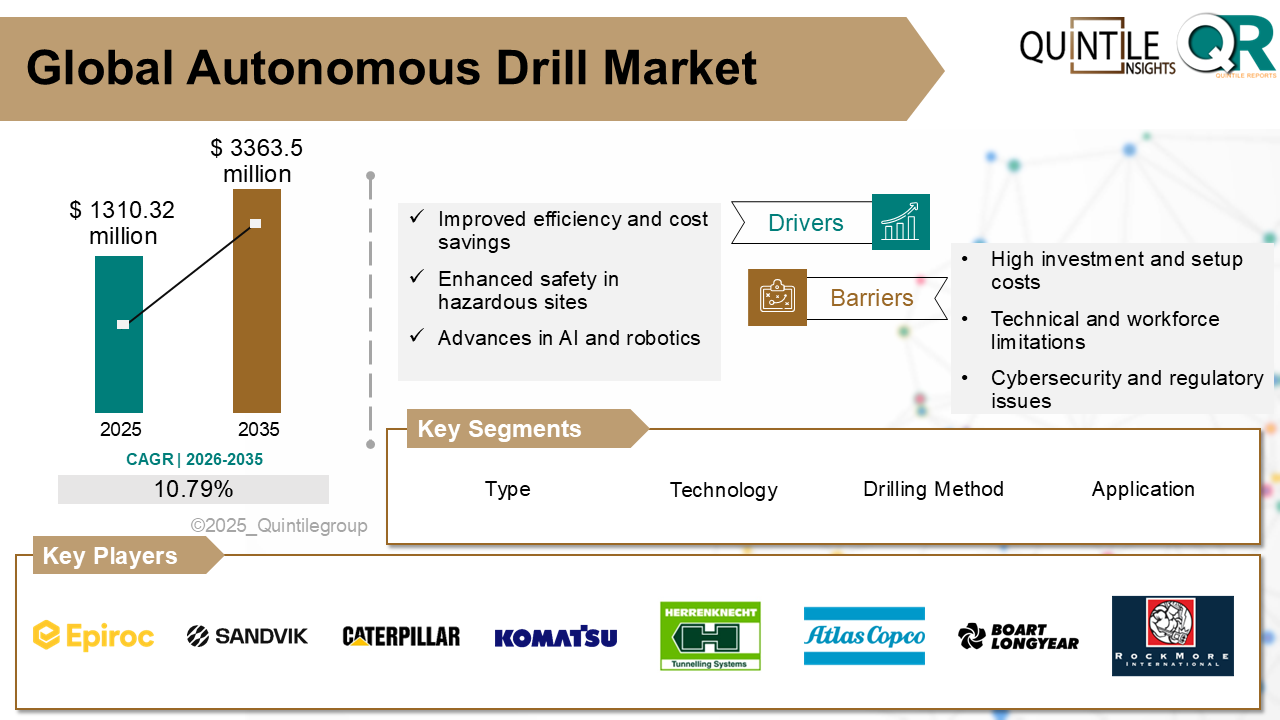

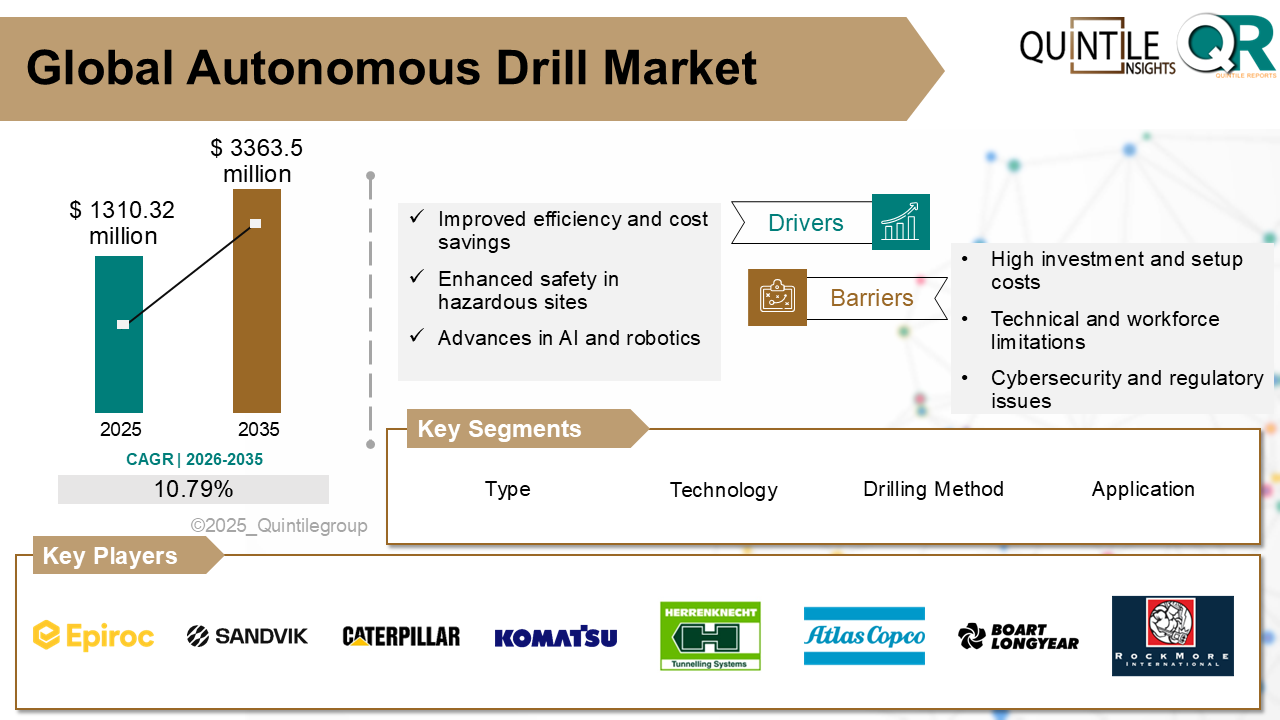

The Global Autonomous Drill Market was estimated at USD 1310.32 million in 2025 and is projected to reach USD 3363.5 million by 2035, reflecting a robust CAGR of 10.79% over the forecast period from 2026 to 2035. The Autonomous Drill market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Autonomous Drill market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Autonomous Drill market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Key trends influencing the Autonomous Drill market include the rapid adoption of digital technologies, the integration of sustainable practices, and the increasing importance of customer experience. These trends are not only driving growth but also creating new challenges for industry participants, who must adapt their GTM strategies to navigate regulatory changes, supply chain disruptions, and fluctuating economic conditions. Despite these challenges, the Autonomous Drill market is poised for sustained growth, with emerging markets playing a critical role in the expansion of the industry.

Looking ahead, the Autonomous Drill market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Autonomous Drill market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period.

Autonomous Drill Market

The autonomous drill market refers to the segment of the industrial equipment landscape focused on drilling systems used in mining, construction, and oil & gas that operate with minimal or no human intervention. These systems leverage automation, artificial intelligence, advanced sensors, and remote-control technologies to execute tasks like directional drilling, pipe handling, and wellbore management independently. The market includes full-automation rigs, semi-autonomous retrofit kits, and drilling robots integrated with environmental monitoring and real-time data feedback for optimized performance.

Adopted across onshore and offshore operations, autonomous drills improve precision and productivity while reducing human exposure to hazardous environments. Major applications include deepwater and harsh-environment drilling, mega-construction projects, mining, and oil & gas exploration. The market is driven by the convergence of technologiesautomation, AI, IoT, remote operations, and digital twinswhich allow drills to self-adjust in real time, optimize drill paths, and enable fleet-wide remote monitoring and diagnostics.

The need to significantly improve operational efficiency and reduce drilling time and costs is the primary driver in the autonomous drill market. Automated drilling rigs enhance productivity and accuracy, lower labour expenses, and streamline resource utilization, making them increasingly indispensable in oil, gas, mining, and construction sectors.

Safety and risk mitigation concerns are amplifying adoption of autonomous drill systems. By minimizing human presence in hazardous drilling environmentsespecially in deepwater, ultra-deepwater, and remote sitesthese systems lessen onsite incidents and support zero-incident objectives.

Technological breakthroughs in AI, robotics, IoT, edge computing, and digital twins are empowering smarter drilling operations. These advances enable real-time monitoring, predictive maintenance, autonomous navigation, and adaptive control, driving performance and accuracy.

The growing global demand for energy and resourcesespecially in offshore, deepwater, mining, and shale projectsis fuelling investment in autonomous drilling. High-capex endeavours in regions like the Gulf of Mexico, Middle East, North Sea, and North America are adopting automation to enhance consistency and reduce operational complexity.

Environmental regulations and sustainability goals are boosting market momentum. Autonomous rigs optimize fuel usage, reduce emissions, and limit environmental impactaligning with stricter HSE mandates and corporate sustainability strategies.

High initial investment and elevated lifecycle costs are significant challenges in the autonomous drilling market. These systems require advanced hardware, sensors, AI capabilities, and high-end control technologies. The cost of acquisition, setup, workforce training, and maintenance is often prohibitive for smaller operators, delaying technology adoption.

Technological complexity and integration challenges further restrain adoption. Integrating autonomous drilling systems into legacy infrastructures requires extensive customization, calibration, and technical expertise, which increases rollout timelines and operational risks.

Regulatory scrutiny, safety compliance, and cybersecurity threats also pose barriers. Variations in safety regulations, the need for certification in hazardous environments, and risks of cyberattacks on connected drilling systems limit fast adoption.

Workforce resistance and skills shortages create an additional challenge. Automation disrupts traditional roles, leading to resistance, while skilled operators capable of handling advanced autonomous systems remain limited.

North America leads the autonomous drill market, driven by strong mining and oil & gas sectors, early technology adoption, and a focus on safety. The U.S. and Canada deploy AI-enabled drills to boost accuracy and reduce carbon emissions.

Europe experiences steady adoption, supported by stringent environmental policies, Industry 4.0 initiatives, and strong automation R&D. Germany and Nordic countries utilize autonomous drill systems in mining, geothermal energy, and tunnelling.

Asia-Pacific is the fastest-growing region, fuelled by rapid industrialization, major mining operations, and massive construction projects. China, India, and Australia are major adopters of robotic and AI-driven drilling systems.

Latin America is gradually integrating autonomous drills in mining-heavy regions like Brazil and Chile, driven by safety requirements and global competitiveness.

The Middle East & Africa region is expanding its adoption through autonomous and remote-controlled systems in oil & gas, and mining operations in South Africa and the Gulf states.

U.S. leads in safety-driven autonomous drill adoption: The U.S. has prioritized mining safety under MSHA guidelines, accelerating autonomous drilling deployment. Technologies like Cat MineStar Command enhance safety by reducing human presence in hazardous areas and improving accuracy and uptime across mining operations.

Germany accelerates autonomous drill adoption through safety and sustainability mandates: Germany's engineering strength and EU environmental regulations support rapid integration of low-emission autonomous drills. R&D initiatives under Industry 4.0 and climate-smart mining strategies are further accelerating adoption.

Japan prioritizes automation and safety in drilling operations: Ageing workforce challenges and high-precision drilling requirements in tunnelling and offshore projects push Japan toward AI-driven autonomous drill systems. Komatsu and domestic automation leaders develop advanced systems tailored for deep underground and urban operations.

The autonomous drill market is highly competitive, driven by innovation in AI, robotics, IoT, and real-time analytics. Companies compete by developing advanced autonomous rigs, navigation systems, predictive maintenance tools, and digital drilling ecosystems.

Major playersincluding Caterpillar, Sandvik, Komatsu, Liebherr, and Epirocinvest heavily in automation R&D, strategic partnerships, and pilot programs with mining and energy companies to accelerate adoption.

Mid-tier and regional vendors compete by offering cost-effective retrofit solutions tailored for smaller mines or regional drilling requirements in APAC, LATAM, and Africa.

Competition also focuses on ecosystem services: cloud monitoring, fleet management, hybrid systems, and mobile apps to enhance user experience and operational safety.

Key players include Epiroc AB, Sandvik AB, Caterpillar Inc., Komatsu Ltd., Herrenknecht AG, Atlas Copco, Boart Longyear, Rockmore International, Center Rock Inc., Schramm Inc., Doosan Infracore, Vermeer Corporation, China National Coal Group Corp., XCMG Group, and Furukawa Rock Drill Co., Ltd.

In July 2024, Epiroc conducted successful trials of its SmartROC D65 MKII Autonomous drill at Fortescues Iron Bridge and Solomon Hub in Western Australia, marking a milestone in autonomous surface mining performance.

In September 2024, Epiroc rebranded its ASI Mining Mobius automation platform to LinkOA, launching LinkOA for Drills as an OEM-agnostic solution for surface drill automation.

In May 2025, Sandvik introduced the AutoMine Surface Fleet enabling remote operation of multiple i-series drill rigs from a single station, with successful trials at Boliden Kevitsa mine in Finland.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Autonomous Drill market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Autonomous Drill market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Autonomous Drill market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Autonomous Drill market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Autonomous Drill market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 10.79 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Type |

|

| The Segment covered by Technology |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Autonomous Drill market share, size, and revenue growth rate were created by Quintile Report™. Autonomous Drill analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Autonomous Drill Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Autonomous Drill Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Autonomous Drill Market, by Region, (USD Million) 2017-2035

Table 21 China Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Autonomous Drill Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Autonomous Drill Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Autonomous Drill Market: market scenario

Fig.4 Global Autonomous Drill Market competitive outlook

Fig.5 Global Autonomous Drill Market driver analysis

Fig.6 Global Autonomous Drill Market restraint analysis

Fig.7 Global Autonomous Drill Market opportunity analysis

Fig.8 Global Autonomous Drill Market trends analysis

Fig.9 Global Autonomous Drill Market: Segment Analysis (Based on the scope)

Fig.10 Global Autonomous Drill Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Autonomous Drill Market was estimated at USD 1310.32 million in 2025 and is projected to reach USD 3363.5 million by 2035, reflecting a robust CAGR of 10.79% over the forecast period from 2026 to 2035. The Autonomous Drill market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Autonomous Drill market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Autonomous Drill market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Key trends influencing the Autonomous Drill market include the rapid adoption of digital technologies, the integration of sustainable practices, and the increasing importance of customer experience. These trends are not only driving growth but also creating new challenges for industry participants, who must adapt their GTM strategies to navigate regulatory changes, supply chain disruptions, and fluctuating economic conditions. Despite these challenges, the Autonomous Drill market is poised for sustained growth, with emerging markets playing a critical role in the expansion of the industry.

Looking ahead, the Autonomous Drill market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Autonomous Drill market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period.

Autonomous Drill Market

The autonomous drill market refers to the segment of the industrial equipment landscape focused on drilling systems used in mining, construction, and oil & gas that operate with minimal or no human intervention. These systems leverage automation, artificial intelligence, advanced sensors, and remote-control technologies to execute tasks like directional drilling, pipe handling, and wellbore management independently. The market includes full-automation rigs, semi-autonomous retrofit kits, and drilling robots integrated with environmental monitoring and real-time data feedback for optimized performance.

Adopted across onshore and offshore operations, autonomous drills improve precision and productivity while reducing human exposure to hazardous environments. Major applications include deepwater and harsh-environment drilling, mega-construction projects, mining, and oil & gas exploration. The market is driven by the convergence of technologiesautomation, AI, IoT, remote operations, and digital twinswhich allow drills to self-adjust in real time, optimize drill paths, and enable fleet-wide remote monitoring and diagnostics.

The need to significantly improve operational efficiency and reduce drilling time and costs is the primary driver in the autonomous drill market. Automated drilling rigs enhance productivity and accuracy, lower labour expenses, and streamline resource utilization, making them increasingly indispensable in oil, gas, mining, and construction sectors.

Safety and risk mitigation concerns are amplifying adoption of autonomous drill systems. By minimizing human presence in hazardous drilling environmentsespecially in deepwater, ultra-deepwater, and remote sitesthese systems lessen onsite incidents and support zero-incident objectives.

Technological breakthroughs in AI, robotics, IoT, edge computing, and digital twins are empowering smarter drilling operations. These advances enable real-time monitoring, predictive maintenance, autonomous navigation, and adaptive control, driving performance and accuracy.

The growing global demand for energy and resourcesespecially in offshore, deepwater, mining, and shale projectsis fuelling investment in autonomous drilling. High-capex endeavours in regions like the Gulf of Mexico, Middle East, North Sea, and North America are adopting automation to enhance consistency and reduce operational complexity.

Environmental regulations and sustainability goals are boosting market momentum. Autonomous rigs optimize fuel usage, reduce emissions, and limit environmental impactaligning with stricter HSE mandates and corporate sustainability strategies.

High initial investment and elevated lifecycle costs are significant challenges in the autonomous drilling market. These systems require advanced hardware, sensors, AI capabilities, and high-end control technologies. The cost of acquisition, setup, workforce training, and maintenance is often prohibitive for smaller operators, delaying technology adoption.

Technological complexity and integration challenges further restrain adoption. Integrating autonomous drilling systems into legacy infrastructures requires extensive customization, calibration, and technical expertise, which increases rollout timelines and operational risks.

Regulatory scrutiny, safety compliance, and cybersecurity threats also pose barriers. Variations in safety regulations, the need for certification in hazardous environments, and risks of cyberattacks on connected drilling systems limit fast adoption.

Workforce resistance and skills shortages create an additional challenge. Automation disrupts traditional roles, leading to resistance, while skilled operators capable of handling advanced autonomous systems remain limited.

North America leads the autonomous drill market, driven by strong mining and oil & gas sectors, early technology adoption, and a focus on safety. The U.S. and Canada deploy AI-enabled drills to boost accuracy and reduce carbon emissions.

Europe experiences steady adoption, supported by stringent environmental policies, Industry 4.0 initiatives, and strong automation R&D. Germany and Nordic countries utilize autonomous drill systems in mining, geothermal energy, and tunnelling.

Asia-Pacific is the fastest-growing region, fuelled by rapid industrialization, major mining operations, and massive construction projects. China, India, and Australia are major adopters of robotic and AI-driven drilling systems.

Latin America is gradually integrating autonomous drills in mining-heavy regions like Brazil and Chile, driven by safety requirements and global competitiveness.

The Middle East & Africa region is expanding its adoption through autonomous and remote-controlled systems in oil & gas, and mining operations in South Africa and the Gulf states.

U.S. leads in safety-driven autonomous drill adoption: The U.S. has prioritized mining safety under MSHA guidelines, accelerating autonomous drilling deployment. Technologies like Cat MineStar Command enhance safety by reducing human presence in hazardous areas and improving accuracy and uptime across mining operations.

Germany accelerates autonomous drill adoption through safety and sustainability mandates: Germany's engineering strength and EU environmental regulations support rapid integration of low-emission autonomous drills. R&D initiatives under Industry 4.0 and climate-smart mining strategies are further accelerating adoption.

Japan prioritizes automation and safety in drilling operations: Ageing workforce challenges and high-precision drilling requirements in tunnelling and offshore projects push Japan toward AI-driven autonomous drill systems. Komatsu and domestic automation leaders develop advanced systems tailored for deep underground and urban operations.

The autonomous drill market is highly competitive, driven by innovation in AI, robotics, IoT, and real-time analytics. Companies compete by developing advanced autonomous rigs, navigation systems, predictive maintenance tools, and digital drilling ecosystems.

Major playersincluding Caterpillar, Sandvik, Komatsu, Liebherr, and Epirocinvest heavily in automation R&D, strategic partnerships, and pilot programs with mining and energy companies to accelerate adoption.

Mid-tier and regional vendors compete by offering cost-effective retrofit solutions tailored for smaller mines or regional drilling requirements in APAC, LATAM, and Africa.

Competition also focuses on ecosystem services: cloud monitoring, fleet management, hybrid systems, and mobile apps to enhance user experience and operational safety.

Key players include Epiroc AB, Sandvik AB, Caterpillar Inc., Komatsu Ltd., Herrenknecht AG, Atlas Copco, Boart Longyear, Rockmore International, Center Rock Inc., Schramm Inc., Doosan Infracore, Vermeer Corporation, China National Coal Group Corp., XCMG Group, and Furukawa Rock Drill Co., Ltd.

In July 2024, Epiroc conducted successful trials of its SmartROC D65 MKII Autonomous drill at Fortescues Iron Bridge and Solomon Hub in Western Australia, marking a milestone in autonomous surface mining performance.

In September 2024, Epiroc rebranded its ASI Mining Mobius automation platform to LinkOA, launching LinkOA for Drills as an OEM-agnostic solution for surface drill automation.

In May 2025, Sandvik introduced the AutoMine Surface Fleet enabling remote operation of multiple i-series drill rigs from a single station, with successful trials at Boliden Kevitsa mine in Finland.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Autonomous Drill market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Autonomous Drill market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Autonomous Drill market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Autonomous Drill market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Autonomous Drill market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 10.79 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Type |

|

| The Segment covered by Technology |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Autonomous Drill market share, size, and revenue growth rate were created by Quintile Report™. Autonomous Drill analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Autonomous Drill Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Autonomous Drill Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Autonomous Drill Market, by Region, (USD Million) 2017-2035

Table 21 China Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Autonomous Drill Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Autonomous Drill Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Autonomous Drill Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Autonomous Drill Market: market scenario

Fig.4 Global Autonomous Drill Market competitive outlook

Fig.5 Global Autonomous Drill Market driver analysis

Fig.6 Global Autonomous Drill Market restraint analysis

Fig.7 Global Autonomous Drill Market opportunity analysis

Fig.8 Global Autonomous Drill Market trends analysis

Fig.9 Global Autonomous Drill Market: Segment Analysis (Based on the scope)

Fig.10 Global Autonomous Drill Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report OverviewThe Global Gas Cylinder Market was valued at USD 12.36 million in 2025 and is project

Read MoreReport OverviewThe Global Drone Mapping Market was valued at USD 2.62 billion in 2025 and is project

Read MoreReport OverviewThe Global CBD Extraction Equipment Market was valued at USD 67.62 million in 2025 an

Read More