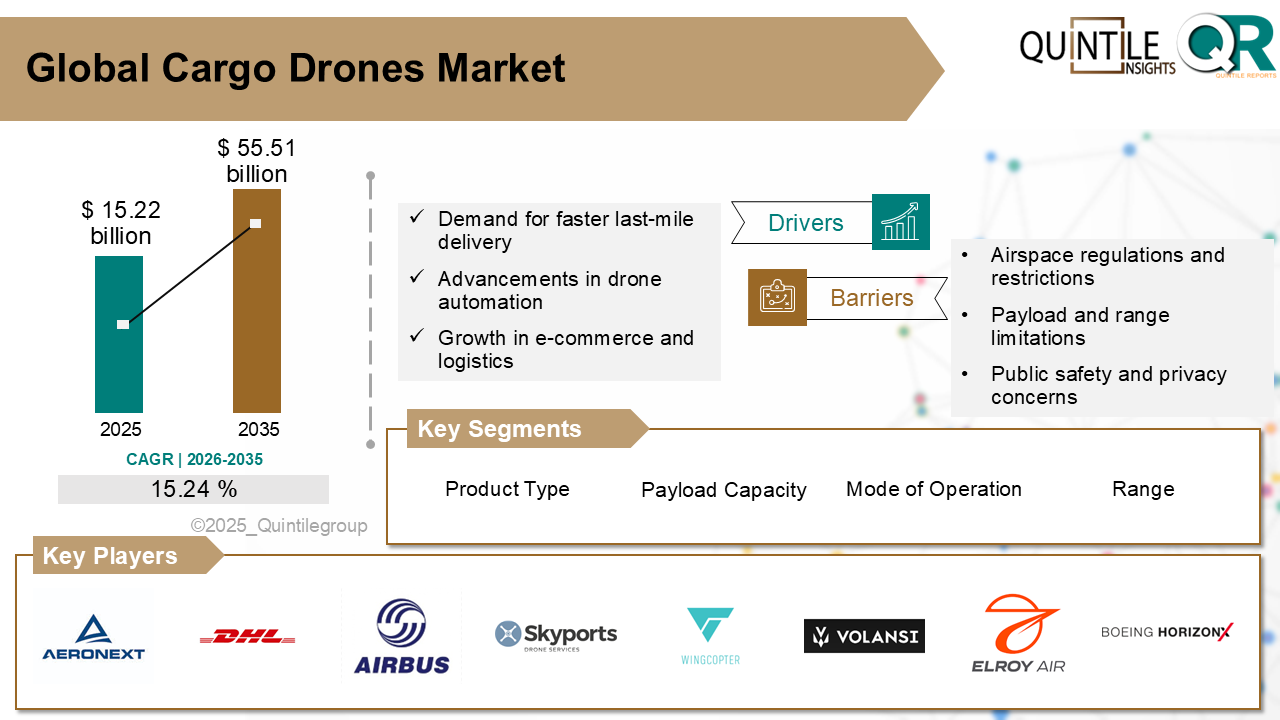

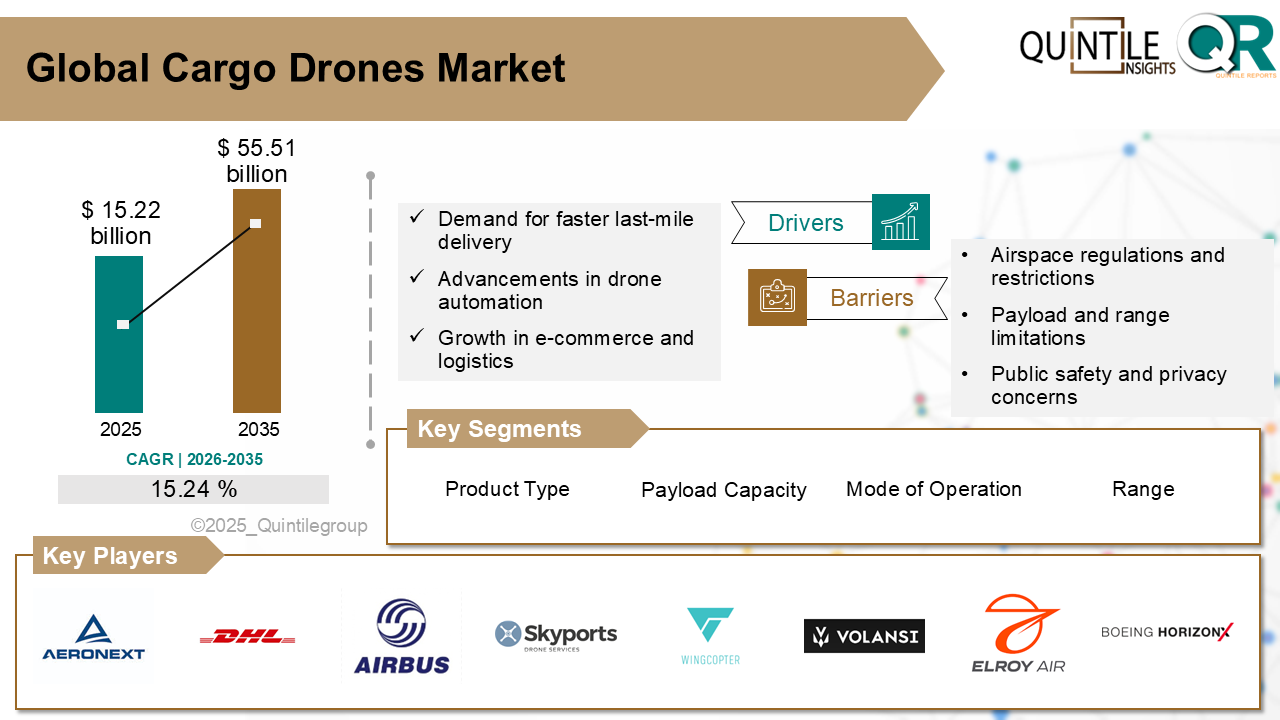

"The Global Cargo Drones Market was estimated at USD 15.22 billion in 2025 and is projected to reach USD 55.51 billion by 2035, reflecting a robust CAGR of 15.24% over the forecast period from 2026 to 2035. The Cargo Drones market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Cargo Drones market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Cargo Drones market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Looking ahead, the Cargo Drones market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Cargo Drones market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period."

Cargo Drones Market

The cargo drones market includes unmanned aerial vehicles (UAVs) designed specifically to transport goods, packages, and supplies. These drones are used for commercial, industrial, humanitarian, and military purposes, offering an alternative to traditional transportation methods. Cargo drones may range in size from small delivery units carrying a few kilograms to large drones capable of transporting hundreds of kilograms over long distances.

They are used in remote deliveries, disaster relief, medical supply distribution, warehouse logistics, and time-sensitive shipping. Cargo drones reduce delivery time, avoid road traffic, and reach areas that are difficult or dangerous for land vehicles. As drone technology improves and delivery networks expand, the use of drones in cargo transport is growing globally.

What are the drivers of cargo drones marketThe United States is leading in cargo drone development and use. Big companies like delivery services (for e.g. Amazon) and online retailers are testing drones for fast delivery of small packages. Hospitals are also using drones to send urgent medical supplies like blood and vaccines.

The U.S. government, through the Federal Aviation Administration (FAA), has approved several drone trials. These allow companies to test drones in real-life situations while making sure they follow safety rules. Startups and tech firms in the U.S. are building more powerful drones that can fly longer and carry heavier goods. These efforts are helping drones become a regular part of logistics in the country.

Germany focuses on industrial use and urban testing under strict rules:Germany is using cargo drones mainly for short-range delivery between factories, warehouses, and nearby facilities. In some cities, drones are being tested to carry packages in busy areas. These projects are closely managed to follow air safety rules and avoid risks.

German companies are strong in engineering, and they are making drones that are safe, quiet, and efficient. The government is supporting drone use through smart city projects, especially in transportation and manufacturing zones. Germany is also testing systems that help drones fly safely in shared airspace.

Japan supports drone delivery in rural and aging areas:Japan is using cargo drones to help people in remote places, like islands or mountain towns, where roads are limited. Drones deliver medicine, food, and daily items to older people living alone or in villages far from stores or hospitals.

The government has created special air routes for drones, making it easier to fly safely without disturbing regular air traffic. Japanese companies are building drones that are quiet and easy to land in small spaces. These are also being used in cities for trial runs of grocery and pharmacy deliveries.

Competitive Analysis:The cargo drones market includes drone manufacturers, logistics providers, aerospace firms, and specialized software developers. Large drone manufacturers offer heavy-lift models designed for long-distance transport. These are used by courier services, emergency responders, and supply chain managers.

Logistics companies are partnering with drone firms to develop dedicated delivery networks. Some are building hybrid systems where drones work alongside trucks and vans to shorten delivery routes. Others focus on warehouse automation, using drones to move goods between floors or storage zones.

Startups are playing an important role in innovation. Many are developing lightweight, modular drones that can be customized for various cargo types and weather conditions. Others are creating navigation, routing, and air traffic management software to make drone operations safer and more efficient.

Firms that offer drone-as-a-service models where clients pay for usage rather than buying drones are gaining popularity. These companies handle fleet management, licensing, and maintenance, making it easier for clients to adopt drone logistics.

Partnerships with governments, healthcare systems, and international agencies are helping expand market reach. Companies that can ensure reliability, safety, and compliance with airspace rules have a competitive edge as drone delivery shifts from trial to regular use.

Key players in the market are Zipline, Wingcopter GmbH, Airbus S.A.S., Volansi Inc., Elroy Air, DHL Parcelcopter (Deutsche Post AG), EmbraerX, Boeing HorizonX, Skyports Ltd., Aeronext Inc., Drone Delivery Canada, Sabrewing Aircraft Company Inc., Flytrex Inc., Matternet Inc., Amazon Prime Air, Alphabets Wing, AeroVironment Inc., EHang Holdings Ltd., Beta Technologies, Joby Aviation, and other players.

Recent Development:In June 2025, Drone Forge, an Australian aerospace start-up, has partnered with Airbus Helicopters to purchase six Flexrotor uncrewed aerial systems (UAS), totaling 17 aircraft. This marks the largest Flexrotor order to date. The systems will be tailored for a variety of missions across the Asia-Pacific region.

In June 2023, Siemens Healthineers is working with German drone company Wingcopter to test a drone-based delivery system for healthcare in Africa. The project will enable two-way transport of blood samples, vaccines, and medicines to improve access to diagnostics and treatment in remote areas.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Cargo Drones market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Cargo Drones market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Cargo Drones market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Cargo Drones market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Cargo Drones market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 15.24 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Type |

|

| The Segment covered by Payload Capacity |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Cargo Drones market share, size, and revenue growth rate were created by Quintile Report™. Cargo Drones analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Cargo Drones Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Cargo Drones Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Cargo Drones Market, by Region, (USD Million) 2017-2035

Table 21 China Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Cargo Drones Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Cargo Drones Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Cargo Drones Market: market scenario

Fig.4 Global Cargo Drones Market competitive outlook

Fig.5 Global Cargo Drones Market driver analysis

Fig.6 Global Cargo Drones Market restraint analysis

Fig.7 Global Cargo Drones Market opportunity analysis

Fig.8 Global Cargo Drones Market trends analysis

Fig.9 Global Cargo Drones Market: Segment Analysis (Based on the scope)

Fig.10 Global Cargo Drones Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

"The Global Cargo Drones Market was estimated at USD 15.22 billion in 2025 and is projected to reach USD 55.51 billion by 2035, reflecting a robust CAGR of 15.24% over the forecast period from 2026 to 2035. The Cargo Drones market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Cargo Drones market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Cargo Drones market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Looking ahead, the Cargo Drones market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Cargo Drones market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period."

Cargo Drones Market

The cargo drones market includes unmanned aerial vehicles (UAVs) designed specifically to transport goods, packages, and supplies. These drones are used for commercial, industrial, humanitarian, and military purposes, offering an alternative to traditional transportation methods. Cargo drones may range in size from small delivery units carrying a few kilograms to large drones capable of transporting hundreds of kilograms over long distances.

They are used in remote deliveries, disaster relief, medical supply distribution, warehouse logistics, and time-sensitive shipping. Cargo drones reduce delivery time, avoid road traffic, and reach areas that are difficult or dangerous for land vehicles. As drone technology improves and delivery networks expand, the use of drones in cargo transport is growing globally.

What are the drivers of cargo drones marketThe United States is leading in cargo drone development and use. Big companies like delivery services (for e.g. Amazon) and online retailers are testing drones for fast delivery of small packages. Hospitals are also using drones to send urgent medical supplies like blood and vaccines.

The U.S. government, through the Federal Aviation Administration (FAA), has approved several drone trials. These allow companies to test drones in real-life situations while making sure they follow safety rules. Startups and tech firms in the U.S. are building more powerful drones that can fly longer and carry heavier goods. These efforts are helping drones become a regular part of logistics in the country.

Germany focuses on industrial use and urban testing under strict rules:Germany is using cargo drones mainly for short-range delivery between factories, warehouses, and nearby facilities. In some cities, drones are being tested to carry packages in busy areas. These projects are closely managed to follow air safety rules and avoid risks.

German companies are strong in engineering, and they are making drones that are safe, quiet, and efficient. The government is supporting drone use through smart city projects, especially in transportation and manufacturing zones. Germany is also testing systems that help drones fly safely in shared airspace.

Japan supports drone delivery in rural and aging areas:Japan is using cargo drones to help people in remote places, like islands or mountain towns, where roads are limited. Drones deliver medicine, food, and daily items to older people living alone or in villages far from stores or hospitals.

The government has created special air routes for drones, making it easier to fly safely without disturbing regular air traffic. Japanese companies are building drones that are quiet and easy to land in small spaces. These are also being used in cities for trial runs of grocery and pharmacy deliveries.

Competitive Analysis:The cargo drones market includes drone manufacturers, logistics providers, aerospace firms, and specialized software developers. Large drone manufacturers offer heavy-lift models designed for long-distance transport. These are used by courier services, emergency responders, and supply chain managers.

Logistics companies are partnering with drone firms to develop dedicated delivery networks. Some are building hybrid systems where drones work alongside trucks and vans to shorten delivery routes. Others focus on warehouse automation, using drones to move goods between floors or storage zones.

Startups are playing an important role in innovation. Many are developing lightweight, modular drones that can be customized for various cargo types and weather conditions. Others are creating navigation, routing, and air traffic management software to make drone operations safer and more efficient.

Firms that offer drone-as-a-service models where clients pay for usage rather than buying drones are gaining popularity. These companies handle fleet management, licensing, and maintenance, making it easier for clients to adopt drone logistics.

Partnerships with governments, healthcare systems, and international agencies are helping expand market reach. Companies that can ensure reliability, safety, and compliance with airspace rules have a competitive edge as drone delivery shifts from trial to regular use.

Key players in the market are Zipline, Wingcopter GmbH, Airbus S.A.S., Volansi Inc., Elroy Air, DHL Parcelcopter (Deutsche Post AG), EmbraerX, Boeing HorizonX, Skyports Ltd., Aeronext Inc., Drone Delivery Canada, Sabrewing Aircraft Company Inc., Flytrex Inc., Matternet Inc., Amazon Prime Air, Alphabets Wing, AeroVironment Inc., EHang Holdings Ltd., Beta Technologies, Joby Aviation, and other players.

Recent Development:In June 2025, Drone Forge, an Australian aerospace start-up, has partnered with Airbus Helicopters to purchase six Flexrotor uncrewed aerial systems (UAS), totaling 17 aircraft. This marks the largest Flexrotor order to date. The systems will be tailored for a variety of missions across the Asia-Pacific region.

In June 2023, Siemens Healthineers is working with German drone company Wingcopter to test a drone-based delivery system for healthcare in Africa. The project will enable two-way transport of blood samples, vaccines, and medicines to improve access to diagnostics and treatment in remote areas.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Cargo Drones market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Cargo Drones market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Cargo Drones market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Cargo Drones market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Cargo Drones market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 15.24 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Type |

|

| The Segment covered by Payload Capacity |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Cargo Drones market share, size, and revenue growth rate were created by Quintile Report™. Cargo Drones analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Cargo Drones Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Cargo Drones Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Cargo Drones Market, by Region, (USD Million) 2017-2035

Table 21 China Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Cargo Drones Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Cargo Drones Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Cargo Drones Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Cargo Drones Market: market scenario

Fig.4 Global Cargo Drones Market competitive outlook

Fig.5 Global Cargo Drones Market driver analysis

Fig.6 Global Cargo Drones Market restraint analysis

Fig.7 Global Cargo Drones Market opportunity analysis

Fig.8 Global Cargo Drones Market trends analysis

Fig.9 Global Cargo Drones Market: Segment Analysis (Based on the scope)

Fig.10 Global Cargo Drones Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report OverviewThe Global Gas Cylinder Market was valued at USD 12.36 million in 2025 and is project

Read MoreReport OverviewThe Global Drone Mapping Market was valued at USD 2.62 billion in 2025 and is project

Read MoreReport OverviewThe Global CBD Extraction Equipment Market was valued at USD 67.62 million in 2025 an

Read More