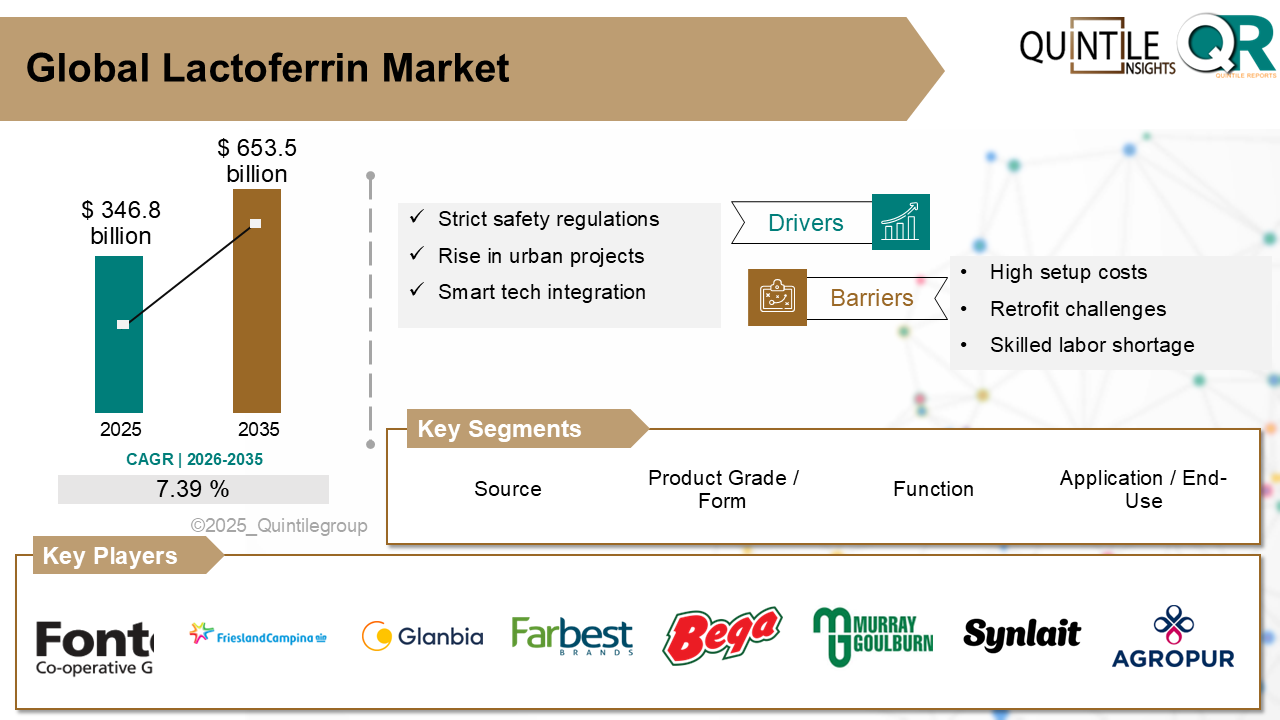

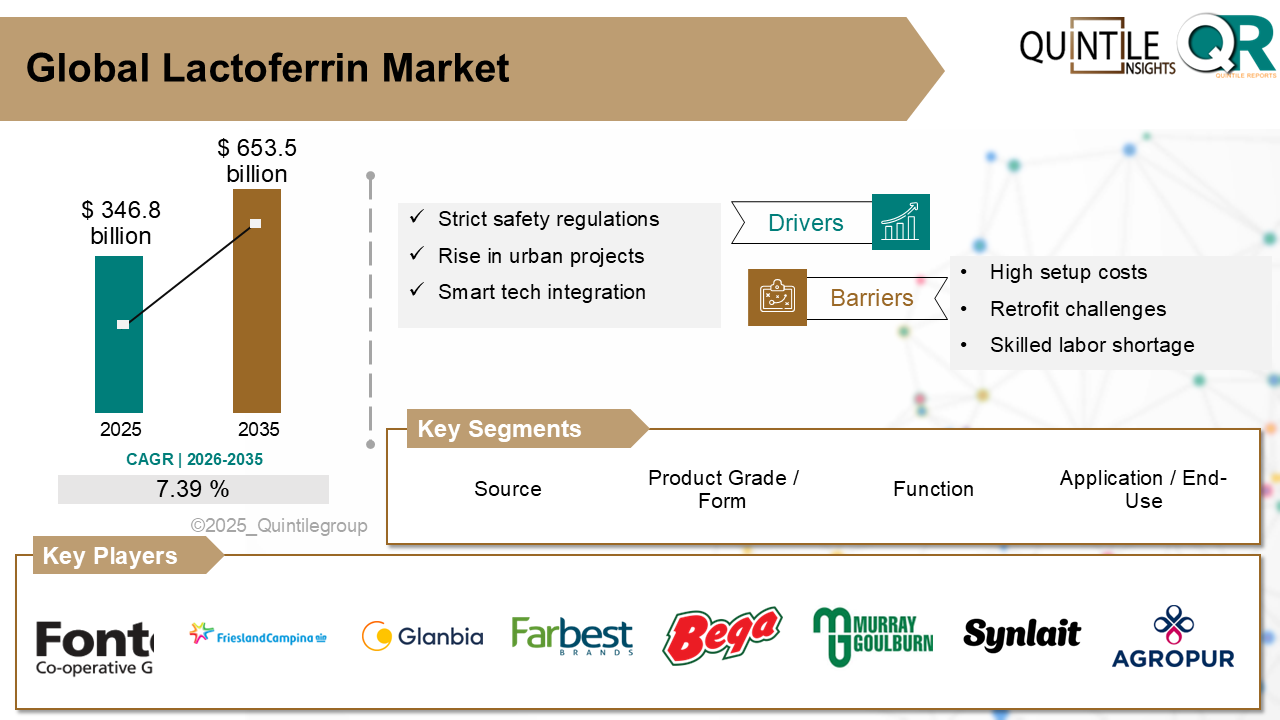

The Global Lactoferrin Market was estimated at USD 346.8 billion in 2025 and is projected to reach USD 653.5 billion by 2035, growing at a robust CAGR of 7.39% during the forecast period from 2026 to 2035. The Lactoferrin market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Lactoferrin market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017–2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026–2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026–2035, enabling stakeholders to evaluate market growth potential over the forecast period.

Lactoferrin Market

The lactoferrin market refers to the global and regional market for lactoferrin, a multifunctional iron-binding glycoprotein naturally found in human and bovine milk and secretions used across industries including infant nutrition, dietary supplements, pharmaceuticals, and personal care products. Products are available in bovine-derived and precision-fermented forms, with freeze-dried and spray-dried formats tailored for ease of formulation and stability. Applications span infant formula, immune-support supplements, functional foods, skincare, and therapeutic formulations where lactoferrin’s antimicrobial, anti-inflammatory, antioxidant, and iron-regulating properties are leveraged to support immunity, digestive health, and skin wellness.

Traditionally, lactoferrin was extracted from bovine whey as a premium ingredient for infant formulations and nutritional supplements. The market has since grown to include precision-fermented variants that offer ethical, scalable, and potentially lower-cost alternatives to milk-derived lactoferrin. Recent developments focus on expanding high-purity grades for pharmaceutical and clinical use, regulatory approvals for use in infant nutrition (e.g. Synlait’s bovine lactoferrin in ANZ), and a rising infusion into skincare and supplements as clean-label bioactive ingredients. Ongoing innovations in production methods and formulation science coupled with strong regional demand in Asia-Pacific, Europe, and North America are transforming lactoferrin into a strategic functional ingredient across multiple markets.

What are the drivers of the lactoferrin market?The United States lactoferrin market is experiencing significant expansion, primarily fueled by a heightened consumer focus on immune health and a strong demand for functional, naturally sourced ingredients. The pandemic further accelerated interest in immunity-boosting products, positioning lactoferrin as a key component in dietary supplements and functional foods designed to bolster the body's defences.

Furthermore, the trend towards preventive healthcare and an increased understanding of gut-immune axis connections are driving innovation in the U.S. market. Manufacturers are increasingly incorporating lactoferrin into a wide array of products, from everyday dairy items to specialised nutritional supplements, catering to a health-conscious populace seeking proactive wellness solutions.

Germany’s Rise in Sports Nutrition and Gut Health Awareness Boosts Adoption:Germany's lactoferrin market is witnessing increasing traction, primarily propelled by the burgeoning sports nutrition sector and a growing awareness of the importance of gut health. Athletes and fitness enthusiasts are increasingly seeking supplements and functional foods that aid in recovery, enhance performance, and support overall well-being, where lactoferrin's immune-modulating and anti-inflammatory properties are highly valued.

Moreover, the broader consumer understanding of the gut microbiome's role in overall health is driving demand for ingredients that support digestive wellness. Lactoferrin's ability to protect intestinal flora and its antimicrobial effects make it an attractive ingredient for German consumers looking for natural solutions to improve gut health and strengthen their immune system.

Japan’s focus on Infant Nutrition and Anti-Ageing Applications Propel Market Expansion:Japan's lactoferrin market is steadily growing, significantly driven by its established leadership in high-quality infant nutrition and emerging applications in anti-ageing and cosmetic products. Lactoferrin is widely recognised and utilised in Japanese infant formulas due to its resemblance to breast milk components, aiming to provide optimal immune and developmental support for infants.

Beyond infant nutrition, there is a burgeoning interest in lactoferrin's potential in anti-aging and dermatological applications within Japan. Its antioxidant and anti-inflammatory properties are being explored for functional cosmetics and supplements aimed at skin health, reflecting a holistic approach to wellness and beauty among Japanese consumers.

Competitive Analysis:The lactoferrin industry is driven by its scientifically validated health benefits, particularly its crucial role in immune modulation and iron absorption, appealing to diverse end-use segments. Key players, predominantly dairy ingredient companies, leverage their extensive raw material sourcing from bovine milk. Their competitive advantage stems from consistent high purity, processing efficiency, and the ability to produce different grades for various applications.

A key competitive trend involves innovation in production methods, including the emergence of precision fermentation. This allows for higher yields and potentially more sustainable production, attracting new players and expanding the supply base. Companies are also developing new formulations, such as spray-dried lactoferrin for ease of incorporation, driving the ingredient into novel functional food and beverage products without compromising its bioactivity.

Investment in scientific research and clinical studies is becoming a major distinguishing factor. Lactoferrin manufacturers are increasingly spending on research to substantiate specific health claims, enhancing product credibility and consumer trust. Technical support, regulatory compliance, and a clear communication of the evidence-based benefits reinforce value perceptions, particularly in the high-value infant formula and pharmaceutical segments.

Regional market dynamics and access to distribution channels play a critical role in competitiveness. Asia-Pacific, especially China and Japan, dominates the market due to strong demand for infant formula and immune-boosting supplements

Recent Development:In June 2025, FrieslandCampina Ingredients showcased its comprehensive portfolio of dairy ingredients, including Bovamilk Lactoferrin, at industry events. They emphasise its role in infant formula and early life nutrition, and its benefits for immune support and gut health across different age groups. This indicates their continued strong focus and promotion of lactoferrin in various applications.

In April 2024, FrieslandCampina Ingredients expanded its Nutri Whey Isolate portfolio with new variants, demonstrating ongoing innovation in high-value dairy proteins, which often aligns with their lactoferrin production and market strategy.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Lactoferrin market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Lactoferrin market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Lactoferrin market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Lactoferrin market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Lactoferrin market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 7.39 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Source |

|

| The Segment covered by Product Grade / Form |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Lactoferrin market share, size, and revenue growth rate were created by Quintile Report™. Lactoferrin analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Lactoferrin Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Lactoferrin Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Lactoferrin Market, by Region, (USD Million) 2017-2035

Table 21 China Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Lactoferrin Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Lactoferrin Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Lactoferrin Market: market scenario

Fig.4 Global Lactoferrin Market competitive outlook

Fig.5 Global Lactoferrin Market driver analysis

Fig.6 Global Lactoferrin Market restraint analysis

Fig.7 Global Lactoferrin Market opportunity analysis

Fig.8 Global Lactoferrin Market trends analysis

Fig.9 Global Lactoferrin Market: Segment Analysis (Based on the scope)

Fig.10 Global Lactoferrin Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Lactoferrin Market was estimated at USD 346.8 billion in 2025 and is projected to reach USD 653.5 billion by 2035, growing at a robust CAGR of 7.39% during the forecast period from 2026 to 2035. The Lactoferrin market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Lactoferrin market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017–2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026–2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026–2035, enabling stakeholders to evaluate market growth potential over the forecast period.

Lactoferrin Market

The lactoferrin market refers to the global and regional market for lactoferrin, a multifunctional iron-binding glycoprotein naturally found in human and bovine milk and secretions used across industries including infant nutrition, dietary supplements, pharmaceuticals, and personal care products. Products are available in bovine-derived and precision-fermented forms, with freeze-dried and spray-dried formats tailored for ease of formulation and stability. Applications span infant formula, immune-support supplements, functional foods, skincare, and therapeutic formulations where lactoferrin’s antimicrobial, anti-inflammatory, antioxidant, and iron-regulating properties are leveraged to support immunity, digestive health, and skin wellness.

Traditionally, lactoferrin was extracted from bovine whey as a premium ingredient for infant formulations and nutritional supplements. The market has since grown to include precision-fermented variants that offer ethical, scalable, and potentially lower-cost alternatives to milk-derived lactoferrin. Recent developments focus on expanding high-purity grades for pharmaceutical and clinical use, regulatory approvals for use in infant nutrition (e.g. Synlait’s bovine lactoferrin in ANZ), and a rising infusion into skincare and supplements as clean-label bioactive ingredients. Ongoing innovations in production methods and formulation science coupled with strong regional demand in Asia-Pacific, Europe, and North America are transforming lactoferrin into a strategic functional ingredient across multiple markets.

What are the drivers of the lactoferrin market?The United States lactoferrin market is experiencing significant expansion, primarily fueled by a heightened consumer focus on immune health and a strong demand for functional, naturally sourced ingredients. The pandemic further accelerated interest in immunity-boosting products, positioning lactoferrin as a key component in dietary supplements and functional foods designed to bolster the body's defences.

Furthermore, the trend towards preventive healthcare and an increased understanding of gut-immune axis connections are driving innovation in the U.S. market. Manufacturers are increasingly incorporating lactoferrin into a wide array of products, from everyday dairy items to specialised nutritional supplements, catering to a health-conscious populace seeking proactive wellness solutions.

Germany’s Rise in Sports Nutrition and Gut Health Awareness Boosts Adoption:Germany's lactoferrin market is witnessing increasing traction, primarily propelled by the burgeoning sports nutrition sector and a growing awareness of the importance of gut health. Athletes and fitness enthusiasts are increasingly seeking supplements and functional foods that aid in recovery, enhance performance, and support overall well-being, where lactoferrin's immune-modulating and anti-inflammatory properties are highly valued.

Moreover, the broader consumer understanding of the gut microbiome's role in overall health is driving demand for ingredients that support digestive wellness. Lactoferrin's ability to protect intestinal flora and its antimicrobial effects make it an attractive ingredient for German consumers looking for natural solutions to improve gut health and strengthen their immune system.

Japan’s focus on Infant Nutrition and Anti-Ageing Applications Propel Market Expansion:Japan's lactoferrin market is steadily growing, significantly driven by its established leadership in high-quality infant nutrition and emerging applications in anti-ageing and cosmetic products. Lactoferrin is widely recognised and utilised in Japanese infant formulas due to its resemblance to breast milk components, aiming to provide optimal immune and developmental support for infants.

Beyond infant nutrition, there is a burgeoning interest in lactoferrin's potential in anti-aging and dermatological applications within Japan. Its antioxidant and anti-inflammatory properties are being explored for functional cosmetics and supplements aimed at skin health, reflecting a holistic approach to wellness and beauty among Japanese consumers.

Competitive Analysis:The lactoferrin industry is driven by its scientifically validated health benefits, particularly its crucial role in immune modulation and iron absorption, appealing to diverse end-use segments. Key players, predominantly dairy ingredient companies, leverage their extensive raw material sourcing from bovine milk. Their competitive advantage stems from consistent high purity, processing efficiency, and the ability to produce different grades for various applications.

A key competitive trend involves innovation in production methods, including the emergence of precision fermentation. This allows for higher yields and potentially more sustainable production, attracting new players and expanding the supply base. Companies are also developing new formulations, such as spray-dried lactoferrin for ease of incorporation, driving the ingredient into novel functional food and beverage products without compromising its bioactivity.

Investment in scientific research and clinical studies is becoming a major distinguishing factor. Lactoferrin manufacturers are increasingly spending on research to substantiate specific health claims, enhancing product credibility and consumer trust. Technical support, regulatory compliance, and a clear communication of the evidence-based benefits reinforce value perceptions, particularly in the high-value infant formula and pharmaceutical segments.

Regional market dynamics and access to distribution channels play a critical role in competitiveness. Asia-Pacific, especially China and Japan, dominates the market due to strong demand for infant formula and immune-boosting supplements

Recent Development:In June 2025, FrieslandCampina Ingredients showcased its comprehensive portfolio of dairy ingredients, including Bovamilk Lactoferrin, at industry events. They emphasise its role in infant formula and early life nutrition, and its benefits for immune support and gut health across different age groups. This indicates their continued strong focus and promotion of lactoferrin in various applications.

In April 2024, FrieslandCampina Ingredients expanded its Nutri Whey Isolate portfolio with new variants, demonstrating ongoing innovation in high-value dairy proteins, which often aligns with their lactoferrin production and market strategy.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Lactoferrin market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Lactoferrin market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Lactoferrin market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Lactoferrin market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Lactoferrin market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 7.39 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Source |

|

| The Segment covered by Product Grade / Form |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Lactoferrin market share, size, and revenue growth rate were created by Quintile Report™. Lactoferrin analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Lactoferrin Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Lactoferrin Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Lactoferrin Market, by Region, (USD Million) 2017-2035

Table 21 China Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Lactoferrin Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Lactoferrin Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Lactoferrin Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Lactoferrin Market: market scenario

Fig.4 Global Lactoferrin Market competitive outlook

Fig.5 Global Lactoferrin Market driver analysis

Fig.6 Global Lactoferrin Market restraint analysis

Fig.7 Global Lactoferrin Market opportunity analysis

Fig.8 Global Lactoferrin Market trends analysis

Fig.9 Global Lactoferrin Market: Segment Analysis (Based on the scope)

Fig.10 Global Lactoferrin Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report Descriptions: The Global Non-GMO Flour Market was estimated at USD 72.87 billion in 2025 and

Read MoreReport Descriptions: The Global Mineral Ingredients Market was estimated at USD 8.12 billion in 2025

Read MoreReport Descriptions: The Global Feeding Distiller Dried Grains with Solubles (DGDS) Market was estim

Read More