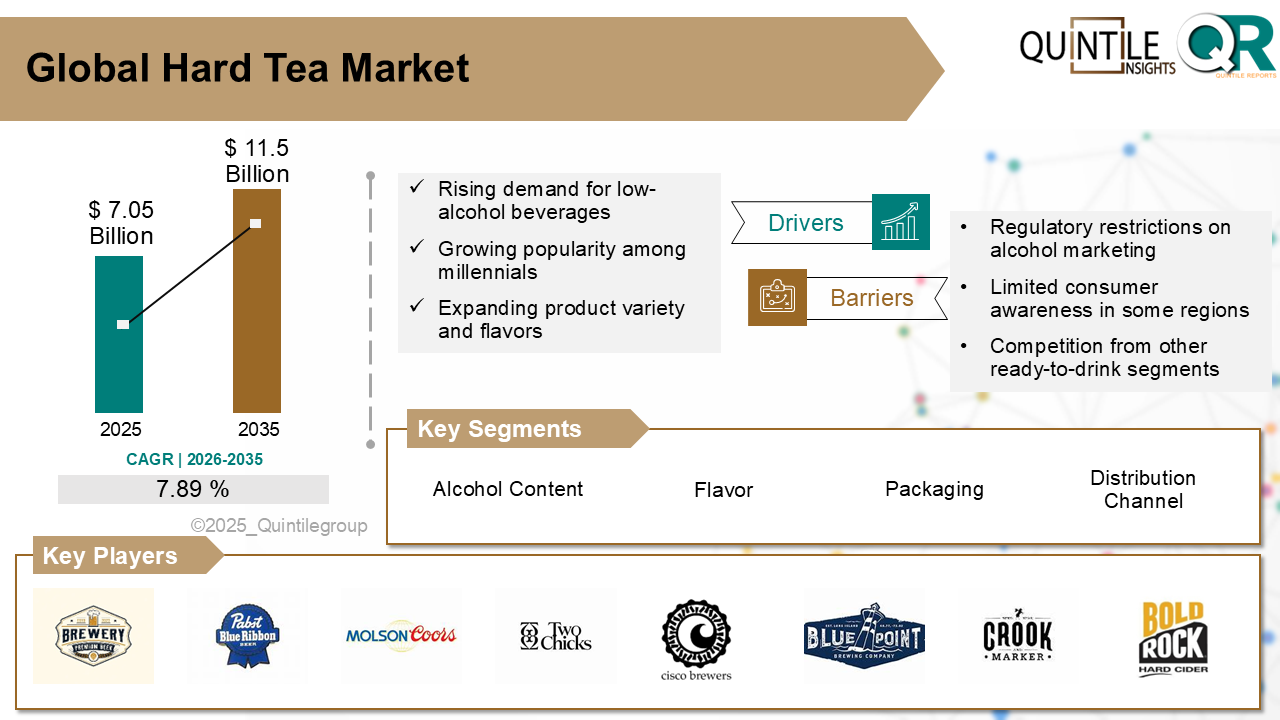

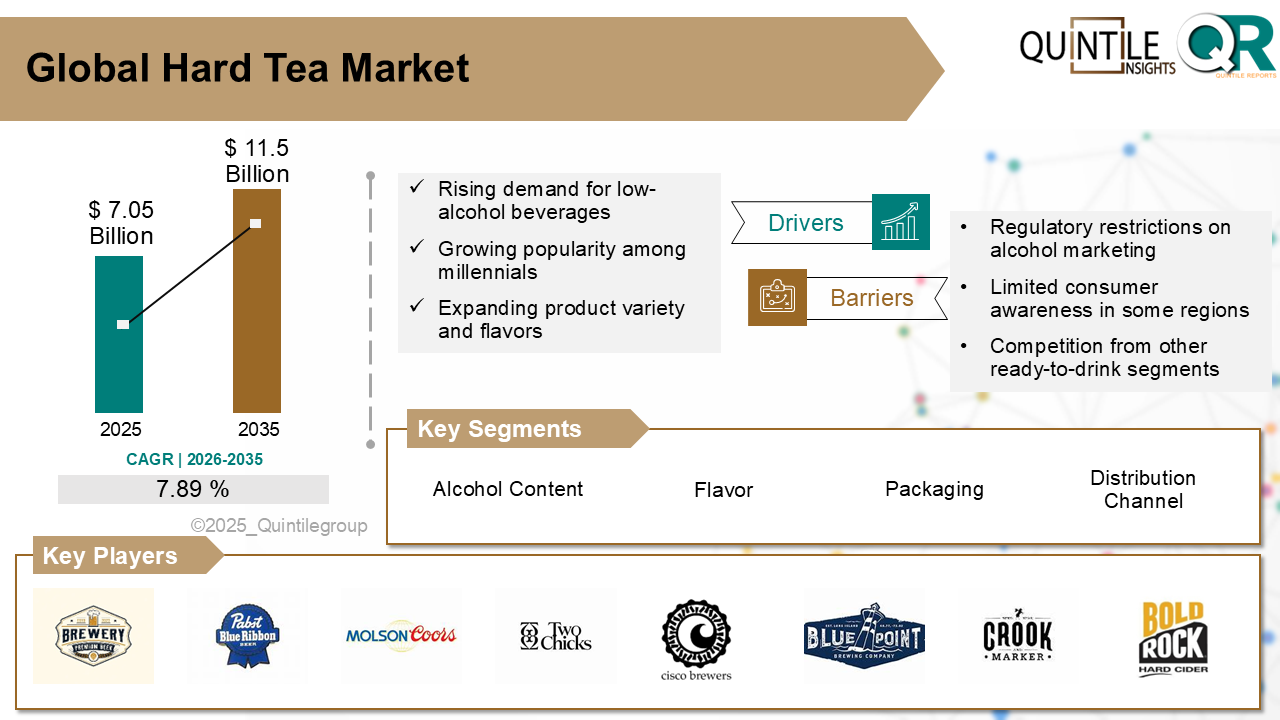

The Global Hard Tea Market was estimated at USD 7.05 Billion in 2025 and is projected to reach USD 11.5 Billion by 2035, reflecting a strong CAGR of 7.89% over the forecast period from 2026 to 2035. The Hard Tea market report delivers a comprehensive overview of the industry, extending beyond traditional analysis. It examines key market dynamics, including economic shifts, technological advancements, regulatory developments, and changing consumer behavior. The report also highlights the projected Compound Annual Growth Rate (CAGR), offering a clear understanding of future market growth.

The Hard Tea market is experiencing dynamic expansion, with 2025 as the base year. Recent data indicates notable growth driven by innovation, rising consumer demand, and rapid technological progress. Companies are refining their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to evolving market conditions.

Looking ahead, the Hard Tea market is expected to maintain its upward trajectory through 2035, supported by continuous R&D investments, strategic collaborations, and mergers and acquisitions. Organizations that adapt their GTM strategies, innovate, and align with shifting consumer needs are positioned for long-term success. The Hard Tea market report provides an in-depth analysis of current conditions and valuable insights into key drivers, challenges, and opportunities shaping the industry over the next decade. It covers market dynamics across segments, regions, and countries, integrating both qualitative and quantitative data from 2017 to 2035.

Historical Analysis (2017-2024): The report reviews market trends, performance indicators, and growth patterns from 2017 to 2024, helping identify historical factors that influence present and future dynamics.

Forecast and Projections (2026-2035): Building on historical insights, the report presents market forecasts and growth expectations from 2026 to 2035, highlighting key trends, opportunities, and challenges across various regions and segments.

Compound Annual Growth Rate (CAGR): The report provides a clear calculation of the CAGR for 2026 to 2035, enabling stakeholders to assess expected growth and market potential during the forecast period.

Hard Tea Market

Hard tea is a refreshing alcoholic beverage that blends brewed tealike black, green, or herbalwith alcohol, typically from malt fermentation or neutral spirits. With an ABV of 4% to 7%, it's similar to hard seltzers and flavored malt drinks. Often flavored with fruits, botanicals, or sweeteners, hard tea appeals to todays taste for natural and flavorful drinks.

It's especially popular among millennials and Gen Z, who value wellness, clean-label ingredients, and lighter alternatives to traditional beer or spirits. The rapid expansion is fueled by increasing consumer preference for flavored, lower-calorie RTD alcoholic drinks and ongoing innovation in product development.

What are the drivers of hard tea marketThe growing hard tea market is being driven by a confluence of consumer trends that reflect a broader shift in lifestyle and drinking habits.

A major force behind its rise is the increasing emphasis on health and wellnessconsumers are seeking beverages that align with their fitness and dietary goals, opting for natural ingredients, low sugar, fewer calories, and even functional benefits like antioxidants. Hard tea stands out as a better-for-you alternative to traditional alcoholic drinks.

At the same time, innovation in flavors and packaging continues to set brands apart, with newer varieties expanding beyond basic black tea to include green, white, oolong, and herbal blends infused with fruits and botanicals. This has led to a significant rise in seasonal and limited-edition SKUs over the past three years, fueling consumer excitement and repeat purchases.

Adding to its appeal is the broader trend favoring ready-to-drink (RTD) beverages, especially among younger demographics who value convenience and portabilityqualities that hard tea readily delivers. As part of the booming RTD category, hard tea is gaining shelf space and market share rapidly.

Finally, shifting alcohol consumption patternsespecially among millennials and Gen Zare pushing demand toward lighter, more sessionable drinks with lower ABV and interesting flavor profiles. Instead of high-proof spirits or heavy beers, todays consumers are increasingly turning to hard teas for casual gatherings and outdoor occasions, as they offer a more moderate and enjoyable drinking experience.

What are the challenges and restraining factors of hard tea marketOne of the biggest challenges is navigating complex regulatory and compliance landscapes, as rules around the sale, labeling, and marketing of alcoholic beveragesparticularly flavored malt drinksvary widely across regions.

Additionally, hard tea competes directly with other ready-to-drink (RTD) beverages like hard seltzers, ciders, and craft cocktails. These alternatives offer similar perkssuch as low calories, diverse flavors, and convenient formatsmaking it harder for hard tea to stand out in a crowded market.

The situation is further complicated by supply chain volatility, with fluctuating prices of tea, alcohol, and packaging materials affecting both availability and profit margins. For instance, sourcing premium tea blends during global logistics disruptions has proven difficult, impacting both product consistency and pricing.

Finally, in less mature marketsparticularly in parts of Asia-Pacific and Europeconsumer awareness around hard tea remains low. Many people are unfamiliar with the concept, especially in regions without strong traditions of tea or alcoholic RTD consumption.

What are the regional trends of hard tea marketNorth America: North America leads the global hard tea market, driven by health-conscious millennials and Gen Z who prefer ready-to-drink, low-calorie alcoholic options. Flavored varieties like lemon, peach, and raspberry dominate, especially those with clean-label, better-for-you ingredients. The U.S. is the largest market, supported by strong retail networksfrom supermarkets to online stores. The regions love for beverage innovation makes hard tea a natural fit for outdoor and social occasions. Regulations are generally supportive, with clear ABV and labeling rules that rarely limit creativity. Recent trends highlight organic, low-sugar, and antioxidant-rich options, plus seasonal and limited-edition releases.

Europe: In Europe, hard tea is quickly catching on, especially among urban millennials and Gen Z who are drawn to lower-alcohol, wellness-oriented drinks. These consumers look for unique, low-sugar, and sustainably sourced optionsmaking flavored hard teas a natural fit given the regions deep-rooted tea culture. The UK, Germany, and France are leading this growth, with demand focused on organic, craft, and premium-quality products made with natural ingredients and backed by environmental certifications. However, producers must navigate strict EU rules around alcohol content, ingredient transparency, and health claims, while also tackling fragmented tastes across countries and stiff competition from other RTD and craft beverages.

Asia Pacific: Asia Pacific is the fastest-growing market for hard tea, fueled by young, urban consumers in countries like China, Japan, and Australia who crave unique beverage experiences that mix traditional tea with alcohol. Popular among 2135-year-olds, this trend leans into premium and local flavors like lychee, matcha, and jasmine, with many willing to pay more for small-batch or specialty options. While strict ABV labeling is common, countries like Japan and South Korea also impose tight rules on imports and product formulation. The deep cultural respect for tea encourages trial, and innovation is constant, with limited-edition and health-positioned products frequently launched.

Latin America: Latin America's hard tea market is still in its early stages but is steadily gaining momentum, especially in urban centers like Brazil, Mexico, and Argentina. Young adults and professionals are driving this growth, drawn to the convenience and global appeal of ready-to-drink (RTD) options. Flavors that resonate with local tastessuch as citrus, tropical fruits, and yerba mateare especially popular. Hard teas are increasingly seen at social gatherings, particularly among women, reflecting a cultural preference for shared drinking experiences. Still, challenges remain, including limited awareness, premium pricing compared to traditional alcohol, and patchy distribution beyond big cities.

Middle East & Africa: Hard tea is still an emerging category in the Middle East and Africa, with its presence largely limited to cosmopolitan areas and expatriate hubs, particularly in the UAE and South Africa. Due to strict alcohol regulations, it's mostly found in licensed venues or specialty stores as a premium, Western-imported novelty. The primary consumers are international residents, affluent city dwellers, and tourists drawn to trending global beverages. To broaden appeal, some mocktail-style or non-alcoholic versions are introduced. Innovation here leans toward luxury experiences and regional flavors like hibiscus, ginger, or Middle Eastern botanicals.

Country-Wise Outlook:America leads the world in hard tea evolution:The United States is the largest and most mature hard tea market globally, with consumption heavily tilted toward flavored varieties. Millennials and Gen Z dominate the consumer base, representing majority of hard tea buyers, with a slight female skew despite an otherwise balanced gender split. This beverages appeal lies in its better-for-you image, moderate alcohol content, and perceived wellness benefits, driving demand for organic and clean-label options. Regulatory oversight remains supportive and structured, with federal and state authorities enforcing clear rules around ABV labeling, ingredient transparency, and age restrictions, classifying most hard teas as flavored malt beverages.

Culturally, hard tea enjoys mainstream acceptance, often featured at social events, tailgates, outdoor activities, and casual get-togethersclosely paralleling the rise of hard seltzers. The market continues to evolve, with brands exploring seasonal flavors, botanical infusions, and functional ingredients like adaptogens and antioxidants, all while ramping up sustainability commitments. It faces stiff competition from other ready-to-drink (RTD) options, making ongoing innovation and brand strength essential for long-term success.

Germany hard tea blends tradition and wellness:In Germany, hard tea is swiftly carving out market share as health-conscious consumers seek out lower-alcohol alternatives that offer both convenience and a sense of tradition. The segment is driven by black and green tea bases infused with citrus, berry, and herbal botanicalsflavors that resonate with familiar tea profiles. The core demographic, primarily urban professionals and younger adults aged 2540, increasingly favors beverages that are organic, low in calories, and sustainably packaged.

Germanys strict EU-aligned regulations mandate clear ABV disclosures, complete ingredient listings, and responsible marketing, creating barriers to entry but reinforcing consumer trust. Hard tea is also culturally resonant, tapping into the countrys rich tea and beer traditions, and is especially popular during brunches, festivals, and outdoor gatherings. A key trend shaping the market is the rise of local craft producers using regionally sourced ingredients to diversify flavor profiles. However, challenges remain due to varied consumer tastes, high taxes on ready-to-drink formats, and strong competition from hard seltzers and beerpushing brands to focus on premium positioning and distinctive flavor innovation.

Japan hard tea market blends tradition and trend:Japans hard tea market is rapidly emerging as one of Asias fastest-growing segments, fueled by the countrys deep-rooted tea culture and a rising openness to ready-to-drink (RTD) alcoholic options. Leading the flavor profile are green tea and oolong-based hard teas, while innovative variants such as matcha, yuzu, and sakura continue to gain popularity. The core demographic driving this surge comprises urban consumers aged 20 to 35, evenly split by gender and drawn to innovation, authenticity, and premium experiences.

Strict regulations govern alcohol advertising and labeling, requiring clear ABV and ingredient disclosures, alongside tight control over online purchases to prevent underage access. Hard tea is culturally embraced at after-work nomikai, izakayas, and seasonal events like cherry blossom festivals. Noteworthy trends include brand collaborations with famous tea estates, growing emphasis on sustainability through biodegradable packaging and local sourcing, and the use of superfood positioning. However, the market faces challenges such as converting traditional drinkers, standing out in an increasingly crowded RTD category, and adapting to frequently changing alcohol regulations.

Competitive Analysis:In the hard tea market, competition is driven by a blend of creativity, convenience, and conscious consumerism.

Flavor innovation stands out, with brands launching diverse options like peach, lychee, green tea, and botanicals, often tailored to regional tastesthink matcha in Asia or citrus in North America. Limited-edition and seasonal blends add excitement and encourage repeat purchases. Pricing varies across mainstream and premium tiers, where organic ingredients or craft methods command a higher price, while the value segment remains fiercely competitive.

Distribution is omnichannelsupermarkets and liquor stores still dominate, but online platforms now account for over a quarter of sales in some markets. Convenience stores and specialty shops serve impulse buyers, while bars and restaurants introduce consumers to new draft or artisanal options. Direct-to-consumer models help brands build communities and stay agile to trends. Product formats like bottled, canned, draft, and RTD cater to a variety of lifestyles and occasions.

Brands also compete on clean-label credentialsusing natural, non-GMO ingredients, promoting sustainability through eco-friendly packaging, and even adding functional benefits like adaptogens or antioxidants. Authentic storytelling, whether through artisanal heritage or festival-centric branding, creates lifestyle resonance, especially when amplified through social media and influencer campaigns.

Packaging plays a vital role toosleek, portable designs not only support convenience but elevate brand appeal, especially among younger consumers. Finally, local sourcing and small-batch production highlight craft quality and community support, rounding out a highly dynamic and differentiated market landscape.

Recent Development:On June 9, 2025, just in time for National Iced Tea Day, Turkey Hill teamed up with Scarlet Letter Beverage Co. to make its debut in the hard tea space. The result A refreshing line of 5% ABV alcoholic teas available in crowd-pleasing flavors like Lemon, Peach, and Raspberry. Designed for easy sipping and summer vibes, these teas come in convenient 12-pack formats and are now hitting shelves at select major retailers.

On April 21, 2025, AriZona leapt into the hard tea scene with AriZona Hard with Vodka, a clever spin on their beloved iced tea lineup that gives fans a spirited twist. The new range blends the brands famous cold-brewed teas with six-times-distilled vodka and real juiceresulting in a crisp, clean drink clocking in at just 100 calories per 22 oz Big Can.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Hard Tea market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Hard Tea market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Hard Tea market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Hard Tea market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Hard Tea market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 7.89 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Alcohol Content |

|

| The Segment covered by Flavor |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Hard Tea market share, size, and revenue growth rate were created by Quintile Report™. Hard Tea analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Hard Tea Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Hard Tea Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Hard Tea Market, by Region, (USD Million) 2017-2035

Table 21 China Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Hard Tea Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Hard Tea Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Hard Tea Market: market scenario

Fig.4 Global Hard Tea Market competitive outlook

Fig.5 Global Hard Tea Market driver analysis

Fig.6 Global Hard Tea Market restraint analysis

Fig.7 Global Hard Tea Market opportunity analysis

Fig.8 Global Hard Tea Market trends analysis

Fig.9 Global Hard Tea Market: Segment Analysis (Based on the scope)

Fig.10 Global Hard Tea Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Hard Tea Market was estimated at USD 7.05 Billion in 2025 and is projected to reach USD 11.5 Billion by 2035, reflecting a strong CAGR of 7.89% over the forecast period from 2026 to 2035. The Hard Tea market report delivers a comprehensive overview of the industry, extending beyond traditional analysis. It examines key market dynamics, including economic shifts, technological advancements, regulatory developments, and changing consumer behavior. The report also highlights the projected Compound Annual Growth Rate (CAGR), offering a clear understanding of future market growth.

The Hard Tea market is experiencing dynamic expansion, with 2025 as the base year. Recent data indicates notable growth driven by innovation, rising consumer demand, and rapid technological progress. Companies are refining their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to evolving market conditions.

Looking ahead, the Hard Tea market is expected to maintain its upward trajectory through 2035, supported by continuous R&D investments, strategic collaborations, and mergers and acquisitions. Organizations that adapt their GTM strategies, innovate, and align with shifting consumer needs are positioned for long-term success. The Hard Tea market report provides an in-depth analysis of current conditions and valuable insights into key drivers, challenges, and opportunities shaping the industry over the next decade. It covers market dynamics across segments, regions, and countries, integrating both qualitative and quantitative data from 2017 to 2035.

Historical Analysis (2017-2024): The report reviews market trends, performance indicators, and growth patterns from 2017 to 2024, helping identify historical factors that influence present and future dynamics.

Forecast and Projections (2026-2035): Building on historical insights, the report presents market forecasts and growth expectations from 2026 to 2035, highlighting key trends, opportunities, and challenges across various regions and segments.

Compound Annual Growth Rate (CAGR): The report provides a clear calculation of the CAGR for 2026 to 2035, enabling stakeholders to assess expected growth and market potential during the forecast period.

Hard Tea Market

Hard tea is a refreshing alcoholic beverage that blends brewed tealike black, green, or herbalwith alcohol, typically from malt fermentation or neutral spirits. With an ABV of 4% to 7%, it's similar to hard seltzers and flavored malt drinks. Often flavored with fruits, botanicals, or sweeteners, hard tea appeals to todays taste for natural and flavorful drinks.

It's especially popular among millennials and Gen Z, who value wellness, clean-label ingredients, and lighter alternatives to traditional beer or spirits. The rapid expansion is fueled by increasing consumer preference for flavored, lower-calorie RTD alcoholic drinks and ongoing innovation in product development.

What are the drivers of hard tea marketThe growing hard tea market is being driven by a confluence of consumer trends that reflect a broader shift in lifestyle and drinking habits.

A major force behind its rise is the increasing emphasis on health and wellnessconsumers are seeking beverages that align with their fitness and dietary goals, opting for natural ingredients, low sugar, fewer calories, and even functional benefits like antioxidants. Hard tea stands out as a better-for-you alternative to traditional alcoholic drinks.

At the same time, innovation in flavors and packaging continues to set brands apart, with newer varieties expanding beyond basic black tea to include green, white, oolong, and herbal blends infused with fruits and botanicals. This has led to a significant rise in seasonal and limited-edition SKUs over the past three years, fueling consumer excitement and repeat purchases.

Adding to its appeal is the broader trend favoring ready-to-drink (RTD) beverages, especially among younger demographics who value convenience and portabilityqualities that hard tea readily delivers. As part of the booming RTD category, hard tea is gaining shelf space and market share rapidly.

Finally, shifting alcohol consumption patternsespecially among millennials and Gen Zare pushing demand toward lighter, more sessionable drinks with lower ABV and interesting flavor profiles. Instead of high-proof spirits or heavy beers, todays consumers are increasingly turning to hard teas for casual gatherings and outdoor occasions, as they offer a more moderate and enjoyable drinking experience.

What are the challenges and restraining factors of hard tea marketOne of the biggest challenges is navigating complex regulatory and compliance landscapes, as rules around the sale, labeling, and marketing of alcoholic beveragesparticularly flavored malt drinksvary widely across regions.

Additionally, hard tea competes directly with other ready-to-drink (RTD) beverages like hard seltzers, ciders, and craft cocktails. These alternatives offer similar perkssuch as low calories, diverse flavors, and convenient formatsmaking it harder for hard tea to stand out in a crowded market.

The situation is further complicated by supply chain volatility, with fluctuating prices of tea, alcohol, and packaging materials affecting both availability and profit margins. For instance, sourcing premium tea blends during global logistics disruptions has proven difficult, impacting both product consistency and pricing.

Finally, in less mature marketsparticularly in parts of Asia-Pacific and Europeconsumer awareness around hard tea remains low. Many people are unfamiliar with the concept, especially in regions without strong traditions of tea or alcoholic RTD consumption.

What are the regional trends of hard tea marketNorth America: North America leads the global hard tea market, driven by health-conscious millennials and Gen Z who prefer ready-to-drink, low-calorie alcoholic options. Flavored varieties like lemon, peach, and raspberry dominate, especially those with clean-label, better-for-you ingredients. The U.S. is the largest market, supported by strong retail networksfrom supermarkets to online stores. The regions love for beverage innovation makes hard tea a natural fit for outdoor and social occasions. Regulations are generally supportive, with clear ABV and labeling rules that rarely limit creativity. Recent trends highlight organic, low-sugar, and antioxidant-rich options, plus seasonal and limited-edition releases.

Europe: In Europe, hard tea is quickly catching on, especially among urban millennials and Gen Z who are drawn to lower-alcohol, wellness-oriented drinks. These consumers look for unique, low-sugar, and sustainably sourced optionsmaking flavored hard teas a natural fit given the regions deep-rooted tea culture. The UK, Germany, and France are leading this growth, with demand focused on organic, craft, and premium-quality products made with natural ingredients and backed by environmental certifications. However, producers must navigate strict EU rules around alcohol content, ingredient transparency, and health claims, while also tackling fragmented tastes across countries and stiff competition from other RTD and craft beverages.

Asia Pacific: Asia Pacific is the fastest-growing market for hard tea, fueled by young, urban consumers in countries like China, Japan, and Australia who crave unique beverage experiences that mix traditional tea with alcohol. Popular among 2135-year-olds, this trend leans into premium and local flavors like lychee, matcha, and jasmine, with many willing to pay more for small-batch or specialty options. While strict ABV labeling is common, countries like Japan and South Korea also impose tight rules on imports and product formulation. The deep cultural respect for tea encourages trial, and innovation is constant, with limited-edition and health-positioned products frequently launched.

Latin America: Latin America's hard tea market is still in its early stages but is steadily gaining momentum, especially in urban centers like Brazil, Mexico, and Argentina. Young adults and professionals are driving this growth, drawn to the convenience and global appeal of ready-to-drink (RTD) options. Flavors that resonate with local tastessuch as citrus, tropical fruits, and yerba mateare especially popular. Hard teas are increasingly seen at social gatherings, particularly among women, reflecting a cultural preference for shared drinking experiences. Still, challenges remain, including limited awareness, premium pricing compared to traditional alcohol, and patchy distribution beyond big cities.

Middle East & Africa: Hard tea is still an emerging category in the Middle East and Africa, with its presence largely limited to cosmopolitan areas and expatriate hubs, particularly in the UAE and South Africa. Due to strict alcohol regulations, it's mostly found in licensed venues or specialty stores as a premium, Western-imported novelty. The primary consumers are international residents, affluent city dwellers, and tourists drawn to trending global beverages. To broaden appeal, some mocktail-style or non-alcoholic versions are introduced. Innovation here leans toward luxury experiences and regional flavors like hibiscus, ginger, or Middle Eastern botanicals.

Country-Wise Outlook:America leads the world in hard tea evolution:The United States is the largest and most mature hard tea market globally, with consumption heavily tilted toward flavored varieties. Millennials and Gen Z dominate the consumer base, representing majority of hard tea buyers, with a slight female skew despite an otherwise balanced gender split. This beverages appeal lies in its better-for-you image, moderate alcohol content, and perceived wellness benefits, driving demand for organic and clean-label options. Regulatory oversight remains supportive and structured, with federal and state authorities enforcing clear rules around ABV labeling, ingredient transparency, and age restrictions, classifying most hard teas as flavored malt beverages.

Culturally, hard tea enjoys mainstream acceptance, often featured at social events, tailgates, outdoor activities, and casual get-togethersclosely paralleling the rise of hard seltzers. The market continues to evolve, with brands exploring seasonal flavors, botanical infusions, and functional ingredients like adaptogens and antioxidants, all while ramping up sustainability commitments. It faces stiff competition from other ready-to-drink (RTD) options, making ongoing innovation and brand strength essential for long-term success.

Germany hard tea blends tradition and wellness:In Germany, hard tea is swiftly carving out market share as health-conscious consumers seek out lower-alcohol alternatives that offer both convenience and a sense of tradition. The segment is driven by black and green tea bases infused with citrus, berry, and herbal botanicalsflavors that resonate with familiar tea profiles. The core demographic, primarily urban professionals and younger adults aged 2540, increasingly favors beverages that are organic, low in calories, and sustainably packaged.

Germanys strict EU-aligned regulations mandate clear ABV disclosures, complete ingredient listings, and responsible marketing, creating barriers to entry but reinforcing consumer trust. Hard tea is also culturally resonant, tapping into the countrys rich tea and beer traditions, and is especially popular during brunches, festivals, and outdoor gatherings. A key trend shaping the market is the rise of local craft producers using regionally sourced ingredients to diversify flavor profiles. However, challenges remain due to varied consumer tastes, high taxes on ready-to-drink formats, and strong competition from hard seltzers and beerpushing brands to focus on premium positioning and distinctive flavor innovation.

Japan hard tea market blends tradition and trend:Japans hard tea market is rapidly emerging as one of Asias fastest-growing segments, fueled by the countrys deep-rooted tea culture and a rising openness to ready-to-drink (RTD) alcoholic options. Leading the flavor profile are green tea and oolong-based hard teas, while innovative variants such as matcha, yuzu, and sakura continue to gain popularity. The core demographic driving this surge comprises urban consumers aged 20 to 35, evenly split by gender and drawn to innovation, authenticity, and premium experiences.

Strict regulations govern alcohol advertising and labeling, requiring clear ABV and ingredient disclosures, alongside tight control over online purchases to prevent underage access. Hard tea is culturally embraced at after-work nomikai, izakayas, and seasonal events like cherry blossom festivals. Noteworthy trends include brand collaborations with famous tea estates, growing emphasis on sustainability through biodegradable packaging and local sourcing, and the use of superfood positioning. However, the market faces challenges such as converting traditional drinkers, standing out in an increasingly crowded RTD category, and adapting to frequently changing alcohol regulations.

Competitive Analysis:In the hard tea market, competition is driven by a blend of creativity, convenience, and conscious consumerism.

Flavor innovation stands out, with brands launching diverse options like peach, lychee, green tea, and botanicals, often tailored to regional tastesthink matcha in Asia or citrus in North America. Limited-edition and seasonal blends add excitement and encourage repeat purchases. Pricing varies across mainstream and premium tiers, where organic ingredients or craft methods command a higher price, while the value segment remains fiercely competitive.

Distribution is omnichannelsupermarkets and liquor stores still dominate, but online platforms now account for over a quarter of sales in some markets. Convenience stores and specialty shops serve impulse buyers, while bars and restaurants introduce consumers to new draft or artisanal options. Direct-to-consumer models help brands build communities and stay agile to trends. Product formats like bottled, canned, draft, and RTD cater to a variety of lifestyles and occasions.

Brands also compete on clean-label credentialsusing natural, non-GMO ingredients, promoting sustainability through eco-friendly packaging, and even adding functional benefits like adaptogens or antioxidants. Authentic storytelling, whether through artisanal heritage or festival-centric branding, creates lifestyle resonance, especially when amplified through social media and influencer campaigns.

Packaging plays a vital role toosleek, portable designs not only support convenience but elevate brand appeal, especially among younger consumers. Finally, local sourcing and small-batch production highlight craft quality and community support, rounding out a highly dynamic and differentiated market landscape.

Recent Development:On June 9, 2025, just in time for National Iced Tea Day, Turkey Hill teamed up with Scarlet Letter Beverage Co. to make its debut in the hard tea space. The result A refreshing line of 5% ABV alcoholic teas available in crowd-pleasing flavors like Lemon, Peach, and Raspberry. Designed for easy sipping and summer vibes, these teas come in convenient 12-pack formats and are now hitting shelves at select major retailers.

On April 21, 2025, AriZona leapt into the hard tea scene with AriZona Hard with Vodka, a clever spin on their beloved iced tea lineup that gives fans a spirited twist. The new range blends the brands famous cold-brewed teas with six-times-distilled vodka and real juiceresulting in a crisp, clean drink clocking in at just 100 calories per 22 oz Big Can.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Hard Tea market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Hard Tea market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Hard Tea market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Hard Tea market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Hard Tea market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 7.89 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Alcohol Content |

|

| The Segment covered by Flavor |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Hard Tea market share, size, and revenue growth rate were created by Quintile Report™. Hard Tea analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Hard Tea Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Hard Tea Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Hard Tea Market, by Region, (USD Million) 2017-2035

Table 21 China Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Hard Tea Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Hard Tea Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Hard Tea Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Hard Tea Market: market scenario

Fig.4 Global Hard Tea Market competitive outlook

Fig.5 Global Hard Tea Market driver analysis

Fig.6 Global Hard Tea Market restraint analysis

Fig.7 Global Hard Tea Market opportunity analysis

Fig.8 Global Hard Tea Market trends analysis

Fig.9 Global Hard Tea Market: Segment Analysis (Based on the scope)

Fig.10 Global Hard Tea Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report Descriptions: The Global Non-GMO Flour Market was estimated at USD 72.87 billion in 2025 and

Read MoreReport Descriptions: The Global Mineral Ingredients Market was estimated at USD 8.12 billion in 2025

Read MoreReport Descriptions: The Global Feeding Distiller Dried Grains with Solubles (DGDS) Market was estim

Read More