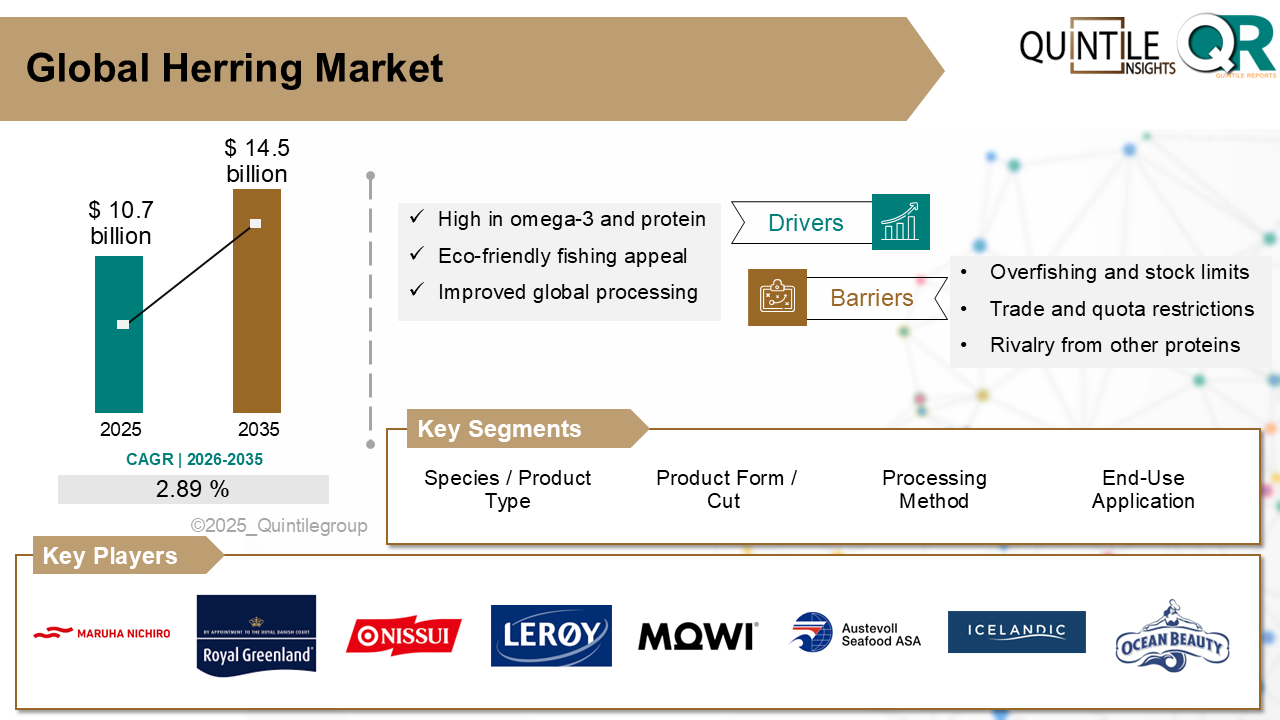

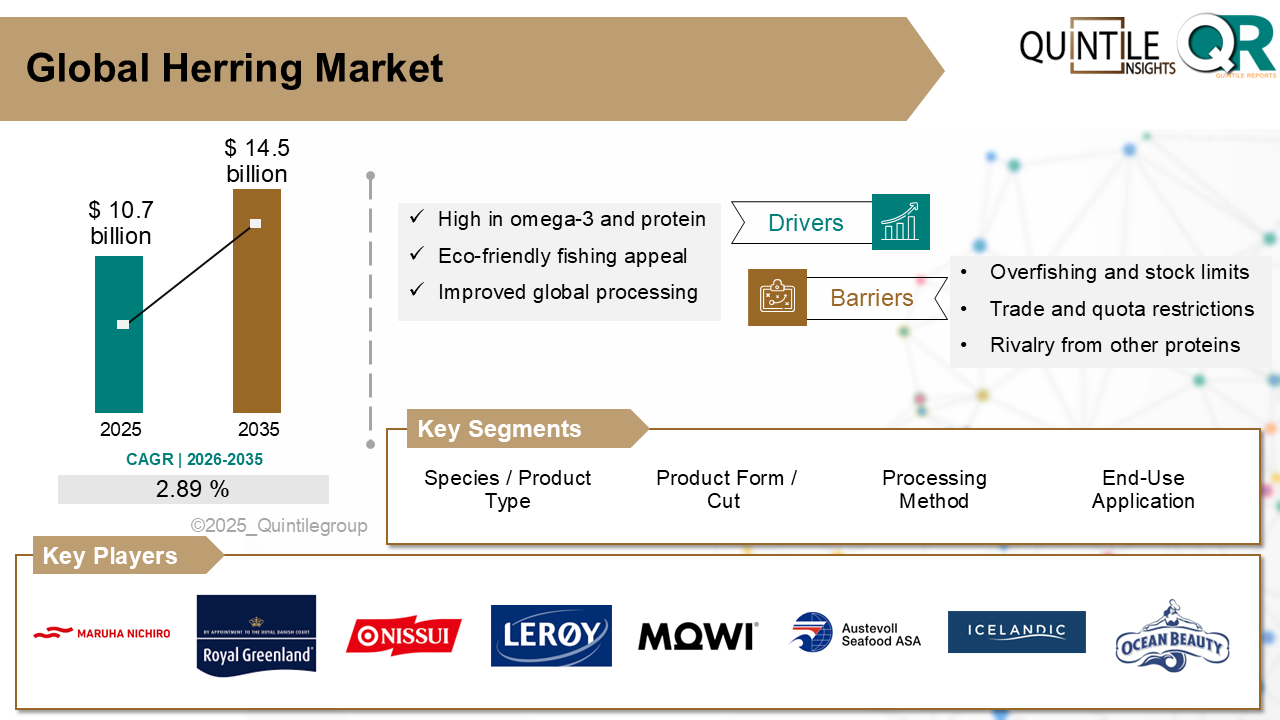

The Global Herring Market was estimated at USD 10.7 billion in 2025 and is projected to reach USD 14.5 billion by 2035, growing at a robust CAGR of 2.89% during the forecast period from 2026 to 2035. The Herring market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Herring market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017–2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026–2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026–2035, enabling stakeholders to evaluate market growth potential over the forecast period.

The herring market refers to the global and regional market for commercial fisheries and processed products derived from herring species (primarily Atlantic and Pacific herring). This includes frozen, smoked, pickled, canned, and marinated forms consumed by households and the foodservice industry as well as processed offal used for fishmeal, fish oil, and pet food. Key applications cover ready-to-eat seafood products and aquaculture feed ingredients, with distribution across supermarkets, convenience stores, specialised retailers, and online channels. Major supply originates from Europe and North America, while emerging markets in Asia-Pacific and Latin America are fueling further adoption.

Traditionally, herring has been valued as an economical, protein-rich, and omega-3–dense fish staple in European diets, popular across dishes like smoked, pickled, or raw preparations. In recent years, the market has evolved through value-added products such as gourmet spreads, single-serve fillets, and flavoured formats, alongside improved preservation methods like flash-freezing to ensure freshness and shelf stability. Growing consumer focus on sustainability has increased demand for certified, responsibly sourced herring. Suppliers are expanding into emerging regions and digital retail while responding to stricter quotas, environmental regulations, and climate-driven supply variability by investing in sustainable fishing practices and traceability systems.

Herring is a good source of first-class protein, essential vitamins, and omega-3 fatty acids and therefore a health-conscious consumer's menu option and a heart disease and inflammation prevention choice.

Overfishing, particularly in vital areas like the Baltic Sea, has led to a significant decline in herring populations in certain regions. To combat this, stricter quotas and even bans are being put in place, which are limiting harvest amounts and throwing supply chains into disarray.

North America is experiencing consistent demand for herring, mostly in processed qualities like canned, smoked, and pickled herring. Health-conscious consumers increasingly see herring as a cost-effective substitute source of omega-3s compared to more expensive seafood. Speciality and ethnic food stores remain supportive of market penetration, particularly with e-commerce retail channels extending the visibility of herring in urban areas. Suppliers to the market stress convenience, traceability, and environmentally friendly sourcing of the product to take advantage of changing consumer interest.

Europe is the leading world herring market, strongly based on tradition and food culture, predominantly in Scandinavia, Germany, and the Netherlands. Pickled, raw ("Hollandse nieuwe"), and smoked herring products are standard fare. MSC-certified fishery labelling and high-level sustainability standards ensure long-term stock status. Demand is founded on traditional culinary culture, and advanced processing technology (e.g., vacuum-packing and value-added products) ensures quality in all markets.

Asia-Pacific is the region with the fastest growth, and rising herring consumption in markets such as China, Japan, and South Korea. Urban consumers favour low-cost sources of high-value seafood nutrition for wellness and healthy diets. Rising imports, value-added product forms (fillets, spicy), and e-retail outlets are widening regional access. Climate-resilient product forms match local taste profiles and retail outlets.

Latin America is a developing market for herring, with market growth in countries such as Brazil, Mexico, and Argentina. The demand is for high-nutrient, low-cost seafood products for low- and middle-income buyers. Suppliers are going further with canned and smoked herring products, and partnership distribution and trading links facilitate greater supply to growing fish protein markets.

Middle East & Africa is in the early stages of adoption. Herring is emerging as a low-cost, protein-rich fish via imports. Urban cities lead demand for ready-to-eat convenient forms, combining health and import-stimulated availability.

Health & Sustainability Awareness Boosts U.S. Herring Market.:

The United States is a major player in the global herring market, thanks to a growing interest in healthy, nutrient-rich foods and sustainable seafood options. One of the key factors driving this growth is the combination of health-conscious eating and a focus on sustainability. Herring, with its impressive omega-3, vitamin D, and B₁₂ content, along with its reputation as a sustainable fish, really resonates with today’s consumers.

Regions that prioritise health, like California, the Pacific Northwest, and the Northeast, are seeing more herring making its way into people's diets—whether it’s smoked, canned, or ready-to-eat. This trend appeals to health-focused shoppers and those looking for ethnic food options. Plus, herring is often more affordable than fish like salmon or tuna, making it a great choice for budget-savvy families who still want to eat well.

At the same time, the ongoing commitment to certified sustainable fishing practices and transparent supply chains is strengthening herring’s position in the market. U.S. regulatory agencies, following guidelines like the Magnuson-Stevens Act, along with fisheries councils, are actively managing Atlantic and Pacific herring stocks through quotas and rebuilding plans to ensure both sustainability and consumer trust.

Rising Health Awareness & Omega-3 Focus Fuel Germany’s Herring Market:

Germany is one of the major European herring markets, supported by rising consumer knowledge of the health value of omega-3 fatty acids and high-protein intake. Highly nutritious herring is increasingly being consumed in the form of pickled, smoked, or canned items, particularly by consumer groups interested in following heart and brain health benefits.

Core markets such as Berlin, Hamburg, and Bayern are seeing increased demand for convenience and ready-to-eat herring varieties such as jar-pack and marinated ones. These are traditional favorites such as Matjes, Rollmops, and Fischbrötchen re-packaged to meet contemporary German retail and snacking lifestyles.

German processors and purchasers such dominant firms as Nordsee, Rugen Fisch, Hawesta, Appel Feinkost, and Dittmann are reacting by marketing responsibly caught, MSC-certified herring that serves consumer demand for nutritional goodness and openness. They are developing packaging and flavor forms to enable convenience and well-being.

Japan’s Focus on Sustainable Fisheries Drives Growth in the Herring Market:

Japan's focus on green fishing and local sourcing of seafood has become the leading force for its herring industry to grow sustainably. As policymakers and consumers alike call for environmentally friendly sea harvests, the demand is rising for the herring caught and processed with low environmental cost—most commonly supplied by certified stock or quota-managed fisheries. Not only does it become suitable for ecology, but also for Japan's prestige in the seafood industry.

Fisheries co-operatives and processors are reacting by investing in traceable, place-based herring supply chains. Seasonal fresh or correctly frozen lines of product such as herring roe (kazunoko) and cured varieties that is responsibly labeled to verify origin and sustainability credentials is being given focus. This is being embraced by consumer and retail customers that insist on responsibly sourced ingredients for special traditional food and gift offerings.

But leading the charge even further is Japan's food culture in bringing herring to prime-grade status through the fusion of creative cooking and product innovation. Artisanal offerings—lightly smoked, marinated, or aged herring blended with regional spices are becoming more prominent in speciality markets and izakayas. These presentation styles pay homage to Japan's seafood legacy while conforming to existing values for traceability and environmental sustainability—enabling a sustainable and culturally true growth of the herring market.

Herring is more accurately characterized as species- and quality-differentiated product positioning. The industry segments by premium-grade product like wild caught vs. farm raised, brined or smoked types, and regionally distinctive style. Cooking-taste-customized offerings Nordic cold-smoking, Japanese sashimi-grade fillets, or canned herring in specialty oils are favored for flavor, heritage, and perceived authenticity.

The second trend is value-added processing and convenience packaging. The industry leaders are at the forefront with ready-to-eat forms portioned tins, vacuum-packed fillets, and marinated snacks—to respond rapidly to changing customer demands. These convenient forms provide longer shelf life, shortened preparation time, and foreign market appeal with wider consumption beyond traditional markets.

Sustainability branding and accountable procurement are becoming significant competitive drivers. Accountable fishery-compliant suppliers (e.g., MSC-compliant) and traceable supply chains powerfully appeal to environmentally aware consumers and regulatory bodies. Ethical harvests, bycatch mitigation, and transparency on fishing practices are trust elements, especially in Western markets.

Regional market leadership in distribution and supply certainty is are key driver. Northern Europe and the Nordic region are the key providers of herring volumes of catch, with North America, Asia-Pacific, and Eastern Europe providing new demand. Through localized processing, cold-chains, and target-market regulatory compliance, it is possible to efficiently serve retailers, food-service players, and exporters.

Lastly, product development, innovation and cross-category collaborations are redefining market dynamics. Producers partnered with chefs, convenience foods, and health-niche nutrient brands to develop hybrid food products such as omega-3–enhanced spreads or ready-to-eat herring meals—for premium-plus segments. Co-branded innovations expand culinary application and enhance herring as a value-added ingredient.

In January 2024, Pelagia announced the signing of contracts for the building of a new fishmeal and fish oil factory in Egersund, Norway. This significant investment aims to modernise production and increase capacity for processing pelagic species, including herring, which is a major source for fishmeal and fish oil. This will impact the supply chain for these valuable herring derivatives.

In June 2025, The Norwegian Seafood Council reported a significant increase in Norwegian herring exports to Ukraine and other markets in May 2025, indicating shifting trade patterns and demand. The export value of herring for May 2025 was NOK 261 million, marking a 31% increase year-on-year. For the year to date, herring exports reached NOK 1.6 billion, up 22%. The rise is attributed to increased demand and higher prices for both whole and fillet herring.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Herring market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Herring market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Herring market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Herring market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Herring market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 2.89 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Species / Product Type |

|

| The Segment covered by Product Form / Cut |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Herring market share, size, and revenue growth rate were created by Quintile Report™. Herring analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Herring Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Herring Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Herring Market, by Region, (USD Million) 2017-2035

Table 21 China Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Herring Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Herring Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Herring Market: market scenario

Fig.4 Global Herring Market competitive outlook

Fig.5 Global Herring Market driver analysis

Fig.6 Global Herring Market restraint analysis

Fig.7 Global Herring Market opportunity analysis

Fig.8 Global Herring Market trends analysis

Fig.9 Global Herring Market: Segment Analysis (Based on the scope)

Fig.10 Global Herring Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Herring Market was estimated at USD 10.7 billion in 2025 and is projected to reach USD 14.5 billion by 2035, growing at a robust CAGR of 2.89% during the forecast period from 2026 to 2035. The Herring market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Herring market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017–2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026–2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026–2035, enabling stakeholders to evaluate market growth potential over the forecast period.

The herring market refers to the global and regional market for commercial fisheries and processed products derived from herring species (primarily Atlantic and Pacific herring). This includes frozen, smoked, pickled, canned, and marinated forms consumed by households and the foodservice industry as well as processed offal used for fishmeal, fish oil, and pet food. Key applications cover ready-to-eat seafood products and aquaculture feed ingredients, with distribution across supermarkets, convenience stores, specialised retailers, and online channels. Major supply originates from Europe and North America, while emerging markets in Asia-Pacific and Latin America are fueling further adoption.

Traditionally, herring has been valued as an economical, protein-rich, and omega-3–dense fish staple in European diets, popular across dishes like smoked, pickled, or raw preparations. In recent years, the market has evolved through value-added products such as gourmet spreads, single-serve fillets, and flavoured formats, alongside improved preservation methods like flash-freezing to ensure freshness and shelf stability. Growing consumer focus on sustainability has increased demand for certified, responsibly sourced herring. Suppliers are expanding into emerging regions and digital retail while responding to stricter quotas, environmental regulations, and climate-driven supply variability by investing in sustainable fishing practices and traceability systems.

Herring is a good source of first-class protein, essential vitamins, and omega-3 fatty acids and therefore a health-conscious consumer's menu option and a heart disease and inflammation prevention choice.

Overfishing, particularly in vital areas like the Baltic Sea, has led to a significant decline in herring populations in certain regions. To combat this, stricter quotas and even bans are being put in place, which are limiting harvest amounts and throwing supply chains into disarray.

North America is experiencing consistent demand for herring, mostly in processed qualities like canned, smoked, and pickled herring. Health-conscious consumers increasingly see herring as a cost-effective substitute source of omega-3s compared to more expensive seafood. Speciality and ethnic food stores remain supportive of market penetration, particularly with e-commerce retail channels extending the visibility of herring in urban areas. Suppliers to the market stress convenience, traceability, and environmentally friendly sourcing of the product to take advantage of changing consumer interest.

Europe is the leading world herring market, strongly based on tradition and food culture, predominantly in Scandinavia, Germany, and the Netherlands. Pickled, raw ("Hollandse nieuwe"), and smoked herring products are standard fare. MSC-certified fishery labelling and high-level sustainability standards ensure long-term stock status. Demand is founded on traditional culinary culture, and advanced processing technology (e.g., vacuum-packing and value-added products) ensures quality in all markets.

Asia-Pacific is the region with the fastest growth, and rising herring consumption in markets such as China, Japan, and South Korea. Urban consumers favour low-cost sources of high-value seafood nutrition for wellness and healthy diets. Rising imports, value-added product forms (fillets, spicy), and e-retail outlets are widening regional access. Climate-resilient product forms match local taste profiles and retail outlets.

Latin America is a developing market for herring, with market growth in countries such as Brazil, Mexico, and Argentina. The demand is for high-nutrient, low-cost seafood products for low- and middle-income buyers. Suppliers are going further with canned and smoked herring products, and partnership distribution and trading links facilitate greater supply to growing fish protein markets.

Middle East & Africa is in the early stages of adoption. Herring is emerging as a low-cost, protein-rich fish via imports. Urban cities lead demand for ready-to-eat convenient forms, combining health and import-stimulated availability.

Health & Sustainability Awareness Boosts U.S. Herring Market.:

The United States is a major player in the global herring market, thanks to a growing interest in healthy, nutrient-rich foods and sustainable seafood options. One of the key factors driving this growth is the combination of health-conscious eating and a focus on sustainability. Herring, with its impressive omega-3, vitamin D, and B₁₂ content, along with its reputation as a sustainable fish, really resonates with today’s consumers.

Regions that prioritise health, like California, the Pacific Northwest, and the Northeast, are seeing more herring making its way into people's diets—whether it’s smoked, canned, or ready-to-eat. This trend appeals to health-focused shoppers and those looking for ethnic food options. Plus, herring is often more affordable than fish like salmon or tuna, making it a great choice for budget-savvy families who still want to eat well.

At the same time, the ongoing commitment to certified sustainable fishing practices and transparent supply chains is strengthening herring’s position in the market. U.S. regulatory agencies, following guidelines like the Magnuson-Stevens Act, along with fisheries councils, are actively managing Atlantic and Pacific herring stocks through quotas and rebuilding plans to ensure both sustainability and consumer trust.

Rising Health Awareness & Omega-3 Focus Fuel Germany’s Herring Market:

Germany is one of the major European herring markets, supported by rising consumer knowledge of the health value of omega-3 fatty acids and high-protein intake. Highly nutritious herring is increasingly being consumed in the form of pickled, smoked, or canned items, particularly by consumer groups interested in following heart and brain health benefits.

Core markets such as Berlin, Hamburg, and Bayern are seeing increased demand for convenience and ready-to-eat herring varieties such as jar-pack and marinated ones. These are traditional favorites such as Matjes, Rollmops, and Fischbrötchen re-packaged to meet contemporary German retail and snacking lifestyles.

German processors and purchasers such dominant firms as Nordsee, Rugen Fisch, Hawesta, Appel Feinkost, and Dittmann are reacting by marketing responsibly caught, MSC-certified herring that serves consumer demand for nutritional goodness and openness. They are developing packaging and flavor forms to enable convenience and well-being.

Japan’s Focus on Sustainable Fisheries Drives Growth in the Herring Market:

Japan's focus on green fishing and local sourcing of seafood has become the leading force for its herring industry to grow sustainably. As policymakers and consumers alike call for environmentally friendly sea harvests, the demand is rising for the herring caught and processed with low environmental cost—most commonly supplied by certified stock or quota-managed fisheries. Not only does it become suitable for ecology, but also for Japan's prestige in the seafood industry.

Fisheries co-operatives and processors are reacting by investing in traceable, place-based herring supply chains. Seasonal fresh or correctly frozen lines of product such as herring roe (kazunoko) and cured varieties that is responsibly labeled to verify origin and sustainability credentials is being given focus. This is being embraced by consumer and retail customers that insist on responsibly sourced ingredients for special traditional food and gift offerings.

But leading the charge even further is Japan's food culture in bringing herring to prime-grade status through the fusion of creative cooking and product innovation. Artisanal offerings—lightly smoked, marinated, or aged herring blended with regional spices are becoming more prominent in speciality markets and izakayas. These presentation styles pay homage to Japan's seafood legacy while conforming to existing values for traceability and environmental sustainability—enabling a sustainable and culturally true growth of the herring market.

Herring is more accurately characterized as species- and quality-differentiated product positioning. The industry segments by premium-grade product like wild caught vs. farm raised, brined or smoked types, and regionally distinctive style. Cooking-taste-customized offerings Nordic cold-smoking, Japanese sashimi-grade fillets, or canned herring in specialty oils are favored for flavor, heritage, and perceived authenticity.

The second trend is value-added processing and convenience packaging. The industry leaders are at the forefront with ready-to-eat forms portioned tins, vacuum-packed fillets, and marinated snacks—to respond rapidly to changing customer demands. These convenient forms provide longer shelf life, shortened preparation time, and foreign market appeal with wider consumption beyond traditional markets.

Sustainability branding and accountable procurement are becoming significant competitive drivers. Accountable fishery-compliant suppliers (e.g., MSC-compliant) and traceable supply chains powerfully appeal to environmentally aware consumers and regulatory bodies. Ethical harvests, bycatch mitigation, and transparency on fishing practices are trust elements, especially in Western markets.

Regional market leadership in distribution and supply certainty is are key driver. Northern Europe and the Nordic region are the key providers of herring volumes of catch, with North America, Asia-Pacific, and Eastern Europe providing new demand. Through localized processing, cold-chains, and target-market regulatory compliance, it is possible to efficiently serve retailers, food-service players, and exporters.

Lastly, product development, innovation and cross-category collaborations are redefining market dynamics. Producers partnered with chefs, convenience foods, and health-niche nutrient brands to develop hybrid food products such as omega-3–enhanced spreads or ready-to-eat herring meals—for premium-plus segments. Co-branded innovations expand culinary application and enhance herring as a value-added ingredient.

In January 2024, Pelagia announced the signing of contracts for the building of a new fishmeal and fish oil factory in Egersund, Norway. This significant investment aims to modernise production and increase capacity for processing pelagic species, including herring, which is a major source for fishmeal and fish oil. This will impact the supply chain for these valuable herring derivatives.

In June 2025, The Norwegian Seafood Council reported a significant increase in Norwegian herring exports to Ukraine and other markets in May 2025, indicating shifting trade patterns and demand. The export value of herring for May 2025 was NOK 261 million, marking a 31% increase year-on-year. For the year to date, herring exports reached NOK 1.6 billion, up 22%. The rise is attributed to increased demand and higher prices for both whole and fillet herring.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Herring market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Herring market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Herring market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Herring market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Herring market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 2.89 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Species / Product Type |

|

| The Segment covered by Product Form / Cut |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Herring market share, size, and revenue growth rate were created by Quintile Report™. Herring analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Herring Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Herring Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Herring Market, by Region, (USD Million) 2017-2035

Table 21 China Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Herring Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Herring Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Herring Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Herring Market: market scenario

Fig.4 Global Herring Market competitive outlook

Fig.5 Global Herring Market driver analysis

Fig.6 Global Herring Market restraint analysis

Fig.7 Global Herring Market opportunity analysis

Fig.8 Global Herring Market trends analysis

Fig.9 Global Herring Market: Segment Analysis (Based on the scope)

Fig.10 Global Herring Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report Descriptions: The Global Non-GMO Flour Market was estimated at USD 72.87 billion in 2025 and

Read MoreReport Descriptions: The Global Mineral Ingredients Market was estimated at USD 8.12 billion in 2025

Read MoreReport Descriptions: The Global Feeding Distiller Dried Grains with Solubles (DGDS) Market was estim

Read More