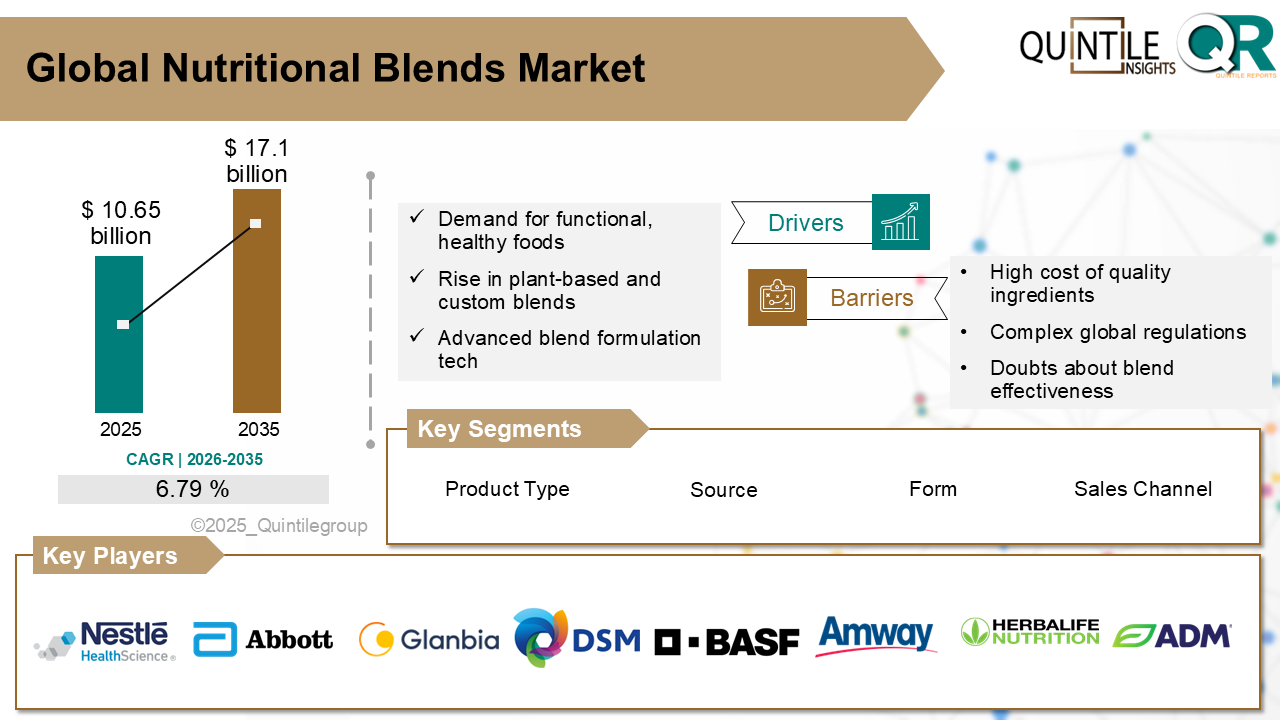

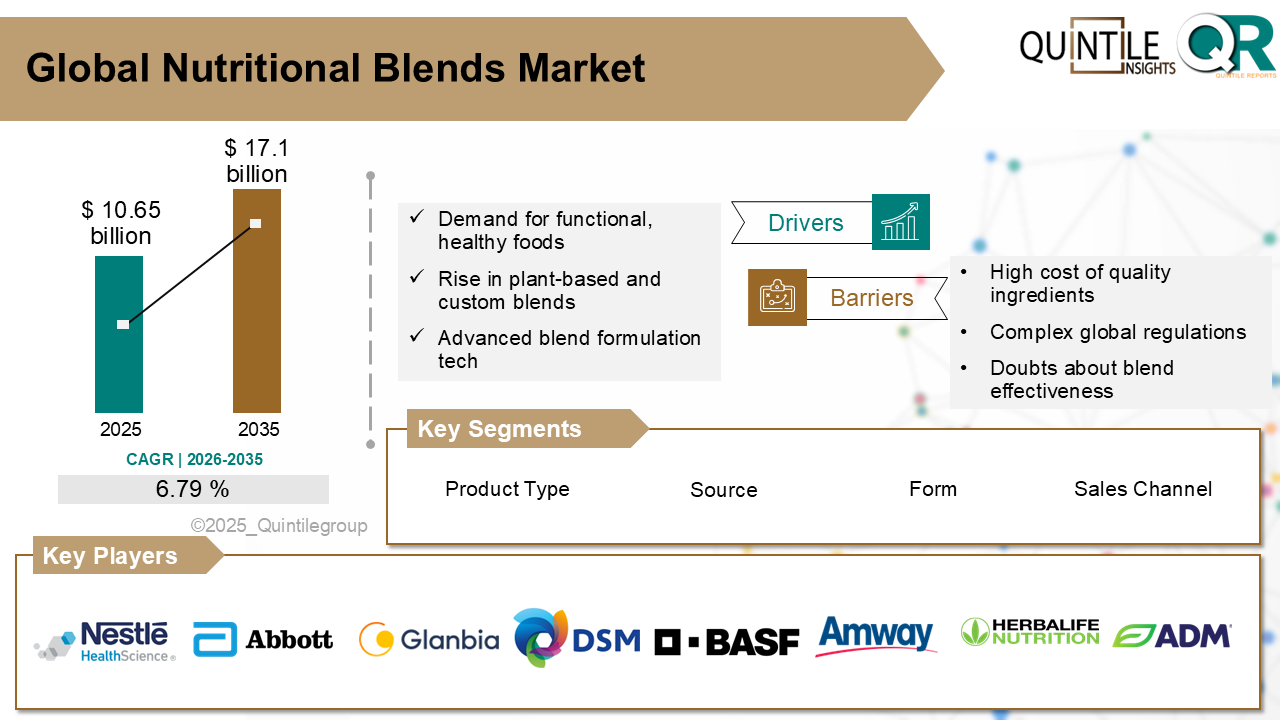

The Global Nutritional Blends Market was estimated at USD 10.65 Billion in 2025 and is projected to reach USD 17.1 Billion by 2035, reflecting a strong CAGR of 6.79% over the forecast period from 2026 to 2035. The Nutritional Blends market report delivers a comprehensive overview of the industry, extending beyond traditional analysis. It examines key market dynamics, including economic shifts, technological advancements, regulatory developments, and changing consumer behavior. The report also highlights the projected Compound Annual Growth Rate (CAGR), offering a clear understanding of future market growth.

The Nutritional Blends market is experiencing dynamic expansion, with 2025 as the base year. Recent data indicates notable growth driven by innovation, rising consumer demand, and rapid technological progress. Companies are refining their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to evolving market conditions.

Looking ahead, the Nutritional Blends market is expected to maintain its upward trajectory through 2035, supported by continuous R&D investments, strategic collaborations, and mergers and acquisitions. Organizations that adapt their GTM strategies, innovate, and align with shifting consumer needs are positioned for long-term success. The Nutritional Blends market report provides an in-depth analysis of current conditions and valuable insights into key drivers, challenges, and opportunities shaping the industry over the next decade. It covers market dynamics across segments, regions, and countries, integrating both qualitative and quantitative data from 2017 to 2035.

Historical Analysis (2017-2024): The report reviews market trends, performance indicators, and growth patterns from 2017 to 2024, helping identify historical factors that influence present and future dynamics.

Forecast and Projections (2026-2035): Building on historical insights, the report presents market forecasts and growth expectations from 2026 to 2035, highlighting key trends, opportunities, and challenges across various regions and segments.

Compound Annual Growth Rate (CAGR): The report provides a clear calculation of the CAGR for 2026 to 2035, enabling stakeholders to assess expected growth and market potential during the forecast period.

Nutritional Blends Market

The nutritional blends market refers to the global and regional market for composite formulations combining vitamins, minerals, amino acids, protein isolates, botanicals, fibers, probiotics, and other bioactive ingredients formulated to meet specific health goals. These blends are utilised in functional foods and beverages, dietary supplements, meal replacements, infant and older adult nutrition, sports and performance products, as well as cosmetic nutraceutical formulations. Packaging formats include powders, ready-to-drink liquids, capsules, tablets, sachets, and bars, with blends tailored to wellness categories such as immune support, weight management, cognitive function, digestive health, and energy enhancement.

Traditionally, nutritional blends were developed using basic vitamin-mineral premixes to fortify foods and supplements. The market has evolved toward more sophisticated multi-ingredient systems leveraging science-backed dosages, bioavailability enhancers, and clean-label certifications. Recent innovations include plant-based proteins paired with botanicals, personalised nutrition blends engineered for genomic or lifestyle needs, microencapsulation technologies for stability and taste masking, and formulations aligned with sustainability trends such as organic, non-GMO, and allergen-free labelling. These developments are driving demand among consumers and manufacturers seeking both functional efficacy and convenience in modern nutritional solutions.

What are the drivers of the nutritional blends marketConsumers are on the lookout for personalised nutritional solutions that cater to specific needs like boosting immunity, increasing energy, supporting gut health, and promoting wellness in older adults. Nutritional blends offer customizable combinations of proteins, vitamins, minerals, fibre, and botanicals to help achieve these targeted health objectives.

The heightened awareness of health, especially due to COVID-19, has led to a surge in demand for convenient, nutrient-rich blends that aid in preventive health, recovery, and everyday well-being. These blends are marketed as easy and accessible nutrition for those with busy lifestyles.

The trend towards vegan, vegetarian, and allergen-free diets, along with a preference for clean-label, non-GMO, and organic ingredients, is driving the development of plant-based blend formulations. This shift is fueling research and development, as well as product diversification in the realm of nutritional blends.

Innovations such as microencapsulation, AI-driven blend optimisation, enhanced bioavailability, flavour masking, and stable liquid or powder formats are improving performance, shelf life, and convenience across various delivery methods.

What are the challenges and restraining factors of the nutritional blends marketNutritional blends are all about using top-notch ingredients like vitamins, minerals, plant proteins, prebiotics, and probiotics. They often involve processes like encapsulation or fortification, which can make manufacturing quite expensive and sensitive to costs, especially for smaller brands or startups that are trying to keep up in price-sensitive markets.

These products also have to navigate a maze of regulations around the world. Different rules regarding health claims, nutrient levels, and labelling, especially in places like the EU, U.S., and emerging markets add a layer of complexity. Making sure everything is compliant in various regions can take a lot of resources and slow down how quickly a brand can enter the market.

With so many fortified food products out there claiming to boost wellness, consumers often find themselves questioning how effective these blends are and whether the marketing claims hold any water.

There's a lot of scepticism surrounding ultra-processed formulations, which can shake consumer confidence unless brands are upfront with their labelling and back up their claims with solid research.

What are the regional trends of the nutritional blends marketNorth America leads the market with strong demand for supplements, functional foods, and ready-to-drink products. Growth is driven by customised blendssuch as protein-fibre-vitamin mixes and adaptogen formulassupported by improved solubility, flavour masking, nutrient stability, and partnerships with foodservice chains, pharmacies, and DTC platforms.

Europes market is mature and compliance-focused, shaped by clean-label trends and strict supplement regulations. Plant-based proteins, fortified cereals, and meal replacements dominate, with certifications like organic and non-GMO reinforcing transparency. Consumers show rising interest in gut health, heart wellness, and energy-support blends.

Asia-Pacific is fast-growing due to rising health awareness, urbanisation, and preventive nutrition trends across China, India, Japan, and Southeast Asia. Ayurvedic-inspired blends, instant health drink mixes, and multivitamin formulations are in demand. Local producers emphasise convenient formats, tropical flavours, and strong e-commerce distribution.

Latin America is expanding rapidly, led by Brazil, Mexico, and Argentina, with growing interest in wellness and fortified blends suited to local diets. Popular formats include protein-fibre-vitamin stick packs and fruit-flavoured fortified drinks. Globallocal partnerships enhance accessibility and consumer education.

The Middle East and Africa show steady growth, driven by rising fitness and urban wellness trends in the UAE, South Africa, and Nigeria. Popular products include vitamin-mineral blends, protein-fibre sachets, and herbal drink powders adapted to local tastes and climate. Distribution through pharmacies, lifestyle retailers, and digital health platforms is increasing.

Country-Wise Outlook:Personalised Health & AI-Driven Nutrition Propel U.S. Nutritional Blends Market.The United States continues to lead the way in the market for nutritional blends, driven by a growing trend towards personalised nutrition and AI-powered wellness platforms. A key factor in this shift is the increasing demand for nutrition solutions that cater to individual health goals like boosting immunity, enhancing energy, promoting gut health, and managing weight by utilising data analytics and digital delivery methods to create tailored macro- and micronutrient mixes.

Innovation hotspots in states such as California, Massachusetts, and New York are witnessing a surge in brands and formulators that provide AI-curated shake blends, powdered supplements, and functional drinks. Consumers, particularly busy professionals and those focused on performance, are on the lookout for blends that are not just convenient and clean-label but also optimised through algorithms based on their lifestyle, health profile, and the latest wellness trends.

In response, nutritional suppliers in the U.S. are pouring resources into modular premix production systems that feature high-speed blending, micro-dosing lines, and customisation platforms. Major food, beverage, and healthcare companies are teaming up with tech firms to facilitate subscription-based delivery, adaptive formula adjustments, and data-tracking feedback loops, making it easier to incorporate personalised nutrition into everyday life.

Clean Label and Plant-Based Ingredients Drive Germanys Nutritional Blends Market:Germany's nutritional blends market is really taking off, driven by a growing appetite for clean-label and plant-based options. Shoppers are becoming more discerning about what goes into their food, opting for blends that are organic, free from artificial additives, and sourced from nature. This trend is part of a larger movement in Germany towards sustainable food systems and ethical consumption, which is shaping how people buy across all nutritional categories.

Cities like Frankfurt, Stuttgart, and Dsseldorf are seeing a surge in vegan and vegetarian lifestyles, with plant-based nutritional blends stepping in to provide proteins, vitamins, and minerals usually found in animal products. Ingredients like pea protein, algae-based omega-3s, and fermented plant extracts are gaining traction in health stores and online shopping platforms.

In response, German manufacturers are ramping up their research and development to create formulations that emphasise traceable sourcing, allergen-free profiles, and eco-friendly packaging options. Clean-label certification and transparent marketing are becoming essential for earning consumer trust in the wellness and sports nutrition markets.

Japans Busy Urban Lifestyles Fuel Growth in the Nutritional Blends Market:Urban professionals and busy consumers in Japan are increasingly turning to nutritional blend products, like meal replacement shakes, fortified powders, and convenient mixables, to keep up with their health and wellness goals amidst their hectic lives. These products offer a handy alternative to traditional meals, providing balanced nutrition, think vitamins, minerals, protein, and functional ingredients all in easy-to-make formats. This blend of wellness and convenience is a direct response to the fast-paced lifestyles and changing demographics in Japan.

To cater to this growing demand, manufacturers are crafting products that align with Japanese tastes and dietary preferences. Youll often find features like low sugar content, a gentle sweetness, and familiar flavours such as matcha or red bean, along with ingredients like collagen, fermented elements, or plant-based protein. The packaging, like single-serve stick sachets and resealable trial pouches, is designed for portability and portion control, making it perfect for commuters, busy parents, and health-conscious millennials.

On top of that, technological advancements are setting brands apart in this market. Companies are rolling out blends with time-targeted release (for instance, an energy boost in the morning and calming nutrients at night), combining traditional botanicals with modern nutrition science, and ensuring compatibility with smart home dissolving appliances. As Japanese consumers continue to prioritise clean-label, nutritionally rich, and versatile solutions, the nutritional blends market is becoming a key part of their daily wellness routines.

Competitive Analysis:The nutritional blends market is increasingly driven by personalised formulation innovation. Companies are shifting from generic mixes to targeted blendssuch as macronutrient-rich or vitamin-fortified powders for immunity, energy, weight management, and gut health. Players using AI-assisted formulation, encapsulation technologies, and functional ingredients like adaptogens and nootropics are standing out, serving both B2B fortification needs and personalised consumer nutrition.

Clean-label, plant-based, and traceable ingredient sourcing has become a key competitive priority. Suppliers that offer non-GMO or organic certifications, plant-based formulations, and transparent ingredient traceability are gaining an edge, especially among health-conscious consumers and in markets with strict regulatory standards.

Digital and direct-to-consumer channels are reshaping competition as well. Brands investing in subscription models, rapid online customisation, and influencer-driven marketing are expanding reach quickly. This agility supports faster market feedback, strong niche positioning, and higher loyalty in wellness, fitness, and personalised nutrition segments.

Quality assurance and strong B2B integration remain essential differentiators. Leading suppliers maintain rigorous manufacturing standards, comply with regulations, and deliver consistent premixes for food, beverage, pharmaceutical, and animal nutrition industries. Ready-to-use premixes simplify product development and strengthen long-term partnerships with industrial clients.

Scalability is another competitive factor. Companies investing in automated supply chains and high-throughput production can meet rising bulk demand without sacrificing quality. Expanding production footprints across regions also helps manage regulatory differences and reduce logistics costs.

Recent Development:In June 2025, Else Nutrition applauded the U.S. government's historic shift in infant formula rules, which may unlock the path to commercialise the world's first whole-food, dairy-free infant formula. This regulatory development is crucial for their innovative plant-based blends for a sensitive consumer segment.

In May 2025, Else Nutrition expanded its nationwide presence with Kids Ready-to-Drink Shakes in 1,000 leading U.S. retailer stores. This indicates successful commercialisation and increased availability of their plant-based nutritional blends for children.

In July 2025, Herbalife launched MultiBurn, a science-backed weight loss supplement featuring clinically studied botanical extracts (including a red chilli pepper and fenugreek blend - Capsifen). This new daily supplement supports metabolic health, healthy fat reduction, and energy expenditure, showcasing innovation in weight management nutritional blends.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Nutritional Blends market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Nutritional Blends market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Nutritional Blends market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Nutritional Blends market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Nutritional Blends market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 6.79 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product Type |

|

| The Segment covered by Source |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Nutritional Blends market share, size, and revenue growth rate were created by Quintile Report™. Nutritional Blends analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Nutritional Blends Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Nutritional Blends Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Nutritional Blends Market, by Region, (USD Million) 2017-2035

Table 21 China Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Nutritional Blends Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Nutritional Blends Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Nutritional Blends Market: market scenario

Fig.4 Global Nutritional Blends Market competitive outlook

Fig.5 Global Nutritional Blends Market driver analysis

Fig.6 Global Nutritional Blends Market restraint analysis

Fig.7 Global Nutritional Blends Market opportunity analysis

Fig.8 Global Nutritional Blends Market trends analysis

Fig.9 Global Nutritional Blends Market: Segment Analysis (Based on the scope)

Fig.10 Global Nutritional Blends Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Nutritional Blends Market was estimated at USD 10.65 Billion in 2025 and is projected to reach USD 17.1 Billion by 2035, reflecting a strong CAGR of 6.79% over the forecast period from 2026 to 2035. The Nutritional Blends market report delivers a comprehensive overview of the industry, extending beyond traditional analysis. It examines key market dynamics, including economic shifts, technological advancements, regulatory developments, and changing consumer behavior. The report also highlights the projected Compound Annual Growth Rate (CAGR), offering a clear understanding of future market growth.

The Nutritional Blends market is experiencing dynamic expansion, with 2025 as the base year. Recent data indicates notable growth driven by innovation, rising consumer demand, and rapid technological progress. Companies are refining their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to evolving market conditions.

Looking ahead, the Nutritional Blends market is expected to maintain its upward trajectory through 2035, supported by continuous R&D investments, strategic collaborations, and mergers and acquisitions. Organizations that adapt their GTM strategies, innovate, and align with shifting consumer needs are positioned for long-term success. The Nutritional Blends market report provides an in-depth analysis of current conditions and valuable insights into key drivers, challenges, and opportunities shaping the industry over the next decade. It covers market dynamics across segments, regions, and countries, integrating both qualitative and quantitative data from 2017 to 2035.

Historical Analysis (2017-2024): The report reviews market trends, performance indicators, and growth patterns from 2017 to 2024, helping identify historical factors that influence present and future dynamics.

Forecast and Projections (2026-2035): Building on historical insights, the report presents market forecasts and growth expectations from 2026 to 2035, highlighting key trends, opportunities, and challenges across various regions and segments.

Compound Annual Growth Rate (CAGR): The report provides a clear calculation of the CAGR for 2026 to 2035, enabling stakeholders to assess expected growth and market potential during the forecast period.

Nutritional Blends Market

The nutritional blends market refers to the global and regional market for composite formulations combining vitamins, minerals, amino acids, protein isolates, botanicals, fibers, probiotics, and other bioactive ingredients formulated to meet specific health goals. These blends are utilised in functional foods and beverages, dietary supplements, meal replacements, infant and older adult nutrition, sports and performance products, as well as cosmetic nutraceutical formulations. Packaging formats include powders, ready-to-drink liquids, capsules, tablets, sachets, and bars, with blends tailored to wellness categories such as immune support, weight management, cognitive function, digestive health, and energy enhancement.

Traditionally, nutritional blends were developed using basic vitamin-mineral premixes to fortify foods and supplements. The market has evolved toward more sophisticated multi-ingredient systems leveraging science-backed dosages, bioavailability enhancers, and clean-label certifications. Recent innovations include plant-based proteins paired with botanicals, personalised nutrition blends engineered for genomic or lifestyle needs, microencapsulation technologies for stability and taste masking, and formulations aligned with sustainability trends such as organic, non-GMO, and allergen-free labelling. These developments are driving demand among consumers and manufacturers seeking both functional efficacy and convenience in modern nutritional solutions.

What are the drivers of the nutritional blends marketConsumers are on the lookout for personalised nutritional solutions that cater to specific needs like boosting immunity, increasing energy, supporting gut health, and promoting wellness in older adults. Nutritional blends offer customizable combinations of proteins, vitamins, minerals, fibre, and botanicals to help achieve these targeted health objectives.

The heightened awareness of health, especially due to COVID-19, has led to a surge in demand for convenient, nutrient-rich blends that aid in preventive health, recovery, and everyday well-being. These blends are marketed as easy and accessible nutrition for those with busy lifestyles.

The trend towards vegan, vegetarian, and allergen-free diets, along with a preference for clean-label, non-GMO, and organic ingredients, is driving the development of plant-based blend formulations. This shift is fueling research and development, as well as product diversification in the realm of nutritional blends.

Innovations such as microencapsulation, AI-driven blend optimisation, enhanced bioavailability, flavour masking, and stable liquid or powder formats are improving performance, shelf life, and convenience across various delivery methods.

What are the challenges and restraining factors of the nutritional blends marketNutritional blends are all about using top-notch ingredients like vitamins, minerals, plant proteins, prebiotics, and probiotics. They often involve processes like encapsulation or fortification, which can make manufacturing quite expensive and sensitive to costs, especially for smaller brands or startups that are trying to keep up in price-sensitive markets.

These products also have to navigate a maze of regulations around the world. Different rules regarding health claims, nutrient levels, and labelling, especially in places like the EU, U.S., and emerging markets add a layer of complexity. Making sure everything is compliant in various regions can take a lot of resources and slow down how quickly a brand can enter the market.

With so many fortified food products out there claiming to boost wellness, consumers often find themselves questioning how effective these blends are and whether the marketing claims hold any water.

There's a lot of scepticism surrounding ultra-processed formulations, which can shake consumer confidence unless brands are upfront with their labelling and back up their claims with solid research.

What are the regional trends of the nutritional blends marketNorth America leads the market with strong demand for supplements, functional foods, and ready-to-drink products. Growth is driven by customised blendssuch as protein-fibre-vitamin mixes and adaptogen formulassupported by improved solubility, flavour masking, nutrient stability, and partnerships with foodservice chains, pharmacies, and DTC platforms.

Europes market is mature and compliance-focused, shaped by clean-label trends and strict supplement regulations. Plant-based proteins, fortified cereals, and meal replacements dominate, with certifications like organic and non-GMO reinforcing transparency. Consumers show rising interest in gut health, heart wellness, and energy-support blends.

Asia-Pacific is fast-growing due to rising health awareness, urbanisation, and preventive nutrition trends across China, India, Japan, and Southeast Asia. Ayurvedic-inspired blends, instant health drink mixes, and multivitamin formulations are in demand. Local producers emphasise convenient formats, tropical flavours, and strong e-commerce distribution.

Latin America is expanding rapidly, led by Brazil, Mexico, and Argentina, with growing interest in wellness and fortified blends suited to local diets. Popular formats include protein-fibre-vitamin stick packs and fruit-flavoured fortified drinks. Globallocal partnerships enhance accessibility and consumer education.

The Middle East and Africa show steady growth, driven by rising fitness and urban wellness trends in the UAE, South Africa, and Nigeria. Popular products include vitamin-mineral blends, protein-fibre sachets, and herbal drink powders adapted to local tastes and climate. Distribution through pharmacies, lifestyle retailers, and digital health platforms is increasing.

Country-Wise Outlook:Personalised Health & AI-Driven Nutrition Propel U.S. Nutritional Blends Market.The United States continues to lead the way in the market for nutritional blends, driven by a growing trend towards personalised nutrition and AI-powered wellness platforms. A key factor in this shift is the increasing demand for nutrition solutions that cater to individual health goals like boosting immunity, enhancing energy, promoting gut health, and managing weight by utilising data analytics and digital delivery methods to create tailored macro- and micronutrient mixes.

Innovation hotspots in states such as California, Massachusetts, and New York are witnessing a surge in brands and formulators that provide AI-curated shake blends, powdered supplements, and functional drinks. Consumers, particularly busy professionals and those focused on performance, are on the lookout for blends that are not just convenient and clean-label but also optimised through algorithms based on their lifestyle, health profile, and the latest wellness trends.

In response, nutritional suppliers in the U.S. are pouring resources into modular premix production systems that feature high-speed blending, micro-dosing lines, and customisation platforms. Major food, beverage, and healthcare companies are teaming up with tech firms to facilitate subscription-based delivery, adaptive formula adjustments, and data-tracking feedback loops, making it easier to incorporate personalised nutrition into everyday life.

Clean Label and Plant-Based Ingredients Drive Germanys Nutritional Blends Market:Germany's nutritional blends market is really taking off, driven by a growing appetite for clean-label and plant-based options. Shoppers are becoming more discerning about what goes into their food, opting for blends that are organic, free from artificial additives, and sourced from nature. This trend is part of a larger movement in Germany towards sustainable food systems and ethical consumption, which is shaping how people buy across all nutritional categories.

Cities like Frankfurt, Stuttgart, and Dsseldorf are seeing a surge in vegan and vegetarian lifestyles, with plant-based nutritional blends stepping in to provide proteins, vitamins, and minerals usually found in animal products. Ingredients like pea protein, algae-based omega-3s, and fermented plant extracts are gaining traction in health stores and online shopping platforms.

In response, German manufacturers are ramping up their research and development to create formulations that emphasise traceable sourcing, allergen-free profiles, and eco-friendly packaging options. Clean-label certification and transparent marketing are becoming essential for earning consumer trust in the wellness and sports nutrition markets.

Japans Busy Urban Lifestyles Fuel Growth in the Nutritional Blends Market:Urban professionals and busy consumers in Japan are increasingly turning to nutritional blend products, like meal replacement shakes, fortified powders, and convenient mixables, to keep up with their health and wellness goals amidst their hectic lives. These products offer a handy alternative to traditional meals, providing balanced nutrition, think vitamins, minerals, protein, and functional ingredients all in easy-to-make formats. This blend of wellness and convenience is a direct response to the fast-paced lifestyles and changing demographics in Japan.

To cater to this growing demand, manufacturers are crafting products that align with Japanese tastes and dietary preferences. Youll often find features like low sugar content, a gentle sweetness, and familiar flavours such as matcha or red bean, along with ingredients like collagen, fermented elements, or plant-based protein. The packaging, like single-serve stick sachets and resealable trial pouches, is designed for portability and portion control, making it perfect for commuters, busy parents, and health-conscious millennials.

On top of that, technological advancements are setting brands apart in this market. Companies are rolling out blends with time-targeted release (for instance, an energy boost in the morning and calming nutrients at night), combining traditional botanicals with modern nutrition science, and ensuring compatibility with smart home dissolving appliances. As Japanese consumers continue to prioritise clean-label, nutritionally rich, and versatile solutions, the nutritional blends market is becoming a key part of their daily wellness routines.

Competitive Analysis:The nutritional blends market is increasingly driven by personalised formulation innovation. Companies are shifting from generic mixes to targeted blendssuch as macronutrient-rich or vitamin-fortified powders for immunity, energy, weight management, and gut health. Players using AI-assisted formulation, encapsulation technologies, and functional ingredients like adaptogens and nootropics are standing out, serving both B2B fortification needs and personalised consumer nutrition.

Clean-label, plant-based, and traceable ingredient sourcing has become a key competitive priority. Suppliers that offer non-GMO or organic certifications, plant-based formulations, and transparent ingredient traceability are gaining an edge, especially among health-conscious consumers and in markets with strict regulatory standards.

Digital and direct-to-consumer channels are reshaping competition as well. Brands investing in subscription models, rapid online customisation, and influencer-driven marketing are expanding reach quickly. This agility supports faster market feedback, strong niche positioning, and higher loyalty in wellness, fitness, and personalised nutrition segments.

Quality assurance and strong B2B integration remain essential differentiators. Leading suppliers maintain rigorous manufacturing standards, comply with regulations, and deliver consistent premixes for food, beverage, pharmaceutical, and animal nutrition industries. Ready-to-use premixes simplify product development and strengthen long-term partnerships with industrial clients.

Scalability is another competitive factor. Companies investing in automated supply chains and high-throughput production can meet rising bulk demand without sacrificing quality. Expanding production footprints across regions also helps manage regulatory differences and reduce logistics costs.

Recent Development:In June 2025, Else Nutrition applauded the U.S. government's historic shift in infant formula rules, which may unlock the path to commercialise the world's first whole-food, dairy-free infant formula. This regulatory development is crucial for their innovative plant-based blends for a sensitive consumer segment.

In May 2025, Else Nutrition expanded its nationwide presence with Kids Ready-to-Drink Shakes in 1,000 leading U.S. retailer stores. This indicates successful commercialisation and increased availability of their plant-based nutritional blends for children.

In July 2025, Herbalife launched MultiBurn, a science-backed weight loss supplement featuring clinically studied botanical extracts (including a red chilli pepper and fenugreek blend - Capsifen). This new daily supplement supports metabolic health, healthy fat reduction, and energy expenditure, showcasing innovation in weight management nutritional blends.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Nutritional Blends market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Nutritional Blends market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Nutritional Blends market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Nutritional Blends market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Nutritional Blends market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 6.79 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product Type |

|

| The Segment covered by Source |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Nutritional Blends market share, size, and revenue growth rate were created by Quintile Report™. Nutritional Blends analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Nutritional Blends Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Nutritional Blends Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Nutritional Blends Market, by Region, (USD Million) 2017-2035

Table 21 China Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Nutritional Blends Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Nutritional Blends Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Nutritional Blends Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Nutritional Blends Market: market scenario

Fig.4 Global Nutritional Blends Market competitive outlook

Fig.5 Global Nutritional Blends Market driver analysis

Fig.6 Global Nutritional Blends Market restraint analysis

Fig.7 Global Nutritional Blends Market opportunity analysis

Fig.8 Global Nutritional Blends Market trends analysis

Fig.9 Global Nutritional Blends Market: Segment Analysis (Based on the scope)

Fig.10 Global Nutritional Blends Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report Descriptions: The Global Non-GMO Flour Market was estimated at USD 72.87 billion in 2025 and

Read MoreReport Descriptions: The Global Mineral Ingredients Market was estimated at USD 8.12 billion in 2025

Read MoreReport Descriptions: The Global Feeding Distiller Dried Grains with Solubles (DGDS) Market was estim

Read More