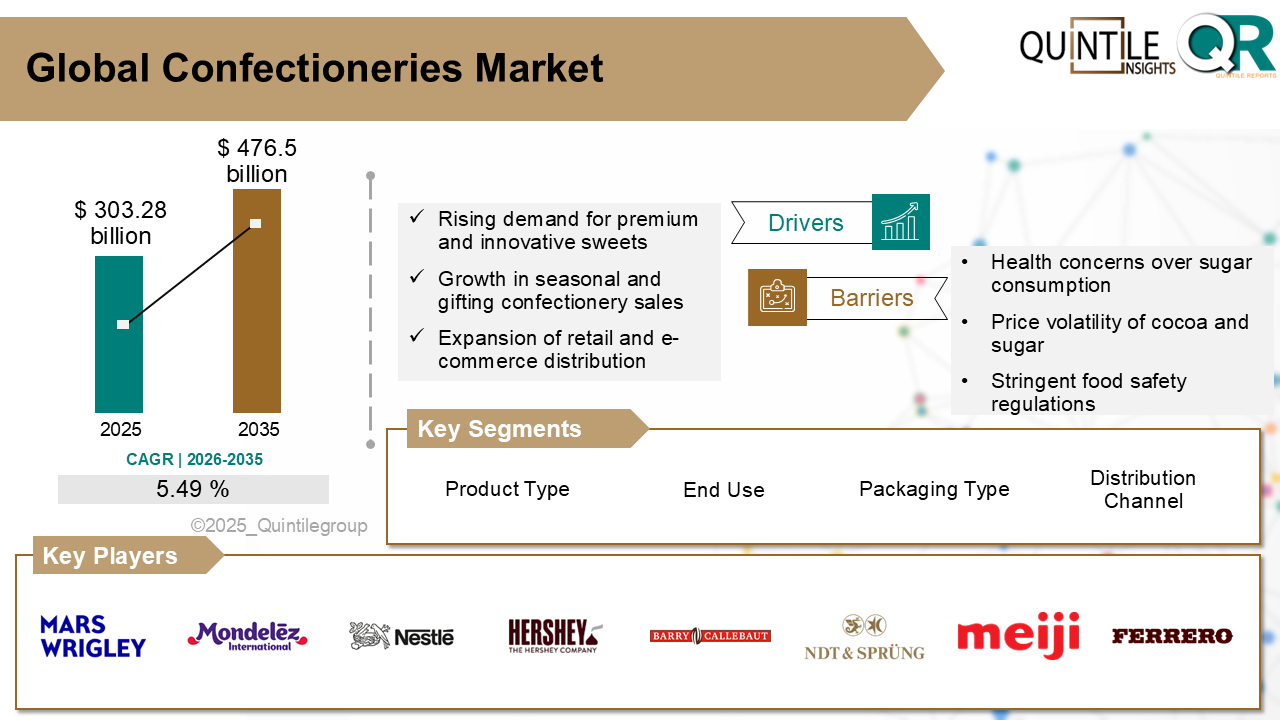

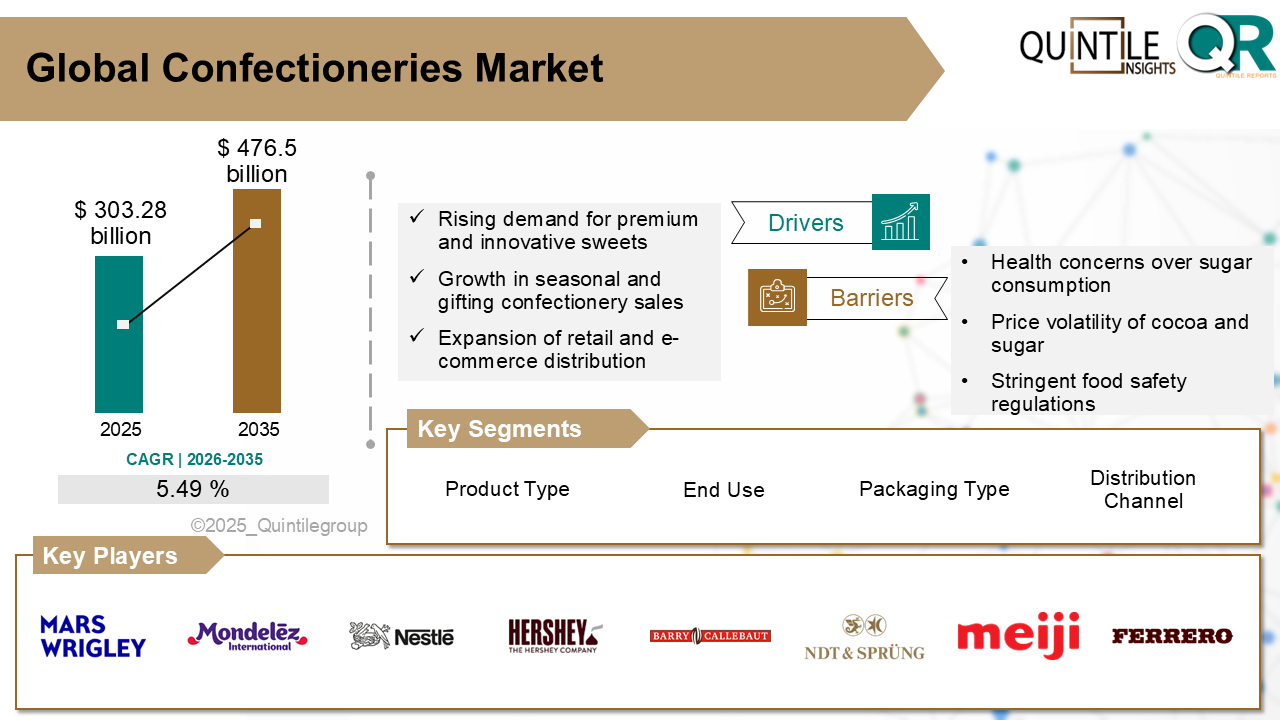

The Global Confectioneries Market was estimated at USD 303.28 Billion in 2025 and is projected to reach USD 476.5 Billion by 2035, reflecting a robust CAGR of 5.49% over the forecast period from 2026 to 2035. The Confectioneries market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Confectioneries market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Confectioneries market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Key trends influencing the Confectioneries market include the rapid adoption of digital technologies, the integration of sustainable practices, and the increasing importance of customer experience. These trends are not only driving growth but also creating new challenges for industry participants, who must adapt their GTM strategies to navigate regulatory changes, supply chain disruptions, and fluctuating economic conditions. Despite these challenges, the Confectioneries market is poised for sustained growth, with emerging markets playing a critical role in the expansion of the industry.

Looking ahead, the Confectioneries market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Confectioneries market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period.

Confectioneries Market

The confectioneries market is a diverse and vibrant space filled with sweet delights like chocolates, candies, chewing gum, pastries, and even ice cream and snack bars in broader definitions. Its typically divided into chocolate confectionerylike bars, truffles, and pralines; sugar confectionerysuch as toffees, marshmallows, and lollipops; and gum confectioneryincluding chewing and bubble gum.

Other subcategories include preserved pastries and cakes, with some functional, health-oriented treats also finding a place. These indulgences are enjoyed both at home and on the go, sold widely through online and offline channels, and cater to a broad spectrum of tastesfrom everyday favorites to premium treats.

What are the drivers of confectioneries marketThe confectionery market is witnessing strong growth driven by several evolving dynamics. One of the key factors is the shift in consumer preferences toward indulgent and premium products that offer unique, luxurious experiences.

With increasing urbanization and rising disposable incomes, especially among young professionals in metropolitan areas, theres a growing appetite for high-quality treats featuring novel flavors, artisanal touches, and premium ingredients.

Manufacturers are keeping pace with this demand through constant innovation. From fusion flavors and healthier options like sugar-free, low-calorie, or organic treats, to plant-based and functional confections enriched with vitamins or proteins, the product range is expanding rapidly. Packaging innovations like smaller, resealable, and convenient formats cater to on-the-go snacking and portion control.

Effective marketing strategies, leveraging social media, influencer collaborations, and visually appealing packaging, play a crucial role in capturing younger consumers. Seasonal gifting during festivals and special occasions further fuels impulse buying, with premium packaging and limited editions becoming especially popular.

The expansion of modern retail spaces and widespread e-commerce reach significantly boosts market accessibility. Improved distribution networks help brands tap not just urban, but increasingly semi-urban and rural markets as well.

What are the challenges and restraining factors of confectioneries marketIncreasing health awareness and concerns about excessive sugar intake are pushing many consumers to limit their consumption of traditional sweets. Rising prevalence of diabetes, obesity, and related health issues fuels demand for low-sugar, natural, or functional alternatives.

Stricter food safety and nutrition labeling regulations are adding pressure on manufacturers. Reformulating products and updating packaging increases compliance costs and operational complexity. Prominent displays of sugar, salt, and fat content can deter purchases of conventional products.

Economic factors further complicate the landscape. Price fluctuations in raw materials like cocoa, sugar, and milk impact sales. During inflation or economic downturns, consumers often reduce discretionary spending or shift to affordable snacks, affecting impulse buys.

The rise of healthier snack alternatives is drawing consumers away from traditional confectionery items. Brands are being pushed to innovate, reformulate, or diversify their offerings to stay competitive.

What are the regional trends of confectioneries marketNorth Americas confectionery market is growing, fueled by rising demand for premium, healthier, and innovative treats. Chocolate remains the top choice, especially dark chocolate. Plant-based, vegan, sugar-free, and functional options are gaining popularity, while seasonal events like Halloween, Easter, and Valentines Day drive consumption spikes. E-commerce and sustainable packaging make these treats more accessible and ethically appealing. The U.S. dominates the region, with Mexico quickly catching up due to unique local flavors and a rising middle class.

Europes confectionery market thrives on premium and artisanal chocolates. Cultural traditions keep confections central to holidays, festivals, and gifting, with seasonal peaks during Christmas, Easter, and Valentines Day. The UK leads in milk chocolate and artisanal treats, while Spain sees growth through local flavors and premium formats. Health-conscious trends and online retail expansion are fueling demand for sugar-free, organic, and low-calorie options.

Asia-Pacifics confectionery market is thriving, driven by rising incomes, urban lifestyles, and festival gifting traditions. China leads with demand for premium artisanal chocolates and global flavor fusions, Japan follows with sustainable, functional, low-sugar treats, and Australia shows high indulgence rates. Digital shopping amplifies regional trends.

The Latin American confectionery market is driven by rising disposable incomes, urbanization, and changing tastes. Brazil leads with chocolate and retail growth, Argentina grows fastest due to a rising middle class. Consumers embrace both classic and innovative treats, with festive seasons boosting sales.

Middle East & Africa confectionery market growth is fueled by a young population and rising urban incomes. Chocolate, gum, and sugar-based sweets remain top favorites. Traditional gifting during Ramadan and Eid drives seasonal spikes, while exposure to global brands encourages flavor experimentation. Innovations like liquid-solid combos and energy-boosted sweets enhance appeal.

Country-Wise Outlook:Sweet cravings of American consumers: Americans love indulgent and experiential confectionery, increasingly shaped by wellness-conscious choices. Sugar-free, plant-based, and functional treats are growing, alongside seasonal products boosting emotional appeal. Major players like Hershey, Mars, Mondelez, and Ferrero lead the market through constant innovation. Distribution spans supermarkets, convenience stores, e-commerce, and direct-to-consumer channels. FDA regulations focus on labeling and ingredient disclosure, while inflation and cocoa prices add pressure. Social media trends and global flavors influence consumer behavior, with 98% of Americans buying confectionery in 2024.

Germany confectionery culture blends heritage and innovation: German consumers favor premium chocolate, marzipan, and licorice, prioritizing quality over sweetness. Domestic and international brands like Haribo, Ritter Sport, Storck, and Ferrero dominate. Regulations drive sugar-reduced, clean-label, and naturally flavored products. Confectionery remains important for everyday enjoyment and festive gifting, with vegan, sugar-free, and artisanal products gaining traction.

Japan confectionery culture blends tradition, innovation, and gifting: Japanese consumers enjoy seasonal, limited-edition, and adventurous sweets, from wagashi to modern chocolates. Major players like Meiji, Lotte, and Ezaki Glico innovate with flavors like matcha, sakura, yuzu, and sake-infused varieties. Strict safety and labeling rules shape product development. Seasonal packaging, gift-focused products, and functional treats like collagen or probiotic-enhanced sweets support premium positioning and high brand loyalty.

Competitive Analysis:In the confectionery market, smaller and regional brands compete on price, quality, and innovation. Rising demand for clean-label, organic, non-GMO, and ethically sourced sweets drives differentiation. Sugar-free, plant-based, fortified, and probiotic-infused treats appeal to health-conscious consumers.

Bold, adventurous flavors and thoughtfully designed packaging provide niche differentiation. Sustainable packaging like resealable or recyclable formats supports brand loyalty, especially in premium and wellness-driven segments.

Key players in the market include: Mars Wrigley, Mondelez International, Nestle SA, The Hershey Company, Pladis (Ferrero Group), Barry Callebaut, Lindt & Sprngli, Meiji Holdings, Ferrero Group, Perfetti Van Melle, Haribo GmbH, Ezaki Glico, Delfi Limited, Lotte Confectionery, Arcor Group, and others.

Recent Development:In March 2025, Ritter Sport launched its Travel Retail Editions mini collection with 15 mini chocolate bars in flavors like salted caramel, butter biscuit, and cornflakes at the IAADFS Summit of the Americas in Miami, boosting brand visibility in American travel retail.

In June 2025, Sweet-Tooth entered the Indian market through a collaboration with Franchise India, aiming to sell natural-ingredient products in airports and shopping malls.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Confectioneries market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Confectioneries market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Confectioneries market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Confectioneries market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Confectioneries market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 5.49 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product Type |

|

| The Segment covered by Distribution Channel |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Confectioneries market share, size, and revenue growth rate were created by Quintile Report™. Confectioneries analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

List of Tables

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Confectioneries Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Confectioneries Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Confectioneries Market, by Region, (USD Million) 2017-2035

Table 21 China Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Confectioneries Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Confectioneries Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Confectioneries Market: market scenario

Fig.4 Global Confectioneries Market competitive outlook

Fig.5 Global Confectioneries Market driver analysis

Fig.6 Global Confectioneries Market restraint analysis

Fig.7 Global Confectioneries Market opportunity analysis

Fig.8 Global Confectioneries Market trends analysis

Fig.9 Global Confectioneries Market: Segment Analysis (Based on the scope)

Fig.10 Global Confectioneries Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

The Global Confectioneries Market was estimated at USD 303.28 Billion in 2025 and is projected to reach USD 476.5 Billion by 2035, reflecting a robust CAGR of 5.49% over the forecast period from 2026 to 2035. The Confectioneries market report offers a comprehensive and nuanced view of the industry, moving beyond conventional analysis. It provides a thorough examination of the markets dynamics, encompassing a detailed exploration of the factors propelling growth, such as evolving economic conditions, advancements in technology, shifts in regulatory policies, and changes in consumer behavior. Furthermore, the report discusses the projected Compound Annual Growth Rate (CAGR), providing stakeholders with a clear understanding of the market's expected growth trajectory and offering data-driven insights into future market dynamics.

The Confectioneries market under analysis is characterized by dynamic growth and evolving trends that are reshaping the competitive landscape. With 2025 serving as the base year for this Confectioneries market study, recent data highlights a significant expansion driven by technological advancements, rising consumer demand, and a growing focus on innovation. Companies are refining their go-to-market (GTM) strategies to effectively capture these emerging opportunities and respond to the rapidly changing market dynamics.

Key trends influencing the Confectioneries market include the rapid adoption of digital technologies, the integration of sustainable practices, and the increasing importance of customer experience. These trends are not only driving growth but also creating new challenges for industry participants, who must adapt their GTM strategies to navigate regulatory changes, supply chain disruptions, and fluctuating economic conditions. Despite these challenges, the Confectioneries market is poised for sustained growth, with emerging markets playing a critical role in the expansion of the industry.

Looking ahead, the Confectioneries market is forecasted to continue its upward momentum through 2035, supported by ongoing investments in research and development, strategic partnerships, and mergers and acquisitions. Companies that can effectively tailor their GTM strategies to the evolving market landscape, innovate, and meet shifting consumer demands are likely to achieve sustained success. Confectioneries market report provides a comprehensive analysis of the current market environment and offers valuable insights into the key drivers, challenges, and opportunities that will shape the industry's future over the next decade. This report offers a comprehensive analysis of market dynamics across various segments, regions, and countries, incorporating both qualitative and quantitative data. It covers the period from 2017 to 2035, providing a detailed examination of historical performance, current market conditions, and future projections.

Historical Analysis (2017-2024): The report presents a thorough review of market trends, performance metrics, and growth trajectories for the years 2017 through 2024. This historical perspective is crucial for understanding past market behavior and identifying patterns that influence current and future market dynamics.

Forecast and Projections (2026-2035) : Building on historical data, the report provides forward-looking insights, including market forecasts and growth projections from 2026 to 2035. It details anticipated market trends, emerging opportunities, and potential challenges across different segments, regions, and countries.

Compound Annual Growth Rate (CAGR): The report includes a precise calculation of the compound annual growth rate (CAGR) for the forecast period of 2026 to 2035. This metric will be instrumental in assessing the expected growth trajectory and the overall market potential during the forecast period.

Confectioneries Market

The confectioneries market is a diverse and vibrant space filled with sweet delights like chocolates, candies, chewing gum, pastries, and even ice cream and snack bars in broader definitions. Its typically divided into chocolate confectionerylike bars, truffles, and pralines; sugar confectionerysuch as toffees, marshmallows, and lollipops; and gum confectioneryincluding chewing and bubble gum.

Other subcategories include preserved pastries and cakes, with some functional, health-oriented treats also finding a place. These indulgences are enjoyed both at home and on the go, sold widely through online and offline channels, and cater to a broad spectrum of tastesfrom everyday favorites to premium treats.

What are the drivers of confectioneries marketThe confectionery market is witnessing strong growth driven by several evolving dynamics. One of the key factors is the shift in consumer preferences toward indulgent and premium products that offer unique, luxurious experiences.

With increasing urbanization and rising disposable incomes, especially among young professionals in metropolitan areas, theres a growing appetite for high-quality treats featuring novel flavors, artisanal touches, and premium ingredients.

Manufacturers are keeping pace with this demand through constant innovation. From fusion flavors and healthier options like sugar-free, low-calorie, or organic treats, to plant-based and functional confections enriched with vitamins or proteins, the product range is expanding rapidly. Packaging innovations like smaller, resealable, and convenient formats cater to on-the-go snacking and portion control.

Effective marketing strategies, leveraging social media, influencer collaborations, and visually appealing packaging, play a crucial role in capturing younger consumers. Seasonal gifting during festivals and special occasions further fuels impulse buying, with premium packaging and limited editions becoming especially popular.

The expansion of modern retail spaces and widespread e-commerce reach significantly boosts market accessibility. Improved distribution networks help brands tap not just urban, but increasingly semi-urban and rural markets as well.

What are the challenges and restraining factors of confectioneries marketIncreasing health awareness and concerns about excessive sugar intake are pushing many consumers to limit their consumption of traditional sweets. Rising prevalence of diabetes, obesity, and related health issues fuels demand for low-sugar, natural, or functional alternatives.

Stricter food safety and nutrition labeling regulations are adding pressure on manufacturers. Reformulating products and updating packaging increases compliance costs and operational complexity. Prominent displays of sugar, salt, and fat content can deter purchases of conventional products.

Economic factors further complicate the landscape. Price fluctuations in raw materials like cocoa, sugar, and milk impact sales. During inflation or economic downturns, consumers often reduce discretionary spending or shift to affordable snacks, affecting impulse buys.

The rise of healthier snack alternatives is drawing consumers away from traditional confectionery items. Brands are being pushed to innovate, reformulate, or diversify their offerings to stay competitive.

What are the regional trends of confectioneries marketNorth Americas confectionery market is growing, fueled by rising demand for premium, healthier, and innovative treats. Chocolate remains the top choice, especially dark chocolate. Plant-based, vegan, sugar-free, and functional options are gaining popularity, while seasonal events like Halloween, Easter, and Valentines Day drive consumption spikes. E-commerce and sustainable packaging make these treats more accessible and ethically appealing. The U.S. dominates the region, with Mexico quickly catching up due to unique local flavors and a rising middle class.

Europes confectionery market thrives on premium and artisanal chocolates. Cultural traditions keep confections central to holidays, festivals, and gifting, with seasonal peaks during Christmas, Easter, and Valentines Day. The UK leads in milk chocolate and artisanal treats, while Spain sees growth through local flavors and premium formats. Health-conscious trends and online retail expansion are fueling demand for sugar-free, organic, and low-calorie options.

Asia-Pacifics confectionery market is thriving, driven by rising incomes, urban lifestyles, and festival gifting traditions. China leads with demand for premium artisanal chocolates and global flavor fusions, Japan follows with sustainable, functional, low-sugar treats, and Australia shows high indulgence rates. Digital shopping amplifies regional trends.

The Latin American confectionery market is driven by rising disposable incomes, urbanization, and changing tastes. Brazil leads with chocolate and retail growth, Argentina grows fastest due to a rising middle class. Consumers embrace both classic and innovative treats, with festive seasons boosting sales.

Middle East & Africa confectionery market growth is fueled by a young population and rising urban incomes. Chocolate, gum, and sugar-based sweets remain top favorites. Traditional gifting during Ramadan and Eid drives seasonal spikes, while exposure to global brands encourages flavor experimentation. Innovations like liquid-solid combos and energy-boosted sweets enhance appeal.

Country-Wise Outlook:Sweet cravings of American consumers: Americans love indulgent and experiential confectionery, increasingly shaped by wellness-conscious choices. Sugar-free, plant-based, and functional treats are growing, alongside seasonal products boosting emotional appeal. Major players like Hershey, Mars, Mondelez, and Ferrero lead the market through constant innovation. Distribution spans supermarkets, convenience stores, e-commerce, and direct-to-consumer channels. FDA regulations focus on labeling and ingredient disclosure, while inflation and cocoa prices add pressure. Social media trends and global flavors influence consumer behavior, with 98% of Americans buying confectionery in 2024.

Germany confectionery culture blends heritage and innovation: German consumers favor premium chocolate, marzipan, and licorice, prioritizing quality over sweetness. Domestic and international brands like Haribo, Ritter Sport, Storck, and Ferrero dominate. Regulations drive sugar-reduced, clean-label, and naturally flavored products. Confectionery remains important for everyday enjoyment and festive gifting, with vegan, sugar-free, and artisanal products gaining traction.

Japan confectionery culture blends tradition, innovation, and gifting: Japanese consumers enjoy seasonal, limited-edition, and adventurous sweets, from wagashi to modern chocolates. Major players like Meiji, Lotte, and Ezaki Glico innovate with flavors like matcha, sakura, yuzu, and sake-infused varieties. Strict safety and labeling rules shape product development. Seasonal packaging, gift-focused products, and functional treats like collagen or probiotic-enhanced sweets support premium positioning and high brand loyalty.

Competitive Analysis:In the confectionery market, smaller and regional brands compete on price, quality, and innovation. Rising demand for clean-label, organic, non-GMO, and ethically sourced sweets drives differentiation. Sugar-free, plant-based, fortified, and probiotic-infused treats appeal to health-conscious consumers.

Bold, adventurous flavors and thoughtfully designed packaging provide niche differentiation. Sustainable packaging like resealable or recyclable formats supports brand loyalty, especially in premium and wellness-driven segments.

Key players in the market include: Mars Wrigley, Mondelez International, Nestle SA, The Hershey Company, Pladis (Ferrero Group), Barry Callebaut, Lindt & Sprngli, Meiji Holdings, Ferrero Group, Perfetti Van Melle, Haribo GmbH, Ezaki Glico, Delfi Limited, Lotte Confectionery, Arcor Group, and others.

Recent Development:In March 2025, Ritter Sport launched its Travel Retail Editions mini collection with 15 mini chocolate bars in flavors like salted caramel, butter biscuit, and cornflakes at the IAADFS Summit of the Americas in Miami, boosting brand visibility in American travel retail.

In June 2025, Sweet-Tooth entered the Indian market through a collaboration with Franchise India, aiming to sell natural-ingredient products in airports and shopping malls.

Our team of experienced researchers has meticulously gathered and analyzed data to deliver a thorough examination of market dynamics, competitive landscape, and emerging technologies. With a focus on delivering actionable intelligence, this report aims to empower decision-makers with the information needed to make informed choices and stay ahead of the competition. Whether you are a seasoned industry player or a new entrant, our market research report serves as a strategic tool to navigate the complexities of the market, aiding in successful business planning and growth strategies.

This chapter of our Confectioneries market report provides an in-depth examination of the factors shaping the industry landscape. This section typically encompasses several key elements to offer a comprehensive understanding of the industry landscape such as market drivers & restraints analysis, market opportunities & trend analysis, market size & growth analysis, competitive analysis, SWOT analysis, business environment tools such as Porter's five forces & PESTEL analysis, Ansoff Matrix analysis, penetration & growth prospect analysis, regulatory framework & reimbursement scenario analysis, impact of macro & micro economic factors analysis such as Covid-19 impact, GDP growth, market inflation, U.S.- China trade war, Russia-Ukraine war impact, and supply chain analysis.

The segment analysis chapter of Confectioneries market report is a critical section that delves into a detailed examination of the market's various segments. Segmentation involves dividing the market into distinct categories based on certain criteria to better understand and address the diverse needs of consumers. This chapter typically follows the introduction and provides a more granular view of the market, offering valuable insights for businesses and stakeholders. The components of the chapter lude segment definitions to understand the inclusions and exclusions of the study, assumptions, market size estimates and growth trend analysis of each segment, qualitative analysis of the segment, technological advancements, market penetration rate, market adoption rate, market share examination by each segment, segment growth drivers and restraint barriers, consumer behaviour and challenge analysis.

The chapter in Confectioneries market research report is a pivotal section that examines and predicts the market dynamics and trends specific to different geographical regions. This chapter is crucial for businesses and stakeholders seeking a comprehensive understanding of how the market behaves across various locations, enabling them to tailor strategies and make informed decisions based on regional variations. The regional analysis chapter of our Confectioneries market report is classified into regions & country-level. The chapter consists of North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa).

This section of a Confectioneries market report is a crucial segment that provides a comprehensive overview of the competitive landscape within the market. This section is vital for businesses, investors, and stakeholders seeking insights into key players, their market positioning, strengths, weaknesses, strategies, and potential impacts on the overall market dynamics. The chapter includes research methodology used to analyse the market competition, list of key players operating in the market, detailed company profile section which includes company overview, business verticals, financial performance, product/services benchmarking, geographical presence, and strategic initiatives.

| Report Scope | Details |

| Report Version | 2026 |

| Growth Rate | CAGR of 5.49 from 2026 to 2035 |

| Base year | 2025 |

| Actual estimates/Historical data | 2017 - 2024 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion & CAGR from 2026 to 2035 |

| Country scope | North America (U.S., Canada), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Denmark, Norway, Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Colombia, Rest of Latin America), Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Rest of Middle East & Africa). |

| The Segment covered by Product Type |

|

| The Segment covered by Distribution Channel |

|

| Companies covered |

|

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| Free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

Statistics for the 2025 Confectioneries market share, size, and revenue growth rate were created by Quintile Report™. Confectioneries analysis includes a market forecast outlook for 2035 and a historical overview. Get a free PDF sample of this market analysis, please get in touch with our principal analyst at sales@quintilereports.com

Table 1 List of Abbreviation and acronyms

Table 2 List of Sources

Table 3 North America Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 4 North America Global Confectioneries Market, by Region, (USD Million) 2017-2035

Table 5 U.S. Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 6 Canada Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 7 Europe Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 8 Europe Global Confectioneries Market, by Region, (USD Million) 2017-2035

Table 9 Germany Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 10 U.K. Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 11 France Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 12 Italy Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 13 Spain Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 14 Sweden Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 15 Denmark Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 16 Norway Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 17 The Netherlands Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 18 Russia Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 19 Asia Pacific Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 20 Asia Pacific Global Confectioneries Market, by Region, (USD Million) 2017-2035

Table 21 China Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 22 Japan Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 23 India Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 24 Australia Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 25 South Korea Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 26 Thailand Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 27 Latin America Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 28 Latin America Global Confectioneries Market, by Region, (USD Million) 2017-2035

Table 29 Brazil Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 30 Mexico Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 31 Argentina Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 32 Middle East and Africa Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 33 Middle East and Africa Global Confectioneries Market, by Region, (USD Million) 2017-2035

Table 34 South Africa Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 35 Saudi Arabia Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 36 UAE Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 37 Kuwait Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Table 38 Turkey Global Confectioneries Market, by Segment Analysis, (USD Million) 2017-2035

Fig.1 Market research process

Fig.2 Market research approaches

Fig.3 Global Confectioneries Market: market scenario

Fig.4 Global Confectioneries Market competitive outlook

Fig.5 Global Confectioneries Market driver analysis

Fig.6 Global Confectioneries Market restraint analysis

Fig.7 Global Confectioneries Market opportunity analysis

Fig.8 Global Confectioneries Market trends analysis

Fig.9 Global Confectioneries Market: Segment Analysis (Based on the scope)

Fig.10 Global Confectioneries Market: regional analysis

Fig.11 Global market shares and leading market players

Fig.12 North America market share and leading players

Fig.13 Europe market share and leading players

Fig.14 Asia Pacific market share and leading players

Fig.15 Latin America market share and leading players

Fig.16 Middle East & Africa market share and leading players

Fig.17 North America, by country

Fig.18 North America

Fig.19 North America market estimates and forecast, 2017-2035

Fig.20 U.S.

Fig.21 Canada

Fig.22 Europe

Fig.23 Europe market estimates and forecast, 2017-2035

Fig.24 U.K.

Fig.25 Germany

Fig.26 France

Fig.27 Italy

Fig.28 Spain

Fig.29 Sweden

Fig.30 Denmark

Fig.31 Norway

Fig.32 The Netherlands

Fig.33 Russia

Fig.34 Asia Pacific

Fig.35 Asia Pacific market estimates and forecast, 2017-2035

Fig.36 China

Fig.37 Japan

Fig.38 India

Fig.39 Australia

Fig.40 South Korea

Fig.41 Thailand

Fig.42 Latin America

Fig.43 Latin America market estimates and forecast, 2017-2035

Fig.44 Brazil

Fig.45 Mexico

Fig.46 Argentina

Fig.47 Colombia

Fig.48 Middle East and Africa

Fig.49 Middle East and Africa market estimates and forecast, 2017-2035

Fig.50 Saudi Arabia

Fig.51 South Africa

Fig.52 UAE

Fig.53 Kuwait

Fig.54 Turkey

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Immediate / Within 24-48 hours - Working days

Online Payments with PayPal and CCavenue

You can order a report by picking any of the payment methods which is bank wire or online payment through any Debit/Credit card or PayPal.

Hard Copy

Report OverviewThe Global Gas Cylinder Market was valued at USD 12.36 million in 2025 and is project

Read MoreReport OverviewThe Global Drone Mapping Market was valued at USD 2.62 billion in 2025 and is project

Read MoreReport OverviewThe Global CBD Extraction Equipment Market was valued at USD 67.62 million in 2025 an

Read More