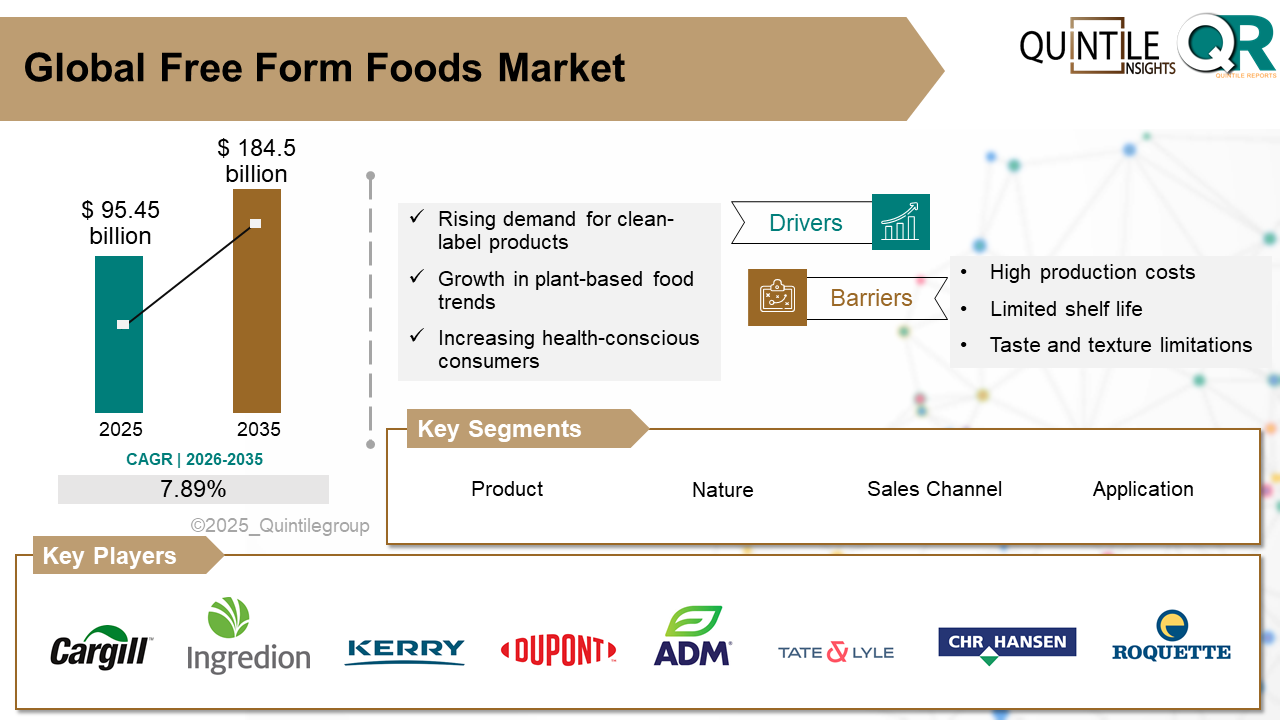

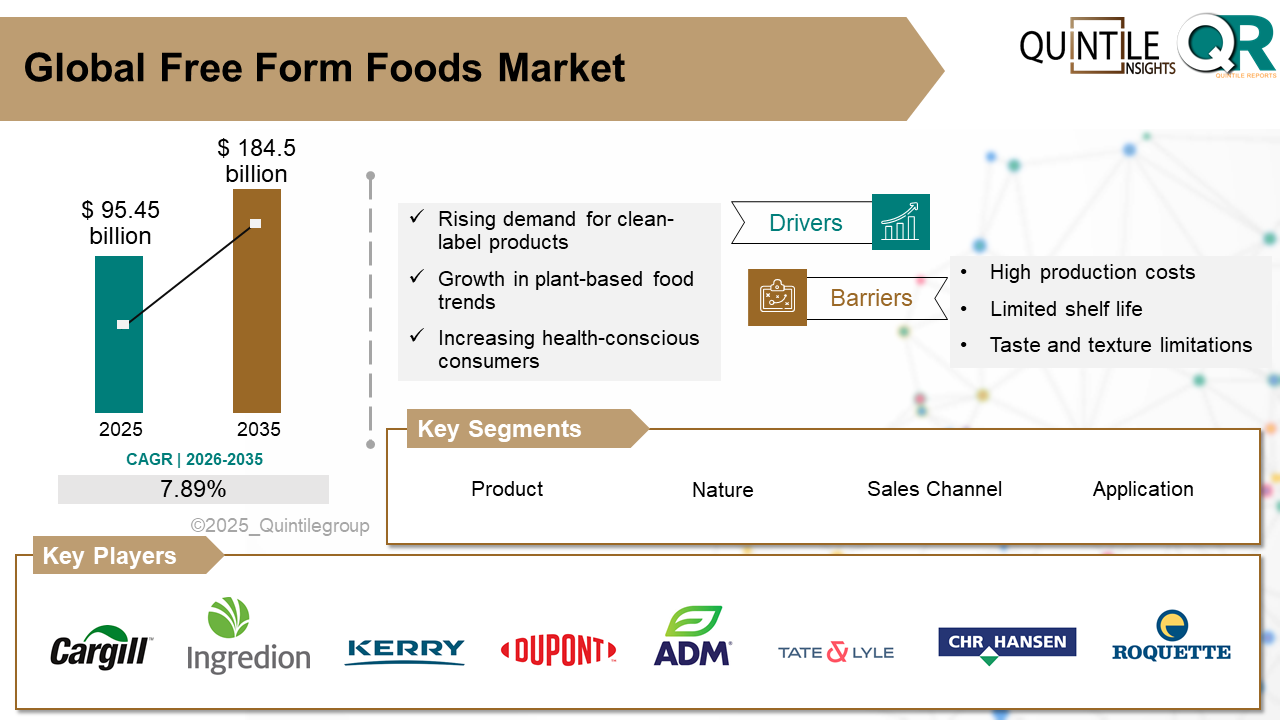

The Global Free Form Foods Market was estimated at USD 95.45 billion in 2025 and is projected to reach USD 184.5 billion by 2035, growing at a robust CAGR of 7.89% during the forecast period from 2026 to 2035. The Free Form Foods market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Free Form Foods market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017–2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026–2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026–2035, enabling stakeholders to evaluate market growth potential over the forecast period.

Free Form Foods Market

The free form foods market refers to the foods those are made without specific ingredients known to cause allergies, intolerances, or other dietary concerns such as gluten, dairy, nuts, or soy. These products are designed to meet the needs of individuals with health conditions like celiac disease, lactose intolerance, or nut allergies. While they are especially beneficial for those with such dietary restrictions, free-from foods are suitable for everyone. The absence of certain ingredients doesn't diminish their nutritional value or taste, and they are increasingly popular among health-conscious consumers seeking cleaner or simpler ingredient lists.

A wide range of foods now come in free-from varieties, including staples like bread, milk, pasta, and flour, as well as sweet treats such as cakes and chocolate. Even items traditionally containing gluten like beer and cereal are being reformulated to cater to gluten-free diets. Products are typically labeled in dedicated 'Free From' sections in supermarkets, making them easier to find. Thanks to growing consumer demand and advances in food technology, free-from foods are more accessible and diverse than ever before.

What are the drivers of free form foods market?Globally, around 20 % of consumers report gluten sensitivity and 19 % lactose sensitivity, with conditions like celiac disease affecting roughly 1 % of people worldwide. As awareness of these conditions increases, more consumers including those without formal diagnoses actively seek out foods that are free from common allergens such as gluten, dairy, soy, nuts, and eggs.

There is a notable rise in the number of individuals diagnosed with allergies and intolerances, particularly to gluten, lactose, nuts, and soy. This shift has made it essential for food producers to offer alternatives that meet these dietary needs, expanding the demand for free-from options.

Popular diets such as veganism, paleo, and gluten-free lifestyles have helped normalize the consumption of free-from foods. Social media and influencer culture further promote these diets, encouraging even non-allergic individuals to incorporate free-from products into their routines.

Major retailers now dedicate shelf space to free-from ranges, making them widely accessible. Private label and specialty brands alike are expanding their portfolios, and e-commerce platforms are making it even easier for consumers to find and purchase free-from items.

Improved food labelling laws and greater transparency around ingredients have built consumer trust in free-from claims. Certifications like “gluten-free” or “dairy-free” help shoppers make informed decisions quickly, reinforcing confidence and encouraging repeat purchases.

What are the challenges and restraining factors of free form foods market?Manufacturing free-from foods often requires specialty ingredients and dedicated facilities to prevent cross-contamination. These requirements raise production costs, which are usually passed on to consumers. As a result, free-from products can be significantly more expensive than conventional alternatives, limiting their accessibility for price-sensitive buyers.

Despite advances in formulation, some free-from products still struggle to match the taste, texture, or mouthfeel of traditional versions. Gluten-free bread, dairy-free cheese, or egg-free baked goods may be perceived as dry, bland, or artificial by consumers accustomed to standard recipes, creating hesitancy around trial and repeat purchases.

While food labelling has improved, many consumers remain uncertain about what “free-from” claims actually mean. Mistrust can arise from inconsistent terminology, unclear allergen warnings, or a lack of standardized certification. This confusion may lead to skepticism and reduce confidence in purchasing free-from options, especially for those with severe allergies.

What are the regional trends of free form foods market?In North America, the free-from food market continues to grow steadily, driven by strong consumer demand for healthier options and greater awareness of food intolerances. Gluten-free, dairy-free, and nut-free products are widely available across both mainstream supermarkets and specialty health stores. Regulatory support through strict labelling laws helps maintain trust, while innovation in plant-based and allergen-free snacks adds momentum to market expansion.

Europe has one of the most developed free-from food markets, supported by a high rate of diagnosed food allergies and intolerances. Consumers in countries like the UK, Germany, and Italy are highly ingredient-conscious, and EU labelling laws ensure transparency in allergen information. The region shows strong demand for gluten-free baked goods, dairy-free alternatives, and vegan convenience foods, with both private labels and niche brands actively competing.

In the Asia-Pacific region, free-from foods are gaining popularity as urban consumers become more health-conscious and retail infrastructure improves. Countries like Australia and Japan lead the adoption of gluten-free and lactose-free products, while plant-based dairy alternatives are growing rapidly in China and India. Although awareness is lower in Southeast Asia, the overall trend is upward due to increasing western influence and dietary shifts among younger consumers.

Latin America is witnessing gradual adoption of free-from foods, particularly among urban middle-class populations in Brazil, Mexico, and Argentina. Influenced by fitness trends and wellness movements, younger consumers are more willing to try dairy-free or gluten-free diets. Availability has improved through supermarkets and e-commerce, though affordability and awareness continue to limit market penetration in rural areas.

In the Middle East and Africa, the free-from segment is expanding slowly, with notable growth in high-income urban areas like the UAE, Saudi Arabia, and South Africa. Growing recognition of conditions like lactose intolerance and gluten sensitivity is encouraging product availability. However, challenges such as limited local production, dependence on imports, and high prices constrain access for the broader population.

Country-Wise Outlook:U.S. Gluten-Free Market Driven by Wellness Trends: In the U.S., around 1% of the population has celiac disease, but a much larger group estimated at 6% experiences non-celiac gluten sensitivity (NCGS). Despite this, gluten-free products are consumed by nearly 25% of Americans, many of whom follow the diet as a wellness trend rather than a medical necessity. A 2016 article in The Guardian noted how this consumer behavior has been fueled by celebrity influence, the association of gluten-free with healthier eating, and broader wellness marketing efforts. While demand has surged, there is growing concern that gluten-free packaged foods are often higher in sugar and lower in fiber, potentially making them less nutritious than traditional options.

Labeling laws enforced by the U.S. FDA have helped boost trust in gluten-free claims, encouraging more consumers to explore the category. The market has expanded beyond basic staples into gluten-free sauces, frozen meals, snacks, and even beverages. However, recent studies and nutrition blogs are beginning to highlight a need for consumer education around the nutritional trade-offs of gluten-free products especially among those adopting it for lifestyle reasons rather than diagnosed medical conditions.

Germany Sees High Self-Reported Gluten Sensitivity: A population-based survey in Germany (Berlin) found that while only 3.7% of adults had confirmed food allergies through double-blind testing, 34.9% of respondents self-reported adverse reactions to foods like wheat and gluten. This gap between perceived and clinically confirmed intolerance reflects how dietary self-diagnosis is common in Germany. German consumers are highly ingredient-conscious and prefer clean-label products, which aligns with the increasing demand for gluten-free and lactose-free foods even among people without medical needs.

Retail availability of free-from foods in Germany is supported by strict EU allergen labeling laws and a strong presence of organic and sustainable food stores. Gluten-free bakery products, lactose-free milk, and plant-based substitutes are especially popular in urban areas. While the consumer base is not entirely driven by diagnosed allergies, the demand is steady due to rising interest in wellness, transparency, and ethical consumption, which positions Germany as a key player in the European free-from landscape.

Japan Balances Tradition with Gluten-Free Innovation: A 2021 peer-reviewed study published in Nutrients found that celiac disease is extremely rare in Japan, with a seroprevalence of only 0.19%. This low prevalence is largely due to genetic factors — Japan’s population has a very low occurrence of HLA-DQ2 and DQ8, the genes associated with celiac disease. Additionally, Japan’s traditional diet, which is rice-based rather than wheat-based, may contribute to the rarity of gluten-related conditions.

Despite this, awareness around gluten intolerance and gluten-free diets remains limited. Tourists and expatriates with gluten sensitivity frequently report challenges in finding safe dining options, as wheat-based ingredients like soy sauce are ubiquitous in Japanese cuisine. Labeling of gluten-containing ingredients is not yet standardized, and the concept of "gluten-free" is often misunderstood as a weight-loss trend. However, in large cities like Tokyo and Osaka, there is a small but growing niche for gluten-free products driven by international influence, online shopping, and health-conscious younger consumers.

Competitive Analysis:Large multinational food companies have strengthened their presence in the free-from market by expanding existing product lines and acquiring smaller niche brands. Firms like Nestlé and General Mills now offer gluten-free, dairy-free, and nut-free options across various categories, using their scale and distribution networks to dominate shelf space. These corporations benefit from strong brand recognition, but face growing pressure to maintain ingredient transparency and clean-label integrity.

Smaller specialist brands have built loyal consumer bases by focusing entirely on allergen-free or health-oriented products. Brands such as Enjoy Life and Amy’s Kitchen are recognized for their commitment to transparency, ethical sourcing, and innovation. Their agility allows them to respond faster to emerging dietary trends, helping them compete against much larger companies despite having smaller marketing budgets.

Supermarkets and retail chains have become influential players by introducing private-label free-from products. Retailers like Tesco, Aldi, and Whole Foods have developed affordable, store-branded alternatives in categories such as gluten-free bread, plant-based dairy, and allergen-free snacks. These private labels appeal to budget-conscious shoppers and have increased pressure on branded products to offer clear value or premium differentiation.

Online retail has transformed how free-from products reach consumers. E-commerce platforms and direct-to-consumer models allow niche brands to expand beyond regional markets and build dedicated customer communities. Subscription services, personalized recommendations, and digital advertising have also helped lesser-known brands compete effectively without relying solely on physical retail placement.

Consumer trust in labeling and safety plays a major role in determining competitive success. Markets with strict allergen labelling standards, such as the U.S., EU, and Australia, reward brands that clearly communicate free-from claims. Regulatory compliance is no longer just a requirement — it is a competitive advantage that builds brand credibility, especially among medically sensitive or highly health-conscious consumers.

Recent Development:In April 2025, Khloé Kardashian launched Khloud Protein Popcorn, a new product in the free-from and high-protein snack category. The product is seed-oil free, gluten-free, kosher, and non-GMO, and features a proprietary “Khloud Dust” that delivers over three times the protein of traditional popcorn — approximately 7g of complete milk protein per serving.

In March 2025, Dave’s Killer Bread launched Organic Snack Bites in six sweet and savory flavors made with whole grains and seeds, targeting health-conscious consumers. In the same month, Kayco Beyond introduced Absolutely! Gluten Free Frozen Cookie Dough in Chocolate Chip, Double Chocolate, and Sugar Cookie variants, free from gluten, dairy, nuts, and artificial additives.

In January 2025, Banza launched its Four Cheese Chickpea Pizza at Costco locations across six Southeastern U.S. states, offering a gluten-free, high-protein alternative with 17g protein and 10g fiber per serving.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Free Form Foods market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Free Form Foods market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Free Form Foods market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Free Form Foods market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Free Form Foods market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 7.89 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product |

|

| The Segment covered by Nature |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Free Form Foods market share, size, and revenue growth rate were created by Quintile Report™. Free Form Foods analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Free Form Foods Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Free Form Foods Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Free Form Foods Market, by Region, (USD Million) 2017-2035

Table 21 China Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Free Form Foods Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Free Form Foods Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Free Form Foods Market: market scenario

Fig.4 Global Free Form Foods Market competitive outlook

Fig.5 Global Free Form Foods Market driver analysis

Fig.6 Global Free Form Foods Market restraint analysis

Fig.7 Global Free Form Foods Market opportunity analysis

Fig.8 Global Free Form Foods Market trends analysis

Fig.9 Global Free Form Foods Market: Segment Analysis (Based on the scope)

Fig.10 Global Free Form Foods Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Free Form Foods Market was estimated at USD 95.45 billion in 2025 and is projected to reach USD 184.5 billion by 2035, growing at a robust CAGR of 7.89% during the forecast period from 2026 to 2035. The Free Form Foods market report provides a comprehensive industry assessment, analyzing economic conditions, technological advancements, regulatory frameworks, and evolving consumer behavior to deliver a clear view of future growth potential.

With 2025 as the base year, the Free Form Foods market is witnessing steady expansion driven by innovation, rising consumer demand, and rapid technological progress. Companies are increasingly refining their go-to-market (GTM) strategies to capture emerging opportunities and respond to shifting market dynamics.

Looking ahead to 2035, the market is expected to sustain its growth momentum, supported by continuous R&D investments, strategic partnerships, and mergers and acquisitions. Businesses that prioritize innovation, agile GTM strategies, and alignment with consumer needs are likely to achieve long-term success. The report delivers detailed insights into key drivers, restraints, opportunities, and challenges across segments, regions, and countries, supported by qualitative and quantitative analysis covering the period from 2017 to 2035.

Historical Analysis (2017–2024): Reviews past market trends, performance metrics, and growth patterns to identify factors shaping current and future market behavior.

Forecast and Projections (2026–2035): Provides forward-looking market estimates, highlighting growth opportunities, emerging trends, and regional developments.

Compound Annual Growth Rate (CAGR): Presents a clear CAGR calculation for 2026–2035, enabling stakeholders to evaluate market growth potential over the forecast period.

Free Form Foods Market

The free form foods market refers to the foods those are made without specific ingredients known to cause allergies, intolerances, or other dietary concerns such as gluten, dairy, nuts, or soy. These products are designed to meet the needs of individuals with health conditions like celiac disease, lactose intolerance, or nut allergies. While they are especially beneficial for those with such dietary restrictions, free-from foods are suitable for everyone. The absence of certain ingredients doesn't diminish their nutritional value or taste, and they are increasingly popular among health-conscious consumers seeking cleaner or simpler ingredient lists.

A wide range of foods now come in free-from varieties, including staples like bread, milk, pasta, and flour, as well as sweet treats such as cakes and chocolate. Even items traditionally containing gluten like beer and cereal are being reformulated to cater to gluten-free diets. Products are typically labeled in dedicated 'Free From' sections in supermarkets, making them easier to find. Thanks to growing consumer demand and advances in food technology, free-from foods are more accessible and diverse than ever before.

What are the drivers of free form foods market?Globally, around 20 % of consumers report gluten sensitivity and 19 % lactose sensitivity, with conditions like celiac disease affecting roughly 1 % of people worldwide. As awareness of these conditions increases, more consumers including those without formal diagnoses actively seek out foods that are free from common allergens such as gluten, dairy, soy, nuts, and eggs.

There is a notable rise in the number of individuals diagnosed with allergies and intolerances, particularly to gluten, lactose, nuts, and soy. This shift has made it essential for food producers to offer alternatives that meet these dietary needs, expanding the demand for free-from options.

Popular diets such as veganism, paleo, and gluten-free lifestyles have helped normalize the consumption of free-from foods. Social media and influencer culture further promote these diets, encouraging even non-allergic individuals to incorporate free-from products into their routines.

Major retailers now dedicate shelf space to free-from ranges, making them widely accessible. Private label and specialty brands alike are expanding their portfolios, and e-commerce platforms are making it even easier for consumers to find and purchase free-from items.

Improved food labelling laws and greater transparency around ingredients have built consumer trust in free-from claims. Certifications like “gluten-free” or “dairy-free” help shoppers make informed decisions quickly, reinforcing confidence and encouraging repeat purchases.

What are the challenges and restraining factors of free form foods market?Manufacturing free-from foods often requires specialty ingredients and dedicated facilities to prevent cross-contamination. These requirements raise production costs, which are usually passed on to consumers. As a result, free-from products can be significantly more expensive than conventional alternatives, limiting their accessibility for price-sensitive buyers.

Despite advances in formulation, some free-from products still struggle to match the taste, texture, or mouthfeel of traditional versions. Gluten-free bread, dairy-free cheese, or egg-free baked goods may be perceived as dry, bland, or artificial by consumers accustomed to standard recipes, creating hesitancy around trial and repeat purchases.

While food labelling has improved, many consumers remain uncertain about what “free-from” claims actually mean. Mistrust can arise from inconsistent terminology, unclear allergen warnings, or a lack of standardized certification. This confusion may lead to skepticism and reduce confidence in purchasing free-from options, especially for those with severe allergies.

What are the regional trends of free form foods market?In North America, the free-from food market continues to grow steadily, driven by strong consumer demand for healthier options and greater awareness of food intolerances. Gluten-free, dairy-free, and nut-free products are widely available across both mainstream supermarkets and specialty health stores. Regulatory support through strict labelling laws helps maintain trust, while innovation in plant-based and allergen-free snacks adds momentum to market expansion.

Europe has one of the most developed free-from food markets, supported by a high rate of diagnosed food allergies and intolerances. Consumers in countries like the UK, Germany, and Italy are highly ingredient-conscious, and EU labelling laws ensure transparency in allergen information. The region shows strong demand for gluten-free baked goods, dairy-free alternatives, and vegan convenience foods, with both private labels and niche brands actively competing.

In the Asia-Pacific region, free-from foods are gaining popularity as urban consumers become more health-conscious and retail infrastructure improves. Countries like Australia and Japan lead the adoption of gluten-free and lactose-free products, while plant-based dairy alternatives are growing rapidly in China and India. Although awareness is lower in Southeast Asia, the overall trend is upward due to increasing western influence and dietary shifts among younger consumers.

Latin America is witnessing gradual adoption of free-from foods, particularly among urban middle-class populations in Brazil, Mexico, and Argentina. Influenced by fitness trends and wellness movements, younger consumers are more willing to try dairy-free or gluten-free diets. Availability has improved through supermarkets and e-commerce, though affordability and awareness continue to limit market penetration in rural areas.

In the Middle East and Africa, the free-from segment is expanding slowly, with notable growth in high-income urban areas like the UAE, Saudi Arabia, and South Africa. Growing recognition of conditions like lactose intolerance and gluten sensitivity is encouraging product availability. However, challenges such as limited local production, dependence on imports, and high prices constrain access for the broader population.

Country-Wise Outlook:U.S. Gluten-Free Market Driven by Wellness Trends: In the U.S., around 1% of the population has celiac disease, but a much larger group estimated at 6% experiences non-celiac gluten sensitivity (NCGS). Despite this, gluten-free products are consumed by nearly 25% of Americans, many of whom follow the diet as a wellness trend rather than a medical necessity. A 2016 article in The Guardian noted how this consumer behavior has been fueled by celebrity influence, the association of gluten-free with healthier eating, and broader wellness marketing efforts. While demand has surged, there is growing concern that gluten-free packaged foods are often higher in sugar and lower in fiber, potentially making them less nutritious than traditional options.

Labeling laws enforced by the U.S. FDA have helped boost trust in gluten-free claims, encouraging more consumers to explore the category. The market has expanded beyond basic staples into gluten-free sauces, frozen meals, snacks, and even beverages. However, recent studies and nutrition blogs are beginning to highlight a need for consumer education around the nutritional trade-offs of gluten-free products especially among those adopting it for lifestyle reasons rather than diagnosed medical conditions.

Germany Sees High Self-Reported Gluten Sensitivity: A population-based survey in Germany (Berlin) found that while only 3.7% of adults had confirmed food allergies through double-blind testing, 34.9% of respondents self-reported adverse reactions to foods like wheat and gluten. This gap between perceived and clinically confirmed intolerance reflects how dietary self-diagnosis is common in Germany. German consumers are highly ingredient-conscious and prefer clean-label products, which aligns with the increasing demand for gluten-free and lactose-free foods even among people without medical needs.

Retail availability of free-from foods in Germany is supported by strict EU allergen labeling laws and a strong presence of organic and sustainable food stores. Gluten-free bakery products, lactose-free milk, and plant-based substitutes are especially popular in urban areas. While the consumer base is not entirely driven by diagnosed allergies, the demand is steady due to rising interest in wellness, transparency, and ethical consumption, which positions Germany as a key player in the European free-from landscape.

Japan Balances Tradition with Gluten-Free Innovation: A 2021 peer-reviewed study published in Nutrients found that celiac disease is extremely rare in Japan, with a seroprevalence of only 0.19%. This low prevalence is largely due to genetic factors — Japan’s population has a very low occurrence of HLA-DQ2 and DQ8, the genes associated with celiac disease. Additionally, Japan’s traditional diet, which is rice-based rather than wheat-based, may contribute to the rarity of gluten-related conditions.

Despite this, awareness around gluten intolerance and gluten-free diets remains limited. Tourists and expatriates with gluten sensitivity frequently report challenges in finding safe dining options, as wheat-based ingredients like soy sauce are ubiquitous in Japanese cuisine. Labeling of gluten-containing ingredients is not yet standardized, and the concept of "gluten-free" is often misunderstood as a weight-loss trend. However, in large cities like Tokyo and Osaka, there is a small but growing niche for gluten-free products driven by international influence, online shopping, and health-conscious younger consumers.

Competitive Analysis:Large multinational food companies have strengthened their presence in the free-from market by expanding existing product lines and acquiring smaller niche brands. Firms like Nestlé and General Mills now offer gluten-free, dairy-free, and nut-free options across various categories, using their scale and distribution networks to dominate shelf space. These corporations benefit from strong brand recognition, but face growing pressure to maintain ingredient transparency and clean-label integrity.

Smaller specialist brands have built loyal consumer bases by focusing entirely on allergen-free or health-oriented products. Brands such as Enjoy Life and Amy’s Kitchen are recognized for their commitment to transparency, ethical sourcing, and innovation. Their agility allows them to respond faster to emerging dietary trends, helping them compete against much larger companies despite having smaller marketing budgets.

Supermarkets and retail chains have become influential players by introducing private-label free-from products. Retailers like Tesco, Aldi, and Whole Foods have developed affordable, store-branded alternatives in categories such as gluten-free bread, plant-based dairy, and allergen-free snacks. These private labels appeal to budget-conscious shoppers and have increased pressure on branded products to offer clear value or premium differentiation.

Online retail has transformed how free-from products reach consumers. E-commerce platforms and direct-to-consumer models allow niche brands to expand beyond regional markets and build dedicated customer communities. Subscription services, personalized recommendations, and digital advertising have also helped lesser-known brands compete effectively without relying solely on physical retail placement.

Consumer trust in labeling and safety plays a major role in determining competitive success. Markets with strict allergen labelling standards, such as the U.S., EU, and Australia, reward brands that clearly communicate free-from claims. Regulatory compliance is no longer just a requirement — it is a competitive advantage that builds brand credibility, especially among medically sensitive or highly health-conscious consumers.

Recent Development:In April 2025, Khloé Kardashian launched Khloud Protein Popcorn, a new product in the free-from and high-protein snack category. The product is seed-oil free, gluten-free, kosher, and non-GMO, and features a proprietary “Khloud Dust” that delivers over three times the protein of traditional popcorn — approximately 7g of complete milk protein per serving.

In March 2025, Dave’s Killer Bread launched Organic Snack Bites in six sweet and savory flavors made with whole grains and seeds, targeting health-conscious consumers. In the same month, Kayco Beyond introduced Absolutely! Gluten Free Frozen Cookie Dough in Chocolate Chip, Double Chocolate, and Sugar Cookie variants, free from gluten, dairy, nuts, and artificial additives.

In January 2025, Banza launched its Four Cheese Chickpea Pizza at Costco locations across six Southeastern U.S. states, offering a gluten-free, high-protein alternative with 17g protein and 10g fiber per serving.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Free Form Foods market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Free Form Foods market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Free Form Foods market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Free Form Foods market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Free Form Foods market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 7.89 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product |

|

| The Segment covered by Nature |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Free Form Foods market share, size, and revenue growth rate were created by Quintile Report™. Free Form Foods analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Free Form Foods Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Free Form Foods Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Free Form Foods Market, by Region, (USD Million) 2017-2035

Table 21 China Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Free Form Foods Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Free Form Foods Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Free Form Foods Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Free Form Foods Market: market scenario

Fig.4 Global Free Form Foods Market competitive outlook

Fig.5 Global Free Form Foods Market driver analysis

Fig.6 Global Free Form Foods Market restraint analysis

Fig.7 Global Free Form Foods Market opportunity analysis

Fig.8 Global Free Form Foods Market trends analysis

Fig.9 Global Free Form Foods Market: Segment Analysis (Based on the scope)

Fig.10 Global Free Form Foods Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report Descriptions: The Global Non-GMO Flour Market was estimated at USD 72.87 billion in 2025 and

Read MoreReport Descriptions: The Global Mineral Ingredients Market was estimated at USD 8.12 billion in 2025

Read MoreReport Descriptions: The Global Feeding Distiller Dried Grains with Solubles (DGDS) Market was estim

Read More