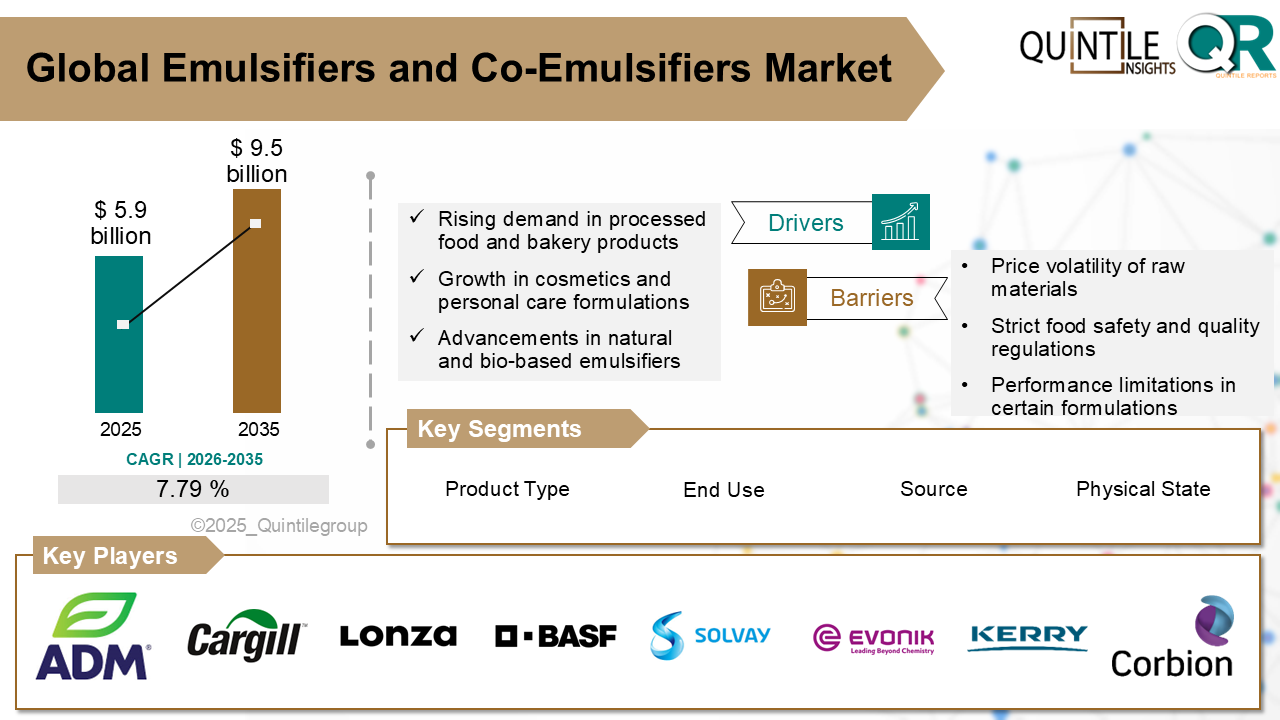

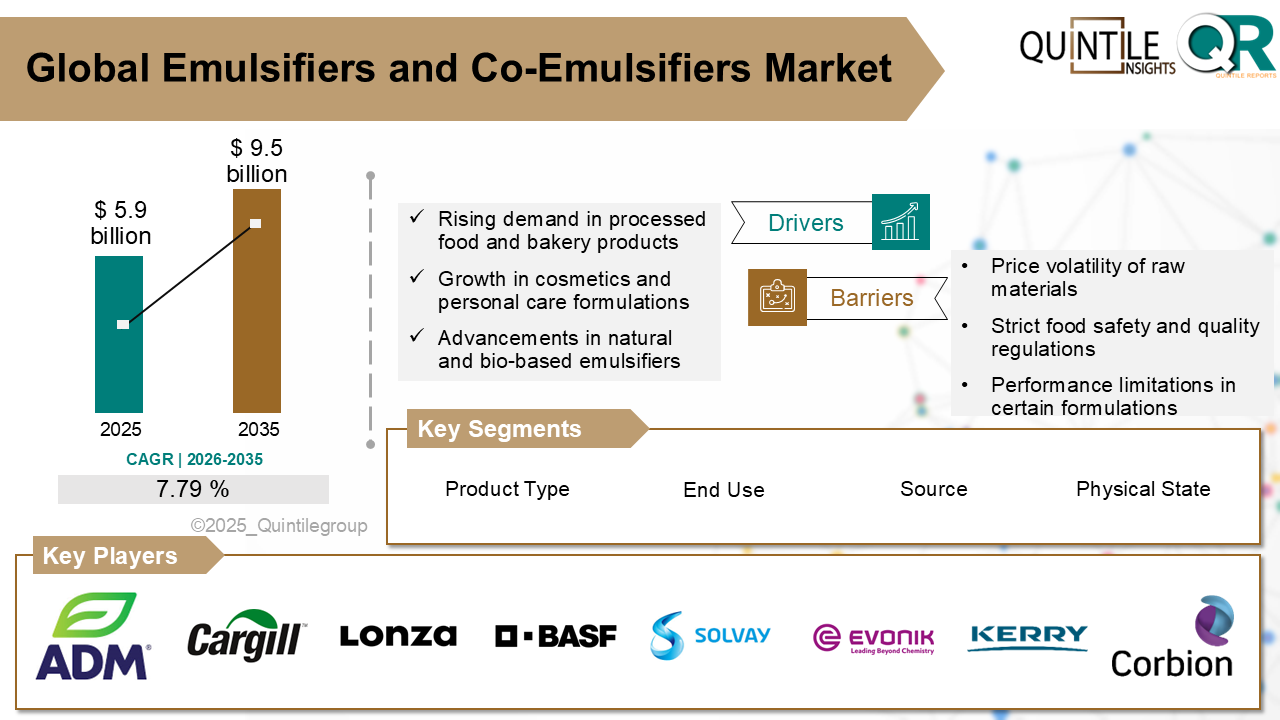

The Global Emulsifiers and Co-Emulsifiers Market was estimated at USD 5.9 billion in 2025 and is projected to reach USD 9.5 billion by 2035, growing at a robust CAGR of 7.79% during the forecast period from 2026 to 2035. The Emulsifiers and Co-Emulsifiers market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Emulsifiers and Co-Emulsifiers market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

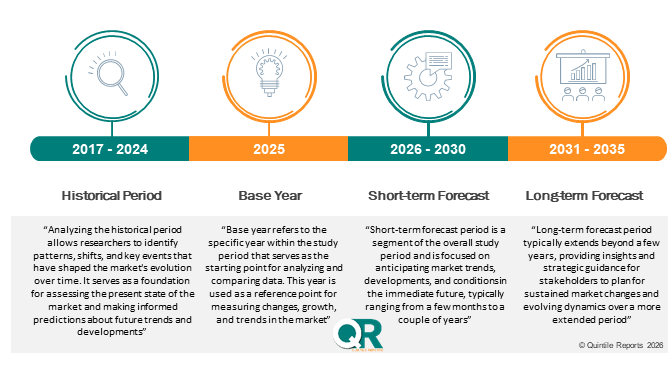

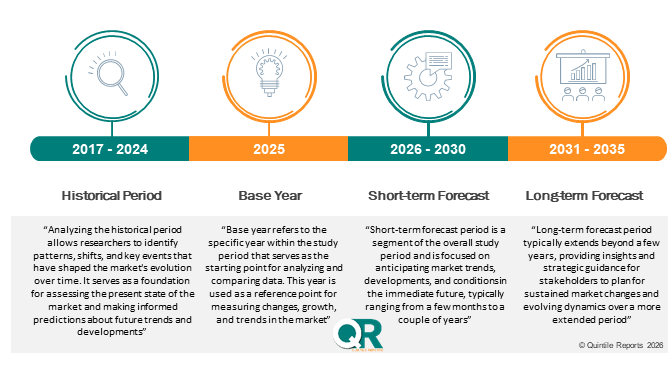

Historical Analysis (2017-2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026-2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026-2035, enabling stakeholders to evaluate market growth potential over the forecast period.

The emulsifiers and co-emulsifiers market encompasses the production and utilization of surface-active agents that aid in the formation and stabilization of emulsions, primarily in food, cosmetics, pharmaceuticals, and industrial formulations. Emulsifiers help blend immiscible liquids such as oil and water by lowering interfacial tension, while co-emulsifiers support this process by enhancing viscosity, texture, or the stability of the emulsion system. These compounds are either derived from natural sources such as lecithin and mono- and diglycerides, or synthesized using food-grade chemical processes.

The role of emulsifiers and co-emulsifiers is essential in improving product uniformity, extending shelf life, and ensuring consistent appearance and texture in formulations. Their application spans diverse sectors, from bakery products, margarine, and dairy to skin creams, oral medications, and industrial lubricants. The rising complexity of formulations and growing demand for product stability under varied conditions have expanded the significance of emulsification systems in both consumer and industrial markets.

Increased demand for processed and convenience food is a leading market driver. Emulsifiers are widely used in baked goods, ice cream, dressings, and sauces to improve mouthfeel, prevent ingredient separation, and maintain freshness. As global urbanization continues and time-constrained consumers seek ready-to-eat options, the food industry increasingly relies on these ingredients for product performance and efficiency.

Stringent regulatory scrutiny is one of the key challenges. Emulsifiers used in food, cosmetics, and pharmaceuticals must meet safety standards established by bodies such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). Any deviation in purity, allergen content, or origin can lead to product recalls or import restrictions, increasing compliance costs for manufacturers.

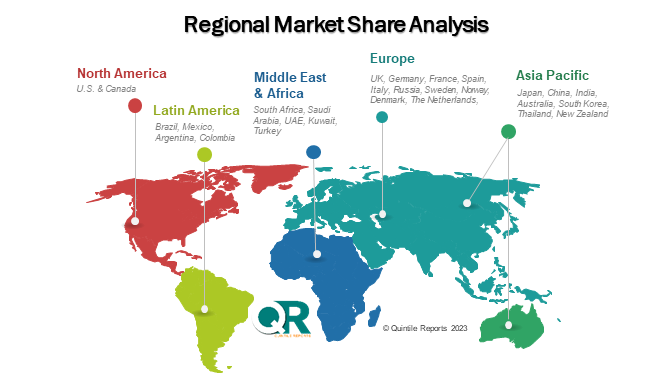

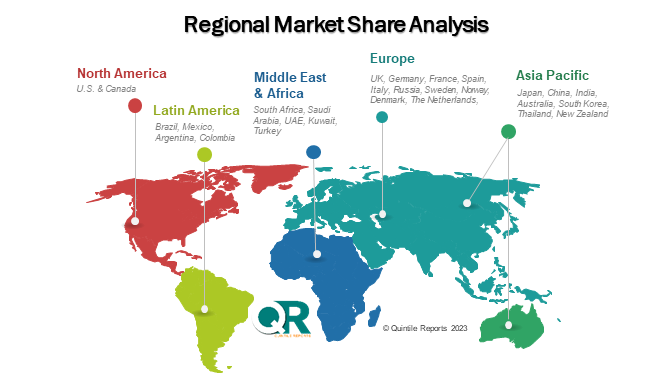

North America remains a major market, driven by large-scale demand in food processing, pharmaceuticals, and personal care. In the United States and Canada, widespread use of processed food, high R&D investment in cosmetics, and expansion of clean-label health products are key contributors. Regulatory clarity and strong technological capacity further support market development in this region.

Europe maintains steady growth due to its well-established food and cosmetic industries. Countries such as Germany, France, and the Netherlands continue to focus on product standardization and sustainable sourcing. Emulsifiers derived from non-GMO and certified organic inputs are gaining popularity, particularly in the EU's natural and organic product segments.

Asia Pacific leads in consumption and growth, supported by industrial expansion and changing consumer preferences. Rising demand for processed food, increasing use of multifunctional skin care, and growth in pharmaceutical manufacturing are key drivers. Countries like China, India, South Korea, and Japan are witnessing increased domestic production of emulsifiers to support local demand.

Latin America is showing positive market expansion, driven by the food industry and improving economic conditions. Brazil and Mexico are key markets where food manufacturers are upgrading formulations to meet consumer expectations for quality and shelf life. The cosmetics sector is also adopting modern emulsifier systems for new product development in skin and hair care.

Middle East and Africa are emerging regions where the emulsifiers market is growing alongside food and cosmetic industry developments. Gulf countries are importing high-grade emulsifiers for premium skincare and packaged food segments, while Sub-Saharan Africa is seeing increased uptake in dairy and bakery processing industries, supported by urban population growth and retail expansion.

United States prioritizes emulsifier innovation in processed food and health-conscious reformulations:

The United States is one of the leading markets for emulsifiers and co-emulsifiers, driven by a strong demand for processed and packaged foods. Food manufacturers use emulsifiers to stabilize low-fat and sugar-free formulations without compromising product quality. Demand is also high in the bakery and dairy sectors, where emulsifiers are critical for maintaining freshness and uniformity across distribution channels.

In parallel, the U.S. personal care industry is adopting new-generation emulsifiers that enhance product performance and texture while meeting consumer expectations for non-toxic and sustainable ingredients. With regulatory clarity from the FDA and robust R&D capabilities, domestic producers and formulators continue to innovate in natural emulsification systems and functional blends.

Germany supports high-quality emulsifiers in organic-certified and multifunctional applications:

Germany maintains a strong position in the European emulsifier market, with emphasis on quality, sustainability, and regulatory compliance. Food companies increasingly incorporate emulsifiers that are compatible with organic and allergen-free product lines. The countrys strict consumer standards promote the use of traceable, non-GMO, and eco-friendly emulsifier sources, particularly in infant nutrition and health food segments.

In cosmetics and pharmaceuticals, Germany has a mature market that favors multifunctional emulsifiers capable of improving sensory appeal, product longevity, and user safety. Collaborations between research institutes and industry players are helping develop new co-emulsifier systems designed for anti-aging creams, sunscreens, and prescription topical formulations.

Japan advances application-specific emulsification for cosmetics and health foods:

Japans emulsifiers market is driven by its sophisticated personal care and food processing sectors. Japanese cosmetic brands are at the forefront of developing lightweight, fast-absorbing emulsions using advanced co-emulsifier technologies. Product differentiation based on texture, hydration performance, and skin compatibility is supported by continual innovation in emulsifier chemistry.

In the food sector, Japan promotes high-purity emulsifiers in health foods, functional beverages, and dairy desserts. Clean-label and minimal additive trends have pushed domestic producers to develop naturally derived emulsifiers from seaweed, soy, and rice. With a strong emphasis on safety, Japanese regulatory agencies ensure that only high-quality emulsification systems reach the market.

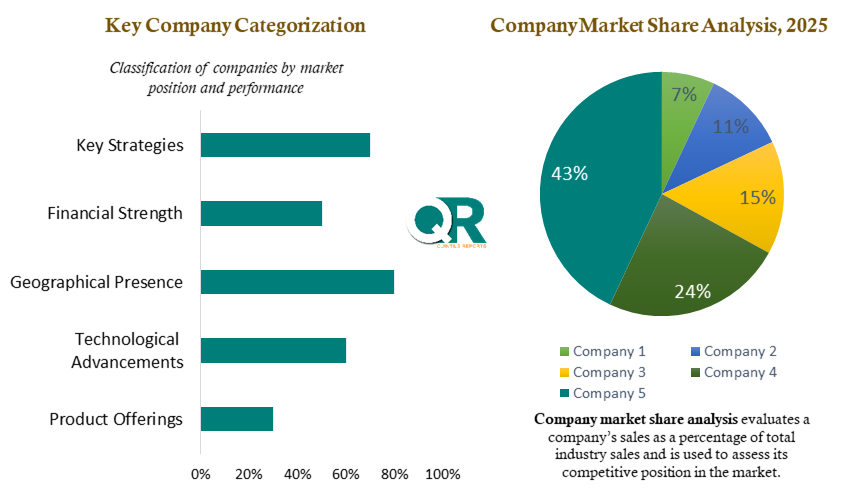

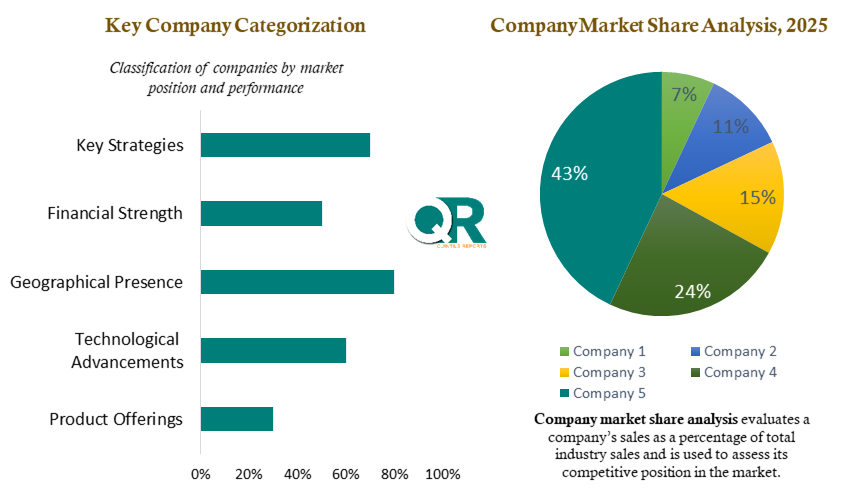

The emulsifiers and co-emulsifiers market is marked by competition across global, regional, and niche product segments. Success in this market depends on the ability to formulate high-performing, stable, and safe emulsification systems that meet evolving regulatory and consumer expectations. Companies must balance technical performance with sustainability, cost, and market-specific requirements.

Large-scale producers typically focus on offering a wide portfolio of emulsifiers suitable for multiple industries, from food and beverage to cosmetics and pharmaceuticals. Their strength lies in global reach, backward integration in raw materials, and the ability to invest in application-based innovation. These companies often collaborate with multinational customers to develop customized solutions for new formulations.

Mid-sized players tend to specialize in plant-based, organic, or synthetic-free emulsifiers targeted at clean-label products. Their competitive edge lies in agility and the ability to cater to niche demands such as allergen-free, halal, or vegan emulsifier systems. These firms often supply to regional food brands and cosmetic manufacturers requiring specialized support.

Research-driven companies are focusing on new functional blends that combine emulsification with antioxidant, antimicrobial, or pH-buffering properties. These multi-functional ingredients offer cost-efficiency and simplify ingredient lists for manufacturers, aligning with consumer demand for simpler, shorter ingredient panels.

Digital and supply chain optimization strategies are emerging as competitive differentiators. Firms that offer technical guidance, formulation support, and responsive supply solutions are favored by food technologists and formulation scientists. Transparency in sourcing, certifications, and ingredient traceability also play a growing role in market preference.

In the long term, competitiveness will hinge on the ability to balance performance, safety, and environmental impact. Firms that successfully innovate in biodegradable, non-GMO, and sustainable emulsifiers while maintaining cost-efficiency are expected to lead the markets next phase of growth.

In March 2025, Perstorp, a prominent global innovator has officially introduced the Neptem range for alkyd applications. This newly launched portfolio consists of advanced emulsifier solutions specifically designed to enable the development of next-generation, high-performance waterborne alkyd systems.

In October 2024, Emulgade Verde 10 MS by BASF has been classified as a naturally derived ingredient, possessing a Natural Origin Index (NOI) of 1. This emulsifier aligns with vegan and cruelty-free formulation standards. Whether employed as a primary emulsifier or as a co-emulsifier, Emulgade Verde delivers consistent and stable emulsifying performance.

Keep Content as it is, even all the headings questions and all

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Emulsifiers and Co-Emulsifiers market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Emulsifiers and Co-Emulsifiers market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Emulsifiers and Co-Emulsifiers market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Emulsifiers and Co-Emulsifiers market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Emulsifiers and Co-Emulsifiers market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 7.79 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product Type |

|

| The Segment covered by Source |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Emulsifiers and Co-Emulsifiers market share, size, and revenue growth rate were created by Quintile Report™. Emulsifiers and Co-Emulsifiers analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Emulsifiers and Co-Emulsifiers Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Emulsifiers and Co-Emulsifiers Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Emulsifiers and Co-Emulsifiers Market, by Region, (USD Million) 2017-2035

Table 21 China Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Emulsifiers and Co-Emulsifiers Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Emulsifiers and Co-Emulsifiers Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Emulsifiers and Co-Emulsifiers Market: market scenario

Fig.4 Global Emulsifiers and Co-Emulsifiers Market competitive outlook

Fig.5 Global Emulsifiers and Co-Emulsifiers Market driver analysis

Fig.6 Global Emulsifiers and Co-Emulsifiers Market restraint analysis

Fig.7 Global Emulsifiers and Co-Emulsifiers Market opportunity analysis

Fig.8 Global Emulsifiers and Co-Emulsifiers Market trends analysis

Fig.9 Global Emulsifiers and Co-Emulsifiers Market: Segment Analysis (Based on the scope)

Fig.10 Global Emulsifiers and Co-Emulsifiers Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Emulsifiers and Co-Emulsifiers Market was estimated at USD 5.9 billion in 2025 and is projected to reach USD 9.5 billion by 2035, growing at a robust CAGR of 7.79% during the forecast period from 2026 to 2035. The Emulsifiers and Co-Emulsifiers market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Emulsifiers and Co-Emulsifiers market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017-2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026-2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026-2035, enabling stakeholders to evaluate market growth potential over the forecast period.

The emulsifiers and co-emulsifiers market encompasses the production and utilization of surface-active agents that aid in the formation and stabilization of emulsions, primarily in food, cosmetics, pharmaceuticals, and industrial formulations. Emulsifiers help blend immiscible liquids such as oil and water by lowering interfacial tension, while co-emulsifiers support this process by enhancing viscosity, texture, or the stability of the emulsion system. These compounds are either derived from natural sources such as lecithin and mono- and diglycerides, or synthesized using food-grade chemical processes.

The role of emulsifiers and co-emulsifiers is essential in improving product uniformity, extending shelf life, and ensuring consistent appearance and texture in formulations. Their application spans diverse sectors, from bakery products, margarine, and dairy to skin creams, oral medications, and industrial lubricants. The rising complexity of formulations and growing demand for product stability under varied conditions have expanded the significance of emulsification systems in both consumer and industrial markets.

Increased demand for processed and convenience food is a leading market driver. Emulsifiers are widely used in baked goods, ice cream, dressings, and sauces to improve mouthfeel, prevent ingredient separation, and maintain freshness. As global urbanization continues and time-constrained consumers seek ready-to-eat options, the food industry increasingly relies on these ingredients for product performance and efficiency.

Stringent regulatory scrutiny is one of the key challenges. Emulsifiers used in food, cosmetics, and pharmaceuticals must meet safety standards established by bodies such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). Any deviation in purity, allergen content, or origin can lead to product recalls or import restrictions, increasing compliance costs for manufacturers.

North America remains a major market, driven by large-scale demand in food processing, pharmaceuticals, and personal care. In the United States and Canada, widespread use of processed food, high R&D investment in cosmetics, and expansion of clean-label health products are key contributors. Regulatory clarity and strong technological capacity further support market development in this region.

Europe maintains steady growth due to its well-established food and cosmetic industries. Countries such as Germany, France, and the Netherlands continue to focus on product standardization and sustainable sourcing. Emulsifiers derived from non-GMO and certified organic inputs are gaining popularity, particularly in the EU's natural and organic product segments.

Asia Pacific leads in consumption and growth, supported by industrial expansion and changing consumer preferences. Rising demand for processed food, increasing use of multifunctional skin care, and growth in pharmaceutical manufacturing are key drivers. Countries like China, India, South Korea, and Japan are witnessing increased domestic production of emulsifiers to support local demand.

Latin America is showing positive market expansion, driven by the food industry and improving economic conditions. Brazil and Mexico are key markets where food manufacturers are upgrading formulations to meet consumer expectations for quality and shelf life. The cosmetics sector is also adopting modern emulsifier systems for new product development in skin and hair care.

Middle East and Africa are emerging regions where the emulsifiers market is growing alongside food and cosmetic industry developments. Gulf countries are importing high-grade emulsifiers for premium skincare and packaged food segments, while Sub-Saharan Africa is seeing increased uptake in dairy and bakery processing industries, supported by urban population growth and retail expansion.

United States prioritizes emulsifier innovation in processed food and health-conscious reformulations:

The United States is one of the leading markets for emulsifiers and co-emulsifiers, driven by a strong demand for processed and packaged foods. Food manufacturers use emulsifiers to stabilize low-fat and sugar-free formulations without compromising product quality. Demand is also high in the bakery and dairy sectors, where emulsifiers are critical for maintaining freshness and uniformity across distribution channels.

In parallel, the U.S. personal care industry is adopting new-generation emulsifiers that enhance product performance and texture while meeting consumer expectations for non-toxic and sustainable ingredients. With regulatory clarity from the FDA and robust R&D capabilities, domestic producers and formulators continue to innovate in natural emulsification systems and functional blends.

Germany supports high-quality emulsifiers in organic-certified and multifunctional applications:

Germany maintains a strong position in the European emulsifier market, with emphasis on quality, sustainability, and regulatory compliance. Food companies increasingly incorporate emulsifiers that are compatible with organic and allergen-free product lines. The countrys strict consumer standards promote the use of traceable, non-GMO, and eco-friendly emulsifier sources, particularly in infant nutrition and health food segments.

In cosmetics and pharmaceuticals, Germany has a mature market that favors multifunctional emulsifiers capable of improving sensory appeal, product longevity, and user safety. Collaborations between research institutes and industry players are helping develop new co-emulsifier systems designed for anti-aging creams, sunscreens, and prescription topical formulations.

Japan advances application-specific emulsification for cosmetics and health foods:

Japans emulsifiers market is driven by its sophisticated personal care and food processing sectors. Japanese cosmetic brands are at the forefront of developing lightweight, fast-absorbing emulsions using advanced co-emulsifier technologies. Product differentiation based on texture, hydration performance, and skin compatibility is supported by continual innovation in emulsifier chemistry.

In the food sector, Japan promotes high-purity emulsifiers in health foods, functional beverages, and dairy desserts. Clean-label and minimal additive trends have pushed domestic producers to develop naturally derived emulsifiers from seaweed, soy, and rice. With a strong emphasis on safety, Japanese regulatory agencies ensure that only high-quality emulsification systems reach the market.

The emulsifiers and co-emulsifiers market is marked by competition across global, regional, and niche product segments. Success in this market depends on the ability to formulate high-performing, stable, and safe emulsification systems that meet evolving regulatory and consumer expectations. Companies must balance technical performance with sustainability, cost, and market-specific requirements.

Large-scale producers typically focus on offering a wide portfolio of emulsifiers suitable for multiple industries, from food and beverage to cosmetics and pharmaceuticals. Their strength lies in global reach, backward integration in raw materials, and the ability to invest in application-based innovation. These companies often collaborate with multinational customers to develop customized solutions for new formulations.

Mid-sized players tend to specialize in plant-based, organic, or synthetic-free emulsifiers targeted at clean-label products. Their competitive edge lies in agility and the ability to cater to niche demands such as allergen-free, halal, or vegan emulsifier systems. These firms often supply to regional food brands and cosmetic manufacturers requiring specialized support.

Research-driven companies are focusing on new functional blends that combine emulsification with antioxidant, antimicrobial, or pH-buffering properties. These multi-functional ingredients offer cost-efficiency and simplify ingredient lists for manufacturers, aligning with consumer demand for simpler, shorter ingredient panels.

Digital and supply chain optimization strategies are emerging as competitive differentiators. Firms that offer technical guidance, formulation support, and responsive supply solutions are favored by food technologists and formulation scientists. Transparency in sourcing, certifications, and ingredient traceability also play a growing role in market preference.

In the long term, competitiveness will hinge on the ability to balance performance, safety, and environmental impact. Firms that successfully innovate in biodegradable, non-GMO, and sustainable emulsifiers while maintaining cost-efficiency are expected to lead the markets next phase of growth.

In March 2025, Perstorp, a prominent global innovator has officially introduced the Neptem range for alkyd applications. This newly launched portfolio consists of advanced emulsifier solutions specifically designed to enable the development of next-generation, high-performance waterborne alkyd systems.

In October 2024, Emulgade Verde 10 MS by BASF has been classified as a naturally derived ingredient, possessing a Natural Origin Index (NOI) of 1. This emulsifier aligns with vegan and cruelty-free formulation standards. Whether employed as a primary emulsifier or as a co-emulsifier, Emulgade Verde delivers consistent and stable emulsifying performance.

Keep Content as it is, even all the headings questions and all

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Emulsifiers and Co-Emulsifiers market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Emulsifiers and Co-Emulsifiers market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Emulsifiers and Co-Emulsifiers market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Emulsifiers and Co-Emulsifiers market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Emulsifiers and Co-Emulsifiers market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 7.79 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product Type |

|

| The Segment covered by Source |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Emulsifiers and Co-Emulsifiers market share, size, and revenue growth rate were created by Quintile Report™. Emulsifiers and Co-Emulsifiers analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Emulsifiers and Co-Emulsifiers Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Emulsifiers and Co-Emulsifiers Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Emulsifiers and Co-Emulsifiers Market, by Region, (USD Million) 2017-2035

Table 21 China Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Emulsifiers and Co-Emulsifiers Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Emulsifiers and Co-Emulsifiers Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Emulsifiers and Co-Emulsifiers Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Emulsifiers and Co-Emulsifiers Market: market scenario

Fig.4 Global Emulsifiers and Co-Emulsifiers Market competitive outlook

Fig.5 Global Emulsifiers and Co-Emulsifiers Market driver analysis

Fig.6 Global Emulsifiers and Co-Emulsifiers Market restraint analysis

Fig.7 Global Emulsifiers and Co-Emulsifiers Market opportunity analysis

Fig.8 Global Emulsifiers and Co-Emulsifiers Market trends analysis

Fig.9 Global Emulsifiers and Co-Emulsifiers Market: Segment Analysis (Based on the scope)

Fig.10 Global Emulsifiers and Co-Emulsifiers Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report Descriptions: The Global Non-GMO Flour Market was estimated at USD 72.87 billion in 2025 and

Read MoreReport Descriptions: The Global Mineral Ingredients Market was estimated at USD 8.12 billion in 2025

Read MoreReport Descriptions: The Global Feeding Distiller Dried Grains with Solubles (DGDS) Market was estim

Read More