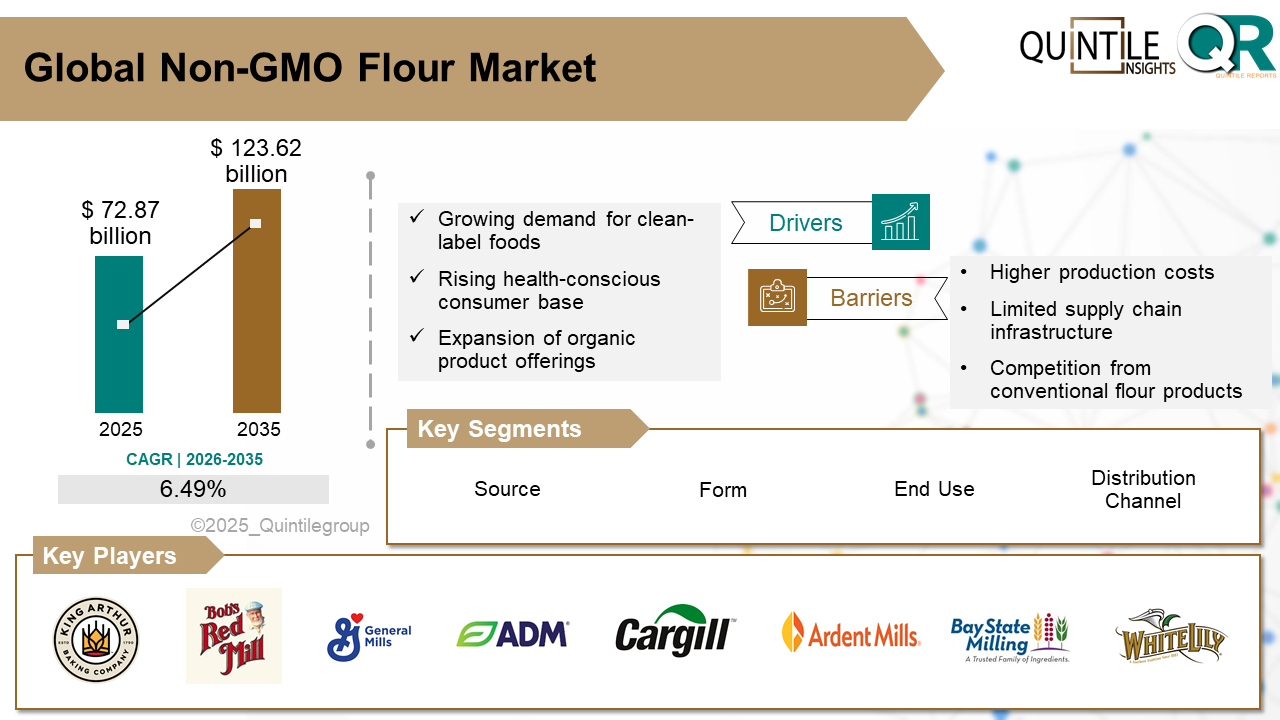

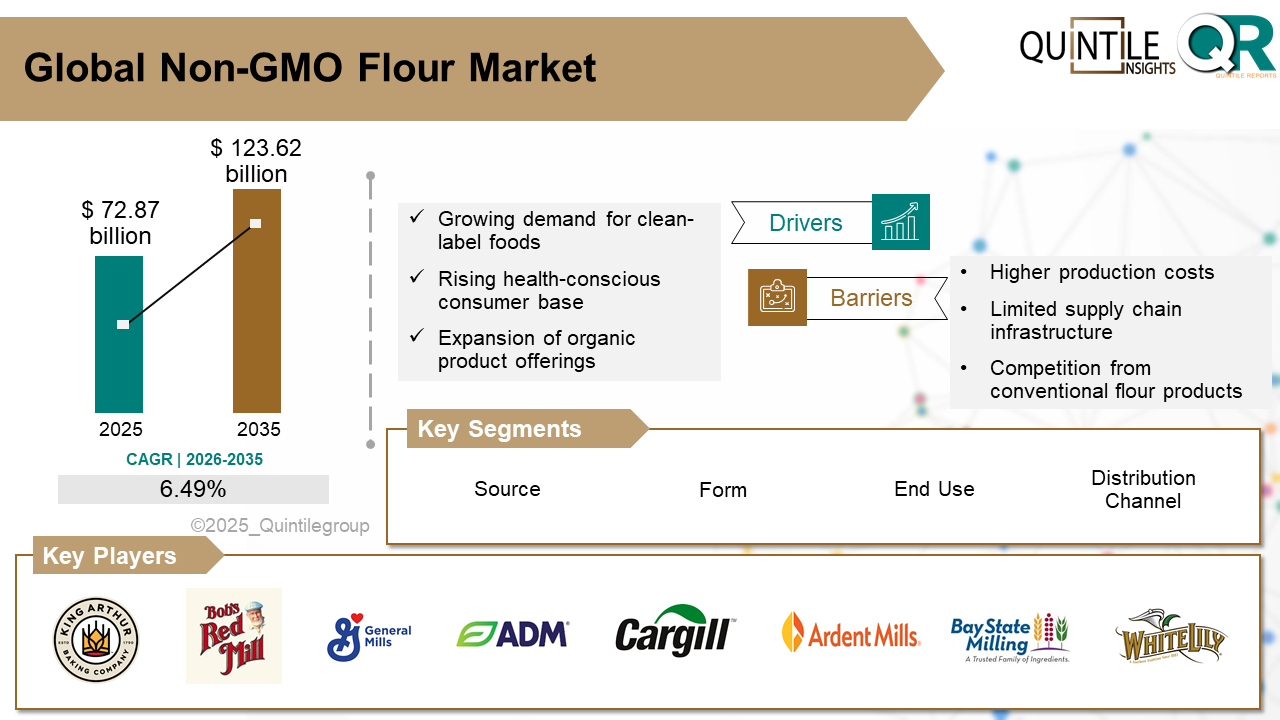

The Global Non-GMO Flour Market was estimated at USD 72.87 billion in 2025 and is projected to reach USD 123.62 billion by 2035, growing at a robust CAGR of 6.49% during the forecast period from 2026 to 2035. The Non-GMO Flour market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017 - 2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026 - 2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026 - 2035, enabling stakeholders to evaluate market growth potential over the forecast period.

The non-GMO flour market comprises flour products made from grains that have not been genetically modified through laboratory-based genetic engineering. These grains are cultivated using conventional breeding and farming practices, aligning with consumer preferences for natural, minimally altered ingredients. Non-GMO flour is commonly verified through third-party certifications such as the Non-GMO Project, which ensures compliance with established non-GMO standards.

Although non-GMO flour is often associated with organic products, the two are distinct categories. Organic flour is always non-GMO, but non-GMO flour may still be grown using synthetic fertilizers or pesticides unless explicitly certified organic. This distinction is important for consumers balancing priorities around health, sustainability, and affordability. Growing demand for clean-label foods, transparency in sourcing, and natural baking ingredients is driving the expansion of non-GMO flour across retail, foodservice, and industrial baking applications.

The non-GMO flour market is being propelled by clean-label trends, dietary shifts, and increased consumer awareness around food sourcing.

Consumers increasingly associate non-GMO products with health, safety, and natural food systems, making non-GMO flour a preferred choice among health-conscious shoppers.

Despite strong consumer interest, the market faces cost, awareness, and supply chain challenges.

North America: The largest and most developed market, driven by high consumer awareness, strong certification programs, and widespread clean-label demand. Private-label non-GMO flours are widely available in major retail chains.

Europe: Strong preference for natural and sustainable foods supports steady demand. Countries such as Germany, France, and the Netherlands benefit from strict GMO regulations and thriving artisan bakery cultures.

Asia Pacific: Gradual growth in urban centers, supported by rising disposable incomes, Western-style baking trends, and expansion of health food retail in markets like Japan, South Korea, and Australia.

Latin America: Moderate but improving adoption, driven by labeling transparency initiatives and growth of organic food categories in countries such as Brazil and Chile.

Middle East & Africa: A nascent market with emerging demand in GCC countries, fueled by premium imports, expatriate populations, and rising interest in health-oriented foods.

United States:

The U.S. leads the global non-GMO flour market, supported by high consumer awareness, established certification systems, and robust retail distribution. Supermarket chains and natural food retailers stock a wide variety of non-GMO flours, including whole wheat, ancient grains, and gluten-free options. Growth is further driven by home baking, plant-based diets, and strong e-commerce penetration.

Germany:

Germany represents one of Europes most trusted markets for non-GMO flour, shaped by strict regulations, consumer skepticism toward GMOs, and strong alignment with sustainability values. Organic mills, cooperatives, and specialty retailers play a key role in supplying stone-ground and heritage grain non-GMO flours.

Japan:

Japans non-GMO flour market is emerging, driven by cultural emphasis on food purity and traceability. Imported non-GMO flours from the U.S. and Australia dominate the niche, particularly in urban specialty stores and premium bakeries. Rising wellness awareness is expected to support gradual growth.

The non-GMO flour market is moderately fragmented, with competition based on quality, transparency, certifications, and alignment with dietary trends.

Brands differentiate through clean-label positioning, gluten-free and specialty flour blends, and clear communication of sourcing and verification practices. Packaging transparency, sustainability credentials, and use of heritage or regenerative grains provide additional competitive advantages.

Consumer engagement through education, recipes, and digital content plays an important role in brand loyalty. Companies that successfully combine authenticity, functionality, and trust are better positioned to compete in premium retail and e-commerce channels.

Key players include King Arthur Baking Company, Bobs Red Mill Natural Foods, General Mills, Archer Daniels Midland Company (ADM), Cargill Incorporated, Ardent Mills, Bay State Milling Company, Pillsbury, White Lily, Amys Kitchen, Eden Foods, Munkebo (Munke Mlle), Doves Farm, Hodgson Mill, Natures Path Foods, and other players.

In January 2025, Maskal Teff launched certified organic, non-GMO brown teff flour and teff grain at the Winter Fancy Food Show, expanding clean-label options for retail and foodservice markets.

In October 2024, Natures Path Foods introduced a new line of organic, non-GMO flours in the U.S., including all-purpose, gluten-free, keto, and whole wheat variants, supporting growing demand for sustainable and health-conscious baking ingredients.

The non-GMO flour market comprises flour products made from grains that have not been genetically modified through laboratory-based genetic engineering. These grains are cultivated using conventional breeding and farming practices, aligning with consumer preferences for natural, minimally altered ingredients. Non-GMO flour is commonly verified through third-party certifications such as the Non-GMO Project, which ensures compliance with established non-GMO standards.

Although non-GMO flour is often associated with organic products, the two are distinct categories. Organic flour is always non-GMO, but non-GMO flour may still be grown using synthetic fertilizers or pesticides unless explicitly certified organic. This distinction is important for consumers balancing priorities around health, sustainability, and affordability. Growing demand for clean-label foods, transparency in sourcing, and natural baking ingredients is driving the expansion of non-GMO flour across retail, foodservice, and industrial baking applications.

The non-GMO flour market is being propelled by clean-label trends, dietary shifts, and increased consumer awareness around food sourcing.

Consumers increasingly associate non-GMO products with health, safety, and natural food systems, making non-GMO flour a preferred choice among health-conscious shoppers.

Despite strong consumer interest, the market faces cost, awareness, and supply chain challenges.

North America: The largest and most developed market, driven by high consumer awareness, strong certification programs, and widespread clean-label demand. Private-label non-GMO flours are widely available in major retail chains.

Europe: Strong preference for natural and sustainable foods supports steady demand. Countries such as Germany, France, and the Netherlands benefit from strict GMO regulations and thriving artisan bakery cultures.

Asia Pacific: Gradual growth in urban centers, supported by rising disposable incomes, Western-style baking trends, and expansion of health food retail in markets like Japan, South Korea, and Australia.

Latin America: Moderate but improving adoption, driven by labeling transparency initiatives and growth of organic food categories in countries such as Brazil and Chile.

Middle East & Africa: A nascent market with emerging demand in GCC countries, fueled by premium imports, expatriate populations, and rising interest in health-oriented foods.

United States:

The U.S. leads the global non-GMO flour market, supported by high consumer awareness, established certification systems, and robust retail distribution. Supermarket chains and natural food retailers stock a wide variety of non-GMO flours, including whole wheat, ancient grains, and gluten-free options. Growth is further driven by home baking, plant-based diets, and strong e-commerce penetration.

Germany:

Germany represents one of Europes most trusted markets for non-GMO flour, shaped by strict regulations, consumer skepticism toward GMOs, and strong alignment with sustainability values. Organic mills, cooperatives, and specialty retailers play a key role in supplying stone-ground and heritage grain non-GMO flours.

Japan:

Japans non-GMO flour market is emerging, driven by cultural emphasis on food purity and traceability. Imported non-GMO flours from the U.S. and Australia dominate the niche, particularly in urban specialty stores and premium bakeries. Rising wellness awareness is expected to support gradual growth.

The non-GMO flour market is moderately fragmented, with competition based on quality, transparency, certifications, and alignment with dietary trends.

Brands differentiate through clean-label positioning, gluten-free and specialty flour blends, and clear communication of sourcing and verification practices. Packaging transparency, sustainability credentials, and use of heritage or regenerative grains provide additional competitive advantages.

Consumer engagement through education, recipes, and digital content plays an important role in brand loyalty. Companies that successfully combine authenticity, functionality, and trust are better positioned to compete in premium retail and e-commerce channels.

In January 2025, Maskal Teff launched certified organic, non-GMO brown teff flour and teff grain at the Winter Fancy Food Show, expanding clean-label options for retail and foodservice markets.

In October 2024, Natures Path Foods introduced a new line of organic, non-GMO flours in the U.S., including all-purpose, gluten-free, keto, and whole wheat variants, supporting growing demand for sustainable and health-conscious baking ingredients.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Non-GMO Flour market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Non-GMO Flour market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Non-GMO Flour market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Non-GMO Flour market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Non-GMO Flour market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 6.49 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Source (Flour Type) |

|

| The Segment covered by Form |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Non-GMO Flour market share, size, and revenue growth rate were created by Quintile Report™. Non-GMO Flour analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Non-GMO Flour Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Non-GMO Flour Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Non-GMO Flour Market, by Region, (USD Million) 2017-2035

Table 21 China Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Non-GMO Flour Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Non-GMO Flour Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Non-GMO Flour Market: market scenario

Fig.4 Global Non-GMO Flour Market competitive outlook

Fig.5 Global Non-GMO Flour Market driver analysis

Fig.6 Global Non-GMO Flour Market restraint analysis

Fig.7 Global Non-GMO Flour Market opportunity analysis

Fig.8 Global Non-GMO Flour Market trends analysis

Fig.9 Global Non-GMO Flour Market: Segment Analysis (Based on the scope)

Fig.10 Global Non-GMO Flour Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Non-GMO Flour Market was estimated at USD 72.87 billion in 2025 and is projected to reach USD 123.62 billion by 2035, growing at a robust CAGR of 6.49% during the forecast period from 2026 to 2035. The Non-GMO Flour market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017 - 2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026 - 2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026 - 2035, enabling stakeholders to evaluate market growth potential over the forecast period.

The non-GMO flour market comprises flour products made from grains that have not been genetically modified through laboratory-based genetic engineering. These grains are cultivated using conventional breeding and farming practices, aligning with consumer preferences for natural, minimally altered ingredients. Non-GMO flour is commonly verified through third-party certifications such as the Non-GMO Project, which ensures compliance with established non-GMO standards.

Although non-GMO flour is often associated with organic products, the two are distinct categories. Organic flour is always non-GMO, but non-GMO flour may still be grown using synthetic fertilizers or pesticides unless explicitly certified organic. This distinction is important for consumers balancing priorities around health, sustainability, and affordability. Growing demand for clean-label foods, transparency in sourcing, and natural baking ingredients is driving the expansion of non-GMO flour across retail, foodservice, and industrial baking applications.

The non-GMO flour market is being propelled by clean-label trends, dietary shifts, and increased consumer awareness around food sourcing.

Consumers increasingly associate non-GMO products with health, safety, and natural food systems, making non-GMO flour a preferred choice among health-conscious shoppers.

Despite strong consumer interest, the market faces cost, awareness, and supply chain challenges.

North America: The largest and most developed market, driven by high consumer awareness, strong certification programs, and widespread clean-label demand. Private-label non-GMO flours are widely available in major retail chains.

Europe: Strong preference for natural and sustainable foods supports steady demand. Countries such as Germany, France, and the Netherlands benefit from strict GMO regulations and thriving artisan bakery cultures.

Asia Pacific: Gradual growth in urban centers, supported by rising disposable incomes, Western-style baking trends, and expansion of health food retail in markets like Japan, South Korea, and Australia.

Latin America: Moderate but improving adoption, driven by labeling transparency initiatives and growth of organic food categories in countries such as Brazil and Chile.

Middle East & Africa: A nascent market with emerging demand in GCC countries, fueled by premium imports, expatriate populations, and rising interest in health-oriented foods.

United States:

The U.S. leads the global non-GMO flour market, supported by high consumer awareness, established certification systems, and robust retail distribution. Supermarket chains and natural food retailers stock a wide variety of non-GMO flours, including whole wheat, ancient grains, and gluten-free options. Growth is further driven by home baking, plant-based diets, and strong e-commerce penetration.

Germany:

Germany represents one of Europes most trusted markets for non-GMO flour, shaped by strict regulations, consumer skepticism toward GMOs, and strong alignment with sustainability values. Organic mills, cooperatives, and specialty retailers play a key role in supplying stone-ground and heritage grain non-GMO flours.

Japan:

Japans non-GMO flour market is emerging, driven by cultural emphasis on food purity and traceability. Imported non-GMO flours from the U.S. and Australia dominate the niche, particularly in urban specialty stores and premium bakeries. Rising wellness awareness is expected to support gradual growth.

The non-GMO flour market is moderately fragmented, with competition based on quality, transparency, certifications, and alignment with dietary trends.

Brands differentiate through clean-label positioning, gluten-free and specialty flour blends, and clear communication of sourcing and verification practices. Packaging transparency, sustainability credentials, and use of heritage or regenerative grains provide additional competitive advantages.

Consumer engagement through education, recipes, and digital content plays an important role in brand loyalty. Companies that successfully combine authenticity, functionality, and trust are better positioned to compete in premium retail and e-commerce channels.

Key players include King Arthur Baking Company, Bobs Red Mill Natural Foods, General Mills, Archer Daniels Midland Company (ADM), Cargill Incorporated, Ardent Mills, Bay State Milling Company, Pillsbury, White Lily, Amys Kitchen, Eden Foods, Munkebo (Munke Mlle), Doves Farm, Hodgson Mill, Natures Path Foods, and other players.

In January 2025, Maskal Teff launched certified organic, non-GMO brown teff flour and teff grain at the Winter Fancy Food Show, expanding clean-label options for retail and foodservice markets.

In October 2024, Natures Path Foods introduced a new line of organic, non-GMO flours in the U.S., including all-purpose, gluten-free, keto, and whole wheat variants, supporting growing demand for sustainable and health-conscious baking ingredients.

The non-GMO flour market comprises flour products made from grains that have not been genetically modified through laboratory-based genetic engineering. These grains are cultivated using conventional breeding and farming practices, aligning with consumer preferences for natural, minimally altered ingredients. Non-GMO flour is commonly verified through third-party certifications such as the Non-GMO Project, which ensures compliance with established non-GMO standards.

Although non-GMO flour is often associated with organic products, the two are distinct categories. Organic flour is always non-GMO, but non-GMO flour may still be grown using synthetic fertilizers or pesticides unless explicitly certified organic. This distinction is important for consumers balancing priorities around health, sustainability, and affordability. Growing demand for clean-label foods, transparency in sourcing, and natural baking ingredients is driving the expansion of non-GMO flour across retail, foodservice, and industrial baking applications.

The non-GMO flour market is being propelled by clean-label trends, dietary shifts, and increased consumer awareness around food sourcing.

Consumers increasingly associate non-GMO products with health, safety, and natural food systems, making non-GMO flour a preferred choice among health-conscious shoppers.

Despite strong consumer interest, the market faces cost, awareness, and supply chain challenges.

North America: The largest and most developed market, driven by high consumer awareness, strong certification programs, and widespread clean-label demand. Private-label non-GMO flours are widely available in major retail chains.

Europe: Strong preference for natural and sustainable foods supports steady demand. Countries such as Germany, France, and the Netherlands benefit from strict GMO regulations and thriving artisan bakery cultures.

Asia Pacific: Gradual growth in urban centers, supported by rising disposable incomes, Western-style baking trends, and expansion of health food retail in markets like Japan, South Korea, and Australia.

Latin America: Moderate but improving adoption, driven by labeling transparency initiatives and growth of organic food categories in countries such as Brazil and Chile.

Middle East & Africa: A nascent market with emerging demand in GCC countries, fueled by premium imports, expatriate populations, and rising interest in health-oriented foods.

United States:

The U.S. leads the global non-GMO flour market, supported by high consumer awareness, established certification systems, and robust retail distribution. Supermarket chains and natural food retailers stock a wide variety of non-GMO flours, including whole wheat, ancient grains, and gluten-free options. Growth is further driven by home baking, plant-based diets, and strong e-commerce penetration.

Germany:

Germany represents one of Europes most trusted markets for non-GMO flour, shaped by strict regulations, consumer skepticism toward GMOs, and strong alignment with sustainability values. Organic mills, cooperatives, and specialty retailers play a key role in supplying stone-ground and heritage grain non-GMO flours.

Japan:

Japans non-GMO flour market is emerging, driven by cultural emphasis on food purity and traceability. Imported non-GMO flours from the U.S. and Australia dominate the niche, particularly in urban specialty stores and premium bakeries. Rising wellness awareness is expected to support gradual growth.

The non-GMO flour market is moderately fragmented, with competition based on quality, transparency, certifications, and alignment with dietary trends.

Brands differentiate through clean-label positioning, gluten-free and specialty flour blends, and clear communication of sourcing and verification practices. Packaging transparency, sustainability credentials, and use of heritage or regenerative grains provide additional competitive advantages.

Consumer engagement through education, recipes, and digital content plays an important role in brand loyalty. Companies that successfully combine authenticity, functionality, and trust are better positioned to compete in premium retail and e-commerce channels.

In January 2025, Maskal Teff launched certified organic, non-GMO brown teff flour and teff grain at the Winter Fancy Food Show, expanding clean-label options for retail and foodservice markets.

In October 2024, Natures Path Foods introduced a new line of organic, non-GMO flours in the U.S., including all-purpose, gluten-free, keto, and whole wheat variants, supporting growing demand for sustainable and health-conscious baking ingredients.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Non-GMO Flour market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Non-GMO Flour market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Non-GMO Flour market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Non-GMO Flour market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Non-GMO Flour market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 6.49 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Source (Flour Type) |

|

| The Segment covered by Form |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Non-GMO Flour market share, size, and revenue growth rate were created by Quintile Report™. Non-GMO Flour analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Non-GMO Flour Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Non-GMO Flour Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Non-GMO Flour Market, by Region, (USD Million) 2017-2035

Table 21 China Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Non-GMO Flour Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Non-GMO Flour Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Non-GMO Flour Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Non-GMO Flour Market: market scenario

Fig.4 Global Non-GMO Flour Market competitive outlook

Fig.5 Global Non-GMO Flour Market driver analysis

Fig.6 Global Non-GMO Flour Market restraint analysis

Fig.7 Global Non-GMO Flour Market opportunity analysis

Fig.8 Global Non-GMO Flour Market trends analysis

Fig.9 Global Non-GMO Flour Market: Segment Analysis (Based on the scope)

Fig.10 Global Non-GMO Flour Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report Descriptions: The Global Mineral Ingredients Market was estimated at USD 8.12 billion in 2025

Read MoreReport Descriptions: The Global Feeding Distiller Dried Grains with Solubles (DGDS) Market was estim

Read More