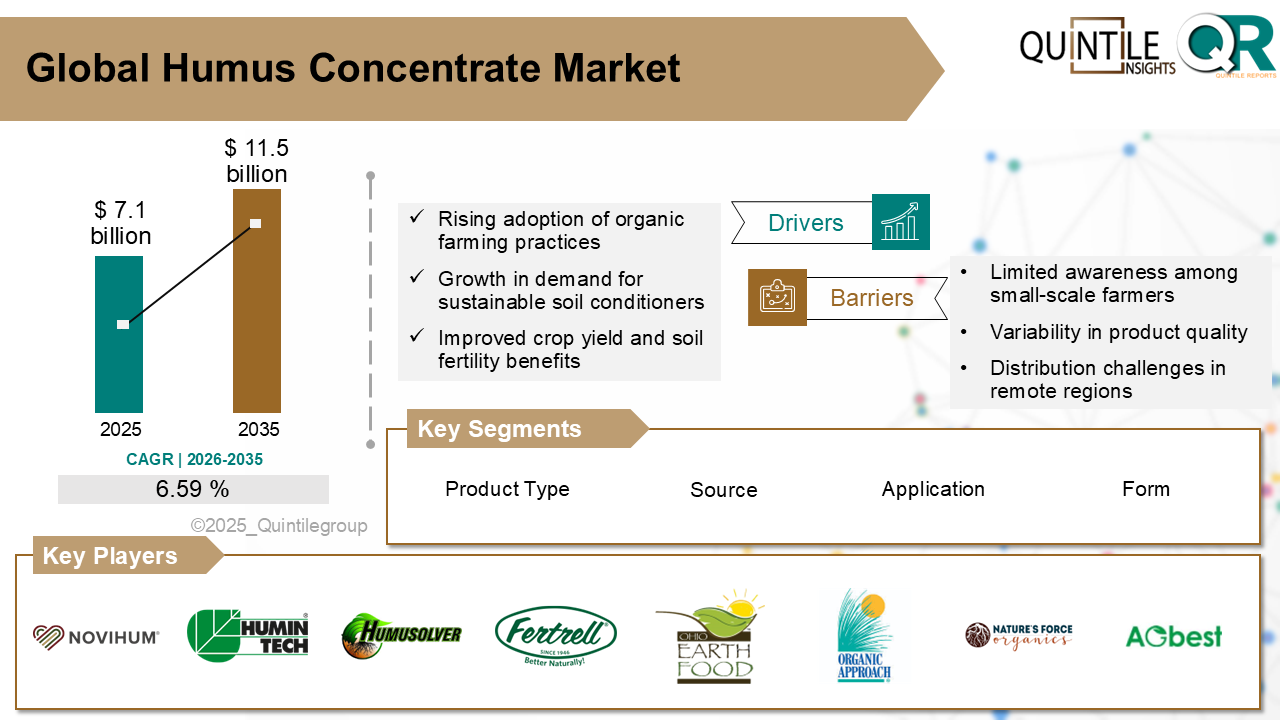

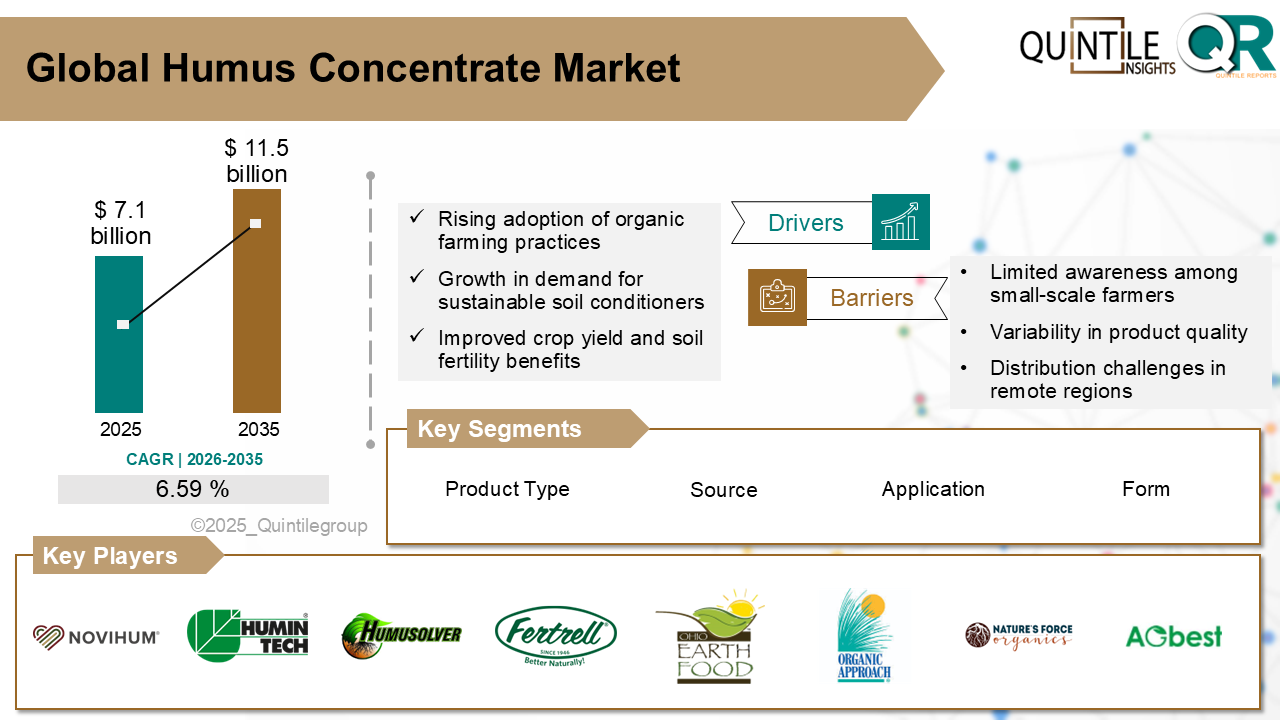

The Global Humus Concentrate Market was estimated at USD 7.1 billion in 2025 and is projected to reach USD 11.5 billion by 2035, growing at a robust CAGR of 6.59% during the forecast period from 2026 to 2035. The Humus Concentrate market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Humus Concentrate market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017 - 2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026-2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026-2035, enabling stakeholders to evaluate market growth potential over the forecast period.

The humus concentrate market involves the production, refinement, and distribution of highly concentrated humic substances derived from organic matter such as peat, composted biomass, or lignite. These substances, including humic acid, fulvic acid, and humin, are processed into liquid, powder, or granular forms to enhance soil health and crop productivity. Humus concentrates are widely utilized in agriculture, horticulture, landscaping, and soil remediation applications for their ability to improve nutrient uptake, water retention, and microbial activity.

Their role has become increasingly significant in sustainable farming systems that prioritize soil regeneration and reduced dependency on chemical fertilizers. By improving soil structure and enhancing the bioavailability of nutrients, humus concentrates contribute to higher crop yields while supporting long-term soil vitality. Their adoption is expanding globally in response to environmental concerns, food safety regulations, and the growing shift toward organic and regenerative agriculture.

A major driver of the humus concentrate market is the global transition toward sustainable agriculture. Farmers and agricultural institutions are increasingly adopting biological inputs to reduce the environmental impacts associated with synthetic fertilizers. Humus concentrates offer a natural alternative that not only improves plant growth but also contributes to long-term soil restoration and carbon sequestration, aligning with climate resilience goals.

One of the key challenges facing the humus concentrate market is the lack of standardization in product quality and composition. The natural variability of organic raw materials results in differences in active humic content, making it difficult for users to compare efficacy across brands. This inconsistency can limit trust among large-scale commercial growers who require predictable performance.

In North America, humus concentrates are being widely adopted in regenerative agriculture and organic farming practices. The United States and Canada are promoting soil health through federal and state-level initiatives, leading to increased use of humus products in row crops, vineyards, and specialty horticulture. Their use is also growing among producers focused on carbon farming and sustainable land management.

Europe remains the largest regional market, driven by policy support for agroecological farming and mandatory soil amendment guidelines. Countries such as Germany, France, and Italy are integrating humus concentrates into vineyard management, organic vegetable production, and land restoration projects. The European regulatory environment, which emphasizes environmental sustainability, is conducive to market growth.

Asia Pacific is emerging as a fast-growing market due to rising concerns about soil degradation and declining crop yields. In countries like India, China, and Japan, government-backed initiatives to promote organic inputs and improve soil fertility are encouraging the use of humic substances. Humus concentrates are increasingly being used in rice paddies, protected cultivation, and high-value fruit farming.

In Latin America, adoption is growing in countries like Brazil and Argentina where no-till and conservation farming systems are prevalent. Farmers are using humus concentrates to improve soil structure, increase organic matter, and reduce erosion. The regions focus on sustainable soy, sugarcane, and fruit exports is also contributing to market expansion.

The Middle East and Africa represent emerging markets with significant potential. Water scarcity and soil salinity issues are prompting interest in soil conditioners that improve water retention and nutrient efficiency. Governments in parts of North Africa and the Gulf are conducting pilot programs to integrate humus concentrates into desert agriculture and greenhouse systems.

United States expands humus concentrate use through sustainable farming incentives and high-value crop production:

The United States is witnessing growing demand for humus concentrates in regenerative agriculture and sustainable crop management. Federal initiatives such as the Conservation Stewardship Program and the Healthy Soils Initiative support the use of organic soil amendments, including humic substances. Growers in California, Iowa, and the Pacific Northwest are incorporating these products into orchards, vineyards, and cereal crop rotations to improve soil health and enhance drought resilience.

In specialty crop sectors, water-soluble humus concentrates are used extensively in fruit and vegetable farming. Farmers report improvements in root development, nutrient absorption, and water retention, leading to higher yields and reduced input dependency. Research institutions and agri-tech startups are also developing precision tools to optimize humus concentrate application, further integrating it into mainstream crop production.

Germany supports humus concentrate integration in organic systems and precision agriculture frameworks:

Germany maintains a strong position in the European humus concentrate market due to its commitment to organic farming and soil health. Regulatory frameworks under the European Common Agricultural Policy encourage the use of natural soil enhancers, and German farmers are adopting humus-based products in cereal, vegetable, and vineyard operations. These products are often derived from composted biomass and lignite, ensuring compatibility with EU organic certification standards.

Precision agriculture is also driving uptake in regions such as Bavaria and Lower Saxony, where soil testing and site-specific input management are well established. Humus concentrates are being used to restore depleted soils, reduce fertilizer leaching, and increase microbial activity. Government funding and training programs continue to support broader adoption, especially among mid-sized farms transitioning toward sustainable practices.

Japan advances humus concentrate application through protected cultivation and paddy-based farming:

In Japan, humus concentrates are gaining importance in horticulture and rice farming, where soil quality and input efficiency are critical. The countrys focus on high-yield, high-quality produce supports the use of concentrated humic inputs in strawberries, melons, and leafy greens grown under controlled environments. Water-soluble formulations are preferred for integration into hydroponic and drip-irrigated systems that dominate modern greenhouse farming.

Paddy rice farmers are also adopting humus concentrates to improve root development, enhance nutrient uptake, and reduce nitrogen losses. The Japanese governments promotion of smart agriculture and environmentally friendly inputs has encouraged cooperative-based trials and localized product development. Universities and agricultural institutes are working with farmers to test humus blends tailored to Japans unique soil and climate conditions.

The competitive landscape of the humus concentrate market is shaped by firms ranging from global agricultural input providers to specialized regional manufacturers. Success in this space depends on the ability to offer high-purity formulations, ensure consistency in performance, and meet regulatory requirements across different countries. Companies that provide technical support and align their products with national soil health agendas are better positioned for long-term success.

Large-scale producers benefit from control over raw material sourcing and advanced processing technologies. These firms can offer a wide range of humic formulations, including liquid and granular forms, customized to suit specific crops and soil conditions. Their established distribution networks and technical advisory services help them cater to both commercial-scale and institutional buyers.

Smaller regional manufacturers often gain market traction by offering locally sourced and tailored products. These companies focus on adapting humus concentrate blends to regional soil profiles and climate conditions. Their close relationships with local cooperatives and farm advisory networks allow them to provide hands-on support and establish trust within target markets.

Innovation in product development is a major factor in competitive positioning. Firms investing in microbial-enriched humus blends, biochar-infused formulations, and compatibility with precision agriculture tools are able to differentiate their offerings. These innovations enhance product functionality and expand usage across modern and traditional farming systems.

Companies that emphasize transparency in sourcing, third-party certifications, and clear labeling are gaining consumer and institutional preference. In regions where traceability and organic integrity are important, such attributes are essential to building long-term market credibility. As demand grows for sustainable inputs, firms that combine scientific validation with farmer-friendly solutions are expected to lead market growth.

Key players in the market are Novihum Technologies GmbH, Humintech, Humusolver, The Fertrell Company, Ohio Earth Food, Organic Approach LLC, Natures Force Organics, AgriEnergy Resources, FAUST Bio-Agricultural Services, Nutri-Tech Solutions Pty Ltd, Agbest Technology Co. Ltd, Black Earth Humic, Humic Growth Solutions Inc., Italpollina S.p.A., Laboratoires Goemar SAS, and other players.

In November 2023, Sipcam Agro USA, Inc. has formally launched Annuity, a suspension concentrate formulated with micronized, naturally derived particles of soluble humus. This innovative product is designed to improve soil structure, promote nutrient retention, and support vigorous root development, ultimately contributing to healthier crops and increased agricultural yields.

In January 2025, WestMET Group has officially announced the acquisition of Black Earth, a Calgary-based leader in humic product manufacturing, as of December 6, 2024. This strategic move reinforces WestMETs position in the biostimulant market and aligns with its objective to deliver cost-effective, high-performance solutions based on its premier humalite reserves in Sheerness, Alberta.

Keep Content as it is, even all the headings questions and all

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Humus Concentrate market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Humus Concentrate market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Humus Concentrate market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Humus Concentrate market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Humus Concentrate market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 6.59 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Form |

|

| The Segment covered by Source |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Humus Concentrate market share, size, and revenue growth rate were created by Quintile Report™. Humus Concentrate analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Humus Concentrate Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Humus Concentrate Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Humus Concentrate Market, by Region, (USD Million) 2017-2035

Table 21 China Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Humus Concentrate Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Humus Concentrate Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Humus Concentrate Market: market scenario

Fig.4 Global Humus Concentrate Market competitive outlook

Fig.5 Global Humus Concentrate Market driver analysis

Fig.6 Global Humus Concentrate Market restraint analysis

Fig.7 Global Humus Concentrate Market opportunity analysis

Fig.8 Global Humus Concentrate Market trends analysis

Fig.9 Global Humus Concentrate Market: Segment Analysis (Based on the scope)

Fig.10 Global Humus Concentrate Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Humus Concentrate Market was estimated at USD 7.1 billion in 2025 and is projected to reach USD 11.5 billion by 2035, growing at a robust CAGR of 6.59% during the forecast period from 2026 to 2035. The Humus Concentrate market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Humus Concentrate market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017 - 2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026-2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026-2035, enabling stakeholders to evaluate market growth potential over the forecast period.

The humus concentrate market involves the production, refinement, and distribution of highly concentrated humic substances derived from organic matter such as peat, composted biomass, or lignite. These substances, including humic acid, fulvic acid, and humin, are processed into liquid, powder, or granular forms to enhance soil health and crop productivity. Humus concentrates are widely utilized in agriculture, horticulture, landscaping, and soil remediation applications for their ability to improve nutrient uptake, water retention, and microbial activity.

Their role has become increasingly significant in sustainable farming systems that prioritize soil regeneration and reduced dependency on chemical fertilizers. By improving soil structure and enhancing the bioavailability of nutrients, humus concentrates contribute to higher crop yields while supporting long-term soil vitality. Their adoption is expanding globally in response to environmental concerns, food safety regulations, and the growing shift toward organic and regenerative agriculture.

A major driver of the humus concentrate market is the global transition toward sustainable agriculture. Farmers and agricultural institutions are increasingly adopting biological inputs to reduce the environmental impacts associated with synthetic fertilizers. Humus concentrates offer a natural alternative that not only improves plant growth but also contributes to long-term soil restoration and carbon sequestration, aligning with climate resilience goals.

One of the key challenges facing the humus concentrate market is the lack of standardization in product quality and composition. The natural variability of organic raw materials results in differences in active humic content, making it difficult for users to compare efficacy across brands. This inconsistency can limit trust among large-scale commercial growers who require predictable performance.

In North America, humus concentrates are being widely adopted in regenerative agriculture and organic farming practices. The United States and Canada are promoting soil health through federal and state-level initiatives, leading to increased use of humus products in row crops, vineyards, and specialty horticulture. Their use is also growing among producers focused on carbon farming and sustainable land management.

Europe remains the largest regional market, driven by policy support for agroecological farming and mandatory soil amendment guidelines. Countries such as Germany, France, and Italy are integrating humus concentrates into vineyard management, organic vegetable production, and land restoration projects. The European regulatory environment, which emphasizes environmental sustainability, is conducive to market growth.

Asia Pacific is emerging as a fast-growing market due to rising concerns about soil degradation and declining crop yields. In countries like India, China, and Japan, government-backed initiatives to promote organic inputs and improve soil fertility are encouraging the use of humic substances. Humus concentrates are increasingly being used in rice paddies, protected cultivation, and high-value fruit farming.

In Latin America, adoption is growing in countries like Brazil and Argentina where no-till and conservation farming systems are prevalent. Farmers are using humus concentrates to improve soil structure, increase organic matter, and reduce erosion. The regions focus on sustainable soy, sugarcane, and fruit exports is also contributing to market expansion.

The Middle East and Africa represent emerging markets with significant potential. Water scarcity and soil salinity issues are prompting interest in soil conditioners that improve water retention and nutrient efficiency. Governments in parts of North Africa and the Gulf are conducting pilot programs to integrate humus concentrates into desert agriculture and greenhouse systems.

United States expands humus concentrate use through sustainable farming incentives and high-value crop production:

The United States is witnessing growing demand for humus concentrates in regenerative agriculture and sustainable crop management. Federal initiatives such as the Conservation Stewardship Program and the Healthy Soils Initiative support the use of organic soil amendments, including humic substances. Growers in California, Iowa, and the Pacific Northwest are incorporating these products into orchards, vineyards, and cereal crop rotations to improve soil health and enhance drought resilience.

In specialty crop sectors, water-soluble humus concentrates are used extensively in fruit and vegetable farming. Farmers report improvements in root development, nutrient absorption, and water retention, leading to higher yields and reduced input dependency. Research institutions and agri-tech startups are also developing precision tools to optimize humus concentrate application, further integrating it into mainstream crop production.

Germany supports humus concentrate integration in organic systems and precision agriculture frameworks:

Germany maintains a strong position in the European humus concentrate market due to its commitment to organic farming and soil health. Regulatory frameworks under the European Common Agricultural Policy encourage the use of natural soil enhancers, and German farmers are adopting humus-based products in cereal, vegetable, and vineyard operations. These products are often derived from composted biomass and lignite, ensuring compatibility with EU organic certification standards.

Precision agriculture is also driving uptake in regions such as Bavaria and Lower Saxony, where soil testing and site-specific input management are well established. Humus concentrates are being used to restore depleted soils, reduce fertilizer leaching, and increase microbial activity. Government funding and training programs continue to support broader adoption, especially among mid-sized farms transitioning toward sustainable practices.

Japan advances humus concentrate application through protected cultivation and paddy-based farming:

In Japan, humus concentrates are gaining importance in horticulture and rice farming, where soil quality and input efficiency are critical. The countrys focus on high-yield, high-quality produce supports the use of concentrated humic inputs in strawberries, melons, and leafy greens grown under controlled environments. Water-soluble formulations are preferred for integration into hydroponic and drip-irrigated systems that dominate modern greenhouse farming.

Paddy rice farmers are also adopting humus concentrates to improve root development, enhance nutrient uptake, and reduce nitrogen losses. The Japanese governments promotion of smart agriculture and environmentally friendly inputs has encouraged cooperative-based trials and localized product development. Universities and agricultural institutes are working with farmers to test humus blends tailored to Japans unique soil and climate conditions.

The competitive landscape of the humus concentrate market is shaped by firms ranging from global agricultural input providers to specialized regional manufacturers. Success in this space depends on the ability to offer high-purity formulations, ensure consistency in performance, and meet regulatory requirements across different countries. Companies that provide technical support and align their products with national soil health agendas are better positioned for long-term success.

Large-scale producers benefit from control over raw material sourcing and advanced processing technologies. These firms can offer a wide range of humic formulations, including liquid and granular forms, customized to suit specific crops and soil conditions. Their established distribution networks and technical advisory services help them cater to both commercial-scale and institutional buyers.

Smaller regional manufacturers often gain market traction by offering locally sourced and tailored products. These companies focus on adapting humus concentrate blends to regional soil profiles and climate conditions. Their close relationships with local cooperatives and farm advisory networks allow them to provide hands-on support and establish trust within target markets.

Innovation in product development is a major factor in competitive positioning. Firms investing in microbial-enriched humus blends, biochar-infused formulations, and compatibility with precision agriculture tools are able to differentiate their offerings. These innovations enhance product functionality and expand usage across modern and traditional farming systems.

Companies that emphasize transparency in sourcing, third-party certifications, and clear labeling are gaining consumer and institutional preference. In regions where traceability and organic integrity are important, such attributes are essential to building long-term market credibility. As demand grows for sustainable inputs, firms that combine scientific validation with farmer-friendly solutions are expected to lead market growth.

Key players in the market are Novihum Technologies GmbH, Humintech, Humusolver, The Fertrell Company, Ohio Earth Food, Organic Approach LLC, Natures Force Organics, AgriEnergy Resources, FAUST Bio-Agricultural Services, Nutri-Tech Solutions Pty Ltd, Agbest Technology Co. Ltd, Black Earth Humic, Humic Growth Solutions Inc., Italpollina S.p.A., Laboratoires Goemar SAS, and other players.

In November 2023, Sipcam Agro USA, Inc. has formally launched Annuity, a suspension concentrate formulated with micronized, naturally derived particles of soluble humus. This innovative product is designed to improve soil structure, promote nutrient retention, and support vigorous root development, ultimately contributing to healthier crops and increased agricultural yields.

In January 2025, WestMET Group has officially announced the acquisition of Black Earth, a Calgary-based leader in humic product manufacturing, as of December 6, 2024. This strategic move reinforces WestMETs position in the biostimulant market and aligns with its objective to deliver cost-effective, high-performance solutions based on its premier humalite reserves in Sheerness, Alberta.

Keep Content as it is, even all the headings questions and all

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Humus Concentrate market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Humus Concentrate market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Humus Concentrate market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Humus Concentrate market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Humus Concentrate market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 6.59 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Form |

|

| The Segment covered by Source |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Humus Concentrate market share, size, and revenue growth rate were created by Quintile Report™. Humus Concentrate analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Humus Concentrate Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Humus Concentrate Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Humus Concentrate Market, by Region, (USD Million) 2017-2035

Table 21 China Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Humus Concentrate Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Humus Concentrate Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Humus Concentrate Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Humus Concentrate Market: market scenario

Fig.4 Global Humus Concentrate Market competitive outlook

Fig.5 Global Humus Concentrate Market driver analysis

Fig.6 Global Humus Concentrate Market restraint analysis

Fig.7 Global Humus Concentrate Market opportunity analysis

Fig.8 Global Humus Concentrate Market trends analysis

Fig.9 Global Humus Concentrate Market: Segment Analysis (Based on the scope)

Fig.10 Global Humus Concentrate Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report Descriptions: The Global Non-GMO Flour Market was estimated at USD 72.87 billion in 2025 and

Read MoreReport Descriptions: The Global Mineral Ingredients Market was estimated at USD 8.12 billion in 2025

Read MoreReport Descriptions: The Global Feeding Distiller Dried Grains with Solubles (DGDS) Market was estim

Read More