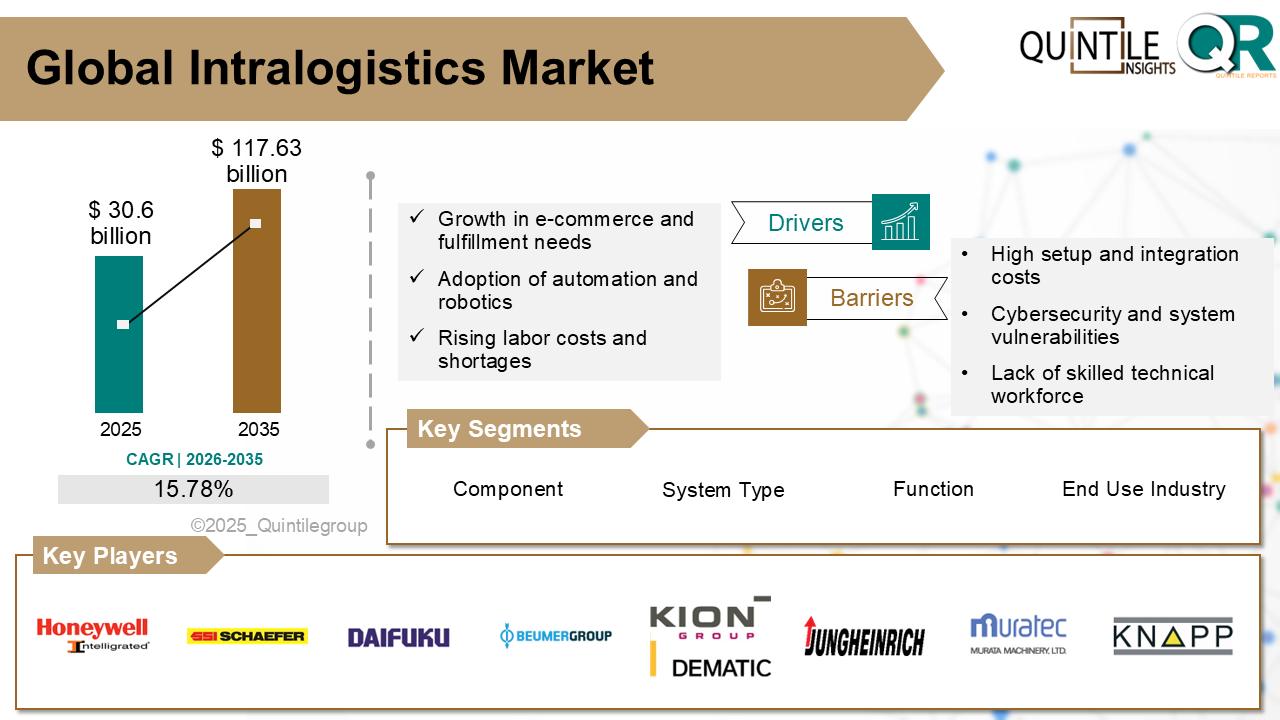

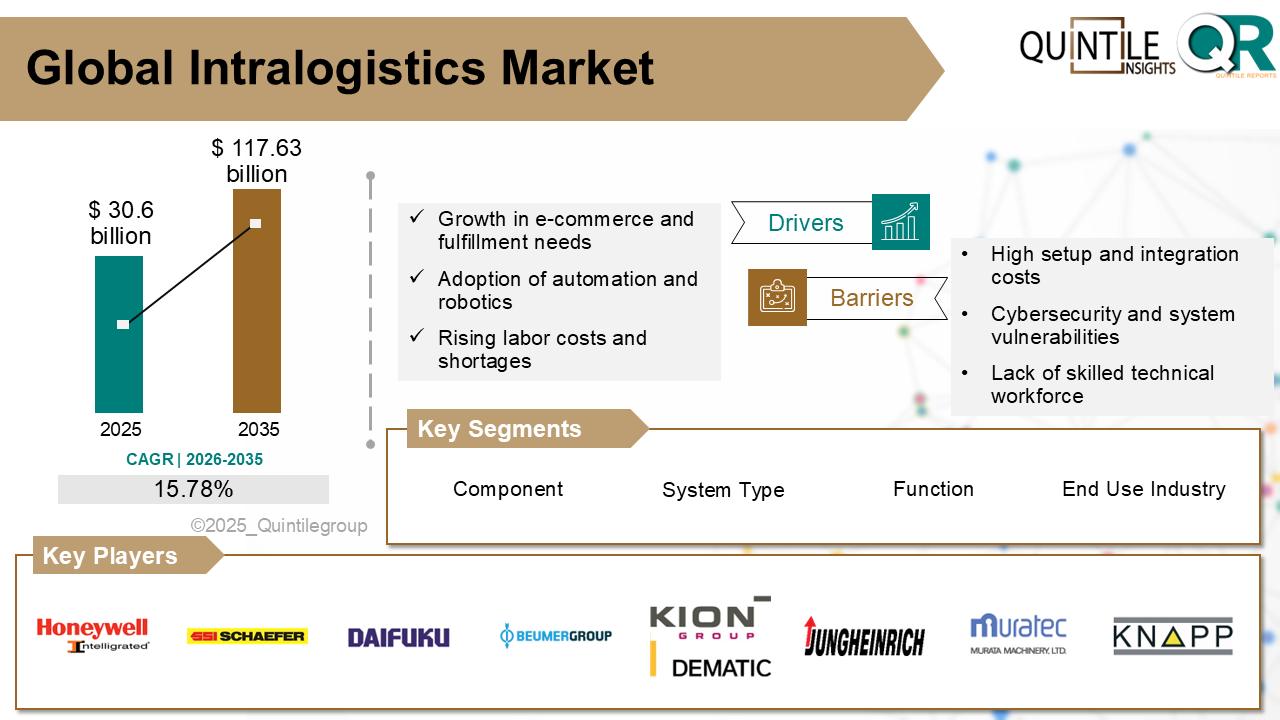

"The Global Intralogistics Market was estimated at USD 30.6 billion in 2025 and is projected to reach USD 117.63 billion by 2035, reflecting a robust CAGR of 15.78% over the forecast period from 2026 to 2035. The Intralogistics market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Intralogistics market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Intralogistics market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Looking ahead, the Intralogistics market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Intralogistics market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period."

Drivers of Intralogistics Market

The rapid growth of e-commerce and omnichannel retail is the major driver in the intralogistics market. Soaring volumes of online orders demand fast, accurate fulfillment prompting adoption of automated storage/retrieval systems, conveyor belts, AGVs, and sorting systems to meet consumer expectations.

Growing focus on digitalization, IoT, and smart warehouses is transforming material handling.

Rising demand for sustainability and green logistics is emerging as a core factor.

The pressure of labour shortages and cost efficiency is pushing firms to automate.

The high initial investment and ongoing lifecycle costs of intralogistics systems such as conveyors, AGVs, AS/RS, and warehouse management software are major barriers. Implementing these automated solutions typically involves significant capital outlay for equipment, customization, infrastructure upgrades, and staff training, followed by recurring expenses for maintenance and software updates. These costs often deter small- and medium-sized enterprises (SMEs) from adopting intralogistics technologies.

The technical complexity of integration and system interoperability further limits adoption. Intralogistics solutions must seamlessly connect with legacy infrastructure, ERP, WMS, and IoT platforms requiring highly tailored configurations and extensive testing. Disruptions during integration and the absence of standardized protocols hinder rollout and raise implementation risk.

Cybersecurity, data privacy, and regulatory compliance concerns also restrain the market. With increased digitization and connectivity come heightened vulnerabilities such as data breaches or operational disruption from cyberattacks. Companies must invest in secure infrastructure and comply with regulations like GDPR or similar local rules, adding cost and complexity to system deployment.

Regional Trends of Intralogistics MarketNorth America dominates the intralogistics market, fuelled by its advanced industrial infrastructure, rapid e-commerce growth, and extensive integration of automation technologies. Companies like Amazon and Walmart heavily invest in AI, IoT, and robotics to enhance warehouse efficiency and meet fast delivery demands. Both the U.S. and Canada show strong uptake of automated pick-and-place systems, AGVs, and smart conveyor setups bolstered by government support, favourable regulations, and a skilled workforce ecosystem.

Europe maintains a mature intralogistics landscape, driven by strong manufacturing, automotive, and retail sectors. Germany, the UK, France, Italy, and Benelux regions lead adoption of modular robotic cells, AGVs, and warehouse orchestration platforms in response to labour shortages and sustainability initiatives. EU policies promoting energy efficiency and carbon-neutral objectives encourage digital warehousing and electrification of material handling. Multi-country logistic hubs and regulatory support for automation projects are accelerating adoption across the region.

Asia-Pacific is the fastest-growing regional market, supported by massive industrial and infrastructure expansion in China, India, Japan, South Korea, and Southeast Asia. Domestic e-commerce giants such as Alibaba and JD.com are driving the adoption of swarm robotics, AI-powered fulfillment centers, and autonomous guided vehicles. Government-led digitization programs like Chinas """"Made in China 2025"""" and India's PM Gati Shakti initiative further boost smart warehouse deployment. Local startups and manufacturers are delivering cost-effective automation tailored to regional logistics challenges.

Latin America's intralogistics sector is gaining momentum in countries such as Brazil, Mexico, and Argentina. Growth in e-commerce is accelerating the need for efficient last-mile logistics and warehouse automation. Governments are providing incentives for technology investment in special economic zones, enhancing infrastructure resilience. Reliability of cross-border trade, especially under USMCA, supports adoption of automated storage and retrieval systems, with rising demand for connectivity and supply chain optimization.

The Middle East & Africa region is emerging with increasing intralogistics investments led by Gulf economies like the UAE, Saudi Arabia, and South Africa.

Country-Wise OutlookU.S. embraces warehouse automation to fuel intralogistics innovation:

The United States intralogistics market is experiencing rapid transformation, largely driven by the surging demand for warehouse automation amid booming e-commerce and omnichannel retail. Companies like Amazon, Walmart, and Target are investing heavily in autonomous mobile robots (AMRs), automated storage and retrieval systems (AS/RS), and AI-powered inventory management tools to handle faster fulfillment cycles. Labor shortages and rising labor costs across logistics hubs have further accelerated this shift, making automation a necessity rather than a luxury for scalable operations.

Distribution centers across the U.S. particularly in states like California, Texas, and Ohio are evolving into smart warehouses where real-time data, IoT-enabled sensors, and robotics streamline material flow and reduce downtime. Logistics tech startups and industrial automation firms are collaborating to deploy flexible, modular systems that reduce dependency on human labor while optimizing throughput and accuracy. Government-backed incentives for reshoring and infrastructure modernization under the CHIPS and Science Act are also indirectly boosting domestic intralogistics upgrades, fostering resilient and agile supply chains across critical industries like retail, manufacturing, and healthcare.

Germany leads intralogistics modernization through e-commerce-driven automation

Germanys intralogistics sector is experiencing rapid transformation due to the boom in e-commerce, which accounted for 80% market penetration in 2022. Rising online order volumes have pushed warehouses to implement advanced automation technologies including AS/RS, conveyor systems, and robotics to streamline operations, enhance inventory accuracy, and accelerate fulfillment cycles.

Key players such as Jungheinrich, Kion Group, and Swisslog, supported by Industry 4.0 initiatives and substantial R&D investments, are deploying IoT-enabled AMRs, AI-driven inventory tools, and mobile shuttles in German fulfillment centers. In 2023 alone, approximately 113,000 robots were installed in logistics operations, marking a 35% year-over-year increase. This technology proliferation is enhancing throughput, reducing dependency on labor, and strengthening Germanys position as a European hub for smart intralogistics solutions.

Japan accelerates intralogistics automation through manufacturing digitization:

Japan's Ministry of Economy, Trade and Industry (METI) spearheaded digitization in manufacturing allocating over USD 2.8 billion between 2020 and 2021 toward Industry 4.0 and supply chain resilience initiatives. This funding underpins deployment of intralogistics systems like automated storage and retrieval solutions, robotics, and mobile conveyors to support smart factory transformation.

Competitive AnalysisThe Intralogistics market is highly competitive and innovation-driven, with companies investing in IoT-enabled robotics, AI-powered analytics, and smart warehouse systems. Manufacturers like Dematic (KION Group), Honeywell Intelligrated, Daifuku, Siemens, Swisslog, and SSI Schaefer are advancing automated guided vehicles (AGVs), autonomous mobile robots (AMRs), warehouse management systems (WMS), digital twins, and predictive maintenance platforms.

Price competitiveness remains a central battleground, particularly in emerging economies. While tier-1 players enjoy scale benefits, regional and mid-tier vendors offer more affordable, simplified automation packages tailored to local requirements. Moreover, rental and leasing models are gaining traction, allowing cost-conscious firms to access intralogistics solutions without incurring high upfront investments.

Recent DevelopmentIn July 2024, Falcon Autotech introduced NEO, a new automated storage and retrieval system (ASRS) leveraging robotics, AI, and advanced sensors to enhance warehouse picking efficiency and storage density reportedly faster and more modular than legacy systems.

In May 2025, HRMANN Intralogistics implemented a fully integrated automation solution at Esders and W-Music Distribution facilities, combining AutoStore bins, AGVs, and AI-controlled robots to significantly enhance warehouse automation and process precision.

Overall, intralogistics solutions are evolving toward flexible, modular and software-driven operations.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Intralogistics market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Intralogistics market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Intralogistics market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Intralogistics market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Intralogistics market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 15.78 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Component |

|

| The Segment covered by System Type |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Intralogistics market share, size, and revenue growth rate were created by Quintile Report™. Intralogistics analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Intralogistics Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Intralogistics Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Intralogistics Market, by Region, (USD Million) 2017-2035

Table 21 China Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Intralogistics Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Intralogistics Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Intralogistics Market: market scenario

Fig.4 Global Intralogistics Market competitive outlook

Fig.5 Global Intralogistics Market driver analysis

Fig.6 Global Intralogistics Market restraint analysis

Fig.7 Global Intralogistics Market opportunity analysis

Fig.8 Global Intralogistics Market trends analysis

Fig.9 Global Intralogistics Market: Segment Analysis (Based on the scope)

Fig.10 Global Intralogistics Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

"The Global Intralogistics Market was estimated at USD 30.6 billion in 2025 and is projected to reach USD 117.63 billion by 2035, reflecting a robust CAGR of 15.78% over the forecast period from 2026 to 2035. The Intralogistics market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Intralogistics market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Intralogistics market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Looking ahead, the Intralogistics market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Intralogistics market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period."

Drivers of Intralogistics Market

The rapid growth of e-commerce and omnichannel retail is the major driver in the intralogistics market. Soaring volumes of online orders demand fast, accurate fulfillment prompting adoption of automated storage/retrieval systems, conveyor belts, AGVs, and sorting systems to meet consumer expectations.

Growing focus on digitalization, IoT, and smart warehouses is transforming material handling.

Rising demand for sustainability and green logistics is emerging as a core factor.

The pressure of labour shortages and cost efficiency is pushing firms to automate.

The high initial investment and ongoing lifecycle costs of intralogistics systems such as conveyors, AGVs, AS/RS, and warehouse management software are major barriers. Implementing these automated solutions typically involves significant capital outlay for equipment, customization, infrastructure upgrades, and staff training, followed by recurring expenses for maintenance and software updates. These costs often deter small- and medium-sized enterprises (SMEs) from adopting intralogistics technologies.

The technical complexity of integration and system interoperability further limits adoption. Intralogistics solutions must seamlessly connect with legacy infrastructure, ERP, WMS, and IoT platforms requiring highly tailored configurations and extensive testing. Disruptions during integration and the absence of standardized protocols hinder rollout and raise implementation risk.

Cybersecurity, data privacy, and regulatory compliance concerns also restrain the market. With increased digitization and connectivity come heightened vulnerabilities such as data breaches or operational disruption from cyberattacks. Companies must invest in secure infrastructure and comply with regulations like GDPR or similar local rules, adding cost and complexity to system deployment.

Regional Trends of Intralogistics MarketNorth America dominates the intralogistics market, fuelled by its advanced industrial infrastructure, rapid e-commerce growth, and extensive integration of automation technologies. Companies like Amazon and Walmart heavily invest in AI, IoT, and robotics to enhance warehouse efficiency and meet fast delivery demands. Both the U.S. and Canada show strong uptake of automated pick-and-place systems, AGVs, and smart conveyor setups bolstered by government support, favourable regulations, and a skilled workforce ecosystem.

Europe maintains a mature intralogistics landscape, driven by strong manufacturing, automotive, and retail sectors. Germany, the UK, France, Italy, and Benelux regions lead adoption of modular robotic cells, AGVs, and warehouse orchestration platforms in response to labour shortages and sustainability initiatives. EU policies promoting energy efficiency and carbon-neutral objectives encourage digital warehousing and electrification of material handling. Multi-country logistic hubs and regulatory support for automation projects are accelerating adoption across the region.

Asia-Pacific is the fastest-growing regional market, supported by massive industrial and infrastructure expansion in China, India, Japan, South Korea, and Southeast Asia. Domestic e-commerce giants such as Alibaba and JD.com are driving the adoption of swarm robotics, AI-powered fulfillment centers, and autonomous guided vehicles. Government-led digitization programs like Chinas """"Made in China 2025"""" and India's PM Gati Shakti initiative further boost smart warehouse deployment. Local startups and manufacturers are delivering cost-effective automation tailored to regional logistics challenges.

Latin America's intralogistics sector is gaining momentum in countries such as Brazil, Mexico, and Argentina. Growth in e-commerce is accelerating the need for efficient last-mile logistics and warehouse automation. Governments are providing incentives for technology investment in special economic zones, enhancing infrastructure resilience. Reliability of cross-border trade, especially under USMCA, supports adoption of automated storage and retrieval systems, with rising demand for connectivity and supply chain optimization.

The Middle East & Africa region is emerging with increasing intralogistics investments led by Gulf economies like the UAE, Saudi Arabia, and South Africa.

Country-Wise OutlookU.S. embraces warehouse automation to fuel intralogistics innovation:

The United States intralogistics market is experiencing rapid transformation, largely driven by the surging demand for warehouse automation amid booming e-commerce and omnichannel retail. Companies like Amazon, Walmart, and Target are investing heavily in autonomous mobile robots (AMRs), automated storage and retrieval systems (AS/RS), and AI-powered inventory management tools to handle faster fulfillment cycles. Labor shortages and rising labor costs across logistics hubs have further accelerated this shift, making automation a necessity rather than a luxury for scalable operations.

Distribution centers across the U.S. particularly in states like California, Texas, and Ohio are evolving into smart warehouses where real-time data, IoT-enabled sensors, and robotics streamline material flow and reduce downtime. Logistics tech startups and industrial automation firms are collaborating to deploy flexible, modular systems that reduce dependency on human labor while optimizing throughput and accuracy. Government-backed incentives for reshoring and infrastructure modernization under the CHIPS and Science Act are also indirectly boosting domestic intralogistics upgrades, fostering resilient and agile supply chains across critical industries like retail, manufacturing, and healthcare.

Germany leads intralogistics modernization through e-commerce-driven automation

Germanys intralogistics sector is experiencing rapid transformation due to the boom in e-commerce, which accounted for 80% market penetration in 2022. Rising online order volumes have pushed warehouses to implement advanced automation technologies including AS/RS, conveyor systems, and robotics to streamline operations, enhance inventory accuracy, and accelerate fulfillment cycles.

Key players such as Jungheinrich, Kion Group, and Swisslog, supported by Industry 4.0 initiatives and substantial R&D investments, are deploying IoT-enabled AMRs, AI-driven inventory tools, and mobile shuttles in German fulfillment centers. In 2023 alone, approximately 113,000 robots were installed in logistics operations, marking a 35% year-over-year increase. This technology proliferation is enhancing throughput, reducing dependency on labor, and strengthening Germanys position as a European hub for smart intralogistics solutions.

Japan accelerates intralogistics automation through manufacturing digitization:

Japan's Ministry of Economy, Trade and Industry (METI) spearheaded digitization in manufacturing allocating over USD 2.8 billion between 2020 and 2021 toward Industry 4.0 and supply chain resilience initiatives. This funding underpins deployment of intralogistics systems like automated storage and retrieval solutions, robotics, and mobile conveyors to support smart factory transformation.

Competitive AnalysisThe Intralogistics market is highly competitive and innovation-driven, with companies investing in IoT-enabled robotics, AI-powered analytics, and smart warehouse systems. Manufacturers like Dematic (KION Group), Honeywell Intelligrated, Daifuku, Siemens, Swisslog, and SSI Schaefer are advancing automated guided vehicles (AGVs), autonomous mobile robots (AMRs), warehouse management systems (WMS), digital twins, and predictive maintenance platforms.

Price competitiveness remains a central battleground, particularly in emerging economies. While tier-1 players enjoy scale benefits, regional and mid-tier vendors offer more affordable, simplified automation packages tailored to local requirements. Moreover, rental and leasing models are gaining traction, allowing cost-conscious firms to access intralogistics solutions without incurring high upfront investments.

Recent DevelopmentIn July 2024, Falcon Autotech introduced NEO, a new automated storage and retrieval system (ASRS) leveraging robotics, AI, and advanced sensors to enhance warehouse picking efficiency and storage density reportedly faster and more modular than legacy systems.

In May 2025, HRMANN Intralogistics implemented a fully integrated automation solution at Esders and W-Music Distribution facilities, combining AutoStore bins, AGVs, and AI-controlled robots to significantly enhance warehouse automation and process precision.

Overall, intralogistics solutions are evolving toward flexible, modular and software-driven operations.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Intralogistics market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Intralogistics market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Intralogistics market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Intralogistics market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Intralogistics market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 15.78 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Component |

|

| The Segment covered by System Type |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Intralogistics market share, size, and revenue growth rate were created by Quintile Report™. Intralogistics analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Intralogistics Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Intralogistics Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Intralogistics Market, by Region, (USD Million) 2017-2035

Table 21 China Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Intralogistics Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Intralogistics Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Intralogistics Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Intralogistics Market: market scenario

Fig.4 Global Intralogistics Market competitive outlook

Fig.5 Global Intralogistics Market driver analysis

Fig.6 Global Intralogistics Market restraint analysis

Fig.7 Global Intralogistics Market opportunity analysis

Fig.8 Global Intralogistics Market trends analysis

Fig.9 Global Intralogistics Market: Segment Analysis (Based on the scope)

Fig.10 Global Intralogistics Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report OverviewThe Global Gas Cylinder Market was valued at USD 12.36 million in 2025 and is project

Read MoreReport OverviewThe Global Drone Mapping Market was valued at USD 2.62 billion in 2025 and is project

Read MoreReport OverviewThe Global CBD Extraction Equipment Market was valued at USD 67.62 million in 2025 an

Read More