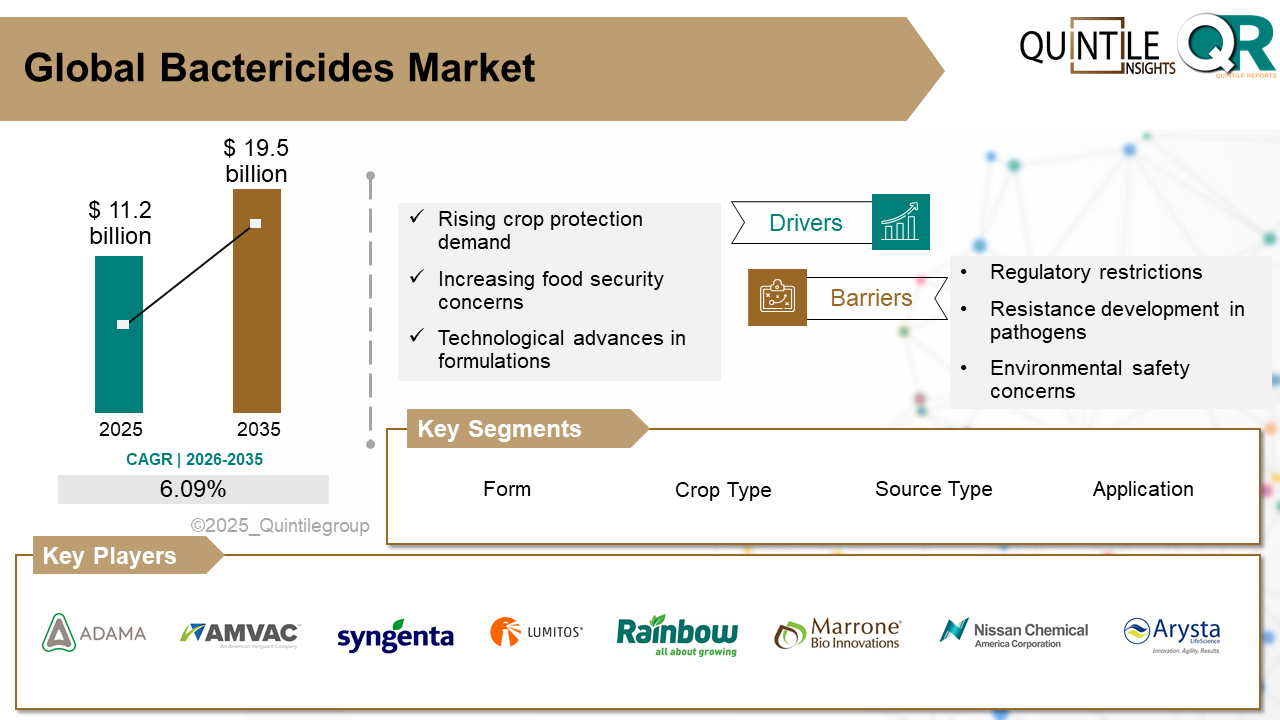

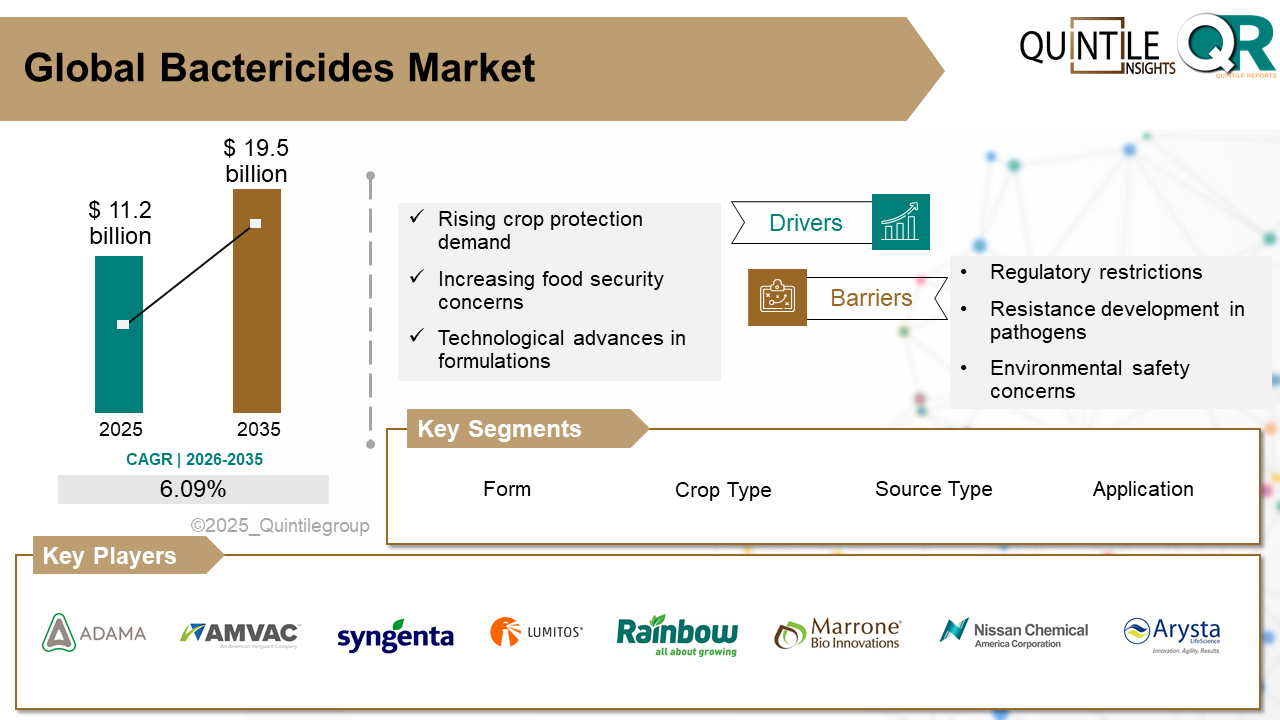

The Global Bactericides Market was estimated at USD 11.2 billion in 2025 and is projected to reach USD 19.5 billion by 2035, growing at a robust CAGR of 6.09% during the forecast period from 2026 to 2035. The Bactericides market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Bactericides market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017–2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026–2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026–2035, enabling stakeholders to evaluate market growth potential over the forecast period.

Bactericides Market

The bactericides market refers to the global and regional market for chemical synthetic or natural that prevents or eliminates bacterial growth. In agriculture, misuse of bactericides has contributed to multidrug-resistant strains, posing global risks. Nanotechnology offers a promising alternative, with metallic and non-metallic nanoparticles (NPs) showing potential due to their ability to interact with microbes, provided their properties and microbial biology are well understood.

Recent research highlights the success of NPs like silver, copper, and chitosan in controlling plant diseases. For example, Ag-NPs from holy basil extract inhibited Xanthomonas on pomegranate, Cu NPs suppressed pathogens like Erwinia amylovora, and chitosan NPs reduced Xanthomonas in chili peppers. These nano-based treatments also improved crop health and nutrient uptake, positioning nanobactericides as a sustainable tool in modern agriculture.

What are the drivers of bactericides market?Growing global concern over crop losses due to bacterial diseases has significantly boosted the demand for bactericides in agriculture. Crops like tomatoes, rice, and citrus are increasingly affected by bacterial blights and wilts, compelling farmers to adopt bactericidal products to safeguard yield and income.

The rise in integrated pest management (IPM) and sustainable farming practices has led to increased use of bactericides that complement fungicides and insecticides. Bactericides, especially copper-based or biological formulations, play a vital role in IPM strategies due to their targeted action and relatively lower environmental impact.

Increased investment in R&D for safer and more effective bactericide formulations is contributing to market expansion. Innovation in nano-based delivery systems, systemic action bactericides, and bio-bactericides are enhancing efficiency while aligning with stricter regulatory and environmental safety norms.

The growth of horticulture and high-value crops in regions like Europe, North America, and parts of Asia is driving demand for crop protection inputs such as bactericides. Farmers cultivating fruits, vegetables, and ornamentals often rely on preventive bactericide applications due to their susceptibility to bacterial infections.

Stringent food safety regulations and export quality standards are encouraging the adoption of bactericides to reduce microbial contamination on produce. For example, several countries now require zero tolerance for certain bacterial contaminants in fresh exports, driving pre-harvest and post-harvest bactericide use.

What are the challenges and restraining factors of bactericides market?Regulatory restrictions on synthetic chemical bactericides, especially those with heavy metals like copper or antibiotics such as streptomycin, are posing serious limitations. These bans or usage limits in many countries push the industry toward finding replacements, which can be costly and slower to commercialize.

Resistance development in bacterial strains, particularly in intensively farmed crops, is diminishing the efficacy of traditional bactericides. Overuse or misuse of bactericides can accelerate resistance, reducing control options and requiring integrated resistance management strategies.

High costs and limited availability of effective biological or organic-certified bactericides remain a challenge, especially for smallholder farmers in developing regions. These products often have shorter shelf lives, require specific storage conditions, and may have slower or variable field performance compared to conventional alternatives.

What are the regional trends of bactericides market?In North America, especially the United States and Canada, the bactericide market is driven by advanced farming practices and regulatory support for integrated pest management. High-value crops like fruits, vegetables, and tree nuts demand consistent bacterial disease control, and growers are rapidly adopting both conventional and biological bactericides. Increasing pressure to reduce chemical residues is also encouraging innovation in residue-free and biocontrol products.

In Europe, the market is heavily influenced by stringent regulations on pesticide use and environmental safety. Copper-based bactericides remain in use but are under increasing scrutiny, which is pushing demand for organic-certified and biological bactericides. Countries like Spain, Italy, and France with large fruit and vegetable production areas are key users, especially in grapevine and tomato cultivation where bacterial diseases are prevalent.

In the Asia-Pacific region, rapid agricultural expansion in countries such as China, India, and Vietnam is driving growth in bactericide use. The region sees frequent outbreaks of bacterial diseases due to warm, humid climates, particularly in rice, citrus, and solanaceous crops. Increasing awareness of crop protection practices and government efforts to boost farm productivity are further fueling demand for bactericides.

In Latin America, countries like Brazil, Argentina, and Mexico are experiencing a rise in bactericide usage due to the growth of export-oriented horticulture. Citrus canker, bacterial blights, and other diseases affecting major crops have pushed growers to adopt preventive treatments. However, product availability and farmer education still vary significantly across the region, creating uneven growth patterns.

In the Middle East and Africa, the bactericide market remains emerging, though rising food security initiatives and climate-related disease pressure are gradually increasing demand. Greenhouse farming in Gulf countries and horticulture expansion in North and Sub-Saharan Africa are notable drivers. However, limited access to modern crop protection tools and regulatory challenges continue to hamper large-scale adoption.

Country-Wise Outlook:U.S. Bactericide Demand Fueled by Large-Scale Farming: The United States bactericide market benefits from advanced agricultural practices, a large-scale commercial farming structure, and substantial government support for crop protection research. The prevalence of bacterial plant diseases in crops such as tomatoes, peppers, and citrus has necessitated the frequent use of bactericides, especially in southern and southeastern states where warm and humid conditions promote pathogen growth. The integration of precision agriculture and adoption of integrated pest management (IPM) techniques have also driven demand for more targeted bactericide formulations.

In addition to agriculture, the use of bactericides in public health, food processing, and industrial water treatment applications strengthens the market landscape. The U.S. Environmental Protection Agency (EPA) plays a pivotal role in the regulation and approval of bactericides, ensuring that products are both effective and environmentally safe. Consumer preference for chemical-free produce and the growing popularity of organic farming has also led to increased innovation in biobased bactericide solutions across the country.

Germany Leads in Sustainable Bactericide Solutions: Germany presents a mature and environmentally conscious bactericide market shaped by stringent regulatory norms and a strong emphasis on sustainability. Farmers are increasingly adopting bactericide solutions that align with the European Union’s Green Deal and Farm to Fork strategy, which promotes reduced reliance on chemical pesticides. The agricultural sector in Germany focuses on high-value crops like grapes, potatoes, and leafy vegetables, where bacterial infections can lead to significant quality losses.

Additionally, Germany's robust research ecosystem encourages the development of next-generation bactericides, including biologically derived and microbe-targeting solutions. Collaboration between public institutions, universities, and agri-tech companies supports continuous innovation. Furthermore, the country's advanced waste and water treatment infrastructure contributes to steady demand for industrial bactericides beyond agriculture.

Japan Focuses on Precision Bactericide Applications: Japan’s bactericide market is influenced by its densely populated urban structure and limited arable land, which puts pressure on maximizing agricultural yield within confined spaces. The country’s preference for high-quality and blemish-free produce makes disease prevention a top priority for farmers. Bacterial diseases in rice paddies and horticultural crops continue to drive the adoption of targeted bactericide applications, often supported by government-led agricultural initiatives.

In addition, Japan has seen a rising trend toward environmentally friendly bactericide products, driven by consumer awareness and strict national policies on chemical usage. The integration of robotics and automation in farming practices also encourages precise and efficient bactericide application, reducing waste and promoting sustainable practices. Local manufacturers and research institutes play a significant role in producing specialized solutions tailored to Japan’s unique agricultural conditions.

Competitive Analysis:The bactericide market is moderately fragmented, with a mix of global agrochemical giants and emerging biopesticide companies. Major players compete through product innovation, regulatory compliance, and regional market reach. Companies like BASF, Bayer, Corteva Agriscience, and Syngenta dominate due to their extensive product portfolios and R&D infrastructure, enabling them to respond to changing resistance patterns and evolving regulatory standards.

Innovation plays a critical role in maintaining competitive edge. Firms are increasingly investing in the development of biologically derived bactericides and resistance-management solutions to meet demand for environmentally sustainable alternatives. Partnerships with biotech startups and academic institutions are becoming more common, facilitating access to new microbial strains and delivery technologies.

Geographic diversification is another key strategy. Companies that can tailor formulations to specific regional crop diseases or climate conditions tend to perform better. For instance, tailored products for bacterial spot in tomatoes or fire blight in apples help players strengthen market share in regions such as North America and Europe, where regulatory approval is rigorous.

The competitive landscape is also influenced by regulatory frameworks. Companies with experience navigating strict pesticide approval processes especially in the EU and Japan are better positioned for long-term success. Product withdrawals due to non-compliance or environmental concerns can impact reputations and market share, giving an advantage to firms with robust compliance and safety track records.

Smaller players and regional manufacturers are increasingly gaining traction through cost-effective and niche solutions, especially in developing markets across Asia-Pacific and Latin America. These firms often focus on localized needs and offer competitively priced products. As resistance issues and sustainability pressures increase, competition is expected to intensify around the innovation and commercialization of next-generation bactericides.

Key players in the market are ADAMA Agricultural Solutions Ltd., AMVAC Chemical Corporation, Syngenta AG, LUMITOS AG, Rainbow Agro, Oxon Italia S.p.A, Marrone Bio Innovations, Nissan Chemical Corporation, Arysta LifeScience Corporation, BASF SE, Bayer AG, FMC Corporation, Corteva, Nufarm Limited, Sumitomo Chemical Co., Ltd., and other players.Recent Development:In February 2025, UPL Corp received a Section 18 emergency exemption from the U.S. EPA and California Department of Pesticide Regulation for the use of KASUMIN® 2L bactericide to prevent bacterial blast in almonds. The exemption allows application across up to 107,143 acres in 16 California counties from February 1 to April 15, 2025, providing growers with a preventive solution during bloom when cold, wet conditions heighten disease risk.

In February 2025, The International Organization for Standardization (ISO) has officially approved the common name “fluquinometoate” for a quinolinone bactericide developed by Shandong United Pesticide Industry Co., Ltd.

In March 2024, the U.S. Environmental Protection Agency granted expanded approval for Sym-Agro’s Instill®, a copper sulfate–based bactericide. This registration now covers new crops such as coffee, potato, hazelnut, and sugar beet. Instill® is notable for its systemically absorbed copper sulfate pentahydrate, which helps provide up to 21 days of internal protection in treated plants.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Bactericides market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Bactericides market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Bactericides market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Bactericides market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Bactericides market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 6.09 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Form |

|

| The Segment covered by Crop Type |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Bactericides market share, size, and revenue growth rate were created by Quintile Report™. Bactericides analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Bactericides Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Bactericides Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Bactericides Market, by Region, (USD Million) 2017-2035

Table 21 China Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Bactericides Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Bactericides Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Bactericides Market: market scenario

Fig.4 Global Bactericides Market competitive outlook

Fig.5 Global Bactericides Market driver analysis

Fig.6 Global Bactericides Market restraint analysis

Fig.7 Global Bactericides Market opportunity analysis

Fig.8 Global Bactericides Market trends analysis

Fig.9 Global Bactericides Market: Segment Analysis (Based on the scope)

Fig.10 Global Bactericides Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Bactericides Market was estimated at USD 11.2 billion in 2025 and is projected to reach USD 19.5 billion by 2035, growing at a robust CAGR of 6.09% during the forecast period from 2026 to 2035. The Bactericides market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Bactericides market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017–2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026–2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026–2035, enabling stakeholders to evaluate market growth potential over the forecast period.

Bactericides Market

The bactericides market refers to the global and regional market for chemical synthetic or natural that prevents or eliminates bacterial growth. In agriculture, misuse of bactericides has contributed to multidrug-resistant strains, posing global risks. Nanotechnology offers a promising alternative, with metallic and non-metallic nanoparticles (NPs) showing potential due to their ability to interact with microbes, provided their properties and microbial biology are well understood.

Recent research highlights the success of NPs like silver, copper, and chitosan in controlling plant diseases. For example, Ag-NPs from holy basil extract inhibited Xanthomonas on pomegranate, Cu NPs suppressed pathogens like Erwinia amylovora, and chitosan NPs reduced Xanthomonas in chili peppers. These nano-based treatments also improved crop health and nutrient uptake, positioning nanobactericides as a sustainable tool in modern agriculture.

What are the drivers of bactericides market?Growing global concern over crop losses due to bacterial diseases has significantly boosted the demand for bactericides in agriculture. Crops like tomatoes, rice, and citrus are increasingly affected by bacterial blights and wilts, compelling farmers to adopt bactericidal products to safeguard yield and income.

The rise in integrated pest management (IPM) and sustainable farming practices has led to increased use of bactericides that complement fungicides and insecticides. Bactericides, especially copper-based or biological formulations, play a vital role in IPM strategies due to their targeted action and relatively lower environmental impact.

Increased investment in R&D for safer and more effective bactericide formulations is contributing to market expansion. Innovation in nano-based delivery systems, systemic action bactericides, and bio-bactericides are enhancing efficiency while aligning with stricter regulatory and environmental safety norms.

The growth of horticulture and high-value crops in regions like Europe, North America, and parts of Asia is driving demand for crop protection inputs such as bactericides. Farmers cultivating fruits, vegetables, and ornamentals often rely on preventive bactericide applications due to their susceptibility to bacterial infections.

Stringent food safety regulations and export quality standards are encouraging the adoption of bactericides to reduce microbial contamination on produce. For example, several countries now require zero tolerance for certain bacterial contaminants in fresh exports, driving pre-harvest and post-harvest bactericide use.

What are the challenges and restraining factors of bactericides market?Regulatory restrictions on synthetic chemical bactericides, especially those with heavy metals like copper or antibiotics such as streptomycin, are posing serious limitations. These bans or usage limits in many countries push the industry toward finding replacements, which can be costly and slower to commercialize.

Resistance development in bacterial strains, particularly in intensively farmed crops, is diminishing the efficacy of traditional bactericides. Overuse or misuse of bactericides can accelerate resistance, reducing control options and requiring integrated resistance management strategies.

High costs and limited availability of effective biological or organic-certified bactericides remain a challenge, especially for smallholder farmers in developing regions. These products often have shorter shelf lives, require specific storage conditions, and may have slower or variable field performance compared to conventional alternatives.

What are the regional trends of bactericides market?In North America, especially the United States and Canada, the bactericide market is driven by advanced farming practices and regulatory support for integrated pest management. High-value crops like fruits, vegetables, and tree nuts demand consistent bacterial disease control, and growers are rapidly adopting both conventional and biological bactericides. Increasing pressure to reduce chemical residues is also encouraging innovation in residue-free and biocontrol products.

In Europe, the market is heavily influenced by stringent regulations on pesticide use and environmental safety. Copper-based bactericides remain in use but are under increasing scrutiny, which is pushing demand for organic-certified and biological bactericides. Countries like Spain, Italy, and France with large fruit and vegetable production areas are key users, especially in grapevine and tomato cultivation where bacterial diseases are prevalent.

In the Asia-Pacific region, rapid agricultural expansion in countries such as China, India, and Vietnam is driving growth in bactericide use. The region sees frequent outbreaks of bacterial diseases due to warm, humid climates, particularly in rice, citrus, and solanaceous crops. Increasing awareness of crop protection practices and government efforts to boost farm productivity are further fueling demand for bactericides.

In Latin America, countries like Brazil, Argentina, and Mexico are experiencing a rise in bactericide usage due to the growth of export-oriented horticulture. Citrus canker, bacterial blights, and other diseases affecting major crops have pushed growers to adopt preventive treatments. However, product availability and farmer education still vary significantly across the region, creating uneven growth patterns.

In the Middle East and Africa, the bactericide market remains emerging, though rising food security initiatives and climate-related disease pressure are gradually increasing demand. Greenhouse farming in Gulf countries and horticulture expansion in North and Sub-Saharan Africa are notable drivers. However, limited access to modern crop protection tools and regulatory challenges continue to hamper large-scale adoption.

Country-Wise Outlook:U.S. Bactericide Demand Fueled by Large-Scale Farming: The United States bactericide market benefits from advanced agricultural practices, a large-scale commercial farming structure, and substantial government support for crop protection research. The prevalence of bacterial plant diseases in crops such as tomatoes, peppers, and citrus has necessitated the frequent use of bactericides, especially in southern and southeastern states where warm and humid conditions promote pathogen growth. The integration of precision agriculture and adoption of integrated pest management (IPM) techniques have also driven demand for more targeted bactericide formulations.

In addition to agriculture, the use of bactericides in public health, food processing, and industrial water treatment applications strengthens the market landscape. The U.S. Environmental Protection Agency (EPA) plays a pivotal role in the regulation and approval of bactericides, ensuring that products are both effective and environmentally safe. Consumer preference for chemical-free produce and the growing popularity of organic farming has also led to increased innovation in biobased bactericide solutions across the country.

Germany Leads in Sustainable Bactericide Solutions: Germany presents a mature and environmentally conscious bactericide market shaped by stringent regulatory norms and a strong emphasis on sustainability. Farmers are increasingly adopting bactericide solutions that align with the European Union’s Green Deal and Farm to Fork strategy, which promotes reduced reliance on chemical pesticides. The agricultural sector in Germany focuses on high-value crops like grapes, potatoes, and leafy vegetables, where bacterial infections can lead to significant quality losses.

Additionally, Germany's robust research ecosystem encourages the development of next-generation bactericides, including biologically derived and microbe-targeting solutions. Collaboration between public institutions, universities, and agri-tech companies supports continuous innovation. Furthermore, the country's advanced waste and water treatment infrastructure contributes to steady demand for industrial bactericides beyond agriculture.

Japan Focuses on Precision Bactericide Applications: Japan’s bactericide market is influenced by its densely populated urban structure and limited arable land, which puts pressure on maximizing agricultural yield within confined spaces. The country’s preference for high-quality and blemish-free produce makes disease prevention a top priority for farmers. Bacterial diseases in rice paddies and horticultural crops continue to drive the adoption of targeted bactericide applications, often supported by government-led agricultural initiatives.

In addition, Japan has seen a rising trend toward environmentally friendly bactericide products, driven by consumer awareness and strict national policies on chemical usage. The integration of robotics and automation in farming practices also encourages precise and efficient bactericide application, reducing waste and promoting sustainable practices. Local manufacturers and research institutes play a significant role in producing specialized solutions tailored to Japan’s unique agricultural conditions.

Competitive Analysis:The bactericide market is moderately fragmented, with a mix of global agrochemical giants and emerging biopesticide companies. Major players compete through product innovation, regulatory compliance, and regional market reach. Companies like BASF, Bayer, Corteva Agriscience, and Syngenta dominate due to their extensive product portfolios and R&D infrastructure, enabling them to respond to changing resistance patterns and evolving regulatory standards.

Innovation plays a critical role in maintaining competitive edge. Firms are increasingly investing in the development of biologically derived bactericides and resistance-management solutions to meet demand for environmentally sustainable alternatives. Partnerships with biotech startups and academic institutions are becoming more common, facilitating access to new microbial strains and delivery technologies.

Geographic diversification is another key strategy. Companies that can tailor formulations to specific regional crop diseases or climate conditions tend to perform better. For instance, tailored products for bacterial spot in tomatoes or fire blight in apples help players strengthen market share in regions such as North America and Europe, where regulatory approval is rigorous.

The competitive landscape is also influenced by regulatory frameworks. Companies with experience navigating strict pesticide approval processes especially in the EU and Japan are better positioned for long-term success. Product withdrawals due to non-compliance or environmental concerns can impact reputations and market share, giving an advantage to firms with robust compliance and safety track records.

Smaller players and regional manufacturers are increasingly gaining traction through cost-effective and niche solutions, especially in developing markets across Asia-Pacific and Latin America. These firms often focus on localized needs and offer competitively priced products. As resistance issues and sustainability pressures increase, competition is expected to intensify around the innovation and commercialization of next-generation bactericides.

Key players in the market are ADAMA Agricultural Solutions Ltd., AMVAC Chemical Corporation, Syngenta AG, LUMITOS AG, Rainbow Agro, Oxon Italia S.p.A, Marrone Bio Innovations, Nissan Chemical Corporation, Arysta LifeScience Corporation, BASF SE, Bayer AG, FMC Corporation, Corteva, Nufarm Limited, Sumitomo Chemical Co., Ltd., and other players.Recent Development:In February 2025, UPL Corp received a Section 18 emergency exemption from the U.S. EPA and California Department of Pesticide Regulation for the use of KASUMIN® 2L bactericide to prevent bacterial blast in almonds. The exemption allows application across up to 107,143 acres in 16 California counties from February 1 to April 15, 2025, providing growers with a preventive solution during bloom when cold, wet conditions heighten disease risk.

In February 2025, The International Organization for Standardization (ISO) has officially approved the common name “fluquinometoate” for a quinolinone bactericide developed by Shandong United Pesticide Industry Co., Ltd.

In March 2024, the U.S. Environmental Protection Agency granted expanded approval for Sym-Agro’s Instill®, a copper sulfate–based bactericide. This registration now covers new crops such as coffee, potato, hazelnut, and sugar beet. Instill® is notable for its systemically absorbed copper sulfate pentahydrate, which helps provide up to 21 days of internal protection in treated plants.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Bactericides market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Bactericides market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Bactericides market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Bactericides market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Bactericides market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 6.09 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Form |

|

| The Segment covered by Crop Type |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Bactericides market share, size, and revenue growth rate were created by Quintile Report™. Bactericides analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Bactericides Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Bactericides Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Bactericides Market, by Region, (USD Million) 2017-2035

Table 21 China Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Bactericides Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Bactericides Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Bactericides Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Bactericides Market: market scenario

Fig.4 Global Bactericides Market competitive outlook

Fig.5 Global Bactericides Market driver analysis

Fig.6 Global Bactericides Market restraint analysis

Fig.7 Global Bactericides Market opportunity analysis

Fig.8 Global Bactericides Market trends analysis

Fig.9 Global Bactericides Market: Segment Analysis (Based on the scope)

Fig.10 Global Bactericides Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report Descriptions: The Global Non-GMO Flour Market was estimated at USD 72.87 billion in 2025 and

Read MoreReport Descriptions: The Global Mineral Ingredients Market was estimated at USD 8.12 billion in 2025

Read MoreReport Descriptions: The Global Feeding Distiller Dried Grains with Solubles (DGDS) Market was estim

Read More