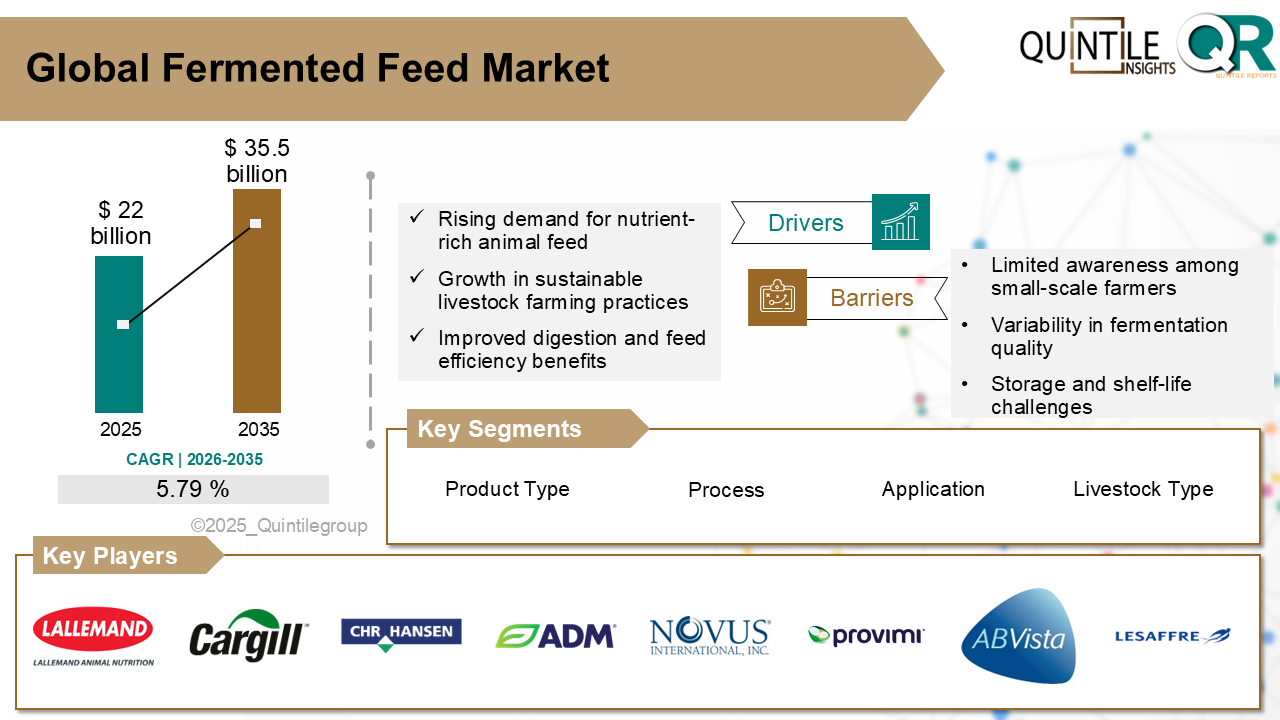

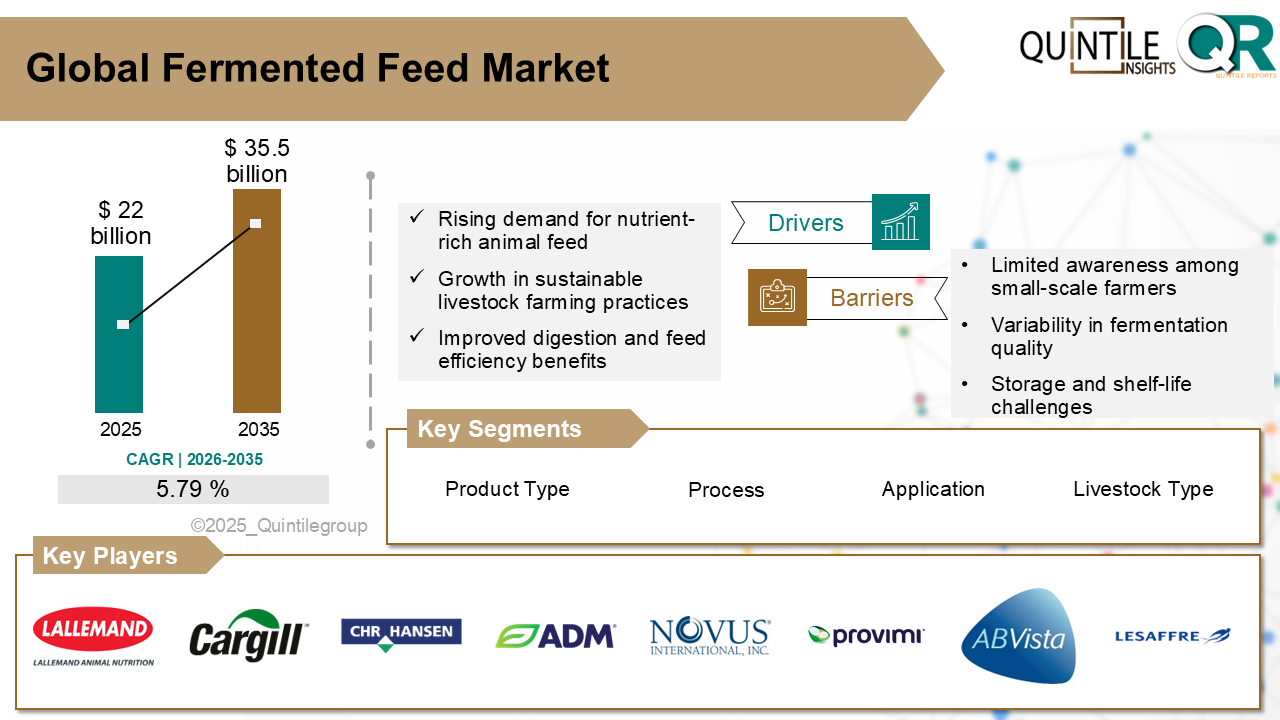

The Global Fermented Feed Market was estimated at USD 22 billion in 2025 and is projected to reach USD 35.5 billion by 2035, growing at a robust CAGR of 5.79% during the forecast period from 2026 to 2035. The Fermented Feed market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Fermented Feed market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017-2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (202-2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026-2035, enabling stakeholders to evaluate market growth potential over the forecast period.

The fermented feed market refers to the production, processing, and distribution of animal feed that has undergone microbial fermentation to enhance its nutritional value, digestibility, and preservation. These feeds are produced by incorporating beneficial microorganisms such as lactic acid bacteria and yeasts into raw feed materials like grains, silage, or by-products. The fermentation process leads to the breakdown of complex nutrients, reduces anti-nutritional factors, and enriches the feed with organic acids and probiotics.

Fermented feeds are widely used in livestock nutrition, particularly for poultry, swine, dairy cattle, and aquaculture. Their application supports improved gut health, feed efficiency, and immunity in animals without relying on synthetic additives or antibiotics. As livestock producers seek natural, sustainable, and cost-effective feed solutions, the adoption of fermented feed is growing across commercial farms, feed mills, and integrated animal husbandry operations.

Rising demand for antibiotic-free animal nutrition is a major factor driving the fermented feed market. With increasing global restrictions on antibiotic growth promoters in livestock, farmers are turning to naturally fermented alternatives that enhance animal health and performance. According to the Food and Agriculture Organization (FAO), responsible antimicrobial use in agriculture is essential to addressing antimicrobial resistance, creating long-term demand for safe, bio-based feeding strategies.

Ensuring uniform product quality remains a challenge. Inconsistencies in raw material composition, microbial activity, and fermentation conditions can affect nutrient density and palatability. Without strict quality control, poorly fermented feed may lead to spoilage or reduced animal performance.

North America remains an established market due to advanced livestock farming practices and demand for antibiotic-free animal products. The United States and Canada are adopting fermented feeds in dairy and swine sectors, supported by research from agricultural universities and feed companies. The trend is reinforced by consumer demand for natural, residue-free meat and milk products.

Europe emphasizes fermented feed as part of its sustainable livestock framework. Countries such as Germany, the Netherlands, and Denmark support reduced antibiotic use in animal husbandry, and fermented feeds are promoted under EU animal welfare and environmental sustainability guidelines. Research institutions and cooperative farms play an active role in promoting feed fermentation systems.

Asia Pacific is witnessing rapid growth in fermented feed adoption due to expanding livestock populations and efforts to improve productivity. China and India, among the largest producers of pork and milk respectively, are scaling up use of fermented feed to enhance animal health and reduce dependency on conventional antibiotics. Governments and agri-tech firms are also promoting rural feed innovation through demonstration projects and subsidies.

Latin America is showing rising interest in fermented feed for poultry and pig farming. Brazil, Argentina, and Mexico are incorporating fermentation practices into integrated feed production systems. Fermented corn and soybean meal are being used in commercial feedlots to improve feed conversion efficiency and reduce mortality rates.

Middle East and Africa represent emerging markets. In regions such as South Africa, Egypt, and the Gulf countries, feed manufacturers are beginning to introduce fermented blends for poultry and ruminants, driven by concerns about feed safety and animal health. Adoption remains gradual but is expected to accelerate with improved access to inoculants and farm training.

United States advances fermented feed in antibiotic-free dairy and swine production:

In the United States, fermented feed is gaining momentum as part of broader efforts to reduce antibiotic use and support animal welfare in commercial livestock systems. Major dairy farms are adopting fermented total mixed rations (TMRs) that include fermented corn silage and grains to improve milk output and digestive health. Swine producers, particularly in the Midwest, are integrating fermented soybean meal to support growth performance while maintaining gut integrity.

Research institutions such as the University of Minnesota and USDA Agricultural Research Service are working closely with industry promote nutritious food. Federal guidance on antibiotic stewardship and farm profitability continues to support fermented feed adoption, especially in vertically integrated operations.

Germany scales up sustainable feed systems through fermentation-based innovation:

Germany has emerged as a key European market for fermented feed through its emphasis on animal health, sustainability, and emission control. The countrys livestock sector benefits from advanced infrastructure and policy support for reducing antibiotic reliance. Fermented feed formulations are being incorporated in dairy, swine, and poultry farms to meet EU standards on antibiotic use, emissions, and animal welfare.

Regional cooperatives and agricultural institutes collaborate to develop fermented feed strategies using local feedstocks like maize, wheat bran, and distillery by-products. These efforts are often supported by funding from the Federal Ministry of Food and Agriculture, promoting on-farm fermentation units and quality monitoring tools. Germanys role in shaping EU feed policy also helps align fermented feed practices across neighboring countries.

Japan supports microbe-rich feed integration for poultry and aquaculture sectors:

Japan is advancing the use of fermented feed through its focus on microbial biotechnology and precision farming. The countrys poultry industry is incorporating fermented rice bran, wheat by-products, and seaweed extracts to improve gut flora and feed efficiency. Aquaculture farms are also experimenting with fermented soybean and fishmeal alternatives to reduce water pollution and improve fish health.

The Ministry of Agriculture, Forestry and Fisheries promotes feed innovation through public-private partnerships that support pilot-scale trials and microbial strain development. Japans consumer market favors traceable, antibiotic-free animal products, and this trend is driving sustained interest in fermented feed systems for both land and aquatic animals.

The fermented feed market is defined by a mix of multinational feed manufacturers, regional cooperatives, and specialized microbial solution providers. Competitive strength in this market stems from the ability to formulate species-specific fermented feeds with consistent nutrient profiles, shelf stability, and proven health benefits.

Large companies leverage integrated operations and advanced research to offer tailored fermented feed solutions, often bundled with probiotics or enzymes. Their investment in feed mills, microbial R&D, and farmer outreach programs allows them to maintain a strong presence in mature and emerging markets alike.

Medium-sized and regional firms focus on localized fermentation practices using regionally available raw materials. Their ability to adapt to specific livestock diets, local climatic conditions, and on-farm fermentation models gives them a competitive edge in rural and cost-sensitive areas.

Innovation in microbial inoculants is a key differentiator. Companies that develop proprietary strains with high fermentation efficiency, acid production, and pathogen resistance gain preference among feed manufacturers. These firms often collaborate with agricultural universities and veterinary research centers to validate performance claims.

Private label and custom formulation services are also expanding. Feed integrators and contract farms increasingly seek bespoke fermented feed solutions tailored to specific herd sizes, species, or life stages. Customization allows smaller players to differentiate themselves in competitive regional markets.

Future competitiveness will depend on technical support, feed safety assurance, and the ability to demonstrate cost savings and productivity gains. Companies that can bridge knowledge gaps, provide turnkey fermentation systems, and align with sustainability goals are expected to gain long-term traction.

Key players in the market are Lallemand Animal Nutrition, DSM (Biomin), Alltech, Cargill, Chr. Hansen, Archer Daniels Midland Company, Novus International, Provimi, AB Vista, Lesaffre (Phileo), DuPont, Kemin Industries, Evonik Industries, BASF SE, Ajinomoto Inc., and other players.

In February 2025, Calysta, in collaboration with Marsapet, has introduced the first complete dry dog food incorporating FeedKind Pet protein, a novel cultured protein developed through fermentation without the use of arable land or animal-derived ingredients.

In October 2023, Lallemand Animal Nutrition and Tereos have partnered to develop an innovative complementary feed solution aimed at enhancing immune function in senior dogs. This newly launched formulation, named Profeed ADVANCED, combines Tereos short-chain fructo-oligosaccharides (FOS) with proprietary yeast fractions selected by Lallemand to address the shifts in gut microbiota and immune response commonly observed in aging dogs.

Keep Content as it is, even all the headings questions and all

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Fermented Feed market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Fermented Feed market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Fermented Feed market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Fermented Feed market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Fermented Feed market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 5.79 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Type |

|

| The Segment covered by Form & Process |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Fermented Feed market share, size, and revenue growth rate were created by Quintile Report™. Fermented Feed analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Fermented Feed Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Fermented Feed Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Fermented Feed Market, by Region, (USD Million) 2017-2035

Table 21 China Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Fermented Feed Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Fermented Feed Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Fermented Feed Market: market scenario

Fig.4 Global Fermented Feed Market competitive outlook

Fig.5 Global Fermented Feed Market driver analysis

Fig.6 Global Fermented Feed Market restraint analysis

Fig.7 Global Fermented Feed Market opportunity analysis

Fig.8 Global Fermented Feed Market trends analysis

Fig.9 Global Fermented Feed Market: Segment Analysis (Based on the scope)

Fig.10 Global Fermented Feed Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Fermented Feed Market was estimated at USD 22 billion in 2025 and is projected to reach USD 35.5 billion by 2035, growing at a robust CAGR of 5.79% during the forecast period from 2026 to 2035. The Fermented Feed market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Fermented Feed market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017-2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (202-2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026-2035, enabling stakeholders to evaluate market growth potential over the forecast period.

The fermented feed market refers to the production, processing, and distribution of animal feed that has undergone microbial fermentation to enhance its nutritional value, digestibility, and preservation. These feeds are produced by incorporating beneficial microorganisms such as lactic acid bacteria and yeasts into raw feed materials like grains, silage, or by-products. The fermentation process leads to the breakdown of complex nutrients, reduces anti-nutritional factors, and enriches the feed with organic acids and probiotics.

Fermented feeds are widely used in livestock nutrition, particularly for poultry, swine, dairy cattle, and aquaculture. Their application supports improved gut health, feed efficiency, and immunity in animals without relying on synthetic additives or antibiotics. As livestock producers seek natural, sustainable, and cost-effective feed solutions, the adoption of fermented feed is growing across commercial farms, feed mills, and integrated animal husbandry operations.

Rising demand for antibiotic-free animal nutrition is a major factor driving the fermented feed market. With increasing global restrictions on antibiotic growth promoters in livestock, farmers are turning to naturally fermented alternatives that enhance animal health and performance. According to the Food and Agriculture Organization (FAO), responsible antimicrobial use in agriculture is essential to addressing antimicrobial resistance, creating long-term demand for safe, bio-based feeding strategies.

Ensuring uniform product quality remains a challenge. Inconsistencies in raw material composition, microbial activity, and fermentation conditions can affect nutrient density and palatability. Without strict quality control, poorly fermented feed may lead to spoilage or reduced animal performance.

North America remains an established market due to advanced livestock farming practices and demand for antibiotic-free animal products. The United States and Canada are adopting fermented feeds in dairy and swine sectors, supported by research from agricultural universities and feed companies. The trend is reinforced by consumer demand for natural, residue-free meat and milk products.

Europe emphasizes fermented feed as part of its sustainable livestock framework. Countries such as Germany, the Netherlands, and Denmark support reduced antibiotic use in animal husbandry, and fermented feeds are promoted under EU animal welfare and environmental sustainability guidelines. Research institutions and cooperative farms play an active role in promoting feed fermentation systems.

Asia Pacific is witnessing rapid growth in fermented feed adoption due to expanding livestock populations and efforts to improve productivity. China and India, among the largest producers of pork and milk respectively, are scaling up use of fermented feed to enhance animal health and reduce dependency on conventional antibiotics. Governments and agri-tech firms are also promoting rural feed innovation through demonstration projects and subsidies.

Latin America is showing rising interest in fermented feed for poultry and pig farming. Brazil, Argentina, and Mexico are incorporating fermentation practices into integrated feed production systems. Fermented corn and soybean meal are being used in commercial feedlots to improve feed conversion efficiency and reduce mortality rates.

Middle East and Africa represent emerging markets. In regions such as South Africa, Egypt, and the Gulf countries, feed manufacturers are beginning to introduce fermented blends for poultry and ruminants, driven by concerns about feed safety and animal health. Adoption remains gradual but is expected to accelerate with improved access to inoculants and farm training.

United States advances fermented feed in antibiotic-free dairy and swine production:

In the United States, fermented feed is gaining momentum as part of broader efforts to reduce antibiotic use and support animal welfare in commercial livestock systems. Major dairy farms are adopting fermented total mixed rations (TMRs) that include fermented corn silage and grains to improve milk output and digestive health. Swine producers, particularly in the Midwest, are integrating fermented soybean meal to support growth performance while maintaining gut integrity.

Research institutions such as the University of Minnesota and USDA Agricultural Research Service are working closely with industry promote nutritious food. Federal guidance on antibiotic stewardship and farm profitability continues to support fermented feed adoption, especially in vertically integrated operations.

Germany scales up sustainable feed systems through fermentation-based innovation:

Germany has emerged as a key European market for fermented feed through its emphasis on animal health, sustainability, and emission control. The countrys livestock sector benefits from advanced infrastructure and policy support for reducing antibiotic reliance. Fermented feed formulations are being incorporated in dairy, swine, and poultry farms to meet EU standards on antibiotic use, emissions, and animal welfare.

Regional cooperatives and agricultural institutes collaborate to develop fermented feed strategies using local feedstocks like maize, wheat bran, and distillery by-products. These efforts are often supported by funding from the Federal Ministry of Food and Agriculture, promoting on-farm fermentation units and quality monitoring tools. Germanys role in shaping EU feed policy also helps align fermented feed practices across neighboring countries.

Japan supports microbe-rich feed integration for poultry and aquaculture sectors:

Japan is advancing the use of fermented feed through its focus on microbial biotechnology and precision farming. The countrys poultry industry is incorporating fermented rice bran, wheat by-products, and seaweed extracts to improve gut flora and feed efficiency. Aquaculture farms are also experimenting with fermented soybean and fishmeal alternatives to reduce water pollution and improve fish health.

The Ministry of Agriculture, Forestry and Fisheries promotes feed innovation through public-private partnerships that support pilot-scale trials and microbial strain development. Japans consumer market favors traceable, antibiotic-free animal products, and this trend is driving sustained interest in fermented feed systems for both land and aquatic animals.

The fermented feed market is defined by a mix of multinational feed manufacturers, regional cooperatives, and specialized microbial solution providers. Competitive strength in this market stems from the ability to formulate species-specific fermented feeds with consistent nutrient profiles, shelf stability, and proven health benefits.

Large companies leverage integrated operations and advanced research to offer tailored fermented feed solutions, often bundled with probiotics or enzymes. Their investment in feed mills, microbial R&D, and farmer outreach programs allows them to maintain a strong presence in mature and emerging markets alike.

Medium-sized and regional firms focus on localized fermentation practices using regionally available raw materials. Their ability to adapt to specific livestock diets, local climatic conditions, and on-farm fermentation models gives them a competitive edge in rural and cost-sensitive areas.

Innovation in microbial inoculants is a key differentiator. Companies that develop proprietary strains with high fermentation efficiency, acid production, and pathogen resistance gain preference among feed manufacturers. These firms often collaborate with agricultural universities and veterinary research centers to validate performance claims.

Private label and custom formulation services are also expanding. Feed integrators and contract farms increasingly seek bespoke fermented feed solutions tailored to specific herd sizes, species, or life stages. Customization allows smaller players to differentiate themselves in competitive regional markets.

Future competitiveness will depend on technical support, feed safety assurance, and the ability to demonstrate cost savings and productivity gains. Companies that can bridge knowledge gaps, provide turnkey fermentation systems, and align with sustainability goals are expected to gain long-term traction.

Key players in the market are Lallemand Animal Nutrition, DSM (Biomin), Alltech, Cargill, Chr. Hansen, Archer Daniels Midland Company, Novus International, Provimi, AB Vista, Lesaffre (Phileo), DuPont, Kemin Industries, Evonik Industries, BASF SE, Ajinomoto Inc., and other players.

In February 2025, Calysta, in collaboration with Marsapet, has introduced the first complete dry dog food incorporating FeedKind Pet protein, a novel cultured protein developed through fermentation without the use of arable land or animal-derived ingredients.

In October 2023, Lallemand Animal Nutrition and Tereos have partnered to develop an innovative complementary feed solution aimed at enhancing immune function in senior dogs. This newly launched formulation, named Profeed ADVANCED, combines Tereos short-chain fructo-oligosaccharides (FOS) with proprietary yeast fractions selected by Lallemand to address the shifts in gut microbiota and immune response commonly observed in aging dogs.

Keep Content as it is, even all the headings questions and all

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Fermented Feed market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Fermented Feed market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Fermented Feed market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Fermented Feed market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Fermented Feed market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 5.79 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Type |

|

| The Segment covered by Form & Process |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Fermented Feed market share, size, and revenue growth rate were created by Quintile Report™. Fermented Feed analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Fermented Feed Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Fermented Feed Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Fermented Feed Market, by Region, (USD Million) 2017-2035

Table 21 China Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Fermented Feed Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Fermented Feed Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Fermented Feed Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Fermented Feed Market: market scenario

Fig.4 Global Fermented Feed Market competitive outlook

Fig.5 Global Fermented Feed Market driver analysis

Fig.6 Global Fermented Feed Market restraint analysis

Fig.7 Global Fermented Feed Market opportunity analysis

Fig.8 Global Fermented Feed Market trends analysis

Fig.9 Global Fermented Feed Market: Segment Analysis (Based on the scope)

Fig.10 Global Fermented Feed Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report Descriptions: The Global Non-GMO Flour Market was estimated at USD 72.87 billion in 2025 and

Read MoreReport Descriptions: The Global Mineral Ingredients Market was estimated at USD 8.12 billion in 2025

Read MoreReport Descriptions: The Global Feeding Distiller Dried Grains with Solubles (DGDS) Market was estim

Read More