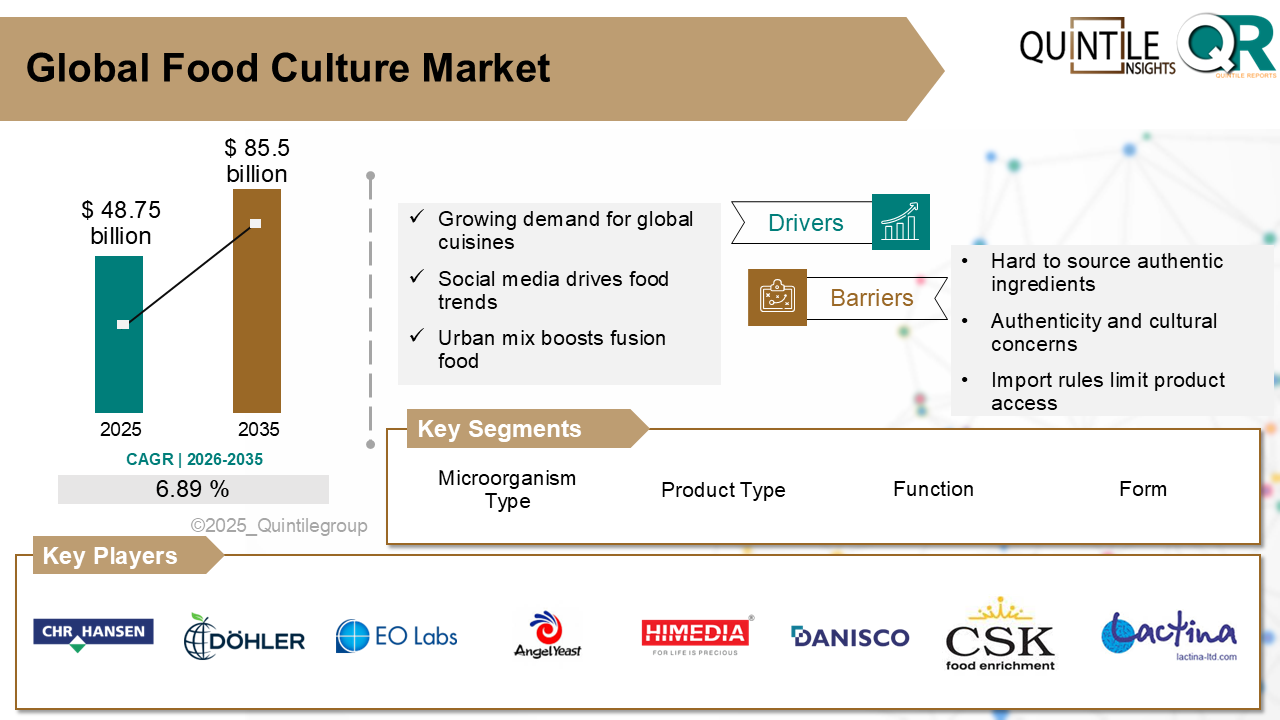

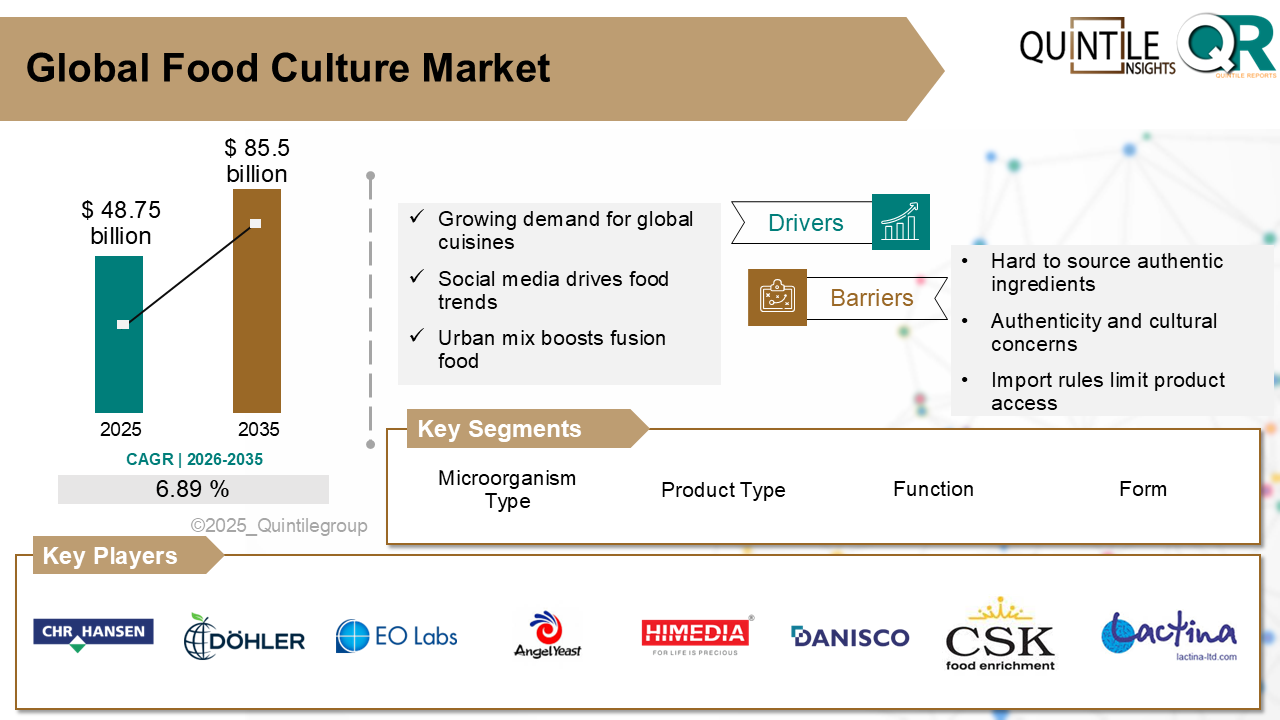

The Global Food Culture Market was estimated at USD 48.75 billion in 2025 and is projected to reach USD 85.5 billion by 2035, growing at a robust CAGR of 6.89% during the forecast period from 2026 to 2035. The Food Culture market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Food Culture market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017–2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026–2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026–2035, enabling stakeholders to evaluate market growth potential over the forecast period.

Food Culture Market

The food cultures market refers to the global and regional market for microbial cultures such as bacteria, yeasts, and moulds used to initiate controlled fermentation in food and beverage products. These food cultures are integral in developing flavour, texture, and shelf life and are deployed across a range of applications including dairy products (yoghurt, cheese), fermented beverages (kombucha, kimchi), meat preservation, and plant-based alternatives. Firms supply a variety of culture types, starter, probiotic, and protective cultures that are tailored to deliver specific functionality in both traditional and modern food systems. These ingredients are purchased by food and beverage manufacturers, producers of functional products, and living-food innovators seeking both sensory quality and functional benefits.

Historically based on standard lactic acid strains for conventional fermented items, the food cultures market has evolved significantly in response to rising consumer demand for health-promoting, clean-label, and plant-based options. New growth areas include tailored probiotic blends, advanced bacterial culture systems, and cultures designed specifically for plant-based yoghurts or meat analogues. Innovation in biotechnology has enabled kits such as Chr. Hansen’s VEGA Culture Kit helps producers create stable, flavour-rich fermented products from a variety of base ingredients.

What are the drivers of the food culture market?Growing concern with traditional cooking techniques has put fermented foods like yogurt, kefir, sourdough, kimchi, and kombucha at the center of consumer demand. They are attractive as heritage-dense and functional benefits, particularly as consumers turn to authenticity and wholeness. Slow- and artisanal food trends have made popularity rise to drive food cultures for domestic as well as professional cooking needs.

The food market is experiencing a robust trend towards simplicity and transparency in ingredients. As consumers stay away from genetically modified organisms and synthetic additives, firms are fast embracing clean-label microbial cultures based on natural origin. The cultures aid firms in complying with regulations while strengthening brand trust for health-conscious consumers.

Growing recognition of the importance of digestive and immune system health has driven the uptake of food cultures critical to probiotic foods. These are lactic acid bacteria and bifidobacteria applied in dairy, dietary supplements, and functional foods. With growing mainstream recognition of the link between gut microbiota and overall health, demand for food cultures with established health impact continues to increase.

Vegan diets have triggered the creation of food cultures that are tolerant to non-dairy substrates like soy, almond, oat, and coconut. These food cultures have become instrumental in the manufacture of vegan yoghurts, cheese, and fermented beverages. The capability of food cultures to replicate native textures and flavour profiles in plant-based versions has created new avenues in both flexitarian and vegan marketplaces.

What are the challenges and restraining factors of the food culture market?Stringent, place-bound regulations like FDA, EFSA, and ANVISA, for example retard market access for novel cultures or probiotic strains. Acceptances, particularly for health claims or new microbial strains, take several months and involve costly safety testing.

Continuous performance across batches of fermentation is difficult to sustain. Reasons such as variation in microbial strains, contamination, varying fermentation conditions, and cold-chain failure may affect safety, flavour, shelf life, and probiotic viability.

Consumer knowledge of the advantages of microbial cultures and fermented foods is low in all but developed markets, particularly beyond these. Long-standing cultural attitudes and deficiencies in training in marketing constrain demand and penetration in these countries.

Vibrancy of live culture requires a trustworthy cold chain. Poor refrigeration and transportation facilities in most emerging nations result in culture decline, loss of potency, and increased wastage and expense.

What are the regional trends of the food culture market?North America leads in fermented and probiotic foods, driven by strong awareness of gut health, high demand for cultured dairy, kombucha, and clean-label functional foods.

Europe has a mature food culture market rooted in tradition and sustainability, with strong demand for fermented foods, artisanal production, and certified, eco-friendly practices.

Asia-Pacific is the fastest-growing region, combining deep-rooted fermentation traditions with rising demand for probiotic beverages and functional foods driven by urbanisation.

Latin America shows steady growth through increased consumption of cultured dairy and fermented drinks, supported by local innovation and clean-label wellness positioning.

Middle East & Africa is an emerging market, blending traditional fermented foods with modern probiotic applications, focused on halal compliance and climate-stable formulations.

Country-Wise Outlook:Social Media–Fueled Culinary Exploration Spurs U.S. Food Culture Market:

The U.S. leads the North American food culture market, with growth increasingly fueled by social media as an influencer of culinary exploration and cross-cultural borrowing. At the center of the momentum is the viral power of apps like TikTok and Instagram, where food trends from international snack foods to vintage comfort foods spread widely and influence consumer activity among demographics.

Cities like New York, Los Angeles, and Chicago are hotbeds for tech-savvy dining trends. The cities have lively restaurant culture and food festivals filled with international, fusion, and experiential food options, often getting national exposure through social shares and viral posts.

In response, food companies and foodservice companies are streamlining their products for Instagram and social relevance, crafting photogenic plates, batched launches, and geography-specific pop-ups. At the same time, online-native brands and online retail sites provide world-sourced snacks and make-at-home kits, satisfying consumers' cultural depth and convenience-driven demands for culinary experience. This social-digital loop greatly extends the influence of food culture on consumption throughout the U.S.

Culinary Tourism & Cultural Festivals Spark Growth in Germany’s Food Culture Market:

Germany's food culture sector is growing rapidly, driven by the increased demand for culinary tourism and food culture festivals. Local and international consumers are being attracted to heritage food festivals, wine trails, and gastronomic festivals around the country, driving demand for local produce, small food producers, cookery classes, and culinary experience eating events that celebrate local food culture.

Destinations and locations like Bavaria, Baden-Württemberg, and Rhineland-Palatinate are renowned for activities like Munich Street Food Festival, Frankfurter Apfelweinfestival, and Stuttgart Weindorf. These are destinations with local charcuterie, cheese, pastry, and craft drinks—yielding to the significance of food culture as a lifestyle industry. There is premium demand created for experiential and authentic foodstuffs.

Regional food producers, family restaurants, and local special food companies such as Weinstube wineries, heritage bakeries, and traditional food cooperatives are countering with regionally branded food products, experiential cooking, and farm-to-table tours. All of these are aimed at Germany's emerging need for active, authentic food experiences, driving micro-food tourism systems in rural and urban settings.

Japan’s Rise in Global Culinary Innovation Fuels Growth in the Food Culture Market:

Japan's increasing status as a leader of global culinary innovation and experiential eating is the prime force behind driving its food culture market. From Michelin-rated restaurants in Tokyo to ramen stalls, izakayas, and cutting-edge fusion cuisine, Japan is the world's leading influence on food trends, methods, and flavours. Demand for genuine Japanese dining experiences—whether classical kaiseki, street food, or avant-garde creations—is taking native food culture to a dynamic, internationally fashionable business.

To propel this trend, food companies and hospitality brands are creating branded eating experiences and culinary events. They take the form of specialty cooking classes, specially designed tasting menus, and theme-pop-up events honoring regional foods and retro recipes with contemporary reinterpretations. Capturing these experiences in bite-sized, convenient segments like culinary tourism, food-in-a-box kits, and live cooking television shows takes the Japanese food culture to home and overseas.

Also, food experience and media convergence are building syncretism among national practices and world sensibilities. Social media tales, transnational collaboration with foreign chefs, and food media platforms demonstrate Japanese cuisine masterfulness and seasonal culture. This cultural tale sparks consumer commitment, reinforces national identity, and offers rich soil for companies to develop food products, restaurants, and web content that ride the wave of Japan's ever-evolving food culture trend.

Competitive Analysis:The food culture market is increasingly defined by localised authenticity and experience storytelling. Brands are distinguishing themselves on regional food stories, family traditions, and culinary heritage. Those that build engagement experiences pop-up kitchens, storytelling dinner events, cultural food festivals—are succeeding at building strong emotional and cultural ties with consumers in search of more authentic food provenance and identity.

A second significant trend is cross-cultural fusion and curation of innovation. Operators that curate or innovate hybrid culinary experiences—blending ingredients from greater than one cuisine without compromising cultural integrity—appeal to globally adventurous consumers. They encompass limited-time fusion, global ingredient blending, and progressive, culture-influenced menus combining tradition with innovation and appealing to global food travellers and trend leaders.

Digital experience and content engagement are transforming presence in the market. Interactive cooking classes, virtual food culture tours, or recipe websites with user-generated content bring food culture to daily touchpoints. User-generated content, chef-hosted livestreams, or virtual meals foster immersive digital experiences that enlarge cultural outreach and engagement beyond geographical locations.

Regional adaptation and local integration are a competitive advantage. Food culture marketing innovators have local consumption trends, seasonal flavour trends, and local taste. They partner with regional street vendors, local artisans, or local chefs to maintain authenticity and preserve global popularity. These localised collaborations enable brands to remain current in local markets and achieve more engagement with local and diaspora communities.

Finally, ethical sustainability and balance are transforming the legitimacy of food culture. Consumers seek cultural experiences to celebrate not just tradition but social and environmental responsibility. Producers selling farm-to-table supply, fair-trade goods, zero-waste cooking models, and relationship-driven purchasing with culture keepers are becoming legitimate and informing their products as culturally responsible and ethically produced.

Recent Development:In January 2024, the merger of Chr. Hansen and Novozymes completed, creating Novonesis. This new entity is a leading biosolutions partner with a significant portfolio in food cultures, enzymes, and other biosolutions. This merger is a major market consolidation, enhancing R&D capabilities and market reach for food cultures.

In April 2023, DSM announced its agreement to acquire Adare Biome, a pioneer in the development and manufacturing of postbiotics. While postbiotics are inactivated microbial cells or their components, this acquisition signifies DSM-Firmenich's strategic expansion in the broader "microbial solutions" space for health and nutrition, which complements their active food cultures business.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Food Culture market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Food Culture market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Food Culture market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Food Culture market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Food Culture market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 6.89 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Microorganism Type |

|

| The Segment covered by Product Type |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Food Culture market share, size, and revenue growth rate were created by Quintile Report™. Food Culture analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Food Culture Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Food Culture Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Food Culture Market, by Region, (USD Million) 2017-2035

Table 21 China Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Food Culture Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Food Culture Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Food Culture Market: market scenario

Fig.4 Global Food Culture Market competitive outlook

Fig.5 Global Food Culture Market driver analysis

Fig.6 Global Food Culture Market restraint analysis

Fig.7 Global Food Culture Market opportunity analysis

Fig.8 Global Food Culture Market trends analysis

Fig.9 Global Food Culture Market: Segment Analysis (Based on the scope)

Fig.10 Global Food Culture Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Food Culture Market was estimated at USD 48.75 billion in 2025 and is projected to reach USD 85.5 billion by 2035, growing at a robust CAGR of 6.89% during the forecast period from 2026 to 2035. The Food Culture market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Food Culture market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017–2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026–2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026–2035, enabling stakeholders to evaluate market growth potential over the forecast period.

Food Culture Market

The food cultures market refers to the global and regional market for microbial cultures such as bacteria, yeasts, and moulds used to initiate controlled fermentation in food and beverage products. These food cultures are integral in developing flavour, texture, and shelf life and are deployed across a range of applications including dairy products (yoghurt, cheese), fermented beverages (kombucha, kimchi), meat preservation, and plant-based alternatives. Firms supply a variety of culture types, starter, probiotic, and protective cultures that are tailored to deliver specific functionality in both traditional and modern food systems. These ingredients are purchased by food and beverage manufacturers, producers of functional products, and living-food innovators seeking both sensory quality and functional benefits.

Historically based on standard lactic acid strains for conventional fermented items, the food cultures market has evolved significantly in response to rising consumer demand for health-promoting, clean-label, and plant-based options. New growth areas include tailored probiotic blends, advanced bacterial culture systems, and cultures designed specifically for plant-based yoghurts or meat analogues. Innovation in biotechnology has enabled kits such as Chr. Hansen’s VEGA Culture Kit helps producers create stable, flavour-rich fermented products from a variety of base ingredients.

What are the drivers of the food culture market?Growing concern with traditional cooking techniques has put fermented foods like yogurt, kefir, sourdough, kimchi, and kombucha at the center of consumer demand. They are attractive as heritage-dense and functional benefits, particularly as consumers turn to authenticity and wholeness. Slow- and artisanal food trends have made popularity rise to drive food cultures for domestic as well as professional cooking needs.

The food market is experiencing a robust trend towards simplicity and transparency in ingredients. As consumers stay away from genetically modified organisms and synthetic additives, firms are fast embracing clean-label microbial cultures based on natural origin. The cultures aid firms in complying with regulations while strengthening brand trust for health-conscious consumers.

Growing recognition of the importance of digestive and immune system health has driven the uptake of food cultures critical to probiotic foods. These are lactic acid bacteria and bifidobacteria applied in dairy, dietary supplements, and functional foods. With growing mainstream recognition of the link between gut microbiota and overall health, demand for food cultures with established health impact continues to increase.

Vegan diets have triggered the creation of food cultures that are tolerant to non-dairy substrates like soy, almond, oat, and coconut. These food cultures have become instrumental in the manufacture of vegan yoghurts, cheese, and fermented beverages. The capability of food cultures to replicate native textures and flavour profiles in plant-based versions has created new avenues in both flexitarian and vegan marketplaces.

What are the challenges and restraining factors of the food culture market?Stringent, place-bound regulations like FDA, EFSA, and ANVISA, for example retard market access for novel cultures or probiotic strains. Acceptances, particularly for health claims or new microbial strains, take several months and involve costly safety testing.

Continuous performance across batches of fermentation is difficult to sustain. Reasons such as variation in microbial strains, contamination, varying fermentation conditions, and cold-chain failure may affect safety, flavour, shelf life, and probiotic viability.

Consumer knowledge of the advantages of microbial cultures and fermented foods is low in all but developed markets, particularly beyond these. Long-standing cultural attitudes and deficiencies in training in marketing constrain demand and penetration in these countries.

Vibrancy of live culture requires a trustworthy cold chain. Poor refrigeration and transportation facilities in most emerging nations result in culture decline, loss of potency, and increased wastage and expense.

What are the regional trends of the food culture market?North America leads in fermented and probiotic foods, driven by strong awareness of gut health, high demand for cultured dairy, kombucha, and clean-label functional foods.

Europe has a mature food culture market rooted in tradition and sustainability, with strong demand for fermented foods, artisanal production, and certified, eco-friendly practices.

Asia-Pacific is the fastest-growing region, combining deep-rooted fermentation traditions with rising demand for probiotic beverages and functional foods driven by urbanisation.

Latin America shows steady growth through increased consumption of cultured dairy and fermented drinks, supported by local innovation and clean-label wellness positioning.

Middle East & Africa is an emerging market, blending traditional fermented foods with modern probiotic applications, focused on halal compliance and climate-stable formulations.

Country-Wise Outlook:Social Media–Fueled Culinary Exploration Spurs U.S. Food Culture Market:

The U.S. leads the North American food culture market, with growth increasingly fueled by social media as an influencer of culinary exploration and cross-cultural borrowing. At the center of the momentum is the viral power of apps like TikTok and Instagram, where food trends from international snack foods to vintage comfort foods spread widely and influence consumer activity among demographics.

Cities like New York, Los Angeles, and Chicago are hotbeds for tech-savvy dining trends. The cities have lively restaurant culture and food festivals filled with international, fusion, and experiential food options, often getting national exposure through social shares and viral posts.

In response, food companies and foodservice companies are streamlining their products for Instagram and social relevance, crafting photogenic plates, batched launches, and geography-specific pop-ups. At the same time, online-native brands and online retail sites provide world-sourced snacks and make-at-home kits, satisfying consumers' cultural depth and convenience-driven demands for culinary experience. This social-digital loop greatly extends the influence of food culture on consumption throughout the U.S.

Culinary Tourism & Cultural Festivals Spark Growth in Germany’s Food Culture Market:

Germany's food culture sector is growing rapidly, driven by the increased demand for culinary tourism and food culture festivals. Local and international consumers are being attracted to heritage food festivals, wine trails, and gastronomic festivals around the country, driving demand for local produce, small food producers, cookery classes, and culinary experience eating events that celebrate local food culture.

Destinations and locations like Bavaria, Baden-Württemberg, and Rhineland-Palatinate are renowned for activities like Munich Street Food Festival, Frankfurter Apfelweinfestival, and Stuttgart Weindorf. These are destinations with local charcuterie, cheese, pastry, and craft drinks—yielding to the significance of food culture as a lifestyle industry. There is premium demand created for experiential and authentic foodstuffs.

Regional food producers, family restaurants, and local special food companies such as Weinstube wineries, heritage bakeries, and traditional food cooperatives are countering with regionally branded food products, experiential cooking, and farm-to-table tours. All of these are aimed at Germany's emerging need for active, authentic food experiences, driving micro-food tourism systems in rural and urban settings.

Japan’s Rise in Global Culinary Innovation Fuels Growth in the Food Culture Market:

Japan's increasing status as a leader of global culinary innovation and experiential eating is the prime force behind driving its food culture market. From Michelin-rated restaurants in Tokyo to ramen stalls, izakayas, and cutting-edge fusion cuisine, Japan is the world's leading influence on food trends, methods, and flavours. Demand for genuine Japanese dining experiences—whether classical kaiseki, street food, or avant-garde creations—is taking native food culture to a dynamic, internationally fashionable business.

To propel this trend, food companies and hospitality brands are creating branded eating experiences and culinary events. They take the form of specialty cooking classes, specially designed tasting menus, and theme-pop-up events honoring regional foods and retro recipes with contemporary reinterpretations. Capturing these experiences in bite-sized, convenient segments like culinary tourism, food-in-a-box kits, and live cooking television shows takes the Japanese food culture to home and overseas.

Also, food experience and media convergence are building syncretism among national practices and world sensibilities. Social media tales, transnational collaboration with foreign chefs, and food media platforms demonstrate Japanese cuisine masterfulness and seasonal culture. This cultural tale sparks consumer commitment, reinforces national identity, and offers rich soil for companies to develop food products, restaurants, and web content that ride the wave of Japan's ever-evolving food culture trend.

Competitive Analysis:The food culture market is increasingly defined by localised authenticity and experience storytelling. Brands are distinguishing themselves on regional food stories, family traditions, and culinary heritage. Those that build engagement experiences pop-up kitchens, storytelling dinner events, cultural food festivals—are succeeding at building strong emotional and cultural ties with consumers in search of more authentic food provenance and identity.

A second significant trend is cross-cultural fusion and curation of innovation. Operators that curate or innovate hybrid culinary experiences—blending ingredients from greater than one cuisine without compromising cultural integrity—appeal to globally adventurous consumers. They encompass limited-time fusion, global ingredient blending, and progressive, culture-influenced menus combining tradition with innovation and appealing to global food travellers and trend leaders.

Digital experience and content engagement are transforming presence in the market. Interactive cooking classes, virtual food culture tours, or recipe websites with user-generated content bring food culture to daily touchpoints. User-generated content, chef-hosted livestreams, or virtual meals foster immersive digital experiences that enlarge cultural outreach and engagement beyond geographical locations.

Regional adaptation and local integration are a competitive advantage. Food culture marketing innovators have local consumption trends, seasonal flavour trends, and local taste. They partner with regional street vendors, local artisans, or local chefs to maintain authenticity and preserve global popularity. These localised collaborations enable brands to remain current in local markets and achieve more engagement with local and diaspora communities.

Finally, ethical sustainability and balance are transforming the legitimacy of food culture. Consumers seek cultural experiences to celebrate not just tradition but social and environmental responsibility. Producers selling farm-to-table supply, fair-trade goods, zero-waste cooking models, and relationship-driven purchasing with culture keepers are becoming legitimate and informing their products as culturally responsible and ethically produced.

Recent Development:In January 2024, the merger of Chr. Hansen and Novozymes completed, creating Novonesis. This new entity is a leading biosolutions partner with a significant portfolio in food cultures, enzymes, and other biosolutions. This merger is a major market consolidation, enhancing R&D capabilities and market reach for food cultures.

In April 2023, DSM announced its agreement to acquire Adare Biome, a pioneer in the development and manufacturing of postbiotics. While postbiotics are inactivated microbial cells or their components, this acquisition signifies DSM-Firmenich's strategic expansion in the broader "microbial solutions" space for health and nutrition, which complements their active food cultures business.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Food Culture market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Food Culture market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Food Culture market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Food Culture market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Food Culture market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 6.89 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Microorganism Type |

|

| The Segment covered by Product Type |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Food Culture market share, size, and revenue growth rate were created by Quintile Report™. Food Culture analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Food Culture Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Food Culture Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Food Culture Market, by Region, (USD Million) 2017-2035

Table 21 China Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Food Culture Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Food Culture Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Food Culture Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Food Culture Market: market scenario

Fig.4 Global Food Culture Market competitive outlook

Fig.5 Global Food Culture Market driver analysis

Fig.6 Global Food Culture Market restraint analysis

Fig.7 Global Food Culture Market opportunity analysis

Fig.8 Global Food Culture Market trends analysis

Fig.9 Global Food Culture Market: Segment Analysis (Based on the scope)

Fig.10 Global Food Culture Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report Descriptions: The Global Non-GMO Flour Market was estimated at USD 72.87 billion in 2025 and

Read MoreReport Descriptions: The Global Mineral Ingredients Market was estimated at USD 8.12 billion in 2025

Read MoreReport Descriptions: The Global Feeding Distiller Dried Grains with Solubles (DGDS) Market was estim

Read More