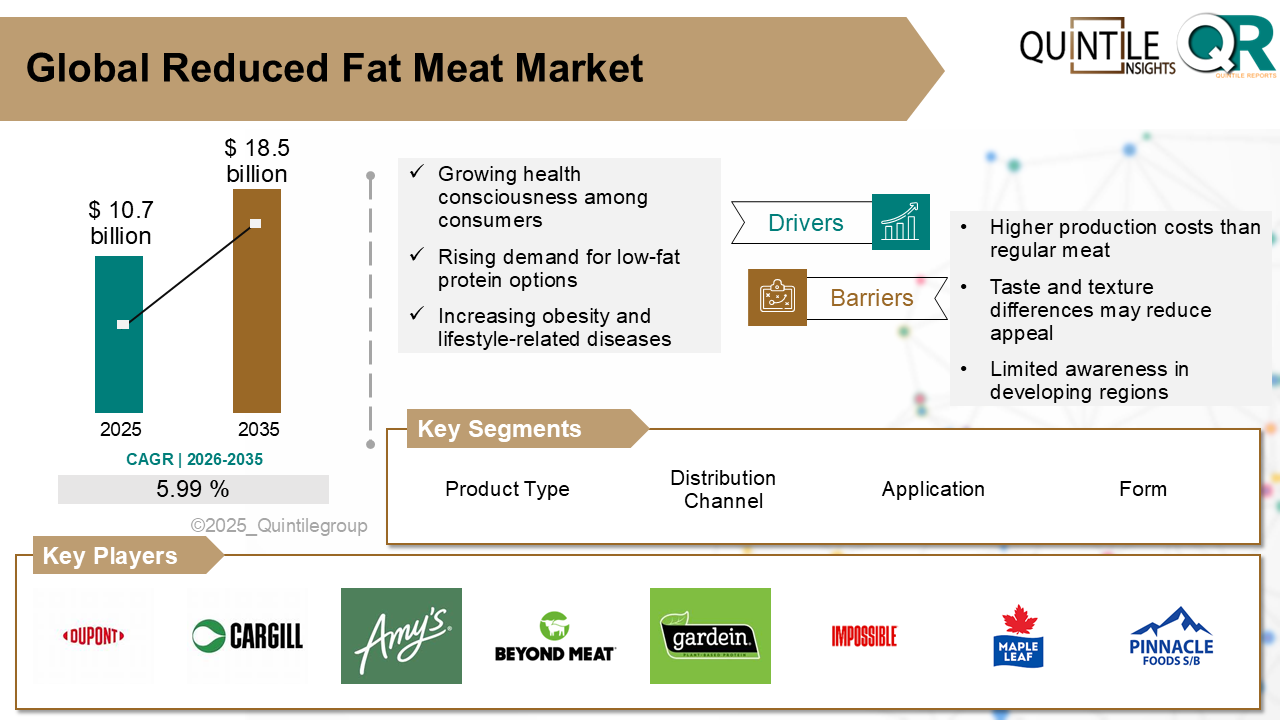

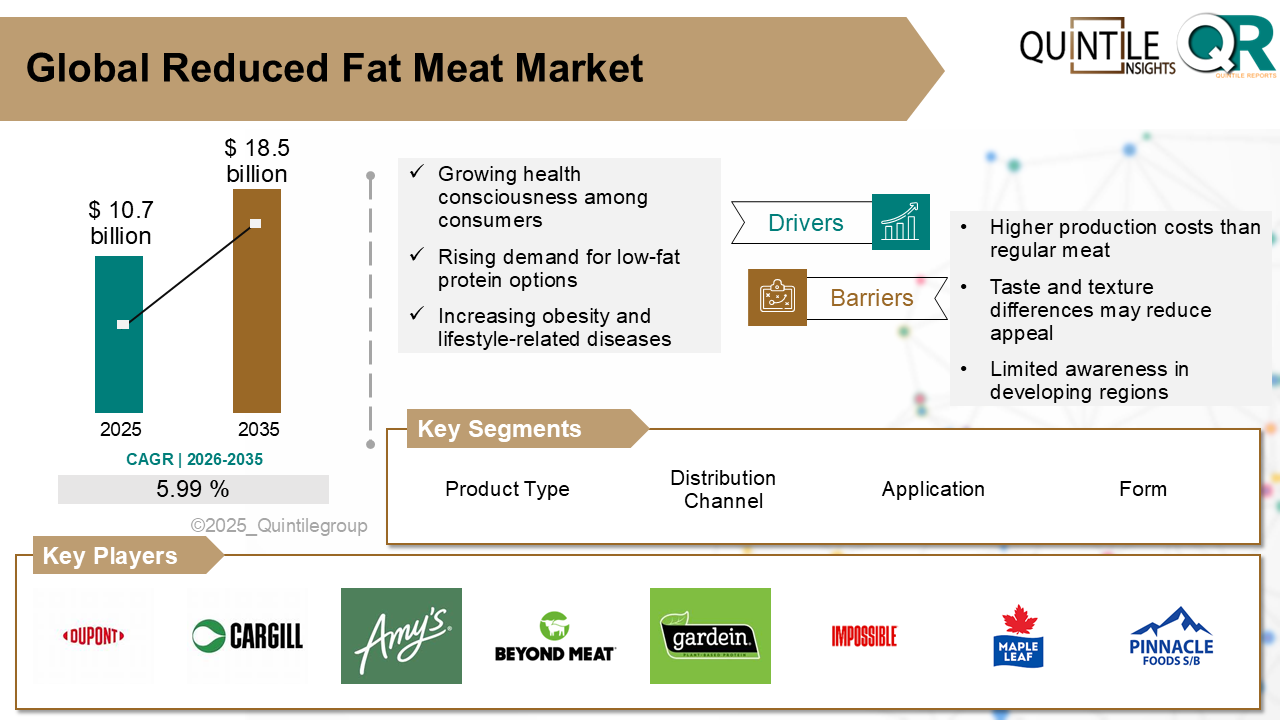

The Global Reduced Fat Meat Market was estimated at USD 10.7 billion in 2025 and is projected to reach USD 18.5 billion by 2035, growing at a robust CAGR of 5.99% during the forecast period from 2026 to 2035. The Reduced Fat Meat market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Reduced Fat Meat market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017 - 2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026 - 2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026 - 2035, enabling stakeholders to evaluate market growth potential over the forecast period.

The reduced fat meat market is a fast-growing segment of the protein industry, offering lower-fat alternatives to traditional meat products such as beef, poultry, pork, and processed items including sausages, deli cuts, and burgers. These products cater to health-conscious consumers seeking to reduce saturated fat and calorie intake without sacrificing flavor or texture.

Manufacturers achieve fat reduction by using leaner cuts, advanced processing technologies, and, in some cases, plant-based fillers or functional fibers to recreate the mouthfeel of conventional meat. Reduced fat meat products are available in fresh, frozen, and packaged formats and are widely distributed through supermarkets, hypermarkets, specialty retailers, quick-service restaurants (QSRs), and online platforms.

The reduced fat meat market is experiencing strong growth driven by rising health awareness, technological innovation, and changing dietary preferences.

Increasing concerns about obesity, cardiovascular diseases, and lifestyle-related health conditions are prompting consumers to seek protein-rich foods with lower fat content. Reduced fat meats align well with weight management and heart-health-oriented diets.

One of the primary challenges remains consumer perception regarding taste and texture. Despite notable technological progress, some consumers still associate reduced fat meat with inferior flavor or mouthfeel.

North America: Demand is driven by heightened awareness of obesity and cardiovascular health, along with interest in clean-label and functional foods. Poultry dominates the segment, while reduced-fat beef and hybrid meat products are gaining traction. Strict USDA and FDA regulations ensure transparency in fat labeling and health claims.

Europe: Europe leads in reduced fat meat adoption due to strong regulatory frameworks and health-focused dietary patterns. Germany, the UK, and France are key markets, with demand for additive-free, organic, and free-from meat products. Reduced fat meats are increasingly used in institutional catering, wellness programs, and public food services.

Asia Pacific: Rapid growth is observed in countries such as China, Japan, and Australia, driven by urbanization and rising middle-class health awareness. Japan emphasizes portion-controlled, premium reduced-fat meats, while Australia benefits from its reputation for lean, grass-fed meat production.

Latin America: Rising obesity rates and dietary shifts are supporting growth in Brazil, Argentina, and Mexico. Producers focus on maintaining traditional flavor profiles while reducing fat through improved trimming and plant-fiber integration.

Middle East & Africa: The market is emerging, supported by urbanization and fitness trends. Adoption is strongest in the UAE, Saudi Arabia, and South Africa, though consumer awareness and regulatory enforcement vary across the region.

United States leads health-driven reduced fat meat evolution:

The U.S. market is shaped by strong demand for lean poultry, reduced-fat beef, and convenience-oriented products. Regulatory oversight by the USDA and FDA ensures transparent labeling and validated health claims. Major brands are investing in R&D to serve flexitarians and fitness-oriented consumers, while supermarkets, hypermarkets, and meal-kit platforms dominate distribution.

Germany embraces reduced fat meat for health and balance:

Germanys reduced fat meat market benefits from strict EU food regulations and strong consumer trust in labeling standards. Demand spans low-fat poultry and lean red meats, supported by innovations such as enzyme-assisted texture enhancement and plant-based binders. Public health campaigns and clean-label initiatives continue to strengthen adoption.

Japans preference for healthier meat choices:

Japan emphasizes premium, portion-controlled reduced-fat meat products aligned with national health and longevity goals. Strict oversight by the Ministry of Agriculture, Forestry and Fisheries (MAFF) ensures high standards for fat content and nutritional claims. Reduced-fat meats are widely available through convenience stores, supermarkets, and e-commerce platforms.

The reduced fat meat market is highly competitive, driven by innovation in taste replication, pricing strategies, health positioning, and distribution reach.

Companies focus heavily on R&D, using plant-based fibers, protein binders, fat replacers, and hybrid meat formulations to deliver sensory parity with conventional meats. Clean labeling, certified health claims, and sustainability messaging are critical to building consumer trust.

Distribution strength across supermarkets, QSRs, online platforms, and meal kits plays a decisive role, while convenience formats such as ready-to-eat and portion-controlled products enhance market penetration. Sustainability initiatives and functional enhancements like omega-3 fortification further differentiate brands.

Key players in the market include Amys Kitchen, Beyond Meat Inc., DuPont, Gardein Protein International, Gold & Green Foods, Impossible Foods, Maple Leaf Foods, Pinnacle Foods, Quorn Foods, Sweet Earth Foods, Taifun-Tofu GmbH, The Vegetarian Butcher, Tyson Foods Inc., JBS S.A., Cargill Incorporated, and other players.

In July 2025, the Food Safety and Standards Authority of India (FSSAI) faced criticism for postponing mandatory Front-of-Pack Nutritional Labeling (FOPNL), despite a Supreme Court directive to finalize reforms within three months of April 2025.

In February 2024, Beyond Meat launched a reformulated beef-style patty with 60% less saturated fat and 20% lower sodium. The product received endorsements from the American Heart Association and the American Diabetes Association, reinforcing its positioning as a heart-healthy option.

Keep content as it is, including all headings and questions.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Reduced Fat Meat market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Reduced Fat Meat market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Reduced Fat Meat market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Reduced Fat Meat market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Reduced Fat Meat market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 5.99 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Type & Source |

|

| The Segment covered by Product |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Reduced Fat Meat market share, size, and revenue growth rate were created by Quintile Report™. Reduced Fat Meat analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Reduced Fat Meat Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Reduced Fat Meat Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Reduced Fat Meat Market, by Region, (USD Million) 2017-2035

Table 21 China Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Reduced Fat Meat Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Reduced Fat Meat Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Reduced Fat Meat Market: market scenario

Fig.4 Global Reduced Fat Meat Market competitive outlook

Fig.5 Global Reduced Fat Meat Market driver analysis

Fig.6 Global Reduced Fat Meat Market restraint analysis

Fig.7 Global Reduced Fat Meat Market opportunity analysis

Fig.8 Global Reduced Fat Meat Market trends analysis

Fig.9 Global Reduced Fat Meat Market: Segment Analysis (Based on the scope)

Fig.10 Global Reduced Fat Meat Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Reduced Fat Meat Market was estimated at USD 10.7 billion in 2025 and is projected to reach USD 18.5 billion by 2035, growing at a robust CAGR of 5.99% during the forecast period from 2026 to 2035. The Reduced Fat Meat market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Reduced Fat Meat market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017 - 2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026 - 2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026 - 2035, enabling stakeholders to evaluate market growth potential over the forecast period.

The reduced fat meat market is a fast-growing segment of the protein industry, offering lower-fat alternatives to traditional meat products such as beef, poultry, pork, and processed items including sausages, deli cuts, and burgers. These products cater to health-conscious consumers seeking to reduce saturated fat and calorie intake without sacrificing flavor or texture.

Manufacturers achieve fat reduction by using leaner cuts, advanced processing technologies, and, in some cases, plant-based fillers or functional fibers to recreate the mouthfeel of conventional meat. Reduced fat meat products are available in fresh, frozen, and packaged formats and are widely distributed through supermarkets, hypermarkets, specialty retailers, quick-service restaurants (QSRs), and online platforms.

The reduced fat meat market is experiencing strong growth driven by rising health awareness, technological innovation, and changing dietary preferences.

Increasing concerns about obesity, cardiovascular diseases, and lifestyle-related health conditions are prompting consumers to seek protein-rich foods with lower fat content. Reduced fat meats align well with weight management and heart-health-oriented diets.

One of the primary challenges remains consumer perception regarding taste and texture. Despite notable technological progress, some consumers still associate reduced fat meat with inferior flavor or mouthfeel.

North America: Demand is driven by heightened awareness of obesity and cardiovascular health, along with interest in clean-label and functional foods. Poultry dominates the segment, while reduced-fat beef and hybrid meat products are gaining traction. Strict USDA and FDA regulations ensure transparency in fat labeling and health claims.

Europe: Europe leads in reduced fat meat adoption due to strong regulatory frameworks and health-focused dietary patterns. Germany, the UK, and France are key markets, with demand for additive-free, organic, and free-from meat products. Reduced fat meats are increasingly used in institutional catering, wellness programs, and public food services.

Asia Pacific: Rapid growth is observed in countries such as China, Japan, and Australia, driven by urbanization and rising middle-class health awareness. Japan emphasizes portion-controlled, premium reduced-fat meats, while Australia benefits from its reputation for lean, grass-fed meat production.

Latin America: Rising obesity rates and dietary shifts are supporting growth in Brazil, Argentina, and Mexico. Producers focus on maintaining traditional flavor profiles while reducing fat through improved trimming and plant-fiber integration.

Middle East & Africa: The market is emerging, supported by urbanization and fitness trends. Adoption is strongest in the UAE, Saudi Arabia, and South Africa, though consumer awareness and regulatory enforcement vary across the region.

United States leads health-driven reduced fat meat evolution:

The U.S. market is shaped by strong demand for lean poultry, reduced-fat beef, and convenience-oriented products. Regulatory oversight by the USDA and FDA ensures transparent labeling and validated health claims. Major brands are investing in R&D to serve flexitarians and fitness-oriented consumers, while supermarkets, hypermarkets, and meal-kit platforms dominate distribution.

Germany embraces reduced fat meat for health and balance:

Germanys reduced fat meat market benefits from strict EU food regulations and strong consumer trust in labeling standards. Demand spans low-fat poultry and lean red meats, supported by innovations such as enzyme-assisted texture enhancement and plant-based binders. Public health campaigns and clean-label initiatives continue to strengthen adoption.

Japans preference for healthier meat choices:

Japan emphasizes premium, portion-controlled reduced-fat meat products aligned with national health and longevity goals. Strict oversight by the Ministry of Agriculture, Forestry and Fisheries (MAFF) ensures high standards for fat content and nutritional claims. Reduced-fat meats are widely available through convenience stores, supermarkets, and e-commerce platforms.

The reduced fat meat market is highly competitive, driven by innovation in taste replication, pricing strategies, health positioning, and distribution reach.

Companies focus heavily on R&D, using plant-based fibers, protein binders, fat replacers, and hybrid meat formulations to deliver sensory parity with conventional meats. Clean labeling, certified health claims, and sustainability messaging are critical to building consumer trust.

Distribution strength across supermarkets, QSRs, online platforms, and meal kits plays a decisive role, while convenience formats such as ready-to-eat and portion-controlled products enhance market penetration. Sustainability initiatives and functional enhancements like omega-3 fortification further differentiate brands.

Key players in the market include Amys Kitchen, Beyond Meat Inc., DuPont, Gardein Protein International, Gold & Green Foods, Impossible Foods, Maple Leaf Foods, Pinnacle Foods, Quorn Foods, Sweet Earth Foods, Taifun-Tofu GmbH, The Vegetarian Butcher, Tyson Foods Inc., JBS S.A., Cargill Incorporated, and other players.

In July 2025, the Food Safety and Standards Authority of India (FSSAI) faced criticism for postponing mandatory Front-of-Pack Nutritional Labeling (FOPNL), despite a Supreme Court directive to finalize reforms within three months of April 2025.

In February 2024, Beyond Meat launched a reformulated beef-style patty with 60% less saturated fat and 20% lower sodium. The product received endorsements from the American Heart Association and the American Diabetes Association, reinforcing its positioning as a heart-healthy option.

Keep content as it is, including all headings and questions.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Reduced Fat Meat market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Reduced Fat Meat market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Reduced Fat Meat market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Reduced Fat Meat market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Reduced Fat Meat market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 5.99 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Type & Source |

|

| The Segment covered by Product |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Reduced Fat Meat market share, size, and revenue growth rate were created by Quintile Report™. Reduced Fat Meat analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Reduced Fat Meat Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Reduced Fat Meat Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Reduced Fat Meat Market, by Region, (USD Million) 2017-2035

Table 21 China Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Reduced Fat Meat Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Reduced Fat Meat Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Reduced Fat Meat Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Reduced Fat Meat Market: market scenario

Fig.4 Global Reduced Fat Meat Market competitive outlook

Fig.5 Global Reduced Fat Meat Market driver analysis

Fig.6 Global Reduced Fat Meat Market restraint analysis

Fig.7 Global Reduced Fat Meat Market opportunity analysis

Fig.8 Global Reduced Fat Meat Market trends analysis

Fig.9 Global Reduced Fat Meat Market: Segment Analysis (Based on the scope)

Fig.10 Global Reduced Fat Meat Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report Descriptions: The Global Non-GMO Flour Market was estimated at USD 72.87 billion in 2025 and

Read MoreReport Descriptions: The Global Mineral Ingredients Market was estimated at USD 8.12 billion in 2025

Read MoreReport Descriptions: The Global Feeding Distiller Dried Grains with Solubles (DGDS) Market was estim

Read More