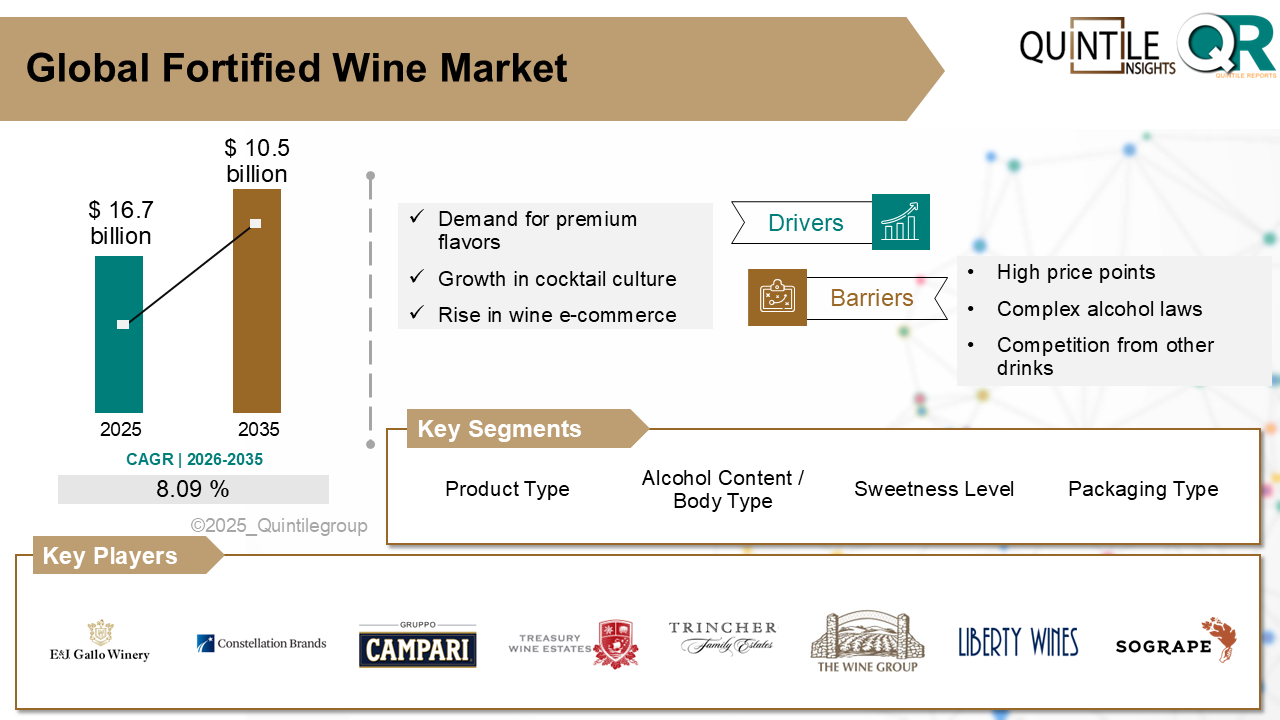

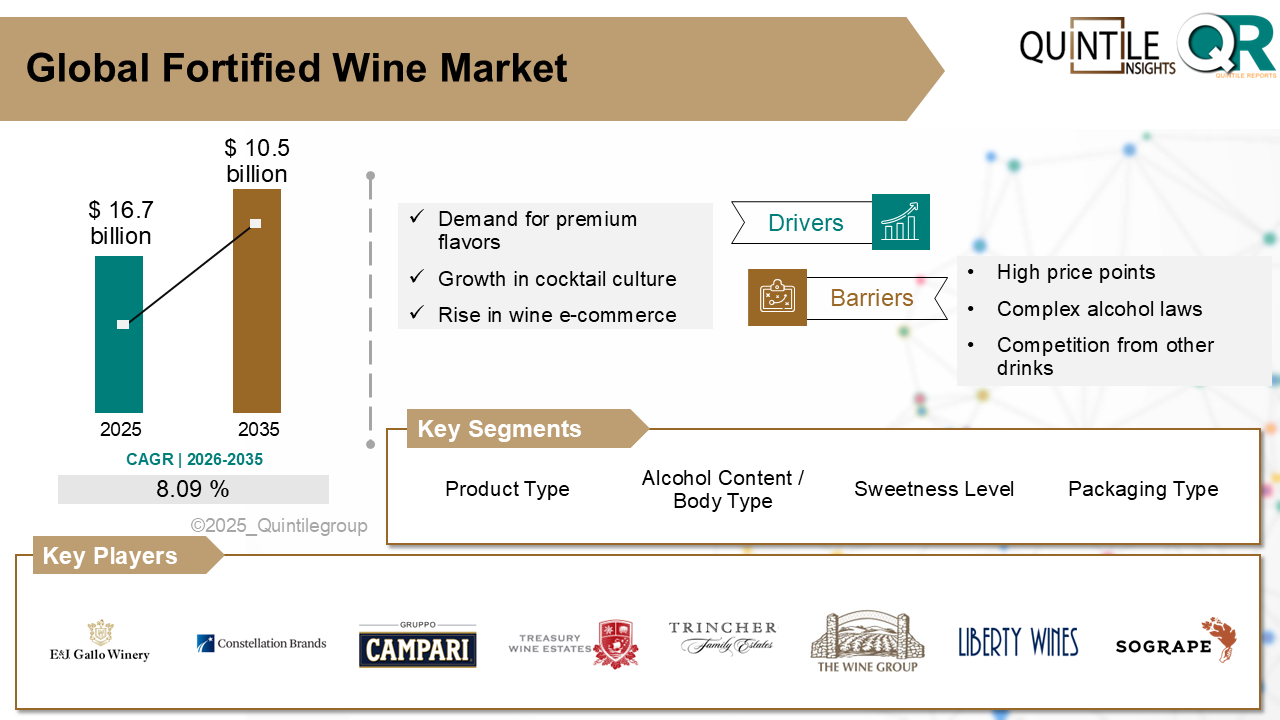

The Global Fortified Wine Market was estimated at USD 16.7 billion in 2025 and is projected to reach USD 10.5 billion by 2035, growing at a robust CAGR of 8.09% during the forecast period from 2026 to 2035. The Fortified Wine market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Fortified Wine market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

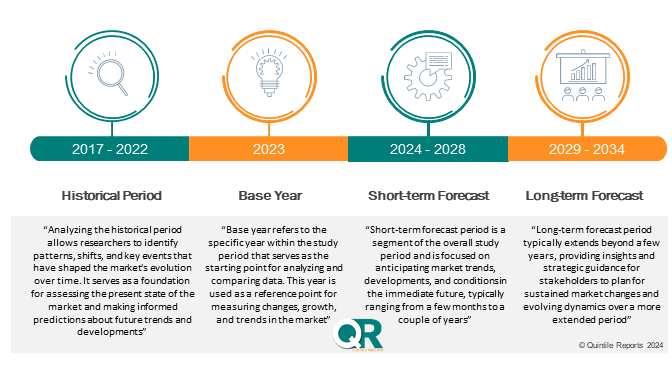

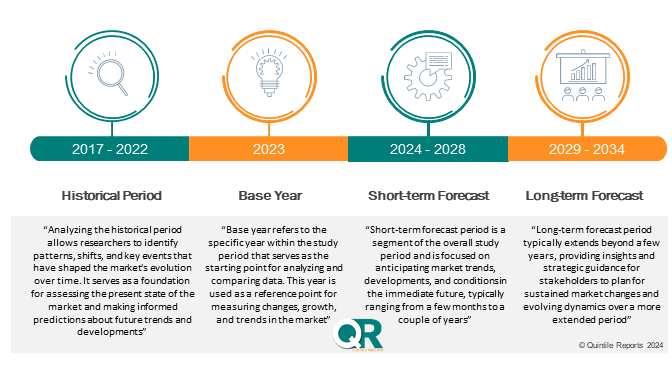

Historical Analysis (2017–2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026–2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026–2035, enabling stakeholders to evaluate market growth potential over the forecast period.

Fortified Wine Market

The fortified wine market refers to the global and regional market for wine products that have had distilled spirits (typically brandy or neutral grape spirit) added to boost alcohol content, enhance flavour profiles, and extend shelf life. This category includes traditional styles such as port, sherry, Madeira, Marsala, and vermouth, ranging from dry to sweet, aged to botanically infused formulations. Fortified wines are distributed across liquor stores, bars, restaurants, supermarkets, and online retail, and serve applications spanning fine dining, mixology, aperitifs, dessert pairings, and ready-to-drink cocktails.

Historically revered in European wine culture, fortified wines were staple choices for social and culinary rituals. In recent years, the market has experienced a revival driven by premiumization, artisanal craftsmanship, and rising interest among younger consumers for heritage and flavour diversity. Innovations include organic and biodynamic fortified varieties, low- and non-alcohol alternatives for wellness-conscious drinkers, and flavour-infused or barrel-aged blends. The surge in cocktail culture and wine tourism has also fuelled popularity, especially for vermouth and sherry, in mixology and tasting experiences. Across regions, Europe remains the largest market rooted in tradition, while Asia-Pacific (notably China and India) is the fastest-growing region supported by rising disposable incomes and changing drinking habits. The growth in e-commerce and direct-to-consumer platforms further enhances accessibility and niche brand visibility.

What are the drivers of the fortified wine market?The United States is a major growth market for fortified wines, propelled by the craft cocktail revival and demand for flavourful aperitifs. Regions such as California, New York, and Illinois lead in consumer experimentation and on-trade usage. Producers respond with botanical vermouths, barrel-aged sherries, and premium ports, leveraging DTC channels and upscale retail to reach younger, experience-seeking drinkers.

Germany: E-commerce & Shifting Consumption Boost Sales:Germany sees growing interest in fortified wines as consumers broaden their wine preferences. Online alcohol retailers and wine clubs expand selection and convenience, enabling discovery of imported and niche fortified labels. Consumers experimenting with aperitifs and cocktail culture are expanding the category beyond traditional contexts.

Japan: Ageing Population & Digestive-Health Positioning Support Uptake:Japan’s ageing demographic and interest in functional foods creates opportunities for fortified wines positioned with digestive or antioxidant attributes, or blended with botanicals perceived as digestive aids. Home-centred entertaining and premiumisation trends support demand for well-crafted, moderately portioned fortified wines.

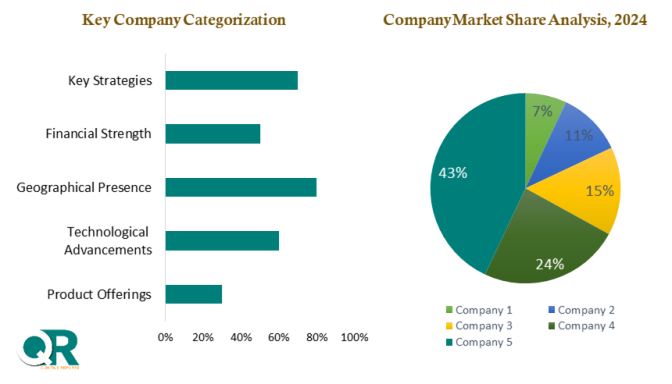

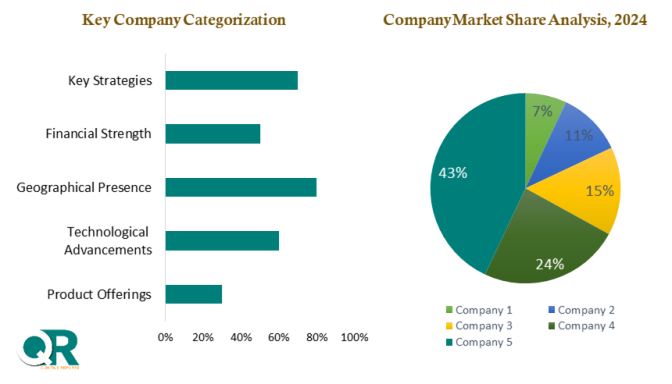

Competitive Analysis:The fortified wine market blends deep heritage producers and innovative challengers. Competitive differentiation is built on terroir and ageing credentials, flavour innovation (botanical infusions, barrel finishing), premium packaging, and experiential marketing (tastings, tourism). Distribution relationships with specialist importers, sommeliers, and cocktail bars are vital for market penetration. Producers expanding into new regions must navigate labelling laws and trade tariffs while telling compelling provenance stories to justify premium pricing.

Key competitive levers include product versatility (cocktail use, food pairing), sustainability credentials, limited editions, and collaborations with chefs and mixologists. Brands that can reinterpret fortified styles for modern occasions—lighter ABV blends, canned aperitifs, and cocktail-ready formats—tend to win younger consumers.

Key players in the market are E. & J. Gallo Winery, Constellation Brands, Davide Campari-Milano S.p.A., Bacardi Limited, Treasury Wine Estates, Trinchero Family Estates, The Wine Group LLC, Liberty Wines Limited, Sogrape SGPS SA, Sogevinus Fine Wines SA, Taylor’s Port (Taylor, Fladgate & Yeatman), Backsberg, Bodegas Williams & Humbert, González Byass, and Lustau.Recent Development:

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Fortified Wine market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Fortified Wine market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

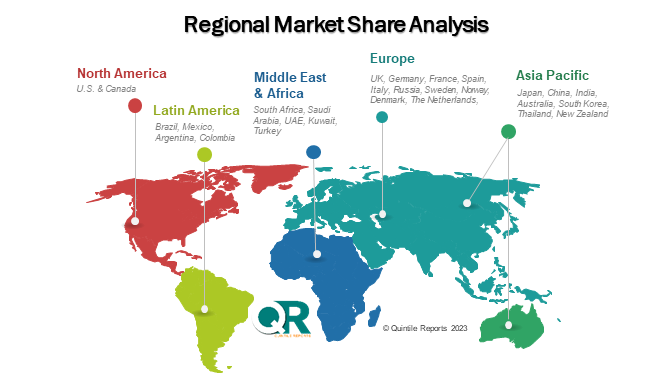

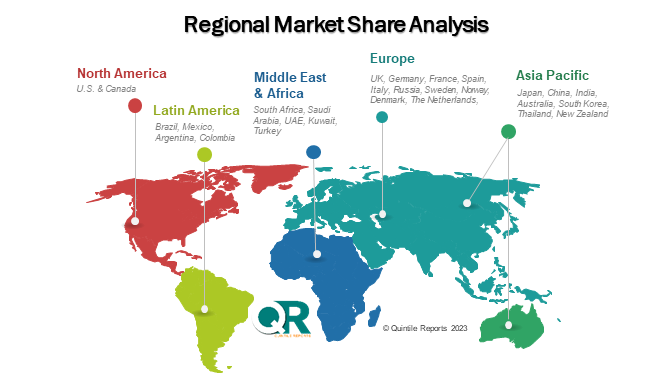

The chapter in Fortified Wine market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Fortified Wine market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Fortified Wine market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 8.09 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product Type |

|

| The Segment covered by Alcohol Content / Body Type |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Fortified Wine market share, size, and revenue growth rate were created by Quintile Report™. Fortified Wine analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Fortified Wine Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Fortified Wine Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Fortified Wine Market, by Region, (USD Million) 2017-2035

Table 21 China Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Fortified Wine Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Fortified Wine Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Fortified Wine Market: market scenario

Fig.4 Global Fortified Wine Market competitive outlook

Fig.5 Global Fortified Wine Market driver analysis

Fig.6 Global Fortified Wine Market restraint analysis

Fig.7 Global Fortified Wine Market opportunity analysis

Fig.8 Global Fortified Wine Market trends analysis

Fig.9 Global Fortified Wine Market: Segment Analysis (Based on the scope)

Fig.10 Global Fortified Wine Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Fortified Wine Market was estimated at USD 16.7 billion in 2025 and is projected to reach USD 10.5 billion by 2035, growing at a robust CAGR of 8.09% during the forecast period from 2026 to 2035. The Fortified Wine market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Fortified Wine market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017–2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026–2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026–2035, enabling stakeholders to evaluate market growth potential over the forecast period.

Fortified Wine Market

The fortified wine market refers to the global and regional market for wine products that have had distilled spirits (typically brandy or neutral grape spirit) added to boost alcohol content, enhance flavour profiles, and extend shelf life. This category includes traditional styles such as port, sherry, Madeira, Marsala, and vermouth, ranging from dry to sweet, aged to botanically infused formulations. Fortified wines are distributed across liquor stores, bars, restaurants, supermarkets, and online retail, and serve applications spanning fine dining, mixology, aperitifs, dessert pairings, and ready-to-drink cocktails.

Historically revered in European wine culture, fortified wines were staple choices for social and culinary rituals. In recent years, the market has experienced a revival driven by premiumization, artisanal craftsmanship, and rising interest among younger consumers for heritage and flavour diversity. Innovations include organic and biodynamic fortified varieties, low- and non-alcohol alternatives for wellness-conscious drinkers, and flavour-infused or barrel-aged blends. The surge in cocktail culture and wine tourism has also fuelled popularity, especially for vermouth and sherry, in mixology and tasting experiences. Across regions, Europe remains the largest market rooted in tradition, while Asia-Pacific (notably China and India) is the fastest-growing region supported by rising disposable incomes and changing drinking habits. The growth in e-commerce and direct-to-consumer platforms further enhances accessibility and niche brand visibility.

What are the drivers of the fortified wine market?The United States is a major growth market for fortified wines, propelled by the craft cocktail revival and demand for flavourful aperitifs. Regions such as California, New York, and Illinois lead in consumer experimentation and on-trade usage. Producers respond with botanical vermouths, barrel-aged sherries, and premium ports, leveraging DTC channels and upscale retail to reach younger, experience-seeking drinkers.

Germany: E-commerce & Shifting Consumption Boost Sales:Germany sees growing interest in fortified wines as consumers broaden their wine preferences. Online alcohol retailers and wine clubs expand selection and convenience, enabling discovery of imported and niche fortified labels. Consumers experimenting with aperitifs and cocktail culture are expanding the category beyond traditional contexts.

Japan: Ageing Population & Digestive-Health Positioning Support Uptake:Japan’s ageing demographic and interest in functional foods creates opportunities for fortified wines positioned with digestive or antioxidant attributes, or blended with botanicals perceived as digestive aids. Home-centred entertaining and premiumisation trends support demand for well-crafted, moderately portioned fortified wines.

Competitive Analysis:The fortified wine market blends deep heritage producers and innovative challengers. Competitive differentiation is built on terroir and ageing credentials, flavour innovation (botanical infusions, barrel finishing), premium packaging, and experiential marketing (tastings, tourism). Distribution relationships with specialist importers, sommeliers, and cocktail bars are vital for market penetration. Producers expanding into new regions must navigate labelling laws and trade tariffs while telling compelling provenance stories to justify premium pricing.

Key competitive levers include product versatility (cocktail use, food pairing), sustainability credentials, limited editions, and collaborations with chefs and mixologists. Brands that can reinterpret fortified styles for modern occasions—lighter ABV blends, canned aperitifs, and cocktail-ready formats—tend to win younger consumers.

Key players in the market are E. & J. Gallo Winery, Constellation Brands, Davide Campari-Milano S.p.A., Bacardi Limited, Treasury Wine Estates, Trinchero Family Estates, The Wine Group LLC, Liberty Wines Limited, Sogrape SGPS SA, Sogevinus Fine Wines SA, Taylor’s Port (Taylor, Fladgate & Yeatman), Backsberg, Bodegas Williams & Humbert, González Byass, and Lustau.Recent Development:

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Fortified Wine market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Fortified Wine market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Fortified Wine market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Fortified Wine market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Fortified Wine market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 8.09 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product Type |

|

| The Segment covered by Alcohol Content / Body Type |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Fortified Wine market share, size, and revenue growth rate were created by Quintile Report™. Fortified Wine analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Fortified Wine Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Fortified Wine Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Fortified Wine Market, by Region, (USD Million) 2017-2035

Table 21 China Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Fortified Wine Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Fortified Wine Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Fortified Wine Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Fortified Wine Market: market scenario

Fig.4 Global Fortified Wine Market competitive outlook

Fig.5 Global Fortified Wine Market driver analysis

Fig.6 Global Fortified Wine Market restraint analysis

Fig.7 Global Fortified Wine Market opportunity analysis

Fig.8 Global Fortified Wine Market trends analysis

Fig.9 Global Fortified Wine Market: Segment Analysis (Based on the scope)

Fig.10 Global Fortified Wine Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report Descriptions: The Global Non-GMO Flour Market was estimated at USD 72.87 billion in 2025 and

Read MoreReport Descriptions: The Global Mineral Ingredients Market was estimated at USD 8.12 billion in 2025

Read MoreReport Descriptions: The Global Feeding Distiller Dried Grains with Solubles (DGDS) Market was estim

Read More