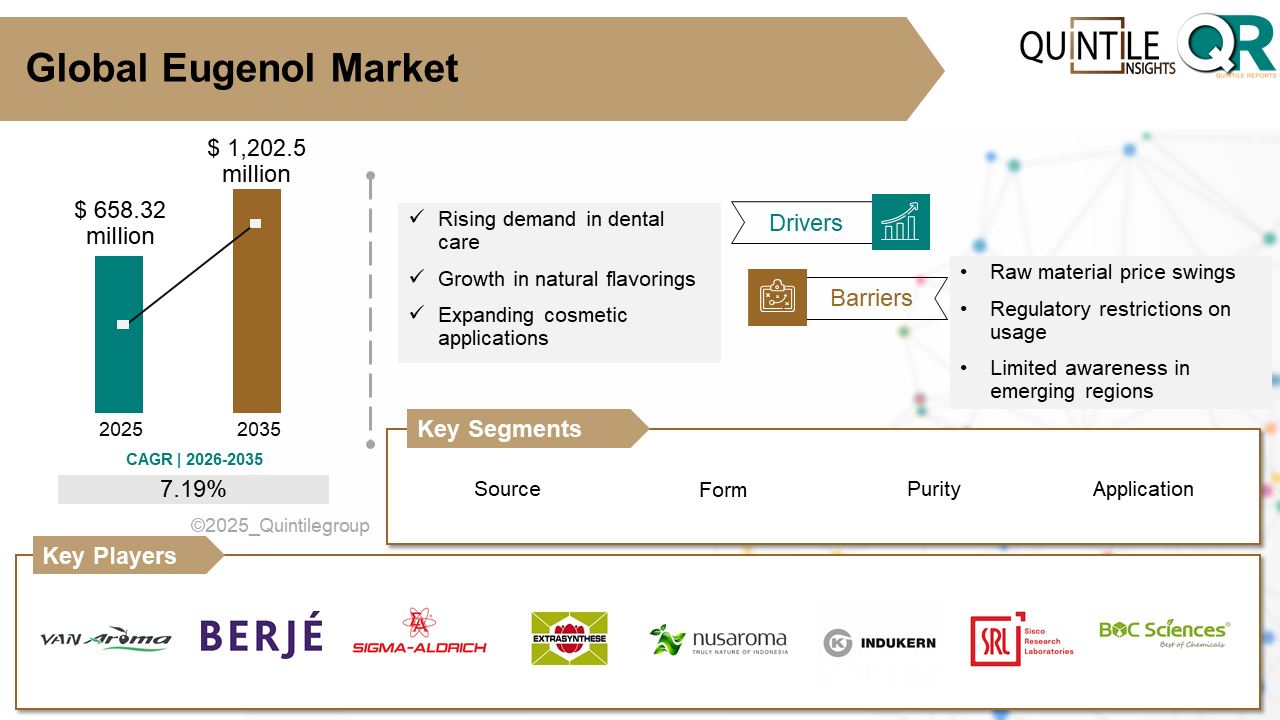

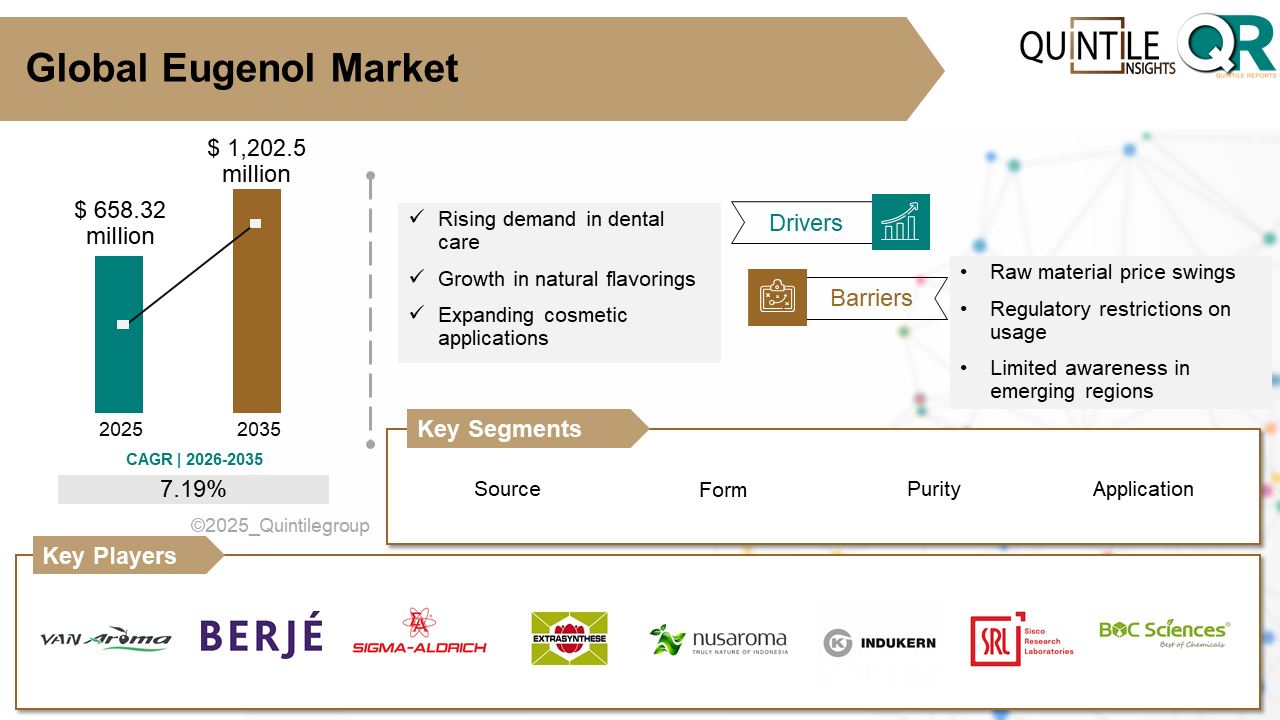

The Global Eugenol Market was estimated at USD 658.32 million in 2025 and is projected to reach USD 1202.5 million by 2035, reflecting a robust CAGR of 7.19% over the forecast period from 2026 to 2035. The Eugenol market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Eugenol market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Eugenol market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Key trends influencing the Eugenol market include the rapid adoption of digital technologies, the integration of sustainable practices, and the increasing importance of customer experience. These trends are not only driving growth but also creating new challenges for industry participants, who must adapt their GTM strategies to navigate regulatory changes, supply chain disruptions, and fluctuating economic conditions. Despite these challenges, the Eugenol market is poised for sustained growth, with emerging markets playing a critical role in the expansion of the industry.

Looking ahead, the Eugenol market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Eugenol market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period.

Eugenol Market

The eugenol market refers to the global and regional market for a naturally occurring phenolic molecule found in several plants such as cinnamon, clove, and bay leaves. It has been used as a topical antiseptic, as a counter-irritant, and in dental preparations with zinc oxide for root canal sealing and pain control. Although not currently available in any FDA-approved products (including OTC), eugenol has been found to have anti-inflammatory, neuroprotective, antipyretic, antioxidant, antifungal, and analgesic properties.

Eugenol, also called clove oil, is an aromatic oil extracted from cloves that is widely used as a flavoring for foods and teas and as an herbal oil used topically to treat toothache, and more rarely taken orally to treat gastrointestinal and respiratory complaints. Eugenol in therapeutic doses has not been implicated in causing serum enzyme elevations or clinically apparent liver injury, but ingestion of high doses, such as during overdose, can cause severe liver injury.

What are the drivers of the eugenol marketConsumers and manufacturers are shifting toward plant-based and natural additives. Eugenols botanical origin makes it ideal for food flavoring, cosmetics, and fragrance formulations that align with clean-label product strategies.

Eugenols antiseptic and analgesic properties make it essential in dental cements and temporary fillings. Increased awareness about oral hygiene and growth in dental care services support sustained demand.

The food industry is incorporating eugenol into active packaging and preservatives. Its antimicrobial traits help extend shelf life and improve the safety of packaged food products as synthetic preservatives face increasing scrutiny.

The compound is utilized in soaps, creams, and perfumes for its aroma and antimicrobial activity. Its inclusion supports natural product claims and appeals to environmentally and health-conscious consumers.

Several countries are easing regulations for natural additives in food and cosmetics. Eugenol benefits from GRAS status in the U.S. and approval across global pharmacopeia.

What are the challenges and restraining factors of the eugenol marketDespite being natural, high concentrations of eugenol may cause allergic reactions, liver toxicity, or mucosal irritation. Regulatory agencies continue to assess and limit exposure levels in food and cosmetic formulations.

Some jurisdictions have imposed usage restrictions due to sensitization risks. Maximum concentration limits in perfumes and food products can restrict broader market expansion.

The production of eugenol depends heavily on clove and related spice crops. Seasonal availability, climatic variations, and geopolitical variables contribute to price volatility and supply inconsistencies.

What are the regional trends of the eugenol marketNorth America dominates the eugenol market due to rising demand for natural ingredients and essential oils supporting its use in food preservation, dental care, and fragrances. Regulatory clarity in the U.S. supports botanical extracts.

Europe maintains strong adoption due to its plant-based preferences and supportive regulatory frameworks. Manufacturers emphasize allergen-free labeling and traceability.

Asia Pacificespecially China, India, and Japanhas a robust supply chain due to being home to major clove producers. Traditional medicine and food processing industries heavily utilize eugenol.

Latin America and the Middle East & Africa are gradually expanding with increasing interest in natural additives in cosmetics and processed foods.

Country-Wise OutlookU.S. Maintains Leadership with Balanced Regulation:

Eugenol is classified as GRAS by the U.S. FDA for specific food applications and regulated in cosmetics and dental materials. It is widely used in dental analgesics, oral antiseptics, and temporary restoratives. The U.S. supports innovation in essential oil applications, enabling safe commercialization under strict monitoring.

Germany Upholds Strict Standards for Consumer Safety:

Germany permits eugenol in food and cosmetics under strong safety guidelines enforced by national and EU bodies. It is used in oral care and fragrances and requires allergen labeling. High-quality, traceable, plant-based ingredients are prioritized by German manufacturers.

Japan Blends Tradition and Modern Innovation:

Eugenol is used in pharmaceuticals, Kampo medicine, food flavoring, and dental formulations. Japan has clearly defined concentration thresholds for safe use. Research into nano-encapsulation and enhanced delivery methods is increasing the versatility of eugenol applications.

Competitive AnalysisThe global eugenol market includes natural extractors, essential oil suppliers, pharmaceutical companies, and cosmetic brands. Indonesia and India dominate production due to abundant clove crops.

In Europe and North America, companies emphasize purity, sustainability, and allergen control. Encapsulated or nano-formulated eugenol is emerging for advanced dental and therapeutic applications.

Collaborations between fragrance houses and research institutions are driving innovation. Multinational personal care companies are expanding natural ingredient portfolios to include eugenol-based formulations.

Synthetic alternatives remain competitive in price-sensitive segments, but natural eugenol is expected to gain market share as regulatory transparency improves and consumer demand rises.

Key players include: Van Aroma, Berje Inc., Sigma-Aldrich Co. LLC, Extrasynthese, Nusaroma Indonesia Essential Oil, Indukern, Sisco Research Laboratories Pvt. Ltd., Boc Sciences, Yogi Enterprise, KM Chemicals, Penta Manufacturing Company, Merck KGaA, Prinova Group LLC, Vallabh Industries, Moellhausen S.p.A., Nile Chemicals, PerfumersWorld, and others.

Recent DevelopmentIn September 2024, the European Chemicals Agency issued updated guidelines on allergenic essential oils, including clove oil, strengthening labeling standards for cosmetics and personal care products.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Eugenol market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Eugenol market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Eugenol market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Eugenol market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Eugenol market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 7.19 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Source |

|

| The Segment covered by Form |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Eugenol market share, size, and revenue growth rate were created by Quintile Report™. Eugenol analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Eugenol Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Eugenol Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Eugenol Market, by Region, (USD Million) 2017-2035

Table 21 China Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Eugenol Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Eugenol Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Eugenol Market: market scenario

Fig.4 Global Eugenol Market competitive outlook

Fig.5 Global Eugenol Market driver analysis

Fig.6 Global Eugenol Market restraint analysis

Fig.7 Global Eugenol Market opportunity analysis

Fig.8 Global Eugenol Market trends analysis

Fig.9 Global Eugenol Market: Segment Analysis (Based on the scope)

Fig.10 Global Eugenol Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Eugenol Market was estimated at USD 658.32 million in 2025 and is projected to reach USD 1202.5 million by 2035, reflecting a robust CAGR of 7.19% over the forecast period from 2026 to 2035. The Eugenol market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Eugenol market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Eugenol market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Key trends influencing the Eugenol market include the rapid adoption of digital technologies, the integration of sustainable practices, and the increasing importance of customer experience. These trends are not only driving growth but also creating new challenges for industry participants, who must adapt their GTM strategies to navigate regulatory changes, supply chain disruptions, and fluctuating economic conditions. Despite these challenges, the Eugenol market is poised for sustained growth, with emerging markets playing a critical role in the expansion of the industry.

Looking ahead, the Eugenol market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Eugenol market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period.

Eugenol Market

The eugenol market refers to the global and regional market for a naturally occurring phenolic molecule found in several plants such as cinnamon, clove, and bay leaves. It has been used as a topical antiseptic, as a counter-irritant, and in dental preparations with zinc oxide for root canal sealing and pain control. Although not currently available in any FDA-approved products (including OTC), eugenol has been found to have anti-inflammatory, neuroprotective, antipyretic, antioxidant, antifungal, and analgesic properties.

Eugenol, also called clove oil, is an aromatic oil extracted from cloves that is widely used as a flavoring for foods and teas and as an herbal oil used topically to treat toothache, and more rarely taken orally to treat gastrointestinal and respiratory complaints. Eugenol in therapeutic doses has not been implicated in causing serum enzyme elevations or clinically apparent liver injury, but ingestion of high doses, such as during overdose, can cause severe liver injury.

What are the drivers of the eugenol marketConsumers and manufacturers are shifting toward plant-based and natural additives. Eugenols botanical origin makes it ideal for food flavoring, cosmetics, and fragrance formulations that align with clean-label product strategies.

Eugenols antiseptic and analgesic properties make it essential in dental cements and temporary fillings. Increased awareness about oral hygiene and growth in dental care services support sustained demand.

The food industry is incorporating eugenol into active packaging and preservatives. Its antimicrobial traits help extend shelf life and improve the safety of packaged food products as synthetic preservatives face increasing scrutiny.

The compound is utilized in soaps, creams, and perfumes for its aroma and antimicrobial activity. Its inclusion supports natural product claims and appeals to environmentally and health-conscious consumers.

Several countries are easing regulations for natural additives in food and cosmetics. Eugenol benefits from GRAS status in the U.S. and approval across global pharmacopeia.

What are the challenges and restraining factors of the eugenol marketDespite being natural, high concentrations of eugenol may cause allergic reactions, liver toxicity, or mucosal irritation. Regulatory agencies continue to assess and limit exposure levels in food and cosmetic formulations.

Some jurisdictions have imposed usage restrictions due to sensitization risks. Maximum concentration limits in perfumes and food products can restrict broader market expansion.

The production of eugenol depends heavily on clove and related spice crops. Seasonal availability, climatic variations, and geopolitical variables contribute to price volatility and supply inconsistencies.

What are the regional trends of the eugenol marketNorth America dominates the eugenol market due to rising demand for natural ingredients and essential oils supporting its use in food preservation, dental care, and fragrances. Regulatory clarity in the U.S. supports botanical extracts.

Europe maintains strong adoption due to its plant-based preferences and supportive regulatory frameworks. Manufacturers emphasize allergen-free labeling and traceability.

Asia Pacificespecially China, India, and Japanhas a robust supply chain due to being home to major clove producers. Traditional medicine and food processing industries heavily utilize eugenol.

Latin America and the Middle East & Africa are gradually expanding with increasing interest in natural additives in cosmetics and processed foods.

Country-Wise OutlookU.S. Maintains Leadership with Balanced Regulation:

Eugenol is classified as GRAS by the U.S. FDA for specific food applications and regulated in cosmetics and dental materials. It is widely used in dental analgesics, oral antiseptics, and temporary restoratives. The U.S. supports innovation in essential oil applications, enabling safe commercialization under strict monitoring.

Germany Upholds Strict Standards for Consumer Safety:

Germany permits eugenol in food and cosmetics under strong safety guidelines enforced by national and EU bodies. It is used in oral care and fragrances and requires allergen labeling. High-quality, traceable, plant-based ingredients are prioritized by German manufacturers.

Japan Blends Tradition and Modern Innovation:

Eugenol is used in pharmaceuticals, Kampo medicine, food flavoring, and dental formulations. Japan has clearly defined concentration thresholds for safe use. Research into nano-encapsulation and enhanced delivery methods is increasing the versatility of eugenol applications.

Competitive AnalysisThe global eugenol market includes natural extractors, essential oil suppliers, pharmaceutical companies, and cosmetic brands. Indonesia and India dominate production due to abundant clove crops.

In Europe and North America, companies emphasize purity, sustainability, and allergen control. Encapsulated or nano-formulated eugenol is emerging for advanced dental and therapeutic applications.

Collaborations between fragrance houses and research institutions are driving innovation. Multinational personal care companies are expanding natural ingredient portfolios to include eugenol-based formulations.

Synthetic alternatives remain competitive in price-sensitive segments, but natural eugenol is expected to gain market share as regulatory transparency improves and consumer demand rises.

Key players include: Van Aroma, Berje Inc., Sigma-Aldrich Co. LLC, Extrasynthese, Nusaroma Indonesia Essential Oil, Indukern, Sisco Research Laboratories Pvt. Ltd., Boc Sciences, Yogi Enterprise, KM Chemicals, Penta Manufacturing Company, Merck KGaA, Prinova Group LLC, Vallabh Industries, Moellhausen S.p.A., Nile Chemicals, PerfumersWorld, and others.

Recent DevelopmentIn September 2024, the European Chemicals Agency issued updated guidelines on allergenic essential oils, including clove oil, strengthening labeling standards for cosmetics and personal care products.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Eugenol market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Eugenol market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Eugenol market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Eugenol market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Eugenol market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 7.19 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Source |

|

| The Segment covered by Form |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Eugenol market share, size, and revenue growth rate were created by Quintile Report™. Eugenol analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Eugenol Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Eugenol Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Eugenol Market, by Region, (USD Million) 2017-2035

Table 21 China Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Eugenol Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Eugenol Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Eugenol Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Eugenol Market: market scenario

Fig.4 Global Eugenol Market competitive outlook

Fig.5 Global Eugenol Market driver analysis

Fig.6 Global Eugenol Market restraint analysis

Fig.7 Global Eugenol Market opportunity analysis

Fig.8 Global Eugenol Market trends analysis

Fig.9 Global Eugenol Market: Segment Analysis (Based on the scope)

Fig.10 Global Eugenol Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report OverviewThe Global Gas Cylinder Market was valued at USD 12.36 million in 2025 and is project

Read MoreReport OverviewThe Global Drone Mapping Market was valued at USD 2.62 billion in 2025 and is project

Read MoreReport OverviewThe Global CBD Extraction Equipment Market was valued at USD 67.62 million in 2025 an

Read More