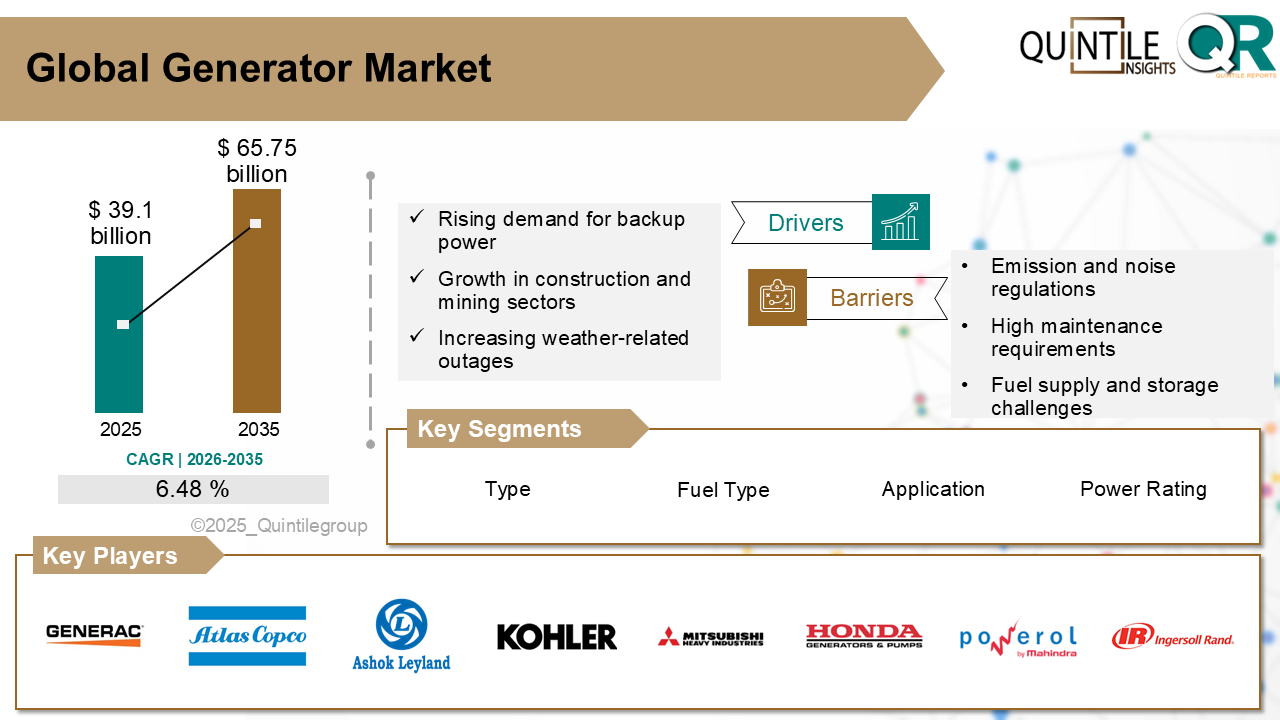

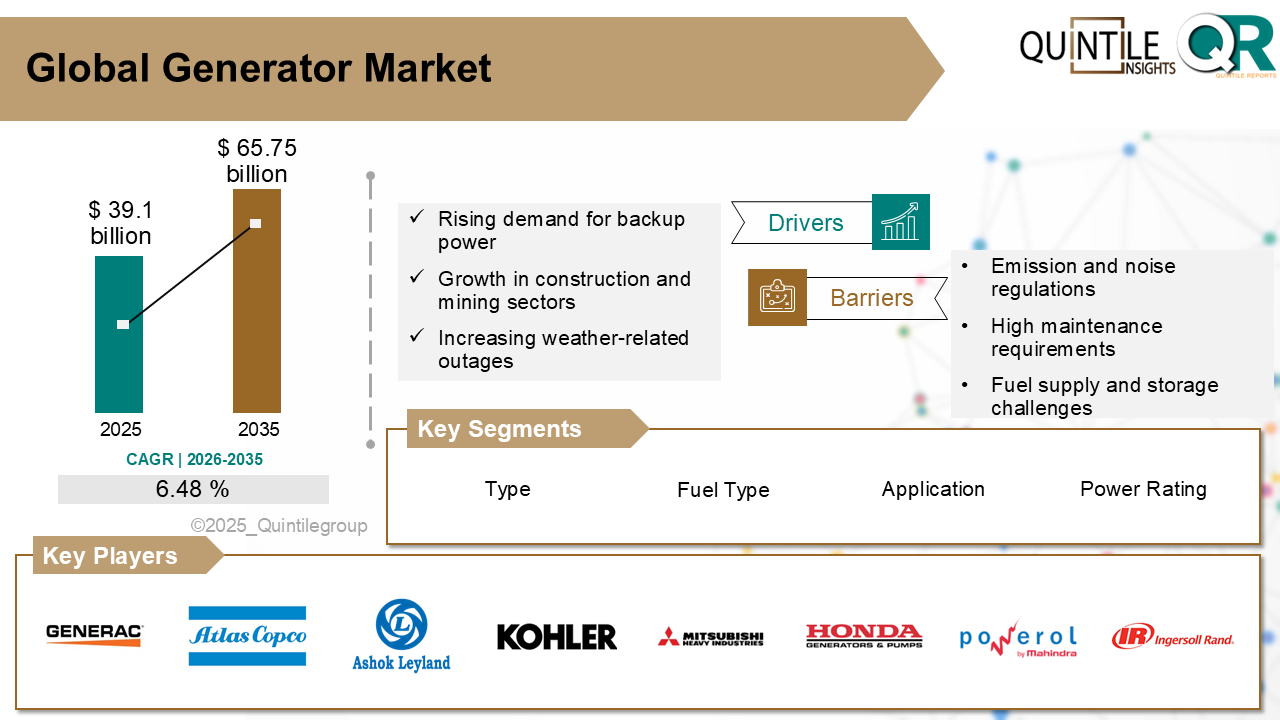

"The Global Generator Market was estimated at USD 39.1 billion in 2025 and is projected to reach USD 65.75 billion by 2035, reflecting a robust CAGR of 6.48% over the forecast period from 2026 to 2035. The Generator market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Generator market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Generator market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Looking ahead, the Generator market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Generator market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period."

DC Generator Market

The DC generator market involves the global and regional production, distribution, and use of direct current (DC) generators, which convert mechanical energy into direct electrical power. These generators are widely used in applications that require stable and consistent DC power, such as telecommunications, battery charging systems, electroplating, welding, mining, railway traction, and defence equipment. Unlike AC generators, DC generators are especially valued in applications where speed control and precision are important. They are commonly used in off-grid systems, mobile units, and areas lacking reliable grid infrastructure, and can be powered by diesel engines, gas turbines, or renewable sources such as solar and wind when paired with energy storage systems.

The market includes a range of generator types, such as separately excited, self-excited, and permanent magnet DC generators serving both industrial and commercial needs.

What are the drivers of the DC generator marketNorth Americas DC generator market is underpinned by strong industrial demand, critical infrastructure resiliency (like data centres and telecom), and environmental pressures prompting cleaner, hybrid systems. The shift toward green backup power, such as renewable-fuel diesel, hydrogen-ready units, and alternatively fueled generators, is accelerating. Legacy diesel units remain, but innovation is steering the market toward low-emission, modular, and efficient designs.

Europe is embracing DC generators within its broader push for sustainable energy solutions, smart grids, and microgrid rollouts. Strict environmental regulations and ambitious renewable-energy targets have driven the adoption of hybrid generator systems and battery charging integration. Innovations in air-cooled designs, IoT-enabled monitoring, and connectivity to solar/battery systems are prominent, especially in Germany, France, and the UK.

Asia-Pacific is the fastest-growing market for DC generators, fueled by rapid industrialisation, infrastructure development, and energy demands in nations like China, India, and Southeast Asia. The need for reliable off-grid and backup power, especially in data centres, telecom towers, and rural electrification, is driving hybrid diesel renewable solutions and smart, remotely monitored systems.

Latin America is emerging as a growth region for DC generators, thanks to a surge in urban infrastructure projects, smart city development, and renewable-energy integration. Countries such as Brazil and Chile are exploring modular and green generator systems that support energy storage and decarbonization goals. Local uptake is supported by strong regional energy transitions and adoption of microgrid architectures.

The Middle East and Africa markets are experiencing steady DC generator market growth through high-scale development, off-grid infrastructure construction, data centre building, and environmental necessities. In the midst of adverse climate stress, solar-plus-storage microgrids and hybrid generator sets are gaining wider momentum primarily in Gulf countries, North Africa, and newly arising industrial regions.

Country-Wise OutlookSurge in Remote Work Sites and Mobile Infrastructure Demands DC Power Solutions in the U.S.

The increasing activity in mobile and remote infrastructure projectsranging from oil & gas fields and mines to disaster response and mobile medical facilitiesis a strong demand driver for DC generators in the U.S. The generators are the preferred option in these types of applications since they provide better fuel efficiency, simplicity of battery integration, and lower mechanical complexity, which translates into improved reliability and lower maintenance.

This demand is extremely high in states such as Texas, North Dakota, and Alaska, whose industrial operations tend to be off the grid. Moreover, heightened sensitivity towards grid stability and severe weather patterns has necessitated public organisations and private businesses to embrace DC microgeneration units for mobile shelters, surveillance towers, and rapid-deployment telecommunication systems.

With such applications more dependent on energy storage and solar panel integration, DC generators are applied due to their energy storage system compatibility, thus being deployable in the field faster and wasting less energy.

Germanys renewable energy transition drives demand for DC generators:

Germany's ambitious energy transition policy aimed at making the country a nuclear-free, low-carbon energy system is one of the drivers of growth in the DC generator market. With solar and wind power increasingly becoming the sources of clean energy, backup and stabilising systems are in growing demand.

In off-grid and rural installations, particularly in eastern and southern Germany, DC generators are core units in hybrid applications. They integrate solar PV, battery banks, and DC generators for the provision of clean, fault-tolerant power where grid connection is marginal or intermittent. DC generators are also being incorporated in household and commercial solar systems as back-up power systems, providing power in the event of grid failure without losing efficiency and with low emissions, according to the needs of Germany's sustainability policies.

Japans Industrial Electrification Push Drives DC Generator Market Growth:

The major stimulus for Japan's DC generator market is its speeding progress towards electrification of industry and infrastructure, with targeted high-growth uses in railways, renewable backup power, and precision manufacturing. As Japan continues to upgrade ageing infrastructure and introduces more DC-powered systems, demand is building for high-tolerance, efficient DC generators, especially in facilities that need stable direct current for specialised processes like plating, welding, and battery charging.

Competitive AnalysisThe market is comprised of a combination of giants like ABB, Siemens, Cummins, Caterpillar, and General Electric that serve large industrial, telecom, defence, and data centre markets with scalable DC systems. Niche players like Polar Power, Fischer Panda, and WhisperPower, on the other hand, serve telecom towers, marine, and remote microgrid niches with smaller, very efficient systems.

Niche participants such as Polar Power distinguish themselves on creating miniaturized, lightweight DC generators well adapted to rooftop or telecom tower applicationsproviding 3040% reduced footprints compared to AC solutions, less complicated permitting, and reduced fuel consumption through direct DC output and eliminated conversion losses. These factors are highly compelling in urban and limited environments, providing a definite competitive entry point over conventional AC units.

US government energy policies aimed at grid resiliency and telecom continuity, such as Federal Communications Commission (FCC) rules to ensure backup power after the likes of Hurricane Sandy, or the Department of Energy preference for efficient backup systems with promotion of fuel-cell and DC hybrids with remote diagnostics, have spurred interest in DC solutions by telecom and data center operators as seen in suburban and rural deployment incentives.

While there are technical advantages, DC generators are met with: lower initial expense and entrenched support for installed AC equipment; telecom operators' familiarity makes them resort to AC infrastructure and CAPEX advantages. In response, DC-specialised manufacturers cite lower total cost of ownership, lower maintenance and fuel expenses, and easier permitting, supported by case studies at U.S. tower locations and DOE-funded projects citing reliability in grid outages.

Recent DevelopmentIn May 2025, Fischer Panda launched a completely new line of variable-speed hybrid DC generators with outputs up to 300 A (~100 kW) complemented by their new fpControl system. The range includes battery charging and constant DC supply, the parameters for battery charging being under flexible control via an easy-to-use digital user interfaceused in marine, telecom, and off-grid energy applications.

In October 2024, Panasonic introduced its second-generation PH3 hydrogen fuel-cell generator, having the capability to deliver as much as 10 kW of DC power (with ~8.2 kW of heat) and scaling through flexible modularity (up to 250 units). Focused on European, Australian, and Chinese commercial and industrial customers, the PH3 system offers clean, zero-emission DC power with high installation density in hard-to-reach environments.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Generator market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Generator market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Generator market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Generator market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Generator market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 6.48 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Type |

|

| The Segment covered by Power Rating |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Generator market share, size, and revenue growth rate were created by Quintile Report™. Generator analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Generator Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Generator Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Generator Market, by Region, (USD Million) 2017-2035

Table 21 China Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Generator Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Generator Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Generator Market: market scenario

Fig.4 Global Generator Market competitive outlook

Fig.5 Global Generator Market driver analysis

Fig.6 Global Generator Market restraint analysis

Fig.7 Global Generator Market opportunity analysis

Fig.8 Global Generator Market trends analysis

Fig.9 Global Generator Market: Segment Analysis (Based on the scope)

Fig.10 Global Generator Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

"The Global Generator Market was estimated at USD 39.1 billion in 2025 and is projected to reach USD 65.75 billion by 2035, reflecting a robust CAGR of 6.48% over the forecast period from 2026 to 2035. The Generator market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Generator market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Generator market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Looking ahead, the Generator market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Generator market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period."

DC Generator Market

The DC generator market involves the global and regional production, distribution, and use of direct current (DC) generators, which convert mechanical energy into direct electrical power. These generators are widely used in applications that require stable and consistent DC power, such as telecommunications, battery charging systems, electroplating, welding, mining, railway traction, and defence equipment. Unlike AC generators, DC generators are especially valued in applications where speed control and precision are important. They are commonly used in off-grid systems, mobile units, and areas lacking reliable grid infrastructure, and can be powered by diesel engines, gas turbines, or renewable sources such as solar and wind when paired with energy storage systems.

The market includes a range of generator types, such as separately excited, self-excited, and permanent magnet DC generators serving both industrial and commercial needs.

What are the drivers of the DC generator marketNorth Americas DC generator market is underpinned by strong industrial demand, critical infrastructure resiliency (like data centres and telecom), and environmental pressures prompting cleaner, hybrid systems. The shift toward green backup power, such as renewable-fuel diesel, hydrogen-ready units, and alternatively fueled generators, is accelerating. Legacy diesel units remain, but innovation is steering the market toward low-emission, modular, and efficient designs.

Europe is embracing DC generators within its broader push for sustainable energy solutions, smart grids, and microgrid rollouts. Strict environmental regulations and ambitious renewable-energy targets have driven the adoption of hybrid generator systems and battery charging integration. Innovations in air-cooled designs, IoT-enabled monitoring, and connectivity to solar/battery systems are prominent, especially in Germany, France, and the UK.

Asia-Pacific is the fastest-growing market for DC generators, fueled by rapid industrialisation, infrastructure development, and energy demands in nations like China, India, and Southeast Asia. The need for reliable off-grid and backup power, especially in data centres, telecom towers, and rural electrification, is driving hybrid diesel renewable solutions and smart, remotely monitored systems.

Latin America is emerging as a growth region for DC generators, thanks to a surge in urban infrastructure projects, smart city development, and renewable-energy integration. Countries such as Brazil and Chile are exploring modular and green generator systems that support energy storage and decarbonization goals. Local uptake is supported by strong regional energy transitions and adoption of microgrid architectures.

The Middle East and Africa markets are experiencing steady DC generator market growth through high-scale development, off-grid infrastructure construction, data centre building, and environmental necessities. In the midst of adverse climate stress, solar-plus-storage microgrids and hybrid generator sets are gaining wider momentum primarily in Gulf countries, North Africa, and newly arising industrial regions.

Country-Wise OutlookSurge in Remote Work Sites and Mobile Infrastructure Demands DC Power Solutions in the U.S.

The increasing activity in mobile and remote infrastructure projectsranging from oil & gas fields and mines to disaster response and mobile medical facilitiesis a strong demand driver for DC generators in the U.S. The generators are the preferred option in these types of applications since they provide better fuel efficiency, simplicity of battery integration, and lower mechanical complexity, which translates into improved reliability and lower maintenance.

This demand is extremely high in states such as Texas, North Dakota, and Alaska, whose industrial operations tend to be off the grid. Moreover, heightened sensitivity towards grid stability and severe weather patterns has necessitated public organisations and private businesses to embrace DC microgeneration units for mobile shelters, surveillance towers, and rapid-deployment telecommunication systems.

With such applications more dependent on energy storage and solar panel integration, DC generators are applied due to their energy storage system compatibility, thus being deployable in the field faster and wasting less energy.

Germanys renewable energy transition drives demand for DC generators:

Germany's ambitious energy transition policy aimed at making the country a nuclear-free, low-carbon energy system is one of the drivers of growth in the DC generator market. With solar and wind power increasingly becoming the sources of clean energy, backup and stabilising systems are in growing demand.

In off-grid and rural installations, particularly in eastern and southern Germany, DC generators are core units in hybrid applications. They integrate solar PV, battery banks, and DC generators for the provision of clean, fault-tolerant power where grid connection is marginal or intermittent. DC generators are also being incorporated in household and commercial solar systems as back-up power systems, providing power in the event of grid failure without losing efficiency and with low emissions, according to the needs of Germany's sustainability policies.

Japans Industrial Electrification Push Drives DC Generator Market Growth:

The major stimulus for Japan's DC generator market is its speeding progress towards electrification of industry and infrastructure, with targeted high-growth uses in railways, renewable backup power, and precision manufacturing. As Japan continues to upgrade ageing infrastructure and introduces more DC-powered systems, demand is building for high-tolerance, efficient DC generators, especially in facilities that need stable direct current for specialised processes like plating, welding, and battery charging.

Competitive AnalysisThe market is comprised of a combination of giants like ABB, Siemens, Cummins, Caterpillar, and General Electric that serve large industrial, telecom, defence, and data centre markets with scalable DC systems. Niche players like Polar Power, Fischer Panda, and WhisperPower, on the other hand, serve telecom towers, marine, and remote microgrid niches with smaller, very efficient systems.

Niche participants such as Polar Power distinguish themselves on creating miniaturized, lightweight DC generators well adapted to rooftop or telecom tower applicationsproviding 3040% reduced footprints compared to AC solutions, less complicated permitting, and reduced fuel consumption through direct DC output and eliminated conversion losses. These factors are highly compelling in urban and limited environments, providing a definite competitive entry point over conventional AC units.

US government energy policies aimed at grid resiliency and telecom continuity, such as Federal Communications Commission (FCC) rules to ensure backup power after the likes of Hurricane Sandy, or the Department of Energy preference for efficient backup systems with promotion of fuel-cell and DC hybrids with remote diagnostics, have spurred interest in DC solutions by telecom and data center operators as seen in suburban and rural deployment incentives.

While there are technical advantages, DC generators are met with: lower initial expense and entrenched support for installed AC equipment; telecom operators' familiarity makes them resort to AC infrastructure and CAPEX advantages. In response, DC-specialised manufacturers cite lower total cost of ownership, lower maintenance and fuel expenses, and easier permitting, supported by case studies at U.S. tower locations and DOE-funded projects citing reliability in grid outages.

Recent DevelopmentIn May 2025, Fischer Panda launched a completely new line of variable-speed hybrid DC generators with outputs up to 300 A (~100 kW) complemented by their new fpControl system. The range includes battery charging and constant DC supply, the parameters for battery charging being under flexible control via an easy-to-use digital user interfaceused in marine, telecom, and off-grid energy applications.

In October 2024, Panasonic introduced its second-generation PH3 hydrogen fuel-cell generator, having the capability to deliver as much as 10 kW of DC power (with ~8.2 kW of heat) and scaling through flexible modularity (up to 250 units). Focused on European, Australian, and Chinese commercial and industrial customers, the PH3 system offers clean, zero-emission DC power with high installation density in hard-to-reach environments.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Generator market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Generator market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Generator market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Generator market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Generator market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 6.48 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Type |

|

| The Segment covered by Power Rating |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Generator market share, size, and revenue growth rate were created by Quintile Report™. Generator analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Generator Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Generator Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Generator Market, by Region, (USD Million) 2017-2035

Table 21 China Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Generator Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Generator Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Generator Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Generator Market: market scenario

Fig.4 Global Generator Market competitive outlook

Fig.5 Global Generator Market driver analysis

Fig.6 Global Generator Market restraint analysis

Fig.7 Global Generator Market opportunity analysis

Fig.8 Global Generator Market trends analysis

Fig.9 Global Generator Market: Segment Analysis (Based on the scope)

Fig.10 Global Generator Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report OverviewThe Global Gas Cylinder Market was valued at USD 12.36 million in 2025 and is project

Read MoreReport OverviewThe Global Drone Mapping Market was valued at USD 2.62 billion in 2025 and is project

Read MoreReport OverviewThe Global CBD Extraction Equipment Market was valued at USD 67.62 million in 2025 an

Read More