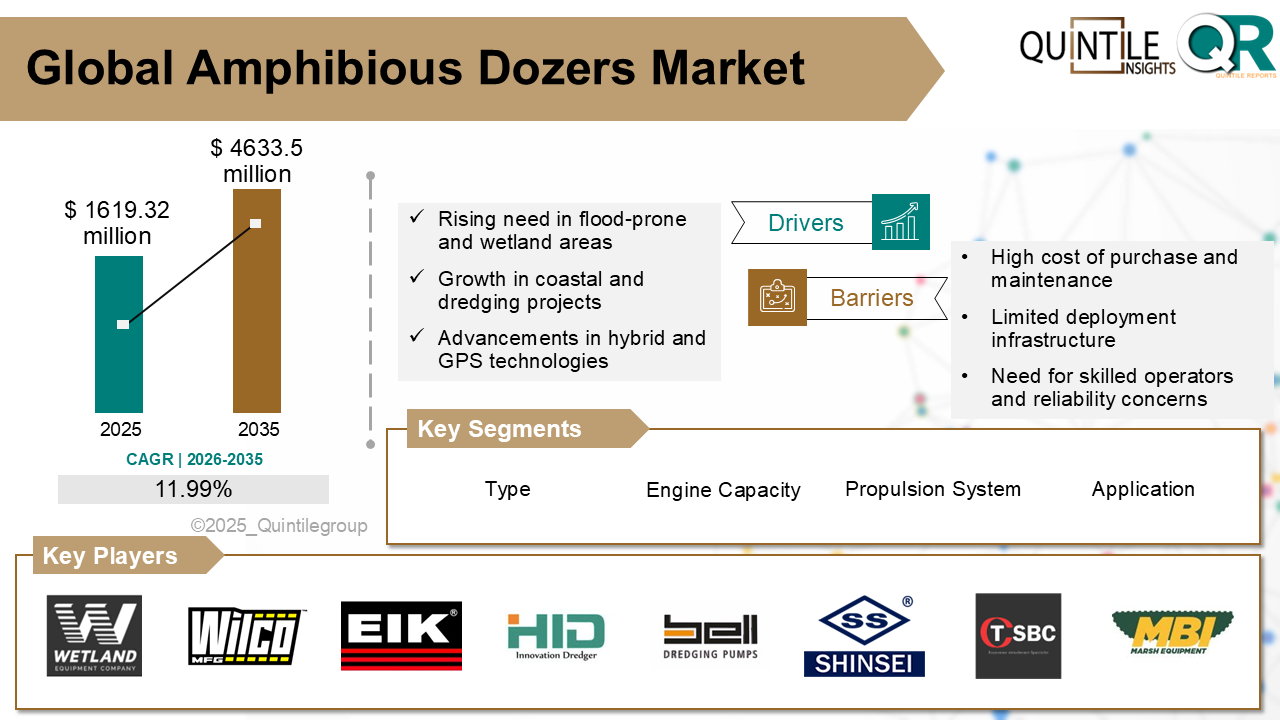

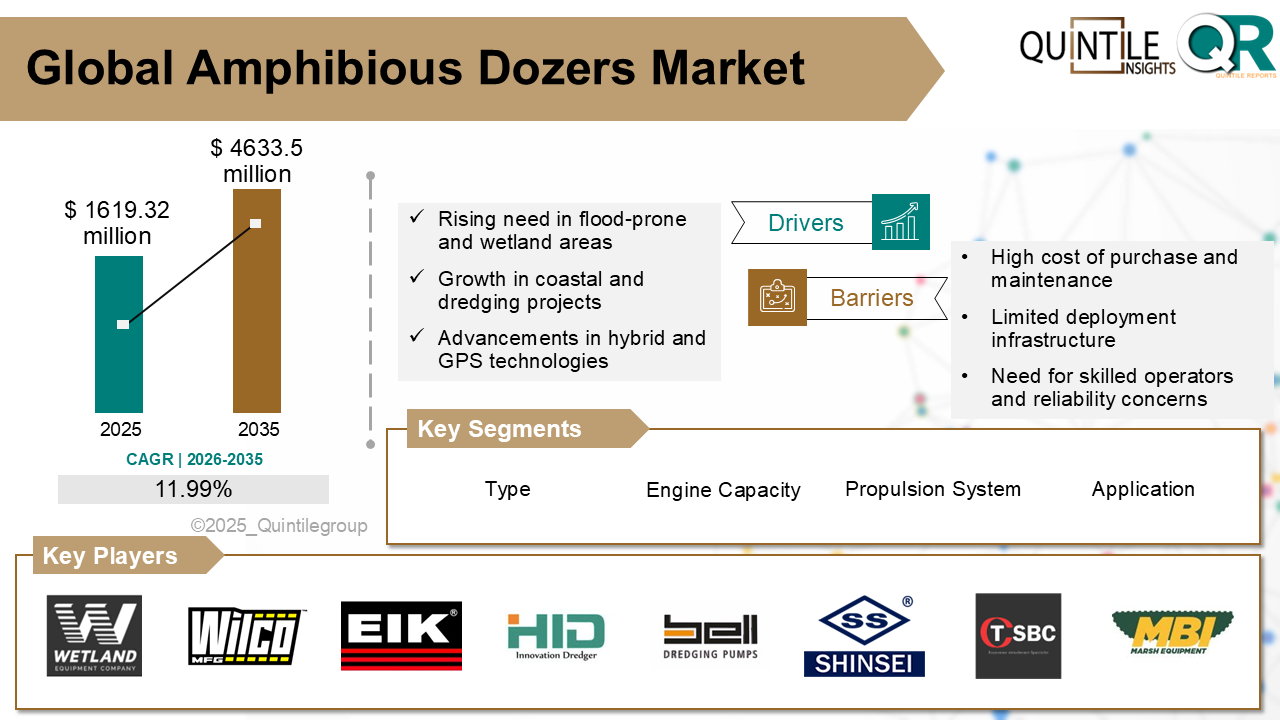

The Global Amphibious Dozers Market was estimated at USD 1619.32 million in 2025 and is projected to reach USD 4633.5 million by 2035, reflecting a robust CAGR of 11.99% over the forecast period from 2026 to 2035. The Amphibious Dozers market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Amphibious Dozers market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Amphibious Dozers market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Key trends influencing the Amphibious Dozers market include the rapid adoption of digital technologies, the integration of sustainable practices, and the increasing importance of customer experience. These trends are not only driving growth but also creating new challenges for industry participants, who must adapt their GTM strategies to navigate regulatory changes, supply chain disruptions, and fluctuating economic conditions. Despite these challenges, the Amphibious Dozers market is poised for sustained growth, with emerging markets playing a critical role in the expansion of the industry.

Looking ahead, the Amphibious Dozers market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Amphibious Dozers market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period.

Amphibious Dozers Market

The amphibious dozers market refers to the segment of heavy construction and civil engineering equipment comprising dozers engineered to operate seamlessly across both terrestrial and aquatic environments such as wetlands, marshes, flooded zones, and shallow water bodies. These machines are distinguished by specialized chassis designs incorporating flotation pontoons or water-jet propulsion systems, enabling efficient movement and earthmoving in submerged or soft-ground conditions. Applications include dredging, land reclamation, flood control, environmental restoration, and infrastructure development in regions with unstable terrain.

This market encompasses the manufacturing and sales of amphibious dozers including both newly built units and retrofit kits alongside essential accessories like fuel/regulator kits, pontoons, specialized monitoring systems, and operator training services. Key regional drivers include increased investment in wetland restoration, disaster mitigation projects, and rising demand for versatile machinery in agriculture and infrastructure, especially in flood-prone coastal zones. Technological evolution such as GPS navigation, hybrid or electric propulsion, autonomous controls, and IoT-enabled diagnostics is further enhancing operational performance and supporting broader adoption of these systems.

The increasing frequency of extreme weather events and rising investment in disaster preparedness are the major drivers in the amphibious dozer market. These dozers are essential for flood control, ecosystem restoration, and emergency response during hurricanes and rising sea levels.

The expanding infrastructure and urban development in flood-prone and coastal regions are further fuelling adoption. Projects like Chinas Sponge City initiative, port expansion, canal management, and embankment construction depend on versatile water- and land-capable machines.

Technological innovation is a key driver, with hybrids, modular pontoons, GPS-integrated navigation, and remote-control or even autonomous operation enhancing performance, fuel efficiency, and operator safety.

Stringent environmental regulations and sustainability goals are raising demand for eco-friendly equipment. Low-emission Tier IV engines, electric amphibious bulldozers, and minimal ecological disruption make them the preferred choice for civil and environmental projects.

Supportive policy frameworks, local manufacturing, and increasing defence applications are driving market growth. Governments, especially in Asia-Pacific and Europe, are investing in localized production, training, and military-grade amphibious dozers for coastal defence and tactical infrastructure missions.

The high purchase price and ongoing maintenance costs of amphibious dozers are primary hurdles in this market. These specialized machines equipped with pontoons, complex hydraulics, and corrosion-resistant materials cost significantly more than conventional excavators or dozers.

The operational and technological complexities of amphibious dozers further constrain market growth. Dual-environment performance demands sophisticated design balancing buoyancy, stability, and land mobility. Maintaining intricate systems like hydraulic seals and pontoons requires skilled technicians, often unavailable in remote regions.

Strict regulatory, environmental compliance, and logistical limitations also restrain the market. These machines are frequently deployed in sensitive ecosystems where permits, impact assessments, and emissions/noise regulations add complexity to projects.

The shortage of trained operators and parts availability issues impedes wider adoption. Operating amphibious dozers demands specialized training for waterland transitions and safety protocols. Supply chain constraints affect component availability and increase downtime.

North America is a key market driven by coastal restoration, flood management, and wetland conservation especially across the Gulf Coast. Strong environmental regulations and government funding are stimulating adoption of low-impact amphibious machines.

Europe shows steady growth under stringent environmental mandates like the EU Water Framework Directive. Countries such as the Netherlands, Germany, and the UK rely on amphibious dozers for canal maintenance, riverbank restoration, and eco-sensitive projects.

Asia-Pacific is the fastest-growing region, fuelled by heavy infrastructure development in China, India, Vietnam, and Indonesia. Land reclamation, swamp agriculture, and coastal megaprojects are major contributors.

Latin America is emerging, led by Brazils demand for flood control, hydropower operations, and wetland management.

The Middle East & Africa region is developing steadily, driven by oil & gas operations, coastal restoration, and flood management projects. The UAE, Saudi Arabia, Nigeria, and South Africa are expanding usage across varied terrains.

U.S. prioritizes worker safety and compliance to boost autonomous drill adoption: Strict safety regulations enforced by OSHA and MSHA encourage adoption of autonomous drilling systems. AI-enabled analytics, real-time monitoring, and predictive maintenance support higher precision and reduced labor exposure.

Germany advances autonomous drilling for environmental compliance and efficiency: Driven by EU sustainability mandates, Germany is deploying autonomous drill rigs for projects in sensitive regions. Low-emission engines and automation help meet climate goals and Industry 4.0 frameworks.

Japan accelerates amphibious dozer adoption for climate resilience and agriculture: Frequent flooding and typhoons push Japan to adopt amphibious dozers for disaster resilience, embankment repairs, and rice field preparation. Government subsidies and engineering innovation further boost adoption.

The Amphibious Dozers market is highly competitive and rapidly innovating with hybrid engines, autonomous controls, modular pontoons, and GPS-based navigation. Players like Komatsu, Caterpillar, Truxor, FNSS, and Volvo are expanding R&D efforts on low-emission engines and smart diagnostics.

Competitive strategies include regulatory alignment, region-specific product development, leasing models, and full-service ecosystems including operator training, mobile apps, remote monitoring, and post-sale maintenance.

Regional players, especially in China and Southeast Asia, offer cost-effective models suited for local terrain, intensifying competition. Military-focused manufacturers like FNSS are introducing advanced amphibious engineering vehicles for defence.

Service-based differentiation is emerging as a key competitive advantage, with companies providing turnkey packages, technical support, and green-compliant equipment to meet environmental mandates.

Wetland Equipment Company, Inc., Wilco Manufacturing LLC, EIK Engineering Sdn Bhd, Normrock Industries, HID Dredging Equipment Company, Bell Dredging Pumps, Shinsei Industry Co., Ltd., TSBC Engineering Sdn Bhd, MARSH BUGGIES INC, PowerPlus Group Pte Ltd., Guangzhou HENGCHUAN Machinery Co., Ltd., Waterking BV, DSC Dredge LLC, Rivard SAS, Remu Oy.

In September 2024, Komatsu unveiled an electric amphibious crawler dozer equipped with automatic control and ICT functions, enabling remote operation without highly skilled operators.

In January 2025, Komatsu debuted its first all-electric, fully autonomous underwater bulldozer at CES Las Vegas, featuring a 450500 kWh battery and operating capability up to 50 meters depth.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Amphibious Dozers market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Amphibious Dozers market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Amphibious Dozers market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Amphibious Dozers market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Amphibious Dozers market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 11.99 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Type |

|

| The Segment covered by Engine Capacity |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Amphibious Dozers market share, size, and revenue growth rate were created by Quintile Report™. Amphibious Dozers analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Amphibious Dozers Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Amphibious Dozers Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Amphibious Dozers Market, by Region, (USD Million) 2017-2035

Table 21 China Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Amphibious Dozers Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Amphibious Dozers Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Amphibious Dozers Market: market scenario

Fig.4 Global Amphibious Dozers Market competitive outlook

Fig.5 Global Amphibious Dozers Market driver analysis

Fig.6 Global Amphibious Dozers Market restraint analysis

Fig.7 Global Amphibious Dozers Market opportunity analysis

Fig.8 Global Amphibious Dozers Market trends analysis

Fig.9 Global Amphibious Dozers Market: Segment Analysis (Based on the scope)

Fig.10 Global Amphibious Dozers Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Amphibious Dozers Market was estimated at USD 1619.32 million in 2025 and is projected to reach USD 4633.5 million by 2035, reflecting a robust CAGR of 11.99% over the forecast period from 2026 to 2035. The Amphibious Dozers market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Amphibious Dozers market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Amphibious Dozers market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Key trends influencing the Amphibious Dozers market include the rapid adoption of digital technologies, the integration of sustainable practices, and the increasing importance of customer experience. These trends are not only driving growth but also creating new challenges for industry participants, who must adapt their GTM strategies to navigate regulatory changes, supply chain disruptions, and fluctuating economic conditions. Despite these challenges, the Amphibious Dozers market is poised for sustained growth, with emerging markets playing a critical role in the expansion of the industry.

Looking ahead, the Amphibious Dozers market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Amphibious Dozers market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period.

Amphibious Dozers Market

The amphibious dozers market refers to the segment of heavy construction and civil engineering equipment comprising dozers engineered to operate seamlessly across both terrestrial and aquatic environments such as wetlands, marshes, flooded zones, and shallow water bodies. These machines are distinguished by specialized chassis designs incorporating flotation pontoons or water-jet propulsion systems, enabling efficient movement and earthmoving in submerged or soft-ground conditions. Applications include dredging, land reclamation, flood control, environmental restoration, and infrastructure development in regions with unstable terrain.

This market encompasses the manufacturing and sales of amphibious dozers including both newly built units and retrofit kits alongside essential accessories like fuel/regulator kits, pontoons, specialized monitoring systems, and operator training services. Key regional drivers include increased investment in wetland restoration, disaster mitigation projects, and rising demand for versatile machinery in agriculture and infrastructure, especially in flood-prone coastal zones. Technological evolution such as GPS navigation, hybrid or electric propulsion, autonomous controls, and IoT-enabled diagnostics is further enhancing operational performance and supporting broader adoption of these systems.

The increasing frequency of extreme weather events and rising investment in disaster preparedness are the major drivers in the amphibious dozer market. These dozers are essential for flood control, ecosystem restoration, and emergency response during hurricanes and rising sea levels.

The expanding infrastructure and urban development in flood-prone and coastal regions are further fuelling adoption. Projects like Chinas Sponge City initiative, port expansion, canal management, and embankment construction depend on versatile water- and land-capable machines.

Technological innovation is a key driver, with hybrids, modular pontoons, GPS-integrated navigation, and remote-control or even autonomous operation enhancing performance, fuel efficiency, and operator safety.

Stringent environmental regulations and sustainability goals are raising demand for eco-friendly equipment. Low-emission Tier IV engines, electric amphibious bulldozers, and minimal ecological disruption make them the preferred choice for civil and environmental projects.

Supportive policy frameworks, local manufacturing, and increasing defence applications are driving market growth. Governments, especially in Asia-Pacific and Europe, are investing in localized production, training, and military-grade amphibious dozers for coastal defence and tactical infrastructure missions.

The high purchase price and ongoing maintenance costs of amphibious dozers are primary hurdles in this market. These specialized machines equipped with pontoons, complex hydraulics, and corrosion-resistant materials cost significantly more than conventional excavators or dozers.

The operational and technological complexities of amphibious dozers further constrain market growth. Dual-environment performance demands sophisticated design balancing buoyancy, stability, and land mobility. Maintaining intricate systems like hydraulic seals and pontoons requires skilled technicians, often unavailable in remote regions.

Strict regulatory, environmental compliance, and logistical limitations also restrain the market. These machines are frequently deployed in sensitive ecosystems where permits, impact assessments, and emissions/noise regulations add complexity to projects.

The shortage of trained operators and parts availability issues impedes wider adoption. Operating amphibious dozers demands specialized training for waterland transitions and safety protocols. Supply chain constraints affect component availability and increase downtime.

North America is a key market driven by coastal restoration, flood management, and wetland conservation especially across the Gulf Coast. Strong environmental regulations and government funding are stimulating adoption of low-impact amphibious machines.

Europe shows steady growth under stringent environmental mandates like the EU Water Framework Directive. Countries such as the Netherlands, Germany, and the UK rely on amphibious dozers for canal maintenance, riverbank restoration, and eco-sensitive projects.

Asia-Pacific is the fastest-growing region, fuelled by heavy infrastructure development in China, India, Vietnam, and Indonesia. Land reclamation, swamp agriculture, and coastal megaprojects are major contributors.

Latin America is emerging, led by Brazils demand for flood control, hydropower operations, and wetland management.

The Middle East & Africa region is developing steadily, driven by oil & gas operations, coastal restoration, and flood management projects. The UAE, Saudi Arabia, Nigeria, and South Africa are expanding usage across varied terrains.

U.S. prioritizes worker safety and compliance to boost autonomous drill adoption: Strict safety regulations enforced by OSHA and MSHA encourage adoption of autonomous drilling systems. AI-enabled analytics, real-time monitoring, and predictive maintenance support higher precision and reduced labor exposure.

Germany advances autonomous drilling for environmental compliance and efficiency: Driven by EU sustainability mandates, Germany is deploying autonomous drill rigs for projects in sensitive regions. Low-emission engines and automation help meet climate goals and Industry 4.0 frameworks.

Japan accelerates amphibious dozer adoption for climate resilience and agriculture: Frequent flooding and typhoons push Japan to adopt amphibious dozers for disaster resilience, embankment repairs, and rice field preparation. Government subsidies and engineering innovation further boost adoption.

The Amphibious Dozers market is highly competitive and rapidly innovating with hybrid engines, autonomous controls, modular pontoons, and GPS-based navigation. Players like Komatsu, Caterpillar, Truxor, FNSS, and Volvo are expanding R&D efforts on low-emission engines and smart diagnostics.

Competitive strategies include regulatory alignment, region-specific product development, leasing models, and full-service ecosystems including operator training, mobile apps, remote monitoring, and post-sale maintenance.

Regional players, especially in China and Southeast Asia, offer cost-effective models suited for local terrain, intensifying competition. Military-focused manufacturers like FNSS are introducing advanced amphibious engineering vehicles for defence.

Service-based differentiation is emerging as a key competitive advantage, with companies providing turnkey packages, technical support, and green-compliant equipment to meet environmental mandates.

Wetland Equipment Company, Inc., Wilco Manufacturing LLC, EIK Engineering Sdn Bhd, Normrock Industries, HID Dredging Equipment Company, Bell Dredging Pumps, Shinsei Industry Co., Ltd., TSBC Engineering Sdn Bhd, MARSH BUGGIES INC, PowerPlus Group Pte Ltd., Guangzhou HENGCHUAN Machinery Co., Ltd., Waterking BV, DSC Dredge LLC, Rivard SAS, Remu Oy.

In September 2024, Komatsu unveiled an electric amphibious crawler dozer equipped with automatic control and ICT functions, enabling remote operation without highly skilled operators.

In January 2025, Komatsu debuted its first all-electric, fully autonomous underwater bulldozer at CES Las Vegas, featuring a 450500 kWh battery and operating capability up to 50 meters depth.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Amphibious Dozers market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Amphibious Dozers market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Amphibious Dozers market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Amphibious Dozers market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Amphibious Dozers market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 11.99 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Type |

|

| The Segment covered by Engine Capacity |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Amphibious Dozers market share, size, and revenue growth rate were created by Quintile Report™. Amphibious Dozers analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Amphibious Dozers Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Amphibious Dozers Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Amphibious Dozers Market, by Region, (USD Million) 2017-2035

Table 21 China Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Amphibious Dozers Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Amphibious Dozers Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Amphibious Dozers Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Amphibious Dozers Market: market scenario

Fig.4 Global Amphibious Dozers Market competitive outlook

Fig.5 Global Amphibious Dozers Market driver analysis

Fig.6 Global Amphibious Dozers Market restraint analysis

Fig.7 Global Amphibious Dozers Market opportunity analysis

Fig.8 Global Amphibious Dozers Market trends analysis

Fig.9 Global Amphibious Dozers Market: Segment Analysis (Based on the scope)

Fig.10 Global Amphibious Dozers Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report Overview: The Global Gas and Liquid Flow Management Systems Market was valued at USD 21.82 bi

Read MoreReport Overview: The Global Product Fall Protection Systems Market was valued at USD 8.62 million in

Read MoreReport Overview: The Global Superconductor Motors Market was valued at USD 135.82 million in 2025 an

Read More