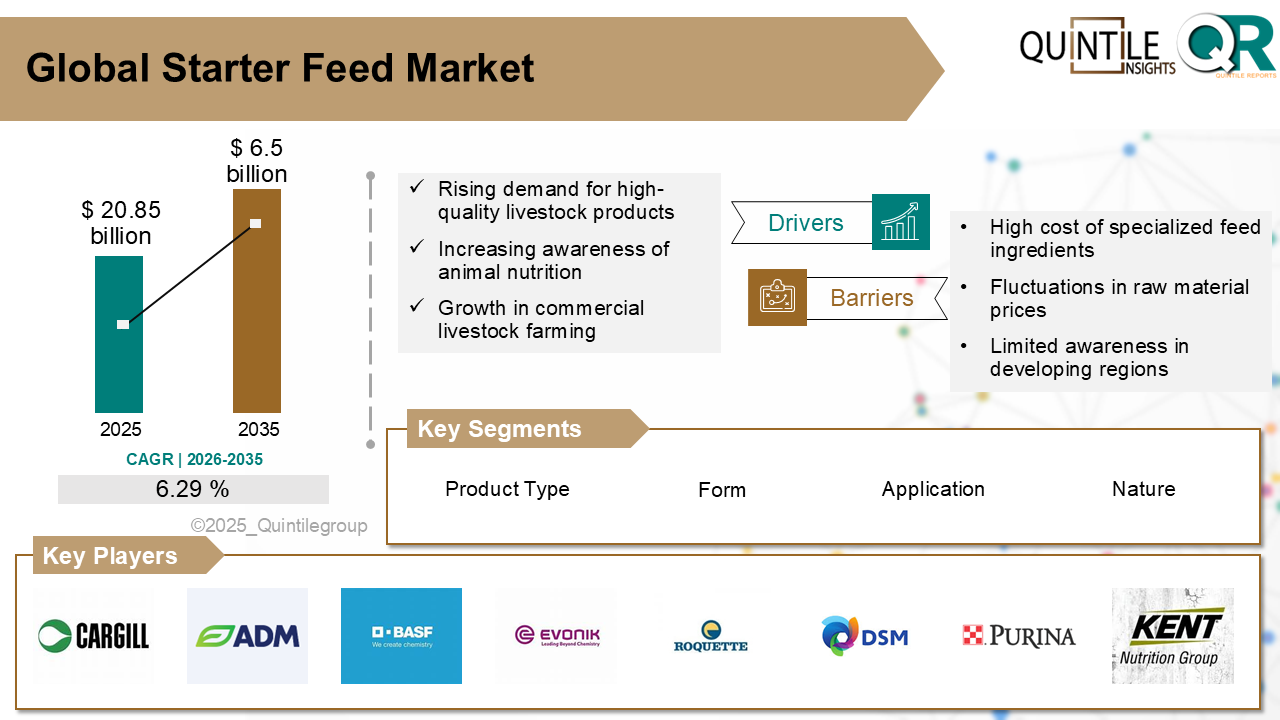

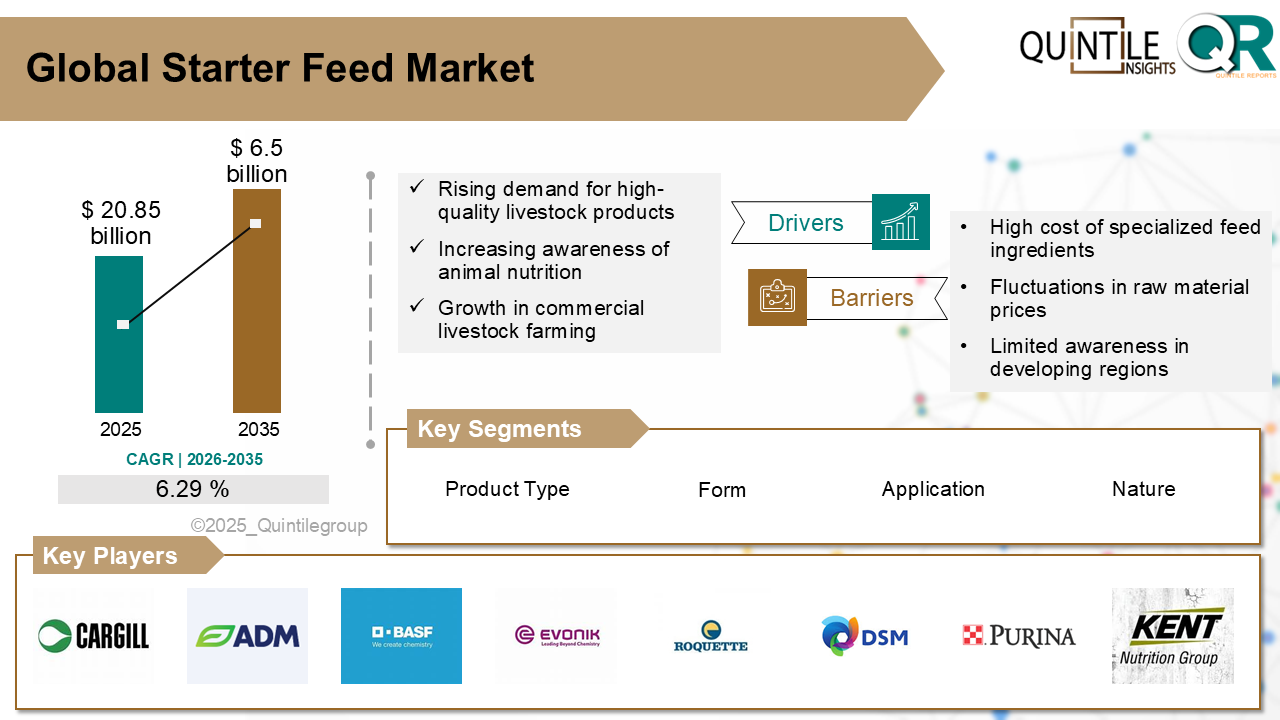

The Global Starter Feed Market was estimated at USD 20.85 billion in 2025 and is projected to reach USD 6.5 billion by 2035, growing at a robust CAGR of 6.29% during the forecast period from 2026 to 2035. The Starter Feed market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Starter Feed market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (20172024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (20262035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 20262035, enabling stakeholders to evaluate market growth potential over the forecast period.

The starter feed market is a vital niche within the livestock feed industry, focusing on specially formulated nutrition for young animals like poultry chicks, piglets, calves, and other ruminants in their early growth stages. These feeds are packed with essential proteins, amino acids, vitamins, minerals, and energy sources that promote healthy growth, strong immunity, and good digestive health.

Starter feeds come in easy-to-eat forms such as mash, pellets, and crumbles, making them ideal for animals transitioning from milk to solid food. For calves, these feeds aid in developing the rumen and help them shift from monogastric to ruminant digestion. In poultry, they support rapid weight gain and set the foundation for future productivity, while for piglets, starter diets boost gut health, ease weaning stress, and enhance long-term performance.

The starter feed market is being significantly shaped by several key drivers.

One major factor is the increasing global demand for meat and dairy products, driven by population growth, urbanization, and rising incomes. As more consumers turn to animal-based foods, livestock farming is expanding, creating a need for efficient starter feeds that support strong early growth and help producers meet growing production targets.

One major concern is the volatility of raw material pricesessential ingredients like corn, soybeans, and other grains often experience price swings due to unpredictable factors such as weather conditions, geopolitical tensions, and market speculation.

North America: The market is rapidly evolving with a focus on advanced nutrition, strict regulations, and tech-driven innovation. Precision feeding systems and AI-driven formulations are increasingly used to optimize early-life nutrition. The shift toward antibiotic-free and sustainable feeds is supported by policies such as the FDAs Veterinary Feed Directive and Health Canadas antimicrobial restrictions. Despite rising input costs and pressure to adopt eco-friendly proteins, opportunities remain strong in functional and personalized feed solutions.

Europe: Growth is driven by strict regulatory frameworks, sustainability goals, and precision nutrition. The EUs ban on antibiotic growth promoters has accelerated adoption of probiotics, enzymes, and botanicals. Pellet-based feeds are gaining popularity for accurate nutrient delivery, with countries like Spain leading adoption. Transparency, sustainability certifications, and traceability are central to market development.

Asia Pacific: This is the fastest-growing region, supported by urbanization, population growth, and rising protein consumption. Government subsidies, community-based feed systems, and capacity-building initiatives are strengthening feed production. Companies are introducing species-specific starter feeds, though challenges remain due to uneven technology adoption and income disparities.

Latin America: The market is expanding steadily, particularly in Brazil, Mexico, and Argentina, driven by poultry production. Manufacturers are adopting natural additives and plant-based growth promoters as regulations tighten on antibiotics. While ingredient availability is a strength, economic volatility and disease risks persist.

Middle East & Africa: Growth is supported by rising disposable incomes and commercial livestock expansion in countries such as Saudi Arabia, South Africa, and the UAE. Challenges include water scarcity, supply chain inefficiencies, and inconsistent regulations, but opportunities exist in locally customized feeds and international partnerships.

United States embraces smart nutrition and sustainability:

The U.S. starter feed market emphasizes innovation, AI-driven precision feeding, and antibiotic-free formulations. Over 30% of livestock farms now use specialized starter feed programs, especially in poultry and swine. Leading players such as Cargill, Purina Mills, and Evonik are introducing enzyme- and protein-enriched feeds, while managing challenges like raw material price volatility and strict traceability requirements.

Germany shaped by precision, safety, and sustainability:

Germanys market operates under strict EU and national regulations, emphasizing animal welfare and feed safety. Companies such as BASF, Evonik, and Cargill lead innovation with probiotic- and enzyme-enhanced feeds. Despite regulatory complexity and disease-related disruptions, demand for antibiotic-free and organic starter feeds continues to rise.

Japan evolving through innovation and regulation:

Japans starter feed market focuses on premiumization, traceability, and functional enhancement. With strong oversight from the Ministry of Agriculture, Forestry and Fisheries, manufacturers are developing small-portion, probiotic-rich starter feeds. Challenges include high import dependence and frequent reformulation needs, but innovation remains strong through R&D and strategic partnerships.

The starter feed market is highly competitive, shaped by pricing strategies, formulation expertise, nutritional innovation, and responsiveness to livestock needs. While affordability is important in cost-sensitive markets, quality and performance are key differentiators.

Leading companies invest in species-specific formulations, microbial encapsulation, enzyme supplementation, and precision nutrition to improve digestibility and growth outcomes. Value-added offeringssuch as organic, antibiotic-free, and plant-based feedsare increasingly in demand due to regulatory and consumer pressures.

Customization, feed form (pellets vs. crumbles), and pelletization technology further distinguish competitors. Sustainability practices, reduced medicated additives, and eco-friendly sourcing are now essential for regulatory compliance and long-term market credibility.

Key players in the market are Cargill Incorporated, Archer Daniels Midland Company, BASF SE, Evonik Industries AG, Koninklijke DSM NV, Purina Mills LLC, Charoen Pokphand Foods, Roquette Frres SA, Alltech Inc., ACI Godrej Agrovet, Associated British Foods plc, Nutreco N.V., Land OLakes Inc., De Heus Animal Nutrition BV, Kent Nutrition Group Inc., and other players.

In July 2024, Roxell unveiled its Fortena chain feeding system, featuring a patented chain design that improves feed accessibility, reduces feed loss, and integrates digitally through the Cynergy cloud platform for remote configuration and management.

In June 2025, Cargill announced a new feed production partnership with Biotech at the Biotech Agro-Industrial Complex in Mindanao, Philippines. This initiative aims to deliver faster, more reliable, and high-quality feed solutions, reinforcing Cargills commitment to supporting regional livestock producers.

Keep content as it is, including all headings and questions.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Starter Feed market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Starter Feed market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Starter Feed market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Starter Feed market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Starter Feed market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 6.29 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product Type & Nature |

|

| The Segment covered by Form |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Starter Feed market share, size, and revenue growth rate were created by Quintile Report™. Starter Feed analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Starter Feed Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Starter Feed Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Starter Feed Market, by Region, (USD Million) 2017-2035

Table 21 China Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Starter Feed Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Starter Feed Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Starter Feed Market: market scenario

Fig.4 Global Starter Feed Market competitive outlook

Fig.5 Global Starter Feed Market driver analysis

Fig.6 Global Starter Feed Market restraint analysis

Fig.7 Global Starter Feed Market opportunity analysis

Fig.8 Global Starter Feed Market trends analysis

Fig.9 Global Starter Feed Market: Segment Analysis (Based on the scope)

Fig.10 Global Starter Feed Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Starter Feed Market was estimated at USD 20.85 billion in 2025 and is projected to reach USD 6.5 billion by 2035, growing at a robust CAGR of 6.29% during the forecast period from 2026 to 2035. The Starter Feed market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Starter Feed market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (20172024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (20262035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 20262035, enabling stakeholders to evaluate market growth potential over the forecast period.

The starter feed market is a vital niche within the livestock feed industry, focusing on specially formulated nutrition for young animals like poultry chicks, piglets, calves, and other ruminants in their early growth stages. These feeds are packed with essential proteins, amino acids, vitamins, minerals, and energy sources that promote healthy growth, strong immunity, and good digestive health.

Starter feeds come in easy-to-eat forms such as mash, pellets, and crumbles, making them ideal for animals transitioning from milk to solid food. For calves, these feeds aid in developing the rumen and help them shift from monogastric to ruminant digestion. In poultry, they support rapid weight gain and set the foundation for future productivity, while for piglets, starter diets boost gut health, ease weaning stress, and enhance long-term performance.

The starter feed market is being significantly shaped by several key drivers.

One major factor is the increasing global demand for meat and dairy products, driven by population growth, urbanization, and rising incomes. As more consumers turn to animal-based foods, livestock farming is expanding, creating a need for efficient starter feeds that support strong early growth and help producers meet growing production targets.

One major concern is the volatility of raw material pricesessential ingredients like corn, soybeans, and other grains often experience price swings due to unpredictable factors such as weather conditions, geopolitical tensions, and market speculation.

North America: The market is rapidly evolving with a focus on advanced nutrition, strict regulations, and tech-driven innovation. Precision feeding systems and AI-driven formulations are increasingly used to optimize early-life nutrition. The shift toward antibiotic-free and sustainable feeds is supported by policies such as the FDAs Veterinary Feed Directive and Health Canadas antimicrobial restrictions. Despite rising input costs and pressure to adopt eco-friendly proteins, opportunities remain strong in functional and personalized feed solutions.

Europe: Growth is driven by strict regulatory frameworks, sustainability goals, and precision nutrition. The EUs ban on antibiotic growth promoters has accelerated adoption of probiotics, enzymes, and botanicals. Pellet-based feeds are gaining popularity for accurate nutrient delivery, with countries like Spain leading adoption. Transparency, sustainability certifications, and traceability are central to market development.

Asia Pacific: This is the fastest-growing region, supported by urbanization, population growth, and rising protein consumption. Government subsidies, community-based feed systems, and capacity-building initiatives are strengthening feed production. Companies are introducing species-specific starter feeds, though challenges remain due to uneven technology adoption and income disparities.

Latin America: The market is expanding steadily, particularly in Brazil, Mexico, and Argentina, driven by poultry production. Manufacturers are adopting natural additives and plant-based growth promoters as regulations tighten on antibiotics. While ingredient availability is a strength, economic volatility and disease risks persist.

Middle East & Africa: Growth is supported by rising disposable incomes and commercial livestock expansion in countries such as Saudi Arabia, South Africa, and the UAE. Challenges include water scarcity, supply chain inefficiencies, and inconsistent regulations, but opportunities exist in locally customized feeds and international partnerships.

United States embraces smart nutrition and sustainability:

The U.S. starter feed market emphasizes innovation, AI-driven precision feeding, and antibiotic-free formulations. Over 30% of livestock farms now use specialized starter feed programs, especially in poultry and swine. Leading players such as Cargill, Purina Mills, and Evonik are introducing enzyme- and protein-enriched feeds, while managing challenges like raw material price volatility and strict traceability requirements.

Germany shaped by precision, safety, and sustainability:

Germanys market operates under strict EU and national regulations, emphasizing animal welfare and feed safety. Companies such as BASF, Evonik, and Cargill lead innovation with probiotic- and enzyme-enhanced feeds. Despite regulatory complexity and disease-related disruptions, demand for antibiotic-free and organic starter feeds continues to rise.

Japan evolving through innovation and regulation:

Japans starter feed market focuses on premiumization, traceability, and functional enhancement. With strong oversight from the Ministry of Agriculture, Forestry and Fisheries, manufacturers are developing small-portion, probiotic-rich starter feeds. Challenges include high import dependence and frequent reformulation needs, but innovation remains strong through R&D and strategic partnerships.

The starter feed market is highly competitive, shaped by pricing strategies, formulation expertise, nutritional innovation, and responsiveness to livestock needs. While affordability is important in cost-sensitive markets, quality and performance are key differentiators.

Leading companies invest in species-specific formulations, microbial encapsulation, enzyme supplementation, and precision nutrition to improve digestibility and growth outcomes. Value-added offeringssuch as organic, antibiotic-free, and plant-based feedsare increasingly in demand due to regulatory and consumer pressures.

Customization, feed form (pellets vs. crumbles), and pelletization technology further distinguish competitors. Sustainability practices, reduced medicated additives, and eco-friendly sourcing are now essential for regulatory compliance and long-term market credibility.

Key players in the market are Cargill Incorporated, Archer Daniels Midland Company, BASF SE, Evonik Industries AG, Koninklijke DSM NV, Purina Mills LLC, Charoen Pokphand Foods, Roquette Frres SA, Alltech Inc., ACI Godrej Agrovet, Associated British Foods plc, Nutreco N.V., Land OLakes Inc., De Heus Animal Nutrition BV, Kent Nutrition Group Inc., and other players.

In July 2024, Roxell unveiled its Fortena chain feeding system, featuring a patented chain design that improves feed accessibility, reduces feed loss, and integrates digitally through the Cynergy cloud platform for remote configuration and management.

In June 2025, Cargill announced a new feed production partnership with Biotech at the Biotech Agro-Industrial Complex in Mindanao, Philippines. This initiative aims to deliver faster, more reliable, and high-quality feed solutions, reinforcing Cargills commitment to supporting regional livestock producers.

Keep content as it is, including all headings and questions.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Starter Feed market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Starter Feed market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Starter Feed market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Starter Feed market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Starter Feed market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 6.29 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product Type & Nature |

|

| The Segment covered by Form |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Starter Feed market share, size, and revenue growth rate were created by Quintile Report™. Starter Feed analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Starter Feed Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Starter Feed Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Starter Feed Market, by Region, (USD Million) 2017-2035

Table 21 China Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Starter Feed Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Starter Feed Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Starter Feed Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Starter Feed Market: market scenario

Fig.4 Global Starter Feed Market competitive outlook

Fig.5 Global Starter Feed Market driver analysis

Fig.6 Global Starter Feed Market restraint analysis

Fig.7 Global Starter Feed Market opportunity analysis

Fig.8 Global Starter Feed Market trends analysis

Fig.9 Global Starter Feed Market: Segment Analysis (Based on the scope)

Fig.10 Global Starter Feed Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report Descriptions: The Global Non-GMO Flour Market was estimated at USD 72.87 billion in 2025 and

Read MoreReport Descriptions: The Global Mineral Ingredients Market was estimated at USD 8.12 billion in 2025

Read MoreReport Descriptions: The Global Feeding Distiller Dried Grains with Solubles (DGDS) Market was estim

Read More