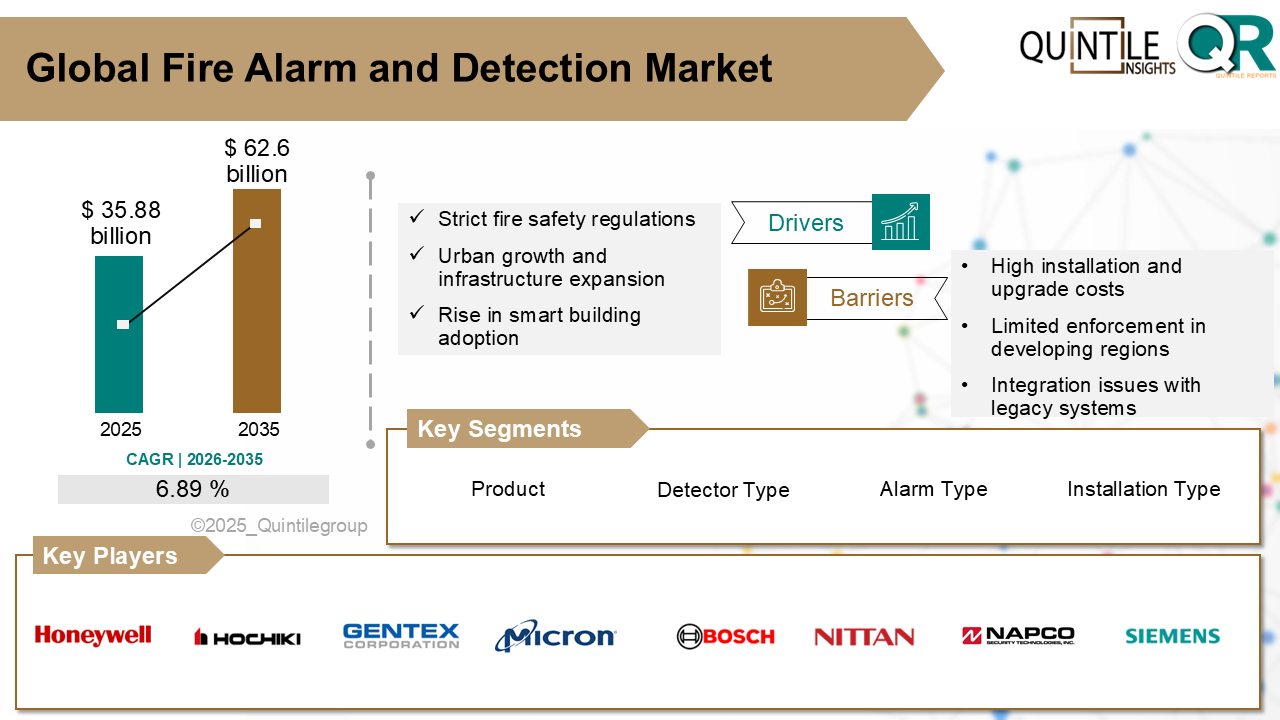

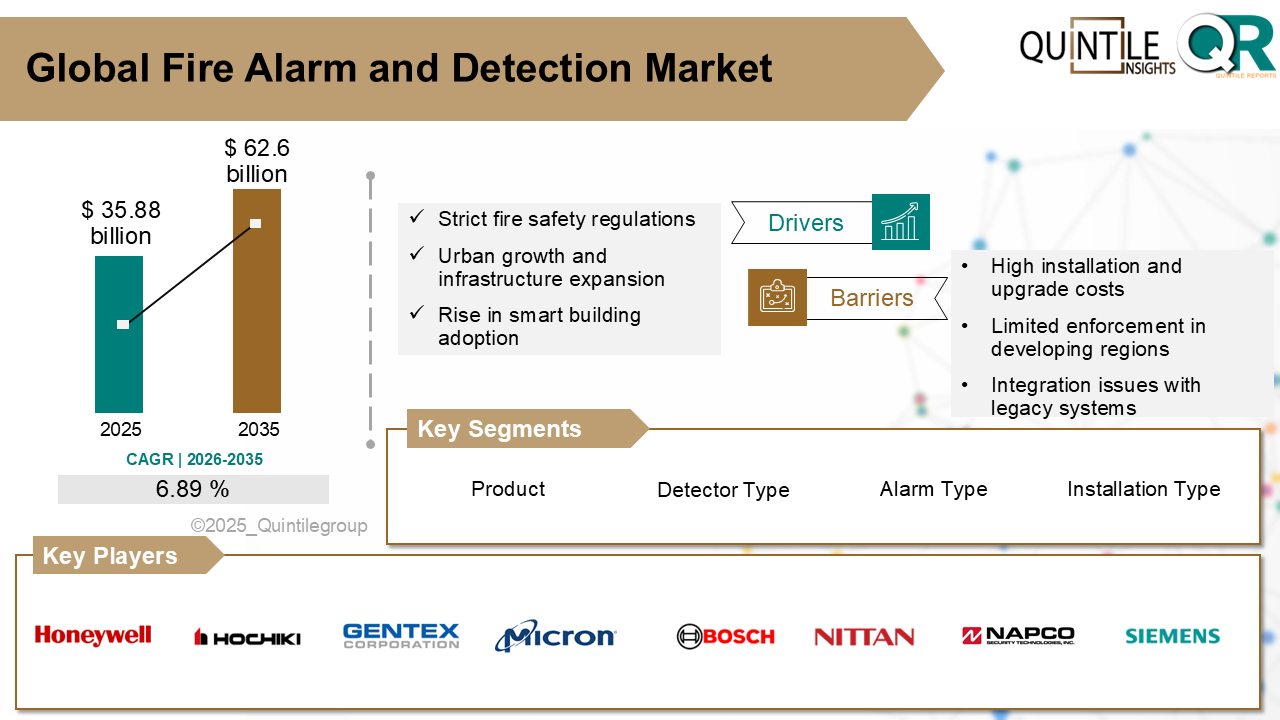

"The Global Fire Alarm and Detection Market was estimated at USD 35.88 billion in 2025 and is projected to reach USD 62.6 billion by 2035, reflecting a robust CAGR of 6.89% over the forecast period from 2026 to 2035. The Fire Alarm and Detection market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Fire Alarm and Detection market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Fire Alarm and Detection market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Looking ahead, the Fire Alarm and Detection market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Fire Alarm and Detection market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period."

Fire Alarm and Detection Market

The fire alarm and detection market includes systems and devices used to sense and alert occupants about the presence of smoke, heat, or flames. These systems help detect fires early and give people time to evacuate or take action before the fire spreads. The market includes both detection components like smoke detectors, heat sensors, flame detectors, and gas sensors, and alerting devices such as sounders, strobe lights, and voice alarms.

These systems are installed in homes, offices, factories, schools, shopping malls, hospitals, and industrial plants. They may be standalone units or part of larger building safety systems. As awareness of fire risks and building safety regulations increases worldwide, the demand for fire detection and alarm systems continues to grow.

What are the drivers of fire alarm and detection marketThe U.S. has one of the highest adoption rates of fire detection and alarm systems. Federal and state regulations require fire alarms in nearly all public buildings, schools, offices, and healthcare facilities. Insurance incentives and legal compliance drive demand for both wired and wireless systems.

Residential use is also growing as homeowners adopt smart alarms that connect to phones and emergency services. Local fire departments often conduct outreach programs that further raise awareness and system use. U.S.-based manufacturers lead in innovation, offering systems with fast detection, low false alarm rates, and integration with broader building safety systems.

Germany upgrades fire safety through innovation and retrofitting:Germanys fire detection market is driven by a mix of modernization and innovation. Public housing, hospitals, and commercial spaces are being retrofitted with smart smoke detectors and heat sensors. Local laws require alarms in all new homes and rental units.

With many older buildings in use, retrofitting is a key market segment. German manufacturers are known for producing durable, highly sensitive detection systems. These are widely used in public infrastructure projects and increasingly integrated with energy and ventilation controls in large buildings.

Japan focuses on compact, efficient detection for dense urban spaces:Japan emphasizes fire safety due to frequent earthquakes and high urban density. Fire detection systems are installed in homes, apartment blocks, schools, and metro stations. The government enforces safety rules across public and private buildings.

Japanese manufacturers are developing compact, fast-response detectors tailored for small, enclosed spaces. Systems are often linked to local monitoring centres, enabling quick alerts. Japan also exports miniaturized detection devices across Asia, especially for use in hotels and elderly care centres.

Competitive Analysis:The fire alarm and detection market are served by a mix of multinational companies, regional brands, and niche technology developers. Large firms offer full-service systems including detectors, control panels, sounders, and monitoring software. These systems are widely used in large infrastructure and commercial projects.

Mid-sized companies and local manufacturers focus on standalone detectors and small-scale alarm units, mostly for residential or small business use. They compete on affordability and simplicity of use, offering battery-operated smoke alarms and plug-and-play models for quick installation.

Technology innovation plays a central role in competition. Companies offering smart detectors with mobile connectivity, voice alerts, and self-testing features are gaining traction. Wireless systems are especially popular in retrofits where traditional wiring is impractical.

Firms that provide complete fire safety solutions, including risk assessment, design, installation, and maintenance, tend to secure large contracts with hospitals, educational institutions, and government facilities. Product reliability, low false alarm rates, and ease of integration are key purchasing factors.

Brand reputation, certifications, and compliance with local safety standards also affect competitiveness. Companies that offer strong after-sales support, system updates, and training programs gain preference in both developed and emerging markets.

Key players in the market are Honeywell International Inc., Siemens AG, Johnson Controls, Robert Bosch GmbH, Carrier Global Corporation, Halma plc, Hochiki Corporation, Nittan Co., Ltd., Napco Security Technologies Inc., Gentex Corporation, Mircom Group of Companies, Cooper Wheelock Inc., Space Age Electronics Inc., Apollo Fire Detectors Ltd., Xtralis Pty Ltd., Fire-Lite Alarms, Panasonic Corporation, Schrack Seconet AG, System Sensor, Bosch Security Systems, and other players.

Recent Development:In March 2023, Honeywell (Nasdaq: HON) has introduced the first fire alarm system with UL-approved self-testing smoke detectors. These detectors can test themselves automatically, making fire safety systems easier to install, maintain, and inspect.

In October 2024, Siemens Smart Infrastructure has decided to buy Danfoss Fire Safety, a part of the Danfoss Group in Denmark. Danfoss specializes in fire suppression technology. This deal will help Siemens grow and move faster toward offering more eco-friendly fire safety solutions.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Fire Alarm and Detection market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Fire Alarm and Detection market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Fire Alarm and Detection market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Fire Alarm and Detection market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Fire Alarm and Detection market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 6.89 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product |

|

| The Segment covered by Detector Type |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Fire Alarm and Detection market share, size, and revenue growth rate were created by Quintile Report™. Fire Alarm and Detection analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Fire Alarm and Detection Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Fire Alarm and Detection Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Fire Alarm and Detection Market, by Region, (USD Million) 2017-2035

Table 21 China Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Fire Alarm and Detection Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Fire Alarm and Detection Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Fire Alarm and Detection Market: market scenario

Fig.4 Global Fire Alarm and Detection Market competitive outlook

Fig.5 Global Fire Alarm and Detection Market driver analysis

Fig.6 Global Fire Alarm and Detection Market restraint analysis

Fig.7 Global Fire Alarm and Detection Market opportunity analysis

Fig.8 Global Fire Alarm and Detection Market trends analysis

Fig.9 Global Fire Alarm and Detection Market: Segment Analysis (Based on the scope)

Fig.10 Global Fire Alarm and Detection Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

"The Global Fire Alarm and Detection Market was estimated at USD 35.88 billion in 2025 and is projected to reach USD 62.6 billion by 2035, reflecting a robust CAGR of 6.89% over the forecast period from 2026 to 2035. The Fire Alarm and Detection market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Fire Alarm and Detection market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Fire Alarm and Detection market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Looking ahead, the Fire Alarm and Detection market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Fire Alarm and Detection market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period."

Fire Alarm and Detection Market

The fire alarm and detection market includes systems and devices used to sense and alert occupants about the presence of smoke, heat, or flames. These systems help detect fires early and give people time to evacuate or take action before the fire spreads. The market includes both detection components like smoke detectors, heat sensors, flame detectors, and gas sensors, and alerting devices such as sounders, strobe lights, and voice alarms.

These systems are installed in homes, offices, factories, schools, shopping malls, hospitals, and industrial plants. They may be standalone units or part of larger building safety systems. As awareness of fire risks and building safety regulations increases worldwide, the demand for fire detection and alarm systems continues to grow.

What are the drivers of fire alarm and detection marketThe U.S. has one of the highest adoption rates of fire detection and alarm systems. Federal and state regulations require fire alarms in nearly all public buildings, schools, offices, and healthcare facilities. Insurance incentives and legal compliance drive demand for both wired and wireless systems.

Residential use is also growing as homeowners adopt smart alarms that connect to phones and emergency services. Local fire departments often conduct outreach programs that further raise awareness and system use. U.S.-based manufacturers lead in innovation, offering systems with fast detection, low false alarm rates, and integration with broader building safety systems.

Germany upgrades fire safety through innovation and retrofitting:Germanys fire detection market is driven by a mix of modernization and innovation. Public housing, hospitals, and commercial spaces are being retrofitted with smart smoke detectors and heat sensors. Local laws require alarms in all new homes and rental units.

With many older buildings in use, retrofitting is a key market segment. German manufacturers are known for producing durable, highly sensitive detection systems. These are widely used in public infrastructure projects and increasingly integrated with energy and ventilation controls in large buildings.

Japan focuses on compact, efficient detection for dense urban spaces:Japan emphasizes fire safety due to frequent earthquakes and high urban density. Fire detection systems are installed in homes, apartment blocks, schools, and metro stations. The government enforces safety rules across public and private buildings.

Japanese manufacturers are developing compact, fast-response detectors tailored for small, enclosed spaces. Systems are often linked to local monitoring centres, enabling quick alerts. Japan also exports miniaturized detection devices across Asia, especially for use in hotels and elderly care centres.

Competitive Analysis:The fire alarm and detection market are served by a mix of multinational companies, regional brands, and niche technology developers. Large firms offer full-service systems including detectors, control panels, sounders, and monitoring software. These systems are widely used in large infrastructure and commercial projects.

Mid-sized companies and local manufacturers focus on standalone detectors and small-scale alarm units, mostly for residential or small business use. They compete on affordability and simplicity of use, offering battery-operated smoke alarms and plug-and-play models for quick installation.

Technology innovation plays a central role in competition. Companies offering smart detectors with mobile connectivity, voice alerts, and self-testing features are gaining traction. Wireless systems are especially popular in retrofits where traditional wiring is impractical.

Firms that provide complete fire safety solutions, including risk assessment, design, installation, and maintenance, tend to secure large contracts with hospitals, educational institutions, and government facilities. Product reliability, low false alarm rates, and ease of integration are key purchasing factors.

Brand reputation, certifications, and compliance with local safety standards also affect competitiveness. Companies that offer strong after-sales support, system updates, and training programs gain preference in both developed and emerging markets.

Key players in the market are Honeywell International Inc., Siemens AG, Johnson Controls, Robert Bosch GmbH, Carrier Global Corporation, Halma plc, Hochiki Corporation, Nittan Co., Ltd., Napco Security Technologies Inc., Gentex Corporation, Mircom Group of Companies, Cooper Wheelock Inc., Space Age Electronics Inc., Apollo Fire Detectors Ltd., Xtralis Pty Ltd., Fire-Lite Alarms, Panasonic Corporation, Schrack Seconet AG, System Sensor, Bosch Security Systems, and other players.

Recent Development:In March 2023, Honeywell (Nasdaq: HON) has introduced the first fire alarm system with UL-approved self-testing smoke detectors. These detectors can test themselves automatically, making fire safety systems easier to install, maintain, and inspect.

In October 2024, Siemens Smart Infrastructure has decided to buy Danfoss Fire Safety, a part of the Danfoss Group in Denmark. Danfoss specializes in fire suppression technology. This deal will help Siemens grow and move faster toward offering more eco-friendly fire safety solutions.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Fire Alarm and Detection market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Fire Alarm and Detection market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Fire Alarm and Detection market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Fire Alarm and Detection market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Fire Alarm and Detection market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 6.89 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product |

|

| The Segment covered by Detector Type |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Fire Alarm and Detection market share, size, and revenue growth rate were created by Quintile Report™. Fire Alarm and Detection analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Fire Alarm and Detection Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Fire Alarm and Detection Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Fire Alarm and Detection Market, by Region, (USD Million) 2017-2035

Table 21 China Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Fire Alarm and Detection Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Fire Alarm and Detection Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Fire Alarm and Detection Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Fire Alarm and Detection Market: market scenario

Fig.4 Global Fire Alarm and Detection Market competitive outlook

Fig.5 Global Fire Alarm and Detection Market driver analysis

Fig.6 Global Fire Alarm and Detection Market restraint analysis

Fig.7 Global Fire Alarm and Detection Market opportunity analysis

Fig.8 Global Fire Alarm and Detection Market trends analysis

Fig.9 Global Fire Alarm and Detection Market: Segment Analysis (Based on the scope)

Fig.10 Global Fire Alarm and Detection Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report OverviewThe Global Gas Cylinder Market was valued at USD 12.36 million in 2025 and is project

Read MoreReport OverviewThe Global Drone Mapping Market was valued at USD 2.62 billion in 2025 and is project

Read MoreReport OverviewThe Global CBD Extraction Equipment Market was valued at USD 67.62 million in 2025 an

Read More