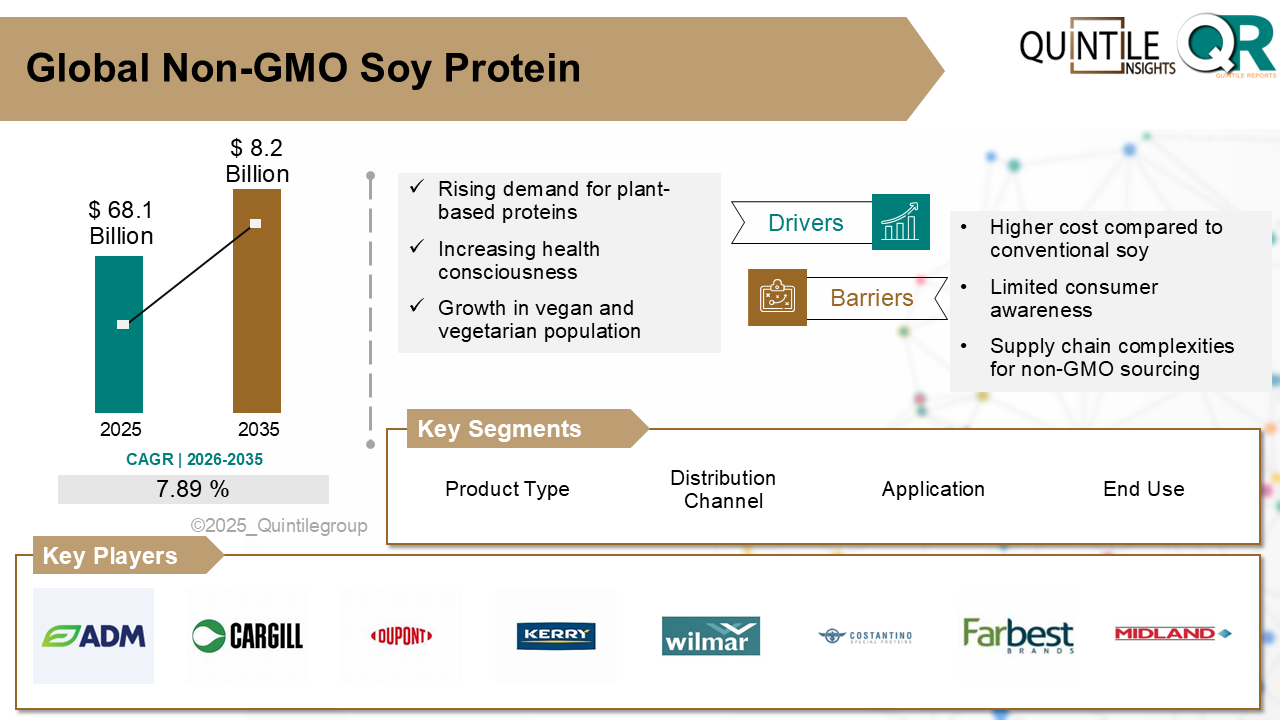

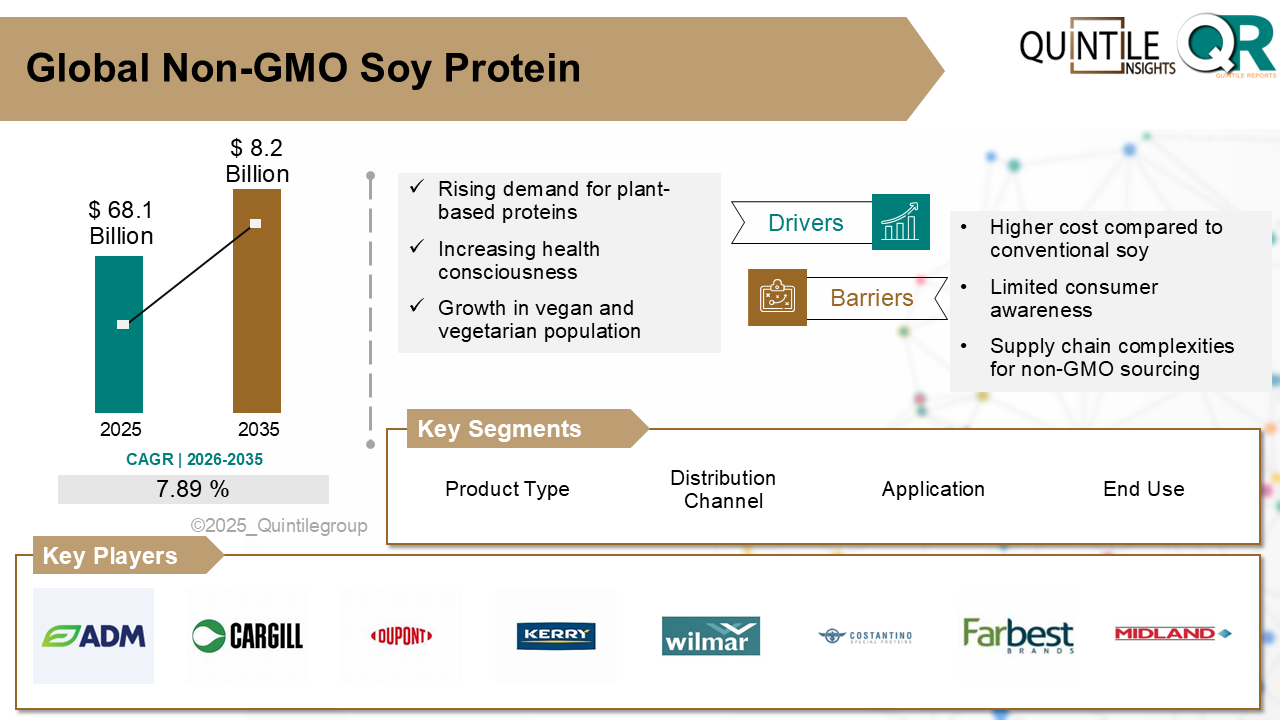

The Global Non-GMO Soy Protein Market was estimated at USD 68.1 Billion in 2025 and is projected to reach USD 8.2 Billion by 2035, reflecting a strong CAGR of 7.89% over the forecast period from 2026 to 2035. The Non-GMO Soy Protein market report delivers a comprehensive overview of the industry, extending beyond traditional analysis. It examines key market dynamics, including economic shifts, technological advancements, regulatory developments, and changing consumer behavior. The report also highlights the projected Compound Annual Growth Rate (CAGR), offering a clear understanding of future market growth.

The Non-GMO Soy Protein market is experiencing dynamic expansion, with 2025 as the base year. Recent data indicates notable growth driven by innovation, rising consumer demand, and rapid technological progress. Companies are refining their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to evolving market conditions.

Looking ahead, the Non-GMO Soy Protein market is expected to maintain its upward trajectory through 2035, supported by continuous R&D investments, strategic collaborations, and mergers and acquisitions. Organizations that adapt their GTM strategies, innovate, and align with shifting consumer needs are positioned for long-term success. The Non-GMO Soy Protein market report provides an in-depth analysis of current conditions and valuable insights into key drivers, challenges, and opportunities shaping the industry over the next decade. It covers market dynamics across segments, regions, and countries, integrating both qualitative and quantitative data from 2017 to 2035.

Historical Analysis (2017-2024): The report reviews market trends, performance indicators, and growth patterns from 2017 to 2024, helping identify historical factors that influence present and future dynamics.

Forecast and Projections (2026-2035): Building on historical insights, the report presents market forecasts and growth expectations from 2026 to 2035, highlighting key trends, opportunities, and challenges across various regions and segments.

Compound Annual Growth Rate (CAGR): The report provides a clear calculation of the CAGR for 2026 to 2035, enabling stakeholders to assess expected growth and market potential during the forecast period.

Market Name: Non-GMO Soy Protein Market

Non-GMO soy protein, derived from soybeans that havent been genetically modified, is valued for its clean-label appeal, high protein content (typically above 35%), and traceable, sustainable sourcing. Available as isolates, concentrates, and textured forms, its a versatile ingredient widely used in todays food industry. It enhances meat alternatives like plant-based burgers and sausages by mimicking meat texture and retaining moisture, boosts protein and shelf life in baked goods and snacks, and serves as the protein base in dairy-free products such as soy milk and yogurt. It's also a key component in protein powders and bars for fitness and weight management, and features in cereals, ready-to-eat meals, and other functional foods designed for health-conscious consumers.

What are the drivers of non-GMO soy protein marketThe market for non-GMO soy protein is being driven by a powerful convergence of consumer preferences, dietary shifts, corporate strategies, and technological innovation. A growing demand for clean-label and plant-based foods is at the forefront, as health-conscious and ethically minded consumers increasingly seek out natural, minimally processed products with transparent sourcing. Non-GMO soy protein stands out in this space, offering manufacturers a reliable, high-quality ingredient that aligns with these values. At the same time, the rise of veganism and flexitarian lifestyles is reshaping food choices, with many consumers looking to reduce or eliminate animal-based proteins. Thanks to its high protein content and ability to closely replicate the taste and texture of animal products, non-GMO soy protein has become a go-to ingredient for meat and dairy alternatives. This shift is further supported by major food companies and retailers committing to non-GMO sourcing, not only to meet regulatory standards but also to build trust through verified, traceable, and clearly labeled ingredients. Adding to this momentum are advancements in food processing technology, which have significantly enhanced the solubility, taste, and texture of soy protein. With innovations ranging from highly functional isolates to customized blends, manufacturers now have greater flexibility to tailor soy protein to meet diverse nutritional needs and flavor profilesbroadening its application across both mainstream and niche food products.

What are the challenges and restraining factors of non-GMO soy protein marketFirstly, production and procurement are notably costlier than conventional or GMO soy protein, due to the added burden of certification, segregation, and supply chain managementcosts that ultimately translate into higher retail prices and may deter price-sensitive consumers. Additionally, sourcing non-GMO soybeans is increasingly difficult in a global landscape dominated by genetically modified crops. Ensuring a consistent, traceable supply demands strong relationships with certified growers and added investment in upstream logistics. The market also faces rising competition from alternative plant proteins like pea, rice, and fava bean, which often attract consumers seeking non-allergenic, soy-free, or locally sourced optionsfurther diverting attention from soy-based products. On top of that, regulatory and compliance hurdles add another layer of complexity. Staying compliant with evolving national and international non-GMO standards requires rigorous documentation, increased costs, and can delay new product development, making it harder for companies to stay agile and competitive in a fast-moving market.

What are the regional trends of non-GMO soy protein marketNorth America: The non-GMO soy protein market is strong, driven by demand for clean-label and sustainable proteins. The U.S. leads production and consumption, with concentrates and isolates used widely in bakery, sports nutrition, and meat substitutes. Strict FDA labeling rules and certifications support market growth, with millennials and Gen Z accelerating adoption. Most sales flow through B2B channels.

Europe: Europes market is growing due to demand for organic, sustainable, and traceable non-GMO proteins. Strict EU GMO labeling makes certification essential. Consumers in the UK, Germany, and France are driving plant-based trends, boosting use in meat alternatives and bakery products. The UK relies heavily on imports to ensure steady supply.

Asia Pacific: Rapid market growth is fueled by rising populations and demand in China, India, and Japan. China is expanding non-GMO cultivation for self-sufficiency, while Japan and South Korea enforce strict labeling standards. Traditional soy-based diets support consistent demand, with urban consumers increasingly preferring non-GMO options.

Latin America: Brazil and Argentina play major roles as global suppliers of non-GMO soy. Brazil has established strong segregation and certification systems to meet export standards. Local demand is growing alongside plant-based eating trends, with non-GMO soy used more in processed and convenience foods.

Middle East & Africa: Emerging demand is rising for sustainable, halal, and allergen-free proteins. While regulations vary, non-GMO certification is increasingly valued. Imports continue to grow, especially for bakery and ready-to-eat foods where protein enrichment and food safety are priorities.

Country-Wise Outlook:Strong momentum for non-GMO soy protein in the United States:The Non-GMO soy protein market in the United States is evolving rapidly, led by industry giants like Archer Daniels Midland (ADM), Cargill, and Zeeland Farm Services. Backed by strict regulatory oversightincluding FDA guidelines and Non-GMO Project Verified certificationsthis segment upholds high standards that boost consumer trust. With health-conscious choices on the rise, around 12% of Americans follow strictly plant-based diets and another 7% identify as flexitarians. Millennials and Gen Z are key drivers, demanding transparent, sustainably sourced ingredients, contributing to an average daily plant protein intake of 40 grams per capita. Soy protein is increasingly used in vegan foods, functional snacks, supplements, and plant-based meat alternatives. To meet food safety and export standards, companies prioritize vertical integration and full supply chain traceability. While soy allergenicity remains a concern, Non-GMO soy is widely appreciated for its high protein content, low saturated fat, and cholesterol-free profile. Sustainability efforts are gaining ground through initiatives like the U.S. Soy Sustainability Assurance Protocol, though genetically modified soy still dominates overall production. Innovations in high-protein isolates, clean-label formulations, and eco-conscious commitments are shaping the future, even as the market grapples with challenges like cost competitiveness and maintaining supply chain segregation in response to growing consumer scrutiny.

Germany non-GMO soy protein market driven by wellness and sustainability:Germanys Non-GMO Soy Protein market reflects mature consumer awareness and strong regulatory oversight, with the EUs strict GMO-labeling laws ensuring non-GMO ingredients are essential for both domestic and imported products. Consumption is largely driven by health-focused demographics, especially consumers aged 25 to 44, who account for approximately 65% of soy protein purchases, fueled by the rise of vegetarian, vegan, and flexitarian diets. Non-GMO soy protein is widely incorporated into meat substitutes, bakery items, sports nutrition, and dairy alternatives, benefiting from strong cultural acceptance of plant-based and sustainable food choices. German agricultural policies and private sector investments are promoting local soybean cultivation and crop rotation practices, aligned with environmental and supply chain resilience goals. While health concerns mainly center around soy allergies, German consumers place high value on the nutritional profile and eco-credentials of soy protein, often associating its non-GMO status with food safety and ecological responsibility. Looking ahead, the market is poised for growth in innovation and product diversityincluding soy isolates, functional blends, and fortified variantsdriven by increasing wellness awareness and demand for sustainable nutrition. Rising demand may pose supply challenges but also opens opportunities for scaling up local, GMO-free raw material production.

Japan leads with trust and tradition in non-GMO soy protein:Japans non-GMO soy protein market thrives on a blend of cultural heritage, strict labeling regulations, and evolving consumer preferences. With government policy mandating clear GMO labeling, consumer trust in non-GMO claims remains high, driving widespread use of soy protein in staples like tofu, natto, miso, and soy sauces. Domestic firms such as Marusan-Ai and Kikkoman dominate the landscape, while global suppliers meet demand for premium, traceable ingredients. Despite limited agricultural land, Japan promotes local cultivationparticularly in Hokkaido and northern Honshuthrough cooperative farming and government support, while strictly sourcing non-GMO soybeans from the U.S., Canada, and China to meet demand. Non-GMO soy protein is widely viewed as a healthy, sustainable, low-fat protein choice, although allergy awareness is growing. Environmental consciousness is also on the rise, with greater emphasis on sustainability and ingredient traceability. Looking ahead, the market is expected to see continued innovation in both traditional and modern soy offerings, deeper localization to address global supply risks, and increased focus on clean-label, allergen-conscious products as plant-based diets steadily gain ground.

Competitive Analysis:The non-GMO soy protein market is evolving quickly, driven by rising demand for clean-label, plant-based, and sustainable proteins. Competition centers on pricing, as non-GMO production requires certification and strict traceability, leading companies to adopt either premium or volume-based pricing strategies. Product qualityespecially purity, solubility, taste, and textureis essential, with innovations enabling high-performance isolates and textured proteins for varied applications. Suppliers who maintain consistent quality and effectively manage allergens gain an advantage in sectors like infant foods and supplements. Certification and compliance remain crucial, with third-party non-GMO verification and strong food safety systems helping companies meet global standards.

Key differentiators include sustainability commitments such as responsible sourcing, lower carbon footprints, and ethical farming. Transparency is increasingly important, with digital traceability tools like blockchain improving reliability and reducing contamination risks. Innovation and customization also strengthen competitiveness, as clean-label, allergen-friendly formulations tailored for beverages, meat alternatives, and supplements attract diverse buyers. Ultimately, brand reputationsupported by trusted certifications, clear labeling, and authentic sustainability messagingdrives consumer loyalty, especially among younger, values-focused shoppers.

Key players in the market are:In July 2025, Indias Soybean Processors Association (SOPA) has joined forces with traceability-tech company TRST01 to help the countrys non-GMO soy sector meet the European Unions strict Deforestation Regulation (EUDR). This new rule demands that all soy entering the EU must come from land not linked to deforestation, with full visibility across the supply chain. To comply, SOPA and TRST01 are rolling out a digital platform using blockchain and geo-mapping to track soybeans from farm to export. The initiative covers key soy-growing states like Madhya Pradesh, Maharashtra, Rajasthan, and Telangana, and also includes farmer training to support sustainable practices.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Non-GMO Soy Protein market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Non-GMO Soy Protein market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Non-GMO Soy Protein market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Non-GMO Soy Protein market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Non-GMO Soy Protein market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 7.89 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product Type |

|

| The Segment covered by Grade |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Non-GMO Soy Protein market share, size, and revenue growth rate were created by Quintile Report™. Non-GMO Soy Protein analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Non-GMO Soy Protein Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Non-GMO Soy Protein Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Non-GMO Soy Protein Market, by Region, (USD Million) 2017-2035

Table 21 China Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Non-GMO Soy Protein Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Non-GMO Soy Protein Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Non-GMO Soy Protein Market: market scenario

Fig.4 Global Non-GMO Soy Protein Market competitive outlook

Fig.5 Global Non-GMO Soy Protein Market driver analysis

Fig.6 Global Non-GMO Soy Protein Market restraint analysis

Fig.7 Global Non-GMO Soy Protein Market opportunity analysis

Fig.8 Global Non-GMO Soy Protein Market trends analysis

Fig.9 Global Non-GMO Soy Protein Market: Segment Analysis (Based on the scope)

Fig.10 Global Non-GMO Soy Protein Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Non-GMO Soy Protein Market was estimated at USD 68.1 Billion in 2025 and is projected to reach USD 8.2 Billion by 2035, reflecting a strong CAGR of 7.89% over the forecast period from 2026 to 2035. The Non-GMO Soy Protein market report delivers a comprehensive overview of the industry, extending beyond traditional analysis. It examines key market dynamics, including economic shifts, technological advancements, regulatory developments, and changing consumer behavior. The report also highlights the projected Compound Annual Growth Rate (CAGR), offering a clear understanding of future market growth.

The Non-GMO Soy Protein market is experiencing dynamic expansion, with 2025 as the base year. Recent data indicates notable growth driven by innovation, rising consumer demand, and rapid technological progress. Companies are refining their go-to-market (GTM) strategies to capitalize on emerging opportunities and adapt to evolving market conditions.

Looking ahead, the Non-GMO Soy Protein market is expected to maintain its upward trajectory through 2035, supported by continuous R&D investments, strategic collaborations, and mergers and acquisitions. Organizations that adapt their GTM strategies, innovate, and align with shifting consumer needs are positioned for long-term success. The Non-GMO Soy Protein market report provides an in-depth analysis of current conditions and valuable insights into key drivers, challenges, and opportunities shaping the industry over the next decade. It covers market dynamics across segments, regions, and countries, integrating both qualitative and quantitative data from 2017 to 2035.

Historical Analysis (2017-2024): The report reviews market trends, performance indicators, and growth patterns from 2017 to 2024, helping identify historical factors that influence present and future dynamics.

Forecast and Projections (2026-2035): Building on historical insights, the report presents market forecasts and growth expectations from 2026 to 2035, highlighting key trends, opportunities, and challenges across various regions and segments.

Compound Annual Growth Rate (CAGR): The report provides a clear calculation of the CAGR for 2026 to 2035, enabling stakeholders to assess expected growth and market potential during the forecast period.

Market Name: Non-GMO Soy Protein Market

Non-GMO soy protein, derived from soybeans that havent been genetically modified, is valued for its clean-label appeal, high protein content (typically above 35%), and traceable, sustainable sourcing. Available as isolates, concentrates, and textured forms, its a versatile ingredient widely used in todays food industry. It enhances meat alternatives like plant-based burgers and sausages by mimicking meat texture and retaining moisture, boosts protein and shelf life in baked goods and snacks, and serves as the protein base in dairy-free products such as soy milk and yogurt. It's also a key component in protein powders and bars for fitness and weight management, and features in cereals, ready-to-eat meals, and other functional foods designed for health-conscious consumers.

What are the drivers of non-GMO soy protein marketThe market for non-GMO soy protein is being driven by a powerful convergence of consumer preferences, dietary shifts, corporate strategies, and technological innovation. A growing demand for clean-label and plant-based foods is at the forefront, as health-conscious and ethically minded consumers increasingly seek out natural, minimally processed products with transparent sourcing. Non-GMO soy protein stands out in this space, offering manufacturers a reliable, high-quality ingredient that aligns with these values. At the same time, the rise of veganism and flexitarian lifestyles is reshaping food choices, with many consumers looking to reduce or eliminate animal-based proteins. Thanks to its high protein content and ability to closely replicate the taste and texture of animal products, non-GMO soy protein has become a go-to ingredient for meat and dairy alternatives. This shift is further supported by major food companies and retailers committing to non-GMO sourcing, not only to meet regulatory standards but also to build trust through verified, traceable, and clearly labeled ingredients. Adding to this momentum are advancements in food processing technology, which have significantly enhanced the solubility, taste, and texture of soy protein. With innovations ranging from highly functional isolates to customized blends, manufacturers now have greater flexibility to tailor soy protein to meet diverse nutritional needs and flavor profilesbroadening its application across both mainstream and niche food products.

What are the challenges and restraining factors of non-GMO soy protein marketFirstly, production and procurement are notably costlier than conventional or GMO soy protein, due to the added burden of certification, segregation, and supply chain managementcosts that ultimately translate into higher retail prices and may deter price-sensitive consumers. Additionally, sourcing non-GMO soybeans is increasingly difficult in a global landscape dominated by genetically modified crops. Ensuring a consistent, traceable supply demands strong relationships with certified growers and added investment in upstream logistics. The market also faces rising competition from alternative plant proteins like pea, rice, and fava bean, which often attract consumers seeking non-allergenic, soy-free, or locally sourced optionsfurther diverting attention from soy-based products. On top of that, regulatory and compliance hurdles add another layer of complexity. Staying compliant with evolving national and international non-GMO standards requires rigorous documentation, increased costs, and can delay new product development, making it harder for companies to stay agile and competitive in a fast-moving market.

What are the regional trends of non-GMO soy protein marketNorth America: The non-GMO soy protein market is strong, driven by demand for clean-label and sustainable proteins. The U.S. leads production and consumption, with concentrates and isolates used widely in bakery, sports nutrition, and meat substitutes. Strict FDA labeling rules and certifications support market growth, with millennials and Gen Z accelerating adoption. Most sales flow through B2B channels.

Europe: Europes market is growing due to demand for organic, sustainable, and traceable non-GMO proteins. Strict EU GMO labeling makes certification essential. Consumers in the UK, Germany, and France are driving plant-based trends, boosting use in meat alternatives and bakery products. The UK relies heavily on imports to ensure steady supply.

Asia Pacific: Rapid market growth is fueled by rising populations and demand in China, India, and Japan. China is expanding non-GMO cultivation for self-sufficiency, while Japan and South Korea enforce strict labeling standards. Traditional soy-based diets support consistent demand, with urban consumers increasingly preferring non-GMO options.

Latin America: Brazil and Argentina play major roles as global suppliers of non-GMO soy. Brazil has established strong segregation and certification systems to meet export standards. Local demand is growing alongside plant-based eating trends, with non-GMO soy used more in processed and convenience foods.

Middle East & Africa: Emerging demand is rising for sustainable, halal, and allergen-free proteins. While regulations vary, non-GMO certification is increasingly valued. Imports continue to grow, especially for bakery and ready-to-eat foods where protein enrichment and food safety are priorities.

Country-Wise Outlook:Strong momentum for non-GMO soy protein in the United States:The Non-GMO soy protein market in the United States is evolving rapidly, led by industry giants like Archer Daniels Midland (ADM), Cargill, and Zeeland Farm Services. Backed by strict regulatory oversightincluding FDA guidelines and Non-GMO Project Verified certificationsthis segment upholds high standards that boost consumer trust. With health-conscious choices on the rise, around 12% of Americans follow strictly plant-based diets and another 7% identify as flexitarians. Millennials and Gen Z are key drivers, demanding transparent, sustainably sourced ingredients, contributing to an average daily plant protein intake of 40 grams per capita. Soy protein is increasingly used in vegan foods, functional snacks, supplements, and plant-based meat alternatives. To meet food safety and export standards, companies prioritize vertical integration and full supply chain traceability. While soy allergenicity remains a concern, Non-GMO soy is widely appreciated for its high protein content, low saturated fat, and cholesterol-free profile. Sustainability efforts are gaining ground through initiatives like the U.S. Soy Sustainability Assurance Protocol, though genetically modified soy still dominates overall production. Innovations in high-protein isolates, clean-label formulations, and eco-conscious commitments are shaping the future, even as the market grapples with challenges like cost competitiveness and maintaining supply chain segregation in response to growing consumer scrutiny.

Germany non-GMO soy protein market driven by wellness and sustainability:Germanys Non-GMO Soy Protein market reflects mature consumer awareness and strong regulatory oversight, with the EUs strict GMO-labeling laws ensuring non-GMO ingredients are essential for both domestic and imported products. Consumption is largely driven by health-focused demographics, especially consumers aged 25 to 44, who account for approximately 65% of soy protein purchases, fueled by the rise of vegetarian, vegan, and flexitarian diets. Non-GMO soy protein is widely incorporated into meat substitutes, bakery items, sports nutrition, and dairy alternatives, benefiting from strong cultural acceptance of plant-based and sustainable food choices. German agricultural policies and private sector investments are promoting local soybean cultivation and crop rotation practices, aligned with environmental and supply chain resilience goals. While health concerns mainly center around soy allergies, German consumers place high value on the nutritional profile and eco-credentials of soy protein, often associating its non-GMO status with food safety and ecological responsibility. Looking ahead, the market is poised for growth in innovation and product diversityincluding soy isolates, functional blends, and fortified variantsdriven by increasing wellness awareness and demand for sustainable nutrition. Rising demand may pose supply challenges but also opens opportunities for scaling up local, GMO-free raw material production.

Japan leads with trust and tradition in non-GMO soy protein:Japans non-GMO soy protein market thrives on a blend of cultural heritage, strict labeling regulations, and evolving consumer preferences. With government policy mandating clear GMO labeling, consumer trust in non-GMO claims remains high, driving widespread use of soy protein in staples like tofu, natto, miso, and soy sauces. Domestic firms such as Marusan-Ai and Kikkoman dominate the landscape, while global suppliers meet demand for premium, traceable ingredients. Despite limited agricultural land, Japan promotes local cultivationparticularly in Hokkaido and northern Honshuthrough cooperative farming and government support, while strictly sourcing non-GMO soybeans from the U.S., Canada, and China to meet demand. Non-GMO soy protein is widely viewed as a healthy, sustainable, low-fat protein choice, although allergy awareness is growing. Environmental consciousness is also on the rise, with greater emphasis on sustainability and ingredient traceability. Looking ahead, the market is expected to see continued innovation in both traditional and modern soy offerings, deeper localization to address global supply risks, and increased focus on clean-label, allergen-conscious products as plant-based diets steadily gain ground.

Competitive Analysis:The non-GMO soy protein market is evolving quickly, driven by rising demand for clean-label, plant-based, and sustainable proteins. Competition centers on pricing, as non-GMO production requires certification and strict traceability, leading companies to adopt either premium or volume-based pricing strategies. Product qualityespecially purity, solubility, taste, and textureis essential, with innovations enabling high-performance isolates and textured proteins for varied applications. Suppliers who maintain consistent quality and effectively manage allergens gain an advantage in sectors like infant foods and supplements. Certification and compliance remain crucial, with third-party non-GMO verification and strong food safety systems helping companies meet global standards.

Key differentiators include sustainability commitments such as responsible sourcing, lower carbon footprints, and ethical farming. Transparency is increasingly important, with digital traceability tools like blockchain improving reliability and reducing contamination risks. Innovation and customization also strengthen competitiveness, as clean-label, allergen-friendly formulations tailored for beverages, meat alternatives, and supplements attract diverse buyers. Ultimately, brand reputationsupported by trusted certifications, clear labeling, and authentic sustainability messagingdrives consumer loyalty, especially among younger, values-focused shoppers.

Key players in the market are:In July 2025, Indias Soybean Processors Association (SOPA) has joined forces with traceability-tech company TRST01 to help the countrys non-GMO soy sector meet the European Unions strict Deforestation Regulation (EUDR). This new rule demands that all soy entering the EU must come from land not linked to deforestation, with full visibility across the supply chain. To comply, SOPA and TRST01 are rolling out a digital platform using blockchain and geo-mapping to track soybeans from farm to export. The initiative covers key soy-growing states like Madhya Pradesh, Maharashtra, Rajasthan, and Telangana, and also includes farmer training to support sustainable practices.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Non-GMO Soy Protein market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Non-GMO Soy Protein market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Non-GMO Soy Protein market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Non-GMO Soy Protein market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Non-GMO Soy Protein market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 7.89 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product Type |

|

| The Segment covered by Grade |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Non-GMO Soy Protein market share, size, and revenue growth rate were created by Quintile Report™. Non-GMO Soy Protein analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Non-GMO Soy Protein Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Non-GMO Soy Protein Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Non-GMO Soy Protein Market, by Region, (USD Million) 2017-2035

Table 21 China Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Non-GMO Soy Protein Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Non-GMO Soy Protein Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Non-GMO Soy Protein Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Non-GMO Soy Protein Market: market scenario

Fig.4 Global Non-GMO Soy Protein Market competitive outlook

Fig.5 Global Non-GMO Soy Protein Market driver analysis

Fig.6 Global Non-GMO Soy Protein Market restraint analysis

Fig.7 Global Non-GMO Soy Protein Market opportunity analysis

Fig.8 Global Non-GMO Soy Protein Market trends analysis

Fig.9 Global Non-GMO Soy Protein Market: Segment Analysis (Based on the scope)

Fig.10 Global Non-GMO Soy Protein Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report Descriptions: The Global Non-GMO Flour Market was estimated at USD 72.87 billion in 2025 and

Read MoreReport Descriptions: The Global Mineral Ingredients Market was estimated at USD 8.12 billion in 2025

Read MoreReport Descriptions: The Global Feeding Distiller Dried Grains with Solubles (DGDS) Market was estim

Read More