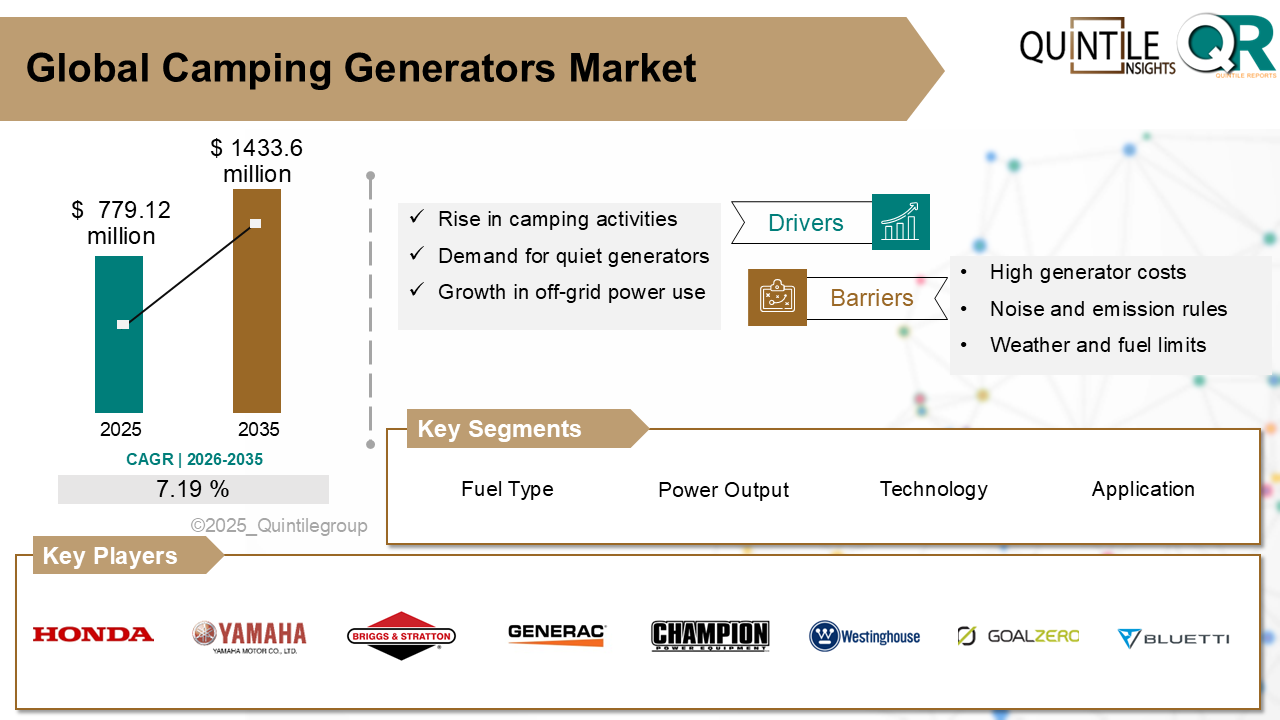

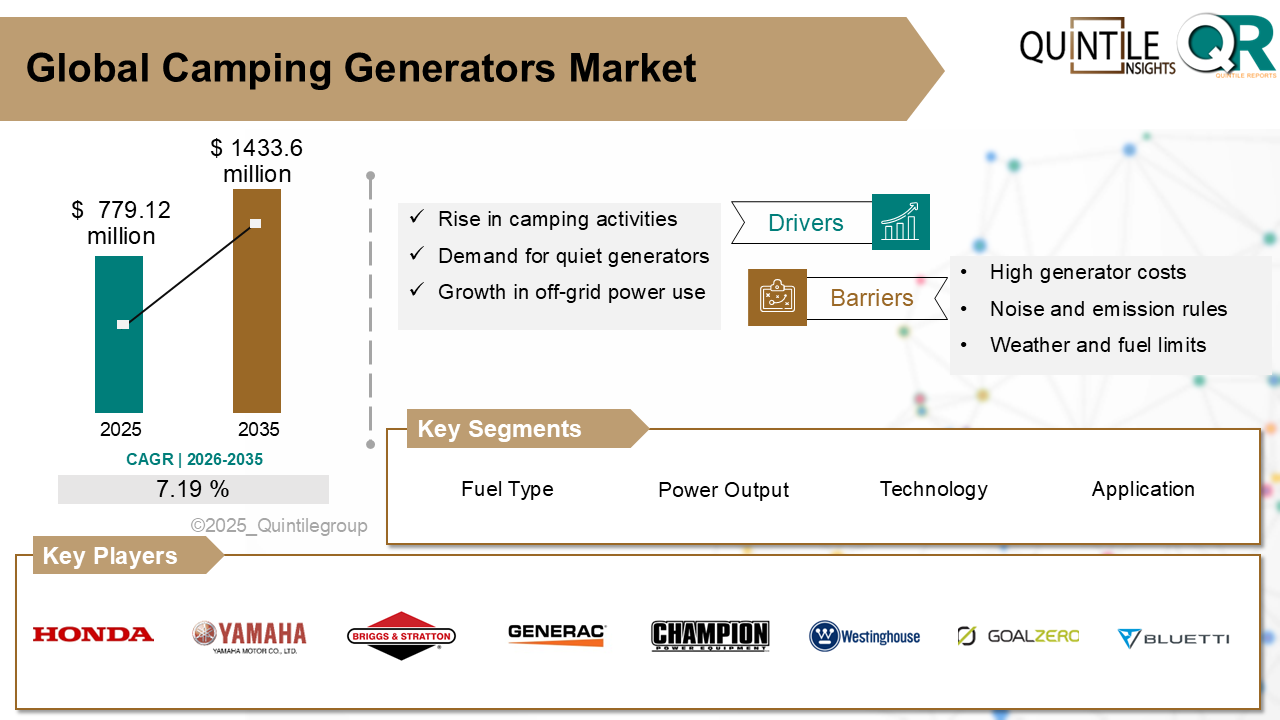

The Global Camping Generators Market was estimated at USD 779.12 million in 2025 and is projected to reach USD 1433.6 million by 2035, reflecting a robust CAGR of 7.19% over the forecast period from 2026 to 2035. The Camping Generators market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Camping Generators market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Camping Generators market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Key trends influencing the Camping Generators market include the rapid adoption of digital technologies, the integration of sustainable practices, and the increasing importance of customer experience. These trends are not only driving growth but also creating new challenges for industry participants, who must adapt their GTM strategies to navigate regulatory changes, supply chain disruptions, and fluctuating economic conditions. Despite these challenges, the Camping Generators market is poised for sustained growth, with emerging markets playing a critical role in the expansion of the industry.

Looking ahead, the Camping Generators market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Camping Generators market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period.

Camping Generators Market Overview

The camping generators market consists of portable electrical generators designed to provide reliable off-grid power during outdoor activities such as camping, RV trips, tailgating, and boondocking. These generators range from small inverter models that combine quiet operation and fuel efficiency to larger dual-fuel or hybrid units capable of powering appliances, lighting, and mobile electronics. They are valued for their ability to deliver stable electricity in remote locations where grid access is unavailable, enabling activities like food preservation, device charging, and powering tools or medical devices.

This market features both traditional fuel-powered units and emerging eco-friendly alternatives such as solar-integrated and hybrid generators. Regulatory frameworks and consumer preferences are shaping product design, demanding quieter models with reduced emissions, inverter technology for clean power, and smart connectivity for monitoring. Regional variations are driven by outdoor recreation habits and local rules: for instance, North America emphasises low-noise and fuel-efficient designs for RV and tent campers, while Europe and Asia see growing adoption of solar and lithium-battery systems supported by environmental policies and tourism trends.

With camping, RVing, tailgating, and overlanding gaining popularity, demand for reliable off-grid power is rising as consumers seek to run lighting, cooking equipment, cooling/heating systems, and mobile electronics.

Unpredictable weather and grid instability make generators a safety and convenience necessity for campers and RV users, even in designated campgrounds.

Hybrid and inverter generators are becoming mainstream due to their fuel efficiency, quiet operation, lower emissions, and integration of smart features such as Bluetooth control and remote monitoring.

Eco-friendly power options are increasingly preferred, boosting adoption of solar-compatible, dual-fuel, and hybrid camping generators.

Despite the rise of solar systems, many campers still choose quieter inverter generators because they remain more reliable and cost-effective than complete solar setups.

Inverter, hybrid, and solar-integrated generators are more expensive than conventional gasoline units, making them less accessible to budget-conscious consumers.

Traditional gasoline/diesel generators are noisy and emit fumes, creating inconvenience for campers and regulatory concerns for parks and eco-sensitive locations.

Lightweight portable generatorsespecially solar-only unitsoften have limited power output and cannot run high-demand appliances such as air conditioners or multiple devices at once.

Solar and hybrid models rely on weather conditions while fuel-based generators depend on fuel availability, which may be limited in remote campsites.

North America: Leads the market due to a strong camping culture and high RV ownership. Regulations on noise and emissions push demand for inverter and solar-hybrid generators. Standards like FCC EMC and state-level emissions rules influence design advancements.

Europe: Driven by eco-consciousness and tourism. Countries such as Germany, France, and the UK favour low-emission generators. EU policies (Ecodesign, RoHS, CE) encourage recyclability, energy efficiency, and quieter hybrid systems.

Asia-Pacific: The fastest-growing region, with rising disposable incomes and expanding outdoor recreation. Frequent power outages increase demand for portable, reliable generators. Innovation includes smartphone-controlled models and cleaner fuels like propane and natural gas.

Latin America: Growth is driven by recreational use and remote-site applications. Eco-tourism and infrastructure development fuel the adoption of convenient and durable portable generators.

Middle East & Africa: Demand rises due to rural electrification, events, and outdoor activities. Rugged, quiet, and climate-resistant inverter generators are preferred, with moderate adoption of hybrid systems.

Sustainability Mandates and Outdoor Culture Fuel U.S. Market: The U.S. leads globally due to its strong RV culture, stricter emissions rules, and increased off-grid recreation. States like California, Colorado, and Washington favour compact, low-noise, eco-friendly generators. Government programs supporting outdoor recreation indirectly boost market demand. R&D collaborations are expanding around lithium-ion hybrid systems, Bluetooth connectivity, and smart app-based controls.

Germany Leads in Circular Economy Solutions: Germany dominates Europes green generator segment due to strict environmental and recycling regulations (WEEE, Ecodesign). Manufacturers focus on recyclable materials, modular battery packs, and ultra-low-emission systems. Solar-compatible inverters and LiFePO-powered generators are increasingly popular among campers and van-life communities. Academicindustrial collaborations drive new designs featuring AI-based energy management and lightweight, foldable power solutions.

Japans Precision Engineering Drives Innovation: Japan excels in miniaturised, quiet, and high-efficiency inverter generators, led by Honda and Yamaha. Lightweight units with USB charging, Bluetooth control, and AI-based fuel optimisation appeal to tech-savvy consumers. Japans emphasis on emergency preparedness boosts generator demand for dual recreational and disaster-response use. Solar-friendly and hybrid models continue to expand due to green energy policies.

The camping generator market is highly fragmented, with global equipment manufacturers and outdoor specialist brands competing for share. Leading players include Honda, Yamaha, Generac, Champion Power Equipment, Westinghouse, and Briggs & Stratton. These companies dominate with extensive line-ups of inverter, dual-fuel, and hybrid-ready generators.

Newer entrants like Jackery, EcoFlow, and Goal Zero are gaining significant traction through battery-powered portable stations that appeal to eco-conscious and tech-driven users. Their competitive edge lies in solar integration, app-based controls, and silent operation.

Established brands emphasise quietness, reliability, and fuel efficiency, while emerging brands prioritise clean energy, modular battery systems, and smartphone-enabled energy management. Retail competition is strong in North America across platforms like Amazon, Walmart, Home Depot, and REI.

Manufacturers face challenges such as raw material price hikes, battery supply-chain limitations, and tightening noise/emission regulations. As a response, companies are investing in advanced fuel systems, long-life battery technologies, modular power kits, and extended warranties to build customer loyalty.

Key Players: Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., Generac Power Systems, Inc., Briggs & Stratton Corporation, Champion Power Equipment, Inc., Westinghouse Electric Corporation, Jackery Inc., Goal Zero LLC, EcoFlow, Bluetti Power Inc., WEN Products, DuroMax Power Equipment, A-iPower Corp., Hyundai Power Equipment, Anker Innovations Ltd.

April 2025: Honda launched the EU3200i and EU7000iS Super-Quiet Series in California, compliant with EPA Phase 3 and CARB Tier 4 emissions standards. These quiet, durable, and clean generators target eco-friendly campers and RV owners.

May 2025: Pulsar introduced the Explorer Bear 4000W dual-fuel generator, offering 62 dB operation, CO Sentry automatic shutdown, and short-circuit protection. At 55 lb and a promotional price of $499.99, it provides an affordable, safe, and high-performance option for campers.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Camping Generators market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Camping Generators market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Camping Generators market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Camping Generators market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Camping Generators market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 7.19 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Fuel Type |

|

| The Segment covered by Power Output |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Camping Generators market share, size, and revenue growth rate were created by Quintile Report™. Camping Generators analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Camping Generators Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Camping Generators Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Camping Generators Market, by Region, (USD Million) 2017-2035

Table 21 China Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Camping Generators Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Camping Generators Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Camping Generators Market: market scenario

Fig.4 Global Camping Generators Market competitive outlook

Fig.5 Global Camping Generators Market driver analysis

Fig.6 Global Camping Generators Market restraint analysis

Fig.7 Global Camping Generators Market opportunity analysis

Fig.8 Global Camping Generators Market trends analysis

Fig.9 Global Camping Generators Market: Segment Analysis (Based on the scope)

Fig.10 Global Camping Generators Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Camping Generators Market was estimated at USD 779.12 million in 2025 and is projected to reach USD 1433.6 million by 2035, reflecting a robust CAGR of 7.19% over the forecast period from 2026 to 2035. The Camping Generators market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Camping Generators market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Camping Generators market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Key trends influencing the Camping Generators market include the rapid adoption of digital technologies, the integration of sustainable practices, and the increasing importance of customer experience. These trends are not only driving growth but also creating new challenges for industry participants, who must adapt their GTM strategies to navigate regulatory changes, supply chain disruptions, and fluctuating economic conditions. Despite these challenges, the Camping Generators market is poised for sustained growth, with emerging markets playing a critical role in the expansion of the industry.

Looking ahead, the Camping Generators market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Camping Generators market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period.

Camping Generators Market Overview

The camping generators market consists of portable electrical generators designed to provide reliable off-grid power during outdoor activities such as camping, RV trips, tailgating, and boondocking. These generators range from small inverter models that combine quiet operation and fuel efficiency to larger dual-fuel or hybrid units capable of powering appliances, lighting, and mobile electronics. They are valued for their ability to deliver stable electricity in remote locations where grid access is unavailable, enabling activities like food preservation, device charging, and powering tools or medical devices.

This market features both traditional fuel-powered units and emerging eco-friendly alternatives such as solar-integrated and hybrid generators. Regulatory frameworks and consumer preferences are shaping product design, demanding quieter models with reduced emissions, inverter technology for clean power, and smart connectivity for monitoring. Regional variations are driven by outdoor recreation habits and local rules: for instance, North America emphasises low-noise and fuel-efficient designs for RV and tent campers, while Europe and Asia see growing adoption of solar and lithium-battery systems supported by environmental policies and tourism trends.

With camping, RVing, tailgating, and overlanding gaining popularity, demand for reliable off-grid power is rising as consumers seek to run lighting, cooking equipment, cooling/heating systems, and mobile electronics.

Unpredictable weather and grid instability make generators a safety and convenience necessity for campers and RV users, even in designated campgrounds.

Hybrid and inverter generators are becoming mainstream due to their fuel efficiency, quiet operation, lower emissions, and integration of smart features such as Bluetooth control and remote monitoring.

Eco-friendly power options are increasingly preferred, boosting adoption of solar-compatible, dual-fuel, and hybrid camping generators.

Despite the rise of solar systems, many campers still choose quieter inverter generators because they remain more reliable and cost-effective than complete solar setups.

Inverter, hybrid, and solar-integrated generators are more expensive than conventional gasoline units, making them less accessible to budget-conscious consumers.

Traditional gasoline/diesel generators are noisy and emit fumes, creating inconvenience for campers and regulatory concerns for parks and eco-sensitive locations.

Lightweight portable generatorsespecially solar-only unitsoften have limited power output and cannot run high-demand appliances such as air conditioners or multiple devices at once.

Solar and hybrid models rely on weather conditions while fuel-based generators depend on fuel availability, which may be limited in remote campsites.

North America: Leads the market due to a strong camping culture and high RV ownership. Regulations on noise and emissions push demand for inverter and solar-hybrid generators. Standards like FCC EMC and state-level emissions rules influence design advancements.

Europe: Driven by eco-consciousness and tourism. Countries such as Germany, France, and the UK favour low-emission generators. EU policies (Ecodesign, RoHS, CE) encourage recyclability, energy efficiency, and quieter hybrid systems.

Asia-Pacific: The fastest-growing region, with rising disposable incomes and expanding outdoor recreation. Frequent power outages increase demand for portable, reliable generators. Innovation includes smartphone-controlled models and cleaner fuels like propane and natural gas.

Latin America: Growth is driven by recreational use and remote-site applications. Eco-tourism and infrastructure development fuel the adoption of convenient and durable portable generators.

Middle East & Africa: Demand rises due to rural electrification, events, and outdoor activities. Rugged, quiet, and climate-resistant inverter generators are preferred, with moderate adoption of hybrid systems.

Sustainability Mandates and Outdoor Culture Fuel U.S. Market: The U.S. leads globally due to its strong RV culture, stricter emissions rules, and increased off-grid recreation. States like California, Colorado, and Washington favour compact, low-noise, eco-friendly generators. Government programs supporting outdoor recreation indirectly boost market demand. R&D collaborations are expanding around lithium-ion hybrid systems, Bluetooth connectivity, and smart app-based controls.

Germany Leads in Circular Economy Solutions: Germany dominates Europes green generator segment due to strict environmental and recycling regulations (WEEE, Ecodesign). Manufacturers focus on recyclable materials, modular battery packs, and ultra-low-emission systems. Solar-compatible inverters and LiFePO-powered generators are increasingly popular among campers and van-life communities. Academicindustrial collaborations drive new designs featuring AI-based energy management and lightweight, foldable power solutions.

Japans Precision Engineering Drives Innovation: Japan excels in miniaturised, quiet, and high-efficiency inverter generators, led by Honda and Yamaha. Lightweight units with USB charging, Bluetooth control, and AI-based fuel optimisation appeal to tech-savvy consumers. Japans emphasis on emergency preparedness boosts generator demand for dual recreational and disaster-response use. Solar-friendly and hybrid models continue to expand due to green energy policies.

The camping generator market is highly fragmented, with global equipment manufacturers and outdoor specialist brands competing for share. Leading players include Honda, Yamaha, Generac, Champion Power Equipment, Westinghouse, and Briggs & Stratton. These companies dominate with extensive line-ups of inverter, dual-fuel, and hybrid-ready generators.

Newer entrants like Jackery, EcoFlow, and Goal Zero are gaining significant traction through battery-powered portable stations that appeal to eco-conscious and tech-driven users. Their competitive edge lies in solar integration, app-based controls, and silent operation.

Established brands emphasise quietness, reliability, and fuel efficiency, while emerging brands prioritise clean energy, modular battery systems, and smartphone-enabled energy management. Retail competition is strong in North America across platforms like Amazon, Walmart, Home Depot, and REI.

Manufacturers face challenges such as raw material price hikes, battery supply-chain limitations, and tightening noise/emission regulations. As a response, companies are investing in advanced fuel systems, long-life battery technologies, modular power kits, and extended warranties to build customer loyalty.

Key Players: Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., Generac Power Systems, Inc., Briggs & Stratton Corporation, Champion Power Equipment, Inc., Westinghouse Electric Corporation, Jackery Inc., Goal Zero LLC, EcoFlow, Bluetti Power Inc., WEN Products, DuroMax Power Equipment, A-iPower Corp., Hyundai Power Equipment, Anker Innovations Ltd.

April 2025: Honda launched the EU3200i and EU7000iS Super-Quiet Series in California, compliant with EPA Phase 3 and CARB Tier 4 emissions standards. These quiet, durable, and clean generators target eco-friendly campers and RV owners.

May 2025: Pulsar introduced the Explorer Bear 4000W dual-fuel generator, offering 62 dB operation, CO Sentry automatic shutdown, and short-circuit protection. At 55 lb and a promotional price of $499.99, it provides an affordable, safe, and high-performance option for campers.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Camping Generators market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Camping Generators market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Camping Generators market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Camping Generators market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Camping Generators market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 7.19 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Fuel Type |

|

| The Segment covered by Power Output |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Camping Generators market share, size, and revenue growth rate were created by Quintile Report™. Camping Generators analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Camping Generators Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Camping Generators Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Camping Generators Market, by Region, (USD Million) 2017-2035

Table 21 China Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Camping Generators Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Camping Generators Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Camping Generators Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Camping Generators Market: market scenario

Fig.4 Global Camping Generators Market competitive outlook

Fig.5 Global Camping Generators Market driver analysis

Fig.6 Global Camping Generators Market restraint analysis

Fig.7 Global Camping Generators Market opportunity analysis

Fig.8 Global Camping Generators Market trends analysis

Fig.9 Global Camping Generators Market: Segment Analysis (Based on the scope)

Fig.10 Global Camping Generators Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report OverviewThe Global Self-Loading Concrete Mixer Market was valued at USD 12.46 billion in 2025

Read MoreReport OverviewThe Global Marine Turbochargers Market was valued at USD 762.32 million in 2025 and i

Read MoreReport OverviewThe Global Drone Services Market was valued at USD 10.18 billion in 2025 and is proje

Read More